TIDMROCK

RNS Number : 7557X

Rockfire Resources PLC

06 May 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("EUWA")) ("UK MAR"). IN ADDITION, MARKET SOUNDINGS (AS

DEFINED IN UK MAR) WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS

CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN

PERSONS BECAME AWARE OF INSIDE INFORMATION (AS DEFINED UNDER UK

MAR). UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION

IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE

INFORMATION, WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

6 May 2021

Rockfire Resources plc

("Rockfire" or the "Company")

Placing to fund drilling at Copper Dome and Copperhead

Rockfire Resources plc (LON: ROCK), the gold and base metal

exploration company, is pleased to announce that it has

successfully completed a placing of new ordinary shares in the

Company, raising gross proceeds of GBP850,000. These funds will be

used to commence Inaugural drilling at the Company's Copper Dome

and Copperhead projects, as well as to fund on-going drilling at

the Company's Plateau Gold Deposit ("Plateau"), part of the

Lighthouse tenement in North Queensland, Australia. All projects

are 100 per cent. owned by Rockfire.

Highlights

-- Successful raise of GBP850,000, through a placing by the

Company's sole broker, Allenby Capital Limited ("Allenby Capital"),

of 121,429,200 new ordinary shares of 0.1p each in the Company (the

"Placing Shares") at an issue price of 0.7 pence per Placing Share

(the "Placing").

-- The Placing Shares will represent approximately 12.72 per

cent. of the enlarged issued share capital of the Company and have

been subscribed for by a combination of new investors and existing

shareholders.

-- The Placing Shares are being issued at a price of 0.7 pence

per Placing Share, representing a discount of approximately 20.45

per cent. to the closing mid-market share price of an existing

ordinary share on 5 May 2021, the business day prior to this

announcement. The Company will not be issuing any warrants in

connection with the Placing.

-- Rockfire's largest shareholder and one of the Company's

non-executive directors, Nicholas Walley, has subscribed for

6,000,000 shares in the Placing, thereby increasing his holding in

the Company to 59,000,000 ordinary shares.

-- The net proceeds of the Placing will be applied to (i)

inaugural RC drilling at Copper Dome; (ii) exploration RC drilling

close to the resource at Plateau; and (iii) inaugural drilling at

Copperhead.

David Price, Chief Executive of Rockfire, said : "The Copper

Dome and Copperhead porphyry projects have not been drilled for

almost 50 years. When drilled in 1972, significant copper (and

gold) was encountered in each drill hole. At Copper Dome, seven (7)

holes were drilled in 1972, and five (5) holes were drilled at

Copperhead. With new data from the very high-resolution magnetic

surveys recently flown by Rockfire, specific targets have been

identified which we expect will vector towards the central parts of

the porphyries.

The Plateau Gold Deposit is shaping up nicely, having returned a

material increase in resource ounces and positive indicators in

early scoping work. It is prudent for the Company to continue to

drill this resource and to extend the gold envelope in areas which

remain open along strike and at depth. Close to Plateau, new

targets have been identified and our intension is to drill these

too.

On behalf of the Board, I would like to extend our thanks to

Allenby Capital for a successful placing. Thank you also to our

supportive shareholders who have participated in this placing and a

warm welcome to investors who have joined the Rockfire register for

the first time. The Board and Management are very much looking

forward to inaugural drilling at our large copper targets and we

anticipate good news as we drill-test these projects.

A reverse circulation drilling rig is available in Charters

Towers and the Company plans to mobilise as quickly as possible to

commence drilling at Copper Dome. Our Exploration Manager is on

site preparing the site for drilling and we anticipate a start

within the next few weeks. The market will be updated on our

drilling progress."

Reasons for the Placing and use of proceeds

Over the last 12 months, Rockfire has successfully increased the

gold resource at the Plateau Gold Deposit by more than 500 per

cent. Following this upgraded resource, the Company instigated a

preliminary Scoping Study to determine if Plateau would be capable

of generating free cash flow, even at such an early stage. A range

of outcomes resulted, dependent on a number of variables. A net

positive cash flow ranging from GBP3.7m - GBP10.7m was achieved.

The study emphasised the additional work required to potentially

upgrade the resources from Inferred to Indicated, as well as

extension drilling which may result in increased resources.

A budget of GBP0.65 million is proposed in order to achieve the

following.

-- Inaugural RC drilling at Copper Dome

-- Exploration RC drilling close to the resource at Plateau

-- Inaugural diamond drilling at Copperhead

The majority of the net proceeds of the Placing will be applied

towards direct drilling expenses, with an amount of GBP200,000

being allocated to working capital.

Director participation in the Placing

Nicholas Walley, a Non-executive Director of the Company, has

subscribed for 6,000,000 Placing Shares, at the issue price of 0.7

pence per ordinary share. Following this subscription, Nicholas

Walley will hold 59,000,000 ordinary shares in the Company,

equivalent to 6.18 per cent. of the Company's issued share capital

as enlarged by the Placing. The FCA notification, made in

accordance with the requirements of the UK Market Abuse Regulation,

is appended below.

Details of the Placing and total voting rights

A total of 121,429,200 Placing Shares are to be issued at a

price of 0.7 pence per Share. The Placing has been conducted

utilising the Company's existing share authorities. Allenby Capital

acted as the Company's sole broker in connection with the Placing.

The Placing is conditional, inter alia, on admission of the Placing

Shares to trading on AIM ("Admission") becoming effective.

Application has been made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that Admission will become effective and that dealings in the

Placing Shares on AIM will commence on or around 11 May 2021.

On Admission, the Company's issued ordinary share capital will

consist of 954,997,653 ordinary shares of 0.1p each, with one vote

per share. The Company does not hold any ordinary shares in

treasury. Therefore, on Admission, the total number of ordinary

shares and voting rights in the Company will be 954,997,653. With

effect from Admission, this figure may be used by shareholders in

the Company as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Notice to Distributors

Solely for the purposes of the temporary product intervention

rules made under sections S137D and 138M of the Financial Services

and Markets Act 2000 and the FCA Product Intervention and Product

Governance Sourcebook (together, the "Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the Product Governance Requirements) may

otherwise have with respect thereto, the Placing Shares have been

subject to a product approval process, which has determined that

the Placing Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, as defined under

the FCA Conduct of Business Sourcebook COBS 3 Client

categorisation, and are eligible for distribution through all

distribution channels as are permitted by the FCA Product

Intervention and Product Governance Sourcebook (the "Target Market

Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

offer no guaranteed income and no capital protection; and an

investment in the Placing is compatible only with investors who do

not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Allenby Capital Limited will only procure investors who

meet the criteria of professional clients and eligible

counterparties. For the avoidance of doubt, the Target Market

Assessment does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of the FCA Conduct of Business

Sourcebook COBS 9A and 10A respectively; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action

whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

For further information on the Company, please visit

www.rockfireresources.com or contact the following:

Rockfire Resources plc: info@rockfireresources.com

David Price, Chief Executive Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0) 20 3328

& Broker) 5656

John Depasquale / Nick Athanas / George

Payne (Corporate Finance)

Matt Butlin (Sales and Corporate Broking)

Yellow Jersey rockfire@yellowjerseypr.com

Sarah Hollins / Henry Wilkinson Tel: +44 (0) 20 3004

9512

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Nicholas Walley

-------------------- --------------------------------------------------

2 Reason for the notification

------------------------------------------------------------------------

a) Position/status Non-Executive Director

-------------------- --------------------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------- --------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------

a) Name Rockfire Resources plc

-------------------- --------------------------------------------------

b) LEI 213800THSZQSFKTXOI24

-------------------- --------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

------------------------------------------------------------------------

a) Description Ordinary shares of 0.1p each in Rockfire Resources

of the financial plc

instrument, Identification code (ISIN) for Rockfire Resources

type of instrument plc ordinary shares: GB00B42TN250

Identification

code

-------------------- --------------------------------------------------

b) Nature of Purchase of shares

the transaction

-------------------- --------------------------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s) 0.7p 6,000,000

---------

-------------------- --------------------------------------------------

d) Aggregated N/A

information

- Aggregated

volume

- Price

-------------------- --------------------------------------------------

e) Date of the 6 May 2021

transaction

-------------------- --------------------------------------------------

f) Place of the Outside a trading venue

transaction

-------------------- --------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDKABKABKKQPK

(END) Dow Jones Newswires

May 06, 2021 02:05 ET (06:05 GMT)

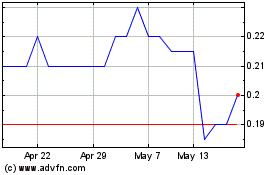

Rockfire Resources (LSE:ROCK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rockfire Resources (LSE:ROCK)

Historical Stock Chart

From Jul 2023 to Jul 2024