U.K. House Market Cools in April

May 11 2016 - 7:40PM

Dow Jones News

LONDON—The U.K. housing market cooled in April for the first

time in over a year, a fresh sign that uncertainty over the outcome

of a coming referendum on Britain's membership of the European

Union is weighing on the economy.

The Royal Institution of Chartered Surveyors said Thursday in a

survey of more than 300 of its members that demand for homes in

April fell, with the percentage of surveyors reporting a decline in

new-buyer inquiries exceeding those reporting an increase by 22

points, the widest margin since March 2015.

The institution, which trains and accredits real estate

surveyors world-wide, said the fall in demand was visible across

the U.K. and in part reflects extra caution among home buyers ahead

of the referendum June 23.

"Uncertainty is a word that features heavily in the feedback we

are receiving from members," said RICS Chief Economist Simon

Rubinsohn.

Higher property-transaction taxes introduced last month have

also dented demand, Mr. Rubinsohn said. On April 1, a change to

U.K. stamp duty added an additional 3% on buyers of second homes

and rental properties.

Britain's market for high-end homes saw a spike in activity

ahead of the new tax, according to U.K. real-estate broker Savills

PLC. "Since then, the volume of activity has moderated, as we

anticipated, in advance of the referendum," Savills said in a

statement Wednesday.

The debate over the U.K.'s future in Europe stepped up a gear

this week, with senior figures on both sides setting out their

stall on what so-called "Brexit" might mean for the economy,

Britain's influence in the world and its national security.

Polls show the public is split on whether to stay in the

28-member union or go it alone.

The economy has become a key battleground in the opposing

campaigns, with supporters of Brexit arguing that Britain would be

richer if it dumped onerous EU regulation and pursued new

free-trade deals with fast-growing parts of the world.

Arrayed against them are institutions including the Organization

for Economic Cooperation and Development, the International

Monetary Fund and the U.K. Treasury, all of which warn leaving the

EU would probably make Britain poorer than staying in the 28-member

union.

Bank of England officials have said weakening business

investment and slipping consumer confidence are among the signs

that the economy is slowing ahead of the vote, as businesses and

consumers put spending plans on hold until after the result is

known.

Commercial property investors have paused ahead of the vote,

with U.K. transaction volumes in the first quarter at £ 10.9

billion down 43% from the same period in 2015, according to

data-provider Real Capital Analytics. Property chiefs have warned

that a vote to leave the EU could cause commercial property values

to fall, especially in London.

In the housing market, RICS expects prices to keep rising

despite the dip in demand, given a shortage of new homes.

Write to Jason Douglas at jason.douglas@wsj.com and Art Patnaude

at art.patnaude@wsj.com

(END) Dow Jones Newswires

May 11, 2016 19:25 ET (23:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

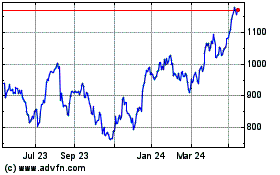

Savills (LSE:SVS)

Historical Stock Chart

From Jun 2024 to Jul 2024

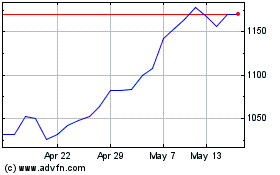

Savills (LSE:SVS)

Historical Stock Chart

From Jul 2023 to Jul 2024