Interim Results

September 20 2002 - 1:36PM

UK Regulatory

RNS Number:4790B

10 Group PLC

20 September 2002

10 Group plc, Interim Results to June 30, 2002.

The six months interim results to June 30, 2002, show a loss for the period of

#1.132 million.

We have continued to make considerable savings on overheads and the losses for

the interim period reported can largely be attributed to our continuing

withdrawal from media and marketing, with the majority from write downs of our

various investments.

In spite of tough trading conditions in the world stock markets, your board

continues to seek investment opportunities that offer prospects of growth.

We are continuing to develop our franchise, leisure and investment business and

I am pleased to announce that the first of two former "Dome" cafe restaurant

bars, in the modern Atlantic Wharf development in Cardiff, is now trading, with

the second, located in the centre of Birmingham's theatreland, expected to be

open soon. We acquired these sites for only #40,000 and consider them a low cost

business opportunity with potential to generate significant returns.

We have also signed two territory franchise agreements for greater Birmingham

and greater Manchester with OnePointfor Ltd to open two One Point sites, one in

Solihull, near Birmingham, and the other in Manchester, with the option to open

a further 18 sites - nine in each territory. We will also have the opportunity

to develop more sites in these and other locations.

One Point is a unique new franchise development, providing a stand-alone,

self-contained unit or in-line unit that will be located in shopping malls, rail

and bus stations and airports containing a cashpoint, mobile phone top up

facility, coffee, treats and snacks.

Despite difficult stock markets we raised further cash through equity issues. In

May we raised #249,000 by way of a placing and in June a further #150,000 was

raised by way of a placing of 500,000,000 shares at 0.03p per share via Seymour

Pierce Ellis Ltd.

We also acquired New York-based World Franchise Solutions (WFS)

(www.worldfranchisesolutions.com) for a consideration of $100,000 US, via our

subsidiary 10 Leisure plc. The total consideration of $100,000 was paid in

shares at 0.35 pence or the offer price on day of issue, whichever was the

greater, as $75,000 initially with $25,000 deferred and payable after six

months.

10 Group plc's shares are now listed as a Level 1 American Depository Receipt

(ADR), having been issued by the Bank of New York which is the authorised

depository. This listing can be viewed at

www.adrbny.com/dr_directory.jsp?country=GB.

These Level 1 ADRs are traded in the US markets and 10 Group plc joins other UK

plcs, ranging from from FTSE 100 companies such as Tesco plc to other AIM

companies.

10i, our investment division, has continued to hold a portfolio of investments

including other listed companies such as Bank Restaurant Group plc and Beaufort

Group International plc, which we are still confident in as investment decisions

in the long term.

10 Leisure is continuing to explore further Master Franchise Opportunities in

the UK, Republic of Ireland, Australia and New Zealand.

Thank you for your continued support.

Andy Moore, Chairman, 10 Group plc.

20 September, 2002

CONSOLIDATED PROFIT AND LOSS ACCOUNT

SIX MONTHS TO 30 JUNE 2002

6 MONTHS ENDED 6 MONTHS ENDED YEAR ENDED

30 JUNE 2002 30 JUNE 2001 31 DECEMBER

2001

(UNAUDITED) (UNAUDITED) (AUDITED)

#000 #000 #000

TURNOVER 581 3,386 4,593

COST OF SALES (361) (1,845) (2,991)

GROSS PROFIT 220 1,541 1,602

ADMINISTRATIVE EXPENSES (577) (1,844) (2,991)

OPERATING (LOSS) (357) (303) (1,389)

AMORTISATION OF GOODWILL - (36) (48)

EXCEPTIONAL ITEMS (724) (104) (293)

(1,081) (443) (1,730)

PROFIT ON DISPOSAL OF SUBSIDIARIES - 267 272

(LOSS) ON ORIDNARY ACTIVITIES BEFORE INTEREST (1,081) (176) (1,458)

INTEREST & SIMILAR CHARGES (11) (13) (41)

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION (1,092) (189) (1,499)

MINORITY INTEREST - - 48

Taxation (40)

LOSS ON ORDINARY ACTIVITIES AFTER TAXATION (1,132) (189) (1,451)

LOSS PER ORDINARY SHARE 0.07p 0.02 p 0.16 p

CONSOLIDATED BALANCE SHEET

SIX MONTHS TO 30 JUNE 2002

6 MONTHS ENDED 6 MONTHS ENDED YEAR ENDED

30 JUNE 2002 30 JUNE 2001 31 DECEMBER 2001

(UNAUDITED) (UNAUDITED) (AUDITED)

#000 #000 #000 #000 #000 #000

FIXED ASSETS

GOODWILL - 571 -

TANGIBLE ASSETS 856 406 886

INTANGIBLE ASSETS 50 57 253

INVESTMENTS 266 198 70

1,172 1,232 1,209

CURRENT ASSETS

BUILDING FOR SALE - 677 -

STOCK - 804 -

INVESTMENTS 604 749

DEBTORS 761 1,955 1,315

CASH 747 1,961 753

2,113 5,397 2,817

CREDITORS: AMOUNTS FALLING DUE WITHIN ONE YEAR (632) (2,196) (501)

NET CURRENT ASSETS 1,481 3,201 2,316

TOTAL ASSETS 2,653 4,433 3,525

CREDITORS: AMOUNTS FALLING DUE AFTER MORE THAN ONE (587) (449) (620)

YEAR

NET ASSETS 2,066 3,984 2,905

CAPITAL AND RESERVES

CALLED UP SHARE CAPITAL 9,483 8,956 9,362

SHARE PREMIUM ACCOUNT 6,988 6,798 6,816

CAPITAL REDEMPTION RESERVE 3,564 3,564 3,564

MERGER RESERVE - 213 -

PROFIT AND LOSS ACCOUNT (17,969) (15,547) (16,809)

EQUITY SHAREHOLDERS' FUNDS 2,066 3,984 2,933

MINORITY INTEREST - - (28)

2,066 3,984 2,905

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZGGZLNGVGZZM

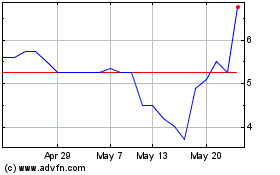

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024