TIDMSIV

RNS Number : 8429N

Sivota PLC

27 September 2023

27 September 2023

SIVOTA PLC

(" Sivota," or "the Company")

HALF YEAR RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Sivota, the London listed investment vehicle focused on

later-stage, Israeli technology companies, announces its results

for the six months ended 30 June 202 3 ("H1 202 3 ").

Sivota seeks to leverage the significant technology investment

potential between the UK and Israel. With Sivota as the investment

vehicle, the Group identifies investment opportunities in

undervalued, well-positioned Israeli technology companies and

leverages the Group's experience to introduce strategic change and

growth.

Highlights:

-- Ongoing implementation of the Group's dual-pronged strategy:

o Focus on seeking investment opportunities, predominantly

across the Israeli technology sector;

o Continue to support and advise Apester Ltd ("Apester"), a

digital marketing engagement platform in which Sivota has a 54.1%

majority stake, on the execution of its growth strategy.

-- Key financial highlights for the six months ended 30 June 2023:

o Revenue of $3.1 million (H1 2022: $1.1 million*)

o Gross profit of $633,000 (H1 2022: $287,000*)

o Cash at 30 June 2023 of $2.4 million (31 December 2022: $4.4

million)

o Net debt of $1.5 million (31 December 2022: $1.4 million)

* Revenue and Gross profit generated in H1 2022 were for the

period from the Acquisition date of Apester on 12 May 2022 to 30

June 2022.

-- As anticipated Apester has generated a loss of $3.2 million

over the first 6 months of the year as management invest in the

development of its base technology, expand its services and client

base despite a very tough market background with significantly

reduced advertising demand. The rate of loss is reducing rapidly

and we anticipate the business will reach breakeven during H2 '24

as revenues continue to increase and the cost base is now right

shaped.

-- Over the course of H1 2023, the Group has implemented a

number of strategic and operational changes within Apester,

including:

o The appointment of Anni Ben Yair as Chief Executive Officer

for Apester, announced in August 2023. Anni is an experienced

digital media and technology executive, well positioned to lead

Apester's international go-to-market strategy;

o Continued development of Apester's underlying technology,

building on the integration of Permutive, a privacy-safe

infrastructure helping publishers and advertisers reach their

audiences which completed in late-2022.

-- Apester has fortified a very strong list of prospects and

opportunities, from existing and new partners, which include:

o A new initiative with Ad Alliance, one of the most prominent

German sports media outlets, which builds on an existing

relationship and seeks to leverage Apester new data collection and

segmentation tools that enable first and zero-party collection,

cross-checking with interactions on sight, and matching to unique

identifiers that enable Apester partners to offer a premium

tailored experience while on their site;

o In the final stages of launching a new partnership with a key

European sports outlet, reinforces our authority within the

European market;

o Launched a new US-based partner that is a new expansion in one

of our key growth markets. We are in final negotiations with one of

the largest US media outlets across multiple key industries.

Ziv Ben-Barouch, Chief Executive Officer of Sivota,

commented:

"We are delighted with the progress we have made in H1 2023 as

we continue to implement a number of growth initiatives. In

addition to supporting Apester on driving engagement to capitalise

on its market opportunity, we are currently evaluating a number of

additional investment opportunities in the Israeli technology

sector, that our new business pipeline has generated.

As funding within the technology sector continues to remain

challenging as a result of the macro-economic conditions, we

believe Sivota continues to be well placed to benefit as the Groups

new business pipeline suggests.

As we move into the second half, I look forward to updating

stakeholders on ongoing Apesters' progress, along with other

investment opportunities that align with our growth strategy."

For further information, please visit www.sivotacapital.com or

contact:

Sivota PLC via Vigo Consulting

Tim Weller, Non-Executive Chairman

Ziv Ben-Barouch, Chief Executive Officer

Canaccord Genuity Limited + 44 (0) 20 7523

Bobbie Hilliam 8000

Vigo Consulting

Jeremy Garcia + 44 (0)20 7390 0230

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Financial Review

Cash flow and net debt

The Group's cash balance as at 30 June 2023 was $2.4 million

compared to $4.4 million at 31 December 2022. The debt at 30 June

2023 was $1.5 was compared to $1.4 million at 31 December 2022.

Revenues

The Group generated $3.1 million of revenues in the six months

ended 30 June 2023, compared to $1.1 million revenues generated in

the period from the acquisition of Apester on 12 May 2022 to 30

June 2022.

Current trading and outlook

Sivota was established in order to acquire controlling stakes

and then act as a holding company for various target businesses

operating or founded in Israel, predominantly in the technology

sector. The Group has made a solid start to FY 2023, with the

recently acquired Apester performing in line with management

expectations.

Apester's acquisition is the first step in executing the Group

strategy. Alongside working to help Apester implement its growth

strategy, the Group continues to evaluate a robust pipeline of new

investment opportunities, refining our next targets.

As a result of the challenging macro-economic environment,

access to funding for start-up companies has become more

challenging. Against this backdrop, the Board of Directors believe

Sivota is well-placed to assess and evaluate more opportunities to

identify the right investment opportunities where the team can

leverage our experience to maximise growth and shareholder

returns.

The Group continues to evaluate investment opportunities,

generating a strong new business pipeline. Furthermore, the Group

is continuing to support Apester and ensure the right executive

team is in place for Apester to maximise its potential as an

interactive experience platform that helps business to better

engage with their audience.

Risk and uncertainties

The Group operates in an uncertain environment and is subject to

a number of risk factors. The Directors have carried out an

assessment of the principal risks facing the Group, including those

that threaten its business model, future performance, solvency or

liquidity.

The Group continues to monitor the principal risks and

uncertainties to ensure that any emerging risks are identified,

managed, and mitigated.

Keeping pace with technological developments

Apester's ability to attract new customers and increase revenue

from existing customers largely depends on its ability to enhance

and improve its existing solutions and introduce compelling new

technology products. The success of any enhancement to its

solutions depends on several factors, including timely completion

and delivery, competitive pricing, adequate quality testing,

integration with other technologies and the Apester platform, and

overall market acceptance. Apester seeks to mitigate this risk by

continuing to improve its solutions and products.

Concentration of key clients

Apester has significant contracts and relationships with a

number of key customers. Although the Company knows of no reason

why such contracts should be terminated or will not be renewed on

the same or more favorable terms, the Directors cannot guarantee

such relevant parties' commercial position or market conditions

will not alter their position. Should any of these contracts be

terminated or not be renewed, it could have a material adverse

effect on the financial position and future prospects of the Group.

Apester seeks to mitigate this risk by increasing the number of

customers.

Changes to the digital advertising landscape

Apester's current revenues are derived partly from revenue

sharing agreements for advertising space sold through its platform.

Such revenues are dependent on the worldwide demand and ask prices

for advertising, which are mainly controlled by large market

participants, such as search engines. If a search engine decides to

reduce its pricing or demand for advertising space is depressed,

this will adversely affect Apester's revenues.

Funding

Although the Directors have confidence in the future revenue

earning potential of the Group from its interests in Apester, there

can be no certainty that the Group will achieve or sustain

profitability or positive cash flow from its operating activities.

If Apester does not meet its targets the Group may not be able to

obtain additional external financing. The board regularly reviews

the revenues, KPIs and expenditures of Apester and continues to

prudently manage its cash resources and has minimised ongoing

operating costs. Additionally, if the Group intends to acquire

further businesses the Company will likely need to raise further

funds.

Difficulties in acquiring suitable targets

The Company's strategy and future success are dependent to a

significant extent on its ability to identify sufficient suitable

acquisition opportunities and to execute these transactions on

terms consistent with the Company's strategy. If the Company cannot

identify suitable acquisitions, or execute any such transactions

successfully, this will have an adverse effect on its financial and

operational performance.

Security, political and economic instability in Israel and the

Middle East

Apester is incorporated under the laws of the State of Israel,

and its principal offices and research and development facilities

are located in Israel. In addition, Sivota seeks additional target

companies based in Israel. Therefore, security, political and

economic conditions in the Middle East, particularly in Israel, may

affect Group's business directly.

Taxation

The Group will be subject to taxation in several different

jurisdictions, and adverse changes to the taxation laws of such

jurisdictions could have an adverse effect on its

profitability.

Statement of directors' responsibilities in respect of the

interim results

The Directors; being Tim Weller (Chairman); Ziv Ben-Barouch

(CEO) and Neil Jones (Non-Executive) confirm that the set of

interim financial statements has been prepared in accordance with

international Accounting Standard 34 "interim financial reporting",

and that interim report includes a fair review of the information

required by DTR 4.2.7R and DTR 4.2.8R, namely an indication of

important events that have occurred during the six months period

ended 30 June 2023; and material related party transactions in the

six months period ended 30 June 2023.

SIVOTA PLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the year

Six months ended ended

30 June 31 December

--------------------------------- ------------------

Note 2023 2022 2022

---------------------- --------- ------------------

Unaudited Audited

--------------------------------- ------------------

Revenues 3,129 1,114 5,918

Cost of revenues 2,496 827 4,361

---------------------- --------- ------------------

Gross Profit 633 287 1,557

---------------------- --------- ------------------

Operating expenses:

Research and development expenses 972 333 1,553

Sales and marketing expenses 745 261 1,309

General and administrative expenses 1,974 1,110 3,513

Total operating expenses 3,691 1,704 6,375

---------------------- --------- ------------------

Operating loss (3,058) (1,417) (4,818)

Financial income - - -

Financial expenses 161 420 295

---------------------- --------- ------------------

Financial expenses, net (161) (420) (295)

Loss before taxes (3,219) (1,837) (5,113)

Taxes on income - - 1

---------------------- --------- ------------------

Net loss (3,219) (1,837) (5,114)

====================== ========= ==================

Net loss attributable to the owners (1,796) (1,258) (3,199)

Net loss attributable to non-controlling

interest (1,423) (579) (1,915)

---------------------- --------- ------------------

Net loss (3,219) (1,837) (5,114)

====================== ========= ==================

Net comprehensive loss

Net comprehensive loss attributable

to the owners (1,796) (1,258) (3,199)

Net comprehensive loss attributable

to non-controlling interest (1,423) (579) (1,915)

---------------------- --------- ------------------

Net comprehensive loss (3,219) (1,837) (5,114)

====================== ========= ==================

Loss per share: 4

Basic loss per ordinary share in

U.S. dollars (0.14) (0.30) (0.38)

====================== ========= ==================

Diluted loss per ordinary share in

U.S. dollars (0.14) (0.30) (0.38)

====================== ========= ==================

U.S. dollars in thousands

The accompanying notes are an integral part of the condensed

consolidated financial statements.

The condensed consolidated financial statements on page 5 to 15

were authorised for issue by the board of directors on 27 September

2023 and were signed on its behalf by Ziv Ben-Barouch.

Ziv Ben-Barouch, CEO, 27 September 2023

SIVOTA PLC

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

U.S. dollars in thousands

As at As at

30 June 31 December

2023 2022

--------- ------------

Unaudited Audited

--------- ------------

ASSETS

Non-current assets

Intangible assets, net 13,136 13,950

Property and equipment, net 23 34

--------- ------------

Total non-current assets 13,159 13,984

Current assets

Trade receivables 1,222 2,467

Other receivables 221 399

Cash and cash equivalents 2,417 4,439

--------- ------------

Total current assets 3,860 7,305

Total assets 17,019 21,289

========= ============

EQUITY AND LIABILITIES

Equity

Ordinary share capital 157 157

Deferred shares 65 65

Capital reserve from transactions

with non-controlling interests (413) (413)

Share premium 15,139 15,139

Accumulated losses (5,493) (3,697)

--------- ------------

Total equity attributable to the

owners 9,455 11,251

Non-controlling interests 3,918 5,141

--------- ------------

Total equity 13,373 16,392

Current liabilities

Current maturity of long-term loan

from related p arty 316 -

Trade payables 1,113 2,042

Other payables 1,078 1,449

--------- ------------

Total current liabilities 2,507 3,491

Non-current liabilities

Long - term loan from related party 1,139 1,394

Employee benefits - 12

Total non-current liabilities 1,139 1,406

Total equity and liabilities 17,019 21,289

========= ============

The accompanying notes are an integral part of the condensed

consolidated financial statements.

SIVOTA PLC

CONDENSED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

U.S. dollars in thousands

Capital reserve

from

transactions

Ordinary with Total equity Non-controlling

Share Deferred Share non-controlling Accumulated attributable interests

capital Shares Premium interests losses to the Total

owners equity

---------- ---------- --------- ---------------- ------------- -------------- ----------------- --------

Unaudited

---------------------------------------------------------------------------------------------------------------

For the six months ended 30 June 2023:

Balance as at 1

January

2023 157 65 15,139 (413) (3,697) 11,251 5,141 16,392

Net loss - - - - (1,796) (1,796) (1,423) (3,219)

---------- ---------- --------- ---------------- ------------- -------------- ----------------- --------

Net

comprehensive

loss - - - (1,796) (1,796) (1,423) (3,219)

Transactions with

owners:

Transactions

with

non-controlling

interests - - - - - - 3 3

Share-based

compensation

by subsidiary - - - - - - 197 197

---------- ---------- --------- ---------------- ------------- -------------- ----------------- --------

Total

transactions

with

the owners - - - - - - 200 200

Balance as at 30

June 2023 157 65 15,139 (413) (5,493) 9,455 3,918 13,373

========== ========== ========= ================ ============= ============== ================= ========

The accompanying notes are an integral part of the condensed

consolidated financial statements.

SIVOTA PLC

CONDENSED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

U.S. dollars in thousands

Capital reserve

from

transactions

Ordinary with Total equity Non-controlling

Share Deferred Share non-controlling Accumulated attributable interests

capital Shares Premium interests losses to the Total

owners equity

---------- ---------- ---------- ---------------- ------------- -------------- ----------------- --------

Unaudited

----------------------------------------------------------------------------------------------------------------

For the six months ended 30 June 2022:

Balance as at 1

January

2022 15 65 1,251 - (498) 833 - 833

Net loss - - - - (1,258) (1,258) (579) (1,837)

---------- ---------- ---------- ---------------- ------------- -------------- ----------------- --------

Net

comprehensive

loss - - - (1,258) (1,258) (579) (1,837)

Transactions with

owners:

Non-controlling

interests

on acquisition

of subsidiary - - - - - - 6,327 6,327

Share-based

compensation

by subsidiary - - - 134 - 134 - 134

Share capital

issuance 142 - 14,053 - - 14,195 - 14,195

Share issue cost - - (131) - - (131) - (131)

---------- ---------- ---------- ---------------- ------------- -------------- ----------------- --------

Total

transactions

with

the owners 142 - 13,922 134 - 14,198 6,327 20,525

Balance as at 30

June 2022 157 65 15,173 134 (1,756) 13,773 5,748 19,521

========== ========== ========== ================ ============= ============== ================= ========

The accompanying notes are an integral part of the condensed

consolidated financial statements.

SIVOTA PLC

CONDENSED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

U.S. dollars in thousands

Capital reserve

from

transactions Total equity

Ordinary with attributable Non-controlling

share Deferred Share non-controlling Accumulated to the interests Total

capital shares premium interests losses owners equity

---------- ---------- ---------- ----------------- ------------- -------------- ----------------- -----------

Audited

--------------------------------------------------------------------------------------------------------------------

For the year ended 31 December 2022:

Balance as at 31 December 2021 15 65 1,251 - (498) 833 - 833

Net loss - - - - (3,199) (3,199) (1,915) (5,114)

----- ---- -------- ------- --------- --------- --------- ---------

Net comprehensive

loss - - - (3,199) (3,199) (1,915) (5,114)

Transactions with

owners:

Share capital

issuance 142 - 14,054 - - 14,196 - 14,196

Share issue cost - - (166) - - (166) - (166)

Non-controlling

interests on

acquisition of

subsidiary - - - - - - 6,355 6,355

Transactions with

non-controlling

interests - - - (413) - (413) 428 15

Share-based

compensation by

subsidiary - - - - - - 273 273

----- ---- -------- ------- --------- --------- --------- ---------

Total transactions

with the

owners 142 - 13,888 (413) - 13,617 7,056 20,673

----- ---- -------- ------- --------- --------- --------- ---------

Balance as at 31

December 2022 157 65 15,139 (413) (3,697) 11,251 5,141 16,392

===== ==== ======== ======= ========= ========= ========= =========

The accompanying notes are an integral part of the condensed

consolidated financial statements.

SIVOTA PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

U.S. dollars in thousands

For year ended 31 December

Six months ended

30 June

--------------------- -----------------------------

2023 2022 2022

--------- ---------- -----------------------------

Unaudited Audited

--------------------- -----------------------------

Cash flows from operating activities

Net loss (3,219) (1,837) (5,114)

Depreciation and amortisation 819 223 1,076

Share-based compensation by subsidiary 197 134 273

Financial expenses, net 127 316 83

Working capital adjustments:

Decrease (increase) in trade receivables 1,245 144 (762)

Decrease (increase) in other receivables 178 (37) (55)

Decrease in trade and other payables (1,300) (820) (816)

Decrease in long term employee benefits (12) (46) (46)

--------- ---------- -----------------------------

Net from operating activities (1,965) 1,923 (5,361)

Cash flows from investing activities

Decrease (increase) in short-term deposit - (47) 7

Net cash acquired on acquisition of subsidiary - 34 337

Proceeds from sale of equipment 6 - -

Convertible loans acquisition - (1,654) (1,654)

--------- ---------- -----------------------------

Net cash from (for) investing activities 6 (1,667) (1,310)

Cash flows from financing activities

Proceeds from the issue of Ordinary Shares, net of issuance

costs - 11,059 11,848

Repayment of lease liability - - (9)

Exercise of subsidiary's options 3 - 8

Loan repayments - (387) (1,512)

--------- ---------- -----------------------------

Net cash from financing activities 3 10,672 10,335

Net change in cash and cash equivalents (1,956) 7,082 3,664

Effect of foreign exchange rate changes (66) - (237)

Cash and cash equivalents at beginning of period 4,439 1,012 1,012

--------- ---------- -----------------------------

Cash and cash equivalents at end of period 2,417 8,094 4,439

========= ========== =============================

The accompanying notes are an integral part of the condensed

consolidated financial statements.

SIVOTA PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

U.S. dollars in thousands

(a) Financing non-cash transactions:

For year

Six months ended ended 31 December

30 June

----------------------------------- -------------------

2023 2022 2022

------------ --------------------- -------------------

Unaudited Audited

----------------------------------- -------------------

Debt offset against the payment

for share capital of the Company - 2,182 2,182

============ ===================== ===================

Unpaid share capital - 823 7

============ ===================== ===================

Receivables from exercise of subsidiary's

options - - 7

============ ===================== ===================

The accompanying notes are an integral part of the condensed

consolidated financial statements.

SIVOTA PLC

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

1. General information

The Company is a public limited company incorporated and

registered in England and Wales on 22 September 2020 with

registered company number 12897590 and its registered office

situated in England and Wales with its registered office The

Scalpel, 18th Floor, 52 Lime Street, London, EC3M 7AF.

In July 2021, the Company completed a placing and listed on the

Main Market (Standard Segment) of the LSE.

In May 2022, the Company completed the acquisition of a majority

stake in Apester Ltd, a digital marketing engagement platform (the

"Acquisition").

The cash consideration for the Acquisition was funded through a

$14.2 million (gross) placing and direct subscription of 11,500,000

new ordinary shares of Sivota of one pence each. In September 2022

the Company completed its readmission to the London Stock

Exchange.

2. Definitions

In these financial statements:

The Company - Sivota PLC

The Group - The Company and its consolidated subsidiaries

Subsidiaries - Entities that are controlled (as defined

in IFRS 10) by the Company and whose accounts

are consolidated with those of the Company.

Dollar/USD - U.S. dollar/"$"

3. Significant accounting policies

The following accounting policies have been applied consistently

in the financial statements for all periods presented, unless

otherwise stated.

a. Basis of accounting

The Group Financial Statements have been prepared in accordance

with International Accounting Standards in conformity with the

requirements of the UK Companies Act 2006.

The interim condensed consolidated financial statements for the

six months ended 30 June 2023 have been prepared in accordance with

IAS 34, Interim Financial Reporting. The interim condensed

consolidated financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Company's

financial statements as at 31 December 2022.

Going concern

The Group raised funds in 2022 to fund the acquisition of

Apester and the Group's working capital needs. The Group projects

that it will need to raise further funds for its planned

development. The Group is expected to further generate losses from

operations during 2023 which will be expressed in negative cash

flows from operating activity. Hence the continuation of Group's

operations depends on raising the required financing resources or

reaching profitability, which are not guaranteed at this point.

Whilst the directors are confident they will be able to raise the

additional finance required, this is not guaranteed and hence there

is a material uncertainty in respect of going concern. However, the

directors have, at the time of approving the financial statements,

a reasonable expectation that the Group will have adequate

resources to continue in operational existence for the foreseeable

future, which is defined as twelve months from the signing of this

report. For this reason, the directors continue to adopt the

going-concern basis of accounting in preparing the financial

statements.

b. Standards and interpretations issued but not yet applied

There were no new standards or interpretations effective for the

first time for periods beginning on or after 1 January 2023 that

had a significant effect on the Company's Financial Statements.

At the date of authorisation of these Financial Statements, a

number of amendments to existing standards and interpretations,

which have not been applied in these Financial Statements, were in

issue but not yet effective for the year presented. The Directors

do not expect that the adoption of these standards will have a

material impact on the financial information of the Company in

future periods.

c. Critical accounting judgements and key sources of estimation uncertainty

In applying the Group's accounting policies the Directors are

required to make judgements (other than those involving

estimations) that have a significant impact on the amounts

recognised and to make estimates and assumptions about the carrying

amounts of assets and liabilities that are not readily apparent

from other sources. The estimates and associated assumptions are

based on historical experience and other factors that are

considered to be relevant. Actual results may differ from these

estimates.

- Business combinations

The Group is required to allocate the acquisition cost of the

subsidiary and activities through business combinations on the

basis of the fair value of the acquired assets and assumed

liabilities. The Group used external valuations to determine the

fair value. The valuations include management estimates and

assumptions as for future cash flow projections from the acquired

business and selection of models to compute the fair value of the

acquired components and their depreciation period.

- Research and development expenses

According to the accounting treatment, as described above, the

Group's management examined whether the conditions for recognising

development costs as intangible assets are met. The Group concluded

that, development costs relating to the group software platform did

not meet the conditions for recognition of as an intangible

asset.

- Share-based payment.

The fair value of share-based payment transactions is calculated

using the fair value of Group company's ordinary shares at the date

of granting the options, this fair value is estimated by using

valuation techniques that are based on actual purchasing price when

applicable and measurement of the share's price by valuation

technique of discounting future cash flows or other valuation

techniques.

4. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

The year

ended 31 December

Six months ended 30 June

----------------------------- --------------------

2023 2022 2022

Unaudited Unaudited Audited

Loss for the period attributable

to the equity holders of the

Company (1,796) (1,258) (3,199)

Weighted average number of ordinary

shares for the purpose of basic

and diluted earnings per share 12,585,000 4,215,556 8,426,096

Basic and diluted loss per share

- U.S. dollars (0.14) (0.30) (0.38)

5. Operating segments

a. General:

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

("CODM") to make decisions about resources to be allocated and

assess its performance.

The Group has one operating segment - digital media

b. Geographic information:

Revenues classified by geographical areas based on client

location:

For the year

ended

Six months ended 30 31 December

June

-------------------------------- ------------------

2023 2022 2022

--------------------- --------- ------------------

Unaudited Audited

-------------------------------- ------------------

North America 1,171 341 2,076

European countries 1,099 467 1,904

UK and Ireland 749 275 1,338

Other countries 110 31 600

--------------------- --------- ------------------

3,129 1,114 5,918

===================== ========= ==================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGZLRNRGFZG

(END) Dow Jones Newswires

September 27, 2023 04:42 ET (08:42 GMT)

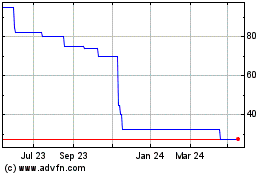

Sivota (LSE:SIV)

Historical Stock Chart

From Jun 2024 to Jul 2024

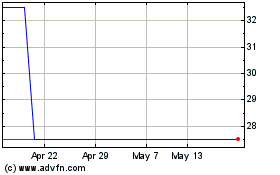

Sivota (LSE:SIV)

Historical Stock Chart

From Jul 2023 to Jul 2024