Final Results

June 28 2002 - 7:43AM

UK Regulatory

RNS Number:9086X

10 Group PLC

28 June 2002

10 Group plc - Final Results

Preliminary results for the year ended 31 December 2001

10 Group plc, an AIM-listed investment, property and leisure company announces its year-end results

CHAIRMAN'S STATEMENT

Results for the year

The results for the year ended 31 December 2001 should be viewed in the light of the economic, political and

financial events of that period.

Early in 2001 we identified the start of an economic downturn in the media sector and as a consequence withdrew from

that business. The alternative would have been to continue to finance it. We decided in the light of falling

advertising revenues that this was not a viable proposition. Accordingly, we sold the magazine titles that we were

able to and placed the remainder of our publications business in receivership. We also announced the sale of CWG, our

advertising agency.

We decided to redirect our activities in less capital intensive directions. We have taken a number of master licences

for franchising established businesses in new territories. 10 Leisure plc, a subsidiary of 10 Group plc, signed an

agreement with Donato Food Corporation of Toronto, Canada, for the master licence for Mrs Vanelli's Pizza and Pasta

outlets and the Teriyaki Experience, sushi and teppanyaki-style food outlets. The master licences are for the

territories of the United Kingdom, Republic of Ireland, Australia and New Zealand.

10i, the investment arm of 10 Group plc, invested approximately £200,000 in Beaufort Group plc which is listed on the

Alternative Investment Market, for some 12 per cent of that company .

The loss for the year was £1.451m on a turnover of £4.593m.A significant amount of this loss was write offs and write

downs in the value of the Group's investments which amounted to £637,000. The directors do not recommend paying a

dividend for the year ended 31 December 2001.

During the year we raised for cash a further £940,000 gross of new capital from investors. We believe this to be a

considerable endorsement of our new strategy. The Group now has a stronger balance sheet than when I became Chairman

in 1998.

Current year and outlook

Simon Cooper, already a board director of 10 Group plc, was appointed Chief Executive in March this year.

In February this year, we acquired New York-based World Franchise Solutions for a consideration of US $100,000

through our subsidiary 10 Leisure plc. This acquisition is already presenting us with other Master Licence

opportunities for UK, Europe and Australia and New Zealand that we are actively pursuing.

In March we carried out a capital reconstruction which was agreed at an Extraordinary General Meeting of the company

on April 10, 2002.

In May and June, we raised a further £399,900 by way of a placing to enhance further our ability to develop our

franchising and leisure investments.

At the time of going to press with this report, we have just announced that 10 Leisure plc, a division of 10 Group

plc, has signed a territory franchise agreement for two territories, greater Birmingham and greater Manchester, with

Onepointfor Ltd to open two One Point sites, one in Birmingham and the other in Manchester, with an option to open a

further 18 sites (9 in each) in the above territories and with the opportunity to develop more sites in these and

other locations.

One Point is a unique new franchise development, providing a stand alone, self-contained unit or in-line unit that

will be located in shopping malls, rail and bus stations and airports containing cashpoint, mobile phone top up

facility, coffee, treats and snacks (see www.onepointfor.com).

Today the Group consists of the following core activities:

- 10i plc - invests in smaller quoted companies and private companies.

- 10 Leisure plc - owner and operator of Master franchising licences including:

o Mrs Vanellis-Quick service Italian food

o Made in Japan-The Teriyaki Experience- Quick service Japanese food

o One point Kiosk with ATM, Mobile phone top up machine, coffee, doughnuts and treats.

- World Franchise Solutions - Franchise consultancy.

- 10 Property - Servicing existing properties that are freehold/leasehold and sub-let to various tenants.

During 2002 your Board has taken all the necessary steps to reduce cash outflow, including staff reductions. In

addition the Directors have deferred part of their salary payments for the immediate future.

Your Board is committed to the protection of your investment and the ultimate success of 10 Group plc. We thank you

for your support and loyalty in these difficult times.

Andy Moore

Chairman

28th June 2002

10 GROUP PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED

31st DECEMBER 2001

2001 As restated 2000

Before Before Total Before Before Total

charging charging Goodwill charging charging Goodwill

goodwill goodwill Amortisati- goodwill goodwill Amortisati-

and and on and and on

exceptional exceptional and exceptional exceptional and

items exceptional £'000 exceptional £'000

items items items items items

Contin-uing Discon-

£'000 tinued

£'000 Continuing Discon- £'000

£'000 £'000 tinued

£'000

Turnover

- Existing 1556 - - 156 2105 - - 2105

operations

- Discontinued - 3037 - 3037 - 5614 - 5614

operations _______ ______ _______ ______ ______ _______ ______ _____

1556 3037 - 4593 2105 5614 - 7719

Cost of sales (1276) (1715) - (2991) (1472) (3536) - (5008)

_______ ______ _______ ______ ______ _______ ______ _____

Gross profit 280 1322 - 1602 633 2078 - 2711

Administrative (1220) (1771) (48) (3039) (1430) (3530) (1538) (6498)

expenses - - (293) (293) - - - -

Exceptional

Items ______ ______ _______ ______ ______ _______ ______ _____

Operating

loss

-Existing (940) - (141) (1081) (797) - (416) (1213)

operations

-Discontinued - (449) (200) (649) - (1452) (1122) (2574)

______ ______ _______ ______ ______ _______ ______ _____

operations

(940) (449) (341) (1730) (797) (1452) (1538) (3787)

______ ______ _______ ______ _______ ______

Profit/(loss) 272 206

on

disposal and

closure of

business

Net interest (41) 57

(payable)/ ______ _____

receivable

Loss on ordinary (1499) (3524)

activities before

taxation

Taxation - -

______ _____

Loss on ordinary (1499) (3524)

activities after

taxation

Minority interests 48 -

______ _____

Loss for the financial year (1451) (3524)

______ _____

Loss per ordinary 0.16p 0.55p

share

Basic

A Statement of total recognised gains and losses is not provided as all such items are included within the above

profit and loss account.

10 GROUP PLC

CONSOLIDATED BALANCE SHEET

31st DECEMBER 2001

2001 2000

£'000 £'000 £'000 £'000

FIXED ASSETS

Intangible assets 253 970

Tangible assets 886 660

Investments 70 121

_______ _______

1209 1751

CURRENT ASSETS

Stock - 536

Freehold property for sale

Investments - 677

Debtors 749 217

Cash at bank and in hand 1315 2353

753 2629

______ _______

2817 6412

CREDITORS: AMOUNTS FALLING DUE (501) (4000)

WITHIN ONE YEAR ______ _______

NET CURRENT ASSETS 2316 2412

______ _______

TOTAL ASSETS LESS CURRENT 3525 4163

LIABILITIES

CREDITORS: AMOUNTS FALLING DUE (620) (609)

AFTER MORE THAN ONE YEAR ______ _______

NET ASSETS 2905 3554

______ _______

CAPITAL AND RESERVES

Called up share capital 9362 8327

Share premium account

Capital redemption reserve 19 6816 6808

Merger reserve

Profit and loss account 3564 3564

- 213

(16809) (15358)

_______ _______

Equity shareholders' funds 2933 3554

Minority interests (28) -

_______ _______

2905 3554

_______ _______

These financial statements were approved by the board of directors on 25th June 2002.

A. MOORE DIRECTOR

S.P. COOPER DIRECTOR

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED

31st DECEMBER 2001

2001 2000

£'000 £'000

OPERATING ACTIVITIES (1778) (3074)

RETURNS ON INVESTMENTS AND

SERVICING OF FINANCE (41) 57

CAPITAL EXPENDITURE (59) (422)

ACQUISITIONS AND DISPOSALS 308 (192)

_______ ______

NET CASH OUTFLOW BEFORE FINANCING (1570) (3631)

MANAGEMENT OF LIQUID RESOURCES (884) (227)

FINANCING 984 3203

_______ ______

DECREASE IN CASH (1470) (655)

______ _______

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

FOR THE YEAR ENDED

31st DECEMBER 2001

2001 2000

£'000 £'000

DECREASE IN CASH IN THE YEAR (1470) (655)

Cash inflow/(outflow) from changes in debt and leasing 59 (405)

______ ______

CHANGE IN NET DEBT RESULTING FROM (1411) (1060)

CASH FLOWS

New finance leases (61) (167)

Finance leases acquired - (106)

Finance leases disposed 180 -

Loan notes converted to share capital - 160

Cash outflow from increase in liquid resources 884 227

Market value provision on current asset investments (252) (10)

Reclassification of current asset investments (100) -

_______ ______

MOVEMENT IN NET DEBT IN THE YEAR (760) (956)

Net funds at 31st December 2000 1532 2488

_______ ______

NET FUNDS AT 31st DECEMBER 2001 772 1532

_______ ______

The full report and accounts for the year ended 31st December, 2001 are being posted to shareholders and are

available from the offices of the company at 10 Clement Street, Birmingham, B1 2SL.

Enquiries

Andy Moore - Chairman,

10 Group plc,

10 Clement Street,

Birmingham B1 2SL

Tel: 0121 233 1122

See also www.10group.co.uk

OR

Andy Skinner,

Marketing Management

Tel: 01527 892004

Mobile: 07990 978257

END

This information is provided by RNS

The company news service from the London Stock Exchange

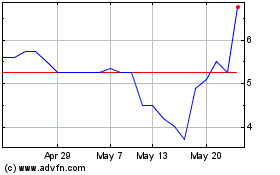

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024