TIDMSDI

RNS Number : 9944J

Scientific Digital Imaging Plc

24 July 2013

SCIENTIFIC DIGITAL IMAGING PLC

Final Results for the year Ended 30 April 2013

Cambridge, UK 24 July 2013: Scientific Digital Imaging's (AIM:

SDI, "SDI" or the "Company"), the AIM quoted group that builds and

sells scientific instruments based on digital imaging technology,

predominantly for applications in the life sciences, announces

today its final results for the year ended 30 April 2013.

Financial Highlights

-- Revenue increased by 6.9% to GBP7.7m (2012: GBP7.2m)

-- Operating profit for the year was GBP280k (2012: GBP84k)

after reorganisation costs of GBP14k (2012: GBP73k) and share based

payments GBP4k (2012; GBPnil)

-- Basic profit per share was 1.05p per share (2012: 0.11p)

-- Expenditure on research and development in the current year

was GBP600k, representing 7.8% of Group sales (2012: GBP494k

representing 6.9% of Group sales)

Operational Highlights

-- Large order for Synbiosis systems from the Chinese State Food and Drug Administration

-- New division Synoptics Health formed to market and supply ProReveal

o Global demand has notably increased and a number of new

worldwide distributors have been appointed

-- To meet demand Syngene has introduced new PXi Touch systems

for image capture which are selling well

Post-period events

-- Successful equity fundraising of GBP850,000 (before expenses)

to enable a loan note repayment and to reinvest in the business

Commenting on the results, Ken Ford, Chairman of SDI said: "I am

convinced we will drive the Company to even greater success in the

coming year".

--ENDS--

FOR FURTHER INFORMATION

Scientific Digital Imaging plc 01223 727144

Ken Ford, Chairman

Mike Creedon, Chief Executive Officer

www.scientificdigitalimaging.com

finnCap Ltd. 020 7220 0500

Ed Frisby/Rose Herbert - Corporate Finance

Simon Starr - Corporate Broking

JW Communications

Julia Wilson - Investor & Public Relations 0781 8430877

Note to Editors

Scientific Digital Imaging Plc

Scientific Digital Imaging plc (SDI) is focused on the

application of digital imaging technology to the needs of the

scientific and technology community. Its principal subsidiary is

Synoptics Limited, which designs and manufactures special-purpose

instruments for use mainly in the life sciences, supplying

customers in the academic, research and health sectors. Within

Synoptics, the recently formed Synoptics Health division has

launched the Synoptics Health ProReveal system. This patented

system offers a highly sensitive fluorescence-based test to detect

dirty surgical instruments in hospitals and aims to reduce

incidences of cross contamination of patients. In addition, under

the Atik brand, SDI designs and manufactures high-sensitivity

cameras for both astronomical and life science applications.

www.scientificdigitalimaging.com

Chairman's statement

OVERVIEW

I am delighted to confirm that in my first report as Chairman

for the 12 months ended 30 April 2013, Scientific Digital Imaging

plc ("SDI") has continued to generate profits during this period of

continued weakened global trading conditions. With the internal

reorganisation completed and the advances in SDI in-house product

development programmes, we now have several new competitively

priced, automated systems in our portfolio, launched in the past

year for which demand is exceeding supply. The Board is confident

that SDI is well positioned to continue to grow.

Post-year end SDI raised GBP850,000 by way of a placing for cash

to enable repayment of a loan note and to reinvest in the business.

This placing ensures we can fulfil the forward orders of our

products, especially the ProReveal system for which global demand

has notably increased.

Group revenues increased and gross margins remained stable in

the year following SDI's reorganisation. Additionally,

re-engineering of the technology portfolio to eliminate the use of

third party camera components is producing improved profitability.

The outcome of these successful activities is a significant

turnaround in the business and there are many opportunities for the

Group to develop especially within the Synoptics Health and

Synbiosis brands to enable on-going growth for the coming year.

FINANCIAL RESULTS

Revenue for the period increased to GBP7.7m (2012: GBP7.2m), an

increase of 6.9%. This has resulted in an operating profit for the

year of GBP280k, a profit margin of 3.6% after reorganisation costs

of GBP14k (2012: GBP73k) and share based payments of GBP4k (2012:

GBPnil). This result is inclusive of currency gains. The increase

in SDI revenue is due to the Synoptics subsidiary, whose Syngene

and Synbiosis brands saw increased revenue. Basic earnings per

share were 1.05p and diluted earnings were 1.01p.

These results are the best we have reported since 2009 and the

Board believes business for the future continues to look promising.

We look forward to new sales from the patented ProReveal product

launched during the year.

STRATEGY

During the year SDI has focused on improving the underlying

business which has proved a successful strategy. In the year, the

Group did not add any new companies but the Board believes the

Group is now in a position to acquire new businesses with

complementary product portfolios and this will be part of SDI's

strategy in the year ending 2014. SDI will also continue to invest

in its current operations to take advantage of the under-exploited

rapid microbiology testing and healthcare sectors where SDI's new

products are currently well positioned for growth.

CURRENT TRADING AND OUTLOOK

The financial year to the end of April 2013 marked a turning

point for SDI, increasing profitability and recommencing its

acquisition strategy. SDI has come through the recession very

robustly, aided by its modernisation and investment programme. We

have continued to seek process improvements during the downturn and

also maintained our skill base and output capability. These factors

stand us in good stead as volume recovery continues.

We continue to see investment in our imaging products in the

developing markets in the Asia-Pacific region continue to invest in

our imaging products.SDI received a large order for Synbiosis

systems from the Chinese State Food and Drug Administration (SFDA),

where there is on-going interest in our automation. We will promote

our products globally but will focus on developing our North

American market and on the Asia-Pacific region where we have put in

place six new distributors to exploit Synoptics Health's unique

ProReveal technology.

The Board expects SDI to continue to make good progress over the

coming financial year as we will continue to pursue our strategy of

organic and acquisitive growth. We believe that the recent SFDA

order independently validates our technology as the "gold standard"

and consider that our growth in Asia will continue to be fuelled by

their need for excellent automation in the life sciences. The

Company's new products, especially in the rapid microbiology

testing and healthcare sectors show commitment to innovation and

the Board views SDI's prospects for 2013 positively.

STAFF

On behalf of the Board, I would like to thank our staff. They

have continued to work tirelessly to ensure our new technology

portfolio is ready for launch at key events. It is their commitment

which has helped SDI to be successful and I am convinced will drive

the Company to even greater success in the coming year.

Ken Ford

Chairman

23 July 2013

CHIEF EXECUTIVE'S OPERATING REPORT

SDI designs and manufactures digital imaging technology for use

by the scientific community, through its Synoptics brands (Syngene,

Synoptics Health, Synbiosis, and Syncroscopy) and the Artemis CCD

Company brands (Atik Cameras and Artemis CCD Cameras).

SYNOPTICS

Synoptics designs and manufactures scientific instruments based

on digital imaging technology, mainly for the life science,

microbiology healthcare and microscopy markets. The Divisions offer

their products under marketing brands including G:BOX, PXi,

ProtoCOL and ProReveal, each targeting a different sector of these

markets.

Syngene

Syngene remains the largest of the Synoptics brands and

accounted in 2013 for 83 percent of the Synoptics company's

turnover. The brand provides systems and software for documenting

and analysing 'gels' and 'blots' used by scientists in genomic and

proteomic studies. Almost all research in biological sciences

requires an understanding of the underlying molecular processes

involving DNA, RNA and proteins, and gel electrophoresis and

Western blotting continue to be key processes in many laboratories

working in this area.

To keep pace with the continuing global trend for the smaller

format imaging systems, this year, Syngene extended its range by

adding the PXi gel documentation product with the introduction of

six new touch screen versions. These new systems have been selling

successfully in Europe and the US where research budgets remain

restricted. The PXi system is also selling well in Asia because lab

space is at a premium and smaller format gels are routinely used in

research.

To ensure PXi and Syngene's higher end G:BOX imaging systems

continue to be competitively priced and generate good gross

margins, the products have been re-engineered to include cameras

(one of the most expensive components of the systems) sourced not

from a third party, but instead from SDI's Artemis CCD Company.

We continue to build a strong sales and marketing team for these

products and this year have appointed a new distributor in Canada

and invested in a dedicated sales person and manufacturer's

representative to cover North America, where a number of our

competitors are based. Our new sales team for the UK and Europe is

performing well and our Syngene sales in the Asia-Pacific and

Middle East region continue to grow.

Syngene's products are particularly strong in the area of

imaging multiple fluorescent dyes. To maintain our competitive

position in this application, we intend to update our image

analysis software, GeneTools, which we anticipate will help us

continue to grow the Syngene's brand.

Synoptics Health

During the year, SDI introduced the new brand of Synoptics

Health to market and supply ProReveal, an automated viewer and

fluorescence-based spray test to detect proteins remaining on

surgical instruments after the decontamination process. ProReveal

could help to prevent hospital infections caused by protein based

prions such as variant Creutzfeldt-Jakob Disease (vCJD). The unique

ProReveal fluorescence imaging technology, the result of our

successful strategic collaboration with Queen Mary University of

London, has been well received in the UK. Independent studies have

shown ProReveal can detect nanogram amounts of protein, which is

100 times more sensitive than current gold standard tests being

used in sterile services department (SSDs).

ProReveal is well positioned in the healthcare market to meet

new UK guidelines for decontamination as the Department of Health

(DOH) in England is preparing to issue a minimum safe standard for

the amount of protein that is allowed to remain on a surgical

instrument after decontamination. The Ninhydrin kit (the current

gold standard test), used in UK SSDs is not sensitive enough to

provide an adequate level of protein detection. ProReveal is the

only technology currently available that can meet nanogram levels

of detection and could potentially be installed in 300 SSD's, in

hospitals and private decontamination companies throughout the

UK.

In 2013, 10 ProReveal systems were sold in the UK and Synoptics

Health's UK distributor has installed three ProReveal systems in

two major SSD's of leading London hospitals and one in an NHS

training facility. This means that existing and future SSD

personnel receiving training at these sites will be familiar with

this technology and are more likely to consider it for use in their

own hospital SSDs.

Synoptics Health is currently enjoying a first mover advantage

in this untapped healthcare market sector not just in the UK but

internationally. During the period, the Synoptics Health Division

appointed a network of six new distributors throughout the

Asia-Pacific region and these partners intend to show the ProReveal

system in numerous hospitals in the region in Q3 of 2013. In

Europe, the Division has appointed a new distributor in Germany and

sold four systems, which are being independently evaluated by

German hospitals. There are plans to have Dutch and Italian

distributors in place, as well as a North American distributor

within the next few months ensuring growth in demand for the

ProReveal viewer and more importantly, a recurring revenue stream

for the ProReveal spray over the coming year.

Synbiosis

The Synbiosis division provides systems for microbiologists to

automatically count and measure microbial colonies and these are

used for microbiological testing in the food, water and

pharmaceutical markets. These systems benefit users by reducing

labour costs, providing more reproducible results, and by automatic

recording data for audit purposes, an area which is becoming

increasingly important as microbiological testing becomes more

regulated.

Like the molecular biology sector, there is a need for

affordable automated microbiology testing and to fill this niche,

in 2013 Synbiosis re-designed and launched aCOLyte 3, a low cost

automated colony counter, which will appeal to the large clinical

and academic markets, where equipment budgets remain

restricted.

In 2013, the ProtoCOL 3 automated high end colony counter proved

popular, especially in Asia where 25 systems were sold in China to

the major government organisation, the Chinese State Food and Drug

Administration (SFDA). This ProtoCOL 3 placement is significant as

it was the result of a six month tender process, in which

technology from 10 other international companies was assessed

alongside and thus validates the ProtoCOL 3 as a world leading

system for automated colony counting.

To build on the success of this brand, Synbiosis launched its

new ProtoCOL 3 statistical analysis software in 2013. The software

is compatible with new European Pharmacopoeia/US Pharmacopeia

regulations and allows microbiologists to rapidly obtain potency

data from their zone measurements or colony count results. The

Chinese SFDA is currently reviewing the software, with a view to

adding the package to each of the 25 ProtoCOL 3 systems installed

throughout China.

To allow Synbiosis to enter the lucrative market of rapid

microbiology testing, we are collaborating with CHROMagar, an

international company that supplies the world's widest range of

chromogenic media to introduce a version of ProtoCOL 3 which will

automatically recognise and identify different types of

microorganisms based on colony colour. This innovation provides

another first mover advantage as no other commercial colony counter

currently in the microbiology market can perform this task with the

same level of accuracy and because of our competitive advantage

Synbiosis expects good sales growth of this product.

Syncroscopy

The Syncroscopy Division provides digital imaging software to

microscope users. Its main product, AutoMontage is a software

package that allows customers to overcome the severely limited

depth of field in an optical microscope. AutoMontage continues to

sell well under licence to Leica Microsystems, a leading microscope

manufacturer as an optional part of Leica's LAS software suite.

ARTEMIS CCD

The Artemis CCD Company acquired by SDI in October 2008 designs

and manufactures high-sensitivity cameras. These are sold to life

science and industrial applications under its Artemis Cameras brand

and for deep-sky astronomy imaging as Atik Cameras. During 2013 we

have reorganised to reduce costs and improve our competitive

advantage.

Artemis Cameras.

In the period, the new Artemis CCD Camera brand together with a

dedicated web site was created to differentiate the scientific

camera range from the existing astronomy focussed Atik brand. This

is proving successful in guiding OEM customers towards long term

direct business to business relationships. Artemis CCD Cameras

provide additional features and compatibility with scientific

equipment control and image analysis software plus a wider model

range to improve flexibility of integration for the system

designer. A completely new VS range was introduced aimed

specifically at the OEM customer base and fluorescence microscopy

users. The Company also appointed its first distributor for

scientific cameras in the territories of France, UK, Ireland and

Spain.

Atik Cameras

During the year Atik Camera sales grew again with increases in

sales to the US leading the way. The release of new, high

performance, sensors from Sony has enabled the introduction of new

cameras based on existing designs. These have proved popular and

provided a cost efficient way to introduce new products as well as

giving Atik a competitive edge against companies relying more

heavily on sensors from other manufacturers.

The Atik dealer network continues to grow with new appointments

being made in America, India, Brazil, Japan and China as well as in

Europe. While it is expected the majority of sales to continue to

come from established western markets Atik are in a good position

to take advantage of increases in discretionary expenditure coming

from faster growing economies.

The majority of Atik's development effort in the year has been

spent on a new platform which is planned to be used to introduce a

new range of cameras this year targeting increased ease of use and

integration of functions. Collaborations with third party

developers has brought MacOS support for our camera to customers

not wishing to run the cameras through Microsoft Windows.

SUMMARY

At Synoptics, Syngene has introduced new PXi Touch systems for

image capture, which are selling well and the Synbiosis ProtoCOL 3

continues to be purchased as the global gold standard colony

counter. These successes combined with the introduction of our

flourishing new Synoptics Health Division and its ProReveal

technology ensure current and forecast sales are very positive.

Artemis CCD continues to make an increasing contribution to the

SDI Group thanks to both intra-group revenues to Synoptics and to

growth in both its amateur astronomy and science markets.

Life science markets are beginning a tentative recovery and we

anticipate that new products, especially in rapid microbiology

testing and healthcare sectors released during the first half of

2013 together with the on-going cost efficiencies within the Group,

should result in steady growth for SDI throughout the coming

year.

Mike Creedon

Chief Executive Officer

FINANCIAL REVIEW

Group Summary

Group revenue for the year increased by 6.9% to GBP7.7m (2012:

GBP7.2m).

Gross profit increased to GBP4.4m (2012: GBP4.1m) with gross

margins at 56.9% (2012: 56.9%).

Operating profit for the year was GBP280k (2012: GBP84k) after

reorganisation costs of GBP14k (2012: GBP73k) and share based

payments of GBP4k (2012: GBPnil).

Investment in R&D

Total research and development in the current year was GBP600k,

representing 7.8% of Group sales (2012: GBP494k representing 6.9%

of Group sales). Under IFRS we are required to capitalise certain

development expenditure and in the year ending 30 April 2013

GBP430k of cost was capitalised and added to the balance sheet.

This expenditure represents the Group's investment in new product

development. The amortisation charge for 2013 was GBP247k (2012:

GBP235k). The carrying value of the capitalised development at 30

April 2013 was GBP622k (2012: GBP454k) to be amortised over three

years.

Reorganisation Costs

The Board has carried out a thorough review of the operations

and structures of the Group in 2012 and GBP14k of costs from the

review and reorganisation were incurred in 2013.

Earnings per Share

Basic earnings per share for Group were 1.05p (2012: 0.11p),

diluted earnings per share for the Group were 1.01p (2012:

0.10p).

Finance Costs and Income

Net financing expense was GBP67k (2012: GBP64k). Loan stock

interest charges for the year were GBP34k (2012: GBP34k). Loan

stock of GBP379k was issued in July 2008.

Taxation

The tax charge of GBP21k (2012: GBPnil) is largely due to the

deferred tax charge in the Group, this is inclusive of any

deduction for R & D expenditure.

Cash Flow

During the year the Group had improved cash flow, reporting a

cash balance of GBP388k (2012: GBP285k) at the year end.

Currency Translation

The results for the Group's overseas businesses are translated

into Pounds Sterling at the average exchange rates for the relevant

year. The balance sheets of overseas businesses are translated into

Pounds Sterling at the relevant exchange rate at the year end.

Exchange gains or losses from translating these items from one year

to the next are recorded in other comprehensive income.

As with the majority of international companies, the Group's UK

and overseas businesses purchase goods and services, and sell some

of their products, in non-functional currencies. Where possible,

the Group nets such exposures or keeps this exposure to a minimum.

The Group's principal exposure is to US Dollar and Euro currency

fluctuations.

Funding and Deposits

The Group utilises short-term facilities to finance its

operations. The Group has one principal banker with an invoice

discounting facility of up to GBP500k. At the year end the Group

had cash on the balance sheet. Surplus funds are placed on

short-term deposit.

The Group utilises long-term borrowings from the issue of loan

stock and finance leases.

Summary

The reorganisation of the Group is now complete and it is in a

position to offer competitive products at competitive prices whilst

achieving improved gross margins.

CONSOLIDATED INCOME STATEMENT

Note 2013 2012

GBP000 GBP000

Revenue 1 7,665 7,170

Cost of sales (3,304) (3,090)

--------- ---------

Gross profit 4,361 4,080

- currency exchange

(losses)/gains (2) 2

- reorganisation costs (14) (73)

- share based payments (4) -

- other administrative

expenses (4,061) (3,925)

--------------- -------

Total administrative

expenses (4,081) (3,996)

--------- ---------

Operating profit 280 84

Finance income - 1

Finance payable and

similar charges (67) (65)

--------------- -------

Net financing expenses (67) (64)

--------- ---------

Profit before tax 213 20

Income tax 2 (21) -

--------- ---------

Profit for the year 192 20

========= =========

Earnings per share

Basic earnings per share 51.05p 0.11p

===== =====

Diluted earnings per

share 51.01p 0.10p

===== =====

All activities of the Group are classed as continuing.

STATEMENT OF COMPREHENSIVE INCOME

2013 2012

GBP000 GBP000

Profit for the period 192 20

Other comprehensive income

Exchange differences on translating

foreign operations 39 (21)

------- ------

Total comprehensive income for the

period 231 (1)

======= ======

CONSOLIDATED BALANCE SHEET

Note 2013 2012

Assets GBP000 GBP000

Intangible assets 896 726

Property, plant and equipment 415 386

Deferred tax asset 3 125 113

------ -----------

1,436 1,225

Current assets

Inventories 947 826

Trade and other receivables 1,467 1,527

Cash and cash equivalents 388 285

------ -----------

2,802 2,638

Total assets 4,238 3,863

------ -----------

Liabilities

Non-current liabilities

Borrowings 4 38 423

Deferred tax liability 3 164 138

------ -----------

202 561

Current liabilities

Trade and other payables 1,423 1,282

Provisions for warranty 17 17

Borrowings 4 472 114

Current tax payable - -

------ -----------

1,912 1,413

Total liabilities 2,114 1,974

------ -----------

Net assets 2,124 1,889

====== ===========

Equity

Share capital 194 187

Merger reserve 2,606 2,606

Share premium account 335 262

Own shares held by Employee Benefit

Trust (85) (85)

Other reserves 100 176

Foreign exchange reserve (34) (73)

Retained earnings (992) (1,184)

------ -----------

Total Equity 2,124 1,889

====== ===========

Ken Ford Mike Creedon

Chairman Chief Executive Officer

CONSOLIDATED STATEMENT OF CASHFLOW

2013 2012

GBP000 GBP000

Operating activities

Profit for the year 192 20

Depreciation and amortisation 492 457

Profit on sale of property, plant and equipment (2) -

Finance costs and income 67 64

Taxation expense in the income statement 21 -

Increase in provisions - -

Exchange difference 39 (26)

Employee share based payments 4 -

------- ---------------

Operating cash flows before movement in

working capital 813 515

Increase in inventories (139) (45)

Changes in trade and other receivables 48 (136)

Changes in trade and other payables 153 228

------- ---------------

Cash generated from operations 875 562

Interest paid (67) (56)

Income taxes received/(paid) - 5

------- ---------------

Cash generated from operating activities 808 511

Investing activities

Capital expenditure (356) (155)

Expenditure on development (430) (229)

Sale of property, plant and equipment 93 41

Interest received - -

------- ---------------

Net cash used in investing activities (693) (343)

Financing activities

Movement of finance leases (12) (21)

Bank borrowing movement - (25)

Issues of shares and warrants - 2

------- ---------------

Net cash from financing (12) (44)

Net changes in cash and cash equivalents 103 124

Cash and cash equivalents, beginning of

year 285 158

Foreign currency movements on cash balances - 3

======= ===============

Cash and cash equivalents, end of year 388 285

======= ===============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share capital Merger Foreign Share premium Own shares held by Other reserves Retained earnings Total

reserve exchange EBT

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 30

April 2013 187 2,606 (73) 262 (85) 176 (1,184) 1,889

---------------- -------------- --------------- -------------- ------------------- ------------------- ------------------- -----------------

Shares issued

as deferred

payment 7 - - 73 - (80) - -

Share based

payments - - - - - 4 - 4

Transaction

with

owners 7 - - 73 - (76) - 4

---------------- -------------- --------------- -------------- ------------------- ------------------- ------------------- -----------------

Profit for the

year

Foreign

exchange on 192 192

consolidation

of

subsidiaries - - 39 - - - - 39

---------------- -------------- --------------- -------------- ------------------- ------------------- ------------------- -----------------

Total

comprehensive

income for

the period - - 39 - - - 192 231

Balance at 30

April 2013 194 2,606 (34) 335 (85) 100 (992) 2,124

================ ============== =============== ============== =================== =================== =================== =================

Share capital Merger Foreign Share Own Other Retained earnings Total

reserve exchange premium shares reserves

held

by EBT

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 30

April 2012 187 2,606 (52) 260 (85) 176 (1,204) 1,888

--------------- --------- --------- -------- ------- --------- -------------------- --------------

Share options

issued - - - 2 - - - 2

--------------- --------- --------- -------- ------- --------- -------------------- --------------

Transactions

with owners - - - 2 - - - 2

--------------- --------- --------- -------- ------- --------- -------------------- --------------

Profit for the

year - - - - - - 20 20

Foreign

exchange on

consolidation

of

subsidiaries - - (21) - - - - (21)

--------------- --------- --------- -------- ------- --------- -------------------- --------------

Total

comprehensive

income for

the period - - (21) - - - 20 (1)

Balance at 30

April 2012 187 2,606 (73) 262 (85) 176 (1,184) 1,889

=============== ========= ========= ======== ======= ========= ==================== ==============

Note 1 SEGMENT ANALYSIS

Management consider that there is a single operating segment

being the supply of digital imaging equipment, encompassing

Synoptics three marketing brands: Syngene, Synbiosis, Syncroscopy

and the Atik brand which is used within Synoptics brands and sold

externally to the amateur astronomy market. Each of the brands have

a number of products and whilst sales performance of each brand are

monitored, resources are managed and strategic decisions made on

the basis of the Group as a whole.

The geographical analysis of revenue by destination and

non-current assets (excluding deferred tax) by location is set out

below:

Revenue by destination of external customer 2013 2012

GBP000 GBP000

United Kingdom (country of domicile) 747 802

Germany 774 505

Rest of Europe 1,443 1,376

America 2,354 2,248

Hong Kong 743 500

India 482 665

Rest of Asia 809 734

Rest of World 313 340

------ ------

7,665 7,170

====== ======

Non-current assets by location 2013 2012

GBP000 GBP000

United Kingdom 1,076 894

Portugal 62 61

America 173 157

------ ------

1,311 1,112

====== ======

NOTE 2 TaxATION

2013 2012

GBP000 GBP000

Corporation tax:

Corporation tax due - 10

Current year R & D claim - -

Prior year R & D claim 2 -

----------------------------------- --------------------

2 10

Deferred tax expense/(credit) 19 (10)

----------------------------------- --------------------

Income tax charge 21 -

=================================== ====================

Reconciliation of effective tax rate

2013 2012

GBP000 GBP000

Profit on ordinary activities before tax 213 20

--------------- ------------------

Profit on ordinary activities multiplied

by standard rate of

Corporation tax in the UK of 23.92% (2012:

25.84%) 51 5

Effects of:

Expenses not deductible for tax purposes 1 14

Additional deduction for R&D expenditure (104) (58)

Transferred to tax losses 73 39

--------------- ------------------

21 -

=============== ==================

The Group takes advantage of the enhanced tax deductions for

Research and Development expenditure in the UK and expects to

continue to be able to do so.

NOTE 3 Deferred tax

2013 2012

Deferred Deferred

tax tax Deferred Deferred

asset liability tax asset tax liability

GBP000 GBP000 GBP000 GBP000

At 1 May 2012 113 (138) 113 (148)

Deferred tax on capitalised

R & D - (20) - 6

Tax losses utilised - - 19 -

Short term temporary differences 12 (14) (11) (4)

Charge on intangibles recognised

on acquisition - 8 - 8

Share based payments - - (8) -

At 30 April 2013 125 (164) 113 (138)

============= ============ ================= ================

2013 2012

Asset Liability Asset Liability

GBP000 GBP000 GBP000 GBP000

Deferred tax on capitalised

R & D - (129) - (109)

Other temporary differences 12 (20) 1 (13)

Deferred tax on acquisition

intangibles - (15) - (16)

Trading losses recognised 113 - 112 -

------------- --------------- ------------- ----------------

125 (164) 113 (138)

============= =============== ============= ================

Deferred tax assets are recognised for tax losses available for

carrying forward to the extent that the realisation of the related

tax benefit through future taxable profits is probable. The Group

did not recognise deferred tax assets of GBP430k (2012: GBP524k) in

respect of losses. Total losses (provided and unprovided) totalled

GBP1.8m (2012: GBP2.4m).

There were no unrecognised taxable temporary differences.

NOTE 4 Borrowings

Borrowings are repayable as follows:

2013 2012

GBP000 GBP000

Within one year

Loan stock 368 -

Bank finance 76 91

Finance leases 28 23

----------------------------- ------------------

472 114

----------------------------- ------------------

After one and within five years

Loan stock - 368

Finance leases 38 40

----------------------------- ------------------

38 408

----------------------------- ------------------

Over five years

Finance leases - 15

----------------------------- ------------------

Total borrowings 510 537

============================= ==================

Bank finance relates to amounts drawn down under the Group's

invoice discounting facility.

The proceeds of GBP368,000 from the issue of the loan stock are

stated after adjustment in accordance with the accounting treatment

required under IAS 32. Certain rights that are attached to the

Company's loan stock result in it having characteristics of both

equity and liabilities. Therefore the loan stock is considered to

be a compound instrument.

The value of the liability component has been calculated based

on the present value of the future cash flows in respect of

payments the Company is obliged to make to holders of its loan

stock. A value of GBP40,986 included within equity under the

heading 'Other reserve' is the residual amount.

The loan stock is unsecured, bears interest at 9% per annum and

could have been converted at any time prior to 30 April 2013 at a

rate of one ordinary share for every GBP0.70 nominal amount of loan

stock. Any unconverted loan stock is due for repayment on 31 July

2013.

Subscribers to the loan stock also received warrants to

subscribe for one ordinary share at a price of GBP0.70 for each

GBP4.00 of loan stock subscribed for. The warrants are valid until

31 July 2013, except that this period may be extended by the

Company at its sole option. The total number of warrants issued by

the Company was 94,750.

NOTE 5 Earnings per share

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of Scientific Digital

Imaging plc divided by the weighted average number of shares in

issue during the year, excluding shares held by the Synoptics

Employee Benefit Trust. All earnings per share calculations relate

to continuing operations of the Group.

Basic earnings

Profits Weighted per share

attributable average number amount in

to shareholders of shares pence

GBP000

Year ended 30 April 2013 192 18,323,464 1.05

Year ended 30 April 2012 20 17,989,257 0.11

The calculation of the diluted earnings per share is based on

the profits attributable to the shareholders of Scientific Digital

Imaging Plc divided by the weighted average number of shares in

issue during the year, as adjusted for dilutive share options and

dilutive deferred consideration.

Diluted

earnings

per share

amount in

pence

Year ended 30 April 2013 1.01

Year ended 30 April 2012 0.10

The reconciliation of average number of ordinary shares used for

basic and diluted earnings is as below:

2013 2012

Weighted average number of ordinary shares

used for basic earnings per share 18,323,464 17,989,257

Weighted average number of ordinary shares

used as deferred consideration - 666,500

Weighted average number of ordinary shares

under option 659,063 370,927

---------- ----------

Weighted average number of ordinary shares

used for diluted earnings per share 18,982,527 19,026,684

========== ==========

Since the balance sheet date the Group announced that it had

raised approximately GBP850,000 (before expenses) through a placing

and a subscription of new ordinary shares. This will increase the

shares in issue to 25,034,910. The impact would be a dilution of

the earnings per share amount to 0.76p.

NOTE 6 FINANCIAL INFORMATION

The financial information set out above, which has been

extracted from the annual report and accounts for the year ended 30

April 2013 does not constitute statutory accounts within the

meaning of section 435 of the Companies Act 2006.

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

www.scientificdigitalimaging.com

The Company's Annual General Meeting is due to take place at

Francis House, 112 Hills Road, Cambridge CB2 1PH on 16 September

2013 at 11:00 am.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR NKNDQFBKDNOB

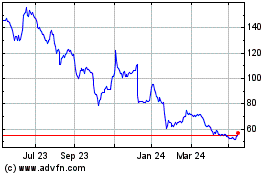

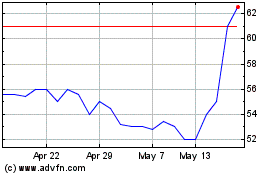

Sdi (LSE:SDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdi (LSE:SDI)

Historical Stock Chart

From Jul 2023 to Jul 2024