Polar Capital Global Health Tst PLC Top Ten Equity Holdings and Exposures (9777I)

April 07 2020 - 2:00AM

UK Regulatory

TIDMPCGH TIDMPGHZ

RNS Number : 9777I

Polar Capital Global Health Tst PLC

06 April 2020

6(th) April 2020

Polar Capital Global Healthcare Trust plc (the "Company")

Top Ten Equity Holdings and Sector and Geographic Exposure as at

31(st) March 2020 and full portfolio listing as at 28(th) February

2020 available from the company's website

Polar Capital Global Healthcare Trust plc is pleased to announce

that as at 28(th) February 2020 the top ten equity holdings and the

sector and geographic breakdown were as follows:

Top 10 Holdings %

Roche 6.4%

Bristol Myers Squibb 5.1%

Novo Nordisk A/S 4.8%

Merck & Co 4.7%

AbbVie 4.4%

Sanofi 4.1%

Bio-Rad Laboratories 3.9%

Becton Dickinson 3.9%

Fresenius Medical Care AG & Co 3.8%

Centene Corp 3.6%

-----

Total 44.7%

------------------------------- -----

Sector Exposure %

Pharmaceuticals 35.5%

Biotechnology 22.9%

Healthcare Equipment 18.2%

Life Sciences Tools & Services 11.3%

Managed Healthcare 7.7%

Healthcare Services 7.2%

Healthcare Facilities 3.1%

Healthcare Technology 1.9%

Healthcare Supplies 1.2%

Healthcare Distributors 0.9%

Cash -9.8%

Total 100.0%

Geographic Exposure %

United States 73.5%

Denmark 8.6%

Switzerland 6.4%

France 4.1%

Germany 3.8%

Spain 3.1%

Belgium 3.1%

United Kingdom 2.8%

Japan 2.0%

Canada 1.8%

Netherlands 0.7%

Cash -9.8%

Total 100.0%

Gearing Ratio as calculated in accordance with the guidelines of

the Association of Investment Companies, was 10.2%. Gearing is made

up of structural debt provided by the subsidiary company PCGH ZDP

plc, through the issue of zero dividend preference shares.

The monthly factsheet will usually be available on the Company's

website on the 10(th) working day after the month end and includes

a commentary by the investment manager.

www.Polarcapitalhealthcaretrust.co m

Neither the contents of the Company's website nor the contents

of any website accessible from the hyperlinks on the Company's

website (or any other website) is incorporated into or forms part

of this announcement .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFUUPUQCCUPUGRQ

(END) Dow Jones Newswires

April 07, 2020 02:00 ET (06:00 GMT)

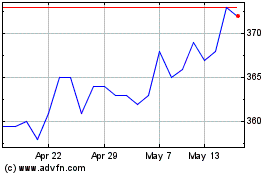

Polar Capital Global Hea... (LSE:PCGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Polar Capital Global Hea... (LSE:PCGH)

Historical Stock Chart

From Jul 2023 to Jul 2024