TIDMPRIM

RNS Number : 4823O

Primorus Investments PLC

18 May 2018

Primorus Investments plc

("Primorus" or the "Company")

Final results for year ended 31 December 2017

Chairman's Statement

I am pleased to present the Chairman's Statement and Strategic

report for the year ended 31 December 2017.

Overview

Primorus Investments plc ("Primorus") has a strong balance sheet

with no debt and with current assets (including cash of GBP561,000)

as at 31 December 2017 amounting to GBP1,286,000. (2016:

GBP1,295,000)

It has been a successful year for the Company with the addition

of several new investments as detailed below in Investments. 2017

was dominated by portfolio acquisition, consolidation and

rationalisation through the participation in our first secondary

funding rounds and the sale of our legacy stake in GMOW and the

strong growth seen at Engage Technology and Fresho.

Highlights for the year were as follows:

-- HHDL received planning permission for the Extended Flow Test of the HH-1 oil discovery;

-- Engage Technology platform expanded significantly and

appointed Microsoft UK Cloud Services Director as non-executive

Director;

-- Sale of entire stake in Gold Mines of Wales for 83,333,333

shares in Alba Mineral Resources plc;

-- Participation in a successful A$4m second round investment in

Fresho Pty Ltd at a 40% premium to first round;

-- Second round investment in WeShop at a 20% premium to first

round. Platform usage grows markedly since second-round investment,

with registered users surging 76% in Q1 2018 to 150,000 and unique

users topped 1m for the first time.

-- Appointment of TPI Limited as exclusive Company Broker;

-- Directors purchased 97m ordinary shares in the Company via on-market purchases;

-- Successfully raised approximately GBPGBP3.4m during the

period through the issue of approximately 1.7 billion Primorus

shares at placing prices of 0.15p and 0.20p per share;

-- A post year end sale of 5% stake in HHDL for consideration of GBP1m; and

-- A further investment post year end in Engage of GBP500,000.

Significant progress has also been made elsewhere in our

portfolio and we look forward to providing updates as key news

develops at TruSpine, Sport80, FOMO Money, Nomad Energy, SOA,

Farina and StreamTV.

We regularly meet the CEOs and management of companies which are

seeking funds to further their businesses. It is notable the

comments we receive on the perceived difficulty in securing funding

outside of the VC/VCT and private equity universe. Several

companies pointed out to us that there is simply a dearth of

investors able to participate directly in pre-IPO and private

funding rounds and that VC/VCT funding terms are onerous to the

point of being unattractive.

It is important for shareholders to understand that whilst we do

everything possible to support our existing investments because it

is in our interest to do so, we do not have a direct effect on the

exact timing of any given IPO and or trade sale. We do however

maintain regular dialogue with the companies in question and use

the Board's extensive experience in public markets to make a value

judgement on when and if a transaction may occur.

Thus, these timings may change over time as the facts change but

we will update shareholders as material changes occur.

Recently we have seen sustained core investment progress,

portfolio rebalancing and more clarity on the likely timing of

several of our investments towards IPO. Going forward we hope to

receive material news from several of our investments as they

commence the formal IPO process.

Investments

Horse Hill Developments Limited

The Company currently owns a 5% direct interest in Horse Hill

Developments Limited ("HHDL"), which is a special purpose company

that owns a 65% participating interest and operatorship of Licence

PEDL137 and the adjacent Licence PEDL246 in the UK Weald Basin.

As announced on 28 February 2018, the Company disposed of half

of its original 10% stake in HHDL for a total consideration of

GBP1m. This sale was designed to increase existing cash reserves,

rebalance the portfolio make-up and reduce the expected cash calls

resulting from the soon-to-commence 90 day extended flow test

("EWT") of the HH-1 discovery well. As a result of this

transaction, Primorus retains a 5% direct shareholding in HHDL. We

remain optimistic that the EWT will return substantial

flow-rates.

As reported in March 2016, the final total aggregate stable dry

oil flow rate from two Kimmeridge limestones plus the overlying

Portland sandstone in HH-1 stands at 1,688 barrels of oil per day

("bopd"), a UK record for an onshore discovery well. Over the 30 to

90 hour flow periods from each of the 3 zones in HH-1, no clear

indication of any reservoir pressure depletion was observed.

The carrying value of this investment remains unchanged however

the Board looks forward with considerable interest to the upcoming

long-term extended flow test programme in 2018 and its likely

potential impact on our investment value going forward.

SOA Energy

SOA Energy ("SOA") is an oil exploration and development company

with prospects in the Dead Sea region of Israel. Primorus

participated in a private funding round by purchasing 14,977 shares

at GBP6.67 per share. SOA is currently seeking a significant

funding package to further their development plans. We are

encouraged by funding progress made by SOA and we expect a funding

deal to be completed soon.

Fresho Pty Ltd

Fresho Pty Ltd ("Fresho"), a company in which Primorus holds an

investment of approximately GBP250,000, representing approximately

3.1% of Fresho's issued share capital, is positioning itself as a

leading Australian B2B company servicing the restaurant and food

service industries. By aggregating and streamlining the food order

process via Fresho's unique cloud-based platform, both customers

and suppliers are able to make savings in time, money and wastage

and also generate powerful reporting and business data

analytics.

We continued to be impressed by the team at Fresho. We met

management in Melbourne in October 2017 and were not only pleased

with the business performance to date but also by the financial

interest generated in Fresho which enabled them to raise A$4m in

what we understand to have been a keenly sought-after funding

round.

Pleasingly the Fresho platform continues to perform strongly

with order volumes and customers numbers in Australia and now New

Zealand growing strongly. Fresho maintains a strong cash balance

and it is anticipated that it should get to a breakeven basis,

including R&D spend, sometime in the second half of 2018.

Whilst much of the data regarding Fresho is now "commercial in

confidence", the Board of Primorus believes the Fresho platform is

exceeding our expectations.

Nomad Energy

Nomad Energy is a private oil and gas exploration and

development company primarily focussed on commercialising existing

gas reserves in shallow offshore waters off the Ivory Coast. Nomad

Energy is currently attempting to negotiate a gas sales agreement

with local utilities for the supply of gas to existing and proposed

power stations in the country. Primorus owns 40,000 shares at the

last investor round price of US$7.50 per share.

We have been informed that negotiations over off-take pricing

for its domestic gas project are moving forward, albeit more slowly

than first anticipated. Completing this off-take is the final step

in allowing Nomad to monetise the asset with its partner VITOL and

thereby potential providing a good return on our investment. We

will keep shareholders up to date as these matters progress.

TruSpine Technologies Limited

Primorus invested GBP500,000 in TruSpine Technologies Limited

("Truspine") on a pre-new money valuation of GBP15m. Founded in

December 2014, TruSpine secured intellectual property and

subsequently developed the Faci-LOK and Cervi-FAS minimally

invasive spine stabilisation devices, and the VOSC Catheter

atherosclerosis treatment product 'VOSC Catheter'. This development

is on-going and TruSpine is targeting FDA clearance and

commercialisation of its first product, the Faci-LOK with a view to

an AIM IPO. We have been informed TruSpine will require further

funding to complete this. We understand TruSpine is in negotiations

with a funder at the current time to provide all the funding

required.

Importantly, TruSpine has appointed Mr Simon Stephens as its new

interim CEO. Most recently, Simon has held the position of Research

Director for London Valve Therapies, where he was responsible for

the provision of a new service for the analysis of

CT/Echocardiography scans for bleeding edge transcathether cardiac

interventions mainly for Mitral Valve/Left Ventricular procedures.

He is also a Research Fellow at the Royal Brompton & Harefield

NHS Foundation Trust. In a previous role as CTO for Hometrack, he

was responsible for developing software technologies that resulted

in the company being sold in 2017 for GBP120m. In addition to Mr

Stephens, Professor Abdallah Raweh has joined the medical advisory

board. He is a professor of Cardiology who was trained in Italy,

the UK and US, and who now operates internationally.

We view the appointment of Mr Stephens and Professor Raweh as

key steps in helping to secure the remaining funding required to

complete the FDA fast-track approvals process and build a credible

Board in advance of an IPO. We look forward to updating

shareholders in the near future as to the progress of the

aforementioned TruSpine funding, as that is key to unlocking the

FDA fast-track and IPO processes.

Sport:80 plc

Primorus invested GBP100,000 in Sport:80 plc ("Sport:80") on a

pre-new money valuation of GBP10m as part of a fundraising of up to

GBP1m. Sport:80 is a technology and management company with a

proprietary cloud-based platform focused on transforming the

business operations and management of sports organisations. The

Sport:80 platform is used by 20 prominent sports organisations.

Sport:80 is revenue-generating with four-fold revenue growth per

annum since 2014. It is the intention of Sport:80 to pursue an AIM

IPO.

Sport:80 remains on track to formally commence the IPO process

soon with our best estimate suggesting a likely Q3 2018 listing

subject to financing and regulatory approvals. We view Sport:80 as

a strong IPO candidate and subject to available funds, we may

participate in any IPO funding round.

Farina Investments (UK) Limited

Primorus invested GBP100,000 in Farina Investments (UK) Limited

("Farina") on a pre-new money valuation of GBP4m. Farina is a

boutique corporate finance and asset management company which

specialises in leveraging profit opportunity in the post-crisis

financial landscape. Farina has been carefully structured and

strategically placed to fully capitalise on these opportunities,

thereby optimising capital growth, profitability and returns for

both the company and investors. Farina is currently exploring

various UK listing opportunities either via IPO or reverse

takeover.

Engage Technology Partners Limited

The Company initially invested GBP400,000 in Engage Technology

Partners Limited ("Engage") on a pre-new money valuation of GBP15m

as part of a fully subscribed GBP5.25m funding round. Founded in

2013, Engage builds software to assist with finding, hiring,

compliance and paying of the rapidly growing contingent workforce

in the UK. Engage has developed and is now selling a unique, fully

integrated SaaS platform servicing the HR industry surrounding the

contingent workforce in the UK.

Engage has developed, and is now selling, access to a unique,

fully-integrated SaaS platform servicing the HR industry

surrounding the contingent workforce in the UK. In recent

shareholder updates we have been informed that the platform has

already reached GBP1m of Annual Recurring Revenue ("ARR").

This is significant because from this ARR figure we believe that

top-line revenues and underlying EBITDA for the Engage platform may

grow exponentially as customers are on-boarded and the product

becomes fully self-serve from a customer point of view. The

underlying attraction of SaaS platforms is their ability to scale

rapidly as a result of a low cost of service base to generate very

high EBITDA margins as a result.

We believe testimony to this potential is the appointment of Mr

Paul Bolt as a non-executive director at Engage. Paul is UK Cloud

Services Director at Microsoft. Microsoft have allowed Paul to take

on the non-executive role at Engage whilst retaining his current

post as UK Cloud Services Director allowing him to foster and

mentor potentially globally scalable SaaS platforms.

We have been informed that Engage continues to be courted by a

large number of VC funds in the UK and US but is considering

maintaining its independence via a further capital raise during

2018. On 13 March 2018, the Company announced that it had invested

a further GBP500,000 in Engage at GBP22 per share and now held

approximately 3.6% of the issued share capital of Engage.

As flagged in our announcement of 13 March 2018, we remain

optimistic regarding Engage as an investment because of the rapid

pace of uptake of the product from UK corporates. It is also

noteworthy that Engage has begun discussions with City brokers

regarding a potential IPO in 2019. The Company is hoping to invest

further in Engage in the coming Quarter should the opportunity

arise.

WeShop Limited

Primorus invested GBP200,000 in WeShop Limited ("WeShop") on a

pre-new money valuation of GBP25m in September 2017. We invested a

further GBP675,000 at a GBP30m valuation in November 2017. WeShop

is a new way to shop online and earn rewards. Users can browse

millions of products from many top brands, discover which have been

recommended by people known to them and earn rewards to withdraw as

cash or donate to charity.

WeShop allows the user to shop with friends to share ideas and

gain inspiration, with everyone earning rewards. An AIM IPO is

planned to take place during 2018.

Stream TV

Primorus invested US$200,000 on a fully-diluted valuation of

US$336m. Stream TV is a Philadelphia-based new media company

created to serve a consumer market seeking enhanced entertainment

and communications experiences through devices with unlimited

accessibility and superior quality. Through its wholly-owned

research subsidiary, SeeCubic B.V., Stream TV has developed

breakthrough glasses-free 3D display technology launched under the

trade name Ultra-D. Stream TV is on the cusp of commercially

launching, via license, a range of TV, tablet and smartphone

glasses-less 3D screens in 2018.

Recently Stream TV has added to their product plan 8K displays

which produce effects approaching hologram-like quality as new

prototypes used by prospective customers. They announced joint

cooperation with Beijing Optical and Electric ("BOE") to

commercialise its Ultra-D Glasses-Free 3D technology in its next

generation 8K panels.

Further licensed products will follow including laptops, PCs,

gaming, medical, and automotive. Stream TV desires to IPO in the

near future.

Gold Mines of Wales

In December 2017, the Company sold its entire 49% stake in Gold

Mines of Wales ("GMOW") for circa 83m shares in Alba Mineral

Resources PLC ("Alba"). We see this as an attractive outcome for

shareholders as we retain some exposure to the project via the

consequent 3.6% shareholding in Alba and by definition increase our

exposure to HHDL in which Alba is a 18.1% shareholder. Furthermore,

the Alba stake is inherently more liquid than our previous direct

stake in GMOW.

Financial Results

The operating loss for the year was GBP703,000 (2016 -

GBP420,000 loss). The net loss after tax was GBP947,000 (2016:

GBP694,000). The increase in the net loss is due to share based

payments expense during the year of GBP311,000 (2016: nil) and loss

on disposal of GMOW of GBP199,000 (2016:nil).

Current assets including cash at 31 December 2017 amounted to

GBP1,286,000 (2016: GBP1,295,000).

Outlook

2017 was dominated by portfolio acquisition, consolidation and

rationalisation through the participation in our first secondary

funding rounds and the sale of our legacy stake in GMOW and the

exceptional growth seen at Engage Technology and Fresho.

The Board remains confident that the private and pre-IPO markets

remain significantly under-served and as such significant

opportunities exist for the Company going forward. We look forward

to 2018 being one in which we can demonstrate our business model by

exiting some more of our investment positions, thereby realising

tangible value for all shareholders.

As evidenced by the above, Primorus has had a busy end to 2017

and start to 2018. We successfully completed the first two

second-round investments and are confident a number of our

investments are making material progress towards either IPO or

trade sale. Furthermore, I am pleased that all Directors have made

significant on-market purchases of Company stock which demonstrates

to investors that the Board are committed and aligned to

shareholders and to generating share price-based outcomes in the

future for the benefit of all.

We will continue to seek out further investments in line with

the Company's investing strategy.

The directors would like to take this opportunity to thank our

shareholders, staff and consultants for their continued

support.

Jeremy Taylor-Firth

Chairman

18 May 2018

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

FINANCIAL STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

YEARED 31 DECEMBER 2017

2017 2016

Notes GBP000 GBP000

Revenue

Realised gain on disposal of AFS investments 2 12 17

Unrealised gain on market value movement

of AFS investments 2 29 45

------- -------

Total gains on AFS investments 41 62

------- -------

Impairment provision on AFS investments - (150)

Share based payments (311) -

Administrative costs (433) (332)

------- -------

Operating (loss) 3 (703) (420)

------- -------

Provision on associate loan - (152)

Share of (loss) of associate 7 (45) (122)

Net (loss) on disposal of associate 7 (199) -

------- -------

(Loss) before tax (947) (694)

Taxation 5 - -

------- -------

(Loss) for the year attributable to equity

holders of the company (947) (694)

------- -------

(Loss) per Share

Basic and diluted (loss) per share (pence) 6 (0.05) (0.07)

------- -------

There are no other recognised gains or losses for the year.

STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2017

2017 2017 2016 2016

ASSETS Notes GBP000 GBP000 GBP000 GBP000

Non-Current Assets

Investment in Associate 7 - 155

Available for Sale Investments 8 3,761 915

--------- ---------

3,761 1,070

Current Assets

Trade and other receivables 9 725 1,074

Cash and cash equivalents 10 561 221

--------- ---------

1,286 1,295

Total Assets 5,047 2,365

------- -------

LIABILITIES

Current Liabilities

Trade and other payables 11 (97) (38)

Total Liabilities (97) (38)

------- -------

Net Assets 4,950 2,327

======= =======

EQUITY

Equity Attributable to Equity

Holders

of the Company

Share capital 13 15,391 15,223

Share premium account 35,296 32,205

Share based payment reserve 471 160

Retained earnings (46,208) (45,261)

--------- ---------

Total Equity 4,950 2,327

======= =======

STATEMENT OF CHANGES IN EQUITY

AT 31 DECEMBER 2017

Share Share Share Retained Total

capital premium based earnings attributable

payment to owners

reserve of the

Company

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31 December 2015 15,188 31,426 160 (44,567) 2,207

========= ========= ========= ========== ==============

Loss for the year - - - (694) (694)

Total comprehensive income

for the year - - - (694) (694)

Shares issued 35 835 - - 870

Share Issue costs - (56) - - (56)

Transactions with owners

of the company 35 779 - - 814

Balance at 31 December 2016 15,223 32,205 160 (45,261) 2,327

========= ========= ========= ========== ==============

Loss for the year - - - (947) (947)

Total comprehensive income

for the year - - - (947) (947)

Shares issued 168 3,219 - - 3,387

Share Issue costs - (128) - - (128)

Share options issued - - 311 - 311

Transactions with owners

of the company 168 3,091 311 - 3,570

Balance at 31 December 2017 15,391 35,296 471 (46,208) 4,950

========= ========= ========= ========== ==============

STATEMENT OF CASH FLOWS

YEARED 31 DECEMBER 2017

2017 2017 2016 2016

GBP000 GBP000 GBP000 GBP000

Cash Flows from Operating Activities

Operating Loss (703) (420)

Adjustments for:

Share based payment charge 311 -

Change in trade and other receivables (26) 24

Change in trade and other payables 59 -

Change in AFS Investments (2,530) (165)

Taxation (paid) - -

(2,186) (141)

-------- -------

Net Cash used in Operating Activities (2,889) (561)

Cash Flows from Investing Activities

Loan advanced to associate (5) (60)

Loan advanced to related party (25) (289)

Net Cash used in Investing Activities (30) (349)

Cash Flows from Financing Activities

Proceeds from share issues 3,387 870

Share issue costs (128) (56)

-------- -------

Net Cash in generated from Financing

Activities 3,259 814

-------- -------

Net Change in Cash and Cash Equivalents 340 (96)

Cash and Cash Equivalents at beginning

of period 221 317

-------- -------

Cash and Cash Equivalents at end

of period 561 221

======== =======

NOTES TO THE FINANCIAL STATEMENTS

YEARED 31 DECEMBER 2017

1. Accounting Policies

Basis of Preparation

Primorus Investments Plc is a company incorporated in the United

Kingdom. The Company's shares are listed on the AIM market of the

London Stock Exchange, and on the NEX Exchange Growth Market as

operated by NEX Exchange Limited ("NEX").

The Financial Statements are for the year ended 31 December 2017

and have been prepared under the historical cost convention and in

accordance with International Financial Reporting Standards as

adopted by the EU ("adopted IFRS"). These Financial Statements (the

"Financial Statements") have been prepared and approved by the

Directors on 18 May 2018 and signed on their behalf by Donald

Strang and Alastair Clayton.

The accounting policies have been applied consistently

throughout the preparation of these Financial Statements, and the

financial report is presented in Pound Sterling (GBP) and all

values are rounded to the nearest thousand pounds (GBP'000) unless

otherwise stated.

Investing Policy

The Company's investing policy is to acquire a diverse portfolio

of direct and indirect interests in exploration and producing

projects and assets in the natural resources sector in addition to

acquisition(s) in the leisure, corporate services, consultancy and

brand licensing sectors. The Company will consider possible

opportunities anywhere in the world.

The Directors have considerable experience investing, both in

structuring and executing deals and in raising funds. The Directors

will use this experience to identify and investigate investment

opportunities, and to negotiate acquisitions. Wherever necessary

the Company will engage suitably qualified technical personnel to

carry out specialist due diligence prior to making an acquisition

or an investment.

The Company may invest by way of outright acquisition or by the

acquisition of assets, including the intellectual property, of a

relevant business, or by entering into partnerships or joint

venture arrangements. Such investments may result in the Company

acquiring the whole or part of a company or project (which in the

case of an investment in a company may be private or listed on a

stock exchange, and which may be pre-revenue), and such investments

may constitute a minority stake in the company or project in

question.

The Company may be both an active and a passive investor

depending on the nature of the individual investments in its

portfolio. Although the Company intends to be a long-term investor,

the Directors will place no minimum or maximum limit on the length

of time that any investment may be held.

The Directors may offer new Ordinary Shares by way of

consideration as well as cash, thereby helping to preserve the

Company's cash for working capital and as a reserve against

unforeseen contingencies including by way of example, and without

limitation, delays in collecting accounts receivable, unexpected

changes in the economic environment and unforeseen operational

problems. The Company may in appropriate circumstances issue debt

securities or otherwise borrow money to complete an investment. The

Directors do not intend to acquire any cross-holdings in other

corporate entities that have an interest in the Ordinary

Shares.

There are no restrictions in the type of investment that the

Company might make nor on the type of opportunity that may be

considered other than set out in this Investing policy.

In addition, the Directors may consider from time to time other

means of facilitating returns to Shareholders including dividends,

share repurchases, demergers, and schemes of arrangements or

liquidation.

Going Concern

The Directors noted the losses that the Company has made for the

Year Ended 31 December 2017. The Directors have prepared cash flow

forecasts for the period ending 31 May 2019 which take account of

the current cost and operational structure of the Company.

The cost structure of the Company comprises a high proportion of

discretionary spend and therefore in the event that cash flows

become constrained, costs can be quickly reduced to enable the

Company to operate within its available funding.

These forecasts demonstrate that the Company has sufficient cash

funds available to allow it to continue in business for a period of

at least twelve months from the date of approval of these financial

statements. Accordingly, the financial statements have been

prepared on a going concern basis.

It is the prime responsibility of the Board to ensure the

Company remains a going concern. At 31 December 2017 the Company

had cash and cash equivalents of GBP561,000 and no borrowings. The

Company has minimal contractual expenditure commitments and the

Board considers the present funds sufficient to maintain the

working capital of the Company for a period of at least 12 months

from the date of signing the Annual Report and Financial

Statements. For these reasons the Directors adopt the going concern

basis in the preparation of the Financial Statements.

New standards, amendments and interpretations adopted by the

Company

No new and/or revised Standards and Interpretations have been

required to be adopted, and/or are applicable in the current year

by/to the Company, as standards, amendments and interpretations

which are effective for the financial year beginning on 1 January

2017 are not material to the Company.

New standards, amendments and interpretations not yet

adopted

At the date of authorisation of these financial statements, the

following Standards and Interpretations which have not been applied

in these financial statements, were in issue but not yet effective

for the year presented:

- IFRS 9 in respect of Financial Instruments which will be

effective for the accounting periods beginning on or after 1

January 2018.

- IFRS 15 in respect of Revenue from Contracts with Customers

which will be effective for accounting periods beginning on or

after 1 January 2018.

- IFRS 16 in respect of Leases which will be effective for

accounting periods beginning on or after 1 January 2019.

- IFRS 17 Insurance Contracts (effective date 1 January

2021).

There are no other IFRSs or IFRIC interpretations that are not

yet effective that would be expected to have a material impact on

the Company.

Sources of Estimation and Key Judgements

The preparation of the Financial Statements requires the Company

to make estimates, judgements and assumptions that affect the

reported amounts of assets, liabilities, revenues and expenses and

related disclosure of contingent assets and liabilities. The

Directors base their estimates on historic experience and various

other assumptions that they believe are reasonable under the

circumstances, the results of which form the basis of making

judgements about the carrying value of assets and liabilities that

are not readily apparent from other sources. Actual results may

differ from these estimates under different assumptions or

conditions.

Revenue

Revenue is measured by reference to the fair value of

consideration received or receivable by the Company for services

provided, excluding VAT and trade discounts. Revenue is credited to

the Income Statement in the period it is deemed to be earned.

Finance Income and Costs

Finance income and costs are reported on an accruals basis.

Taxation

Current tax is the tax currently payable based on taxable profit

for the year.

Deferred income taxes are calculated using the liability method

on temporary differences. Deferred tax is generally provided on the

difference between the carrying amounts of assets and liabilities

and their tax bases. However, deferred tax is not provided on the

initial recognition of goodwill, nor on the initial recognition of

an asset or liability unless the related transaction is a business

combination or affects tax or accounting profit. Deferred tax on

temporary differences associated with shares in subsidiaries and

joint ventures is not provided if reversal of these temporary

differences can be controlled by the Company and it is probable

that reversal will not occur in the foreseeable future. In

addition, tax losses available to be carried forward as well as

other income tax credits to the Company are assessed for

recognition as deferred tax assets.

Deferred tax liabilities are provided in full, with no

discounting. Deferred tax assets are recognised to the extent that

it is probable that the underlying deductible temporary differences

will be able to be offset against future taxable income. Current

and deferred tax assets and liabilities are calculated at tax rates

that are expected to apply to their respective period of

realisation, provided they are enacted or substantively enacted at

the balance sheet date.

Changes in deferred tax assets or liabilities are recognised as

a component of tax expense in the income statement, except where

they relate to items that are charged or credited directly to

equity in which case the related deferred tax is also charged or

credited directly to equity.

Foreign Currencies

Transactions in foreign currencies are translated at the

exchange rate ruling at the date of the transaction. Monetary

assets and liabilities in foreign currencies are translated at the

rates of exchange ruling at the balance sheet date. Non-monetary

items that are measured at historical cost in a foreign currency

are translated at the exchange rate at the date of the transaction.

Non-monetary items that are measured at fair value in a foreign

currency are translated using the exchange rates at the date when

the fair value was determined. Any exchange differences arising on

the settlement of monetary items or on translating monetary items

at rates different from those at which they were initially recorded

are recognised in the profit or loss in the period in which they

arise. Exchange differences on non-monetary items are recognised in

other comprehensive income to the extent that they relate to a gain

or loss on that non-monetary item taken to other comprehensive

income, otherwise such gains and losses are recognised in the

income statement.

The Company's functional currency and presentational currency is

Sterling.

Equity

Equity comprises the following:

-- "Share capital" representing the nominal value of equity shares.

-- "Share premium" representing the excess over nominal value of

the fair value of consideration received for equity shares, net of

expenses of the share issue.

-- "Share based payment reserve" represents the value of equity

benefits provided to employees and directors as part of their

remuneration and provided to consultants and advisors hired by the

Company from time to time as part of the consideration paid.

-- "Retained earnings" representing retained profits.

Investment in associates

An associate is an entity over which the Company has significant

influence and that is neither a subsidiary nor an interest in a

joint venture. Significant influence is the power to participate in

the financial and operating policy decisions of the investee but is

not control or joint control over those policies. The investment in

an associate is initially recognised at cost and adjusted for the

Company's share of in the net assets of the investee after the date

of acquisition, and for any impairment in value (equity method),

except when the investment is classified as held-for-sale in

accordance with IFRS 5 Non-current assets held-for-sale and

discontinued operations. If the Company's share of losses of an

associate exceed the cost of the investment in the associate, from

that point the Company discontinues recognising its share of

further losses.

Financial Assets

Financial assets are divided into the following categories:

loans and receivables and available-for-sale financial assets.

Financial assets are assigned to the different categories by

management on initial recognition, depending on the purpose for

which they were acquired, and are recognised when the Company

becomes party to contractual arrangements. Both loans and

receivables and available for sale financial assets are initially

recorded at fair value.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market. Trade, most other receivables and cash and cash equivalents

fall into this category of financial assets. Loans and receivables

are measured subsequent to initial recognition at amortised cost

using the effective interest method, less provision for impairment.

Any change in their value through impairment or reversal of

impairment is recognised in the income statement.

Provision against trade receivables is made when there is

objective evidence that the Company will not be able to collect all

amounts due to it in accordance with the original terms of those

receivables. The amount of the write-down is determined as the

difference between the asset's carrying amount and the present

value of estimated future cash flows.

A financial asset is derecognised only where the contractual

rights to the cash flows from the asset expire or the financial

asset is transferred and that transfer qualifies for derecognition.

A financial asset is transferred if the contractual rights to

receive the cash flows of the asset have been transferred or the

Company retains the contractual rights to receive the cash flows of

the asset but assumes a contractual obligation to pay the cash

flows to one or more recipients. A financial asset that is

transferred qualifies for derecognition if the Company transfers

substantially all the risks and rewards of ownership of the asset,

or if the Company neither retains nor transfers substantially all

the risks and rewards of ownership but does transfer control of

that asset.

Available-for-sale financial assets are non-derivative financial

assets that are either designated to this category or do not

qualify for inclusion in any of the other categories of financial

assets. The Company's available-for-sale financial assets include

unlisted securities. These available-for-sale financial assets are

measured at fair value. Gains and losses are recognised in other

comprehensive income and reported within the available-for-sale

reserve within equity, except for impairment losses and foreign

exchange differences, which are recognised in profit or loss. When

the asset is disposed of or is determined to be impaired, the

cumulative gain or loss recognised in other comprehensive income is

reclassified from the equity reserve to profit or loss and

presented as a reclassification adjustment within other

comprehensive income. Interest calculated using the effective

interest method and dividends are recognised in profit or loss

within finance income

Financial Liabilities

Financial liabilities are obligations to pay cash or other

financial assets and are recognised when the Company becomes a

party to the contractual provisions of the instrument.

All financial liabilities initially recognised at fair value

less transaction costs and thereafter carried at amortised cost

using the effective interest method, with interest-related charges

recognised as an expense in finance cost in the income statement. A

financial liability is derecognised only when the obligation is

extinguished, that is, when the obligation is discharged or

cancelled or expires.

Cash and Cash Equivalents

Cash and cash equivalents comprise cash on hand and demand

deposits, together with other short-term, highly liquid investments

that are readily convertible into known amounts of cash and which

are subject to an insignificant risk of changes in value.

Share-Based Payments

The Company operates a number of equity-settled, share-based

compensation plans, under which the entity receives services from

employees as consideration for equity instruments (options) of the

Company. The fair value of the employee services received in

exchange for the grant of the options is recognised as an expense.

The total amount to be expensed is determined by reference to the

fair value of the options granted:

-- including any market performance conditions;

-- excluding the impact of any service and non-market

performance vesting conditions (for example, profitability or sales

growth targets, or remaining an employee of the entity over a

specified time period; and

-- including the impact of any non-vesting conditions (for

example, the requirement for employees to save).

Non-market vesting conditions are included in assumptions about

the number of options that are expected to vest. The total expense

is recognised over the vesting period, which is the period over

which all of the specified vesting conditions are to be

satisfied.

In addition, in some circumstances, employees may provide

services in advance of the grant date, and therefore the grant-date

fair value is estimated for the purposes of recognising the expense

during the period between service commencement period and grant

date.

At the end of each reporting period, the entity revises its

estimates of the number of options that are expected to vest based

on the non-market vesting conditions. It recognises the impact of

the revision to original estimates, if any, in profit or loss, with

a corresponding adjustment to equity.

When the options are exercised, the Company issues new shares.

The proceeds received, net of any directly attributable transaction

costs, are credited to share capital (nominal value) and share

premium.

2. Segment Reporting

The Company is now operating as a single UK based segment with a

single primary activity to invest in businesses so as to generate a

return for the shareholders. The revenue from this segment,

generated from sale of investments, was GBP12,000 (2016 -

GBP17,000). The non-current assets of the segment is GBP3,761,000

(2016 - GBP1,070,000).

3. Operating Activities and Auditor's Remuneration

2017 2016

GBP000 GBP000

Included within results from operating activities

are the following:

Operating lease rentals - land and buildings 10 23

Auditor's remuneration:

Audit services:

* Company statutory audit 10 10

Non-audit services:

- -

* Taxation compliance

------- -------

4. Information Regarding Directors and Employees

2017 2016

GBP000 GBP000

Employment costs, including Directors, during

the year:

Wages and salaries 190 72

Share based payments 311 -

501 72

------- -------

Average number of persons, including Directors No. No.

employed

Administration 4 3

------- -------

4 3

------- -------

Directors' remuneration GBP000 GBP000

Emoluments 489 72

------- -------

The Company operates only the basic pension plan required under

UK legislation, contributions thereto during the year amounted

to GBP15.

Emoluments of the Individual Directors

Fees and Share based

salaries payments Total

(non-cash)

2017 GBP000 GBP000 GBP000

A Clayton 112 156 268

J Taylor Firth 42 - 42

D Strang 24 155 179

178 311 489

--------------- --------- ------------ -------

2016 GBP000 GBP000 GBP000

A Clayton 24 - 24

J Taylor Firth 24 - 24

D Strang 24 - 24

72 - 72

--------------- --------- ------------ -------

Directors' interest in share options is set out in note 14.

Key Management Personnel

The key management personnel are considered to be the Directors.

There remuneration is included in note 4 above.

5. Income Tax (Credit)/Expense

The relationship between the expected tax (credit)/expense based

on the effective tax rate of the Company at 19/20% (2016 - 20%) and

the tax (credit)/expense actually recognised in the income

statement can be reconciled as follows:

2017 2016

GBP000 GBP000

Loss for the year before tax (947) (694)

Tax rate 19/20% 20%

Expected tax credit (182) (139)

Expenses not deductible for tax purposes 68 51

Deferred tax asset not recognised 114 88

Actual tax expense - -

------- -------

Deferred Tax

The amount of approximate unused tax losses for which no

deferred tax asset is recognised in the statement of financial

position is GBP1,973,000 (2016 - GBP1,382,000).

6. Loss per Share

Weighted Basic per

average share amount

No. of shares

2017 GBP000 (pence)

Loss after tax (947)

Earnings attributable to ordinary

shareholders (947)

=======

Weighted average number of shares 1,743,253,998 (0.05)

==============

Total basic and diluted loss

per share (0.05)

==============

2016 GBP000 (pence)

Loss after tax (694)

Earnings attributable to ordinary

shareholders (694)

=======

Weighted average number of shares 1,052,549,167 (0.07)

==============

Total basic and diluted loss

per share (0.07)

==============

7. Investment in associate

2017 2016

GBP000 GBP000

Investment in associate - 155

-------- --------

2017 2016

GBP'000 GBP'000

Carrying amount at 1 January 155 277

Share of associate loss (45) (122)

Value at disposal of associate (110) -

-------- --------

Carrying amount at 31 December - 155

-------- --------

On 1 December 2017, the Company completed the sale of its entire

49% interest in Gold Mines of Wales Limited to Alba Mineral

Resources PLC ("Alba") for a total consideration of 83,333,333

shares in Alba. Alba's closing share price on December 1 2017 was

0.38p, these shares had a market value of approximately GBP316,667

and will represent 3.6% of the so enlarged issued capital in Alba.

These shares are subject to a six month orderly market agreement

and were issued immediately upon completion of the sale.

Disposal of Associate GBP'000

Sale Proceeds 316

Value of loan to associate satisfied on

disposal (405)

Value of associate at disposal (110)

--------

(Loss) on disposal of associate (199)

--------

8. Available for Sale Investments

2017 2016

Investment in listed and unlisted securities GBP000 GBP000

Valuation at beginning of the period 915 750

Additions at cost 3,052 291

Disposal proceeds (247) (37)

Gains on disposals 12 16

Gain on Market value revaluation 29 45

Impairment in value of unlisted investment - (150)

---------- ----------

Valuation at the end of the period 3,761 915

========== ==========

The available for sale investments splits are as below:

Non-current assets - listed 466 135

Non-current assets - unlisted 3,295 780

3,761 915

The Directors have reviewed the carrying value of the unlisted investments, and have considered

no impairment is required in the current year to 31 December 2017. For the year ended 31 December

2016, an impairment of GBP150,000 against the Company's investment in Boletus Resources Ltd

has been deemed appropriate on the basis that Boletus's potential projects are not deemed

commercially viable.

Available-for-sale investments comprise both listed and unlisted investments. The listed investments

are traded on stock markets throughout the world, and are held by the Company as a mix of

strategic and short term investments.

9. Trade and Other Receivables

Current trade and other receivables 2017 2016

GBP000 GBP000

Trade receivables - -

Other receivables 24 11

Due from associate undertaking - 400

Due from related party (see note 16) 683 658

Prepayments and accrued income 18 5

725 1,074

------- -------

The directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

10. Cash at Bank and Cash Equivalents

2017 2016

GBP000 GBP000

Cash at Bank 561 221

------- -------

11. Trade and Other Payables

2017 2016

Current trade other payables GBP000 GBP000

Trade payables 44 16

Taxation and social security 13 3

Accruals and deferred income 40 19

------- -------

97 38

------- -------

All amounts are short term and the carrying values are

considered to be a reasonable approximation of fair value.

12. Risk Management Objectives and Policies

Financial assets by category

The categories of financial asset included in the balance sheet

and the headings in which they are included are as follows:

Current assets 2017 2016

GBP000 GBP000

Loans and receivables 725 1,074

Cash 561 221

------- -------

1,268 1,295

------- -------

Financial Liabilities by Category

The categories of financial liability included in the balance

sheet and the headings in which they are included are as

follows:

Current liabilities

Financial liabilities measured at amortised

cost 97 38

--- ---

The Company is exposed to market risk through its use of

financial instruments and specifically to credit risk, and

liquidity risk which result from both its operating and investing

activities. The Company's risk management is coordinated at its

headquarters, in close co-operation with the board of Directors,

and focuses on actively securing the Company's short to medium term

cash flows by minimising the exposure to financial markets. Long

term financial investments are managed to generate lasting returns.

The Company does not actively engage in the trading of financial

assets for speculative purposes nor does it write options. The most

significant financial risks to which the Company is exposed to are

described below.

Interest rate sensitivity

The Company is not substantially exposed to interest rate

sensitivity, other than in relation to interest bearing bank

accounts.

Credit risk analysis

The Company's exposure to credit risk is limited to the carrying

amount of trade receivables. The Company continuously monitors

defaults of customers and other counterparties, identified either

individually or by Company, and incorporates this information into

its credit risk controls. Where available at reasonable cost,

external credit ratings and/or reports on customers and other

counterparties are obtained and used. Company's policy is to deal

only with creditworthy counterparties. Company management considers

that trade receivables that are not impaired for each of the

reporting dates under review are of good credit quality, including

those that are past due.

None of the Company's financial assets are secured by collateral

or other credit enhancements.

The credit risk for liquid funds and other short-term financial

assets is considered negligible, since the counterparties are

reputable banks with high quality external credit ratings.

Liquidity risk analysis

The Company's continued future operations depend on the ability

to raise sufficient working capital through the issue of equity

share capital. The Directors are confident that adequate funding

will be forthcoming with which to finance operations. Controls over

expenditure are carefully managed.

Capital Management Policies

The Company's capital management objectives are:

-- to ensure the Company's ability to continue as a going concern; and

-- to provide a return to shareholders

The Company monitors capital on the basis of the carrying amount

of equity less cash and cash equivalents.

13. Share Capital

2017 2016

GBP000 GBP000

Allotted, issued and fully paid

2,796,619,344 ordinary shares of 0.01p each

(2016 - 1,110,549,167of 0.01p each) 279 111

28,976,581 deferred shares of 45p each (2016

- 28,976,581) 13,040 13,040

28,976,581 A deferred shares of 4p each (2016-

28,976,581) 1,159 1,159

92,230,985 B deferred shares of 0.99p each

(2016- 92,230,985) 913 913

------- -------

15,391 15,223

------- -------

The deferred shares and the A and B deferred shares do not carry

voting rights.

Ordinary Nominal

Shares Value

Number GBP'000

Ordinary shares of 0.01p each

As at 31 December 2015 762,549,167 76

1 March 2016 - Placing for cash at 0.25p

per share 308,000,000 31

2 March 2016 - Placing for cash at 0.25p

per share 40,000,000 4

As at 31 December 2016 1,110,549,167 111

-------------- --------

2 March 2017 - Placing for cash at 0.15p

per share 158,000,000 16

7 July 2017 - Placing for cash at 0.15p

per share 333,333,334 33

2 August 2017 - Placing for cash at 0.15p

per share 694,736,843 69

23 November 2017 - Placing for cash at 0.20p

per share 500,000,000 50

As at 31 December 2017 2,796,619,344 279

-------------- --------

Details of the share options and warrants the Company has in

issue are disclosed in Note 14.

14. Share-based payments

Details of share options and warrants granted to Directors,

employees & consultants, over the ordinary shares are as

follows:

Exercised

or

At Issued expired At Exercise Date from Expiry

1 January during during 31 December price which

2017 the year the year 2017 exercisable date

No. No. No. No. GBP

Share options

D. Strang 10,000,000 - - 10,000,000 0.004 14/11/2013 14/11/2023

D. Strang 12,000,000 - - 12,000,000 0.003 30/11/2015 31/12/2020

A Clayton 12,000,000 - - 12,000,000 0.003 30/11/2015 31/12/2020

J Taylor-Firth 12,000,000 - - 12,000,000 0.003 30/11/2015 31/12/2020

Consultants 10,000,000 - - 10,000,000 0.004 14/11/2013 14/11/2023

D Strang - 75,000,000 - 75,000,000 0.003 03/08/2017 03/08/2022

A Clayton - 75,000,000 - 75,000,000 0.003 03/08/2017 03/08/2022

56,000,000 150,000,000 - 206,000,000

----------- ------------ ---------- -------------

Warrants

Various 4,075,000 - - 4,075,000 0.004 29/10/2013 14/11/2018

----------- ------------ ---------- -------------

4,075,000 - - 4,075,000

----------- ------------ ---------- -------------

The share price range during the year was GBP0.00075 to

GBP0.0036 (2016 - GBP0.0014 to GBP0.0030).

The weighted average values of options are 2017 2016

as follows:

Weighted average exercise price of options 0.30p -

granted

Weighted average exercise price of options

exercisable at the

end of the year 0.31p 0.33p

Weighted average option life remaining 4.43 years 5.03 years

For those options granted where IFRS 2 "Share-Based Payment" is

applicable, the fair values were calculated using the Black-Scholes

model. The inputs into the model were as follows:

Risk free Share price Expected Share

rate volatility life price

at date

of grant

3 August 2017 0.75% 108.7% 5.00 years GBP0.0027

Expected volatility was determined by calculating the historical

volatility of the Company's share price for 12 months prior to the

date of grant. The expected life used in the model has been

adjusted, based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations.

The Company recognised total expenses of GBP311,000 (2016:

GBPnil) relating to equity-settled share-based payment transactions

during the year, and GBPnil was transferred via equity to retained

earnings on the exercise of nil options (2016: nil options) during

the year (2016: GBPnil).

15. Capital Commitments

The directors have confirmed that there were no contingent

liabilities or capital commitments which should be disclosed at 31

December 2017. No provision has been made in the financial

statements for any amounts in relation to any capital expenditure

requirements of the Company's associate or investments, and such

costs are expected to be fulfilled in the normal course of the

operations of the Company.

16. Related Party Transactions

The Company had the following amounts outstanding from its

investee companies (Note 9) at 31 December:

2017 2016

GBP'000 GBP'000

Horse Hill Development Ltd ("Horse Hill") 683 658

--------- ---------

The above loan outstanding is included within trade and other

receivables, Note 9. The loan to Horse Hill has been made in

accordance with the terms of the investment agreement whereby it

accrues interest daily at the Bank of England base rate and is

repayable out of future cashflows.

Key Management Personnel

The key management personnel are considered to be the Directors.

There remuneration is included in note 4 to the accounts.

17. Events after the end of the reporting period

On 9 January 2018, the Company announced that it had agreed to

grant 75 million share options each to Alastair Clayton and Jeremy

Taylor-Firth ("New Options"). Each New Option will entitle the

holder to subscribe for new ordinary shares of 0.01p each in the

Company ("Shares") at an exercise price of 0.3 pence per Share and

are exercisable at any time until 9 January 2025, which represented

a premium of circa 67 per cent over the closing mid-price on 8

January 2018.

On 9 March 2018, the Company announced it had completed the

disposal of a 5% interest in Horse Hill Developments Limited for

consideration of GBP1m in cash and publicly trading shares.

On 13 March 2018, the Company announced it had invested a

further GBP500,000 in an existing investment, Engage Technology

Partners Limited.

18. Ultimate Controlling Party

There is not considered to be an ultimate controlling party of

the company.

19. Posting of Accounts

The Report and Accounts for the year ended 31 December 2017 will

be posted to shareholders and uploaded to the Company's website in

due course.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFEFIWFASESI

(END) Dow Jones Newswires

May 18, 2018 02:00 ET (06:00 GMT)

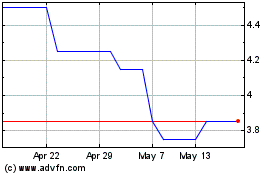

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Aug 2023 to Aug 2024