TIDMPCGH TIDMPGHZ

RNS Number : 8408K

Polar Capital Global Health Tst PLC

10 May 2022

POLAR CAPITAL GLOBAL HEALTHCARE TRUST PLC

(the "Company")

Unaudited Results Announcement for the Six Months to 31 March

2022

LEI: 549300YV7J2TWLE7PV84 10 May 2022

HIGHLIGHTS IN DETAIL

For the six For the year

months to to

31 March 30 September

Performance 2022 2021

Net asset value per Ordinary share (total return)

(note 1)* +5.05% 19.46%

Benchmark index

MSCI ACWI/Healthcare Index (total return in

GBP sterling with dividends reinvested) +5.03% 13.40%

Since restructuring on 20 June 2017

Net asset value per Ordinary share (total return)

(note 2)* +59.97% 52.28%

Benchmark index total return +61.15% 53.42%

Expenses*

Ongoing charges (note 3) 0.86% 0.83%

Financials (Audited)

(Unaudited) As at

As at 30 September Change

31 March 2022 2021

Total net assets (Group and Company) GBP403,902,000 GBP385,728,000 4.7%

Net asset value per Ordinary share 333.06p 318.07p 4.7%

Net asset value per ZDP share 115.19p 113.50p 1.5%

Price per Ordinary share 300.00p 288.00p 4.2%

Discount per Ordinary share* 9.9% 9.5%

Price per ZDP share 114.50p 113.50p 0.9%

Net gearing* 5.92% 6.04%

Ordinary shares in issue (excluding

those held in treasury) 121,270,000 121,270,000 -

Ordinary shares held in treasury 2,879,256 2,879,256 -

ZDP shares in issue 32,128,437 32,128,437 -

Amount

Dividends paid and declared per Ordinary Record Ex-Dividend Declared

in the period: Pay Date share Date Date date

The Company has paid the

following dividend relating

to the financial year 28 February 4 February 3 February 16 December

ended 30 September 2021: 2022 1.00p 2022 2022 2021

Dividends for the current financial year ending 30 September 2022,

if declared, will be paid in August 2022 and February 2023.

All data sourced from Polar Capital LLP/HSBC.

Note 1 NAV total return is calculated as the change in NAV from the start of the period, assuming

that dividends paid to shareholders are reinvested on the payment date in Ordinary shares

at their net asset value.

Note 2 The Company's portfolio was restructured on 20 June 2017. The total return NAV performance

since restructuring is calculated by reinvesting the dividends in the assets of the Group

and Company from the relevant payment date.

Note 3 Ongoing charges represents the total expenses of the Company, excluding finance costs, transaction

costs, tax and nonrecurring expenses expressed as a percentage of the average daily net asset

value, in accordance with AIC guidance issued in May 2012. The ongoing charges figure as at

31 March 2022 is for the six month period from 30 September 2021 and is annualised for comparison

with the full year's calculation as at 30 September 2021.

*See Alternative Performance Measures below.

For further information Tracey Lago FCG Tel: 020 7227 2700

please contact: Company Secretary

Polar Capital Global Healthcare

Trust Plc

INTERIM MANAGEMENT REPORT

CHAIR'S STATEMENT

On behalf of the Board, I am pleased to provide you with the

Company's Half Year Report for the six months to 31 March 2022.

Only two years ago I wrote my first Chair's Statement as

COVID-19 was sweeping the globe, a situation viewed by many as a

once in a generation event. I certainly did not anticipate writing

so soon against the backdrop of another major humanitarian crisis

unfolding, in the form of the invasion of the Ukraine by Russia at

the end of February. Our thoughts and good wishes go out to all

those affected by these terrible events.

Performance

Not surprisingly, the deteriorating geo-political situation

layered upon increasingly negative economic factors, proved to be

another challenging period for most managers, although equity

markets overall remained remarkably resilient.

The net asset value per Ordinary share (total return) rose 5.05%

over the period, broadly in line with the Benchmark index (+5.03%)

and comfortably ahead of our AIC sector peer group. Whilst we would

always aim to be further ahead of the benchmark, given the backdrop

combined with some of the extreme stock price moves within the

healthcare sector, this was arguably a good outcome.

The discount widened slightly through the period by 0.4% to

9.9%. We had seen a gradual narrowing of the discount earlier in

the period, but in common with many investment trusts, as the

Russia-Ukraine situation developed, discounts widened. The Board

continues to monitor the discount.

Outlook

Whilst the global geo-political situation and economic

conditions are likely to remain challenging for the foreseeable

future, the outlook for healthcare is very compelling. The

Company's managers believe that the macro-economic environment has

shifted to one that is supportive for the healthcare sector,

especially for those companies that sit higher up the

capitalisation and quality scale. More detail is provided in the

Investment Manager's Review below.

The Board

There have been no changes to the membership of the Board in the

six months to 31 March 2022. The Directors' biographical details

are available on the Company's website and are provided in the

Annual Report. In late April 2022, the FCA published the results

and revisions to the Listing Rules in relation to Diversity and

Inclusion on company boards. We will be reviewing the revisions to

the requirements and will advise in the next Annual Report if we

feel that it is necessary or appropriate to take any action.

Principal Risks and Uncertainties

A detailed explanation of the Company's principal risks and

uncertainties, and how they are managed through mitigation and

controls, can be found on pages 29 to 31 of the Annual Report for

the year ended 30 September 2021. The principal risks and

uncertainties are categorised into four main areas: Portfolio

Management, Operational Risk, Regulatory Risk and Economic/Market

Risk. The Directors consider that, overall, the principal risks and

uncertainties faced by the Company for the remaining six months of

the financial year have not changed from those outlined within the

Annual Report. The Board continues to carefully monitor the impact

of the Russian invasion of Ukraine and whilst this worsens the

macroeconomic outlook, there is no direct impact to the Company's

portfolio or the healthcare sector.

Further detail on the Company's performance and portfolio can be

found in the Investment Managers' Report.

Going Concern

As detailed in the notes to the financial statements, the Board

continually monitors the financial position of the Group and

Company and has undertaken additional stress-testing and analysis

in determining the appropriateness of preparing the Financial

Statements on a going concern basis. Having carried out the

additional testing, the Directors are satisfied that it is

appropriate to continue to adopt the going concern basis in

preparing the financial results of the Group and Company. In

reaching this conclusion, the Board also considered the Company's

performance and its assessment of any material uncertainties and

events that might cast significant doubt upon the Group and

Company's ability to continue as a going concern.

Related Party Transactions

In accordance with DTR 4.2.8R, there have been no new related

party transactions during the six month period to 31 March 2022.

There have been no changes in any related party transaction

described in the last Annual Report that could have a material

effect on the financial position or performance of the Group or

Company in the first six months of the current financial year or to

the date of this report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors of Polar Capital Global Healthcare Trust Plc

confirm to the best of their knowledge that:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34, in conformity with the requirements of

the Companies Act 2006 and gives a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company as at 31 March 2022; and

-- The Interim Management Report includes a fair review of the

information required by the Disclosure Guidance and Transparency

Rules 4.2.7R and 4.2.8R.

The half year financial report for the six month period to 31

March 2022 has not been audited or reviewed by the Auditors. The

half year financial report was approved by the Board on 9 May

2022.

Lisa Arnold

Chair

INVESTMENT MANAGER'S REVIEW

Executive Summary

An unwelcome combination of economic and geo-political events

has made the first half of 2022 an extremely challenging period for

global equity markets. Despite being faced with a cocktail of

rising inflation, hawkish central banks and war in Ukraine, the

equity markets have been remarkably resilient and over the six

month period to the end of March 2022. The Company returned 5.05%

versus 5.03% for the benchmark (MSCI AC World Daily Total Return

Net Health Care Index in sterling). More importantly, the macro

environment has shifted to one that is very supportive for the

healthcare sector, especially for larger and generally higher

quality companies. The potential for slowing economic growth and

elevated inflation, i.e. stagflation, is one that should benefit

healthcare. The essential nature of its products and services

provides an offset to slowing economic growth. On the inflation

side, healthcare is populated with businesses that have pricing

power, are vertically integrated, or have high gross and operating

margins and thus can absorb the additional costs.

Reflecting on performance, strong stock selection across the

market capitalisation spectrum was offset by the allocation effect

of having a relative overweight position in small and

mid-capitalisation stocks. More importantly, we did start to see

some evidence that COVID-19 is becoming less disruptive, especially

in the US, as evidenced by a sharp reduction in COVID-19

infections, a material decline in patients needing ICU treatment

and some signs that staffing pressures have plateaued and could

eventually ease. There may well be further COVID-19 bumps in the

road, but if that general direction of travel continues, consumers

will start to re-engage with healthcare systems, which could put

upwards pressure on utilisation, consumption and ultimately company

revenues. With relative valuations attractive and absolute

valuations supportive, the outlook for the healthcare sector is

highly compelling.

Performance review

Over the six month period to the end of March 2022, the

healthcare sector outperformed the broader market indices as the

retreat into more defensive sectors accelerated in late February

following the Russian invasion of Ukraine. It is worth noting that

the Company has not had, and does not have, direct investments in

Russia or Ukraine but is invested in companies that either generate

sales or are running clinical trials in the region. We note that

the healthcare industry is also exposed to some of the supply

chains pressures that have been a direct result of the conflict,

with titanium and energy two good examples. The Company's

performance was in line with that of its benchmark index, with

further details provided below.

Performance - 30 September 2021 to 31 March 2022

From the 30(th) September 2021 to the end of March 2022, the

Company returned 5.05% versus 5.03% for the benchmark. Over the

period under review, market price moves across the healthcare

sector have been quite extreme. In the 4th quarter of calendar 2021

and the 1(st) quarter of calendar 2022, small capitalisation

healthcare, including biotech, which would be regarded as one of

the more speculative sub-sectors, was heavily sold off as investors

switched to more value and higher quality stocks at the expense of

higher growth and smaller stocks. This clearly impacted the

allocation effect for the Company given the higher exposure to

small and mid-capitalisation companies than its benchmark.

Average Weight (Fund) Average Weight (Bench)

>$10bn 79.20 96.46

>$5bn - $10bn 15.15 2.38

<$5bn 11.12 1.16

Cash and Others -5.47 0.00

Source: Polar Capital as at 31 March 2022, average calculated

over the reporting period

From a geographical perspective, the Asia Pacific region

(excluding Japan) was the biggest contributor, mainly due to our

underweight exposure to the region. The overweight in North America

and underweight in Japan were also positive, but negative stock

selection meant that the overall contribution from these regions

was only marginal. The other notable impact over the period was the

negative contribution from Europe with stock selection being a

detractor despite a good allocation effect. The impact of gearing

on performance was negligible over the six months. Although we

decreased the level of gearing in December 2021 and January 2022 on

the back of increased concerns about the Omicron COVID-19 variant,

the overall level was relatively stable during the period under

review. Net gearing at the end of September 2021 was 6.0% and this

was reduced slightly to 5.9% by the end of March 2022.

In terms of sub-sectors, outperformance was split between

allocation and stock selection. The most positive impact came from

strong stock selection in healthcare equipment and facilities,

whilst managed care was a positive contributor due to the

allocation effect. Negative contributors were as follows:

pharmaceuticals due to the underweight exposure, and biotechnology

and healthcare distributors through adverse stock selection.

Stocks that contributed positively to the relative performance

over the period included Moderna, Molina Healthcare, Steris, Wuxi

Biologics, and UnitedHealth Group. A lack of exposure to US

biotechnology company Moderna was a positive relative contributor

with the stock continuing to struggle, as the market re-assessed

not only the future opportunity for COVID-19 vaccines but the

broader utility of the company's mRNA platform. Managed care

organisations Molina Healthcare and UnitedHealth Group delivered

positive results and provided reassuring commentary around 2022

consensus earnings. Further, the stocks benefitted from the

sector's overall strong performance with rising interest rates

providing a tailwind. Wuxi Biologics, a Chinese-based contract

development and manufacturing company, was affected by the broader

growth-to-value rotation (from which Chinese companies were

particularly impacted) but also by the addition of two of its

subsidiaries to the US Commerce department's Unverified List, a

list of companies that the Bureau of Industry Security could not

verify as bona fide. Steris is a leading provider of infection

prevention and procedural products and services, focused primarily

on the critical markets of healthcare, pharmaceuticals and medical

devices. The company's strong performance over the period has been

driven by strong execution despite the challenging environment.

Indeed, Steris upgraded its outlook for the 2022 fiscal year on

stronger growth across the business coupled with higher synergies

from a recent acquisition, which triggered positive revenue and

earnings revisions, putting upwards pressure on the stock's share

price.

Stocks that impacted relative performance negatively over the

period were AbbVie, Bio-Rad Laboratories, Pfizer, Medley and Eli

Lilly. US biotechnology company AbbVie, which was not held during

the period, impacted relative performance, with management

executing well and producing solid sets of financial results that

were well received by the market. There was no significant news

flow for Bio-Rad Laboratories or Medley, but the stocks were caught

up in the derating experienced by highly valued, high-growth

sub-sectors such as life sciences tools and services (Bio-Rad

Laboratories) and healthcare technology (Medley). A lack of

exposure to Pfizer and Eli Lilly hurt performance as the stocks

performed well due to positive announcements (e.g. the FDA granting

an emergency use authorisation to Pfizer's Paxlovid, a COVID-19

oral anti-viral) combined with investors' increased appetite for

large-capitalisation, defensive stocks.

Relative Contributors (%) - 30 September 2021 - 31 March

2022

Average Stock Total Attribution

Stock Active Stock Return Effect

Top 10 Weight Weight Return vs BM

Moderna 0.00 -1.02 -54.14 -59.18 1.01

Molina Healthcare 2.24 2.01 25.97 20.93 0.48

Steris 3.01 2.71 21.25 16.22 0.46

Wuxi Biologics Cayman 0.00 -0.52 -47.63 -52.67 0.40

UnitedHealth Group 6.91 1.24 33.71 28.68 0.37

Centene Corp 1.23 0.65 38.43 33.39 0.33

Envista Holdings

Corp 2.34 2.34 19.36 14.32 0.32

Medtronic 0.00 -1.92 -9.32 -14.35 0.30

Essilor International

SA 0.69 0.69 -1.40 -6.44 0.29

Bristol Myers Squibb 3.38 1.58 26.45 21.41 0.26

Average Stock Total Attribution

Stock Active Stock Return Effect

Bottom 10 Weight Weight Return vs BM

AbbVie 0.00 -2.99 53.97 48.93 -1.24

Bio-Rad Laboratories 3.01 2.82 -22.64 -27.68 -0.89

Pfizer 0.00 -3.67 23.32 18.28 -0.61

Medley 0.78 0.78 -41.73 -46.76 -0.57

Eli Lilly & Co 0.00 -2.67 26.98 21.95 -0.55

Zealand Pharma A/S 0.74 0.74 -44.74 -49.78 -0.49

Avantor 2.41 2.16 -15.28 -20.32 -0.47

Genmab A/S 2.05 1.73 -13.91 -18.94 -0.40

Ship Healthcare 0.83 0.83 -33.95 -38.98 -0.39

Anthem 0.00 -1.38 34.99 29.96 -0.36

Source: Polar Capital as at 31 March 2022. Past performance is

not indicative or a guarantee of future results.

Near term considerations; Stagflation

The healthcare industry is composed of a broad and diversified

universe of businesses that range from pharmaceuticals and

biotechnology to medical equipment, medical insurance, healthcare

facilities and life sciences tools and services. This diversity,

with many different business models across the

market-capitalisation spectrum, is one of the reasons the sector

can offer investors protection against the prospect of global

stagflation. In fact, the correlation of both earnings and the

share prices of healthcare stocks to various economic indicators

(global GDP; the Current Activity Indicator; PMI) is one of the

lowest in the market.

There are also three more fundamental reasons why the healthcare

sector should be relatively attractive in a stagflationary

environment. Firstly, with high inflation and low economic growth,

consumers' purchasing power and confidence are greatly reduced,

adversely affecting consumer demand. However, given the essential

nature of many products and services provided by healthcare

companies, demand for these tends to be consistent. That

consistency should offer investors greater confidence in healthcare

companies' ability to generate steady revenues, earnings and cash

flow.

Secondly, certain pockets of healthcare offer some protection

from inflationary pressures given they can pass on costs to their

customers, are vertically integrated (thus offering greater control

of their supply chains) or have high gross and operating margins

that can absorb the additional costs. On the pricing side we would

highlight healthcare supplies and contract manufacturers and on the

margin side we would point to pharmaceuticals and large

capitalisation biotechnology companies.

Finally, during periods of prolonged stagflation, quality

companies with high cash flow generation, solid balance sheets and

high returns on equity and invested capital should perform better

than higher growth but less cash-generative businesses. This is

because future earnings and cash flows have a lower present value

when nominal interest rates are high, with investors tending to

prefer businesses that can generate earnings and cash flows in the

near term. We are therefore particularly constructive on larger

capitalisation healthcare stocks, many of which display these

characteristics. In summary, near-term macroeconomic uncertainty

and the rising spectre of stagflation lead us to believe the

healthcare sector is an attractive investment proposition,

especially on a relative basis.

Medium term drivers; Healthcare in a COVID-endemic world

In last year's Annual Report we outlined six key investment

themes, which we believe offer the potential for significant

returns in the years ahead. As a reminder the themes are; Delivery

disruption; Innovation; Emerging markets; Consolidation;

Outsourcing; Prevention. These themes remain relevant today, but we

are currently focused on two of the original investment themes plus

a new theme ("Tackling the backlog") that we believe have greater

near-term relevance. That view is based on the assumption that

COVID-19 becomes less disruptive over the next few months and years

because if so, there are positive implications for the healthcare

industry that should yield some exciting investment opportunities.

In order of immediacy, these are;

-- Tackling the backlog

-- Disrupting the delivery of healthcare

-- Prevention

Tackling the backlog

COVID-19 has been incredibly disruptive for millions of people,

for many different reasons, but the impact on global healthcare

systems has been particularly profound. The COVID-19 pandemic has

had significant repercussions for the delivery of elective care,

meaning that many patients are now waiting longer for treatment

than they were before the pandemic began. In order to address the

ever-growing backlog healthcare systems, and their staffing

policies, will need to learn to live with COVID-19, increase

capacity, prioritise diagnosis and treatment and look to utilise

alternative sites of delivery. If successfully delivered, then

utilisation and volumes should accelerate, which is a clear

positive for the top-lines of healthcare facilities, healthcare

providers and medical device companies.

To try and understand the magnitude of the problem, and indeed

the opportunity for the healthcare industry, a recent NHS report

pointed to 6 million people on waiting lists, up from 4.4 million

before the pandemic. The NHS is just one example of the challenge

that healthcare systems face, but it is perfectly reasonable to

assume that similar dynamics exist in other jurisdictions globally.

What that statistic does not capture, however, is the number of

people who have missed all-important diagnoses and could now be

faced with more advanced and more problematic health challenges.

Cancer is a case in point, with the NHS launching the Help Us Help

You campaign to encourage people with cancer symptoms to come

forward. Recent analysis by Macmillan Cancer Support has suggested

that around 50,000 patients have missed a cancer diagnosis during

the pandemic. Research has also shown that women being diagnosed

with stage four breast cancer has increased by 48% over the last

few months, which the charity say is down to COVID-19 disruption to

NHS care. Tackling the backlog is a clear and immediate

priority.

Disrupting the delivery of healthcare

The disruption of delivery is critical given there is an acute

need globally to generate greater efficiencies and deliver more

healthcare to more people for less money. Investment in products

and services that drive efficiencies has been evident for some

time, but the COVID-19 crisis has brought a greater level of focus

and has accelerated momentum in certain areas. The use of

out-patient facilities and Ambulatory Surgery Centres to perform

surgeries that might previously have been performed in a more

traditional hospital setting has really accelerated during the

tail-end of the COVID-19 pandemic. Cataract surgeries, endoscopies

and colonoscopies have been performed in out-patient settings/

Ambulatory Surgery Centres for some time, but there is a clear

drive to conduct more and more procedures, for example orthopaedic

surgery and cardiovascular intervention, in those facilities.

We would also highlight home health as an area that should see

considerable growth over the medium-term as healthcare systems look

to shift patient volumes to lower-cost and more convenient

settings. The Centers for Medicare & Medicaid Services, a

federal agency that administers the United States' major healthcare

programs, has projected that home health spending will grow in the

mid- to high-single-digits per annum through 2028 which should

translate into healthy organic growth for providers. It is

interesting to note that in March UnitedHealth Group announced its

intention to acquire home-health provider, LHC Group, helping to

underpin our view that home-health offers durable growth prospects.

Once part of the UnitedHealth Group, management will look to

improve care coordination, improve outcomes and patient experiences

as well as drive better value for the healthcare system.

Prevention: The cornerstone of public health systems

Effective prevention should be the cornerstone of public health

systems, not just vaccinations, but early and accurate diagnoses to

set patients on to optimal treatment pathways. The COVID-19 crisis

has offered a timely reminder not only of the value of safe and

effective vaccines, but also of the need for effective diagnostics

infrastructure. Early intervention coupled with effective disease

management should drive better outcomes for patients and,

ultimately, generate much-needed cost savings. Genetic testing to

help greater understanding of underlying disease biology will only

accelerate from here, as will the use of biomarkers to enhance

therapeutic accuracy and reduce waste.

Preventative medicine and preventative measures come in a very

wide range of guises, but we feel it appropriate to focus on

diagnostics and vaccines. In a post-COVID-19 world there is hope

that the much-needed investment in diagnostics infrastructure will

be put to good use as testing menus expand. As such, companies like

Abbott Laboratories, Hologic, Roche Holdings and Siemens

Healthineers should be well-positioned to capitalise. Definitive

diagnosis, coupled with guided therapies, are foundational to

precision medicine with the goal of driving better outcomes for

patients. Safe and effective vaccines will also continue to be a

critical part of the healthcare eco-system, with French

pharmaceuticals giant Sanofi one of the world's leading vaccine

manufacturers. Sanofi manufactures not just seasonal vaccines like

influenza, but also travel and paediatric vaccines.

Strategy and positioning

As a reminder, the objective of the Company is to achieve

long-term capital appreciation by investing in a portfolio of

global healthcare companies, to include, but not limited to,

pharmaceutical, biotechnology, medical device and healthcare

services companies. The aim is to identify companies where there is

a disconnect between valuations and intrinsic value. The Company is

a high conviction (81.5% active share as at 31st March 2022),

actively managed investment vehicle that gives investors exposure

to the global healthcare universe. Stock-picking remains critical

to the process, but it is worth noting there will be a continued

focus on the key investment themes some of which appear to be

accelerating in the near-term but also have medium-term

durability.

The Company attempts to combine a Growth at a Reasonable Price

(GARP) approach with the opportunity to invest in earlier-stage,

more disruptive companies. The Growth portfolio dominates the

portfolio with exposure to companies that sit further up the market

capitalisation scale. This part of the portfolio consists of

holdings where we see a disconnect between the current share price

and intrinsic value. The positions also reflect, in part but not

exclusively, the investment themes where we have the highest

conviction. This part of the portfolio drives the lower volatility

of the Company relative to other, more volatile areas of

healthcare. The innovation portfolio provides optionality through

investments in the most exciting small capitalisation stocks we can

find.

http://www.rns-pdf.londonstockexchange.com/rns/8408K_1-2022-5-9.pdf

Period end positioning; Diverse but with high conviction

From a sub-sector perspective, there were a few material changes

during the six month period under review to positioning in response

to both macro and stock-specific drivers. Although pharmaceuticals

remains the largest underweight relative to the benchmark, the

exposure to this sub-sector was increased over the last quarter of

the period (-11.1% as at 31 March 2022 from -13.5% at 30 September

2021) given the defensive characteristics of the sector. Starting

from a modest overweight at the start of the fiscal year,

biotechnology became the biggest overweight at the end of the

period (6.5% as at 31 March 2022) as the large sell-off in this

sector at the end of calendar 2021 offered an opportunity to buy

established, large-capitalisation companies with commercialised

assets and some smaller stocks with exciting pipeline potential. We

reduced our overweight to the managed healthcare and distributors

sub-sectors as they performed well over the period, leaving less

room for upside. Finally, in line with our thesis that healthcare

systems will need to step up their efforts to tackle an

ever-growing large backlog of patients, we remain optimistic on the

healthcare facilities, supplies and medical equipment

sub-sectors.

http://www.rns-pdf.londonstockexchange.com/rns/8408K_2-2022-5-9.pdf

As mentioned above, we continue to be underweight in

pharmaceuticals relative to the benchmark given the industry's

anaemic growth profile and mature operating margins, but at a less

extreme level than at the start of the financial year. The

sub-sector's valuations and dividend yields offer downside

protection, plus the defensive profiles of component companies

should provide some safety against a more cautious macroeconomic

backdrop. Further, the possibility of drug pricing pressures in the

US are likely to recede, especially if the mid-term elections in

November 2022 result in the Republicans gaining a majority in the

House of Representatives. However, our overall underweight is

predicated on our belief that we can find more opportunities in

other areas of the healthcare universe.

Share prices in the biotechnology sub-sector came under

significant pressure during the first four months of the reporting

period due to a less favourable macroeconomic environment, with

higher interest rates weighing down on stocks with high implied

terminal-values and low or negative free cashflow generation. This

broad correction presented some interesting opportunities,

especially with companies that have commercialised assets and/or

overly discounted, late-stage pipelines. More importantly, however,

we believe the biotechnology sector's fundamentals remain intact;

these include ever-improving understanding of human biology and the

ability to take that knowledge into the clinic, and ultimately onto

the market to help patients.

The managed healthcare sub-sector experienced a substantial

re-rating during the period under review, aided by a supportive

political environment but also rising interest rates, which allow

the companies to generate a higher return on their capital.

Similarly, distributors performed very well, mainly due to their

resilient and stable earnings algorithms.

Our thesis that there is increased desire to shift patient

volumes to low-cost settings like the home and Ambulatory Surgery

Centres is unchanged, therefore we have remained overweight in

healthcare facilities despite short-term challenges in the form of

staffing shortages and wage inflation. Tenet Healthcare, the

largest operator of Ambulatory Surgery Centres in the United

States, was added during the period as we believe its portfolio is

well geared to capitalise from this trend. Furthermore, hospitals

and providers are a direct beneficiary of the post-COVID-19

"opening up" trade as patients re-enter the system to access the

care that has been denied them during the height of the coronavirus

crisis.

Other beneficiaries of the "opening up" trade should be

healthcare equipment and supplies companies, to which we have

higher exposure relative to the benchmark. Unfortunately, both

sub-sectors have underperformed the benchmark during the period for

two main reasons. Firstly, the COVID-19 Omicron variant continues

to spread across the world, thus reducing the volumes of elective

procedures and consequently the sales of medical equipment used for

these operations. Secondly, a number of companies have flagged

inflationary pressures and staffing shortages as challenges they

will need to navigate in the coming months. Both transient in

nature, we remain constructive on the sub-sectors, given their

strong fundamentals and the opportunity that the patient backlog

presents.

Stock-selection is a key driver

The table below displays the Company's top 10 relative

overweight and underweights at the end of the reporting period,

highlighting the highest conviction ideas in the portfolio. Whilst

conviction is the appropriate term to use when discussing

positioning versus the benchmark, it is important to stress that

valuation inefficiencies can be relatively short-lived, especially

amongst well-covered large capitalisation stocks. With opportunity

cost also a key decision driver as we look to maximise returns, the

Company's top 10 relative overweights are subject to change.

Top 10 Overweights and Top 10 Underweights relative to

Benchmark

Active Active

(%) (%)

Steris 3.19% Roche -3.74%

Sanofi 2.98% Pfizer -3.70%

Bio-Rad Laboratories 2.92% AbbVie -3.65%

Bristol Myers Squibb 2.87% Eli Lilly & Co -2.97%

Horizon Pharma 2.84% Thermo Fisher Scientific -2.97%

Seattle Genetics 2.59% Abbott Laboratories -2.67%

Alcon 2.58% Merck & Co -2.64%

Boston Scientific Corp 2.58% Novartis -2.46%

SARTORIUS AG 2.55% Danaher -2.40%

Zimmer Biomet Holdings 2.52% Novo Nordisk A/S -2.40%

Source: Polar Capital, as at 31 March 2022

The majority of the Top 10 overweights relative to the benchmark

have been in the portfolio for some time, with the exception of

Sartorius, Seattle Genetics and Zimmer Biomet, all of which were

added during the reporting period. Sartorius is a life sciences

tools and services company that partners with the

biopharmaceuticals industry via the provision of products,

technologies and expertise to produce biopharmaceuticals reliably

and efficiently. The stock performed strongly in 2021, with

COVID-19 a material contributor, but has since de-rated alongside

similar highly rated, high-growth companies. That contraction in

the valuation presented an opportunity to re-engage with a

high-quality business that enjoys a strong position in buoyant

end-markets. Seattle Genetics is a US-based, commercial stage

biotechnology company that focusses on oncology with a particular

expertise in the field of antibody-drug conjugates (ADCs). ADCs are

highly targeted drugs that combine monoclonal antibodies specific

to surface antigens present on particular tumour cells, with highly

potent anti-cancer agents linked via a chemical linker. With a rich

pipeline of potential newsflow, coupled with a number of de-risked

assets, we believe Seattle Genetics carries a positive risk-reward

profile. Zimmer Biomet manufactures and distributes reconstructive

implants, with hips and knees the primary revenue drivers. The

addition of Zimmer Biomet gives the portfolio direct exposure to

the "tackling the backlog" theme, with hip and knee surgeries an

area that should see a near-term increase in demand.

There were few changes in the Innovation Portfolio during the

reporting period, as one would expect given the long-dated nature

of the investment's return profiles. We did, however, sell UK

diagnostics company Renalytix and add US-based Surgery Partners to

the portfolio. The decision to exit the position in Renalytix was

based on a combination of a rich valuation but also concerns over

the pace of the company's revenue generation. Surgery Partners is a

US-based healthcare services company that focusses on the

out-patient setting. The group operates more than 180 locations in

31 states, including Ambulatory Surgery Centres, surgical

hospitals, and multi-specialty physician practices. The addition of

Surgery Partners gives the portfolio direct exposure to the

"disrupting the delivery of healthcare" theme, as more and more

patient volumes switch from traditional in-patient hospital

settings to alternative sites of care.

Given their size, stocks held in the Innovation portfolio have

the potential to be more volatile than their larger peers held in

the Growth portfolio. It is also worth noting that companies

further down the market capitalisation scale tend to be less well

researched, increasing the chances of valuation inefficiencies. It

is that combination of volatility and valuation inefficiency that

we hope will yield some interesting ideas that could offer

significant potential over the long-term.

The outlook for healthcare is compelling, especially for high

quality large-cap stocks

The combination of a challenging macro-economic environment and

positive industry dynamics drives a compelling investment case for

healthcare. On the macro side, rising inflation, slowing economic

activity and dented consumer confidence all point to a scenario

that enhances the appeal of a defensive sector like healthcare.

Further, as we all learn to live with COVID-19, the consumption of

healthcare products and services should accelerate, putting upward

pressure on revenues and potentially earnings. One final

observation is that the greater the uncertainty, the more

attractive larger capitalisation companies become given their high

operating margins and enhanced ability to absorb inflationary

pressures. Importantly, many will continue to invest in future

growth opportunities in concert with delivering attractive

earnings.

James Douglas and Gareth Powell

Co-Managers

9 May 2022

PORTFOLIO AS AT 31 MARCH 2022

(Figures in brackets denote the comparative ranking as at 30

September 2021)

Ranking Stock Market Value % of total

Sector Country GBP'000 net assets

2022 2021 31 30 31 30

March September March September

2022 2021 2022 2021

Johnson &

1 (1) Johnson Pharmaceuticals United States 33,248 29,093 8.2% 7.5%

2 (2) UnitedHealth Managed Healthcare United States 30,020 24,053 7.4% 6.2%

Bristol Myers

3 (4) Squibb Pharmaceuticals United States 19,946 15,580 4.9% 4.0%

4 (5) Sanofi Pharmaceuticals France 18,046 13,629 4.5% 3.5%

Healthcare

5 (8) Steris Equipment United States 14,139 10,912 3.5% 2.8%

Healthcare

6 (10) Boston Scientific Equipment United States 13,657 10,810 3.4% 2.8%

7 (9) Horizon Pharma Biotechnology United States 12,655 10,910 3.1% 2.8%

Healthcare

8 (31) Alcon Supplies Switzerland 12,469 7,678 3.1% 2.0%

Life Sciences

9 (28) Bio-Rad Laboratories Tools & Services United States 12,437 8,439 3.1% 2.2%

Healthcare

10 (-) Zimmer Biomet Equipment United States 11,556 - 2.9% -

Top 10 investments 178,173 44.1%

11 (-) Seagen Biotechnology United States 11,488 - 2.9% -

Healthcare

12 (6) Baxter International Equipment United States 11,470 13,582 2.8% 3.5%

13 (3) AstraZeneca Pharmaceuticals United Kingdom 11,429 19,954 2.8% 5.2%

Healthcare

14 (-) Sartorius Equipment Germany 10,901 - 2.7% -

Life Sciences

15 (27) Avantor Tools & Services United States 10,655 8,637 2.6% 2.2%

Healthcare

16 (12) Siemens Healthineers Equipment Germany 10,067 10,450 2.5% 2.7%

17 (-) Astellas Pharma Pharmaceuticals Japan 9,800 - 2.5% -

Healthcare

18 (26) CooperCompanies Supplies United States 9,495 8,776 2.4% 2.3%

19 (22) Cytokinetics Biotechnology United States 9,462 8,974 2.3% 2.3%

Healthcare

20 (13) Hologic Equipment United States 9,394 10,401 2.3% 2.7%

Top 20 investments 282,334 69.9%

21 (-) Chugai Pharmaceutical Pharmaceuticals Japan 9,227 - 2.3% -

22 (17) ArgenX Biotechnology Netherlands 9,199 9,703 2.3% 2.5%

23 (25) UCB Pharmaceuticals Belgium 9,181 8,799 2.3% 2.3%

Healthcare

24 (18) Envista Equipment United States 9,067 9,619 2.2% 2.5%

25 (-) Incyte Biotechnology United States 8,988 - 2.2% -

Healthcare

26 (-) Tenet Healthcare Facilities United States 8,810 - 2.2% -

Healthcare

27 (19) Acadia Healthcare Facilities United States 8,509 9,595 2.1% 2.5%

28 (29) Biohaven Pharmaceutical Biotechnology United States 8,356 8,411 2.1% 2.2%

Metal & Glass

29 (24) AptarGroup Containers United States 8,305 8,852 2.1% 2.3%

Encompass Healthcare

30 (23) Health Facilities United States 8,279 8,893 2.0% 2.3%

Top 30 investments 370,255 91.7%

31 (-) Biovitrum Biotechnology Sweden 7,806 - 1.9% -

Healthcare

32 (32) Amedisys Services United States 6,085 6,856 1.5% 1.8%

33 (34) Genmab Biotechnology Denmark 5,642 5,712 1.4% 1.5%

34 (16) Molina Healthcare Managed Healthcare United States 5,194 9,961 1.3% 2.6%

Healthcare

35 (35) Uniphar Distributors Ireland 4,903 5,438 1.2% 1.4%

Healthcare

36 (39) LivaNova Equipment United Kingdom 4,029 3,810 1.0% 1.0%

37 (-) United Therapeutics Biotechnology United States 3,812 - 0.9% -

Intelligent Healthcare

38 (38) Ultrasound Technology United Kingdom 3,176 3,811 0.8% 1.0%

Healthcare

39 (36) Medley Technology Japan 3,039 4,404 0.8% 1.1%

Axonics Modulation Healthcare

40 (42) Technologies Equipment United States 3,025 2,180 0.7% 0.6%

Top 40 investments 416,966 103.2%

Healthcare

41 (-) Surgery Partners Facilities United States 2,650 - 0.7% -

Healthcare

42 (41) Ship Healthcare Distributors Japan 2,587 2,882 0.7% 0.7%

43 (40) Zealand Pharma Biotechnology Denmark 2,105 3,807 0.5% 1.0%

44 (44) Avadel Pharmaceuticals Pharmaceuticals Ireland 1,717 2,018 0.4% 0.5%

Healthcare

45 (43) Quotient Supplies Switzerland 1,115 2,123 0.3% 0.5%

Healthcare

46 (46) Verici DX Technology United Kingdom 99 230 - 0.1%

Total Equities 427,239 105.8%

Other Net Liabilities (23,337) (5.8%)

Net Assets 403,902 100.0%

Note - Sectors are from the GICS (Global Industry Classification

Standard).

PORTFOLIO REVIEW AS AT 31 MARCH 2022

30 September

Geographical Exposure at: 31 March 2022 2021

United States 71.8% 69.0%

Japan 6.3% 1.8%

Germany 5.2% 2.7%

United Kingdom 4.6% 7.3%

France 4.5% 6.2%

Switzerland 3.4% 2.5%

Netherlands 2.3% 5.2%

Belgium 2.3% 2.3%

Denmark 1.9% 4.6%

Sweden 1.9% -

Ireland 1.6% 1.9%

Australia - 2.4%

Other net liabilities (5.8%) (5.9%)

Total 100.0% 100.0%

30 September

Sector Exposure at: 31 March 2022 2021

Pharmaceuticals 27.9% 23.0%

Healthcare Equipment 24.0% 23.4%

Biotechnology 19.6% 14.8%

Managed Healthcare 8.7% 11.8%

Healthcare Facilities 7.0% 7.2%

Healthcare Supplies 5.8% 6.3%

Life Sciences Tools & Services 5.7% 5.4%

Metal & Glass Containers 2.1% 2.3%

Healthcare Distributors 1.9% 4.9%

Healthcare Technology 1.6% 2.3%

Healthcare Services 1.5% 1.8%

Apparel, Accessories & Luxury Goods - 2.7%

Other net liabilities (5.8%) (5.9%)

Total 100.0% 100.0%

Market Capitalisation breakdown 30 September

at: 31 March 2022 2021

Large (>US$10bn) 79.3% 78.9%

Medium (US$5bn - US$10bn) 17.1% 14.8%

Small (<US$5bn) 9.4% 12.2%

Other net liabilities (5.8%) (5.9%)

100.0% 100.0%

STATEMENT OF COMPREHENSIVE INCOME

For the half year ended 31 March 2022

Group Group Group

(Unaudited) (Unaudited) (Audited)

Half year ended Half year ended Year ended

31 March 2022 31 March 2021 30 September 2021

Revenue Capital Total Revenue Capital Total Revenue Capital Total

return return return return return return return return return

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 2 1,973 - 1,973 1,595 - 1,595 3,685 - 3,685

Other operating

income 2 2 - 2 - - - - - -

Gains on investments

held at fair

value - 20,201 20,201 - 12,287 12,287 - 64,165 64,165

Other currency

losses - (214) (214) - (151) (151) - (144) (144)

Total income 1,975 19,987 21,962 1,595 12,136 13,731 3,685 64,021 67,706

Expenses

Investment management

fee (291) (1,162) (1,453) (245) (982) (1,227) (518) (2,070) (2,588)

Other administrative

expenses (317) (36) (353) (247) (15) (262) (553) (59) (612)

Total expenses (608) (1,198) (1,806) (492) (997) (1,489) (1,071) (2,129) (3,200)

Profit before

finance costs

and tax 1,367 18,789 20,156 1,103 11,139 12,242 2,614 61,892 64,506

Finance costs - (541) (541) - (526) (526) - (1,064) (1,064)

Profit before

tax 1,367 18,248 19,615 1,103 10,613 11,716 2,614 60,828 63,442

Tax (228) - (228) (170) - (170) (421) - (421)

Net profit for

the period and

total comprehensive

income 1,139 18,248 19,387 933 10,613 11,546 2,193 60,828 63,021

Earnings per

Ordinary share

(pence) 3 0.94 15.05 15.99 0.77 8.75 9.52 1.81 50.16 51.97

The total column of this statement represents the Group's

Statement of Comprehensive Income, prepared in accordance with

UK-adopted International Accounting Standards.

The revenue return and capital return columns are supplementary

to this and are prepared under guidance published by the

Association of Investment Companies.

The Group does not have any other income or expense that is not

included in net profit/(loss) for the period/year. The net

profit/(loss) for the period/year disclosed above represents the

Group's total comprehensive Income.

There are no dilutive securities and therefore the Earnings per

Share and the Diluted Earnings per Share are the same.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the period/year.

BALANCE SHEETS

For the half year ended 31 March 2022

Group Company

(Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Audited)

31 March 31 March 30 September 31 March 31 March 30 September

2022 2021 2021 2022 2021 2021

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Investments held

at fair value 427,239 344,597 408,561 427,239 344,597 408,561

Investment in

subsidiary - - - 50 50 50

Current assets

Receivables 2,055 285 2,300 2,055 285 2,300

Overseas tax

recoverable 606 547 572 606 547 572

Cash and cash

equivalents 11,450 26,306 13,718 11,400 26,256 13,668

14,111 27,138 16,590 14,061 27,088 16,540

Total assets 441,350 371,735 425,151 441,350 371,735 425,151

Current liabilities

Payables (440) (339) (2,956) (440) (339) (2,956)

(440) (339) (2,956) (440) (339) (2,956)

Non-current liabilities

Zero dividend

preference

shares (37,008) (35,930) (36,467) - - -

Loan from subsidiary - - - (37,008) (35,930) (36,467)

Total liabilities (37,448) (36,269) (39,423) (37,448) (36,269) (39,423)

Net assets 403,902 335,466 385,728 403,902 335,466 385,728

Equity attributable

to equity shareholders

Called up share

capital 31,037 31,037 31,037 31,037 31,037 31,037

Share premium reserve 80,685 80,685 80,685 80,685 80,685 80,685

Capital redemption

reserve 6,575 6,575 6,575 6,575 6,575 6,575

Special distributable

reserve 3,672 3,672 3,672 3,672 3,672 3,672

Capital reserves 280,225 211,762 261,977 280,225 211,762 261,977

Revenue reserve 1,708 1,735 1,782 1,708 1,735 1,782

Total equity 403,902 335,466 385,728 403,902 335,466 385,728

Net asset value

per Ordinary share

(pence) 4 333.06 276.63 318.07 333.06 276.63 318.07

Net asset value

per ZDP share (pence) 4 115.19 111.83 113.50 - - -

The parent company has taken advantage of section 408 of the

Companies Act 2006 and has not included its own income statement in

the financial statements. The parent company's profit for the half

year was GBP19,387,000 (31 March 2021: profit of GBP11,546,000 and

30 September 2021: profit of GBP63,021,000).

STATEMENT OF CHANGES IN EQUITY

For the half year ended 31 March 2022

Group and Company

Half year ended 31 March 2022 (Unaudited)

Called Capital Share Special

up share redemption premium distributable Capital Revenue Total

capital reserve reserve reserve reserves reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total equity at 1 October

2021 31,037 6,575 80,685 3,672 261,977 1,782 385,728

Total comprehensive income:

Profit for the half

year ended 31 March

2022 - - - - 18,248 1,139 19,387

Transactions with owners, recorded

directly to equity:

Equity dividends

paid - - - - - (1,213) (1,213)

Total equity at 31

March 2022 31,037 6,575 80,685 3,672 280,225 1,708 403,902

Group and Company

Half year ended 31 March 2021 (Unaudited)

Called Capital Share Special

up share redemption premium distributable Capital Revenue Total

capital reserve reserve reserve reserves reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total equity at 1 October

2020 31,037 6,575 80,685 3,672 201,149 2,015 325,133

Total comprehensive income:

Profit for the half

year ended

31 March 2021 - - - - 10,613 933 11,546

Transactions with owners, recorded

directly to equity:

Equity dividends

paid - - - - - (1,213) (1,213)

Total equity at 31

March 2021 31,037 6,575 80,685 3,672 211,762 1,735 335,466

Group and Company

Year ended 30 September 2021 (Audited)

Called Capital Share Special

up share redemption premium distributable Capital Revenue Total

capital reserve reserve reserve reserves reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total equity at 1 October

2020 31,037 6,575 80,685 3,672 201,149 2,015 325,133

Total comprehensive income:

Profit for the year

ended 30 September 2021 - - - - 60,828 2,193 63,021

Transactions with owners, recorded

directly to equity:

Equity dividends

paid - - - - - (2,426) (2,426)

Total equity at 30

September 2021 31,037 6,575 80,685 3,672 261,977 1,782 385,728

CASH FLOW STATEMENT

For the half year ended 31 March 2022

Group and Company

(Unaudited) (Unaudited) (Audited)

Half year Half year Year ended

ended ended 30 September

31 March 31 March 2021

2022 2021 GBP'000

GBP'000 GBP'000

Cash flows from operating activities

Profit before finance costs and tax 20,156 12,242 64,506

Adjustment for non-cash items:

Gains on investments held at fair value

through profit or loss (20,201) (12,287) (64,165)

Adjusted (loss)/profit before tax (45) (45) 341

Adjustments for:

Purchases of investments, including transaction

costs (245,517) (329,996) (626,164)

Sales of investments, including transaction

costs 244,829 340,486 625,115

Increase in receivables (130) (133) (108)

(Decrease)/increase in payables 71 (509) (479)

Overseas tax deducted at source (262) (128) (404)

Net cash (used in)/generated from operating

activities (1,054) 9,675 (1,699)

Cash flows from financing activities

Interest paid (1) (1) (2)

Equity dividends paid (1,213) (1,213) (2,426)

Net cash used in from financing activities (1,214) (1,214) (2,428)

Net (decrease)/increase in cash and cash

equivalents (2,268) 8,461 (4,127)

Cash and cash equivalents at the beginning

of the period 13,718 17,845 17,845

Cash and cash equivalents at the end of

the period 11,450 26,306 13,718

NOTES TO THE FINANCIAL STATEMENTS

For the half year ended 31 March 2022

1. General Information

The consolidated financial statements comprise the unaudited

results of the Company and its wholly-owned subsidiary PCGH ZDP plc

(together referred to as the Group) for the six month period to 31

March 2022.

The Group and Company unaudited financial statements to 31 March

2022 have been prepared using the accounting policies used in the

Group and Company's financial statements to 30 September 2021.

These accounting policies are based on UK-adopted International

Accounting Standards (IAS), International Financial Reporting

Standards ("IFRS"), which comprise standards and interpretations

approved by the International Accounting Standards Board

("IASB").

The financial information in this half year financial report

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006.

The financial information for the periods ended 31 March 2022

and 31 March 2021 have not been audited. The figures and financial

information for the year ended 30 September 2021 are an extract

from the latest published accounts and do not constitute statutory

accounts for that year. Full statutory accounts for the year ended

30 September 2021, prepared under IFRS, including the report of the

auditors which was unqualified, did not draw attention to any

matters by way of emphasis and did not contain a statement under

section 498 of the Companies Act 2006, have been delivered to the

Registrar of Companies.

The Group and Company's accounting policies have not varied from

those described in the financial statements for the year ended 30

September 2021.

The Group and Company's financial statements are presented in

Pound Sterling and all values are rounded to the nearest thousand

pounds (GBP'000), except where otherwise stated.

The Directors believe it is appropriate to adopt the going

concern basis in preparing the financial statements. The Board

continually monitors the financial position of the Group and

Company. The Directors have considered a detailed assessment of the

Group and Company's ability to meets its liabilities as they fall

due. The assessment took account of the Company's current financial

position, its cash flows and its liquidity position. In light of

the results of these tests, the Group and Company's cash balances,

and the liquidity position, the Directors consider that the Group

and Company have adequate financial resources to enable them to

continue in operational existence. Accordingly, the Directors are

satisfied that it is appropriate to continue to adopt the going

concern basis in preparing the financial results of the Group and

Company.

There were no new IFRSs or amendments to IFRSs applicable to the

current year which had any significant impact on the Group and

Company's Financial Statements.

2. DIVIDS and OTHER Income (Unaudited) (Unaudited) (Audited)

For the half For the half For the

year ended year ended year ended

31 March 31 March 30 September

2022 2021 2021

GBP'000 GBP'000 GBP'000

Investment income

Revenue:

UK Dividend income 335 286 430

Overseas Dividend income 1,638 1,309 3,255

Total investment income allocated

to revenue 1,973 1,595 3,685

Other operating income

Bank interest 2 - -

Total other operating income 2 - -

There were no dividends allocated to capital as at 31 March

2022

3. EARNING per ORDINARY share (Unaudited) (Unaudited) (Audited)

For the half For the half For the

year ended year ended year ended

31 March 31 March 30 September

2022 2021 2021

GBP'000 GBP'000 GBP'000

Net profit for the period:

Revenue 1,139 933 2,193

Capital 18,248 10,613 60,828

Total 19,387 11,546 63,021

Weighted average number of shares

in issue during the period 121,270,000 121,270,000 121,270,000

Revenue 0.94p 0.77p 1.81p

Capital 15.05p 8.75p 50.16p

Total 15.99p 9.52p 51.97p

As at 31 March 2022 there were no potentially dilutive shares in

issue (31 March 2021 and 30 September 2021: nil).

4. Net asset value per share (Unaudited) (Unaudited)

For the half For the half (Audited)

year year For the year

ended ended ended

31 March 31 March 30 September

2022 2021 2021

(i) Ordinary shares

Net assets attributable to Ordinary

shareholders (GBP'000) 403,902 335,466 385,728

Ordinary shares in issue at

end of period (excluding those

held in treasury) 121,270,000 121,270,000 121,270,000

Net asset value per Ordinary

share (pence) 333.06 276.63 318.07

As at 31 March 2022 there were no potentially dilutive shares in

issue (31 March 2021 and 30 September 2021: nil).

(ii) ZDP shares

Calculated entitlement of ZDP

shareholders (GBP'000) 37,008 35,930 36,467

ZDP shares in issue at the

end of the year 32,128,437 32,128,437 32,128,437

Net asset value per ZDP share

(pence) 115.19 111.83 113.50

5. DIVIDS

Dividends for the current financial year ending 30 September

2022, if declared, will be paid in August 2022 and February

2023.

6. RELATED PARTY TRANSACTIONS

There have been no related party transactions that have

materially affected the financial position or the performance of

the Company during the six month period to 31 March 2022.

7. POST BALANCE SHEET EVENTS

There are no significant events that have occurred after the end

of the reporting period to the date of this report which require

disclosure.

ALTERNATIVE PERFORMANCE MEASURES (APMS)

In assessing the performance of the Company, the Investment

Manager and the Directors use the following APMs which are not

defined in accounting standards or law but are considered to be

known industry metrics:

Net Asset Value (NAV) and NAV per share

The NAV is the value attributed to the underlying assets of the

Company less the liabilities, presented either on a per share or

total basis.

The NAV is often expressed in pence per share after being

divided by the number of shares which have been issued. The NAV per

share is unlikely to be the same as the share price which is the

price at which the Company's shares can be bought or sold by an

investor. See Note 4 above for detailed calculations. The NAV per

Ordinary share is published daily.

NAV Total Return (APM)

The NAV total return shows how the net asset value has performed

over a period of time taking into account both capital returns and

dividends paid to shareholders. NAV total return is calculated as

the change in NAV from the start of the period, assuming that

dividends paid to shareholders are reinvested on the payment date

in Ordinary shares at their net asset value.

Year ended Year ended

31 March 30 September

2022 2021

Opening NAV per share a 318.07 268.11p

Closing NAV per share b 333.06p 318.07p

Dividend reinvestment factor c 1.003247 1.006997

Adjusted closing NAV per share d=b*c 334.14p 320.30p

NAV total return for the year (d/a)-1 5.05% 19.46%

NAV Total Return Since Restructuring (APM)

The NAV total return shows how the net asset value has performed

over a period of time taking into account both capital returns and

dividends paid to shareholders. NAV total return is calculated as

the change in NAV from the start of the period, assuming that

dividends paid to shareholders are reinvested on the payment date

in Ordinary shares at their net asset value.

Year ended Year ended

31 March 30 September

2022 2021

NAV per share at reconstruction a 215.85p 215.85p

Closing NAV per share b 333.06p 318.07p

Dividend reinvestment factor c 1.036736 1.033409

Adjusted closing NAV per share d=b*c 345.30p 328.70p

NAV total return since reconstruction (d/a)-1 59.97% 52.28%

(Discount)/Premium (APM)

A description of the difference between the share price and the

net asset value per share usually expressed as a percentage (%) of

the net asset value per share. If the share price is higher than

the NAV per share the result is a premium. If the share price is

lower than the NAV per share, the shares are trading at a

discount.

Year ended Year ended

31 March 30 September

2022 2021

Closing share price a 300.00p 288.00p

Closing NAV per share b 333.06p 318.07p

Discount per Ordinary share (a/b)-1 9.93% 9.45%

Ongoing Charges (APM)

Ongoing charges are calculated in accordance with AIC guidance

by taking the Company's annual ongoing charges, excluding

performance fees and exceptional items, if any, and expressing them

as a percentage of the average daily net asset value of the Company

over the year.

Ongoing charges include all regular operating expenses of the

Company. Transaction costs, interest payments, tax and nonrecurring

expenses are excluded from the calculation as are the costs

incurred in relation to share issues and share buybacks.

Where a performance fee is paid or is payable, a second ongoing

charge is provided, calculated on the same basis as the above but

incorporating the amount of performance fee due or paid.

The ongoing charges figure as at 31 March 2022 is for the six

month period from 30 September 2021 and is annualised for

comparison with the full year's calculation as at 30 September

2021.

Year ended Year ended

31 March 30 September

2022 2021

Investment Management fee GBP1,453,000 GBP2,588,000

Other Administrative Expenses GBP353,000 GBP612,000

a GBP1,806,000 GBP3,200,000

Average daily net assets value b GBP422,791,000 GBP384,905,000

Ongoing Charges excluding

performance fee (a/182*365)/b 0.86% 0.83%

Performance fee c - -

d=a+c GBP1,806,000 GBP3,200,000

Ongoing charges including

performance fee (d/182*365)/b 0.86% 0.83%

Net Gearing (APM)

Gearing is calculated in line with AIC guidelines and represents

net gearing, i.e. total assets less cash and cash equivalents

divided by net assets. The total assets are calculated by adding

back the structural gearing which is the ZDP value. Cash and cash

equivalents are cash and purchases and sales for future settlement

outstanding at the year end.

Year ended Year ended

31 March 30 September

2022 2021

Net assets a GBP403,902,000 GBP385,728,000

ZDP loan value b GBP37,008,000 GBP36,467,000

Total assets c=(a+b) GBP440,910,000 GBP422,195,000

Cash and cash equivalents

(including amounts awaiting

settlement) d GBP13,115,000 GBP13,171,000

Net gearing (c-d)/a 5.92% 6.04%

FORWARD LOOKING STATEMENTS

Certain statements included in this half-year financial report

incorporating the interim management report contain forward-looking

information concerning the Company's strategy, operations,

financial performance or condition, outlook, growth opportunities

or circumstances in the countries, sectors or markets in which the

Company operates. By their nature, forward-looking statements

involve uncertainty because they depend on future circumstances,

and relate to events, not all of which are within the Company's

control or can be predicted by the Company. Although the Company

believes that the expectations reflected in such forward-looking

statements are reasonable, no assurance can be given that such

expectations will prove to have been correct. Actual results could

differ materially from those set out in the forward-looking

statements. For a detailed analysis of the factors that may affect

our business, financial performance or results of operations, we

urge you to look at the principal risks and uncertainties included

in the Strategic Report section on pages 29 to 31 of the Annual

Report for the year ended 30 September 2021. No part of these

results constitutes, or shall be taken to constitute, an invitation

or inducement to invest in Polar Capital Global Healthcare Trust

plc or any other entity and must not be relied upon in any way in

connection with any investment decision. The Company undertakes no

obligation to update any forward-looking statements.

HALF YEAR REPORT

The Company has opted not to post half year reports to

shareholders. Copies of this announcement will be available from

the Company Secretary at the Registered Office, 16 Palace Street,

London, SW1E 5JD and from the Company's website at

www.polarcapitalglobalhealthcaretrust.co.uk

Neither the contents of the Company's website nor the contents

of any website accessible from the hyperlinks on the Company's

website (or any other website) is incorporated into or forms part

of this announcement .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDULUGDGDC

(END) Dow Jones Newswires

May 10, 2022 03:40 ET (07:40 GMT)

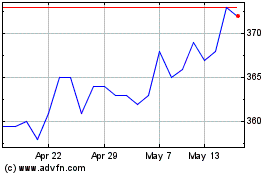

Polar Capital Global Hea... (LSE:PCGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Polar Capital Global Hea... (LSE:PCGH)

Historical Stock Chart

From Jul 2023 to Jul 2024