RNS Number:7226Y

PC Medics Group PLC

16 July 2002

CHIEF EXECUTIVE OFFICER STATEMENT

FOR THE YEAR ENDED 31 MARCH 2002

The statement at the time of the Interims (30th September 2001), written in

early November, was upbeat and the Group had every reason for optimism however,

the second half of the year proved much more difficult with the Group suffering

a severe and unexpected fall in sales. Despite these more challenging trading

conditions I am pleased to report that the management team have taken the

necessary action to rectify this situation and we now believe that the company

is well positioned to continue to grow, albeit at a more conservative rate.

The Group has incurred a serious loss of capital as defined in section 142 of

the Companies Act 1985 and are convening an Extraordinary General Meeting to

consider this. For the avoidance of doubt the accounts are not qualified in any

respect.

The single most important challenge for the Group's future is to maintain a

thriving sales department and the Group have now in place a highly motivated and

successful team which is delivering results. The Group re-launched its

services in September last year following the introduction of its new Web-based

remote access ability, and this involved the increase of our annual membership

from £90 to £150 and the removal of our premium line telephony in lieu. The

Group expected and got some price resistance, but believes it is now attracting

a better size and quality of customer. New recruits and the development of our

reseller and affiliate programme are beginning to realise early promise and will

shortly, it believes, justify confidence in the future.

The Group's reseller programme, whereby manufacturers, retailers, software

companies and those who specialise in on-site support resell our memberships to

their customers to provide them with Smart Helpdesk support, is proving a useful

route to market. In pursuing this vigorously the Group have introduced the PC

Medics concept to a number of industry colleagues and gained many new

associations throughout the UK that should become profitable in the near future.

The Group also have in place an affiliate programme which is intended to build a

database of IT support companies and people outside the Central London area.

With the remote access capability being able to resolve some 80% of all problems

over the telephone and via the Web, we need a reliable source of on-site support

to cater to the needs of the other 20%, and allow us to sell our memberships

throughout the UK.

The delivery of remote access support via the Web is proving successful and the

Group are confident that this is the way ahead, ie the delivery of IT support

on-line rather than on-site. This method of operating has the effect of

significantly reducing our reliance on the field technical force, and we have

already been able to reduce our headcount as a result.

PC Medics remains a fledgling company with less than three years of trading

history. In that time, thanks to shareholders support both at admission to Ofex

in March 2000 and AIM in May 2001, the Group has come a long way towards

achieving its goal of becoming the IT support company of choice for smaller SMEs

and SoHo/domestic users.

Finally I thank my fellow Board members for their extraordinary support and

commitment to our business. The executive directors have taken significantly

reduced salaries, foregone bonus payments that were awarded by the remuneration

committee at the beginning of the financial year, and worked long and unsociable

hours. With shareholders support the Group can continue to press that commitment

into the service of profitable growth in the near future.

Robin Parker

Chief Executive Officer

15 July 2002

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 MARCH 2002

Notes 2002 2001

£ £

Turnover 1 967,501 711,827

Cost of sales (617,457) (522,989)

350,044 188,838

Administrative expenses (1,116,504) (1,212,795)

Operating loss 2 (766,460) (1,023,957)

Interest payable and similar charges 3 (1,718) (3,544)

Interest receivable 6,210 19,984

Loss on ordinary activities before taxation (761,968) (1,007,517)

Tax on loss on ordinary activities 4 - -

Loss on ordinary activities after taxation (761,968) (1,007,517)

Loss for the financial period (761,968) (1,007,517)

Basic loss per share as previously published 6 - (6.30p)

As restated 6 (0.64p) (1.57p)

Fully diluted loss per share 6 (0.64p) (1.57p)

All income was derived from within the United Kingdom.

The profit and loss account has been prepared on the basis that all operations are continuing operations.

The group has no recognised gains or losses other than the loss for the financial year.

CONSOLIDATED BALANCE SHEET

AT 31 MARCH 2002

Notes 2002 2001

£ £ £ £

Fixed assets

Intangible assets 6,250 78,085

Tangible assets 107,279 142,717

113,529 220,802

Current assets

Stocks 4,700 4,825

Debtors 168,733 159,110

Cash at bank 128,330 101,532

301,763 265,467

Creditors: Amounts falling

due within one year 335,991 604,843

Net current liabilities (34,228) (339,376)

Total assets less current

Liabilities 79,301 (118,574)

Creditors: Amounts falling due

after more than one year (2,490) (3,262)

76,811 (121,836)

Capital and reserves

Called up share capital 8 333,380 160,000

Share premium account 9 1,705,815 918,580

Profit and loss account 9 (1,962,384) (1,200,416)

Equity shareholders' funds 76,811 (121,836)

These financial statements were approved by the Board of Directors on 15 July 2002.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD 1 APRIL 2001 TO 31 MARCH 2002

Note 2002 2001

£ £ £ £

Net cash outflow from

Operating activities 10 (910,318) (615,768)

Return on investments and

Servicing of finance

Interest received 6,210 19,984

Interest paid (462) (1,509)

Interest element of finance lease

Payments (1,256) (2,035)

Net cash inflow from 4,492 16,440

Returns on investment and

Servicing of finance

Taxation 231 6,033

Capital expenditure and financial

Investment

Purchase of intangible fixed assets - (15,000)

Purchase of tangible fixed assets (33,884) (158,839)

Sale of tangible fixed assets 6,144 4,910

Net cash (outflow) for capital

Expenditure and financial

Investment (27,740) (168,929)

Acquisitions and disposals

Purchase of subsidiary undertaking - (1)

Net cash acquired with Subsidiary - 39,127

Net cash inflow for

Acquisition and disposals - 39,126

Cash outflow before use of liquid

Resources and financing (933,335) (723,098)

Financing

Issue of equity share capital 173,380 -

Premium on issue of share capital 1,106,563

Expenses paid in connection with (319,328)

share issue

Capital repayment on finance (482) (5,490)

Leases

Net cash inflow/(outflow) from financing 960,133 (5,490)

Increase/(Decrease) in cash 11 26,798 (728,588)

ACCOUNTING POLICIES

Financial information

The financial information included in the above statement is an abridged version of the Group's accounts for the year

ended 31 March 2002, and does not constitute statutory accounts within the meaning of Section 240 of the Companies

Act 1985.

The Group's statutory accounts for the period ended 31 March 2002 have been reported on by the Company's auditors and

their report was unqualified.

Basis of accounting

The financial statements have been prepared under the historical cost convention and in accordance with applicable

accounting standards and on a going concern basis which the directors consider appropriate given their continued

support and the continued support of the Group's bankers who, as stated in the directors' report in the full

financial statements, following the year end have agreed to provide a bank overdraft facility to the Group.

The most significant accounting policies are described below.

Basis of consolidation

The consolidated financial statements incorporate the results of the Company and all its subsidiary undertakings as

if they were a single entity.

The accounts have been consolidated using the acquisition method of accounting.

Turnover

Turnover represents the invoiced amount of goods sold and services provided, and is stated net of VAT. Income from

maintenance contracts and service contracts is spread evenly over the contract term.

Intangible assets - Goodwill

Goodwill represent the excess of the cost of acquisition over the fair value of the separable net assets acquired. In

accordance with FRS10, "Goodwill and Intangible Assets," goodwill is capitalised and amortised in equal instalments

over its estimated useful economic life.

Intangible assets - Licences

Licences are valued at cost less accumulated amortisation. Amortisation is calculated to write off the cost in equal

annual instalments over their estimated useful lives.

Tangible fixed assets

Tangible fixed assets are stated at cost less provision for depreciation. Depreciation is provided on all tangible

fixed assets at rates calculated to write off the cost of each asset less its estimated residual value evenly over

its estimated useful life, as follows:

Computer equipment over three years

Office equipment over four years

Motor vehicles over two years

Stocks

Stocks are valued at the lower of cost and net realisable value

Leasing and finance lease commitments

Assets obtained under hire purchase contracts and finance leases are capitalised in the balance sheet and depreciated

over their useful lives. The interest element of the rental obligations is charged to the profit and loss account

over the period of the contract and represents a constant proportion of the balance of capital payments outstanding.

Rentals paid under operating leases are charge to the profit and loss account on a straight line basis over the term

of the lease.

Deferred taxation

Provision is made at current rates for taxation deferred in respect of all material timing differences except to the

extent that, in the opinion of the Directors, there is a reasonable probability that the liability will not

crystallise in the foreseeable future.

Investments

Fixed asset investments are stated at cost less provision for diminution in value.

Leases

Assets held for use in operating leases are included as a separate category in fixed assets at cost and depreciated

over their useful life. Rental income from operating leases are recognised on a straight line basis over the term of

the lease.

Pensions

Following the acquisition of Heed Limited, PC Medics (London) Limited took over operating its defined contribution

pension scheme. The assets of the scheme are held separately from those of the Group in an independently administered

fund. The pension costs charged in the consolidated financial statements represent contributions payable by the

company during the period in accordance with FRS17.

Website development costs

Website development costs are written off as they are incurred in accordance with UITF 29.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2002

1 Turnover

The total turnover of the Group for the period has been derived from its principal activity wholly undertaken in the

United Kingdom.

The post acquisition results of the acquired operations have not been separately disclosed as the businesses were

integrated into the existing operations, and it is not possible to separately identify the post acquisition results.

2 Operating loss

2002 2001

£ £

Operating loss is stated after charging/(crediting):

Depreciation of tangible fixed assets:

- owned assets 55,778 44,410

- assets held under hire purchase contracts and

finance leases 2,975 4,915

Website development costs written off - 15,000

Amortisation of intangible fixed assets 71,835 65,885

Auditors' remuneration:

- audit services 21,900 12,900

- non-audit services 29,044 24,035

Operating lease payments

- land and buildings 71,881 75,468

3 Interest payable

2002 2001

£ £

On bank overdrafts and other loans 462 1,509

On finance leases 1,256 2,035

1,718 3,544

4 Taxation

No liability to corporation tax arises due to losses incurred. At 31 March 2002 the Group had corporation tax losses

of approximately £1,900,000 (31 March 2001: losses £1,200,000) to set against profits of the same trade, subject to

agreement by the Inland Revenue.

5 Loss attributable to ordinary shareholders

The Company has taken advantage of the exemption under Section 230 (1)(b), (4) of the Companies Act 1985 from

presenting its own profit and loss account. The loss dealt with in the financial statements of the Company was

£2,087,106 (31 March 2001 loss £2,447).

6 Loss per share

The calculation of the basic loss per share is based on the loss for the period after tax of £761,968 (31 March 2001

£1,007,517) and on 117,900,650 (31 March 2001 restated 64,000,000) ordinary shares, being the weighted average number

of ordinary shares in issue during the period. The previous year's loss per share has been restated to take account

of the conversion of the nominal value of ordinary shares from shares of 1p each to shares of 0.25p each in May 2001.

In calculating the fully diluted loss per share, share options and warrants have been considered to be non-dilutive

because their exercise price are above the current share price.

7. Deferred taxation

There is no liability to deferred taxation provided in the financial statements due to the trading losses incurred in

the period.

8. Share capital

2002 2001

Authorised £ £

1,000,000,000 Ordinary shares of 1p each - 10,000,000

4,000,000,000 Ordinary shares of 0.25p each 10,000,000 -

10,000,000 10,000,000

Allotted, called up and fully paid - 160,000

16,000,000 Ordinary shares of 1p each 333,380 -

133,352,152 Ordinary of 0.25p each

On 8 May 2001 the 16,000,000 ordinary 1p shares were subdivided into 64,000,000 ordinary 0.25p shares.

On 11 May 2001 55,072,152 ordinary 0.25p shares were issued through a placing and open offer at a value of 2p

per share.

On 20 November 2001 13,800,000 ordinary 0.25p shares were issued through a placing with Fitel Nominees Limited

at 1.25p per share.

A further 480,000 ordinary 0.25p shares were issued for 1.25p per share on 12 February 2002.

Warrants

On 11 May 2001, 27,536,076 warrants were issued. Registered holders of warrants have the right to subscribe for

1 ordinary share in the Company at 4p per share at any time up to and including 30 June 2003.

Share option schemes

At 31 March 2002 the following share options were outstanding:

Date options granted Number of options Description of shares Exercise price Period over which the

granted option granted upon option is exercisable

1/2/00 3,200,000* Ordinary shares of 6.25p* 5 years from date of

0.25p* grant

7/2/00 1,920,000* Ordinary shares of 6.25p* 5 years from date of

0.25p* grant

9/4/01 7,144,330 Ordinary shares of 0.25p 2p 5 years from 10/5/01

*Terms restated to reflect the subdivision of the Company's share capital which took place on 8 May 2001.

9. Reserves

Group Share premium Profit and loss account

£ £

At 31 March 2001 918,580 (1,200,416)

Premium on shares issued during the year 1,106,563 -

Issue costs (319,328) -

Loss for the year - (761,968)

At 31 March 2002 1,705,815 (1,962,384)

10. Reconciliation of operating loss to net cash

outflow from operating activities

2002 2001

£ £

Operating loss (766,460) (1,023,957)

Depreciation of tangible fixed assets 58,753 52,060

Amortisation of intangible fixed assets 71,835 65,884

Decrease/(increase) in stock 125 (2,196)

(Increase)/decrease in debtors (9,854) 71,884

(Decrease)/increase in creditors (269,142) 224,412

Profit on disposal of tangible fixed assets 4,425 (3,855)

Net cash outflow from operating activities (910,318) (615,768)

11. Reconciliation of net cashflow to movement

in net funds

2002 2001

£ £

Increase/(decrease) in cash in the period 26,798 (728,588)

Cash outflow from decrease in debt 482 5,490

Change in net debt resulting from cash flows 27,280 (723,098)

Loans and finance leases acquired with subsidiary - -

New finance leases and hire purchase contracts - (9,000)

Movement in funds in the period 27,280 (732,098)

Opening net funds 93,571 825,669

Closing net funds 120,851 93,571

12. Dividends

The directors are unable to declare a dividend because the company does not have distributable reserves (2001: £Nil).

13. Full financial statements

Full financial statements will be available at the Company's registered office and will be posted to shareholders on

22 July 2002.

This information is provided by RNS

The company news service from the London Stock Exchange

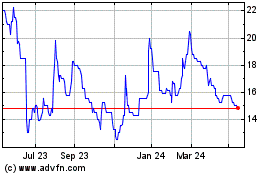

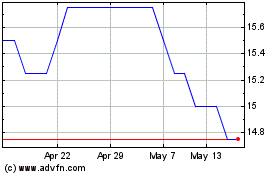

Parkmead (LSE:PMG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Parkmead (LSE:PMG)

Historical Stock Chart

From Jul 2023 to Jul 2024