TIDMDGB

RNS Number : 1112Y

Digital Barriers plc

27 November 2014

27 November 2014

Digital Barriers plc

("Digital Barriers" or the "Group")

Interim Results for the six months ended 30 September 2014

Digital Barriers (AIM: DGB), the specialist provider of advanced

surveillance technologies to the international homeland security

and defence markets, announces its unaudited results for the six

months ended 30 September 2014.

Key Highlights

-- Group revenues in the six-month period to 30 September 2014

were 13% higher than the same period last year at GBP10.1m (2013:

GBP9.0m)

-- Adjusted losses of GBP5.8m showinga year-on-year reduction

(2013: GBP6.8m), which is expected to further improve through the

remainder of the financial year. Loss before tax GBP13.2m (2013:

GBP7.2m).

-- International revenues increased 62% to GBP3.7m (2013: GBP2.3m)

-- The Group's sales pipeline is significantly stronger than in

prior periods, with core products (TVI Video Surveillance,

Integrated Surveillance Platform (ISP) - incorporating RDC Ground

Sensors and TVI, and ThruVision Passive People Screening) now

accounting for almost the entire sales pipeline

-- Additional core product, the Cloud Video Platform built on

the Group's class-leading TVI technology, now under development and

expected to launch this financial year

-- Net cash at the end of the period was GBP7.6m

Commenting on the results, Tom Black, Chairman of Digital

Barriers, said:

"The Group's international momentum is high and we have an

increasing number of flagship customers around the world who have

trialled and then selected our technology. Our challenge now is to

grow these relationships to become much larger-scale and to

overcome the procurement delays that inevitably come with large

government and commercial customers. Our qualified sales pipeline

continues to strengthen and our assessment of likely sales in the

second half provides confidence that we will achieve our

expectations for the full year.

For further information please contact:

Digital Barriers plc +44 (0)20 7940 4740

Zak Doffman, Chief Executive Officer

Sharon Cooper, Group Finance Director

Investec Investment Banking +44 (0)20 7597 5970

Andrew Pinder / Dominic Emery

FTI Consulting +44 (0)20 3727 1000

Edward Bridges / Matt Dixon

About Digital Barriers:

Digital Barriers provides advanced surveillance technologies to

the international homeland security and defence markets,

specialising in 'edge-intelligent' solutions that are designed for

remote, hostile or complex operating environments. We work with

governments, multinational corporations and system integrators in

the defence, law enforcement, critical infrastructure,

transportation and natural resources sectors. Our surveillance

technologies have been successfully proven on some of the most

demanding operational and environmental deployments around the

world.

www.digitalbarriers.com

Chairman's Statement

Introduction

Following a number of years of acquisitions and a period of

integration, the Group is now focused on a single coherent strategy

of delivering sales from our core product offerings and developing

new core products leveraging our intellectual property. We have

devoted significant resources over the past two years to developing

and launching a set of integrated product solutions built around

the core intellectual property that we have acquired. This has

included developing high-definition, IP-camera, platform-agnostic

software and mobile-device variants of our TVI video surveillance

solution, as well as integrating the technology with market leading

video management systems. We have developed the Integrated

Surveillance Platform, which combines TVI and our RDC unattended

ground sensor, into a fully integrated wide area surveillance

solution that provides a new level of capability to the market.

Furthermore we have launched an updated version of the ThruVision

passive screening solution that provides an enhanced level of

functionality and usability.

Although we acquired world-class intellectual property with the

businesses brought into the Group, material product development has

been required to ensure that the products we take to market have

the right level of functionality and capability to meet our wider

market opportunities. We have also worked on providing our

technologies as integrated solutions rather than standalone

products. The Board has confidence in the compelling nature of

these new products, which comprise the majority of our sales

pipeline. However this two-year period of product development,

along with lengthy procurement cycles, has delayed the Group's

ability to leverage value from the integrated businesses and

generate sales in the expected timeframes and as a consequence an

impairment charge of GBP6.25m has been recorded in the period.

In addition to encouraging revenue growth, losses for the period

show a year-on-year reduction. The Board sees this as a genuine

inflection point for the Group, as it moves closer towards

break-even driven by a continued acceleration in revenue growth

alongside a successful reduction in the cost base.

International revenue growth of 62% over the same period last

year was particularly strong, reinforcing the Board's view of the

opportunity open to Digital Barriers in international markets. This

strong international revenue growth came despite delays in our

ability to progress opportunities in West Africa due to the Ebola

crisis, as announced by the Group on 11 August 2014, a proportion

of which the Board had expected to be delivered during the period.

The Group maintains a strong sales pipeline into the region, which

we are looking to progress as the Ebola crisis is brought under

control. UK revenues contracted slightly due to a major MoD

programme in the previous year having no counterpart in this

period, although we remain highly confident of further revenues

from this customer going forward. Balancing this, the UK Services

division had a strong half due to work in support of the 2014

Summer Games.

The focus of the Group remains on its core product areas.

Integrated Surveillance Platform (incorporating TVI and RDC

technologies)

This solution provides real-time video surveillance and

intrusion alerts for remote and inaccessible locations, combining

with existing infrastructure and surveillance assets to deliver

maximum value for money and use of legacy systems. This provides a

Common Operating Picture enabling live video streaming and

intrusion data to be shared at local, regional and national levels

across multiple agencies, supporting a coordinated, timely response

to identified threats. Applications include force and border

protection, critical infrastructure, oil & gas installations,

maritime security and law enforcement. Highlights during the period

include:

-- An initial sale and successful delivery into West Africa for

the protection of a secure government facility. This was the first

of a set of government projects that were then delayed by the Ebola

crisis but which are still expected to progress over this financial

year and into FY16.

-- A successful trial with a government customer in Asia

Pacific. The trial included participation from central government

and all branches of the military and is expected to lead to

material sales over the coming months and has significant potential

to extend into future years.

-- Numerous smaller sales into law enforcement agencies in the

US, Asia Pacific, Mainland Europe and the Middle East, as well as

the first ISP sale for commercial facility protection in the UK

which came after the period-end.

TVI Video Surveillance Platform

The TVI technology combines an enterprise-grade server

architecture with the world's most efficient video compression and

transmission system. It offers an unparalleled real-time

'surveillance from anywhere to anywhere' capability, overcoming the

challenges of video transmission over low or variable bandwidth

networks, such as cellular, and providing multiple ways to access,

share and manipulate critical video information. TVI enables

'edge-based' storage and analysis, for the optimal combination of

flexibility and affordability. Highlights from the period

include:

-- The largest TVI hardware sale, valued at around $1.5m, to a

US federal agency for our new HDS600 high-definition product, which

is expected to lead to much wider TVI adoption within the

agency.

-- Initial TVI sales into three new US federal agencies, where

the objective again is to achieve agency-wide adoption.

-- Modest TVI sales into multiple markets in the Middle East for

law enforcement agencies for both static and vehicle-based

solutions.

-- The development and subsequent first sale of an Integrated

TVI vehicle solution, based on our IP450 and including multiple

devices and cameras all integrated into a turn-key customer

solution.

-- The formal launch of a TVI powered service, based on our

Minicam, by the UK's largest telecoms company.

ThruVision Passive People Screening

ThruVision uses a unique passive sensing method that relies only

on millimeter-wave energy produced by and reflected from the body -

thereby making it 100% safe, non-invasive and, if necessary, covert

in operation. The technology can screen for both metallic and

non-metallic objects concealed under clothing, including

explosives, weapons, drugs, currency and other contraband. It is

the world's leading passive people scanning technology. This was

the best ever period for ThruVision sales, and highlights

included:

-- A sale into the security agencies protecting the recent ASEAN

summit in Myanmar, where the technology was used to secure those

areas where key dignitaries were in attendance.

-- An initial sale into a major Asia Pacific customs agency for

airport screening, this sale followed a user trial and has now been

operationally deployed with significant success.

-- The first sale into the counter-terrorism division of a major

US metropolitan police department, the technology will be used for

the protection of high-profile facilities and is expected to be

part of a wider adoption.

Cloud Video Platform (CVP)

Development commenced during the period on the Group's fourth

and new core product area: its enterprise-grade Cloud Video

Platform. This is expected to significantly widen the market for

TVI video surveillance technology and will capitalise on the major

investment the Group has made in the technology. TVI is a unique

video technology that has been proven to be more efficient at the

compression of live video than competing technologies on the market

today. As a consequence, TVI is now being adopted by flagship

customers around the world, including US federal agencies and major

telecom operators. The Group intends to use this same technical

advantage to power a cloud-based architecture that can meet the

demands of enterprises and the wider market for surveillance and

other video based applications in the future. TVI can stream live

video in and out of a cloud-based service more efficiently than any

other technology on the market, delivering major cost and

operational efficiencies, as well as significantly improved

usability.

The Group expects to launch CVP towards the end of the financial

year.

Changes to Management Arrangements

Zak Doffman was appointed to the position of Chief Executive

Officer of the Group on 14 October 2014. Tom Black continues to

serve as Chairman of the Board in a Non-Executive capacity,

providing Zak with strong support and guidance in his new role.

A founding Executive Director of the Group and member of the

Board, Zak has been responsible for developing the strategy and

acquiring the businesses brought into the Group, as well as

establishing and managing commercial and sales operations around

the world. Zak leads an executive team which includes Colin Evans,

who became Chief Operating Officer on the same date, and Sharon

Cooper, who continues in her role as Group Finance Director.

Financials

Revenue and Gross Margin

Revenue in the period grew 13% to GBP10.1m in the six-months

ended 30 September 2014 compared to GBP9.0m in the same period last

year. Underlying Product revenues contracted 25% to GBP5.5m (2013:

GBP7.3m), driven by a reduction in UK Product revenues.

International Product revenues grew 62% over the same period last

year, reflecting the continued sales focus in this area where the

Board sees the greatest opportunity for growth. Services revenue

grew significantly in the period up from GBP1.7m in 2013 to GBP4.6m

in 2014.

The Group generated a gross profit of GBP3.1m (2013: GBP3.8m),

which equates to a gross margin of 31% (2013: 42%). The lower gross

margin is predominantly due to the strong performance within the

Services division in the period, with revenues within the Services

division attracting a lower gross margin than the Product division.

Gross margin for the Group is forecast to increase through the

second half with Product revenues contributing a greater proportion

of total revenue.

Adjusted Loss

The adjusted loss before tax was GBP5.8m (2013: GBP6.8m) and on

an unadjusted basis was GBP13.2m (2013: GBP7.2m). The reduction in

the adjusted loss is driven by a reduction in underlying overheads

which have declined from GBP10.6m in 2013 to GBP9.0m in 2014. The

unadjusted loss includes a GBP6.25m non-cash impairment charge

against the carrying value of goodwill within the Products

division. This impairment reflects a period of product development,

which has delayed the Group's ability to leverage value from the

integrated businesses in the expected timeframes, along with delays

in sales cycles reported to the market by the Group on 11 August

and the corresponding impact on short-term performance.

Cash

The Group ended the period with a GBP7.6m cash balance (31 March

2014: GBP14.2m). Net cash outflow from operating activities was

GBP6.4m including a GBP0.7m working capital outflow together with

GBP5.7m of other operating outflows, primarily cash loss before

tax. Capital expenditure in the period of GBP0.2m accounts for the

balance of the cash spend.

Outlook

The momentum in the Group, underpinned by significant

international growth and a strengthening sales pipeline, gives the

Board confidence for the second half of the financial year. While

customer procurement processing delays can adversely impact Group

results in any particular period, the Board's assessment of likely

sales in the second half provides confidence that the Group will

achieve its expectations for the full year.

Independent review report to Digital Barriers plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

6 months ended 30 September 2014 which comprises the consolidated

income statement, the consolidated statement of comprehensive

income, the consolidated balance sheet, the consolidated statement

of changes in equity, the consolidated statement of cash flows, and

related notes 1 to 7. We have read the other information contained

in the half-yearly financial report and considered whether it

contains any apparent misstatements or material inconsistencies

with the information in the condensed set of financial

statements.

This report is made solely to the Company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The Directors are responsible

for preparing the half-yearly financial report in accordance with

International Accounting Standards 34, "Interim Financial

Reporting," as adopted by the European Union and the AIM Rules

issued by the London Stock Exchange.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standards 34, "Interim

Financial Reporting, " as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the 6 months ended 30

September 2014 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the AIM Rules issued by the London Stock

Exchange.

Ernst & Young LLP

London

26 November 2014

DIGITAL BARRIERS PLC

Consolidated income statement

for the six months ended 30 September 2014

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

-------------------------------- ----- ------------- ------------- -----------

Revenue 2 10,137 9,009 19,042

Cost of sales (6,993) (5,223) (10,319)

-------------------------------- ----- ------------- ------------- -----------

Gross profit 3,144 3,786 8,723

Administration costs (16,326) (11,490) (24,341)

Other income - 489 706

Other costs - - (160)

-------------------------------- ----- ------------- ------------- -----------

Operating loss (13,182) (7,215) (15,072)

Finance revenue 8 1 32

Finance costs - (20) (27)

-------------------------------- ----- ------------- ------------- -----------

Loss before tax (13,174) (7,234) (15,067)

Income tax 57 334 458

-------------------------------- ----- ------------- ------------- -----------

Loss for the period /

year (13,117) (6,900) (14,609)

-------------------------------- ----- ------------- ------------- -----------

Adjusted loss: 3

Loss before tax (13,174) (7,234) (15,067)

Amortisation of intangibles

initially recognised

on acquisition 996 867 1,733

Impairment of goodwill

& intangibles 6,250 - 160

Loss on disposal of businesses 83 - -

Adjustments to deferred

consideration - (472) (679)

Reorganisation costs - - 1,860

Adjusted loss before

tax for the period (5,845) (6,839) (11,993)

-------------------------------- ----- ------------- ------------- -----------

(Loss) per share - basic 4 (20.30p) (13.54p) (25.87p)

(Loss) per share - diluted 4 (20.30p) (13.54p) (25.87p)

(Loss) per share - adjusted 4 (9.03p) (12.87p) (21.49p)

(Loss) per share - adjusted

diluted 4 (9.03p) (12.87p) (21.49p)

-------------------------------- ----- ------------- ------------- -----------

The results for the period and the prior period are derived from

continuing activities.

DIGITAL BARRIERS PLC

Consolidated statement of comprehensive income

for the six months ended 30 September 2014

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ------ ------------- ------------- -----------

Loss for the period /

year (13,117) (6,900) (14,609)

Other comprehensive income

to be reclassified to

profit or loss in

subsequent periods

------------------------------ ------ ------------- ------------- -----------

Exchange differences

on retranslation of foreign

operations (327) (27) 9

-------------------------------------- ------------- ------------- -----------

Net other comprehensive

income to be reclassified

to profit or

loss in subsequent periods (327) (27) 9

-------------------------------------- ------------- ------------- -----------

Total comprehensive loss

attributable to owners

of the parent (13,444) (6,927) (14,600)

-------------------------------------- ------------- ------------- -----------

DIGITAL BARRIERS PLC

Consolidated balance sheet

at 30 September 2014

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ------------- ------------- ---------

Assets

Non current assets

Property, plant and

equipment 783 1,245 1,108

Goodwill 18,298 24,647 24,802

Other intangible assets 2,791 4,931 3,857

------------------------------ ----- ------------- ------------- ---------

21,872 30,823 29,767

Current assets

Inventories 4,117 3,743 3,895

Trade and other receivables 7,634 7,261 7,706

Current tax recoverable 845 1,102 826

Cash and cash equivalents 7,582 1,145 14,246

------------------------------ ----- ------------- ------------- ---------

20,178 13,251 26,673

------------------------------ ----- ------------- ------------- ---------

Total assets 42,050 44,074 56,440

------------------------------ ----- ------------- ------------- ---------

Equity and liabilities

Attributable to owners

of the parent

Equity share capital 6 646 510 646

Share premium 75,879 57,989 75,879

Capital redemption

reserve 4,786 4,735 4,786

Merger reserve 454 454 454

Translation reserve (539) (248) (212)

Other reserves (307) (307) (307)

Retained earnings (44,266) (23,904) (31,352)

------------------------------ ----- ------------- ------------- ---------

Total equity 36,653 39,229 49,894

Non current liabilities

Deferred tax liabilities 163 305 194

Financial liabilities - 207 -

Provisions 147 - 161

------------------------------ ----- ------------- ------------- ---------

310 512 355

Current liabilities

Trade and other payables 4,865 4,115 5,608

Financial liabilities 163 218 163

Provisions 59 - 420

------------------------------ ----- ------------- ------------- ---------

5,087 4,333 6,191

Total liabilities 5,397 4,845 6,546

------------------------------ ----- ------------- ------------- ---------

Total equity and liabilities 42,050 44,074 56,440

------------------------------ ----- ------------- ------------- ---------

DIGITAL BARRIERS PLC

Consolidated statement of changes in equity

for the 6 months ended 30 September 2014

Profit

Share Capital and

Share Premium Redemption Merger Translation Other loss Total

capital account reserve reserve reserve reserves reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

At 31 March

2013 510 57,989 4,735 454 (221) (307) (17,267) 45,893

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Loss for the

period - - - - - - (6,900) (6,900)

Other comprehensive

loss - - - - (27) - - (27)

Share-based

payment credit - - - - - - 263 263

At 30 September

2013 510 57,989 4,735 454 (248) (307) (23,904) 39,229

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Loss for the

period - - - - - - (7,709) (7,709)

Other comprehensive

loss - - - - 36 - - 36

Share-based

payment credit - - - - - - 261 261

Share issue

cost - (677) - - - - - (677)

Share placement 133 18,567 - - - - - 18,700

Incentive share

conversion 3 - 51 - - - - 54

At 31 March

2014 646 75,879 4,786 454 (212) (307) (31,352) 49,894

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Loss for the

period - - - - - - (13,117) (13,117)

Other comprehensive

loss - - - - (327) - - (327)

Share-based

payment credit - - - - - - 203 203

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

At 30 September

2014 646 75,879 4,786 454 (539) (307) (44,266) 36,653

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

DIGITAL BARRIERS PLC

Consolidated statement of cash flows

for the 6 months ended 30 September 2014

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------ ------------- ------------- -----------

Operating activities

Loss before tax (13,174) (7,234) (15,067)

Non-cash adjustment to reconcile

loss before tax to net cash flows

Depreciation of property, plant

and equipment 341 394 739

Amortisation of intangible assets 1,067 929 1,819

Impairment of intangible assets 6,250 - 160

Share-based payment transaction

expense 203 263 524

Release of deferred consideration - (260) (494)

Reassessment of deferred consideration - (229) (212)

Disposal of fixed assets 162 (2) 178

Finance income (8) (1) (32)

Finance costs - 20 27

Working capital adjustments:

(Increase) / decrease in trade

and other receivables (11) 5,966 5,353

Increase in inventories (137) (1,964) (2,116)

Decrease in trade and other payables (562) (1,937) (919)

(Decrease) / increase in deferred

revenue (182) - 704

(Decrease) / increase in provisions (375) - 581

------------------------------------------ ------------- ------------- -----------

Cash utilised in operations (6,426) (4,055) (8,755)

Tax received 7 146 220

------------------------------------------ ------------- ------------- -----------

Net cash flow from operating activities (6,419) (3,909) (8,535)

------------------------------------------ ------------- ------------- -----------

Investing activities

Sale of property, plant & equipment - 2 -

Purchase of property, plant & equipment (188) (269) (624)

Expenditure on intangible assets (44) (32) (8)

Payment of deferred consideration - (188) (188)

Interest received 8 1 32

------------------------------------------ ------------- ------------- -----------

Net cash flow from investing activities (224) (486) (788)

------------------------------------------ ------------- ------------- -----------

Financing activities

Proceeds from issue of shares - - 18,700

Share issue costs - - (677)

Interest paid - (3) -

------------------------------------------ ------------- ------------- -----------

Net cash flow from financing activities - (3) 18,023

------------------------------------------ ------------- ------------- -----------

Net (decrease) / increase in cash

and cash equivalents (6,643) (4,398) 8,700

Cash and cash equivalents at beginning

of period / year 14,246 5,544 5,544

Effect of foreign exchange rate

changes on cash and cash equivalents (21) (1) 2

------------------------------------------ ------------- ------------- -----------

Cash and cash equivalents at end

of period / year 7,582 1,145 14,246

------------------------------------------ ------------- ------------- -----------

DIGITAL BARRIERS PLC

Notes to the financial statements

for the 6 months ended 30 September 2014

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of

Digital Barriers plc and all of its subsidiary undertakings

(together "the Group") drawn up at 30 September 2014, and have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting" ("IAS 34") as adopted for use in the

European Union ("EU"). The consolidated interim financial

statements have been prepared using accounting policies and methods

of computation consistent with those applied in the consolidated

financial statements for the period ended 31 March 2014.

The Group's original forecasts and projections for the year

ended 31 March 2015 have been revised downwards during the period,

as announced on 11 August 2014. As a result of modifying

expectations the Directors have undertaken a detailed review of

revised forecasts and projections for the Group. These revised

forecasts and projections assume accelerated revenue growth in the

six-month period to 31 March 2015, with a material reduction in the

losses incurred by the Group. Revenue growth is forecast to

continue into the financial year ended 31 March 2016 with further

improvements in the profitability of the Group. Based on these

projections, and taking account of reasonably possible changes in

trading performance, the Group should be able to operate within its

current level of cash reserves of GBP7.6m, as at 30 September 2014.

The Directors therefore have a reasonable expectation that the

Group has adequate resources to continue operating for the

foreseeable future, and for this reason they have adopted the going

concern basis in these consolidated interim financial

statements.

The annual consolidated financial statements of the Group are

prepared on the basis of International Financial Reporting

Standards ("IFRS"). The consolidated interim financial statements

are presented on a condensed basis as permitted by IAS 34 and

therefore do not include all the disclosures that would otherwise

be required in a full set of financial statements and should be

read in conjunction with the most recent Annual Report and Accounts

which were approved by the Board of Directors on 27 May 2014 and

have been filed with Companies House. The condensed interim

financial statements do not constitute statutory accounts as

defined in Section 434 of the Companies Act 2006 and are unaudited

for all periods presented. The financial information for the 12

month period ended 31 March 2014 is extracted from the financial

statements for that period. The auditors' report on those financial

statements was unqualified and did not contain an emphasis of

matter reference and did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

The Company is a limited liability company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange.

The following new and revised international financial reporting

standards are effective for this interim period:

IFRS 10 Consolidated Financial Statements and IAS 27 Separate

Financial Statements. Effective for annual periods beginning on or

after 1 January 2014. IFRS 10 replaces the portion of IAS 27 that

addresses the accounting for consolidated financial statements. It

also addresses the issues raised in SIC-12 Consolidation - Special

Purpose Entities, which resulted in SIC-12 being withdrawn. IAS 27,

as revised, is limited to the accounting for investments in

subsidiaries, joint ventures, and associates in separate financial

statements. The standard is not expected to significantly affect

the Group's results or financial position.

IFRS 12 Disclosure of Interests in Other Entities.Effective for

annual periods beginning on or after 1 January 2014. IFRS 12

applies to an entity that has an interest in subsidiaries, joint

arrangements, associates and/or structured entities. Many of the

disclosure requirements of IFRS 12 were previously included in IAS

27, IAS 31, and IAS 28, while others are new.

IAS 32 Offsetting Financial Assets and Financial Liabilities -

Amendments to IAS 32. Effective for annual periods beginning on or

after 1 January 2014. These amendments to IAS 32 clarify the

meaning of 'currently has a legally enforceable right to set-off'.

The amendments also clarify the application of the IAS 32

offsetting criteria to settlement systems (such as central clearing

house systems), which apply gross settlement mechanisms that are

not simultaneous. The standard is not expected to significantly

affect the Group's results or financial position.

2. Segmental information

The Group is organised into the Services and Products divisions

for internal management, reporting and decision-making, based on

the nature of the products and services of the Group's businesses.

These are the reportable operating segments in accordance with IFRS

8 "Operating Segments". As the Group continues to develop and

change, the Directors closely monitor these reporting operating

segments to ensure they remain relevant to the management of the

Group.

6 months ended 30 September 6 months ended 30 September

2014 2013

---------------------------------- ----------------------------------

Services Products Total Services Products Total

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Total segment revenue 4,614 5,664 10,278 1,672 7,414 9,086

Inter-segment revenue - (141) (141) - (77) (77)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Revenue 4,614 5,523 10,137 1,672 7,337 9,009

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Segment operating

(loss) / profit 200 (1,368) (1,168) (290) (1,904) (2,194)

Corporate overheads (4,685) (4,626)

Net adjusted loss

items (see note 3) (7,329) (395)

Operating loss (13,182) (7,215)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Finance income 8 1

Finance costs - (20)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Loss before tax (13,174) (7,234)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Income tax 57 334

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Loss for the period (13,117) (6,900)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Year ended 31 March 2014

-------------------------------

Services Products Total

Audited Audited Audited

GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ---------

Total segment revenue 4,527 14,696 19,223

Inter-segment revenue - (181) (181)

----------------------- --------- --------- ---------

Revenue 4,527 14,515 19,042

----------------------- --------- --------- ---------

Segment operating

profit / (loss) (97) (1,854) (1,951)

Corporate overheads (10,074)

Net adjusted loss

items (see note 3) (3,047)

Operating loss (15,072)

----------------------- --------- --------- ---------

Finance income 32

Finance costs (27)

----------------------- --------- --------- ---------

Loss before tax (15,067)

----------------------- --------- --------- ---------

Income tax 458

----------------------- --------- --------- ---------

Loss for the year (14,609)

----------------------- --------- --------- ---------

3. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a more relevant measure of the

Group's underlying performance. Adjusted loss is not defined under

IFRS and has been shown as the Directors consider this to be

helpful for a better understanding of the performance of the

Group's underlying business. It may not be comparable with

similarly titled measurements reported by other companies and is

not intended to be a substitute for, or superior to, IFRS measures

of profit. The net adjustments to loss before tax are summarised

below:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------- ------------- -----------

Amortisation of intangibles initially

recognised on acquisition 996 867 1,733

Adjustments to deferred consideration - (472) (679)

Impairment of goodwill and intangible

assets (note 5) 6,250 - 160

Loss on disposal of businesses

(i) 83 - -

Reorganisation costs (ii) - - 1,860

Total adjustments 7,329 395 3,074

--------------------------------------- ------------- ------------- -----------

(i) During the 6 months ended 30 September 2014 Margaux Matrix

Limited and Visimetrics (UK) Limited, two wholly owned

subsidiaries, were disposed of for GBPnil consideration.

(ii) Reorganisation costs of GBP1.9m in the year ended 31 March

2014 relate to a restructuring programme undertaken to rationalise

the cost base of the Group. A provision for GBP0.6m remained on the

balance sheet as at 31 March 2014 representing amounts still to be

settled. Of this, GBP0.4m has been settled in cash in the

period.

4. Loss per share

The basic loss per share is calculated on the loss after tax and

the weighted average number of shares in issue during the

period.

The basic adjusted loss per share is calculated on the adjusted

loss after tax and the weighted average number of shares in issue

during the period.

Diluted earnings per share measures are calculated using the

same number of shares as the basic loss per share measures, as the

inclusion of potential Ordinary Shares arising from share options

and Incentive Shares in issue would be anti-dilutive.

The following reflects the loss and share data used in the basic

and diluted loss per share calculations:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss after tax (13,117) (6,900) (14,609)

Amortisation of acquired intangible

assets, net of tax 951 815 1,559

Adjustments to deferred consideration - (472) (679)

Impairment of goodwill and intangibles,

net of tax 6,250 - 160

Reorganisation costs - - 1,432

Loss on disposal of assets 83 - -

----------------------------------------- --------------- --------------- -----------

Adjusted loss after tax (5,833) (6,557) (12,137)

----------------------------------------- --------------- --------------- -----------

Weighted average number of shares 64,624,616 50,963,166 56,472,084

----------------------------------------- --------------- --------------- -----------

Basic and diluted loss per share (20.30p) (13.54p) (25.87p)

----------------------------------------- --------------- --------------- -----------

Basic and diluted adjusted loss

per share (9.03p) (12.87p) (21.49p)

----------------------------------------- --------------- --------------- -----------

5. Impairment of goodwill

Goodwill acquired through business combinations has been

allocated for impairment testing purposes to two groups of

cash-generating Units ('CGUs'). These groups of CGUs are its two

operating segments 'services' and 'products' as the goodwill

relates to synergies at this level. The Group conducts annual

impairment tests on the carrying value of the CGUs in the balance

sheet as at 28 February each year. Impairment testing is only

re-performed if an impairment triggering event occurs in the

intervening period. As announced on 11 August 2014, the Group's

original forecasts for the year ended 31 March 2015 were revised

downwards during the period. As a result the Group conducted an

impairment test on the carrying value of the Product division as at

30 September 2014.

Value in use calculations are used to determine the recoverable

amount of the Product cash-generating unit. The key assumptions for

the value in use calculations are the forecast revenue growth of

the CGU, cost allocations, the discount rate applied and the

long-term growth rate of the net operating cash flows. In

determining the key assumptions, management have taken into

consideration the nature of the markets in which it operates, the

ability of the CGU to exploit those opportunities and the current

economic climate, the resulting impact on expected growth, cost

base and pre-tax discount rates, and the pressure this places on

impairment calculations.

The Group prepares cash flow forecasts for the cash-generating

unit based on the most recent three-year detailed financial

forecasts. These forecasts have been revisited in light of the

announcement on 11 August 2014 and progression of the business

through its phases of development. The cash flow forecasts are

based on an internal assessment of the strength of the CGU in the

markets in which it operates, the costs attributable to the CGU and

the expected growth in revenue and margins, reflecting the size and

opportunities in its core strategic markets. Revenue growth in

years two and three is forecast at 40% and 20% per annum

respectively based on lowered forecast, with revenue growth of 2.5%

assumed from year four onwards, being an external estimate of the

UK's long-term growth rate. A discount rate of 11.6% has been

applied. Based on these assumptions, an impairment charge of

GBP6.25m arises.

The value of the Product division is sensitive to changes in the

discount rate and profits generated by the division. An increase in

the discount rate above 11.6%, with all other assumptions

unchanged, would result in an incremental impairment in the

six-month period to 31 March 2015. Similarly a reduction in the

profits generated by the division, either through reduced revenues

or increased costs, which is not recovered sufficiently in future

periods, would also result in an incremental impairment in the

six-month period to 31 March 2015.

6. Issued share capital

As at 30 September 2014, there were 64,624,616 Ordinary Shares

in issue (30 September 2013: 50,984,761, 31 March 2014:

64,624,616).

7. Related party transactions

On 12 June 2014 the Remuneration Committee of the Group made a

conditional grant to Colin Evans, Zak Doffman and Sharon Cooper,

under the rules of The Digital Barriers Long Term Incentive Plan

(the "Plan"). The award comprised three elements as detailed

below:

-- An award of HMRC approved Options at an exercise price of GBP1.195

-- An award of nil cost parallel options; and

-- A top-up award of nil cost options

Value of

HMRC approved Parallel

options options Top-up award

(no of shares) GBP (no of shares)

--------------- ---------------- ------------- ----------------

Colin Evans 25,104 GBP29,999.28 100,419

--------------- ---------------- ------------- ----------------

Zak Doffman 25,104 GBP29,999.28 100,419

--------------- ---------------- ------------- ----------------

Sharon Cooper 25,104 GBP29,999.28 79,498

--------------- ---------------- ------------- ----------------

Full details of the plan can be found in the 2014 Annual Report

on page 34.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGGWWGUPCGQQ

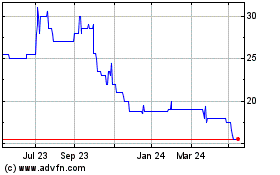

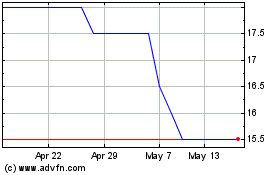

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024