Acquisition

July 23 2010 - 2:00AM

UK Regulatory

TIDMDGB

RNS Number : 8033P

Digital Barriers plc

23 July 2010

23 July 2010

Digital Barriers plc

Acquisition of Overtis Solutions

The Board of Digital Barriers plc ("Digital Barriers" or the "Company"), the

specialist provider of products and services to the homeland security market,

today announces the acquisition of the business and assets of the Solutions

division of Overtis Group Limited ("Overtis Solutions") for GBP3.20 million in

cash (the "Acquisition").

Overtis Solutions is a UK-based specialist provider of integrated security

solutions used in the protection of high value physical, human and information

assets on a global basis held by high risk government departments, public sector

bodies and major corporations.

Rationale for the Acquisition

At present, one of the most significant threats to UK security comes not from

state-to-state conflict, but from international and domestic terrorism.

Potential target locations range from crowded public spaces to high-profile

individual and geographic targets, as well as parts of the country's critical

national infrastructure. Each of these assets requires highly sophisticated

means of protection if they are to be adequately safeguarded.

Overtis Solutions is considered by Digital Barriers to be highly complementary

to the activities of Security Applications Limited ("SAL"), which Digital

Barriers acquired on 25 March this year. SAL is a UK-based specialist supplier,

installer and integrator of thermal imaging equipment for perimeter surveillance

and the protection of high-profile target locations and has an adjacent but

distinct customer base to Overtis Solutions.

The Board of Digital Barriers believes that the activities of Overtis Solutions

combined with those of SAL will enable the Company to take a further step

forward in its strategic ambition to build a specialist mid-market business that

can work directly with end-customers and through key partner organisations both

at home and abroad to provide focused, proportionate and effective solutions

which help protect key assets from attack.

Terms of the Acquisition

The total consideration of GBP3.20 million is payable in cash on completion and

will be satisfied from the Company's existing cash resources.

Financial information

Overtis Group Limited's latest audited accounts for the financial year ended 31

October 2009 reported Overtis Solutions' turnover of GBP2.64 million, with

EBITDA of GBP0.07 million. At 31 October 2009, Overtis Solutions had net assets

of GBP1.30 million.

Tom Black, Executive Chairman of Digital Barriers, commented:

"I am very pleased to be moving forward with the strategy we set out at the time

of our flotation in March. The fit between our existing business and the Overtis

Solutions business is extremely complementary and exciting. I look forward to

exploring the many opportunities now open to us to engage with customers and

partners not just here in the UK but also on an international basis."

Andy Durham, Managing Director of Overtis Solutions, commented:

"As our discussions progressed, it became increasingly clear to me that both

Digital Barriers and the team at Overtis Solutions share many common beliefs,

aspirations and viewpoints on the security space and its potential for growth.

I look forward to working as part of the Digital Barriers team as we capitalise

on that potential together, as a larger and broader solutions organisation."

For further details please contact:

+---------------------------------+-----------------+

| Digital Barriers plc | +44 (0)20 7940 |

| | 4740 |

+---------------------------------+-----------------+

| Tom Black, Executive Chairman | |

+---------------------------------+-----------------+

| Colin Evans, Managing Director | |

| | |

+---------------------------------+-----------------+

| | |

+---------------------------------+-----------------+

| Investec Investment Banking | +44 (0)20 7597 |

| | 5970 |

+---------------------------------+-----------------+

| Andrew Pinder / Erik Anderson | |

| | |

+---------------------------------+-----------------+

| | |

+---------------------------------+-----------------+

| Financial Dynamics | +44 (0)20 7831 |

| | 3113 |

+---------------------------------+-----------------+

| Edward Bridges / Matt Dixon | |

+---------------------------------+-----------------+

About Digital Barriers:

Founded by the leadership team behind Detica Group, Digital Barriers is focused

on the provision of specialist products and services to the homeland security

market where the threat of international and domestic terrorism represents a

compelling commercial opportunity. Over time, the Company aims to become a

mid-market specialist, working directly with end-customers and internationally

through key partner organisations, to provide focused, proportionate and

effective solutions for the protection of high-profile targets, crowded spaces

and the critical national infrastructure.

www.digitalbarriers.com

This announcement includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "plans", "projects", "anticipates", "expects",

"intends", "may", "will", or "should" or, in each case, their negative or other

variations or comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of places

throughout this announcement and include statements regarding the Company's

current intentions, beliefs or expectations concerning, among other things, the

Company's results of operations, financial condition, liquidity, prospects,

growth, strategies and the Company's markets. By their nature, forward-looking

statements involve risk and uncertainty because they relate to future events and

circumstances. Actual results and developments could differ materially from

those expressed or implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results. Any

forward-looking statements in this announcement are based on certain factors and

assumptions, including the Company's current view with respect to future events

and are subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the Company considers these

assumptions to be reasonable based upon information currently available, they

may prove to be incorrect. Save as required by law or by the AIM Rules for

Companies, the Company undertakes no obligation to publicly release the results

of any revisions to any forward-looking statements in this announcement that may

occur due to any change in the Company's expectations or to reflect events or

circumstances after the date of this announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUURARRUABUUR

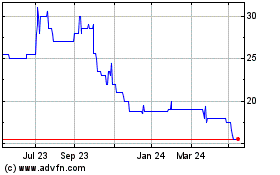

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

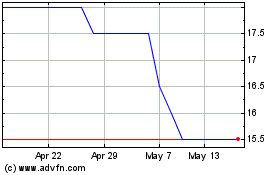

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024