Tatton Asset Management PLC Acquisition of Sinfonia Asset Management Limited

October 17 2019 - 2:00AM

RNS Non-Regulatory

TIDMTAM

Tatton Asset Management PLC

17 October 2019

17 October 2019

None of the information contained in this announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014, nor does it contain

any information that is required to be announced via a Regulatory

Information Service under the AIM Rules for Companies.

Tatton Asset Management plc (or the 'Group')

Acquisition of Sinfonia Asset Management Limited (SAM)

Tatton Asset Management plc (AIM: TAM), the on-platform

discretionary fund management (DFM) and IFA support services

business, is pleased to announce the recent acquisition of the

entire issued share capital of Sinfonia Asset Management Limited

(SAM), a wholly owned subsidiary of the Tenet Group (Tenet) for up

to GBP2.7 million.

Background to the transaction

The growth of our AUM is at the core of Tatton's strategy. To

achieve this, we will continue to develop our centralised

investment proposition while enhancing and evolving our product

offerings for our firms' advisers and their clients, both

organically and through acquisition. In line with this, SAM was

identified as providing a good strategic fit and comprises five

risk-targeted funds with a total AUM of GBP135 million. These five

additional funds will complement TAM's existing fund range and give

IFAs' clients further access to a range of investments balanced to

reflect a particular risk profile.

Financial impacts

The consideration of up to GBP2.7 million will be satisfied out

of existing cash resources. GBP2.0 million was payable on

completion with the remaining balance payable against specific AUM

targets in two equal instalments at the end of years one and two

post completion. Further details of the financial impacts will be

set out at the time of our Interim Results in November.

Commenting on the transaction Paul Hogarth, Founder and CEO of

Tatton Asset Management plc, said:

"Following the strategic partnership agreement with the Tenet

Group which we announced in June of this year, we are delighted to

have acquired the Sinfonia range of funds from Tenet. The

acquisition of these funds continues to strengthen our relationship

with Tenet and complements our current portfolio range of

investments which both broadens our proposition to the wider

investment community and contributed to the Group reaching the GBP7

billion AUM milestone."

Enquiries:

Tatton Asset Management plc

Paul Hogarth (Chief Executive Officer) +44 (0) 161 486 3441

Paul Edwards (Chief Financial Officer)

Lothar Mentel (Chief Investment Officer)

Zeus Capital - Nomad and Broker

Martin Green (Corporate Finance) +44 (0) 20 3829 5000

Dan Bate (Corporate Finance and QE)

Pippa Hamnett (Corporate Finance)

Media Enquiries

Roddi Vaughan-Thomas +44 (0) 20 7190 2952

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRAGGGWCUUPBGUA

(END) Dow Jones Newswires

October 17, 2019 02:00 ET (06:00 GMT)

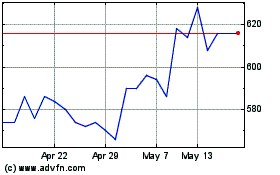

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

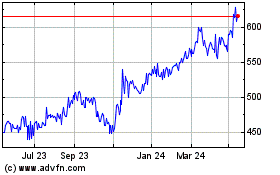

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Nov 2023 to Nov 2024