Final Results

June 15 2001 - 12:00PM

UK Regulatory

RNS Number:3244F

10 Group PLC

15 June 2001

10 Group plc - Final Results

Preliminary results for the year ended 31 December 2000

10 Group plc, an AIM-listed investment, property and leisure company

announces its year-end results

Chairman's Statement.

2000 Year and Results

We have now completed our second full year under my chairmanship. This was a

year of considerable corporate activity.

In February, we launched 10i Ltd, which was originally our Internet

investment fund, now a general investment company. Further announcements

during the year related to investments made by 10i Ltd, in particular we made

an investment into RexOnline plc another AIM quoted company, of #217,000 and

realised a profit in March 2000 of #545,000 before expenses on the sale of

that investment in just over 3 months.

We also invested in Bon Appetit Direct.com plc, another AIM quoted company,

now called 7 Group plc.

We raised a further #2.85 million in cash during the year from equity issues

and we made a total of 22 Stock Exchange announcements in 2000.

Despite difficult market conditions we remained one of the most traded stocks

on AIM out of a total of approximately 550 companies, still retaining five

market makers.

The loss for the year was #3.524m on a turnover of #7.719m. The directors do

not recommend paying a dividend for the year ending December 31, 2000.

A significant proportion of the loss can be ascribed to the writing off of

goodwill and exceptional items, amounting to some #2.594m. Our actual

operating loss was #1.193m. However I am pleased to report that the Group's

Balance Sheet remains healthy with net assets of #3.554m and cash reserves of

#2.629m.

Outlook and current year

At the end of the financial year to December 31, 2000, as Chairman I needed

to make some harsh and radical decisions during 2001 and your Board took

swift action to redirect the Group's focus and cash resources on areas where

felt there was more certain short to medium term prospects of making profit.

We are withdrawing from marketing/media and internet related activities to

focus on investment in public and private companies where we feel

opportunities exist to achieve significant return on investment and capital

growth, property, and our new leisure division, 10 Leisure plc - more news

due later in the year.

CWG (formerly Charles Wall Group) and Internet Evolution (formerly 10

Internet) remain as wholly owned operating subsidiaries of 10 Group but it is

envisaged that these will become investments in our 10i division later this

year.

After acquiring the Mill House Media publishing operation a global downturn

in advertising revenue impacted severely on our publishing division and most

of the directors and staff left soon after our acquisition, including the

Managing Director.

The publishing operation was making substantial losses far in excess of the

targets provided by the departed operating board of directors of that

division, and 10 Group plc could not continue to fund these losses, without

affecting other Divisions of the Group and weakening the Group's cash

reserves substantially, although it was envisaged that the publishing

division would have made a profit within two years. The Board considered that

the risk of making further investment in this division outweighed the likely

return.

With deep regret, I took the decision to place our subsidiary into

administrative receivership on 30th March 2001 under the debenture that 10

Group plc held over the assets of that division. This decision was taken to

recoup some of our investment in the Publishing Division.

I am pleased to report that in early 2001 we sold one of the Publishing

Division's magazine titles for #395,000 cash and we remain hopeful of

realising further value from the remaining assets of that Division.

Paul Harvey, the Chief Executive, resigned at the end of January 2001. Paul

has been a personal friend of mine of many years and was instrumental in the

birth of 10 Group plc. The Board would like to take this opportunity to thank

him for his contribution to the development of 10 Group and wish him well in

the future.

The first half of this year, 2001, has been spent reducing overheads, and

disposing of non-performing businesses and investments, including putting our

Head Office in Birmingham, which was too large for our requirements, up for

sale.

I am pleased to report that on 12th April 2001 we raised a further #590,000

before expenses via a private placing which will be used to fund new

opportunities in Leisure and Investment. I believe this to be a vote of

confidence from the City in 10 Group plc and its Board and the new direction.

I am also pleased to report that on the 1st June 2001 10 Group plc signed an

agreement with Friedland Capital to have 10 Group's shares listed as a Level

1 American Depository Receipt (ADR). These ADRs will be issued by the Bank of

New York who are the authorised depository and will be traded in the USA

markets. The creation of ADRs will prove beneficial in opening up the huge US

investor markets to 10 Group and further enhance the liquidity of its shares.

As chairman my role is to increase shareholder value. This can involve

complete changes of strategy as we have done, if certain businesses and

investments do not produce the expected results.

Your Board is confident that the new strategy will produce positive results

in the coming years and enhance shareholder value, and we hope that the share

price will reflect the Group's value, potential and entrepreneurial skills.

Thank you for your continued support.

Andy Moore,

Chairman,

10 GROUP PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED

31st DECEMBER 2000

2000

Notes Before Before

charging charging Goodwill

goodwill goodwill Amortisation

and and and

exceptional exceptional exceptional

items items items Total

Continuing Discounted

#'000 #'000 #'000 #'000

Turnover

- Existing 5519 - - 5519

operations 945 - - 945

- Acquisitons

- Discontinued - 1255 - 1255

operations _____ ______ ______ _____

6464 1255 - 7719

Cost of sales (3735) (1273) - (5008)

_____ ______ ______ _____

Gross profit/(loss) 2729 (18) - 2711

Administrative (3922) (1038) (1538) (6498)

expenses ______ _____ ______ _____

Operating

profit/(loss)

-Existing (1484) - (706) (2190)

operations 291 - - 291

-Acquisitions

-Discontinued - (1056) (832) (1888)

operations ______ ______ ______ _____

(1193) (1056) (1538) (3787)

______ ______ ______

Profit/(loss) on 206

disposal and

closure of

business

Net interest 57

receivable _____

Loss on ordinary (3524)

activities before

taxation

Taxation -

_____

Loss for the (3524)

financial year _____

Loss per

ordinary share

Basic 0.55p

As restated

1999

Notes Before Before

charging charging Goodwill

goodwill goodwill Amortisation

and and and

exceptional exceptional exceptional

items items items Total

Continuing Discounted

#'000 #'000 #'000 #'000

Turnover

- Existing 9044 - - 9044

operations - - - -

- Acquisitons

- Discontinued - 197 - 197

operations _____ _____ _____ _____

9044 197 - 9241

Cost of sales (5380) (226) - (5606)

_____ _____ _____ _____

Gross profit/(loss) 3664 (29) - 3635

Administrative (4654) (134) (189) (4977)

expenses _____ _____ _____ _____

Operating

profit/(loss)

-Existing (990) - (189) (1179)

operations - - - -

-Acquisitions

-Discontinued - (163) - (163)

operations _____ _____ _____ _____

(990) (163) (189) (1342)

_____ _____ _____

Profit/(loss) on (56)

disposal and

closure of

business

Net interest -

receivable _____

Loss on ordinary (1398)

activities before

taxation

Taxation -

_____

Loss for the (1398)

financial year _____

Loss per

ordinary share

Basic 0.43p

A Statement of total recognised gains and losses is not provided as all such

items are included within the above profit and loss account.

10 GROUP PLC

CONSOLIDATED BALANCE SHEET

31st DECEMBER 2000

Notes

2000 1999

#'000 #'000 #'000 #'000

FIXED ASSETS

Intangible assets 970 720

Tangible assets 660 360

Investments 121 -

_______ ______

1751 1080

CURRENT ASSETS

Stock 536 79

Freehold property for sale 677 -

Investments 217 -

Debtors 2353 1576

Cash at bank and in hand 2629 2993

_______ ______

6412 4648

CREDITORS: AMOUNTS FALLING DUE (4000) (2381)

WITHIN ONE YEAR _______ ______

NET CURRENT ASSETS 2412 2267

______ ______

TOTAL ASSETS LESS CURRENT 4163 3347

LIABILITIES

CREDITORS: AMOUNTS FALLING DUE (609) (173)

AFTER MORE THAN ONE YEAR ______ ______

NET ASSETS 3554 3174

______ ______

CAPITAL AND RESERVES

Called up share capital 8327 8004

Share premium account 6808 3915

Capital redemption reserve 3564 3564

Merger reserve 213 213

Profit and loss account (15358) (12522)

______ ______

EQUITY SHAREHOLDERS' FUNDS 3554 3174

______ ______

These financial statements were approved by the board of directors on 14 June

2001

A. MOORE DIRECTOR

S. COOPER DIRECTOR

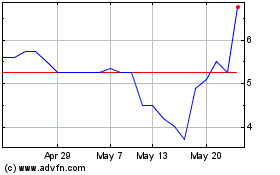

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024