Polar Capital Global Health Tst PLC Net Asset Value(s) (6667H)

November 25 2022 - 7:48AM

UK Regulatory

TIDMPCGH TIDMPGHZ

RNS Number : 6667H

Polar Capital Global Health Tst PLC

25 November 2022

POLAR CAPITAL GLOBAL HEALTHCARE TRUST PLC ("the Company")

Legal Entity Identifier: 549300YV7J2TWLE7PV84

25(th) November 2022

Net Asset Values

As at close of business on 24(th) November 2022 the Company's

unaudited Net Asset Value, calculated in accordance with the

guidelines of the Association of Investment Companies, was:

Ordinary Share (cum income) 340.25p

PCGH ZDP PLC

Legal Entity Identifier: 5493004C3YRF9HEVQI09

As at close of business on 24(th) November 2022 the redemption

value of the ZDP Shares was:

Zero Dividend Preference (ZDP) Share 117.43p

The Redemption Value of the ZDP Shares compounds annually at 3%

and accrues daily, with a redemption value of 122.99p per ZDP Share

on 19 June 2024.

For further information, please call:

Ellie Martin

Investment Trust Operations Department

Polar Capital Partners Limited

Tel: 020 7227 2700

http://www.polarcapitalhealthcaretrust.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVPPGMCGUPPGPA

(END) Dow Jones Newswires

November 25, 2022 07:48 ET (12:48 GMT)

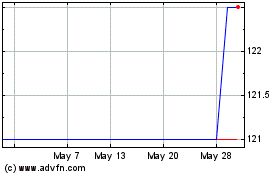

Pcgh Zdp (LSE:PGHZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

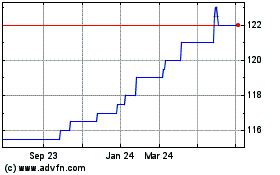

Pcgh Zdp (LSE:PGHZ)

Historical Stock Chart

From Nov 2023 to Nov 2024