TIDMSOHO

RNS Number : 7545A

Triple Point Social Housing REIT

14 September 2018

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

14 September 2018

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2018

The Board of Triple Point Social Housing REIT plc (ticker:

SOHO), the specialist REIT that invests in primarily newly

developed social housing assets in the UK (let or pre-let to

Approved Providers), with a particular focus on supported housing,

today announced the Company's half year results for the six months

ended 30 June 2018.

This is the Group's first full six month period to 30 June. Our

first audited results related to trading from incorporation on 12

June 2017 to 31 December 2017.

Financial highlights

-- The IFRS Net Asset Value ("NAV") and EPRA NAV per share of

101.61 pence at 30 June 2018 (at 31 December 2017: 100.84 pence),

an increase of 0.76% in the period. The IFRS NAV per share at IPO

was 98.00 pence, an increase of 3.68% to 30 June 2018.

-- At the half year end, the portfolio was independently valued

at GBP190.0 million on an IFRS basis, reflecting a valuation uplift

of 8.53% against the portfolio's aggregate purchase price

(excluding transaction costs).

o The valuation reflects a portfolio yield of 5.32%, against the

portfolio's net initial yield at purchase of 5.91% (excluding

forward funding transactions).

-- The Group's assets were valued at GBP203.4 million on a

portfolio valuation basis, reflecting a portfolio premium of

GBP13.4 million against the IFRS valuation.

o A portfolio valuation basis assumes the portfolio of

properties is held in a single Special Purpose Vehicle ("SPV")

holding structure, is sold to a third party on arm's length terms

and attracts purchaser's costs of 2.3%.

-- 3.5 pence per ordinary share: dividends paid or declared to date since IPO.

-- The Company is on track to pay an initial total dividend of

5.0 pence per Ordinary Share (in respect of the Company's first

full financial year to 31 December 2018) in line with the Company's

stated target at launch*.

-- The Company intends to increase this target dividend

thereafter in line with inflation, at a rate reflecting the

CPI-based rent reviews typically contained in the Leases of the

assets within the Portfolio*.

-- Earnings per share was 3.02 pence for the period.

-- The Company raised GBP47.5 million (GBP46.5 million net of

proceeds) at an issue price of 100 pence per share through a

Placing, Open Offer and Offer for Subscription of C shares in March

2018.

-- Ongoing Charges ratio of 1.85%.

o Increase largely attributable to the C Shares being treated as

a financial liability, not increasing the Net Asset Value, but

incurring costs which are included in the ongoing charges

calculation. If the Ordinary Shares arising on conversion of the C

Shares had been in issue on 30 June 2018, the ongoing charges ratio

at 30 June 2018 would be 1.50%.

Operational highlights

-- The Group has made further commitments totalling GBP51.5

million (excluding transaction costs) in relation to the

acquisition and development of UK social housing assets as at 30

June 2018.

-- During the period to 30 June 2018, the Group acquired 51 new assets.

o Since IPO, the Company has purchased 167 properties with an

aggregate net purchase price of GBP175 million (including

costs).

-- The majority of the Group's assets are still located in the

Midlands and the North of England, however, in the first six months

of this year we increased our percentage of assets acquired in the

South of England, which has given the portfolio a stronger

geographical balance, and we expect this trend to continue for the

remainder of 2018.

-- As at 30 June 2018, the contracted rental income was GBP10.4 million per annum.

-- 100% of the Group's portfolio was fully let or pre-let and

income producing during the period.

-- As at 30 June 2018, the Investment Portfolio comprised 1,158

self-contained units, 100 leases with 12 Approved Providers with

the weighted average unexpired lease term of 29 years (including

put and call options).

-- 100% of the contracted rental income is either CPI or RPI linked.

-- In March 2018, the Company gained entrance to the FTSE

All-Share index and in June we were included in the FTSE

EPRA/NAREIT Global Real Estate Index Series.

Post Period Balance Sheet Activity

-- An interim dividend in respect of the period 1 April to 30

June 2018 of 1.25 pence per Ordinary Share was declared on 16

August 2018. The Board also declared dividends payable to holders

of C Shares comprising a fixed dividend of 3% per annum pro rated

for the period from admission to trading on 27 March to 30 August

2018. The dividends will be payable on or around 28 September 2018

to shareholders on the register on 24 August 2018.

-- On 30 August 2018, the C Shares converted into Ordinary

Shares on the basis of their respective NAV per share on 30 June

2018, adjusted for the dividends payable on 28 September 2018 and

the fair value gain on an acquisition by the C Share class that had

exchanged by 30 June 2018 but not completed. The effect of these

transactions has diluted the NAV after conversion to 101.44

pence.

-- The Company has announced the acquisition of 41 supported

housing properties, comprising 306 units in total, for an aggregate

purchase price of approximately GBP46.9 million (excluding costs)

as at 13 September 2018(1).

-- The Company has entered into a long dated, fixed rate,

interest only financing arrangement for an amount of GBP68.5

million with a US life insurance company. The loan notes represent

a loan-to-value of 40% of the value of the secured pool of assets

and have a weighted duration of 12 years and a blended coupon of

3.039%.

o This is in line with the Company's investment policy and debt

strategy of securing low loan-to-value, long-dated debt to

capitalise on the low interest rate environment in order to enhance

shareholders' returns.

o The debt facility is the first of a planned debt funding

programme designed to support the Group's continued growth. The

Group intends to utilise the debt proceeds to fund an extensive

pipeline of further acquisitions in the second half of 2018.

-- The Investment Manager has access to a significant pipeline

of potential investments and is currently engaged in discussions

with various parties (including Approved Providers and developers)

in relation to a number of assets that meet the Company's

investment criteria and on terms the Investment Manager considers

attractive to the Company.

-- The Company expects to have substantially invested or

committed the proceeds of its recent debt raise (announced on 23

July 2018) by the end of October and therefore intends to undertake

a further issue of equity by way of a placing, open offer and offer

for subscription shortly. The Company expects to publish a

prospectus in connection with the issue in September.

(1) This includes the completion of the acquisition of TPHSIL

for a total commitment of GBP24.1 million.

* These are targets only and not a profit forecast and there can

be no assurance that they will be met.

Christopher Phillips, Chairman of Triple Point Social Housing

REIT plc, commented:

"The outlook is positive and we expect the strong performance of

the first half of 2018 to continue into the next six months of this

year. We have identified, predominantly through our existing

developer relationships, a strong pipeline of properties in line

with our investment strategy. While a number of assets will be

turned down as a result of our established due diligence process,

which focuses on asset and lessee quality, we are confident our

pipeline and deal flow will be sufficient to meet or exceed our

deployment targets.

The market fundamentals remain strong and are demonstrated by

stark undersupply and strong central and local government support

for Supported Housing. We are therefore optimistic about the

performance of our existing portfolio and our ability to deliver on

the pipeline of assets that have already been identified for

2018."

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management (via Newgate below)

LLP

(Delegated Investment Manager)

James Cranmer

Ben Beaton

Max Shenkman

Justin Hubble

Akur Limited (Joint Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

Canaccord Genuity Limited (Joint Tel: 020 7523 8000

Financial Adviser and Corporate

Broker)

Lucy Lewis

Denis Flanagan

Andrew Zychowski

Newgate (PR Adviser) Tel: 020 7680 6550

James Benjamin Em: triplepoint@newgatecomms.com

Anna Geffert

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com.

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-adjusted,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring ("FRI") leases with Approved Providers (being Housing

Associations, Local Authorities or other regulated organisations in

receipt of direct payment from local government). The portfolio

comprises investments into properties which are already subject to

an FRI lease with an Approved Provider, as well as forward funding

of pre-let developments but does not include any direct development

or speculative development.

There is increasing political and financial pressure on Housing

Associations to increase their housing delivery and this is

creating opportunities for private sector investors to participate

in the market. The Group's ability to provide forward financing for

new developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

Triple Point Investment Management LLP (part of the Triple Point

Group) is responsible for management of the Group's portfolio (with

such functions having been delegated to it by Langham Hall Fund

Management LLP, the Company's alternative investment fund

manager).

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust ("REIT") and is a

constituent of the FTSE EPRA/NAREIT index.

A Company presentation to analysts and investors will be held at

9.00am today at:

Newgate Communications

Sky Light City Tower

50 Basinghall Street

London, EC2V 5DE

The presentation will also be accessible via a live conference

call and on-demand via the Company website:

https://www.triplepointreit.com/investors/72/

Those wishing to attend the presentation or access the live

conference call are kindly asked to contact Newgate at

triplepoint@newgatecomms.com or by telephone on +44 (0) 20 7680

6550.

CHAIRMAN'S STATEMENT

The Group made good progress in the first half of 2018. The

strong relationships that we have established with a number of

developers has, up to 30 June 2018, enabled us to acquire a total

of GBP46.4 million(1) of recently developed properties and

development sites across the UK. We continue to benefit from strong

local authority demand for Supported Housing which is driven by the

cost savings and enhanced living opportunities that our homes can

offer tenants relative to traditional alternatives such as

residential or inpatient care.

In addition to deploying GBP46.4 million in the period, as at 30

June 2018 the Group had made further commitments totalling GBP51.5

million in relation to the acquisition and development of UK social

housing assets. These commitments include GBP24.1 million resulting

from the exchange of contracts on the acquisition of TPSHIL and

GBP27.4 million of other exchanges and forward funding

transactions.

In March 2018 the Company moved up from the Specialist Fund

Segment to the Premium Segment of the Main Market of the London

Stock Exchange and was admitted to the Official List. At the same

time, the Company raised GBP47.5 million (GBP46.5 million net

proceeds) of additional capital through a C Share issue.

By the end of June 2018, we had successfully invested or

committed over 90% of the net proceeds of the C Share placing

triggering the calculation date for the purposes of conversion of

the C Shares. Commitments included, for these purposes, an amount

of GBP24.1 million in relation to the acquisition of TPSHIL, a

portfolio of 18 Supported Housing assets, which we acquired from

the Triple Point Group and exchanged contracts on 22 June 2018,

subject to shareholder approval as a related party transaction.

Approval was received and the transaction completed on 13 July

2018. The C Shares converted on 30 August 2018.

Over the past six months, we have focused on our relationships

with developers of high quality supported living properties. These

relationships give us access to allocated future pipelines of newly

developed and renovated Supported Housing properties. Our developer

relationships have ensured that we can successfully deploy funds

into a pool of high-quality, diversified assets and developers

continue to provide us with strong deployment prospects for the

future. Predominantly we have acquired newly constructed, recently

renovated properties that were subject to a lease with an Approved

Provider counterparty who has been subject to our due diligence

process. In this way, we acquired Meadowhurst Gardens which is

leased to Inclusion Housing and which helps individuals with

learning disabilities live more independently, and Bold Street,

which is leased to My Space Housing Solutions and which assisted in

alleviating the undersupply of housing for people with complex

mental health needs in Warrington.

We also entered into our first forward funding transactions in

the period. We have acquired and commenced work on our first site

in Bradford in January and since then have acquired a further seven

forward funding sites, totalling eight forward funding transactions

completed by the Group in the period. Forward funding is an

integral part of the Company's investment strategy providing the

Group access to high quality assets at attractive yields.

Being able to provide forward funding enables us to acquire new

build assets that have been designed in conjunction with Approved

Providers and local authorities to meet specified local demand.

This gives us access to high quality assets while strengthening our

relationships with local authorities, Approved Providers and

developers - providing a competitive advantage over our peer

group.

Deployment

In the first half of 2018, we acquired 51 assets at a total

investment cost of GBP46.4 million(2) adding 1 new Approved

Provider. Our portfolio is well diversified by geography and

Approved Provider.

Since the half year end, we continued to acquire high quality

social housing properties and at 13 September 2018 had deployed a

further GBP49.3 million which included GBP23.9 million of committed

funds as at 30 June 2018. Consequently, we have made good progress

with deploying the proceeds of our recent debt raise, which I

discuss further below.

The 167 assets we had acquired by 30 June 2018 have the capacity

to house 1,158 tenants, are leased to 12 Approved Providers, are

located in 69 different local authorities and are serviced by 34

care providers. The portfolio at 30 June 2018 benefited from a

weighted average unexpired lease term of 29.0 years. Since 30 June

2018, the 41 assets the Group has acquired house 306 tenants.

After deploying our capital, we continue to maintain a close

relationship with our Approved Provider lessees. This relationship

involves regular meetings, site visits and the receipt of key

management information.

Investment Performance

We continue to benefit from the Investment Manager's strong

network of counterparties, from developers to local authorities and

Approved Providers. Through its network, we have been able to

source the majority of our properties off-market and at attractive

yields. The Investment Manager's capital discipline manifests

itself through its diligence process. Before completing an

acquisition, it scrutinises properties and developers in a

comprehensive and timely manner, ensuring that the assets we

acquire are of high build quality and enjoy robust occupant demand.

This means, now and in the longer term, the Group will possess a

high quality portfolio of attractive, occupied assets.

In the current market environment, investors have demonstrated

that there is appetite for companies that offer reduced risk and

secure inflation-linked income. Since IPO, we have deployed funds

into property investments that are subject to long leases with

upwards-only, inflation-linked rent reviews. The lessees are

Approved Providers who receive funding for the rent due directly

from local government.

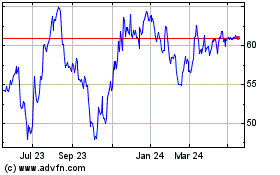

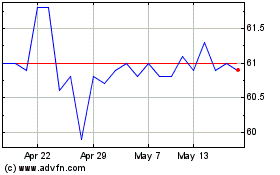

Share Price

In March, the Company became eligible for inclusion in the FTSE

Indices as it moved up to the Premium Segment of the Main Market.

It became a constituent of the FTSE All-Share Index in March and in

June we were included in the FTSE EPRA/NAREIT Global Real Estate

Index Series. We have enjoyed strong share price performance, with

our shares trading at a sustained premium to IFRS NAV.

Financial Results

At the half year end, the portfolio was independently valued at

GBP190.0 million on an IFRS basis, reflecting a valuation uplift of

8.53% against the portfolio's aggregate purchase price (excluding

transaction costs). The valuation reflects a portfolio yield of

5.32%, against the portfolio's blended net initial yield at

purchase of 5.91% (excluding forward funding transactions).

The Group's assets were valued at GBP203.4 million on a

portfolio valuation basis, reflecting a portfolio premium of

GBP13.4 million against the IFRS valuation. A portfolio valuation

basis assumes the portfolio of properties is held in a single SPV

holding structure, is sold to a third party on arm's length terms

and attracts purchaser's costs of 2.30%.

The audited IFRS NAV per Ordinary Share was 101.61 pence, which

has increased since IPO by 3.68%.

Dividends

The Group has paid dividends totalling 2.25 pence per Ordinary

Share since IPO. An interim dividend of 1.25 pence per Ordinary

Share in respect of the period 1 April to 30 June 2018 was declared

on 16 August 2018. The Board also declared dividends payable to

holders of C Shares comprising a fixed dividend of 3% per annum

prorated for the period from admission to trading on 27 March to 30

August 2018. The Ordinary Share and C Share dividends will be

payable on 28 September 2018 to shareholders on the register on 30

August 2018 (being the date on which the C Shares were converted

into Ordinary Shares). The Group intends to continue paying four

equally weighted interim dividends in respect of the preceding

quarter in each of June, September, December and March for future

years. The target dividend for the year to 31 December 2018 is 5

pence per Ordinary Share.

Loan Financing

Shortly after the end of the half year, in July 2018, the

Company successfully completed its first debt financing,

undertaking a private placement of GBP68.5 million of loan notes

with a major US life insurance company. The Company raised GBP68.5

million of debt, secured against a specific pool of Supported

Housing assets acquired by the Group in the period from August 2017

to the end of March 2018. The loan notes are split into two

tranches, a 10 and a 15-year tranche. The fixed rate coupon of the

10 and 15-year tranches are 2.924% and 3.215%, respectively. On a

blended basis, the weighted average term is 12 years with an

average fixed rate coupon of 3.039%.

The debt arrangement represents a loan-to-value of 40% of the

reported GBP172.0 million market value of the secured assets. This

is in line with the Company's investment policy and debt strategy

of securing low loan-to-value, long-dated debt to capitalise on the

low interest rate environment in order to enhance shareholder

returns.

The fixed rate loan note issuance is the first of a planned debt

funding programme designed to support the Group's continued growth.

The Group intends to utilise the debt proceeds to fund an extensive

pipeline of further acquisitions in the second half of 2018.

Further Capital Raising

The Investment Manager has access to a significant pipeline of

potential investments and is currently engaged in discussions with

various parties (including Approved Providers and developers) in

relation to a number of assets that meet the Company's investment

criteria and on terms the Investment Manager considers attractive

to the Company.

The Company expects to have substantially invested or committed

the proceeds of its recent debt raise (announced on 23 July 2018)

by the end of October and therefore intends to undertake a further

issue of equity by way of a placing, open offer and offer for

subscription shortly. The Company expects to publish a prospectus

in connection with the issue in September.

Investment Manager

The Board and the Investment Manager, Triple Point Investment

Management LLP, work closely together, meeting regularly to discuss

developments in the Group and the market. We will continue this

approach going forward to help maintain the efficient and effective

management of the Group. During the period the Investment Manager

further deepened the long-standing relationships with developers

from whom we have previously purchased and continued to implement a

disciplined policy focused on quality opportunities and rejecting

those that failed to meet our rigorous criteria. The Board is

grateful for the continued hard work and support of the Investment

Manager.

Social Impact

By working with developers to bring new Supported Housing

properties to market, the Group is helping to resolve the chronic

social housing shortage currently prevalent across the UK. The

types of tenants that are housed in properties owned by the Group

include people with mental health problems, autism, learning

disabilities and physical and sensory impairments. The Supported

Housing homes provided to these tenants typically provide

individuals with the opportunity for a better quality of life

whilst coming at a lower cost to local authorities than

alternatives such as residential care.

The Group is committed to the important social aim of helping to

provide more and appropriate accommodation to some of the most

vulnerable in society such that they can aspire to live more

autonomously in local communities. At the same time, our

consistent, high-quality approach to due diligence and development,

combined with significant investment in the sector, is helping to

drive quality in constructors and developers in the Supported

Housing space.

Outlook

The outlook is positive and we expect the strong performance of

the first half of 2018 to continue into the next six months of this

year. We have identified, predominantly through our existing

developer relationships, a strong pipeline of properties in line

with our investment strategy. While a number of assets will be

turned down as a result of our established due diligence process,

which focuses on asset and lessee quality, we are confident our

pipeline and deal flow will be sufficient to meet or exceed our

deployment targets.

The market fundamentals remain strong and are demonstrated by

stark undersupply and strong central and local government support

for Supported Housing. We are therefore optimistic about the

performance of our existing portfolio and our ability to deliver on

the pipeline of assets that have already been identified for

2018.

I would like to take this opportunity to thank my fellow board

members for their support and commitment in the first half of the

year, and to all shareholders for your continued support.

Chris Phillips

Chairman

13 September 2018

(1) (Excluding acquisition costs)

(2) (.) (Excluding acquisition costs)

INVESTMENT MANAGER'S REPORT

In 2018, we continued to implement the Group's strategy of

focusing on investing in good quality Supported Housing properties.

In the first quarter of 2018, we completed the deployment of the

IPO proceeds within the target deployment period of nine months

from listing. By the end of June, we had successfully invested or

committed 90% of the net proceeds of the C Share issue which

triggered the process for conversion of the C Shares to Ordinary

Shares on 30 August 2018. We are pleased that the Company was able

to report an IFRS NAV per share of 101.61 pence at 30 June 2018, a

3.68% increase since IPO.

During the period to 30 June 2018, the Group acquired 51 assets.

All assets are fit for purpose, sustainable and benefit from strong

local authority support. We have also rejected a number of deals

that fell within the Company's investment strategy but were not

deemed to be of sufficiently high quality to warrant investment.

The assets acquired by the Group all benefit from inflation-linked,

fully repairing and insuring long term leases (typically 20 to 30

years) to expert housing managers (usually Registered Providers).

The properties are leased to a diversified range of 12 Approved

Providers, who have different areas of geographical focus and

expertise.

In addition to the strong pipeline of assets acquired over the

period, we are pleased that the Group secured its first long-term

debt financing. This loan financing, at a competitive all-in fixed

interest rate of 3.039%, a 40% loan-to-value and an average term of

12 years, is a demonstration of the quality of the Group's

portfolio and the Group's ability to attract high-quality,

long-term lenders to the market.

The majority of the Group's assets are located in the Midlands

and the North of England, however, in the first six months of this

year we have increased our percentage of assets acquired in the

South of England, which has given the portfolio a stronger

geographical balance, and we expect this trend to continue for the

remainder of 2018. Most of the assets we have acquired in 2018 have

been purchased from developers with whom we have a long-standing

relationship. By working closely with a stable of high calibre

developers, we have been able to build up a strong pipeline of

deals that, subject to the completion of satisfactory due diligence

and agreement on pricing and terms, we expect to be able to acquire

for the Group. Currently, we have visibility of a pipeline of deal

flow with an aggregate value of over GBP400 million, which we

expect to be able to close in the next 12 months. All potential

acquisitions remain subject to our exacting due diligence process

and pricing analysis to ensure that the Group only acquires high

quality assets that will provide robust, sustainable returns for

shareholders in the longer term.

Market Review

Over the period, the well-documented mismatch between supply and

demand in the UK social housing market has continued to persist. In

the Supported Housing sector, this mismatch is particularly acute,

with the National Housing Federation predicting the shortfall in

Supported Housing assets to increase 86% from 2015 to 2020. On top

of this, an increasing number of people in the UK are finding

themselves priced out of both the private rental and property

ownership markets which, combined with a growing population, is

creating considerable demand for social housing assets.

The UK's "housing crisis" continues to be fuelled by the

inability to meet national (private and public) new house building

targets. In the Supported Housing sector, demand for new homes is

expected to increase by 30% by 2030 and, in particular, demand for

housing from those with learning disabilities is expected to

increase 55% over the same period. Against this backdrop, the

Group's aim of funding high quality Supported Housing assets is

well-placed.

Although there is now an upward trend in new house completions

in the UK and the government has recently announced that additional

funding will be made available to fund new social housing

developments, as of April 2017 there were 1.16 million households

on social housing waiting lists and, in 2016 - 2017, few more than

160,000 new homes were built against an estimated requirement of

300,000.

The impact of insufficient social housing supply is exacerbated

by demand in the Supported Housing market. Demand for assets is

two-fold. Firstly, improvements in healthcare are increasing the

number of people requiring long-term accommodation adapted to

provide care services. Secondly, following the 2012 Winterborne

View care home scandal, the UK Government introduced the Care Act

2014. This placed a statutory obligation on local authorities to

house people needing care in independent living situations based in

communities where possible (as opposed to providing in-patient or

institutional care). In light of these developments, not only do

local authorities have more people needing care, but they also have

a responsibility to rehouse people already receiving care in more

suitable accommodation of the sort provided by the Group's

Supported Housing assets.

Alongside the supply and demand issues, local authorities are

facing widely reported regulatory and downward cost pressures.

These are incentivising local authorities to find creative,

high-quality and cost-effective housing solutions for those for

whom they are responsible. Supported Housing assets provide part of

this solution.

Supported Housing is compelling not only due to the quality of

life it can afford occupants, but also because of the potential

cost savings for local authorities. Research recently commissioned

by Mencap (a leading UK charity for people with learning

disabilities) showed that demand for new Supported Housing

properties is expected to grow over the next ten years. The report

found that it costs on average GBP1,596 per week to house and care

for a person with learning disabilities living in Supported

Housing, compared with GBP1,760 per week for a residential care

placement and GBP3,500 per week for inpatient care. This is further

substantiated by a 2017 government report showing that, in that

year, local authorities received 135,950 requests for community

care support - which consists of home care, supported living and

other long-term care. Such demand meant that the area in which

local authorities saw the largest increase in expenditure was "Long

Term" support, which increased by GBP539.0 million to GBP13.6

billion in 2016-17. Community care accounted for 46% of this

total.

The Group works closely with specialist Supported Housing

Approved Providers who are seeking to meet housing demand in the

Supported Housing sector. These Approved Providers are increasing

their assets under management in order to achieve scale, to better

leverage expertise and efficiencies in order to help vulnerable

people who cannot meet their housing needs in the private market.

These Approved Providers look to the Group to fund the development

of new social housing assets, given insufficient or inaccessible

grant funding. After funding an asset, an Approved Provider enters

into a long lease with the Group in respect of that property, the

income of which contributes to shareholders' long-term index-linked

returns.

Regulatory Oversight

The Investment Manager undertakes thorough due diligence on any

Registered Provider before the Group enters into a lease, with the

intention of contracting only with counterparties of a sufficiently

high quality. All of the Registered Providers with whom the Group

has leases are regulated by the Regulator of Social Housing ("the

Regulator").

Registered Providers are subject to a detailed in-depth

assessment ("IDA") by the Regulator within three years of passing

through the 1,000 units under management barrier. The IDA assesses

the Registered Provider's compliance with the requirements of the

Governance and Financial Viability Standard. Each IDA is a bespoke

piece of work and will consider in detail a provider's viability

(its ability to meet financial obligations), its approach to value

for money and its governance. The IDA is likely to encompass

assessment of risk profiles, exposures, financial strengths and

weaknesses, governance and the delivery of value for money in the

broadest sense. The outcome of an IDA results in the Regulator

publishing a formal grading (V 1-4 for Viability and G 1-4 for

Governance), known as a regulatory judgement.

Most of the Registered Providers with whom the Group has leases

specialise in providing Supported Housing accommodation and

currently have less than 1,000 units under management, which means

that they have historically been subject to a lower level of

regulation than the IDA regime applicable to larger Registered

Providers. However, the Group has leases with a number of

Registered Providers who are close to progressing through the

threshold of 1,000 units under management and who the Group

therefore expects to be the subject of an IDA in due course. The

Group and the Investment Manager see this as a positive for these

Registered Providers due to the increased accountability and higher

degree of transparency which it will bring.

The Regulator seeks to work closely with a Registered Provider

that is failing to meet any aspect of the Governance and Financial

Viability Standard, with a view to remedying the issue as soon as

possible in a manner which protects the integrity of the Social

Housing regime. The recent case of First Priority Housing

Association Limited ("FPHA"), a Registered Provider with whom the

Group has no leases, offers an example of this collaborative

approach to regulation. In February 2018, the Regulator issued a

Regulatory Notice stating that it had been approached by FPHA and

that, following a review, it appeared that FPHA did not have the

financial capacity to meet its debts as they fell due. As FPHA had

fewer than 1,000 units at its last regulatory submission, the

Regulator had not yet published a regulatory judgement on FPHA, so

published the Regulatory Notice instead. The Regulator worked with

FPHA to understand its financial position, to strengthen its board

and to secure the long-term future of the 227 individual properties

leased and managed by FPHA. On 9 May 2018, one of FPHA's landlords,

Civitas Social Housing Plc, announced that all of its leases with

FPHA had been assigned on the same terms to another Registered

Provider and, over the course of the following two months, a large

portion of the remaining leases were transferred away from FPHA to

other Registered Providers. Finally, on 17 July 2018, FPHA entered

into a Company Voluntary Arrangement with its remaining creditors.

Whilst the Group did not have any exposure to FPHA this provides a

recent example of the Regulator facilitating the management of

Approved Providers entering into financial difficulties.

Financial Review

As at 30 June 2018, the annualised rental income of the Group

was GBP10.4 million (excluding forward funding transactions). The

Group is a UK REIT for tax purposes and is exempt from corporation

tax on its property rental business.

The fair value gain of GBP3.3 million was recognised during the

period on the revaluation of the Group's properties.

Earnings per share was 3.02 pence for the period(3) , compared

to 3.94 pence for the period ending 31 December 2017(4) calculated

on the weighted average number of shares in issue during the

period. Adjusted earnings per share were 9.38 pence for the period,

where post-tax earnings were adjusted for a valuation on a

portfolio basis (as opposed to individual asset) IFRS basis.

The IFRS NAV per share was 101.61 pence, which has increased

since IPO by 3.68%. The EPRA NAV per share and the IFRS NAV per

share were equivalent for the period. The IFRS NAV adjusted for the

portfolio valuation (including portfolio premium) was GBP215.9

million, which equates to a Portfolio NAV of 107.97 pence per

share.

The ongoing charges ratio is calculated as a percentage of the

average net asset value for the period under review. The ongoing

charges ratio for the period is 1.85%. This increase is in large

part attributable to the fact that the C Shares issued during the

period are not deemed to have increased the average net asset value

as they are treated as a financial liability prior to conversion.

However, the costs associated with the C Shares are included in the

ongoing charges calculation. If the Ordinary Shares arising on

conversion of the C Shares had been in issue on 30 June 2018, the

ongoing charges ratio at 30 June 2018 would be 1.50%.

At the period end, the portfolio was independently valued at

GBP190.0 million on an IFRS basis, reflecting a valuation uplift of

8.53% against the portfolio's aggregate purchase price (excluding

transaction costs). The valuation reflects a portfolio yield of

5.32%, against the portfolio's blended net initial yield of 5.91%.

This yield arbitrage of 59 basis points implies a

purchase-to-valuation margin of 11.1%, underpinning the quality of

the Group's asset selection and acquisition process.

The Group's properties were valued at GBP203.4 million on a

portfolio valuation basis, reflecting a portfolio premium of

GBP13.4 million against the IFRS valuation. A portfolio valuation

basis assumes the portfolio of properties is held in a single SPV

holding structure, is sold to a third party on arm's length terms

and attracts purchaser's costs of 2.3%.

Continued Strategic Alignment and Asset Selection

In the first half of 2018, the Group has continued to execute

its investment strategy, delivering inflation-protected income

underpinned by a careful asset selection of secure, long-let and

index-linked properties. During this period, the Group purchased 51

assets which included its first series of forward funding

transactions. For the standing investments, the aggregate net

purchase prices were GBP46.4 million.

2017 Q4 2018 Q2 CHANGE

# of Assets 116 167 +51

------------ ---------- ---------- ----------

# of Leases 65 100 +35

------------ ---------- ---------- ----------

# of Units 828 1,158 +330

------------ ---------- ---------- ----------

# of APs 11 12 +1

------------ ---------- ---------- ----------

# of FFAs 0 8 +8

------------ ---------- ---------- ----------

WAULT 30.6 years 29.0 years -1.6 years

In addition, the Group has made further commitments totalling

GBP51.5 million (excluding transaction costs) in relation to the

acquisition and development of UK social housing assets as at 30

June 2018. These commitments include GBP24.1 million resulting from

the exchange of contracts on the acquisition of TPSHIL and GBP27.4

million of other exchanges and forward funding transactions.

COMMITTED CAPITAL TOTAL FUNDS

AS AT 30 JUNE 2018 GBPM

Total Deployed GBP180.5

Exchanges GBP43.4

Forward Funding Commitments GBP8.1

---------------------------- ------------

Total Capital Committed GBP232.0

---------------------------- ------------

Property Portfolio

As at 30 June 2018, the property portfolio comprised 167 assets

with 1,158 units and showed a broad geographic diversification

across the UK. The 3 largest concentrated areas were the North West

(31.2%), West Midlands (16.6%) and the North East (16.5%). The fair

value of the property portfolio is GBP190.0 million (an average of

GBP1.1 million per property).

During the first half of 2018, the Group committed to its first

series of forward funding transactions. Forward funding forms an

integral part of the Group's investment strategy, adding

significant value-add to the property portfolio. A total of 8

forward funding transactions have been signed with various lease

start dates following build programmes of up to 12 months and with

an aggregate funding commitment of GBP8.1 million.

Rental Income

As at 30 June 2018, the property portfolio is fully let with the

assets either being let or pre-let on completion, comprising 100

fully repairing and insuring leases which includes the current

forward funding transactions. The total annualised rental income of

GBP10.4 million solely accounts for the aggregate rental income of

the standing investments.

In the first half 2018, the Group has further diversified its

tenant base by adding one additional Approved Provider to the

portfolio; Encircle Housing. Another Approved Provider, Care

Housing Association, has entered into an Agreement for Lease on a

Forward Funding acquisition which is expected to be producing

rental income in early 2019. With the Group having entered into

active leases with 12 Approved Providers, the Group's tenant base

is well diversified across the sector with some of the most desired

UK housing associations. Our three largest Approved Providers by

rental income were Inclusion Housing (24.7%), My Space Housing

Solutions (19.4%) and Falcon Housing Association (16.0%).

Our three largest Approved Providers by units were My Space

Housing Solutions (259), Inclusion Housing (226) and Falcon Housing

Association (190).

As at 30 June 2018, the property portfolio had a WAULT of 29.0

years, with 81.3% of the portfolio's rental income showing an

unexpired lease term of between 21-30 years. Compared with Q4 2017,

the WAULT has shortened slightly by 1.6 years as the majority of

additions in the reporting period showed a lease term certain of 25

years. The WAULT includes the initial lease term upon completion as

well as any reversionary leases and/or put and call options

available to the Group at expiry.

Income by Lease Length

Rents under the leases are indexed against either CPI (82.3% of

the 30 June 2018 portfolio) or RPI (17.7% of the 30 June 2018

portfolio), which provides investors the security that the rental

income is in line with inflation. For the purposes of the portfolio

valuation, Jones Lang LaSalle assumed CPI and RPI to increase at

2.0% per annum and 2.5% per annum respectively over the term of the

relevant leases.

As at 30 June 2018, the total rent passing was GBP10.4 million

(excluding forward funding transactions)(5) . In this reporting

period, there were 28 leases which benefited from a rental uplift

linked to CPI/RPI, equating to a total rental value increase of

approximately GBP91,000 more than the initially contracted

rent.

Pipeline and Outlook

Since IPO, the Group has benefited from demand for new Supported

Housing assets and the reliance of specialist Supported Housing

Approved Providers on private funders such as the Company to help

fund new developments. This has enabled the Group to build up a

strong pipeline over the next 12 months. The pipeline has

principally been developed through our relationships with a number

of high quality developers of Supported Housing assets. The

developers, in conjunction with local authorities, care providers

and Approved Providers, have identified where the need for more

Supported Housing assets is most acute and have continued to

develop new Supported Housing assets in these areas. It is these

assets that make up the majority of the pipeline.

The properties in the pipeline are at various stages of

development. For example, some may require planning permission,

some are still at the design stage and some are nearly ready to be

acquired by the Group. It is important to note that the Group will

only acquire an asset when a lease with an Approved Provider is in

place or, in the case of forward funding, when the assets are

pre-let to an Approved Provider. Nearly all of the properties that

the Group intends to acquire from developers in 2018 and 2019 are

off market, as they are expected to be sold directly to the Group

without being marketed to other funds.

While the focus has been on working with developers, the Group

has also acquired portfolios of assets. Some of these portfolios

were off market and some were marketed to a limited number of

funders. The Group does not tend to participate in large auction

processes. We will continue to look at portfolios of assets

opportunistically although we do not generally include portfolios

in pipeline calculations.

Portfolio acquisitions tend to be more opportunistic (and

therefore harder to predict) and if they become competitive

processes the probability of successfully completing the

acquisition is considerably lower than for deals that come through

our developer pipelines.

The Group's future pipeline, like its current portfolio, has a

good geographical spread. As such, the Group should maintain a

balanced, diverse portfolio into the future. In addition, the

pipeline should enable the Group to broaden the range of Approved

Providers that it works with. This, in turn, should lead to

additional opportunities to fund Supported Housing assets in 2018,

2019 and beyond.

(3.) (EPRA Earnings per share was 1.39 pence for the period to

30 June 2018.)

(4.) (The period to 31 December 2017 ran from the Company's

incorporation on 12 June 2017. The Company's Ordinary Shares were

admitt) (ed to trading on the Specialist) (Fund Segment of the Main

Market of the London Stock Exchange on 8 August 2017.)

(5) (The passing rent value of GBP10.4 million excludes all

Forward Funding) (transactions that are yet to be rental income

producing.)

KEY PERFORMANCE INDICATORS

In order to track the Group's progress the following key

performance indicators are monitored:

1. ORDINARY SHARE DIVID

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

Dividends paid The dividend reflects Dividends paid The Company declared

to shareholders the Company's ability or declared for a dividend of 1.25

and declared in to deliver a low the period 1 January pence per Ordinary

relation to the risk but growing 2018 to 30 June Share in respect

period. income stream from 2018 were 2.5 pence of the period 1

the portfolio. per Ordinary Share. April 2018 to 30

June 2018, payable

on 28 September

2018, which is in

line with the Company's

target.

---------------------------

2. IFRS NAV PER SHARE

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

The value of our The IFRS NAV reflects 101.61 pence at The IFRS NAV per

assets (based on our ability to grow 30 June 2018. share at

an independent the portfolio and 31 December 2017

valuation) less to add value to was 100.84 pence.

the book value it throughout the This is an increase

of our liabilities, life cycle of our of 0.76% since 31

attributable to assets. December 2017 driven

shareholders. by growth in the

underlying asset

value of the investment

properties.

---------------------- ------------------------ ---------------------------

3. LOAN TO GAV

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

It is envisaged The Company will 0.0% at 30 June Although no gearing

that a proportion seek to use gearing 2018. is in place as of

of our investment to enhance equity 30 June 2018, appropriate

portfolio is funded returns. gearing has been

by borrowings. introduced since

Our medium to long the period end.

term target. Loan

to GAV is 40% with

a hard cap of 50%.

----------------------

4. EARNINGS PER SHARE

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

The post-tax earnings The EPS reflects 3.02 pence per The outlook remains

generated that our ability to generate share for the six positive and we

are attributable earnings from our month period to continue to invest

to shareholders. portfolio including 30 June 2018. to generate an attractive

valuation increases. total return.

---------------------- --------------------------- -------------------- -----------------------------

5. ADJUSTED EARNINGS PER SHARE

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

The post-tax earnings The Adjusted EPS 9.38 pence per The Adjusted EPS

adjusted for the reflects the application share for the period shows the value

market portfolio of using the portfolio to 30 June 2018. per share on a long-term

valuation including value. basis.

portfolio premium.

----------------------- ---------------------------- ----------------------- ---------------------------

6. WEIGHTED AVERAGE UNEXPIRED LEASE TERM (WAULT)

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

The average unexpired The WAULT is a key 29 years at 30 As at 30 June 2018,

lease term of the measure of the quality June 2018 (includes the portfolio's WAULT

investment portfolio, of our portfolio. put and call options). stood at 29 years

weighted by annual Long lease terms and remains ahead

passing rents. underpin the security of the Group's minimum

Our target is a of our income stream. term of 15 years.

WAULT of at least

15 years.

------------------------ -------------------------- ------------------------ --------------------------

7. PORTFOLIO NET ASSET VALUE

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

The IFRS NAV adjusted The Portfolio NAV The Portfolio Net The Portfolio NAV

for the market measure is to highlight Assets of GBP215.9 per share shows a

portfolio valuation the fair value of million equates good market growth

including portfolio net assets on an to a Portfolio in the underlying

premium. ongoing, longterm NAV of 107.97 pence asset value of the

basis. per Ordinary Share. investment properties.

----------------------- --------------------------- --------------------- --------------------------

8. EXPOSURE TO LARGEST APPROVED PROVIDER

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

The percentage The exposure to the 19.40%. Our target is lower

of the Group's largest Approved Provider than 25%. We are

gross assets that must be monitored materially below

are leased to the to ensure that we our maximum exposure

single largest are not overly exposed target with our

Approved Provider. to one Approved Provider largest Approved

in Provider, Inclusion

the event of a default Housing.

scenario.

--------------------- ----------------------------- ------------------------

EPRA PERFORMANCE MEASURES

The table below shows additional performance measures,

calculated in accordance with the Best Practices

Recommendations of the European Public Real Estate Association

("EPRA"). We provide these measures to aid comparison with other

European real estate businesses.

1. EPRA EARNINGS PER SHARE

KPI AND DEFINITION PURPOSE PERFORMANCE

EPRA Earnings per share excludes A measure of a Group's underlying 1.39 pence per

gains from fair value adjustment operating results and an share for the

on investment property that indication of the extent period to 30

are included in the IFRS calculation to which current dividend June 2018.

for Earnings per share. payments are supported by 0.02 pence per

earnings. share for the

period to 31

December 2017.

As the Company

is currently

in ramp up phase

to full investment

(including debt

at 40%) and undertaking

forward fundings

there will be

a lag in the

Company's ability

to fully cover

dividends. Our

priority remains

to achieve a

fully covered

dividend from

operations.

---------------------------------------- ------------------------------------ --------------------------

2. EPRA NAV PER SHARE

KPI AND DEFINITION PURPOSE PERFORMANCE

EPRA NAV makes certain adjustments Provides stakeholders with GBP249.9 million/

to IFRS NAV to exclude items the most relevant information 101.61 pence

not expected to crystallise on the fair value of the per share. GBP201.7

in a long-term investment assets and liabilities within million/ 100.84

property business model. As a true real estate investment pence per share

at 30 June 2018 both the EPRA company with a long-term as at 31 December

NAV and the IFRS NAV are equivalent. investment strategy. 2017.

---------------------------------------- --------------------------------- ----------------------

3. EPRA NET INITIAL YIELD (NIY)

KPI AND DEFINITION PURPOSE PERFORMANCE

Annualised rental income based A comparable measure for 5.14% at 30 June

on the cash rents passing portfolio valuations. This 2018. 4.26% at

at the balance sheet date, measure should make it easier 31 December 2017.

less non-recoverable property for investors to judge for

operating expenses, divided themselves how the valuation

by the market value of the of a portfolio compares with

property, increased with (estimated) others.

purchasers' costs.

---------------------------------------- --------------------------------- --------------------

4. EPRA "TOPPED-UP" NIY

KPI AND DEFINITION PURPOSE PERFORMANCE

This measure incorporates The topped-up net initial 5.32% at 30 June

an adjustment to the EPRA yield is useful in that it 2018. 5.32% at

NIY in respect of the expiration allows investors to see the 31 December 2017.

of rent-free periods (or other yield based on the full rent

unexpired lease incentives that is contracted at 30

such as discounted rent periods June 2018.

and step rents).

------------------------------------ -------------------------------- --------------------

5. EPRA VACANCY RATE

KPI AND DEFINITION PURPOSE PERFORMANCE

Estimated Market Rental Value A 'pure' percentage measure 0.00% at 30 June

(ERV) of vacant space divided of investment property space 2018. 0.00% as

by ERV of the whole portfolio. that is vacant, based on at 31 December

ERV 0.00% at 30 June 2018. 2017.

---------------------------------- -------------------------------- ------------------

PRINCIPAL RISKS AND UNCERTAINTIES

The Board has overall responsibility for the Group's risk

management and internal controls, with the audit committee

reviewing the effectiveness of the Group's risk management process

on its behalf.

The principal risks and uncertainties we face are described in

detail in our Annual Report for the period ended 31 December

2017.

The identified risks have the potential to materially affect our

business, either favourably or unfavourably. Some risks may

currently be unknown, while others that we currently regard as

immaterial, and have therefore not been included here, may turn out

to be material in the future.

RISK CATEGORY: FINANCIAL

Expensive or lack of debt finance may limit our ability to

grow

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

Without sufficient debt When raising debt finance the Moderate Low

funding at sustainable Investment Manager adopts a

rates, we will be unable flexible approach involving

to pursue suitable investments speaking to multiple funders

in line with our Investment offering various rates, structures

Policy. This would significantly and tenors. Doing this allows

impair our ability to the Investment Manager to maintain

pay dividends to shareholders maximum competitive tension

at the targeted rate. between funders. After proceeding

with a funder, the Investment

Manager agrees heads of terms

early in the process to ensure

a streamlined, transparent

fund-raising process. The Board

also keeps our liquidity under

constant review and we will

always aim to have headroom

in our debt facilities ensuring

that we have a level of protection

in the event of adverse fund-raising

conditions.

---------------------------------- -------------------------------------- --------- -----------

RISK CATEGORY: PROPERTY

Default of one or more Approved Provider lessees

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

The default of one or Under the terms of our Investment Low to Low

more of our lessees Policy and restrictions, no Moderate

could impact the revenue more than 30% of the Group's

gained from relevant gross asset value may be exposed

assets. If the lessee to one lessee, meaning the

cannot remedy the default risk of significant rent loss

or no support is offered is low. The lessees are predominantly

to the lessee by the regulated by the Regulator

Regulator of Social of Social Housing, meaning

Housing, we may have that, if a lessee was to suffer

to terminate or negotiate financial difficulty, it is

the lease, meaning a likely that the Regulator of

sustained reduction Social Housing would assist

in revenues while a in making alternative arrangements

replacement is found. to ensure continuity for residents

who are vulnerable members

of the community.

--------------------------- --------------------------------------- ---------- -----------

RISK CATEGORY: PROPERTY

Forward-funding properties involves a higher degree of risk than

that associated with completed investments

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

Our forward funded developments Before entering into any forward Low to Low to

are likely to involve funding arrangements, the Investment Moderate Moderate

a higher degree of risk Manager undertakes substantial

than is associated with due diligence on developers

standing investments. and their main subcontractors,

This could include general ensuring they have a strong

construction risks, track record. We enter into

delays in the development contracts on a fixed price

or the development not basis and then, during the

being completed, cost development work, we defer

overruns or developer/ development profit until work

contractor default. has been completed and audited

If any of the risks by a chartered surveyor. Further,

associated with our less than 10% of our portfolio

forward funded developments is forward-funded at present

materialised, this could and we are limited by our Investment

reduce the value of Policy which restricts us to

these assets and our forward funding a maximum of

portfolio. 20% of the Group's net asset

value at any one time. Ultimately,

with these mitigating factors

in place, the flexibility to

forward fund allows us to acquire

assets and opportunities which

will provide prime revenues

in future years.

-------------------------------- -------------------------------------- ---------- -----------

RISK CATEGORY: REGULATORY

Risk of an Approved Provider receiving a non-compliant financial

viability or governance rating by the Regulator

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

Should an Approved Provider As part of the Company's acquisition Moderate Low to

with which the Group process, the Investment Manager to High Moderate

has one or more leases conducts a thorough due diligence

in place receive a non-compliant process on all Registered Providers

rating by the Regulator, with which the Company enters

in particular in relation into lease agreements that

to viability, depending takes account of their financial

on the further actions strength and governance procedures.

of the Regulator, it The Investment Manager has

is possible that there established relationships with

may be a negative impact the Approved Provider with

on the market value whom it works. The Approved

of the relevant properties Providers keep them informed

which are the subject of developments surrounding

of such lease(s). Depending the regulatory notices.

on the exposure of the

Group to such Approved

Provider, this in turn

may have a material

adverse effect on Group's

Net Asset Value until

such time as the matter

is resolved through

an improvement in the

relevant Approved Provider's

rating or a change in

Approved Provider.

---------------------------------- ------------------------------------- --------- -----------

RISK CATEGORY: REGULATORY

Risk of changes to the Social Housing regulatory regime

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

Future Governments may As demand for social housing High Low to

take a different approach remains high relative to supply, Moderate

to the Social Housing the Group is confident there

regulatory regime, resulting will continue to be a viable

in changes to the law market within which to operate,

and other regulation notwithstanding any future

or practices of the change of government. Even

Government with regard if government funding was to

to Social Housing. reduce, the nature of the rental

agreements the Group has in

place means that the Group

will enjoy continued lessee

rent commitment for the term

of the agreed leases.

------------------------------ ---------------------------------- ------- -----------

RISK CATEGORY: REGULATORY

Risk of not being qualified as REIT

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

If the Group fails to The Group intends to stay as High Low

remain in compliance a REIT and work within its

with the REIT conditions, investment objective and policy.

the members of the Group The Investment Manager will

will be subject to UK retain legal and regulatory

corporation tax on some advisers and consult with them

or all of their property on a regular basis to ensure

rental income and chargeable it understands and complies

gains on the sale of with the requirements. In addition,

properties which would the Board oversees adherence

reduce the funds available to the REIT regime, maintaining

to distribute to investors. close dialogue with the Investment

Manager to ensure we remain

compliant with legislation.

------------------------------ ------------------------------------- ------- -----------

RISK CATEGORY: CORPORATE

Reliance on the Investment Manager

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

We continue to rely Unless there is a default, High Low

on the Investment Manager's either party may terminate

services and its reputation the Investment Management Agreement

in the social housing by giving not less than 12

market. As a result, months' written notice, which

our performance will, may expire before August 2020.

to a large extent, depend The Board regularly reviews

on the Investment Manager's and monitors the Investment

abilities in the property Manager's performance. In addition,

market. Termination the Board meets regularly with

of the Investment Management the Manager to ensure that

Agreement would severely we maintain a positive working

affect our ability to relationship.

effectively manage our

operations and may have

a negative impact on

the share price of the

Company.

------------------------------ ------------------------------------- ------- -----------

RISK CATEGORY: FINANCIAL

Property valuations may be subject to change over time

RISK IMPACT RISK MITIGATION IMPACT LIKELIHOOD

-----------

Property valuations All of the Group's property Moderate Moderate

are inherently subjective assets are independently valued

and uncertain. Market quarterly by Jones Lang LaSalle,

conditions, which may a specialist property valuation

impact the creditworthiness firm who are provided with

of lessees, may adversely regular updates on portfolio

affect valuations. The activity by the Investment

portfolio is valued Manager. The Investment Manager

on a Market Value basis, meets with the external valuers

which takes into account to discuss the basis of their

the expected rental valuations and their quality

income to be received control processes. Default

under the leases in risk of lessees is mitigated

future. This valuation in accordance with the lessee

methodology provides default principal risk explanation

a significantly higher provided above. In order to

valuation than the Vacant protect against loss in value,

Possession value of the Investment Manager's property

a property. In the event management team seeks to visit

of an unremedied default each property in the portfolio

of an Approved Provider once a year, and works closely

lessee, the value of with lease counterparties to

the assets in the portfolio ensure, to the extent reasonably

may be negatively affected. possible, their financial strength

and governance procedures remain

Any changes could affect robust through the duration

the Group's net asset of the relevant lease.

value and the share

price of the Group.

The borrowings the Company

currently has and which

the Group uses in the

future may contain loan

to value and interest

covenants. If property

valuations decrease,

such covenants could

be breached, and the

impact of such an event

could include: an increase

in borrowing costs;

a call for additional

capital from the lender;

payment of a fee to

the lender; a sale of

an asset; or a forfeit

of any asset to a lender.

----------------------------- ------------------------------------ --------- -----------

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge this

condensed set of financial statements has been prepared in

accordance with IAS 34 as adopted by the European Union and that

the operating and financial review includes a fair review of the

information required by DTR 4.2.7 and DTR 4.2.8 of the Disclosure

and Transparency rules of the United Kingdom's Financial Conduct

Authority namely:

-- an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed financial statements and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months

of the financial year as disclosed in note 22.

Shareholder information is as disclosed on the Triple Point

Social Housing REIT plc website.

Approval

This Directors' responsibilities statement was approved by the

Board of Directors and signed on its behalf by

Chris Phillips

Chairman

13 September 2018

Independent Review Report to the members of Triple Point Social

Housing REIT plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2018 which comprises the Condensed Group

Statement of Comprehensive Income, the Condensed Group Statement of

Financial Position, the Condensed Group Statement of Changes in

Equity, the Condensed Group Statement of Cash Flows and the Notes

to the Group Condensed Interim Financial Statements.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of and

has been approved by the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as adopted

by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting its responsibilities in

respect of half-yearly financial reporting in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2018 is not prepared, in all material respects, in accordance

with International Accounting Standard 34, as adopted by the

European Union, and the Disclosure Guidance and Transparency Rules

of the United Kingdom's Financial Conduct Authority.

Thomas Edward Goodworth

BDO LLP

Chartered Accountants

London, United Kingdom

13 September 2018

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

CONDENSED GROUP STATEMENT OF COMPREHENSIVE INCOME

For the period from 1 January 2018 to 30 June 2018

Period from Period from

1 January 2018 12 June 2017

to 30 June to 31 December

2018 2017

(unaudited) (audited)

Note GBP'000 GBP'000

----------------------------------------- ----- ------------------------- -------------------------

Income

Rental income 5 4,744 1,027

Total income 4,744 1,027

Expenses

Directors' remuneration 6 (127) (147)

Management fees 7 (868) (472)

General and administrative expenses (878) (446)

Total expenses (1,873) (1,065)

Gain from fair value adjustment

on investment property 11 3,257 5,639

Operating profit 6,128 5,601

Finance income 8 70 79

Finance expense 9 (24) (8)

Finance expense - C Shares amortisation 9 (134) -

Profit for the period before

tax 6,040 5,672

------------------------- -------------------------

Taxation 10 - -

Profit and total comprehensive

income 6,040 5,672

========================= =========================

attributable to shareholders

for the period

========================= =========================

Earnings per share - basic 26 3.02p 3.94p

Earnings per share - diluted 26 2.75p 3.94p

All amounts reported in the Condensed Group Statement of

Comprehensive Income for the period ended 30 June 2018 relate to

continuing operations.

The accompanying notes below form an integral part of these

Group Financial Statements.

CONDENSED GROUP STATEMENT OF FINANCIAL POSITION

As at 30 June 2018

30 June 2018 31 December

2017

Note (unaudited) (audited)

------------------------------------- -----

GBP'000 GBP'000

------------------------------------- ----- ------------- ------------

Assets

Non-current assets

Investment properties 11 190,581 138,512

Total non-current assets 190,581 138,512

Current assets

Trade and other receivables 12 2,411 12,002

Cash and cash equivalents 13 63,346 58,185

------------- ------------

Total current assets 65,757 70,187

Total assets 256,338 208,699

============= ============

Liabilities

Current liabilities

Trade and other payables 14 5,288 5,876

C shares 15 46,684 -

------------- ------------

Total current liabilities 51,972 5,876

Non-current liabilities

Other payables 16 1,154 1,151