Regional REIT Limited Portfolio Valuation and Update (3735M)

January 20 2016 - 2:00AM

UK Regulatory

TIDMRGL

RNS Number : 3735M

Regional REIT Limited

20 January 2016

20 January 2015

Regional REIT Limited

("Regional REIT" or the "Company")

Portfolio valuation and update on recent Basingstoke

purchase

The Board of Regional REIT (LSE: RGL), the recently listed

regional commercial property company, today announces the valuation

of the Group's property portfolio as at 31 December 2015.

The value of the property portfolio as at 31 December 2015 was

GBP407,107,500. This is an increase of 7.25%, on a like for like

basis, from the 30 June 2015 value of GBP379,575,000. During the

period the Company undertook the sale of six properties for a total

of GBP8.79m, generating a GBP2.365m surplus to their 30 June 2015

valuation. Since the sale of these properties completed before 31

December, they are not included in the valuation announced

today.

In addition, following the recent announcement on 6 January 2016

regarding the purchase of Rosalind House, Basingstoke, the Company

has now agreed a lease surrender for a reverse premium of

GBP888,000 and back to back letting following refurbishment to New

Voice Media on a new 10 year lease at GBP394,755 per annum.

Enquiries:

Regional REIT Limited

Press enquiries through Headland

London & Scottish Investments Tel: +44 (0) 141 248 4155

Asset manager to the Company

Stephen Inglis

Derek McDonald

Toscafund Asset Management Tel: +44 (0) 20 7845 6100

Investment manager to the Company

Nigel Gliksten

Headland Tel: +44 (0)20 7367 5222

Financial PR

Francesca Tuckett

About Regional REIT

Regional REIT Ltd (LSE: RGL) is a London Stock Exchange Main

Market listed specialist real estate investment company focused on

office and industrial property interests in the principal regional

locations of the UK outside of the Greater London area.

The REIT is a managed by a partnership between London &

Scottish and Toscafund, and was formed by the merger of two

existing funds created by the managers to achieve a differentiated

play on recovery in UK regional property to deliver an attractive

total return to shareholders, with a strong focus on income.

The Company's investment portfolio is spread across more than

130 regional properties consisting of around 720 individual units,

with over 500 tenants. As at December 2015, the investment

portfolio had a value of GBP407,107,500 and an overall income yield

of 8.3%. The weighted average unexpired lease term is just under 6

years.

The Company's shares were admitted to the Main Market of the

London Stock Exchange on 6 November 2015. For more information,

please visit http://www.regionalreit.com/

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCZMGMMRLRGVZM

(END) Dow Jones Newswires

January 20, 2016 02:00 ET (07:00 GMT)

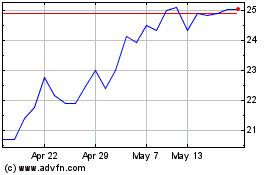

Regional Reit (LSE:RGL)

Historical Stock Chart

From Oct 2024 to Nov 2024

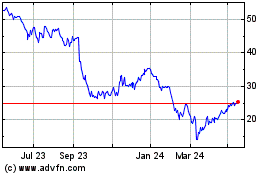

Regional Reit (LSE:RGL)

Historical Stock Chart

From Nov 2023 to Nov 2024