Premier Miton Group PLC Q1 AuM Update (9936X)

January 11 2022 - 2:00AM

UK Regulatory

TIDMPMI

RNS Number : 9936X

Premier Miton Group PLC

11 January 2022

Premier Miton Group plc

('Premier Miton', the 'Group' or the 'Company')

Q1 AuM update

Premier Miton AuM GBP13.9 billion with new sustainable

multi-asset fund to launch on 1 March 2022

Premier Miton Group plc (AIM: PMI) today provides an update on

its unaudited statement of Assets under Management ('AuM') for the

first quarter of its current financial year (the 'Quarter' or

'Period').

-- GBP13.9 billion closing AuM at 31 December 2021 (30 September 2021: GBP13.9 billion)

-- GBP87 million of net outflows from open ended funds for the Quarter

-- 49 (1) products managed by 17 investment teams at the Period end

-- 80%(2) of funds in the first or second quartile of their respective sectors

Mike O'Shea, Chief Executive Officer, commented:

"The Group's AuM ended the Quarter flat at GBP13.9 billion. The

closing AuM includes the previously announced winding up of the

GBP101 million Acorn Income Fund Limited and GBP87m of net

outflows.

Although it was disappointing to experience net outflows

following four quarters of net inflows totalling GBP830 million,

the net flows reflect a challenging period for UK fund flows in

general, and for UK equities in particular. Importantly, our

investment performance remains strong, with 80% (2) of funds in the

first or second quartile of their respective sectors since launch

or fund manager tenure, with both our more established and newer

funds performing well.

We are also delighted to be launching the Premier Miton

Diversified Sustainable Growth Fund on 1 March 2022, managed by the

same investment team behind the existing, strongly performing range

of five Diversified, directly invested multi-asset funds(3) . The

fund will focus on investments with a strong environmental, social

and governance ('ESG') profile and those which we believe offer

longer-term sustainable growth themes. Our key strengths of

investment excellence, active management and acting responsibly as

we move towards a more sustainable future, coupled with our strong

financial position means I am confident that Premier Miton is well

positioned for future growth."

Assets under Management:

Opening Quarter Closing

AuM 1 Market AuM

1 Oct net / investment 31 Dec

2021 flows performance 2021(4)

GBPm GBPm GBPm GBPm

Equity funds 8,223 (70) 145 8,298

Multi-asset

funds 3,919 (79) 65 3,905

Fixed income

funds 594 62 (7) 649

Investment

trusts 784 (100) (10) 674

Segregated

mandates 411 (1) 1 411

Total 13,931 (188) 194 13,937

(1) Comprising of 43 open-ended funds, four investment trusts

and two external segregated mandates.

(2) The quartile performance rankings are based on Investment

Association sector classifications where applicable, this covers 35

open-ended funds. Data is sourced from FE fundinfo using the main

representative post-RDR share class, based on a total return, UK

Sterling basis. All data is as at 31 December 2021 and the

performance period relates to when the fund launched or the assumed

tenure of the fund manager(s).

(3) Premier Miton Balanced Multi Asset Fund will be renamed

Premier Miton Diversified Sustainable Growth Fund on 1 March

2022.

(4) AuM and net flows are presented after the removal of AuM

invested in other funds managed by the Group. At the Period end

these totalled GBP192 million.

ENDS

For further information, please contact:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Investec Bank plc (Nominated Adviser and

Broker)

Bruce Garrow / Ben Griffiths / Virginia

Bull / Harry Hargreaves 020 7260 1000

Edelman Smithfield Consultants (Financial

PR) 07785 275665/

John Kiely / Latika Shah/ Andrew Wilde 07950 671948

Notes to editors:

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFETLFIILIF

(END) Dow Jones Newswires

January 11, 2022 02:00 ET (07:00 GMT)

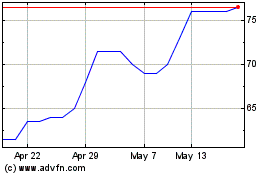

Premier Miton (LSE:PMI)

Historical Stock Chart

From Oct 2024 to Nov 2024

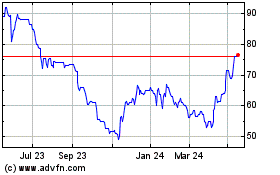

Premier Miton (LSE:PMI)

Historical Stock Chart

From Nov 2023 to Nov 2024