TIDMAISI

RNS Number : 0485M

Aisi Realty Public Limited

09 August 2011

Aisi Realty Public Limited

("Aisi" or the "Company")

Final Results for the year ended 31 December 2010

Aisi Realty Public Limited (AIM: AISI), a property investment

company focusing on development projects and related investments in

Ukraine, announces its audited results for the year ended 31

December 2010.

Highlights:

Financial Summary:

o Investment portfolio valued by DTZ at $43.9 million (2009:

$58.2 million)

o Net asset value was $25.0 million (2009: $49.7 million)

o Net asset value per share of $0.06 (2009: $0.12)

o Loss before tax was $25.2 million (2009: 39.2 million)

Operational Summary:

o Brovary warehouse is now 21% leased

o Continuing negotiations with a number of international

logistics operators

o In May 2011 the Group signed a restructuring agreement with

EBRD for the repayment of the outstanding principal amount of

$15.5m to be deferred until September 2012.

Enquiries:

AISI Realty Public Ltd

Paul Ensor, Chairman +44 (0)7595 219011

Beso Sikharulidze +38 (0)44 459 3000

Seymour Pierce Limited

Nandita Sahgal / David Foreman (Corporate

Finance) +44 (0)20 7107 8000

Leti McManus (Corporate Broking)

REPORT OF THE BOARD OF DIRECTORS

The Board of Directors presents its report and audited

consolidated financial statements of Aisi Realty Public Limited

(the Company) and its subsidiaries (the Group) for the year ended

31 December 2010.

Principal activity

The principal activity of the Group, which is unchanged from

last year, is the investment in real estate in major population

centers in Ukraine, with a particular focus on the capital city,

Kiev.

Review of current position, future development and significant

risks

Whilst we have only one bank debt and numerous uncharged assets,

the Group's financial position as presented in the consolidated

financial statements is not considered satisfactory by the

Directors, and they have been working on a number of strategic

opportunities to secure adequate working capital and make the

Group's operations profitable.

In May of 2011 the Group signed a restructuring agreement with

EBRD for the repayment of the outstanding principal amount of

US$15.5m to be deferred until September 2012. This is the only bank

debt of the Group.

Whilst the restructuring of the EBRD facility is the first step

in securing the ongoing financial position of the Group, given the

small contracted rental income to date, the available working

capital of the Group continues to be very tight. On 20 June 2011

the Group was not able to meet the interest payment due, and plans

to remedy the situation once the funding explained below is

concluded.

On 1 June 2011 the Company made a further announcement that it

had requested that trading in the Existing Ordinary Shares on AIM

be suspended until such time that it had secured all necessary

funding to enable to it to carry on as a going concern.

The discussions with an independent third party investor group,

namely South East Continent Unique Real Estate (SECURE) Management

("Secure Management"), have now been concluded and the Board is

pleased to announce that the Company has entered into a

Subscription Agreement with Narrowpeak Consultants Limited (the

"Investor"), a member of the Secure Management group, conditional

on, inter alia, the Proposed Investment Resolutions (as set out in

the Notice of First EGM) being passed by the shareholders at the

First EGM and completion of due diligence to the satisfaction of

the Investor, following which the Investor proposes to make a

substantial investment in the Company on certain terms.

The Brovary Warehouse is currently 21% leased and we are pleased

to report that we are continuing negotiations (some being at an

advanced stage) with a number of international logistics operators,

and expect a positive conclusion in the near future such as full

coverage of leasable area, which should provide improved visibility

on the ongoing cash generation of the property.

The Board of Directors has discussed and agreed on the potential

structure of the management internalisation which will be proposed

to the shareholders at a General Meeting in the coming few

weeks.

Considering the current market conditions, the Board of

Directors has decided to focus the strategy of the Group away from

speculative development to investing in income generating assets.

The focus will now be on warehouses and big box retail, with well

established international tenants with long term leases. We have

built a strong pipeline of potential new investments. All other

non-core assets will be used to generate additional equity for

implementing a new strategic focus.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended 31 December 2010

2010 2009

US$ US$

Revenue from operations

Fair value losses on investment

property (19 965 122) (17 470 085)

Other income, net 25 292 (523)

(19 939 830) (17 470 608)

Expenses

Administration expenses (5 978 087) (5 946 723)

Finance income/(costs), net 115 527 (4 872 270)

Other income/(expenses), net 561 733 (10 882 650)

Loss before tax (25 240 657) (39 172 251)

Tax - (10)

Net loss for the year (25 240 657) (39 172 261)

Other comprehensive income

Translation to presentation currency 22 430 973 378

Total comprehensive income for

the year (25 218 227) (38 198 883)

-------------- -------------

Loss attributable to:

Equity holders of the parent (24 934 873) (38 901 144)

Non controlling interest (305 784) (271 117)

-------------

(25 240 657) (39 172 261)

============== =============

Loss and total comprehensive income

attributable to:

Equity holders of the parent (24 933 034) (37 879 359)

Non controlling interest (285 193) (319 524)

-------------

(25 218 227)) (38 198 883)

============== =============

Losses per share attributable

to equity holders

of the parent (cent) (6) (14)

-------------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 December 2010

2010 2009

US$ US$

ASSETS

Non current assets

Property, plant and equipment 54 783 72 764

Investment property under construction 10 300 000 35 319 000

Investment property 33 631 000 22 873 000

Advances for investments 6 000 000 9 297 945

VAT non-current 2 926 939 3 213 709

52 912 722 70 776 418

------------- -------------

Current assets

Accounts receivable 3 487 598 1 776 063

Cash and cash equivalents 291 053 5 020 657

3 778 651 6 796 720

------------- -------------

Total assets 56 691 373 77 573 138

------------- -------------

EQUITY AND LIABILITIES

Equity and reserves attributable

to owners of the parent

Share capital 5 431 918 5 431 918

Share premium 94 523 283 94 523 283

Accumulated losses (74 217 972) (49 283 099)

Advances from shareholders 223 118 -

Other reserves 68 390 68 390

Translation reserve (1 068 153) (1 069 992)

------------- -------------

24 960 584 49 670 500

------------- -------------

Non-controlling interest 1 030 793 1 315 986

Total equity 25 991 377 50 986 486

------------- -------------

Non current liabilities

Long - term borrowings 15 529 412 15 529 412

Obligations under finance leases 591 245 589 249

Accounts payable 673 078 766 365

------------- -------------

16 793 735 16 885 026

------------- -------------

Current liabilities

Short - term borrowings 41 237 508 555

Accounts payable 13 234 905 8 534 465

Obligations under finance leases 44 969 73 675

Current tax liabilities 510 240 510 240

Provision for litigation claims 74 910 74 691

------------- -------------

13 906 261 9 701 626

------------- -------------

Total liabilities 30 699 996 26 586 652

------------- -------------

Total equity and liabilities 56 691 373 77 573 138

============= =============

On 8 August 2011 the Board of Directors of Aisi Realty Public

Limited authorised these financial statements for issue.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Year ended 31 December 2010

Other

reserves Advances

Share Share Accumulated (Note for issue Translation Non-controlling

capital premium loss 10) of shares reserve Total interest Total

US$ US$ US$ US$ US$ US$ US$ US$ US$

--------- --------- ---------------- ---------- ----------- ------------ -------- ---------------- ---------------

Balance as at 1 2 283 92 683 (10 381 (2 091 82 540 1 635 84 175

January 2009 299 930 955) 46 710 - 777) 207 510 717

========= ========= ================ ========== =========== ============ ======== ================ ===============

Total

comprehensive

income for the (38 901 (38 901 (39 172

year - - 144) - - - 144) (271 117) 261)

Increase of 3 148 1 839 4

share capital 619 353 - - - - 987972 - 4 987972

Translation to

presentation 1

currency - - - - - 1 021 785 021785 (48 407) 973 378

Directors'

options - - - 21 680 - - 21 680 - 21 680

Balance as at 31

December 2009 / 5 431 94 523 (49 283 (1 069 49 670 1 315 50 986

1 January 2010 918 283 099) 68 390 - 992) 500 986 486

========= ========= ================ ========== =========== ============ ======== ================ ===============

Total

comprehensive

income for the (24 934 (24 934 (25 240

year - - 873) - - - 873) (305 784) 657)

Advances from

shareholders - - - - 223 118 - 223 118 - 223 118

Translation to

presentation

currency - - - - - 1 839 1 839 20 591 22 430

Balance as at 31 5 431 94 523 (74 217 (1 068 24 960 1 030 25 991

December 2010 918 283 972) 68 390 223 118 153) 584 793 377

========= ========= ================ ========== =========== ============ ======== ================ ===============

CONSOLIDATED STATEMENT OF CASH FLOWS

Year ended 31 December 2010

2010 2009

US$ US$

Operating activities

Profit/(loss) before tax (25 240 657) (39 172 251)

Adjustments for:

Depreciation of property, plant and

equipment 81 183 60 881

Advances for investments impairment

(reversal) / loss (780 267) 6 128 205

Foreign exchange losses/(gain) (263 388) 2 301 804

Loss on revaluation of investment property 19 965 122 17 470 085

Loss/(gain) from discounting VAT (1 050 843) 2 398 890

Other non-cash changes in investment

property (3 541 458)

Receivables impairment loss 111 899 1 253 167

Property, plant and equipment impairment

loss - 95 772

Other expenses - 141 218

Interest income (84 694) (15 553)

Interest expense 1 150 869 7 209

Operating loss before working capital

changes (9 652 234) (9 330 573)

Increase in advances to related parties (4) (1 252)

(Increase)/Decrease in prepayments and

other

current assets (1 311 786) (314 523)

Increase in trade and other payables 1 110 659 2 515 095

Increase in payables due to related

parties 3 652 706 2 752 894

Cash flows used in operating activities (6 200 659) (4 378 359)

------------- -------------

Investing activities

Decrease in prepayments under development

contracts - 2 511 292

Decrease/(Increase) in advances for

investments 4 640 494 68 244

(Decrease)/Increase in payables to

constructors (156 212) (196 767)

Additions to investment property (1 946 719) (13 106 851)

Changes of property, plant and equipment (2 498) (20 883)

Increase in VAT receivable (871 735) (2 055 671)

Increase/(Decrease) in financial lease

liabilities (26 710) 576 941

Interest received 84 694 15 553

Cash flows used in investing activities 1 721 314 (12 208 142)

------------- -------------

Financing activities

Proceeds from shareholders advances

/ proceed 223 118 4 987 972

from issue of share capital

Proceeds from bank loan (470 588) 16 000 000

Proceeds from other borrowings 12 4 321

Net cash (used in) / from financing

activities (247 458) 20 992 293

------------- -------------

Effect of foreign exchange rates on

cash and cash equivalents (2 801) 579 132

Net (decrease) / increase in cash and

cash equivalents (4 729 604) 4 984 924

------------- -------------

Cash and cash equivalents:

At beginning of the year 5 020 657 35 733

At end of the year 291 053 5 020 657

============= =============

NOTES TO THE ACCOUNTS

Basis of preparation

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union (EU) and the requirements of the

Cyprus Companies Law, Cap.113. The consolidated financial

statements are presented in United States Dollars (US$). The

consolidated financial statements have been prepared under the

historical cost convention as modified by the revaluation of

investment property and investment property under construction to

fair value.

The preparation of financial statements in conformity with IFRSs

requires the use of certain critical accounting estimates and

requires management to exercise its judgement in the process of

applying the Group's accounting policies. It also requires the use

of assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Although these

estimates are based on management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates.

The Company's Annual Report and Accounts for the year ended 31

December 2010 have been posted to shareholders and copies are

available on the Company's website: www.aisicap.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKRVRARAWRAR

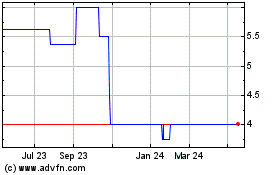

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024