TIDMPMI

RNS Number : 0888B

Premier Miton Group PLC

31 May 2023

PREMIER MITON GROUP PLC

HALF YEAR RESULTS FOR THE SIX MONTHSED 31 MARCH 2023

Premier Miton Group plc ('Premier Miton', 'Company' or 'Group'),

the AIM quoted fund management group, today announces its half year

results for the six months ended 31 March 2023 (the 'Period').

Highlights

-- GBP11.0 billion closing Assets under Management (2) ('AuM') (2022 HY: GBP12.8 billion)

-- Net outflows of GBP32 million in the Period (2022 HY: GBP401 million outflows)

-- Continued inflows into fixed income strategies of GBP399

million in the Period (2022 HY: GBP138 million inflows)

-- 76% of funds above median investment performance since launch or tenure (3) (2022 HY: 80%)

-- Adjusted profit before tax (1,2) of GBP7.9 million (2022 HY: GBP14.6 million)

-- Profit before tax of GBP2.4 million (2022 HY: GBP9.9 million)

-- Proposed interim dividend of 3.0 pence per share (2022 interim: 3.7 pence per share)

-- Successful launch of Premier Miton Emerging Markets Sustainable Fund on 21 April 2023

-- Continued focus on distribution capabilities to service our

existing and new client base, and positioning for inflows when

market and sentiment conditions turn positive again, by showcasing

the depth and breadth of our investment talent across asset

classes

-- GBP11.0 billion closing AuM at 30 April 2023

Notes

(1) Adjusted profit before tax is calculated before the

deduction of taxation, amortisation, share-based payments, merger

related costs and exceptional items.

(2) These are Alternative Performance Measures ('APMs').

(3) At 31 March 2023. Based on Investment Association sector

classifications where applicable, with data sourced from FE

Analytics FinXL using the main representative post-RDR share class,

based on a total return, UK Sterling basis. All data is as at 31

March 2023 and the performance period relates to when the fund

launched or the assumed tenure of the fund manager(s). Performance

for investment trusts is calculated on Net Asset Value ('NAV'),

ranked against the relevant Morningstar category for each

investment trust.

Mike O'Shea, Chief Executive Officer of Premier Miton Group,

commented:

"Although this has been a tougher period for investors, we

remain convinced that the work we have done in building a

diversified active manager that can offer products across equities,

fixed income and multi-asset will bear fruit in the long term.

At times of market stress there are substantial opportunities

for genuinely active managers who have the courage of their

convictions to run differentiated, long-term, and focussed

portfolios by taking an agile and positive role in the capital

allocation process.

Our long term investment performance record is good, we have a

strong distribution and marketing capability, a strong balance

sheet and an operational platform that can handle many times the

current level of assets we manage. As confidence returns to markets

and to investors, we are well placed to return to growth."

S

For further information, please contact:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Investec Bank plc (Nominated Adviser and

Broker)

Bruce Garrow / Ben Griffiths / Virginia Bull

/ Harry Hargreaves 020 7260 1000

--------------

Edelman Smithfield Consultants (Financial

PR) 07785 275665/

John Kiely / Latika Shah 07950 671948

--------------

www.premiermiton.com

About Premier Miton

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

Chairman's Statement

The political and financial turmoil in the UK in late 2022 has

revealed with brutal clarity some deep problems affecting the

structure of the UK savings market, especially for longer term

savings and access to capital and investment support in public

markets. A healthy, successful and efficiently functioning capital

market is vital for the UK's strategic and business interests. I am

pleased to see there are many initiatives now under way to identify

what can be done to create better conditions for the future. Well

thought through changes will also, if implemented soon, provide us

with a much more attractive environment for our business and, more

importantly, for our clients. We will continue to do what we can to

encourage positive and well implemented changes and to successfully

navigate these testing times.

I met several of our shareholders following the announcement of

our results for 2022 to discuss their thoughts and views on our

business, and to listen to the issues that they raise. I value

these exchanges and am always impressed by the care and attention

they give to their investment. Their focus and issues are varied

and I appreciate the support of our shareholders for the business

we are building, and the recognition that we are seeking to do our

very best for all stakeholders in these challenging times for our

industry.

During the period we again held a Board strategy day to review

our markets, our industry, our ambitions, plans and resources,

taking a clear look at what we can do to improve our business.

While I am sure that we are working as hard as we can, with

discipline and focus, and that there are always things that can be

improved or adjusted, we are to a great extent dependent on the

overall market environment improving.

We are continuing with our ambitious organic growth plans, and I

am pleased that good progress is being made here especially in our

overall client, distribution and marketing initiatives.

We have also been active in reviewing several strategic ideas

which have the potential to materially advance our

business, contributing to shareholder value. We have an

experienced team and focussed approach as to how we assess these

strategic ideas and we will need to continue to apply this focus as

the industry is going through a period of potentially deep

change.

I continue to be impressed by the hard work and dedication of

our people. We all feel that the responsibility of looking after

other people's savings is something to be proud of and we seek to

do to the best of our abilities. Businesses like ours which have a

strong and healthy culture should be able to prosper relative to

others and I believe this is happening. Of course, it isn't easy

and the leadership group has a clear focus on managing Premier

Miton to achieve our purpose, while remembering that, essentially,

the business of business is business! From this, other positive

things can flow.

Our financial performance has been broadly flat over the period,

with AuM standing at GBP11 billion at period end and adjusted

profit before tax of GBP7.9 million.

These are challenging and, we believe, unusual times for the

whole UK asset management market, affecting savings flows and

investment market levels and performance. The Board is confident

that we have a well-considered and coherent strategy supported by a

business model and resources that promote long term shareholder

value creation and growth. We recognise that we need to navigate

these times with great care and that our management team must

actively and confidently manage the business to position us for

success. This means we closely examine and make decisions on the

mix, focus and financial management of all our activities.

The business is fundamentally cash generative and has

operational gearing which should allow for improved profit and cash

creation as markets and savings flows improve and our financial

results recover. We know it is important to manage our capital

resources prudently, not just to cover our regulatory capital

requirements but also to maintain a strong balance sheet which

allows us to navigate more difficult times, to be agile, invest for

future growth, and, critically, to focus leadership energies on

creating a valuable business.

We have a clearly stated dividend policy of paying a total

annual dividend in a range of 50-65% of adjusted profit after tax,

in line with our peer group. Our dividend payments are a key part

of our overall approach to generate shareholder value and we intend

to keep to this policy over time. However, reflecting the inherent

strengths of our business and our overall approach to capital

management, we are willing to exceed this policy if appropriate to

do so and within the bounds of prudence. Indeed, we did so for the

dividend for the last financial year. I should say that we are

highly reluctant to pay an uncovered dividend except in exceptional

circumstances, specifically these would include where both the

market and business outlook are obviously both clearer and

brighter. And shareholders will understand that paying an uncovered

dividend for an extended period of time is neither prudent nor a

sustainable policy.

We will consider the position more closely at year end,

reflecting business results and outlook, and overall trading and

market conditions, conscious that there is plenty of potential for

a range of developments to affect our business. We are always

mindful of the reasonable near-term income expectations of

shareholders and a need to balance these with longer term interests

of the business as a whole. We are also confident that we have a

high quality, attractively positioned and well managed business and

that in due course markets, investment flows and business

performance will recover. However, it is not clear when this will

be. Accordingly we have decided to pay an interim dividend of 3.0p

equal to approximately 68% of interim adjusted EPS of 4.4p and we

believe that this reflects all these matters in the round. In the

current market conditions, our shareholders ought not to infer that

the split between interim and final dividend will be consistent

with prior years.

The political, economic and social outlook is still clouded with

challenges, yet there is a huge need for good management of long

term savings and we believe there is a valuable and significant

role for genuinely active investment management, in both retail and

institutional markets. With our breadth of product, our strong

performance and experienced teams, we are well placed to continue

building a successful business in the interests of all our

stakeholders.

Robert Colthorpe

Chairman

30 May 2023

Chief Executive Officer's Statement

The current financial year has seen a recovery in equity and

fixed income markets after the difficult period experienced in the

last financial year. Despite this, we have seen a continuation of

the more challenging environment for the UK's long term savings

industry.

Investors appear to have been shaken by the events of 2022 and

are reluctant to commit to new investments. This has been reflected

in industry data which continues to show large outflows from

actively managed funds - particularly in areas like UK equities and

European equities - during the six months. There has, however, been

an uptick in demand for fixed income strategies where we are well

placed to serve our clients.

It is some comfort that our own performance is slightly better

than the wider industry with net outflows from our funds of GBP32

million in total over the six months. Whilst it is disappointing

that our strong investment performance record has not allowed us

able to make more positive headway, this must be set against the

overall industry backdrop.

Business performance

At the end of March 2023 Assets under Management ('AuM') stood

at GBP11.0 billion representing an increase of 4% on the beginning

of the year. Average AuM stood at GBP11.2 billion for the period,

which is 17% lower than in the previous period. The drop in AuM has

been driven by falling markets during 2022 and a reluctance on the

part of investors to invest during market turbulence and the

continuation of uncertain macro-conditions.

The net management fee margin (the retained revenue margin of

the firm after deducting the costs of OCF caps, direct research

costs and any enhanced fee arrangements) was 62.5bps compared with

65.1bps last year.

The adjusted operating margin decreased from 33% to 23%

reflecting the lower level of AuM and our continuing strategic

investment in the fixed cost base of the business via new fund

management teams and the launch of new funds, which in turn will

enhance the Group's long term growth profile.

Over the six months, the group generated GBP7.9 million of

adjusted profit before tax for the year and had a closing cash

position of GBP31.5 million.

Investment flows

For the first half of the current financial year, we saw inflows

into our largest US equity strategy although these were more than

offset by outflows from our European and UK equity strategies.

In total, our equity strategies had GBP360 million of outflow

during the period. Our fixed income strategies saw net inflows of

GBP380 million during the six months mainly driven by flows into

our Strategic and Corporate bond funds. We also saw small inflows

into our segregated fixed income mandates. In multi-asset, we

continued to see good levels of interest in our Diversified funds,

although continued outflow from our multi-manager and

macro-thematic funds meant that in total we saw GBP69 million of

outflow across our multi-asset strategies.

Investment performance

Across our equity strategies we invest across the market

capitalisation with a number of our strategies often favouring mid

and smaller capitalisation stocks. This is because we believe that

these companies will deliver strong long term returns for our

investors. There are periods, however, when these sectors of the

market perform less well relative to the very largest companies. We

have been through just such a period in the last six months or so

and this has impacted our very short-term performance. We expect

this to reverse in our favour in due course.

It is pleasing to note that our longer-term numbers remain

attractive across our equity, fixed income and multi-asset

strategies with 83% of our assets under management (where a sector

comparison is appropriate) performing ahead of median since manager

inception.

Fund range

We have made no significant changes to our portfolio of funds

during the last six months. We have been preparing, however, for

the launch of a new Global Emerging Markets Sustainable fund that

will be managed by Fiona Manning and William Scholes who joined us

from abdrn in the second half of last year.

We believe that a product investing in the fast-growing emerging

markets will be attractive to investors, particularly with Fiona

and Will's strong investment process that focuses on identifying

companies offering exposure to sustainable growth themes and a

positive influence on society and the environment, as identified

through a material alignment to the UN Sustainable Development

Goals. In the longer term it will also help to further diversify

the asset mix within Premier Miton, increasing our exposure to

global equites alongside our existing global sustainable, global

smaller companies and global infrastructure funds.

Distribution

During the last six months we were delighted to welcome Jonathan

Willcocks to the team as Head of Global Distribution. Jonathan

brings a wealth of experience to Premier Miton gained during his

time in a similar role at M&G and before that with MFS, abrdn,

Prolific and Hambros.

Since joining he has created a unified distribution and

marketing team that can bring our full product range of equity,

fixed income and multi-asset funds into our key markets of wealth

manager, independent adviser and institutional fund buyers.

Strategy

Looking forwards we have a well-diversified product offering

that is managed by experienced and talented investment managers. We

cover around 82% of the key demand pools in terms of assets under

management within the UK market according to Investment Association

data. This means that there is a sizeable market for us take our

products to and to capture increased market share within. We know

that investors will continue to seek out strategies where they

believe managers can add long term value over and above investing

in a simple index strategy. And we know that our managers have

demonstrated an ability to deliver this for investors over the long

term.

Our distribution team has been restructured and reinvigorated

and can cover the key fund buyer markets in the UK. As and when

market sentiment improves and fund buyers return, we are confident

of growing our business organically once more. We are also mindful

of the opportunities that exist outside our home market and

continue to investigate ways in which our funds and our services

can be brought to a wider audience in Europe and beyond.

And of course, having successfully completed the merger of

Premier and Miton, we are open minded about the prospects to grow

our business through further merger and acquisition activity should

the opportunity present itself.

Closing

Although this has been a tougher period for our investors, as

indeed it has for our shareholders, we remain convinced that the

work we have done in building a diversified active manager that can

offer products across equities, fixed income and multi-asset will

bear fruit in the long term.

Our investment performance record is good, we have a strong

distribution and marketing capability, a strong balance sheet and

an operational platform that can handle many times the current

level of assets we manage. As confidence returns to markets and to

investors, we are well placed to return to growth.

Mike O'Shea

Chief Executive Officer

30 May 2023

Financial Review

Financial performance

Profit before tax for the period was GBP2.4 million (2022 HY:

GBP9.9 million). The decrease in profitability is due to the lower

average level of assets being managed by the Group when compared to

the comparative period, detailed below.

Adjusted profit before tax *, which is stated before

amortisation, share-based payments, merger related costs and

exceptional costs decreased to GBP7.9 million (2022 HY: GBP14.6

million).

Adjusted profit and profit before tax

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBPm GBPm GBPm

---------------------------- ------------ ------------ -------------

Net revenue 35.0 43.7 81.2

Administrative expenses (27.1) (29.1) (56.8)

Adjusted profit before tax* 7.9 14.6 24.3

---------------------------- ------------ ------------ -------------

Amortisation (2.4) (2.4) (4.8)

Share-based payments (2.6) (2.2) (4.5)

Merger related costs - - (0.1)

Exceptional costs (0.5) - -

---------------------------- ------------ ------------ -------------

Profit before tax 2.4 9.9 14.9

---------------------------- ------------ ------------ -------------

* Indicates Alternative Performance Measures ('APMs').

Assets under Management * ('AuM')

AuM at 31 March 2023 was GBP10,995 million (2022 HY: GBP12,847

million) representing a 4% increase from the opening position for

the period of GBP10,565 million.

Despite this, the Group's average AuM decreased by 17% over the

comparative period to GBP11,194 million (2022 HY: GBP13,453

million) reflecting the lower opening AuM position.

Whilst there were early signs of returning confidence amongst

fund buyers in the latter stages of 2022 this did not follow

through into 2023 and the banking shocks that unfolded towards the

end of the period appear to have dented risk appetite.

The Group saw continued inflows into the fixed income, US equity

and Diversified multi-asset funds and outflows from the European

equity and UK equity funds which broadly reflects what the wider

industry data is showing. The net outflows for the period were

GBP32 million (2022 HY: GBP(401) million).

Movement in AuM by asset class

Opening Closing

AuM AuM

1 October Half year Market/ investment 31 March

2022 net flows performance 2023

GBPm GBPm GBPm GBPm

-------------------- ---------- ---------- ------------------ ---------

Equity funds 5,631 (360) 366 5,637

Multi-asset funds 3,263 (69) 80 3,274

Fixed income funds 750 380 (2) 1,128

Investment trusts 519 (2) (4) 513

Segregated mandates 402 19 22 443

-------------------- ---------- ---------- ------------------ ---------

Total 10,565 (32) 462 10,995

-------------------- ---------- ---------- ------------------ ---------

Net revenue

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBPm GBPm GBPm

-------------------------------------- ------------ ------------ -------------

Management fees 38.8 48.5 90.6

Fees and commission expenses (3.9) (4.8) (9.1)

-------------------------------------- ------------ ------------ -------------

Net management fees (1 *) 34.9 43.7 81.5

-------------------------------------- ------------ ------------ -------------

Other income/(loss) 0.1 - (0.3)

-------------------------------------- ------------ ------------ -------------

Net revenue 35.0 43.7 81.2

-------------------------------------- ------------ ------------ -------------

Average AuM (2) (*) 11,194 13,453 12,615

-------------------------------------- ------------ ------------ -------------

Net management fee margin (bps) (3 *) 62.5 65.1 64.6

-------------------------------------- ------------ ------------ -------------

1 Being management fee income less trail/rebate expenses

2 Calculated using the daily AuM adjusted for the monthly

closing AuM invested in other funds managed by the Group

3 Net management fee margin represents annualised net management

fees divided by the average AuM

The Group's revenue represents management fees generated on the

assets being managed by the Group. The net management fee margin

for the period was 62.5 basis points. The decrease from the

comparative period primarily reflects the change in the Group's

product mix.

Net management fees decreased by 20% to GBP34.9 million (2022

HY: GBP43.7 million) reflecting the lower level of average AuM

compared to the comparative period.

Administration expenses

Administration expenses for the period (excluding share-based

payments) totalled GBP27.1 million (2022 HY: GBP29.1 million), a

decrease of 7%.

Staff costs continue to be the largest component of

administration expenses, consisting of both fixed and variable

elements. The fixed staff costs, which includes salaries and

associated National Insurance, employers' pension contributions and

other indirect costs of employment increased to GBP10.9 million

(2022 HY: GBP9.8 million). At the period end the Group had 167 full

time staff including non-executive directors (2022 HY: 163).

Variable staff costs totalled GBP6.6 million (2022 HY: GBP9.5

million). Included within this are general discretionary bonuses,

sales bonuses and bonuses in respect of the fund management teams,

plus associated employers' national insurance. These costs move

with the net revenues of the Group and the adjusted profit before

tax.

Overheads and other costs were broadly flat at GBP9.1 million

(2022 HY: GBP9.2 million).

Administration expenses

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBPm GBPm GBPm

---------------------------- ------------ ------------ -------------

Fixed staff costs 10.9 9.8 20.4

Variable staff costs 6.6 9.5 17.3

Overheads and other costs 9.1 9.2 17.9

Depreciation - fixed assets 0.2 0.3 0.6

Depreciation - leases 0.3 0.3 0.6

---------------------------- ------------ ------------ -------------

Administration expenses 27.1 29.1 56.8

---------------------------- ------------ ------------ -------------

Exceptional costs

During the period the Group incurred exceptional costs totalling

GBP0.5 million. These comprise of GBP0.25 million relating to

restructuring of the Group's distribution activities and GBP0.25

million following the strategic review to cease development of the

Group's online portal 'Connect'.

Share-based payments

The share-based payment charge for the period was GBP2.6 million

(2022 HY: GBP2.2 million). Of this charge, GBP2.2 million related

to nil cost contingent share rights ('NCCSR').

During the period 1,577,500 NCCSR awards were issued (2022 HY:

1,902,500).

On 13 January 2023, the Group granted 2,651,034 long-term

incentive plan ('LTIP') awards (2022 HY: nil). The cost of the

awards is the estimated fair value at the date of grant of the

estimated entitlement to ordinary shares. At each reporting date

the estimated number of ordinary shares that may be ultimately

issued is assessed.

At 31 March 2023 the Group's Employee Benefit Trusts ('EBTs')

held 11,469,161 ordinary shares representing 7.3% of the issued

ordinary share capital (2022 HY: 12,692,553 shares). See note 12

for further detail.

Balance sheet, capital management and dividends

Total shareholders' equity as at 31 March 2023 was GBP121.4

million (2022 HY: GBP127.7 million). At the period end the cash

balances of the Group totalled GBP31.5 million (2022 HY: GBP36.0

million). The Group has no external bank debt.

Dividends totalling GBP9.1 million were paid in the period (2022

HY: GBP9.3 million). The Board is recommending an interim dividend

payment of 3.0p per share (2022 HY: 3.7p). The interim dividend

will be paid on 4 August 2023 to shareholders on the register at

the close of business on 7 July 2023.

The Group's dividend policy is to target an annual ordinary

dividend pay-out of approximately 50 to 65% of profit after tax,

adjusted for exceptional costs, merger related costs, share-based

payments and amortisation.

Piers Harrison

Chief Financial Officer

30 May 2023

Alternative Performance Measures ('APMs')

APM Unit Definition Purpose

Adjusted GBP Profit before interest, Except for the noted costs, this

profit before taxation, amortisation, encompasses all operating expenses

tax share-based payments, in the business, including fixed

merger related costs and variable staff cash costs. Provides

and exceptional costs. a proxy for cash generated and is

the key measure of profitability

for management decision making.

---- -------------------------- ----------------------------------------

AuM GBP The value of external Management fee income is calculated

assets that are managed based on the level of AuM managed.

by the Group. The AuM managed by the Group is used

to measure the Group's relative size

against the industry peer group.

---- -------------------------- ----------------------------------------

Net management GBP The net management fee Provides a consistent measure of

fee revenue of the Group. the profitability of the Group and

Calculated as gross its ability to grow and retain clients,

management fee income, after removing amounts paid to third

less the cost of OCF parties.

caps, direct research

costs and any enhanced

fee arrangements.

---- -------------------------- ----------------------------------------

Net management bps Net management fees A measure used to demonstrate the

fee margin divided by average AuM. blended fee rate earned from the

AuM managed by the Group. A basis

point ('bps') represents one hundredth

of a percent, this measure is used

within the asset management sector

and provides comparability of the

Group's net revenue generation.

---- -------------------------- ----------------------------------------

Adjusted p Profit after tax excluding Provides a clear measure to shareholders

earnings amortisation, share-based of the profitability of the Group

per share payments, merger related from its underlying operations. The

(basic) costs and exceptional exclusion of amortisation, share-based

costs, divided by the payments, merger related costs and

weighted average number exceptional items provides a consistent

of shares in issue in basis for comparability of results

the period. period on period.

---- -------------------------- ----------------------------------------

Unaudited Condensed Consolidated Statement of Comprehensive

Income

for the six months ended 31 March 2023

Unaudited Unaudited

six months six months Audited

to to year to

31 March 31 March 30 September

2023 2022 2022

Notes GBP000 GBP000 GBP000

---------------------------------- ----- ----------- ----------- --------------

Revenue 4 38,838 48,503 90,233

Fees and commission expenses (3,868) (4,789) (9,062)

---------------------------------- ----- ----------- ----------- --------------

Net revenue 34,970 43,714 81,171

Administration expenses (27,067) (29,140) (56,818)

Share-based payment expense 12 (2,581) (2,240) (4,505)

Amortisation of intangible assets 8 (2,424) (2,424) (4,861)

Merger related costs 5 (25) (25) (51)

Exceptional items 5 (462) - -

---------------------------------- ----- ----------- ----------- --------------

Operating profit 2,411 9,885 14,936

Finance income/(expense) 5 (7) (23)

---------------------------------- ----- ----------- ----------- --------------

Profit for the period before

taxation 2,416 9,878 14,913

Taxation 6 (776) (4,062) (5,346)

---------------------------------- ----- ----------- ----------- --------------

Profit for the period after

taxation attributable to equity

holders of the parent 1,640 5,816 9,567

---------------------------------- ----- ----------- ----------- --------------

Pence pence pence

--------------------------------- ---- ----- ----- -----

Basic earnings per share 7(a) 1.12 3.97 6.54

--------------------------------- ---- ----- ----- -----

Diluted basic earnings per share 7(a) 1.05 3.71 6.12

--------------------------------- ---- ----- ----- -----

No other comprehensive income was recognised during 2023 or

2022. Therefore, the profit for the period is also the total

comprehensive income.

All of the amounts relate to continuing operations.

Unaudited Condensed Consolidated Statement of Changes in

Equity

for the six months ended 31 March 2023

Employee Capital

Share Merger Benefit redemption Retained

capital reserve Trust reserve earnings Total

Notes GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 1 October 2022 60 94,312 (16,744) 4,532 44,604 126,764

------------------------------- ----- -------- -------- -------- ----------- --------- --------

Profit for the period - - - - 1,640 1,640

Purchase of own shares held

by an EBT 12(c) - - (381) - - (381)

Exercise of options - - 1,617 - (1,617) -

Share-based payment expense 12 - - - - 2,581 2,581

Other amounts direct to equity - - - - (17) (17)

Deferred tax direct to equity - - - - (9) (9)

Equity dividends paid 3 - - - - (9,147) (9,147)

------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 31 March 2023 (Unaudited

half year) 60 94,312 (15,508) 4,532 38,035 121,431

------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 1 October 2021 60 94,312 (15,790) 4,532 49,110 132,224

------------------------------- ----- -------- -------- -------- ----------- --------- --------

Profit for the period - - - - 5,816 5,816

Purchase of own shares held

by an EBT 12(c) - - (3,222) - - (3,222)

Exercise of options - - 393 - (393) -

Share-based payment expense 12 - - - - 2,240 2,240

Deferred tax direct to equity - - - - (103) (103)

Equity dividends paid 3 - - - - (9,269) (9,269)

------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 31 March 2022 (Unaudited

half year) 60 94,312 (18,619) 4,532 47,401 127,686

------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 1 October 2021 60 94,312 (15,790) 4,532 49,110 132,224

------------------------------- ----- -------- -------- -------- ----------- --------- --------

Profit for the year - - - - 9,567 9,567

Purchase of own shares held

by an EBT - - (4,492) - - (4,492)

Exercise of options - - 3,538 - (3,538) -

Share-based payment expense - - - - 4,505 4,505

Deferred tax direct to equity - - - - (344) (344)

Equity dividends paid - - - - (14,696) (14,696)

------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 30 September 2022 (Audited) 60 94,312 (16,744) 4,532 44,604 126,764

------------------------------- ----- -------- -------- -------- ----------- --------- --------

Unaudited Condensed Consolidated Statement of Financial

Position

as at 31 March 2023

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

Notes GBP000 GBP000 GBP000

--------------------------------------- ----- --------- --------- -------------

Non-current assets

Goodwill 8 70,688 70,688 70,688

Intangible assets 8 20,092 24,953 22,516

Other investments 100 100 100

Property and equipment 488 1,561 1,192

Right-of-use assets 646 1,411 908

Deferred tax asset 1,757 2,431 1,928

Finance lease receivables 1 - 77

Trade and other receivables 563 803 1,081

--------------------------------------- ----- --------- --------- -------------

94,335 101,947 98,490

--------------------------------------- ----- --------- --------- -------------

Current assets

Financial assets at fair value through

profit and loss 1,171 3,458 2,089

Finance lease receivables 176 - 197

Trade and other receivables 167,513 114,395 136,052

Cash and cash equivalents 9 31,520 36,038 45,764

--------------------------------------- ----- --------- --------- -------------

200,380 153,891 184,102

--------------------------------------- ----- --------- --------- -------------

Total assets 294,715 255,838 282,592

--------------------------------------- ----- --------- --------- -------------

Current liabilities

Trade and other payables (167,250) (120,241) (148,820)

Lease liabilities (651) (868) (887)

--------------------------------------- ----- --------- --------- -------------

(167,901) (121,109) (149,707)

--------------------------------------- ----- --------- --------- -------------

Non-current liabilities

Provisions 10 (374) (374) (374)

Deferred tax liability (4,950) (5,958) (5,485)

Lease liabilities (59) (711) (262)

--------------------------------------- ----- --------- --------- -------------

Total liabilities (173,284) (128,152) (155,828)

--------------------------------------- ----- --------- --------- -------------

Net assets 121,431 127,686 126,764

--------------------------------------- ----- --------- --------- -------------

Equity

Share capital 11 60 60 60

Merger reserve 94,312 94,312 94,312

Own shares held by an Employee Benefit

Trust 12(c) (15,508) (18,619) (16,744)

Capital redemption reserve 4,532 4,532 4,532

Retained earnings 38,035 47,401 44,604

--------------------------------------- ----- --------- --------- -------------

Total equity shareholders' funds 121,431 127,686 126,764

--------------------------------------- ----- --------- --------- -------------

Unaudited Condensed Consolidated Statement of Cash Flows

for the six months ended 31 March 2023

Unaudited Unaudited

six months six months Audited

to to year to

31 March 31 March 30 September

2023 2022 2022

Notes GBP000 GBP000 GBP000

Cash flows from operating activities:

---------------------------------------------------- ----- ----------- ----------- --------------

Profit after taxation 1,640 5,816 9,567

Adjustments to reconcile profit to net cash

flow from operating activities:

- Tax on continuing operations 6 776 4,062 5,346

- Finance (income)/expense (5) 7 23

- Interest payable on leases 18 34 60

- Depreciation - fixed assets 220 282 580

- Depreciation - leases 263 337 621

- Gain on derecognition of right-of-use asset - - (115)

- Receivable for the net investment in sub-lease - - 334

- (Gain)/loss on revaluation of financial assets

at fair value through profit and loss (98) 18 345

- Loss on disposal of property and equipment 500 - 171

- Amortisation of intangible assets 8 2,424 2,424 4,861

- Share-based payment expense 12 2,581 2,240 4,505

-(Increase)/decrease in trade and other receivables (30,650) 32,157 10,800

- Increase/(decrease) in trade and other payables 18,430 (42,980) (14,403)

Cash generated from operations (3,901) 4,397 22,695

Income tax paid (1,363) (3,008) (5,352)

---------------------------------------------------- ----- ----------- ----------- --------------

Net cash flow from operating activities (5,264) 1,389 17,343

---------------------------------------------------- ----- ----------- ----------- --------------

Cash flows from investing activities:

Interest received/(paid) 5 (7) (23)

Acquisition of assets at fair value through

profit and loss - (55) (85)

Proceeds from disposal of assets at fair value

through profit and loss 1,016 107 1,180

Purchase of property and equipment (16) (106) (207)

Net cash flow from investing activities 1,005 (61) 865

---------------------------------------------------- ----- ----------- ----------- --------------

Cash flows from financing activities:

Lease payments (457) (474) (931)

Purchase of own shares held by an EBT 12(c) (381) (3,222) (4,492)

Equity dividends paid 3 (9,147) (9,269) (14,696)

Net cash flow from financing activities (9,985) (12,965) (20,119)

---------------------------------------------------- ----- ----------- ----------- --------------

Decrease in cash and cash equivalents (14,244) (11,637) (1,911)

Opening cash and cash equivalents 45,764 47,675 47,675

---------------------------------------------------- ----- ----------- ----------- --------------

Closing cash and cash equivalents 9 31,520 36,038 45,764

---------------------------------------------------- ----- ----------- ----------- --------------

Notes to the Unaudited Condensed Consolidated Financial

Statements

for the six months ended 31 March 2023

1. Basis of accounting

These interim unaudited Condensed Consolidated Financial

Statements do not constitute statutory accounts within the meaning

of section 435 of the Companies Act 2006. They have been prepared

on the basis of the accounting policies as set out in the Group's

Annual Report for the year ended 30 September 2022.

The interim unaudited Condensed Consolidated Financial

Statements to 31 March 2023 have been prepared in accordance

with

IAS 34 'Interim Financial Reporting' and the Listing Rules of

the Financial Conduct Authority.

Premier Miton Group plc (the 'Group') is the Parent Company of a

group of companies which provide a range of investment management

services in the United Kingdom and Channel Islands.

The Group's 2022 Annual Report is prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted by

the United Kingdom, and is available on the Premier Miton Group plc

website (www.premiermiton.com).

The Group has considerable financial resources and ongoing

investment management contracts. As a consequence, the Directors

believe that the Group demonstrates the financial resilience

required to manage its business risks successfully. The Directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for a period of at least 12

months after the date the interim financial statements are signed.

Thus, the Directors continue to adopt the going concern basis of

accounting in preparing the interim unaudited Condensed

Consolidated Financial Statements. The Directors note that the

Group has no external borrowings and maintains significant levels

of cash reserves. The Group has conducted financial modelling at

materially lower levels of AuM with the business remaining cash

generative. The Directors have also reviewed and examined the

financial stress testing inherent in the Internal Capital Adequacy

and Risk Assessment ('ICARA').

These interim unaudited Condensed Consolidated Financial

Statements were approved and authorised for issue by the Board

acting through a duly authorised committee of the Board of

Directors on 30 May 2023.

The full-year accounts to 30 September 2022 were approved by the

Board of Directors on 1 December 2022 and have been delivered to

the Registrar of Companies. The report of the auditor on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498 of

the Companies Act 2006. The figures for the six months ended 31

March 2023 and the six months ended 31 March 2022 have not been

audited.

The interim unaudited Condensed Consolidated Financial

Statements are presented in Sterling and all values are rounded to

the nearest thousand pounds (GBP000) except where otherwise

indicated.

Forward looking statements

These interim unaudited Condensed Consolidated Financial

Statements are made by the Directors in good faith based on

information available to them at the time of their approval of the

accounts. Forward looking statements should be treated with caution

due to the inherent uncertainties, including economic, regulatory

and business risk factors underlying any such statement. The

Directors undertake no obligation to update any forward looking

statement whether as a result of new information, future events or

otherwise. The interim unaudited Condensed Consolidated Financial

Statements have been prepared to provide information to the Group's

shareholders and should not be relied upon by any other party or

for any other purpose.

2. Segmental reporting

The Group has only one business operating segment, asset

management for reporting and control purposes.

IFRS 8 'Operating Segments' requires disclosures to reflect the

information which the Group's management uses for evaluating

performance and the allocation of resources. The Group is managed

as a single asset management business and as such, there are no

additional operating segments to disclose. Under IFRS 8, the Group

is also required to make disclosures by geographical segments. As

Group operations are solely in the UK and Channel Islands, there

are no additional geographical segments to disclose.

3. Dividend

The final dividend for the year ended 30 September 2022 of 6.3p

per share was paid on 10 February 2023 resulting in a distribution

of GBP9,147,109. This is reflected in the unaudited Condensed

Consolidated Statement of Changes in Equity (2022 HY:

GBP9,268,748).

4. Revenue

Revenue recognised in the unaudited Condensed Consolidated

Statement of Comprehensive Income is analysed as follows:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

-------------------- ------------ ------------ --------------

Management fees 38,737 48,516 90,570

Commissions 2 2 4

Other income/(loss) 99 (15) (341)

-------------------- ------------ ------------ --------------

Total revenue 38,838 48,503 90,233

-------------------- ------------ ------------ --------------

All revenue is derived from the United Kingdom and Channel

Islands.

5. Exceptional items and merger related costs

Recognised in arriving at operating profit from continuing

operations:

Unaudited

Unaudited six months Audited

six months to 31 year to

to 31 March March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

------------------------ ------------ ----------- -------------

Restructuring 212 - -

Closure of connect 250 - -

------------------------ ------------ ----------- -------------

Total exceptional costs 462 - -

------------------------ ------------ ----------- -------------

Merger related costs 25 25 51

Total merger related costs 25 25 51

---------------------------

Exceptional items are those items of income or expenditure that

are considered significant in size and/or nature to merit separate

disclosure and which are non-recurring.

GBP211,185 of employment related redundancy costs were incurred

arising from the restructuring of the Group's distribution

activities undertaken in the period (2022 HY: GBPnil).

Exceptional items, net of associated income were incurred in

relation to the cessation of the development of the Group's online

portal 'Connect'. This resulted in net expenditure of

GBP250,000.

There were GBP25,496 of merger related legal and professional

costs in the period (2022 HY: GBP25,496).

6. Taxation

Unaudited

Unaudited six months Audited

six months to 31 year to

to 31 March March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

---------------------------------------------------- ------------ ----------- -------------

Corporation tax charge 1,150 2,708 4,203

Deferred tax liability arising on historic business

combination - 2,066 2,066

Deferred tax credit (374) (712) (923)

---------------------------------------------------- ------------ ----------- -------------

Tax charge reported in the unaudited Condensed

Consolidated Statement of Comprehensive Income 776 4,062 5,346

---------------------------------------------------- ------------ ----------- -------------

In the Spring Budget 2021, the Government announced that from 1

April 2023 the corporation tax rate will increase to 25% from

19%. This was subsequently enacted on 24 May 2021. The deferred

tax balances included within the Consolidated Financial Statements

have been calculated with reference to the rate of 25% to the

relevant balances from 1 April 2023.

7. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to ordinary equity shareholders of the

Parent Company by the weighted average number of ordinary shares

outstanding during the period.

The weighted average of issued ordinary share capital of the

Company is reduced by the weighted average number of shares held by

the Group's Employee Benefit Trusts ('EBTs'). Dividend waivers are

in place over shares held in the Group's EBTs.

In calculating diluted earnings per share, IAS 33 'Earnings Per

Share' requires that the profit is divided by the weighted average

number of ordinary shares outstanding during the period plus the

weighted average number of ordinary shares that would be issued on

conversion of all the dilutive potential ordinary shares into

ordinary shares during the period.

(a) Reported earnings per share

Reported basic and diluted earnings per share has been

calculated as follows:

Unaudited

Unaudited six months Audited

six months to 31 year to

to 31 March March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

---------------------------------------------------- ------------ ----------- -------------

Profit attributable to ordinary equity shareholders

of the Parent Company for basic earnings 1,640 5,816 9,567

No.000 No.000 No.000

Issued ordinary shares at 1 October 157,913 157,913 157,913

-Effect of own shares held by an EBT (12,111) (11,571) (11,677)

Weighted average shares in issue 145,802 146,342 146,236

---------------------------------------------------- ------------ ----------- -------------

-Effect of movement in share options 10,936 10,259 10,184

---------------------------------------------------- ------------ ----------- -------------

Weighted average shares in issue - diluted 156,738 156,601 156,420

---------------------------------------------------- ------------ ----------- -------------

Basic earnings per share (pence) 1.12 3.97 6.54

Diluted earnings per share (pence) 1.05 3.71 6.12

---------------------------------------------------- ------------ ----------- -------------

(b) Adjusted earnings per share

Adjusted earnings per share is based on adjusted profit after

tax, where adjusted profit is stated after charging interest but

before share-based payments, amortisation, merger related costs and

exceptional items.

Adjusted profit for calculating adjusted earnings per share:

Unaudited

Unaudited six months Audited

six months to 31 year to

to 31 March March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

---------------------------------------------- ------------ ----------- -------------

Profit before taxation 2,416 9,878 14,913

Add back:

-Share-based payment expense 2,581 2,240 4,505

-Amortisation of intangible assets 2,424 2,424 4,861

-Merger related costs 25 25 51

-Exceptional items 462 - -

---------------------------------------------- ------------ ----------- -------------

Adjusted profit before tax 7,908 14,567 24,330

---------------------------------------------- ------------ ----------- -------------

Taxation:

-Tax in the unaudited Consolidated Statement

of Comprehensive Income (776) (4,062) (5,346)

-Tax effect of adjustments (697) 1,344 1,176

---------------------------------------------- ------------ ----------- -------------

Adjusted Profit after tax for the calculation

of adjusted earnings per share 6,435 11,849 20,160

---------------------------------------------- ------------ ----------- -------------

Adjusted earnings per share was as follows using the number of

shares calculated at note 7(a):

Unaudited

Unaudited six months Audited

six months to to year to

31 March 31 March 30 September

2023 2022 2022

pence pence pence

---------------------------- -------------- ----------- -------------

Adjusted earnings per share 4.41 8.10 13.79

Diluted adjusted earnings

per share 4.11 7.57 12.89

---------------------------- -------------- ----------- -------------

8. Goodwill and other intangible assets

Cost amortisation and net book value of intangible assets are as

follows:

Unaudited

Unaudited six months Audited

six months to to year to

31 March 31 March 30 September

2023 2022 2022

Goodwill GBP000 GBP000 GBP000

----------------------------- -------------- ----------- --------------

Cost:

At 1 October 77,927 77,927 77,927

Additions - - -

----------------------------- -------------- ----------- --------------

At 31 March/30 September 77,927 77,927 77,927

----------------------------- -------------- ----------- --------------

Amortisation and impairment:

At 1 October 7,239 7,239 7,239

Amortisation during the - -

period -

----------------------------- -------------- ----------- --------------

At 31 March/30 September 7,239 7,239 7,239

----------------------------- -------------- ----------- --------------

Carrying amount:

----------------------------- -------------- ----------- --------------

At 31 March/30 September 70,688 70,688 70,688

----------------------------- -------------- ----------- --------------

Unaudited

Unaudited six months Audited

six months to to year to

31 March 31 March 30 September

2023 2022 2022

Other intangible assets GBP000 GBP000 GBP000

------------------------- -------------- ----------- --------------

Cost:

At 1 October 81,025 81,025 81,025

Additions - - -

------------------------- -------------- ----------- --------------

At 31 March/30 September 81,025 81,025 81,025

------------------------- -------------- ----------- --------------

Accumulated amortisation

and impairment:

At 1 October 58,509 53,648 53,648

Amortisation during the

period 2,424 2,424 4,861

------------------------- -------------- ----------- --------------

At 31 March/30 September 60,933 56,072 58,509

------------------------- -------------- ----------- --------------

Carrying amount:

------------------------- -------------- ----------- --------------

At 31 March/30 September 20,092 24,953 22,516

------------------------- -------------- ----------- --------------

Other intangible assets relate to the investment management

agreements acquired in business combinations between the funds to

which they were the investment manager and the value arising from

the underlying client relationships.

The Group has determined that it has a single cash-generating

unit ('CGU') for the purpose of assessing the carrying value of

goodwill. Impairment testing is performed at least annually whereby

the recoverable amount of the goodwill is analysed via the

value-in-use method and compared to the respective carrying value.

During the period no impairment was identified.

9. Cash and cash equivalents

Unaudited Unaudited

six months six months Audited

to to year to

31 March 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

------------------------- ----------- ----------- --------------

Cash at bank and in hand 31,520 36,038 45,764

------------------------- ----------- ----------- --------------

10. Provisions

GBP000

----------------------------- ------

At 1 October 2022 374

Disposals -

----------------------------- ------

At 31 March 2023 (Unaudited) 374

----------------------------- ------

Current -

Non-current 374

----------------------------- ------

374

----------------------------- ------

At 1 October 2021 389

Additions (15)

------------------------------------------------------------- ----

At 31 March 2022 (Unaudited) and 30 September 2022 (Audited) 374

------------------------------------------------------------- ----

Provisions relate to dilapidations for the offices at 6th Floor,

Paternoster House, London, the lease on this property runs to 28

November 2028 and the provision for dilapidations has been

disclosed as non-current.

11. Share capital

Ordinary

shares Deferred

Allotted, called up and fully paid: 0.02 pence shares

Number of shares each Number Number

------------------------------------------------------------- ------------ --------

At 1 October 2022 157,913,035 1

Issued - -

------------------------------------------------------------- ------------ --------

At 31 March 2023 (Unaudited) 157,913,035 1

------------------------------------------------------------- ------------ --------

At 1 October 2021 157,913,035 1

Issued - -

------------------------------------------------------------- ------------ --------

At 31 March 2022 (Unaudited) and 30 September 2022 (Audited) 157,913,035 1

------------------------------------------------------------- ------------ --------

Ordinary shares Deferred

Allotted, called up and fully paid: 0.02 pence each shares Total

Value of shares GBP000 GBP000 GBP000

---------------------------------------------- ---------------- -------- -------

At 1 October 2022 31 29 60

Issued - - -

---------------------------------------------- ---------------- -------- -------

At 31 March 2023 (Unaudited) 31 29 60

---------------------------------------------- ---------------- -------- -------

At 1 October 2021 31 29 60

Issued - - -

---------------------------------------------- ---------------- -------- -------

At 31 March 2022 (Unaudited) and 30 September

2022 (Audited) 31 29 60

---------------------------------------------- ---------------- -------- -------

12. Share-based payment

The total expense recognised for share-based payments in respect

of employee services received during the period to 31 March 2023

was GBP2,580,666 (2022 HY: GBP2,240,420), of which GBP2,208,196

related to nil cost contingent share rights (2022 HY:

GBP2,176,867).

(a) Nil cost contingent share rights ('NCCSRs')

During the period, 1,577,500 (2022 HY: 1,902,500) NCCSRs over

ordinary shares of 0.02p in the Company were granted to 19

employees (2022 HY: 32 employees). Of the total award, nil (2022

HY: 375,000) NCCSRs were awarded to Executive Directors. The awards

will be satisfied from the Group's EBTs.

The share-based payment expense is calculated in accordance with

the fair value of the NCCSRs on the date of grant. The price per

right at the date of grant was GBP1.045 on 14 December 2022,

resulting in a fair value of GBP1,648,488 to be expensed over the

relevant vesting period of between two to five years.

The key features of the awards include: automatic vesting at the

relevant anniversary date with the delivery of the shares to

the

participant within 30 days of the relevant vesting date.

During the period, 1,251,668 NCCSRs over ordinary shares of

0.02p in the Company were exercised by 14 employees. Of the total,

150,000 were exercised by an Executive Director.

After the period end 2,016,661 NCCSRs over ordinary shares of

0.02p in the Company that vested on 14 April 2023, were exercised

by 37 employees. Of the total, 400,000 were exercised by an

Executive Director.

(b) Long-Term Incentive Plan ('LTIP')

On 13 January 2023 the Group granted 2,651,034 LTIP awards (2022

HY: nil). Of the total award, 811,541 were awarded to Executive

Directors.

Vesting of awards is subject to continued employment and

performance conditions based on Total Shareholder Return ('TSR'),

Earnings Per Share ('EPS'), fund performance and other operational

conditions, all measured over a three-year performance period.

The cost of the awards is the estimated fair value at the date

of grant of the estimated entitlement to ordinary shares of 0.02p

in the Company. At 13 January 2023 the cost was estimated at

GBP797,961 and is to be expensed over the vesting period of three

year. At each reporting date the estimated number of ordinary

shares that may be ultimately issues is assessed.

The fair value of the LTIP awards was estimated using a Monte

Carlo Simulation ('MCS') and the prepaid forward share price,

adjusting the loss of dividends over the vesting period. The

following table lists the inputs to the model used for the period

ended 31 March 2023.

13 January

2023

Dividend yield (%) 2.24

Nominal risk-free rate (%) 3.27

Expected share price volatility (%) 40.00

Discount for lack of marketability ('DLOM') (%) 12.00

Share price (GBP) 1.19

Performance period (months) 36

Holding period post vesting (months) 24

(c) Employee Benefit Trusts ('EBTs')

Premier Miton Group plc established an EBT on 25 July 2016 to

purchase ordinary shares in the Company to satisfy share awards to

certain employees.

During the period, 364,525 (2022 HY: 1,902,500) shares were

acquired and held by the Group's EBTs at a cost of GBP380,804 (2022

HY: GBP3,222,043).

At 31 March 2023, 11,469,161 (2022 HY: 12,692,553) shares are

held by the Group's EBTs.

At 31 March 2023, the cost of the shares held by the EBTs of

GBP15,508,385 (2022 HY: GBP18,619,283) has been disclosed as own

shares held by an EBT in the unaudited Condensed Consolidated

Statement of Changes in Equity and the unaudited Condensed

Consolidated Statement of Financial Position.

13. Subsequent events post balance sheet

At 30 May 2023, there were no subsequent events to report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZGFKLGNGFZM

(END) Dow Jones Newswires

May 31, 2023 02:00 ET (06:00 GMT)

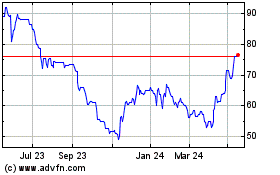

Premier Miton (LSE:PMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

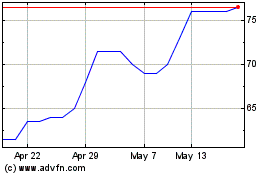

Premier Miton (LSE:PMI)

Historical Stock Chart

From Dec 2023 to Dec 2024