TIDMCSS

RNS Number : 4858J

CSS Stellar PLC

30 June 2011

For Immediate Release

CSS Stellar plc

("CSS Stellar" or the "Group")

Final Audited Results

CSS Stellar today announces its final audited results for the

year ended 31 December 2010.

Highlights:

-- Operating loss from continuing operations prior to impairment

of goodwill of GBP0.2 million (2009: loss of GBP0.6 million)

-- All significant trading activities ceased

-- Company now an investing business

-- Continued reduction in corporate overheads

-- Group continues to be debt free

For further information please contact:

CSS Stellar plc

Julian Jakobi Tel: 07785 317202

Northland Capital Partners Limited (Nominated

Adviser and Broker)

Luke Cairns / Edward Hutton Tel: 020 7796 8800

CHAIRMAN'S STATEMENT

Overview

In 2010, the Company disposed of its 50% share in the business

and assets of its golf management business Hambric Stellar Golf

Limited and ceased to undertake its motorsports client business. As

a result, it effectively ceased to own, control or conduct any

trading business. As such, the Company was deemed under Rule 15 of

the AIM Rules to be an investing company. It was necessary to adopt

an investing policy, shareholder approval of which was obtained in

March 2011.

The Company retains an interest in the motorsports client

business, a business which is now undertaken by a company ("GPSH")

wholly-owned by myself with a former consultant to the Company.

Further details of the arrangements between the Company and GPSH as

announced in December 2010 are set out in the Operating and

Financial Review below.

Investing Policy

The Company's investing policy, approved at the General Meeting

in March 2011, is to focus on making an acquisition or acquisitions

of unquoted businesses or companies which would constitute a

reverse takeover under Rule 14 of the AIM Rules, creating a

platform for further acquisitions. The Directors retain the

flexibility to make investments which do not constitute a reverse

takeover under Rule 14 of the AIM Rules where shareholder value can

be enhanced; in such cases, however, any investments will be

significant minority stakes in companies which are actively managed

and which serve as a platform for a future reverse takeover.

The strategy of the Directors is to pursue acquisition(s) in the

leisure, corporate services, consultancy and brand licensing

sectors which will allow the Board to leverage its knowledge,

experience and contacts. Suitable acquisitions outside these

sectors will also be considered.

In conjunction with following the investing policy, the

Directors will proactively consider raising additional funds,

either in the form of equity or debt, to help implement the

proposed investing policy.

The Directors will focus primarily on acquisition opportunities

within the European Union and the United States. It is anticipated

that returns to shareholders will be delivered primarily through an

appreciation in the Company's share price.

The Board is aware that the Company's cash resources, currently

standing at approximately GBP80,000, are limited and this may

restrict the extent to which the investing policy can be

implemented. However, the Board continues to evaluate opportunities

to make acquisitions within the scope of the investing policy.

Financial Results

Revenue from continuing operations for the Group of GBP0.3

million was 295% higher than the prior year (2009: GBP0.08 million)

due the receipt of a legal case settlement. Group operating loss

prior to the impairment of goodwill of GBP0.4 million was GBP0.2

million, which was reduced from 2009. There was a net loss from

discontinued operations of GBP0.8million (2009: GBP0.9million)

recognised during the year.

Corporate overheads

The level of ongoing corporate overheads has been reduced and

the Group continues to identify opportunities to further reduce

these costs. It is forecast that corporate overheads in 2011 will

be further reduced.

Board changes

There were no board changes during the year.

Future strategy

CSS Presenters Limited remains the Group's only trading business

and as such is now deemed to be an investing business. The Group

has budgeted for a much lower cost base in 2011 whilst it seeks

other business opportunities.

I should like to thank all of our employees for their efforts

and support during the past year.

Julian Jakobi

Chairman

30 June 2011

OPERATING AND FINANCIAL REVIEW

Group Review of 2010

Revenue from continuing operations for the Group in the year

ended 31 December 2010 was GBP0.3 million, a 295% increase from

2009 (GBP0.08 million). These are adhoc revenues resulting from one

off events.

Group operating loss on continuing operations prior to the

impairment of goodwill of GBP0.4 million was GBP0.2 million, which

was broadly in line with 2009. There was a net loss from

discontinued operations of GBP0.8million (2009: GBP0.9million)

recognised during the year.

Review of continuing operations

The Group's trading operations now consists only of CSS

Presenters. This company made an operating loss prior to impairment

of goodwill of GBP0.14 million (2009: loss of GBP0.05 million) on

revenue of GBP0.02 million (2009 GBP0.02 million). There was an

impairment of goodwill of GBP0.4million relating to this

business.

Discontinued Operations

During the year, the Board took the decision to cease all of its

trading activities in the Motorsports and Golf core areas. These

businesses were based on contracts that were due to end during the

year ended 31 December 2010 and there was no certainty that these

contracts would be renewed.

Disposal of European Golf Business

On 30 September 2010, the Group disposed of its European Golf

Business via a trade and assets disposal.

Cessation of motorsports

On 17 December 2010 the group announced that it had entered into

arrangement with GP Sports Holdings Limited ("GPSH"), a company

wholly owned by Julian Jakobi the company's chairman, whereby the

group ceased to undertake its motor sport client business (the

"Arrangements"). As part of the Arrangements, the company agreed to

terminate Julian Jakobi's consultancy and executive arrangements

and to waive the non compete clause and the 12 month notice

period.

Under the Arrangements, GPSH are providing receivables

collection services for contracted fees through to 2012. The group

will also have a 20% carried economic interest in GPSH which will

entitle it to a cash payment based on what the group would have

received it has a 20% share holding in GPSH. Further details of

these arrangements are included in the announcement dated 17

December 2010.

The motorsports client business was built entirely around the

client representation agreements, all of which were due to expire

on 31 December 2010 with the exception of an agreement with one

client which is due to expire on 31 December 2011. The costs

associated with servicing these agreements, the fact that there was

no certainty of any renewal, together with the unrelated public

company costs, lead the board to conclude that the continuation of

the motor sports client business was no longer viable nor in

shareholders' interests.

Julian Jakobi, by virtue of being a director and substantial

shareholder of the Company, was deemed a related party for the

purposes of the Arrangements. The directors, other than Mr Jakobi

who took no part in the board's consideration of the Arrangements,

considered, having consulted with Northland Capital Partners

Limited, the Company's Nominated Adviser, that the Arrangements

were fair and reasonable in so far as the shareholders of the

Company were concerned.

Adoption of Investing Policy

Under the Arrangements, the group effectively ceased to own,

control or conduct any of its existing trading business and as a

result was deemed an investing company for the purposes of the AIM

Rules for Companies. Pursuant to Rule 15 of the AIM Rules, a

circular to adopt an Investing Policy was passed without amendment

at a general meeting of the Company on 15 March 2011.

Goodwill

In accordance with IAS 36, the Board reviewed the carrying value

of goodwill held in the Balance Sheet for impairment. As a result

of the review, the Board concluded that a write down of GBP0.4

million is required relating to CSS Presenters.

Taxation

The Group's tax charge was GBPNil (2009: credit of

GBP24,000).

Loss per Share

Loss per share on continuing operations on a basic and fully

diluted basis shows a loss of 2.24p per share (2009: loss of

1.88p). Basic unadjusted and fully diluted earnings per share on

discontinued operations were a profit of 2.83p (2009: loss of

2.95p). The losses are due to the impact of the disposals and the

impairment write down booked in the year.

Cash Flow

The cash flow statement shows a decrease in cash of GBP0.18

million (2009: decrease of GBP0.3 million) as a consequence of the

closure of its trading activities.

Julian Jakobi

Chairman

30 June 2011

CONSOLIDATED INCOME STATEMENT

Year ended 31 December 2010

2010 2009

Notes GBP000 GBP000

Revenue 3 324 82

Cost of sales - -

-------- --------

Gross profit 324 82

Impairment of goodwill (402) -

Other administrative costs (572) (632)

-------- --------

Total administrative costs (974) (632)

-------- --------

Operating loss (650) (550)

-------- --------

Finance income - 1

Finance costs - (22)

-------- --------

Loss before tax (650) (571)

Income tax credit/(expense) - 24

-------- --------

Net loss from continuing operations (650) (547)

Net loss from discontinued operations 5 (819) (854)

Net loss for the year (1,469) (1,401)

======== ========

Attributable to:

Equity holders of the parent (1,469) (1,401)

======== ========

Loss per share (pence) 4 pence pence

Continuing operations

Basic and diluted loss per share (2.24) (1.88)

Discontinued operations

Basic and diluted loss per share (2.83) (2.95)

Total

Basic and diluted loss per share (5.07) (4.83)

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

GBP000 GBP000

Loss for the year (1,469) (1,401)

Exchange differences on translation of

foreign operations (1) (9)

Total comprehensive income for the year (1,470) (1,410)

======== ========

Attributable to:

Equity holders of the parent (1,470) (1,410)

======== ========

STATEMENT OF FINANCIAL POSITION

As at 31 December 2010

2010 2010 2009 2009

GBP000 GBP000 GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 4 12

Goodwill - 402

Available for sale assets 152 -

--------- ---------

156 414

Current assets

Trade and other receivables 375 1,242

Cash and cash equivalents 6 188

--------- ---------

381 1,430

Disposal group classified as held for

resale 239 -

Total assets 776 1,844

======= =======

EQUITY

Equity attributable to equity holders

of the parent

Share capital 14,488 14,488

Share premium account 28,158 28,158

Translation reserve 31 (120)

Profit and loss account (42,533) (41,064)

--------- ---------

Total equity 144 1,462

LIABILITIES

Current liabilities

Trade and other payables 418 357

Current tax payable - 25

--------- ---------

418 382

Liabilities directly associated with

disposal group classified as held

for resale 214

Total liabilities 632 382

Total equity and liabilities 776 1,844

======= =======

CONSOLIDATED STATEMENT OF CASH FLOWS

Year ended 31 December 2010

2010 2010 2009 2009

GBP000 GBP000 GBP000 GBP000

Cash flows from operating activities

Loss after taxation (1,469) (1,401)

Adjustments for:

Depreciation 6 8

Impairment of goodwill 400 500

Net interest expense - 21

Taxation credit/(expense) recognised in

profit and loss - (24)

Change in trade and other receivables 678 1,196

Change in trade and other payables 234 (925)

Income taxes paid - (88)

------- -------

1,318 688

-------- --------

Net cash used in operating activities (151) (713)

Cash flows from investing activities

Purchase of property, plant and

equipment - (4)

Proceeds from sale of investments - 12

Proceeds from sale of subsidiaries - 340

Reclassification of cash held in

disposal group (32) -

Proceeds from sale of property, plant

and equipment - 17

Interest received - 1

------- -------

Net cash generated by investing

activities (32) 366

Cash flows from financing activities

Interest paid - (22)

------- -------

Net cash used in financing activities (22)

Net change in cash and cash equivalents (183) (369)

Exchange loss/(gain) on cash and cash

equivalents 1 33

Cash and cash equivalents at beginning

of period 188 524

Cash and cash equivalents at end of

period 6 188

======== ========

STATEMENT OF CHANGES IN EQUITY

Year ended 31 December

2010

Total

attributable

Share Share Other Retained to owners of

capital premium Reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2010 14,488 28,158 (120) (41,064) 1,462

Loss for the

year - - - (1,469) (1,469)

Other

comprehensive

income:

Exchange

differences on

translation of

foreign 152 152

operations - - (1) - (1)

Total

comprehensive

income for

the year - - 151 (1,469) (1,318)

--------- --------- ------------ ---------- -------------

Balance at 31

December

2010 14,488 28,158 31 (42,533) 144

--------- --------- ------------ ---------- -------------

Total

attributable

Share Share Other Retained to owners of

capital premium Reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2009 14,488 28,158 (111) (39,663) 2,872

Loss for the

year - - - (1,401) (1,401)

Other

comprehensive

income:

Exchange

differences

on

translation

of foreign

operations - - (9) - (9)

Deferred tax

on revaluation

of freehold

property - - - - -

--------- --------- ------------ ---------- -------------

Total

comprehensive

income for

the year - - (9) (1,401) (1,410)

--------- --------- ------------ ---------- -------------

Balance at 31

December

2009 14,488 28,158 (120) (41,064) 1,462

--------- --------- ------------ ---------- -------------

NOTES TO THE FINANCIAL INFORMATION

Year ended 31 December

2010

1. Basis of preparation

CSS Stellar plc is a company incorporated in the United Kingdom.

The Group financial statements are for the year ended 31 December

2010 and have been prepared under the historical cost convention,

except for revaluation of certain properties and financial

instruments.

These consolidated financial statements (the financial

statements) have been prepared and approved by the directors in

accordance with International Financial Reporting Standards as

adopted by the EU ("adopted IFRS").

The principal accounting policies of the Group are set out in

the Group's 2009 Annual Report and Financial Statements. These

policies have remained unchanged.

2. Financial Information

The financial information relating to the year ended 31 December

2010 set out in this announcement does not constitute Statutory

Accounts as defined in Section 435 of the Companies Act 2006, but

has been extracted from the statutory accounts, which have received

an unqualified auditors' report and which have not yet been with

the Registrar of Companies. The financial information relating to

the period ended 31 December 2009 is extracted from the statutory

accounts, which incorporated an unqualified audit report and which

has been filed with the Registrar of Companies.

3. Segmental Reporting

During the year all of the Group's major operating segments were

either disposed of or ceased to trade. Accordingly no segmental

information has been presented other than that of Continuing and

Discontinued activities.

Following the disposals and cessation of the group's major

trading businesses the group is operating as one segment,

represented as continuing operations in the income statement. All

information regarding discontinued operations has been given in

note 5.

4.Loss Per Share

Weighted average Basic per share

amount

no. of shares (pence)

2010 GBP000

Continuing operations

Loss after tax (650)

Earnings attributable to

ordinary shareholders (650)

-------

Weighted average number of

shares 28,976,581 (2.24)

==============

Discontinued operations

Loss after tax (819)

Earnings attributable to

ordinary shareholders (819)

-------

Weighted average number of

shares 28,976,581 (2.83)

==============

Total basic and diluted loss

per share (5.07)

==============

2009

Continuing operations

Loss after tax (547)

Earnings attributable to

ordinary shareholders (547)

-------

Weighted average number of

shares 28,976,581 (1.88)

==============

Discontinued operations

Loss after tax (854)

Earnings attributable to

ordinary shareholders (854)

-------

Weighted average number of

shares 28,976,581 (2.95)

==============

Total basic and diluted loss per

share (4.83)

==============

5. Net loss from discontinued operations

On 30 September 2010, the Board disposed of its European golf

business and on 31 December 2010 ceased its Motorsports client

business. As a consequence of this decision, revenue and expenses,

gains and losses relating to these businesses have been eliminated

from the Group's continuing results and presented as a single line

item on the face of the income statement (see "net loss from

discontinued operations"). The comparative income statement has

been represented to show the discontinued operations separately

from continuing operations. The operating results for these

businesses are summarised below.

Prior year disposals

In 2009, the Board closed its New York based promotions

business. These results are described in detail in the 2009 Report

and Financial Statements, and are shown below for comparative

purposes.

Operating activities of discontinued operations

GEM Sports Golf Total GEM Sports Golf Total

2010 2010 2010 2010 2009 2009 2009 2009

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 175 1,074 76 1,325 359 1,050 286 1,695

Cost of sales - - - - - - - -

------- -------- ------- -------- -------- ------- ------- --------

Gross profit 175 1,074 76 1,325 359 1,050 286 1,695

Impairment of

goodwill - - - - (200) (300) - (500)

Administrative

costs (208) (1,785) (151) (2,144) (1,035) (722) (292) (2,049)

------- -------- ------- -------- -------- ------- ------- --------

Operating

(loss)/profit (33) (711) (75) (819) (876) 28 (6) (854)

Finance income - - - - - - - -

Finance costs - - - - - - - -

------- -------- ------- -------- -------- ------- ------- --------

(Loss)/profit

before tax (33) (711) (75) (819) (876) 28 (6) (854)

Income tax

expense - - - - - - - -

------- -------- ------- -------- -------- ------- ------- --------

(Loss)/profit

for the year (33) (711) (75) (819) (876) 28 (6) (854)

(Loss)/profit

on disposal - - - - - - - -

Net result from

discontinued

operations (33) (711) (75) (819) (876) 28 (6) (854)

======= ======== ======= ======== ======== ======= ======= ========

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR WGUAUQUPGGWU

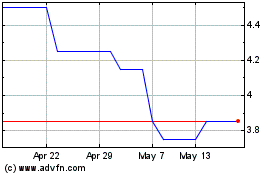

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Jul 2023 to Jul 2024