TIDMPRTC

RNS Number : 4077D

PureTech Health PLC

31 January 2018

31 January 2018

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN WHOLE OR IN PART IN OR INTO THE UNITED STATES OR

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION.

PureTech Health plc

PureTech Affiliate resTORbio Announces Closing of Initial Public

Offering and Full Exercise of Underwriters' Option to Purchase

Additional Shares

PureTech Health affiliate raises additional $12.8 million,

bringing gross offering proceeds to $97.8 million

PureTech Health plc (LSE: PRTC), an advanced, clinical-stage

biopharmaceutical company, announced today that resTORbio, Inc.

(resTORbio), an affiliate of PureTech Health, has announced the

closing of its initial public offering of 6,516,667 shares of

common stock at a public offering price of $15.00 per share, which

includes the exercise in full by the underwriters of their option

to purchase up to 850,000 additional shares. The gross proceeds

from the offering were $97.8 million, before deducting underwriting

discounts and commissions and estimated offering expenses. The

shares commenced trading on the Nasdaq Global Select Market on

January 26, 2018 under the ticker symbol "TORC."

The full text of the announcement from resTORbio is as

follows:

resTORbio Announces Closing of Initial Public Offering and Full

Exercise of Underwriters' Option to Purchase Additional Shares

BOSTON, Massachusetts, January 30, 2018 - resTORbio, Inc.

(NASDAQ:TORC), a clinical-stage biopharmaceutical company focused

on the development and commercialization of novel therapeutics for

the treatment of aging-related diseases, today announced the

closing of its initial public offering of 6,516,667 shares of

common stock at a public offering price of $15.00 per share, which

includes the exercise in full by the underwriters of their option

to purchase up to 850,000 additional shares. The gross proceeds

from the offering are expected to be $97.8 million, before

deducting underwriting discounts and commissions and estimated

offering expenses. All of the shares in the offering were offered

by resTORbio. The shares commenced trading on the NASDAQ Global

Select Market on January 26, 2018 under the ticker symbol

"TORC."

BofA Merrill Lynch, Leerink Partners, and Evercore ISI acted as

joint book-running managers for the offering. Wedbush PacGrow acted

as a co-manager for the offering.

A registration statement relating to these securities has been

filed with, and declared effective by, the Securities and Exchange

Commission. Copies of the final prospectus relating to this

offering may be obtained from BofA Merrill Lynch, NC1-004-03-43,

200 North College Street, 3rd floor, Charlotte, NC 28255-0001,

Attention: Prospectus Department, or by email at

dg.prospectus_requests@baml.com; Leerink Partners, Attention:

Syndicate Department, One Federal Street, 37th Floor, Boston, MA

02110, or by telephone at (800) 808-7525 ext. 6132, or by email at

syndicate@leerink.com; or Evercore ISI, Attention: Equity Capital

Markets, 55 East 52nd Street, 36th Floor, New York, NY 10055,

telephone: (888) 474-0200, or by email at

ecm.prospectus@evercore.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About resTORbio

resTORbio, Inc. is a clinical-stage biopharmaceutical company

focused on the development and commercialization of novel

therapeutics for the treatment of aging-related diseases.

resTORbio's lead program focuses on selective inhibition of the

target of rapamycin complex 1 (TORC1) pathway to treat

aging-related diseases with an initial focus on diseases caused by

immunosenescence, the decline in immune function that occurs during

aging.

Contacts:

Beth DelGiacco

Stern Investor Relations, Inc.

212-362-1200

beth@sternir.com

Michael Lampe

Scient PR

484-575-5040

michael@scientpr.com

Ownership Information and Other Required Disclosures

PureTech Health invested $19.0 million in resTORbio prior to its

IPO and invested $3.5 million in the IPO. After giving effect to

the IPO, PureTech Health owns 9,800,396 shares of common stock

representing approximately 34.2% of resTORbio including the

exercise of the underwriters' option to purchase additional 850,000

shares (calculated on a diluted basis)(1) .

(1) This calculation includes issued and outstanding shares as

well as outstanding options to purchase shares, but excludes

unallocated shares authorised to be issued pursuant to equity

incentive plans.

About PureTech Health

PureTech Health (PureTech Health plc, PRTC.L) is an advanced,

clinical-stage biopharmaceutical company developing novel medicines

targeting serious diseases that result from dysfunctions in the

nervous, immune, and gastrointestinal systems (brain-immune-gut or

the "BIG" axis), which together represent the adaptive human

systems. PureTech Health is at the forefront of understanding and

addressing the biological processes and crosstalk associated with

the BIG axis. By harnessing this emerging field of human biology,

PureTech Health is pioneering new categories of medicine with the

potential to have great impact on people with serious diseases.

PureTech Health is advancing a rich pipeline of innovative

therapies that includes two pivotal stage programmes, multiple

human proof-of-concept studies and a number of early clinical and

pre-clinical programmes. PureTech's rich research and development

pipeline has been advanced in collaboration with some of the

world's leading scientific experts, who along with PureTech's team

of biopharma pioneers, entrepreneurs and seasoned Board, identify,

invent, and clinically de-risk new medicines. With this experienced

team pursuing cutting edge science, PureTech Health is building the

biopharma company of the future focused on improving and extending

the lives of people with serious disease.

Forward Looking Statement

This press release contains statements that are or may be

forward-looking statements, including statements that relate to

PureTech's future prospects, developments and strategies. The

forward-looking statements are based on current expectations and

are subject to known and unknown risks and uncertainties that could

cause actual results, performance and achievements to differ

materially from current expectations, including, but not limited

to, those risks and uncertainties described in the risk factors

included in the regulatory filings for PureTech Health. These

forward-looking statements are based on assumptions regarding the

present and future business strategies of the company and the

environment in which it will operate in the future. Each

forward-looking statement speaks only as at the date of this press

release. Except as required by law and regulatory requirements,

neither PureTech Health nor any other party intends to update or

revise these forward-looking statements, whether as a result of new

information, future events or otherwise.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Contact:

PureTech Health

Investor Relations

Allison Mead

Talbot

+1 617 651 3156

amt@puretechhealth.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAEFFDLNPEEF

(END) Dow Jones Newswires

January 31, 2018 02:00 ET (07:00 GMT)

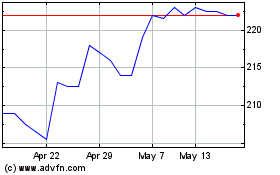

Puretech Health (LSE:PRTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Puretech Health (LSE:PRTC)

Historical Stock Chart

From Jul 2023 to Jul 2024