RNS No 3523a

DRINGS OF BATH PLC

8th December 1997

UNAUDITED INTERIM FINANCIAL STATEMENTS FOR THE 6 MONTH PERIOD ENDED 30

SEPTEMBER 1997

Drings of Bath plc announces its interim results, copies of which can be

obtained from the Company at Avon Mill Lane, Keynsham, Bristol BS31 2UG for a

period of 14 days from the date hereof.

Further to the announcement dated 12 November 1997, the options over 959,375

ordinary shares of 0.2 pence each at an exercise price of 3 pence granted on

that date to Peter Burridge, a non-executive director were cancelled and

notified to the Company on 5 December 1997 to enable the Company to release its

interim results today.

CHAIRMAN'S STATEMENT

The first half of our 1997/98 Financial Year has been a very eventful one, and

at the end of it I am pleased to be able to report an improvement in the

trading position of the business.

As I advised you in my last statement, Drings acquired the assets of Capital

Masonry from the receivers in May of this year, since which time the addition

of quality staff and the facilities at Corsham have significantly enhanced the

earnings ability of the company both through the additional throughput

capacity and by enabling us to focus production of specific stone types to

each facility.

In addition to the assets purchased from the receiver, certain assets which

were personally owned by Peter Carroll were also acquired, these included the

freehold property at Corsham. The total consideration for these assets being

#320,000 cash and #400 in shares in Capital. This has generated a minority

interest in Capital but it is intended that all profits will continue to

accrue to the benefit of Drings. Drings has retained a call option on the

minority shares (see note 4).

Our performance early in the year continued to be affected by the problems

that were highlighted in my last statement. We have, however, benefited

greatly from the change in management of the business which we can see from

both the improving profit position and the stronger balance sheet. I am

pleased to report that the recovery provides confidence that our full year

targets can still be met and that the second half of this year will produce an

acceptable return. Sales in Drings (the original business) are up 2% on the

same period last year and sales in Capital Masonry are currently ahead of

budget. Overall profit performance is consistent with the level budgeted for

the first half of the year.

The net assets of the business have risen by 8% since the year end, and I am

pleased to report a positive cash flow after financing the purchase of Capital

Masonry and #420k of fixed assets.

I reported at last year end that your Board are committed to implement the

Cadbury Committee Code of Best Practice where practicable, and to that end I

am pleased to advise you that Peter Burridge joined the Board at the beginning

of September as a non-executive director. Peter brings with him a wealth of

practical business experience from his years as a Regional Director of

Barclays Bank plc.

You will note that this Interim Statement contains more information than

hitherto. This follows from our intention to subscribe to best practice at

all times and it is therefore compiled in accordance with The Accounting

Standards Board's latest Statements on Interim Reports as far as it is

applicable.

Subsequent to the date of the balance sheet attached, Drings have purchased

Blue Pennant Stone Company Limited, a single asset company having extraction

rights to stone from a quarry in Mid Glamorgan, particularly suited to an area

of business in which your Board are investing heavily, to the extent that we

have committed to spend in excess of #300,000 on a new plant to be sited at

our Corsham premises. We firmly believe that this expansion will have a

significant and beneficial impact on the business in the years to come.

I am pleased to be able to announce that we are again the recipients of a

National Award from the Stone Federation for the works we carried out at

Cavendish Lodge in Bath. (This building was shown on the outside back cover

of our Admission Document as an artists impression). This is the second

successive award for our new build work.

As always, the success of the business is substantially dependent on the

efforts of all the management and staff who have worked extremely hard to

achieve the results set before you. What distinguishes this business from

others, brings accolades and satisfied customers, is the quality of the

workmanship and the dedication and pride of the workforce, for which your

Board and I are extremely grateful.

VINCENT MORAN

CHAIRMAN

DRINGS OF BATH PLC

Unaudited half yearly report to 30 September 1997

CONSOLIDATED PROFIT AND LOSS ACCOUNT

6 Months to 6 Months to Year to

30 September 30 September 31 March

1997 1996 1997

(unaudited) (unaudited) (audited)

Notes # # #

TURNOVER

Continuing operations UK 1,847,798 1,852,694 3,600,727

Europe 31,698 10,875 10,875

Rest of World 21,800 - -

Acquisitions UK 659,011 - -

Total Turnover 2,560,307 1,863,569 3,611,602

OPERATING PROFIT

Continuing operations 124,783 135,818 138,227

Acquisitions 65,838 -- --

190,621 135,818 138,227

Interest payable and similar

charges (17,897) (21,158) (28,393)

PROFIT ON ORDINARY ACTIVITIES

BEFORE TAXATION 172,724 114,660 109,834

Tax on profit on ordinary

activities 2 (53,544) (40,828) (36,008)

PROFIT ON ORDINARY ACTIVITIES

AFTER TAXATION 119,180 73,832 73,826

Earnings per share 4 0.16p 0.12p 0.11p

Fully diluted

earnings per share 4 0.14p - Dilution not

material -

Unaudited half yearly report to 30 September 1997

CONSOLIDATED BALANCE SHEET

6 Months to 6 Months to Year to

30 September 30 September 31 March

1997 1996 1997

(unaudited) (unaudited) (audited)

# # #

FIXED ASSETS

Intangible assets 7,196 9,919 8,558

Tangible assets 1,239,509 659,515 811,670

1,246,705 669,434 820,228

CURRENT ASSETS

Stocks 161,384 117,681 126,683

Debtors 1,323,982 1,253,984 977,313

Cash at bank and in hand 39,574 - 271

1,524,940 1,371,665 1,104,267

CREDITORS

Falling due in one year (1,024,407) (761,606) (564,002)

NET CURRENT ASSETS 500,533 610,059 540,265

TOTAL ASSETS LESS

CURRENT LIABILITIES 1,747,238 1,279,493 1,360,493

CREDITORS

Falling due after one year (476,545) (109,093) (180,493)

PROVISIONS FOR LIABILITIES

AND CHARGES (48,000) (38,468) (48,000)

NET ASSETS 1,222,693 1,131,932 1,132,000

CAPITAL AND RESERVES

Called up share capital 153,500 153,500 153,500

Minority shareholding in

subsidiary 400 - -

Share premium account 764,983 687,409 764,983

Profit and loss account 303,810 291,023 213,517

TOTAL EQUITY

SHAREHOLDERS' FUNDS 1,222,693 1,131,932 1,132,000

Unaudited half yearly report to 30 September 1997

CONSOLIDATED CASH FLOW STATEMENT

6 Months to 6 Months to Year to

30 September 30th September 31 March

1997 1996 1997

Notes (unaudited) (unaudited) (audited)

# # #

Operating profit 190,621 135,818 138,227

Depreciation Charges 64,789 60,074 80,643

Decrease/(increase) in stock 82,249 11,338 2,336

Decrease/(increase) in

debtors (346,669) (259,061) 16,888

(Decrease)/increase in

creditors 427,597 (273,603) (318,015)

Net cash inflow (outflow) from

operating activities 418,587 (325,434) (79,921)

Returns on Investments and

servicing of finance

Interest paid (13,127) (20,759) (27,594)

Finance lease interest paid (4,770) (399) (799)

- - (96,569)

Taxation

Capital expenditure

Purchase of tangible fixed

assets (420,267) (69,340) (96,999)

Sale of tangible fixed assets 1,000 - 6,296

Purchase of business 5 (187,162) - -

Financing

Issue of shares - 830,983 830,983

Borrowings 258,293 (282,394) (282,394)

Capital element of finance

leases (6,777) (21,875) (43,750)

Increase in cash 45,777 110,782 209,253

Reconciliation of net cash flow to movement in net debt and analysis of net debt

For the six months to 30 September 1997

#

Increase in cash in the period 45,777

Cash inflow from increase in debt/lease financing 251,516

Movement in net debt in the period (205,739)

At 1 April Cash Non-cash At 30 September

1997 Flow items 1997

# # # #

Cash at bank and

in hand (6,203) 45,777 - 39,574

Debt falling due

after one year (104,000) (258,293) 34,000 (328,293)

Debt falling due

within one year (26,000) - (34,000) (60,000)

Finance leases (117,054) 6,777 - (110,277)

Total (253,257) (205,739) - (458,996)

DRINGS OF BATH PLC

Unaudited half yearly report to 30 September 1997

NOTES

1. ACCOUNTING POLICIES

The financial information contained in this interim report does not constitute

statutory accounts. The interim results, which have not been audited, have

been prepared using accounting policies and practices consistent with those

used in the preparation of the Annual Report and Accounts for the year ended

31 March 1997 which should be read in conjunction with this report. Those

accounts, which contained an unqualified audit report, have been filed with

the Registrar of Companies.

2. TAXATION

Taxation for the half year ended 30 September 1997 is based on the effective

rate of 31% which is estimated will apply to the year ending 31 March 1998.

For the year ended 31 March 1997 the effective rate was 33%.

3. DIVIDENDS

The directors have decided that there should be no interim dividend. (1996

#nil).

4. EARNINGS PER SHARE

Earnings per share are based on profits on ordinary activities after tax of

#119,180 and the weighted average number of shares in issue of 76,750,000

(1996 interim 60,250,000, 1997 final 68,500,000). The company has an option

to buy back the minority shareholding in Capital Masonry Limited by the issue

of 8,543,200 ordinary shares in Drings of Bath plc. There are also grants of

options in relation to 4,796,875 ordinary shares in accordance with the 1996

Share Option Scheme. Fully diluted earnings per share based on 90,090,075

shares in issue are 0.14p.

5. ACQUISITIONS

Turnover and operating profit in respect of acquisitions include the results

of Capital Masonry Limited for the period from 1 May to 30 September 1997.

Summary of acquisition

#

Net assets acquired at fair value in accordance with FRS7

Tangible fixed assets 71,999

Stocks 116,950

Corporation tax payable (30,674)

Goodwill written off 28,887

187,162

Satisfied by:

Cash 187,162

6. APPROVAL

This report was approved by the Board of Directors on 5 December 1997.

REVIEW REPORT BY THE AUDITORS TO DRINGS OF BATH PLC

We have reviewed the interim financial information for the six months ended 30

September 1997 set out on pages 4 to 7 which is the responsibility of, and has

been approved by, the directors. Our responsibility is to report on the

results of our review.

Our review was carried out having regard to the Bulletin "Review of Interim

Financial Information" issued by the Auditing Practices Board. This review

consisted principally of applying analytical procedures to the underlying

financial data, assessing whether accounting policies have been consistently

applied, and making enquiries of management responsible for financial and

accounting matters. The review excluded audit procedures such as tests of

controls and verification of assets and liabilities, and was therefore

substantially less in scope than an audit performed in accordance with

Auditing Standards. Accordingly, we do not express an audit opinion on the

interim financial information.

On the basis of our review:

(i) in our opinion the interim financial information has been prepared using

accounting policies consistent with those adopted by Drings of Bath plc in

its financial statements for the year ended 31 March 1997, and

(ii) we are not aware of any material modifications that should be made to the

interim financial information as presented.

Grant Thornton

Registered Auditors

Chartered Accountants

BRISTOL

5 December 1997

END

IR FSEFLIUWUFDE

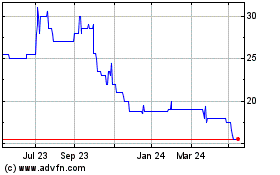

Thruvision (LSE:THRU)

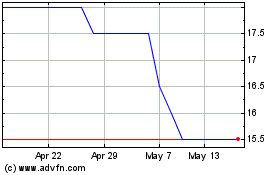

Historical Stock Chart

From Jun 2024 to Jul 2024

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024