RNS Number:2939D

Panther Securities PLC

24 September 2004

Interim Results

CHAIRMAN'S STATEMENT

Introduction

I am delighted to report on the interim figures for the six months to 30th June

2004. Pre tax profits amount to #1,947,000 compared to #1,407,000 for the same

period last year.

Rental income receivable was #4,650,000 as against #4,423,000 for the comparable

half year.

Eurocity Properties PLC

On 27th May 2004 we sold Eurocity (Crawley) Limited which was a wholly owned

subsidiary of Eurocity Properties PLC. The consideration was #750,000 in cash

plus shares and convertible loan stock valued at #650,000 in Real Estate

Investments PLC, a new AIM listed property company. The ordinary shares were

issued to us at the placing price of 10p each and the current market price is

13p per share. If sold at these values we would have recouped almost the entire

cost of Eurocity Properties PLC from one third of its assets and income.

Elektron PLC

In December 2003 we assisted Elektron PLC in the acquisition of the business of

Arcolectric PLC from the receiver by purchasing Arcolectric's freehold factories

in West Molesey, Surrey, and then leasing them to Elektron PLC. This property

transaction was a good deal in its own right. In addition, we provided #500,000

of equity capital at 5.5p per Elektron PLC share. Now that the two businesses

have been merged and are substantially profitable, Elektron's share price has

risen to reflect this and at approximately 15p per share justifies our

confidence in this transaction.

Wickford, Essex

For some years we have owned a factory estate in Wickford, Essex which was held

on a long lease at a low fixed ground rent from Basildon District Council. In

May we purchased the freehold at auction for approximately #650,000 including

costs. Whilst this expenditure produces little extra income the factory estate

is now freehold and the quality and value of the investment is improved.

Panther House/Gray's Inn Road/Churchills public house

Panther House, Mount Pleasant and 156/164 Grays Inn Road (even), London WC1 were

sold at auction in July. The figure achieved of #8,810,000 was at the top end of

our expectations. Churchills public house in Mount Pleasant was sold after the

auction at #940,000. Yardworth Limited, our wholly owned subsidiary, took a 5

year management lease (with an option to break at the end of the 2nd year) on

Panther House at #400,000 per annum which is mostly covered by income from

sub-licensees - of course we now have to pay for the use of our own offices.

Most shareholders will know that Panther House was the company's Head Office for

70 years, initially bought by the original Levers Optical Company for #35,000

out of funds raised when it went public in 1934 and, since my involvement with

the company in 1972, has been the subject of much effort on our part to maximise

its value. Initially by creating London's first business centre (making small

licensed units available at affordable terms), acquiring an adjoining leasehold,

then freehold interests, negotiating for 25 years with London Regional Transport

to acquire their part of the site and during the same period and onward trying

to negotiate the planning aspect of the site with those Mandarins of the Soviet

Socialist Republic of Camden, to little avail, but much frustration. The final

outcome was indeed successful for the years of effort and I wish the purchaser

good luck and more success than we had with those "Bureaucratic Terrorists" at

Camden.

Of course, the sales referred to in the previous two paragraphs are not

reflected in these half year figures.

On 21st June Panther acquired 15% of Hawtin PLC, an AIM quoted company (Portnard

Limited, one of my private companies, having previously acquired 14.5%). The

price paid in both instances was 13p per share. Hawtin PLC was previously a

conglomerate which had, in recent years, sold off all of its trading businesses

whilst retaining its former freehold factories as investments. It also holds 35

acres of land in Blackwood/Gwent, South Wales zoned for residential and

industrial use. The revalued book value of Hawtin PLC's net assets was 15p per

share. I have been appointed to its Board and hope it will prove a successful

investment for Panther.

Finance

Having drawn down the balance of our loan facility, and realised the Panther

House/Gray's Inn Road/Churchills complex we currently have approximately

#15,000,000 in cash available for investment. We are also in the process of

negotiating additional and improved facilities which will give us wider scope to

invest in any interesting and good value proposals that may become available to

us.

Dividends

We will be paying an interim dividend of 4p per share on 29th October 2004 and

it is the Board's intention to recommend an increased final dividend of not less

than 4.5p per share in due course.

Outlook

Whilst commercial property prices have been extremely resilient over the last

year, the residential market has begun to falter and I suspect will continue to

do so and thus will create a chain reaction slowing down general economic

activity. It is, however, in these times that our company is often able to

secure its most profitable investments. So, as always, I look forward to the

future with optimism and confidence.

INTERIM CONSOLIDATED RESULTS

for the six months ended 30th June 2004

Six months to Six months to Year ended

30th June 30th June 31st December

2004 2003 2003

(Unaudited) (Unaudited) (Audited)

#' 000 #' 000 #' 000

Turnover 4,679 4,741 9,791

Cost of sales (765) (894) (1,654)

-------- -------- --------

Gross profit 3,914 3,847 8,137

Administrative expenses (539) (609) (1,336)

-------- -------- --------

Operating profit 3,375 3,238 6,801

Income from participating

interests 50 (2) (67)

Income from current asset

investments 31 17 426

Profit on sale of subsidiary

subsidiary 149 - -

Amortisation of goodwill 221 - -

Profit on disposal of

investments - - (20)

Interest receivable 61 180 293

Interest payable (1,940) (2,026) (4,020)

-------- -------- --------

Profit on ordinary activities

before taxation 1,947 1,407 3,413

Taxation (453) (413) (880)

-------- -------- --------

Profit on ordinary activities

after taxation 1,494 994 2,533

Minority interests (2) 9 9

-------- -------- --------

Profit attributable to

members of the Parent

undertaking 1,492 1,003 2,542

Dividends (680) (850) (2,125)

-------- -------- --------

Retained profits for the

6 months 812 153 417

Transferred from revaluation

reserve 116 - -

Retained profit brought

forward 12,714 12,297 12,297

-------- -------- --------

Retained profit carried

forward 13,642 12,450 12,714

======== ======== ========

Earnings per share 8.8p 5.9p 15.0p

Dividend per share -

special - 5.0p 5.0p

Dividend per share -

interim 4.0p 3.5p 3.5p

Dividend per share -

final - - 4.0p

Notes:

1. Results

The six months results have been prepared on the historical cost basis modified

to include the revaluation of fixed asset land and buildings, although no

further revaluation has been undertaken on any part of the property portfolio

since results were last reported. They are unaudited and do not constitute

statutory accounts within the meaning of section 240 of the Companies Act 1985.

2. Accounts

The figures for the year to 31st December 2003 have been extracted from the

statutory accounts which have been reported on by the Group's auditors and have

been delivered to the Registrar of Companies. The auditor's report was

unqualified and did not contain any statement under section 237(2), (3) or (4)

of the Companies Act 1985.

3. Accounting policies

Accounting policies and presentation are consistent to previous periods.

4. Dividends

An interim dividend of 4p per ordinary share will be paid on 29th October 2004

to shareholders on the Register on 8th October 2004.

5. Earnings per share

Earnings per ordinary share have been calculated on profit attributable to

members of the holding company and on 16,998,151 (June 2003 - 16, 986,593)

ordinary shares being the weighted average number of ordinary shares in issue

throughout the six months ended 30th June 2004.

6. Copies of this report are to be sent to all shareholders and are available

from the Company's registered office at Panther House, 38 Mount Pleasant, London

WC1X 0AP.

CONSOLIDATED BALANCE SHEET

for the six months ended 30th June 2004

30th June 30th June 31st December

2004 2003 2003

(Unaudited) (Unaudited) (Audited)

#' 000 #' 000 #' 000

Fixed assets

Tangible assets 93,020 79,807 93,996

Negative goodwill (571) (791) (793)

Investments 2,388 288 223

-------- -------- --------

94,837 79,304 93,426

-------- -------- --------

Current assets

Stock 8,828 7,104 8,790

Current asset investments 1,600 945 1,297

Debtors 3,186 2,422 5,580

Cash at bank and in hand 2,094 9,230 2,444

-------- -------- --------

15,708 19,701 18,111

Current liabilities

Creditors:

Amounts falling due

within one year (6,175) (9,755) (5,767)

-------- -------- --------

Net current assets 9,533 9,946 12,344

-------- -------- --------

Total assets less

current liabilities 104,370 89,250 105,770

Creditors

Amounts falling due after

more than one year (53,362) (50,715) (55,576)

Minority interests (92) (94) (90)

-------- -------- --------

Net assets 50,916 38,441 50,104

======== ======== ========

Capital and reserves

Share capital 4,250 4,250 4,250

Revaluation reserve 29,355 18,072 29,471

Profit and loss account 13,642 12,450 12,714

Share premium account 2,886 2,886 2,886

Negative goodwill reserve 212 212 212

Capital redemption reserve 571 571 571

-------- -------- --------

Shareholders' funds 50,916 38,441 50,104

======== ======== ========

Net assets per share 299.5p 226.2p 294.8p

GROUP CASH FLOW STATEMENT

for the six months ended 30th June 2004

Six months to Six months to Year ended

30th June 30th June 31st December

2004 2003 2003

(Unaudited) (Unaudited) (Audited)

#' 000 #' 000 #' 000

Cash inflow from

operating activities 5,777 3,356 2,242

Returns on investments and

Servicing of finance

Interest received 61 180 293

Interest paid (1,940) (2,026) (4,020)

Net cash outflow from returns

on Investments and servicing

of finance (1,879) (1,846) (3,727)

Taxation

Corporate tax paid (171) (14) (1,097)

Capital expenditure and

Financial investment

Purchase of investments (1,797) (264) (2,026)

Sale of investments - - 1,746

Purchase of minority interest - - (267)

Purchase of other tangible

fixed assets (1,056) (44) (2,841)

Net cash outflow from capital

Expenditure and financial

investment (2,853) (308) (3,388)

Acquisitions and disposals

Sale of subsidiary undertaking 26 - -

Net cash inflow/(outflow)

from Acquisitions and

disposals 26 - -

Equity dividends paid (671) (1,435) (2,036)

-------- -------- --------

Cash inflow/(outflow) before

use of Liquid resources and

financing 229 (247) (8,006)

Financing

(Decrease)/increase in debt (577) (223) 750

Issue of ordinary share capital - 48 48

(577) (175) 798

-------- -------- --------

Decrease in cash (348) (422) (7,208)

======== ======== ========

NOTES TO GROUP CASH FLOW STATEMENT

for the six months ended 30th June 2004

1. Reconciliation of net cash flow to movement in net debt

Six months to Six months to Year ended

30th June 30th June 31st December

2004 2003 2003

(Unaudited) (Unaudited) (Audited)

#' 000 #' 000 #' 000

Decrease in cash in

the period (348) (422) (7,208)

Loans acquired

on acquisition 1,730 - -

Cash (outflow)/inflow

from increase in debt 577 223 (750)

-------- -------- --------

Change in net debt

arising from cash

flows 1,959 (199) (7,958)

Net debt at start of

period (53,977) (46,019) (46,019)

-------- -------- --------

Net debt at period end (52,018) (46,218) (53,977)

======== ======== ========

2. Analysis of net debt

At At

1st January Disposal 30th June

2004 Cash flow (excl cash) 2004

#' 000 #' 000 #'000 #' 000

Cash at bank and

in hand 2,444 (350) - 2,094

Overdrafts (1) 1 - -

-------- -------- -------- --------

2,443 (349) - 2,094

Debt due within

one year (844) 94 - (750)

Debt due after

one year (55,576) 484 1,730 (53,362)

-------- -------- -------- --------

(56,420) 578 1,730 (54,112)

-------- -------- -------- --------

(53,977) 229 1,730 (52,018)

======== ======== ======== ========

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEIFADSLSESU

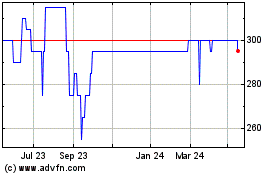

Panther Securities (LSE:PNS)

Historical Stock Chart

From Jul 2024 to Aug 2024

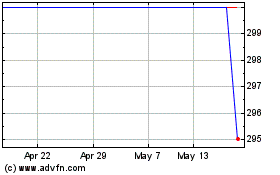

Panther Securities (LSE:PNS)

Historical Stock Chart

From Aug 2023 to Aug 2024