TIDMREC

RNS Number : 8815T

Record PLC

23 July 2015

RECORD PLC

("Record" or "the Company")

Notification of shareholder resolutions at

2015 Annual General Meeting

in compliance with Listing Rule 9.6.18R

23 July 2015

Record plc held its Annual General Meeting at 10.00 a.m. on 23

July 2015 at Morgan House, Madeira Walk, Windsor SL4 1EP.

All of the eleven resolutions set out in the Notice of Annual

General Meeting sent to shareholders on 25 June 2015 were passed.

The following is a summary of the proxy votes that were received by

the Company's registrars:

Votes Votes Total Votes

For Against votes Withheld

(including cast

Discretionary) as a %

of Record

plc issued

ordinary

shares

------------------------ --------------------- ---------------- ------------ ----------

Resolution Number % Number % Number

of of of of % of

votes votes votes votes votes

cast cast

------------------------ ------------ ------- ------- ------- ------------ ----------

1. To receive

and adopt the

Annual Report

& Financial

Statements of

the Company

for the year

ended 31 March

2015. 150,949,016 99.99% 9,300 0.01% 68.19% 0

------------------------ ------------ ------- ------- ------- ------------ ----------

2. To declare

a final dividend

of 0.90 pence

per ordinary

share of GBP0.00025

in the capital

of

the Company. 150,958,316 100% 0 0.00% 68.19% 0

------------------------ ------------ ------- ------- ------- ------------ ----------

3. To re-elect

James Wood-Collins

as a director

of the Company. 150,947,834 99.99% 10,482 0.01% 68.19% 0

------------------------ ------------ ------- ------- ------- ------------ ----------

4. To re-elect

Andrew Sykes

as

an independent

director of

the Company. 150,944,834 99.99% 13,482 0.01% 68.19% 0

5. To re-elect

David Morrison

as

an independent

director of

the Company. 150,863,686 99.94% 94,630 0.06% 68.19% 0

6. To re-appoint

Grant Thornton

UK LLP as auditor

of the Company

and to authorise

the directors

to agree their

remuneration. 150,923,316 99.99% 9,000 0.01% 68.18% 26,000

------------------------ ------------ ------- ------- ------- ------------ ----------

7. To approve

the Directors'

Remuneration

Report (excluding

the Directors'

Remuneration

Policy) as set

out on pages

43 to 53 of

the Annual Report

& Financial

Statements of

the Company. 150,902,249 99.97% 51,197 0.03% 68.19% 4,870

------------------------ ------------ ------- ------- ------- ------------ ----------

8. To authorise

the Directors

to allot Ordinary

Shares on the

terms set out

in the notice

of annual general

meeting. 150,929,016 99.98% 29,300 0.02% 68.19% 0

------------------------ ------------ ------- ------- ------- ------------ ----------

9. To disapply

statutory pre-emption

rights on the

terms set out

in the notice

of annual general

meeting. 150,885,016 99.97% 47,300 0.03% 68.18% 26,000

------------------------ ------------ ------- ------- ------- ------------ ----------

10. To authorise

the Company

to purchase

own shares on

the terms set

out in the notice

of annual general

meeting. 150,943,016 99.99% 15,300 0.01% 68.19% 0

------------------------ ------------ ------- ------- ------- ------------ ----------

11. To permit

general meetings

of the Company

(other than

annual general

meetings) to

be called on

not less than

14 clear days'

notice. 150,929,016 99.98% 29,300 0.02% 68.19% 0

------------------------ ------------ ------- ------- ------- ------------ ----------

VOTES OF SHAREHOLDERS EXCLUDING CONTROLLING SHAREHOLDERS

Votes Votes Total Votes

For Against votes Withheld

(including cast

Discretionary) as a %

of Record

plc issued

ordinary

shares

----------------- -------------------- ---------------- ------------ ----------

Resolution Number % Number % Number

of of of of % of

votes votes votes votes votes

cast cast

----------------- ----------- ------- ------- ------- ------------ ----------

4. To re-elect

Andrew Sykes

as

an independent

director of

the Company. 79,537,005 99.98% 13,482 0.02% 36.13% 0

----------------- ----------- ------- ------- ------- ------------ ----------

5. To re-elect

David Morrison

as

an independent

director of

the Company. 79,455,857 99.88% 94,630 0.12% 36.13% 0

----------------- ----------- ------- ------- ------- ------------ ----------

As the Company has a controlling shareholder (as defined in the

Financial Conduct Authority's Listing Rules), each resolution to

re-elect an independent director (being resolutions 4 and 5) have,

under Listing Rule 9.2.2E, been approved by a majority of the votes

cast by:

-- the shareholders of the Company as a whole; and

-- the independent shareholders of the Company, that is, all the

shareholders entitled to vote on each resolution excluding the

controlling shareholder.

Note: A "vote withheld" is not a vote in law and is not counted

in the calculation of the proportion of the votes "for" and

"against" a resolution.

All of the above resolutions were passed on a show of hands.

Each was passed unanimously in favour. Resolutions 9, 10 and 11

were passed as special resolutions.

The number of ordinary shares in issue at the date of this

announcement is 221,380,800.

For further information, please contact:

Record plc Tel: +44 (0) 1753 852 222

James Wood-Collins

Steve Cullen

MHP Tel: +44 (0) 20 3128 8100

Nick Denton

Notes to Editors

Record is a specialist currency manager and provider of currency

hedging services for institutional clients. Founded in 1983, Record

has established a market leading position as a currency manager.

Specifically, the Group has a leading position in managing Dynamic

Hedging and Currency for Return for institutional clients.

The Group has three principal product lines:

- Dynamic Hedging, formerly known as Active Hedging, where

Record seeks to eliminate the impact of currency movements on

elements of clients' investment portfolios that are denominated in

foreign currencies when these movements are expected to result in

an economic loss to the client, but not to do so when they are

expected to result in an economic gain;

- Passive Hedging, where Record seeks to eliminate fully or

partially the economic impact of currency movements on elements of

clients' investment portfolios that are denominated in foreign

currencies; and

- Currency for Return, in which Record enters into currency

contracts for clients with the objective of generating positive

returns.

Record (LSE: REC) was admitted to trading on the main market of

London Stock Exchange plc on 3 December 2007.

This information is provided by RNS

The company news service from the London Stock Exchange

END

RAGSELSUDFISELW

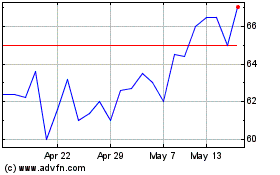

Record (LSE:REC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Record (LSE:REC)

Historical Stock Chart

From Jul 2023 to Jul 2024