S4 Capital PLC Issue of Shares (4198J)

December 13 2022 - 2:00AM

UK Regulatory

TIDMSFOR

RNS Number : 4198J

S4 Capital PLC

13 December 2022

13 December 2022

S(4) Capital plc

("S(4) Capital" or the "Company")

Issue of Shares

On 20 November 2019, S4 Capital plc (SFOR.L) announced a merger

with WhiteBalance, a Delhi-based content creation and production

company (the "WhiteBalance Transaction"). Pursuant to the terms of

the WhiteBalance Transaction, the Company has agreed to issue

370,650 ordinary shares of 25 pence each in the capital of the

Company, credited as fully paid, as deferred consideration (the

"WhiteBalance Shares"). The WhiteBalance Shares will be subject to

a restriction on sale until 14 December 2024.

On 29 July 2020, S4 Capital plc (SFOR.L) announced a merger with

Orca Pacific, a market leading full-service Amazon agency and

boutique consultancy firm based out of Seattle (the "Orca

Transaction"). Pursuant to the terms of the Orca Transaction, the

Company has agreed to issue 530,158 ordinary shares of 25 pence

each in the capital of the Company, credited as fully paid, as

deferred consideration (the "Orca Shares"). The Orca Shares will be

subject to a restriction on sale until 14 December 2024.

Two separate applications have been made to the FCA and to the

London Stock Exchange for the WhiteBalance Shares and Orca Shares

to be admitted to the standard segment of the Official List of the

FCA and to trading on the London Stock Exchange's Main Market for

listed securities respectively ("Admission"). It is expected that

Admission will become effective at 8.00 a.m. on 14 December 2022

.

Enquiries:

S(4) Capital Tel: +44 (0)20 3793 0003

Sir Martin Sorrell (Executive

Chairman)

Powerscourt (PR Adviser Tel: +44 (0) 7970 246 725

to S(4) Capital)

Elly Williamson

Jane Glover

About S(4) Capital

S(4) Capital plc (SFOR.L) is the tech-led, new age/new era

digital advertising and marketing services company, established by

Sir Martin Sorrell in May 2018.

Its strategy is to build a purely digital advertising and

marketing services business for global, multinational, regional,

local clients and millennial-driven influencer brands. This will be

achieved by integrating leading businesses in three practice areas:

Content, Data&digital media and Technology services, along with

an emphasis on "faster, better, more efficient" executions in an

always-on consumer-led environment, with a unitary structure.

Digital is by far the fastest-growing segment of the advertising

market. S(4) Capital estimates that in 2021 digital accounted for

over 60% or $420-450 billion of total global advertising spend of

$700-750 billion (excluding over $500 billion of trade promotion

marketing, the primary target of the Amazon advertising platform)

and projects that by 2022 total global advertising spend will

expand to $770-850 billion and digital's share will grow to

approximately 65% and by 2024 to approximately 70%, accelerated by

the impact of covid-19.

In 2018, S(4) Capital combined with MediaMonks, the leading

AdAge A-listed creative digital content production company led by

Victor Knaap and Wesley ter Haar and then with MightyHive, the

market-leading digital media solutions provider for future thinking

marketers and agencies, led by Peter Kim and Christopher S.

Martin.

Since then, MediaMonks and MightyHive have combined with more

than 25 companies across Content, Data&digital media and

Technology services. For a full list, please see the S(4) Capital

website.

In August 2021, S(4) Capital launched its unitary brand by

merging MediaMonks and MightyHive into Media.Monks, represented by

a dynamic logo mark that features MightyHive's iconic hexagon. As

the operational brand, Media.Monks underpins S(4) Capital's

agility, digital knowledge and efficiency and is the next step in

delivering on its foundational promise to unify Content,

Data&digital media and Technology services.

Victor Knaap, Wesley ter Haar, Christopher Martin, Scott Spirit

and Mary Basterfield all joined the S(4) Capital Board as Executive

Directors. The S(4) Capital Board also includes Rupert Faure

Walker, Paul Roy, Daniel Pinto, Sue Prevezer, Elizabeth Buchanan,

Naoko Okumoto, Margaret Ma Connolly, Miles Young and Colin Day.

The Company has over 9,000 people in 32 countries with

approximately 70% of revenue across the Americas, 20% across Europe

and 10% across the Middle East and Africa and Asia-Pacific. The

longer term objective is a split of 60%:20%:20%. Content currently

accounts for approximately 60% of revenue, Data&analytics 30%

and Technology services 10%. The long-term objective is a split of

50%:25%:25%.

Sir Martin was CEO of WPP for 33 years, building it from a GBP1

million "shell" company in 1985 into the world's largest

advertising and marketing services company, with a market

capitalisation of over GBP16 billion on the day he left. Prior to

that Sir Martin was Group Financial Director of Saatchi &

Saatchi Company Plc for nine years.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEADAAFSKAFFA

(END) Dow Jones Newswires

December 13, 2022 02:00 ET (07:00 GMT)

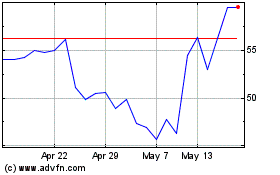

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Jun 2024 to Jul 2024

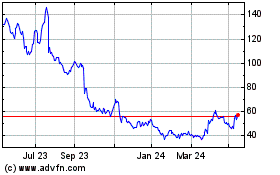

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Jul 2023 to Jul 2024