TIDMOCN

RNS Number : 6165V

Ocean Wilsons Holdings Ltd

11 August 2022

2022 Interim Statement

About Ocean Wilsons Holdings Limited

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda holding company which, through its

subsidiaries, holds a portfolio of international investments and

operates a maritime services company in Brazil. The Company is a

premium listed entity on the London Stock Exchange and is also

listed on the Bermuda Stock Exchange.

It has two principal subsidiaries: Ocean Wilsons (Investments)

Limited ("OWIL") and Wilson Sons Holdings Brasil S.A. ("Wilson

Sons") (together with the Company and their subsidiaries, the

"Group"). OWIL is wholly owned, and Wilson Sons is 57% owned and

therefore is fully consolidated in the accounts with a 43%

non-controlling interest. Wilson Sons is one of the largest

providers of maritime services in Brazil with activities including

towage, container terminals, offshore oil and gas support services,

small vessel construction, logistics and ship agency.

Objective

Ocean Wilsons focuses on long-term performance and value

creation. This approach applies to both the investment portfolio

and our investment in Wilson Sons. This longer-term view of the

Board results in an investment strategy whereby we hold a balanced

thematic portfolio of funds leveraging our long-standing investment

market relationships and supported by detailed insights and

analysis. The Wilson Sons maritime logistic services investment

strategy focuses on providing best in class innovative solutions in

a rapidly growing market.

Data Highlights

KEY OPERATING DATA (in US$ millions)

6 months ended 6 months ended

30 June 2022 30 June 2021 Change

-------------------------------- --------------- --------------- -------

Revenue 211.0 188.9 22.1

--------------- --------------- -------

Operating profit 54.7 53.6 1.1

--------------- --------------- -------

Return of investment portfolio (48.9) 29.5 (78.4)

--------------- --------------- -------

(Loss) /Profit after tax (20.4) 51.8 (72.2)

--------------- --------------- -------

Net cash inflow from operating

activities (24.7) 41.6 (16.9)

--------------- --------------- -------

KEY FINANCIAL POSITION DATA (in US$ millions)

At 30 June At 31 December

2022 2021 Change

--------------------------------------- ------------- --------------- ------------

Investment portfolio assets

including cash and cash equivalents 296.9 351.8 (54.9)

------------- --------------- ------------

Net Assets 729.3 783.7 (54.4)

------------- --------------- ------------

Debt net of cash and cash equivalents 492.8 440.9 51.9

------------- --------------- ------------

SHARE DATA

6 months ended 6 months ended

30 June 2022 30 June 2021 Change

------------------- ---------------- --------------- -----------------

Dividend per share US 70 cents US 70 cents -

---------------- --------------- -----------------

Earnings per share US (98.0) cents US 111.7 cents US (209.7) cents

---------------- --------------- -----------------

At 30 June At 31 December

2022 2021 Change

----------------------------- ----------- --------------- -----------

Share discount 39.3% 41.6% (2.3%)

----------- --------------- -----------

Implied net asset value per GBP 15.50 GBP 15.95 GBP (0.45)

share

----------- --------------- -----------

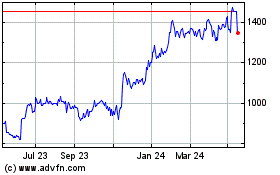

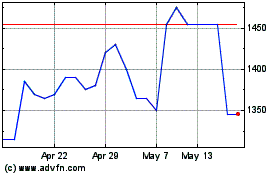

Share price GBP 9.40 GBP 9.32 GBP 0.12

----------- --------------- -----------

Chair's Statement

The Group has delivered a mixed financial performance for the

period which is not unexpected given the market conditions in the

first half of 2022. Global supply chain challenges and continued

container shortages, that we saw at the end of 2021 are still

impacting the financial results of Wilson Sons. Despite these

headwinds, Wilson Sons maintained its operating profit when

compared to the prior period due primarily to the resilience of its

operations and improved revenue mix in its various business lines

that offset the impact of lower container volumes. The performance

is a direct result of the Management team's continued focus on

business growth and driving innovation at all levels of the

organization.

Whilst the investment portfolio results were loss making, in the

context of the overall market and our consistent strategy, the

Board is pleased with the Investment Manager's performance and by

the underlying performance of some of the specific fund holdings.

With the market backdrop of geo-political instability and surging

inflation, the performance of the portfolio for the remainder of

the year will continue to be challenging. The Investment Manager

provides more context with regards to the underlying investments

results for the period. The portfolio strategy continues to be

focused on producing returns with a long-term view.

Environmental, Social and Governance ("ESG")

The Board's commitment to further enhance its ESG practices is

evidenced with several initiatives producing tangible outcomes

during the period. At Wilson Sons, there was the launch of a new

tug, one of six, which substantially reduces emissions over the

older fleet. In addition, Wilson Sons continues to electrify its

terminal operating machines with the order placement of new

machinery at its Salvador terminals. The Investment Manager, as

part of the Hanseatic Group, has applied to become a signatory to

the United Nations' Principles for Responsible Investment.

Investment Manager's Report

Market backdrop

Stock markets have declined through the first half of 2022, with

the MSCI ACWI + FM Index declining by 20.2%, as persistently high

inflation caused investors to worry about the threat of rising

interest rates and their possible impact on economic growth. The

US, Europe and Japan have all fallen broadly in line with the

global index, while emerging markets have fallen by slightly less

(-17.6%). Emerging markets have been helped by China's relatively

stronger performance so far this year (-11.3%), after it

significantly underperformed last year. Additionally, and

unusually, bonds have not been a haven this period, with US

Treasuries down 9.1% year-to-date (YTD), while investment grade and

high yield bonds have fallen further. Commodities have been one

area of strength, with the Bloomberg Commodity Index up 18.4%, but

even here gold and copper have declined over the last six months,

while the main contributors have been energy commodities, such as

WTI crude oil which has gained 37.4%.

It has been pleasing to see the portfolio's basket of

less-correlated investments resist the steep falls of both the

equity and bond markets so far this year, with this part of the

portfolio down just 1.1% YTD. The trend-following CTA funds have

done very well in this environment, with the GAM Systematic Core

Macro Fund up 9.2% and Schroder GAIA Blue Trend Fund up 4.6% since

its purchase in April. Keynes Systematic Absolute Fund return

(+8.8%) and MKP Opportunity Fund (+6.3%) are other notable

performers.

The private equity part of the portfolio has held up better than

public markets and gained 1.1% over the last six months. There have

been significant contributions from funds such as Pangaea II and

Great Point Partners III thanks to recent exits.

With equity markets falling sharply YTD, many of the portfolio's

long-only regional exposures declined as a result. Findlay Park

American Fund fell 23.8%, while in Japan, Goodhart Partners: Hanjo

Fund declined 23.1%. The thematic exposures saw mixed returns, with

the passive exposure to the energy sector benefiting as the iShares

MSCI World Energy ETF gained 5.4%, but funds focusing on the

healthcare and technology sectors have fallen in value.

Outlook

With markets having already entered a bear market, the question

now is how close are they to the bottom. While some comfort can be

taken from the fact that the current fall of 23% from the peak of

the MSCI World Index is greater than the 19% average fall of

previous declines, this may be overly optimistic if central banks

engage in more aggressive policy measures in their battle against

inflation. The outcome from here is very dependent on the path of

inflation and interest rates, although continued volatility in

markets seems likely, whatever happens. However, with a portfolio

comprised of a variety of risk-on and risk-off assets and with a

blend of sectors including growth and value, we will hopefully

stand in reasonable stead for the challenging months ahead.

Cumulative Portfolio Returns

3 Years 5 Years

Performance (Time-weighted) YTD p.a. p.a.

------------------------------------------- ------ ------- -------

OWIL -14.1% 5.3% 5.6%

------------------------------------------- ------ ------- -------

OWIL (net)* -14.5% 3.9% 4.3%

------------------------------------------- ------ ------- -------

Absolute Performance Benchmark** 7.7% 8.0% 6.9%

------------------------------------------- ------ ------- -------

60:40 Composite of MSCI ACWI and Bloomberg

Global Treasury -18.0% 2.2% 3.9%

------------------------------------------- ------ ------- -------

MSCI ACWI + FM -20.2% 6.2% 7.0%

------------------------------------------- ------ ------- -------

MSCI Emerging Markets -17.6% 0.6% 2.2%

------------------------------------------- ------ ------- -------

Notes:

*Net of management and performance fees

**The OWIL Performance Benchmark is an absolute benchmark of US

CPI Urban Consumers NSA +3% p.a.

Investment Portfolio at 30 June 2022

Market % of

Value US$000 NAV Primary Focus

--------------------------------- -------------- ------ -----------------------------------

Findlay Park American Fund 27,967 9.4 US Equities - Long Only

Private Assets - US Venture

Stepstone Global Partners 15,778 5.3 Capital

BlackRock Strategic Equity

Hedge Fund 13,838 4.7 Europe Equities - Long/Short

Silver Lake Partners 11,939 4.0 Private Assets - Global Technology

Egerton Long - Short Fund

Limited 11,807 4.0 Europe/US Equities - Long/Short

iShares Core MSCI Europe UCITS

ETF 10,917 3.7 Europe Equities - Long Only

Select Equity Offshore, Ltd 10,406 3.5 US Equities - Long Only

Private Assets - Global Emerging

Pangaea II, LP 8,619 2.9 Markets

NG Capital Partners II, LP 8,159 2.7 Private Assets - Latin America

TA Associates 7,144 2.4 Private Assets - Global Growth

--------------------------------- -------------- ------ -----------------------------------

Top 10 Holdings 126,574 42.6

--------------------------------- -------------- ------ -----------------------------------

Schroder ISF Asian Total Return Asia ex-Japan Equities - Long

Fund 6,771 2.3 Only

GAM Star Fund PLC - Disruptive Technology Equities - Long

Growth 6,758 2.3 Only

KKR America 6,661 2.2 Private Assets - North America

Asia ex-Japan Equities - Long

NTAsian Discovery Fund 5,179 1.7 Only

Hudson Bay International Fund

Ltd 5,116 1.7 Market Neutral - Multi-Strategy

Pershing Square Holdings Ltd 5,012 1.7 US Equities - Long Only

Goodhart Partners: Hanjo Fund 4,849 1.6 Japan Equities - Long Only

Polar Capital Global Insurance Financials Equities - Long

Fund 4,768 1.6 Only

Helios Investors II, LP 4,525 1.5 Private Assets - Africa

PAI Europe 4,415 1.5 Private Assets - Europe

--------------------------------- -------------- ------ -----------------------------------

Top 20 Holdings 180,628 60.7

--------------------------------- -------------- ------ -----------------------------------

Indus Japan Long Only Fund 4,135 1.4 Japan Equities - Long Only

Baring Asia Private Equity

Fund VII, LP 3,813 1.3 Private Assets - Asia

Global Event Partners Ltd 3,603 1.2 Market Neutral - Event-Driven

Reverence Capital Partners

Opportunities 3,339 1.1 Private Assets - North America

L Capital Asia 3,223 1.1 Private Assets - Asia

Worldwide Healthcare Trust Healthcare Equities - Long

PLC 3,192 1.1 Only

Schroder GAIA BlueTrend 3,137 1.1 Market Neutral - Multi-Strategy

EQT Mid Market Europe, LP 3,086 1.0 Private Assets - Europe

Dynamo Brasil VIII 3,048 1.0 Brazil Equities - Long Only

GAM Systematic Core Macro

(Cayman) Fund 3,005 1.0 Market Neutral - Multi-Strategy

--------------------------------- -------------- ------ -----------------------------------

Top 30 Holdings 214,209 72.1

--------------------------------- -------------- ------ -----------------------------------

Remaining Holdings 71,691 24.2

--------------------------------- -------------- ------ -----------------------------------

Cash and Cash Equivalents 11,046 3.7

--------------------------------- -------------- ------ -----------------------------------

TOTAL 296,946 100.0

--------------------------------- -------------- ------ -----------------------------------

Wilson Sons' Management Report

The Wilson Sons second quarter 2022 earnings report released on

11 August 2022 is available on the Wilson Sons website:

www.wilsonsons.com.br.

In the report, Fernando Salek, CEO, said:

"Wilson Sons' 2Q22 revenues US$211.0 million are 11.7% higher

than the prior year period of US$188.9 million.

Towage results were resilient with an increased average revenue

per manoeuvre, despite higher fuel costs. Towage revenues increased

by 9.5% to US$101.7 million in the period.

Container terminal results were impacted by the limited

availability of empty containers and global logistics bottlenecks

causing vessel call cancellations. We believe that this challenging

scenario could show some signs of improvement in the second half of

2022 depending on the resolution of port closures in China.

During the second quarter, our shipyard delivered WS Centaurus,

the most powerful tugboat in Brazil and the first of a series of

six 90-tonne bollard pull vessels joining our fleet over the next

two years. The vessels' design comply with the International

Maritime Organization (IMO) Tier III standard, and improves hull

efficiency for an estimated reduction of up to 14.0% in greenhouse

gas emissions compared to previous technology. In addition to the

launch of the new tugboat, the Salvador terminal signed a contract

to acquire 12 fully electric yard tractors to further support our

commitment to reduce our carbon footprint.

In July, Wilson Sons launched the first innovation hub focused

on making port and maritime operations in Latin America more

efficient, safe and sustainable. The initiative aims to integrate

different ends of the ecosystem to accelerate innovation and foster

the development of start-ups dedicated to our industry.

We are pleased to have delivered these financial results

together with important operating milestones which adds to the safe

and efficient offering we provide our clients and to minimize our

impact on the environment. We continue to strive to improve the

world-class performance of our infrastructure, our portfolio of

activities, and the resilience and versatility of our services

which we believe is the best possible way to address our sector

challenges, transforming, over time, the maritime transport and

creating a better future."

Fernando Salek,

CEO

Financial Report

Revenue

Revenues in this section relate to the sales of services by

Wilson Sons which increased by 11.7% compared to the first half of

the prior year to US$211.0 million (2021: US$188.9 million). Towage

and ship agency services were $106.3 million for the period (2021:

US$97.2 million), an increase of 9.3% driven by higher average

revenues per manoeuvre in towage services and by reductions in

operating expenses for shipping agency services, improving the

overall margin.

Despite global container availability challenges resulting in

lower container volumes, financial results remained resilient in

the Port terminal division with revenues at US$77.5 million for the

period (2021: US$72.5 million) due to increased storage times

driving warehousing revenues higher.

Logistics revenues increased 51.2% to $24.2 million (2021:

US$16.0 million) due to favourable conditions in both volumes and

pricing for the international logistics business.

Operating volumes

(to 30 June) 2022 2021 % Change

-------------------------- ------ ------ --------

Container Terminals

(container movements

in TEU '000s)* 458.1 538.6 (14.9%)

-------------------------- ------ ------ --------

Towage (number of harbour

manoeuvres performed) 26,746 26,957 (0.8%)

-------------------------- ------ ------ --------

Offshore Vessels (days

in operation) 3,104 2,573 20.6%

-------------------------- ------ ------ --------

*TEUs stands for "twenty-foot equivalent units".

Operating Profit

Operating profit was close to flat at US$54.7 million (2021:

US$53.6 million). Raw materials and consumables increased US$3.8

million over the prior period driven by higher fuel costs in the

towage division and employee costs increased US$8.6 million over

the prior period; these costs were expected to increase as the

workforce resumed activity post pandemic and increasing cost of

living expenses driven by inflation. Other operating expenses

increased US$7.9 million due to higher international freight rates

in the logistics division and increases in utilities costs with

longer refrigerated warehousing. The depreciation and amortisation

expense at US$31.7 million was US$0.4 million higher than the

comparative period (2021: US$31.3million) due to additions of fixed

assets. Foreign currency exchange gains of US$2.0 million (2021:

US$2.3 million) arose from the Group's foreign currency monetary

items and reflect the movement of the BRL against the USD during

the period.

Share of results of joint ventures

The share of results of joint ventures is Wilson Sons' 50% share

of the net results for the period from our offshore support vessel

joint venture. The net profit attributable to Wilson Sons for the

period was US$0.5 million (2021: US$0.8million loss) as vessel

turnaround times increased and the start of two new drilling

campaigns by international oil companies.

Returns on the investment portfolio at fair value through profit

and loss

The loss for the period on the investment portfolio of US$48.9

million (2021: gain of US$29.5 million) comprises unrealised losses

on financial assets at fair value through profit and loss of

US$68.0 million (2021: US$23.4 million profit), net investment

income of US$7.6 million (2021: US$1.2 million) and realised

profits on the disposal of financial assets at fair value through

profit and loss of US$15.6 million (2021: US$5.0 million).

Finance costs

Finance costs for the period were US$3.5 million more than the

comparative period at US$18.1 million (2021: US$14.6 million). In

the prior period lenders in Brazil were extending Covid-19 relief

on repayment of borrowings which are no longer in effect.

Exchange rates

The Group reports in USD and has revenue, costs, assets and

liabilities in both BRL and USD. Therefore, movements in the

USD/BRL exchange rate impact from period to period. In the six

months to 30 June 2022 the BRL appreciated 8.1% against the USD

from R$5.71 at 1 January 2022 to R$5.25 at the period end. In the

comparative period in 2021 the BRL depreciated 3.8% against the USD

from R$5.00 to R$5.20.

Profit/(Loss) before tax

Loss before tax was US$9.7 million compared with prior year

(2021: profit US$66.2 million) with this sharp decrease mainly

attributable to the negative return on the investment portfolio of

US$48.9 million and finance costs increased US$3.5 million to

US$18.1 million for the period.

Taxation

The corporate tax rate prevailing in Brazil is 34%. The Group

recorded an income tax expense for the period of US$10.7 million

(2021:US$14.4 million). The principal items not included in

determining taxable profit in Brazil are foreign exchange

gains/losses, share of results of joint ventures, and deferred tax

items. These are mainly deferred tax charges or credits arising on

the retranslation in USD of BRL denominated fixed assets, tax

depreciation, foreign exchange variance on borrowings, prior

periods accumulated tax losses, and profit on construction

contracts.

Profit/(Loss) for the period

After deducting the profit attributable to non-controlling

interests of US$14.2 million (2021: US$12.3 million), the loss

attributable to equity holders of the Company is US$34.7 million

(2021: US$39.5 million profit). The earnings per share for the

period was US 98.0 cents loss (2021: US 111.7 cents profit).

Investment portfolio performance

As markets struggle with inflation and uncertainty, the

investment portfolio and cash under management was US$54.9 million

lower at US$296.9 million as at 30 June 2022 (31 December 2021:

US$351.8 million), after paying dividends of US$2.5 million to the

parent company and deducting management and other fees of US$1.6

million.

Cash flow and debt

Net cash inflow from operating activities for the period was

US$24.7 million (2021: US$41.6 million). Dividends of US$24.8

million were paid to shareholders in the period (2021: US$24.8

million) with a further US$18.5 million paid to non-controlling

interests in our subsidiaries (2021: US$14.9 million). At 30 June

2022, the Group had cash and cash equivalents of US$12.8 million

(31 December 2021: US$28.6 million). Group borrowings including

lease liabilities at the period end were US$505.6 million (31

December 2021: US$469.4 million). New loans were raised in the

period of US$20.5 million (2021: US$8.0 million) while capital

repayments on existing loans in the period of US$24.3 million

(2021: US$41.1 million) were made.

Balance sheet

Equity attributable to shareholders at the balance sheet date

was US$539.0 million compared with US$593.7 million at 31 December

2021. The main movements in equity for the half year was the loss

for the period attributable to shareholders of US$34.7 million,

dividends paid of US$24.8 million and a positive currency

translation adjustment of US$4.1 million. The currency translation

adjustment arises from exchange differences on the translation of

operations with a functional currency other than USD.

Other matters

Principal risks

The Board reported on the principal risks and uncertainties

faced by the Company in the Annual Report and Financial Statements

for the year ended 31 December 2021. A detailed description can be

found in the Report of Directors of the 2021 Annual Report and

Financial Statements which are available on the website at

www.oceanwilsons.bm.

The Board notes that there is an increase in the financial risk

exposure detailed in the 2021 annual report, due to the current

geo-political risk and inflationary environment on our investments.

The Board continues to receive regular reports from Wilson Sons on

their cash and debt management as well as impacts of domestic and

international trade volumes on their operations, As previously

noted in this report, reductions in container volumes are being

offset with other revenues streams and cashflow forecasts remain

unchanged. The Investment Manager's report provides a commentary on

the financial markets' reaction to the current economic and

political environments and an outlook for the remainder of the year

that is very dependent on the direction that central banks take as

it relates to interest rates. The Board is actively engaged with

the Investment Manager to discuss ongoing strategy and to consider

any adjustments in the portfolio weighting to balance risk exposure

across the investment holdings.

Related party transactions

Related party transactions during the period are set out in note

17.

Going concern

The Group closely monitors and manages its liquidity risk. The

Group has considerable financial resources including US$12.8

million in cash and cash equivalents and the majority of the

Group's borrowings have a long maturity profile. The Group's

business activities together with the factors likely to affect its

future development and performance are set out in the Chair's

statement and Investment Manager's report. Details of the Group's

borrowings are set out in note 15 to the accounts. Based on the

Group's year to date results and cash forecasts, the Directors have

a reasonable expectation that the Company and the Group have

adequate resources to continue in operation for the foreseeable

future.

The Group manages its liquidity risk and does so in a manner

that reflects its structure and two distinct businesses, being the

parent company along with OWIL and Wilson Sons.

OWIL

OWIL has no debts but has made commitments in respect of

investment subscriptions amounting to US$45.3 million, details are

provided in note 7. The timing of the investment commitments may be

accelerated or delayed in comparison with those indicated in note

7.

However, highly liquid investments held are significantly in

excess of the commitments. Neither Ocean Wilsons nor OWIL have made

any commitments or have obligations towards Wilsons Sons and its

subsidiaries and their creditors or lenders. Therefore, in the

unlikely circumstance that Wilsons Sons was to encounter financial

difficulty, the parent company and its investment subsidiary have

no obligations to provide support and have sufficient cash and

other liquid resources to continue as a going concern on a

standalone basis.

Wilson Sons

Wilson Sons has adequate cash, other liquid resources and

undrawn credit facilities to enable it to meet its obligations as

they fall due in order to continue its operations. All of the debt,

as set out in note 15, and all of the lease liabilities, as set out

in note 11, relate to Wilson Sons, and generally have a long

maturity profile. The debt held by Wilson Sons is subject to

covenant compliance tests as summarised in note 15, which were

satisfied at 30 June 2022.

Based on the Board's review of Wilson Sons' going concern

assessment and the liquidity and cash flow reviews of the Company

and its subsidiary OWIL, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the Interim report and accounts.

Responsibility statement

The Directors confirm that this interim financial information

has been prepared in accordance with IAS 34 and that the interim

management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the set of interim

financial statements and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual Report.

Caroline Foulger

Chair

10 August 2022

Interim Consolidated Financial Statements

Interim Consolidated Statement of Profit or Loss and Other

Comprehensive Income

(Unaudited) for the 6 months ended 30 June 2022

(Expressed in thousands of US Dollars)

Unaudited Unaudited

Note 30 June 2022 30 June 2021

------------------------------------------------------- ---- ------------------- -------------

Sales of services 4 210,980 188,877

Raw materials and consumables used (15,014) (11,216)

Employee charges and benefits expense (62,012) (53,369)

Other operating expenses (49,717) (41,805)

Depreciation of owned assets 10 (23,706) (23,896)

Depreciation of right-of-use assets 11 (6,805) (5,982)

Amortisation of intangible assets 12 (1,175) (1,374)

Gain on disposal of property, plant and equipment

and intangible assets 88 2

Foreign exchange gains on monetary items 2,018 2,315

------------------------------------------------------- ---- ------------------- -------------

Operating profit 54,657 53,552

Share of results of joint ventures 9 529 (749)

Return on investment portfolio at fair value

through profit or loss 4 (48,899) 29,548

Investment portfolio performance and management

fees (1,626) (2,872)

Other investment income 4 3,693 1,307

Finance costs 5 (18,070) (14,584)

------------------------------------------------------- ---- -------------

(Loss)/profit before tax (9,716) 66,202

Tax expense 6 (10,723) (14,424)

------------------------------------------------------- ---- ------------------- -------------

(Loss)/profit for the period (20,439) 51,778

------------------------------------------------------- ---- ------------------- -------------

Other comprehensive income:

Items that will be or may be reclassified subsequently

to profit or loss

Exchange differences arising on translation

of foreign operations 7,272 4,804

Effective portion of changes in fair value of

derivatives 9 106

------------------------------------------------------- ---- ------------------- -------------

Other comprehensive income for the period 7,281 4,910

------------------------------------------------------- ---- ------------------- -------------

Total comprehensive (loss)/income for the period (13,158) 56,688

------------------------------------------------------- ---- ------------------- -------------

(Loss)/profit for the period attributable to:

Equity holders of the Company (34,673) 39,516

Non-controlling interests 14,234 12,262

------------------------------------------------------- ---- ------------------- -------------

(20,439) 51,778

------------------------------------------------------- ---- ------------------- -------------

Total comprehensive (loss)/income for the period

attributable to:

Equity holders of the Company (30,558) 42,284

Non-controlling interests 17,400 14,404

------------------------------------------------------- ---- ------------------- -------------

(13,158) 56,688

------------------------------------------------------- ---- ------------------- -------------

Earnings per share:

Basic and diluted 19 (98.0)c 111.7c

------------------------------------------------------- ---- ------------------- -------------

Interim Consolidated Statement of Financial Position

(Unaudited) at 30 June 2022

(Expressed in thousands of US Dollars)

Audited

Unaudited 31 December

Note 30 June 2022 2021

---------------------------------------------- ---- ----------------- ------------

Current assets

Cash and cash equivalents 12,761 28,565

Financial assets at fair value through profit

and loss 7 307,406 392,931

Recoverable taxes 28,529 25,380

Trade and other receivables 8 70,663 59,350

Inventories 15,844 12,297

---------------------------------------------- ---- ------------

435,203 518,523

---------------------------------------------- ---- ----------------- ------------

Non-current assets

Other trade receivables 8 1,538 1,580

Related party loans receivable 17 13,517 10,784

Other non-current assets 16 3,845 3,582

Recoverable taxes 14,033 12,816

Investment in joint ventures 9 67,108 61,553

Deferred tax assets 23,986 22,332

Property, plant and equipment 10 578,471 563,055

Right-of-use assets 11 185,285 157,869

Other intangible assets 12 14,759 14,981

Goodwill 13 13,411 13,272

---------------------------------------------- ---- ------------

915,953 861,824

---------------------------------------------- ---- ----------------- ------------

Total assets 1,351,156 1,380,347

---------------------------------------------- ---- ----------------- ------------

Current liabilities

Trade and other payables 14 (48,198) (58,513)

Tax liabilities (7,694) (8,057)

Lease liabilities 11 (24,438) (19,449)

Bank overdrafts and loans 15 (57,859) (45,287)

---------------------------------------------- ---- ------------

(138,189) (131,306)

---------------------------------------------- ---- ----------------- ------------

Net current assets 297,014 387,217

---------------------------------------------- ---- ----------------- ------------

Non-current liabilities

Bank loans 15 (248,703) (256,312)

Post-employment benefits (1,741) (1,562)

Deferred tax liabilities (49,265) (50,194)

Provisions for legal claims 16 (9,406) (8,907)

Lease liabilities 11 (174,571) (148,394)

---------------------------------------------- ---- ------------

(483,686) (465,369)

---------------------------------------------- ---- ----------------- ------------

Total liabilities (621,875) (596,675)

---------------------------------------------- ---- ----------------- ------------

Capital and reserves

Share capital 11,390 11,390

Retained earnings 619,271 678,006

Translation and hedging reserve (91,623) (95,739)

---------------------------------------------- ---- ----------------- ------------

Equity attributable to equity holders of the

Company 539,038 593,657

---------------------------------------------- ---- ----------------- ------------

Non-controlling interests 190,243 190,015

---------------------------------------------- ---- ----------------- ------------

Total equity 729,281 783,672

---------------------------------------------- ---- ----------------- ------------

Interim Consolidated Statement of Changes in Equity

(Unaudited) for the 6 months ended 30 June 2022

(Expressed in thousands of US Dollars)

Hedging and Attributable to

Retained Translation equity holders Non-controlling

Share capital earnings reserve of the Company interests Total equity

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 1

January 2021 11,390 635,987 (91,595) 555,782 187,925 743,707

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Currency

translation

adjustment - - 2,708 2,708 2,096 4,804

Effective portion

of changes in

fair value of

derivatives - - 60 60 46 106

Profit for the

period - 39,516 - 39,516 12,262 51,778

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

income for the

period - 39,516 2,768 42,284 14,404 56,688

Dividends (note

18) - (24,754) - (24,754) (14,948) (39,702)

Share options

exercised in

subsidiary - 3,025 - 3,025 3,860 6,885

Share based

payment expense

in subsidiary - - - - 113 113

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 30

June 2021 11,390 653,774 (88,827) 576,337 191,354 767,691

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 1

January 2022 11,390 678,006 (95,739) 593,657 190,015 783,672

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Currency

translation

adjustment - - 4,111 4,111 3,161 7,272

Effective portion

of changes in

fair value of

derivatives - - 5 5 4 9

(Loss)/profit for

the period - (34,673) - (34,673) 14,234 (20,439)

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

(loss)/income

for the period - (34,673) 4,116 (30,557) 17,399 (13,158)

Dividends (note

18) - (24,754) - (24,754) (18,473) (43,227)

Share options

exercised in

subsidiary - 1,261 - 1,261 1,565 2,826

Share buyback in

subsidiary - (569) - (569) (436) (1,005)

Share based

payment expense

in subsidiary - - - - 173 173

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 30

June 2022 11,390 619,271 (91,623) 539,038 190,243 729,281

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Hedging and translation reserve

The hedging and translation reserve arises from exchange

differences on the translation of operations with a functional

currency other than US Dollars and effective movements on

designated hedging relationships.

Transactions in subsidiary

Wilson Sons Holdings Brasil S.A. (WSSA), a controlled subsidiary

listed on the Novo Mercado exchange, has in place a share option

plan and a share buyback plan. During the period ended 30 June

2022, 2,808,840 share options of WSSA were exercised (2021:

6,743,100) and 601,400 shares of WSSA were repurchased (2021:

none), resulting in a net increase in non-controlling interest of

0.28% (2021: 0.89%).

Amounts in the statement of changes of equity are stated net of

tax where applicable.

Interim Consolidated Statement of Cash Flow

(Unaudited) for the 6 months ended 30 June 2022

(Expressed in thousands of US Dollars)

Unaudited Unaudited

Note 30 June 2022 30 June 2021

------------------------------------------------------------------------ -------- ------------------ -------------

Operating activities

(Loss)/profit for the period (20,439) 51,778

Adjustment for:

Depreciation & amortisation 10,11,12 31,686 31,252

Gain on disposal of property, plant and equipment and intangible assets (88) (2)

Share of results of joint ventures 9 (529) 749

Returns on investment portfolio at fair value through profit or loss 7 48,899 (29,548)

Other investment income 4 (3,693) (1,307)

Finance costs 5 18,070 14,584

Foreign exchange gains on monetary items (2,018) (2,315)

Share based payment expense 173 113

Tax expense 6 10,723 14,424

Changes in:

Inventories (3,547) (894)

Trade and other receivables 8,17 (14,004) (15,521)

Other current and non-current assets (4,629) (715)

Trade and other payables 14 (10,678) 5,524

Provisions for legal claims 16 499 (703)

Taxes paid (10,848) (13,814)

Interest paid (14,872) (12,023)

Net cash inflow from operating activities 24,705 41,582

------------------------------------------------------------------------ -------- ------------------ -------------

Investing activities

Income received from trading investments 9,563 2,023

Purchase of trading investments (59,418) (14,429)

Proceeds on disposal of trading investments 88,448 56,036

Purchase of property, plant and equipment 10 (27,513) (16,585)

Proceeds on disposal of property, plant and equipment 270 49

Purchase of intangible assets 12 (575) (405)

Proceeds on disposal of intangible assets - 4

Investment in joint ventures 9 (4,937) (9,985)

Net cash inflow from investing activities 5,838 16,708

------------------------------------------------------------------------ -------- ------------------ -------------

Financing activities

Payments of lease liabilities 11 (4,399) (4,376)

Repayments of borrowings 15 (24,312) (41,059)

New bank loans drawn down 15 20,476 7,978

Dividends paid to equity holders of the Company 18 (24,754) (24,754)

Dividends paid to non-controlling interests in subsidiary (18,473) (14,948)

Shares repurchased in subsidiary (1,005) -

Share options exercised in subsidiary 2,826 6,885

------------------------------------------------------------------------ -------- ------------------ -------------

Net cash used in financing activities (49,641) (70,274)

------------------------------------------------------------------------ -------- ------------------ -------------

Net decrease in cash and cash equivalents (19,098) (11,984)

------------------------------------------------------------------------ -------- ------------------ -------------

Cash and cash equivalents at the beginning of the period 28,565 63,255

------------------------------------------------------------------------ -------- ------------------ -------------

Effect of foreign exchange rate changes 3,294 4,345

------------------------------------------------------------------------ -------- ------------------ -------------

Cash and cash equivalents at the end of the period 12,761 55,616

------------------------------------------------------------------------ -------- ------------------ -------------

Notes to the Interim Consolidated Financial Statements

(Unaudited) for the 6 months ended 30 June 2022

(Expressed in thousands of US Dollars)

1 General Information

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, operates a maritime services company in Brazil

and holds a portfolio of international investments. The Company is

incorporated in Bermuda under the Companies Act 1981 and the Ocean

Wilsons Holdings Limited Act, 1991. The Company's registered office

is Clarendon House, 2 Church Street, Hamilton, Bermuda. These

interim consolidated financial statements comprise the Company and

its subsidiaries (the "Group").

These interim consolidated financial statements were approved by

the Board 10 August 2022.

2 Significant accounting policies

These interim consolidated financial statements have been

prepared in accordance with IAS 34 - Interim Financial Reporting

and follow the same accounting policies disclosed in the 31

December 2021 annual report. These interim consolidated financial

statements do not include all the information required in the

annual report and should be read in conjunction with the 31

December 2021 annual report.

3 Business and geographical segments

The Group has two reportable segments: maritime services and

investments. These segments report their financial and operational

data separately to the Board. The Board considers these segments

separately when making business and investment decisions. The

maritime services segment provides towage and ship agency, port

terminals, offshore, logistics and shipyard services in Brazil. The

investment segment holds a portfolio of international investments

and is a Bermuda based company.

Brazil -

Maritime Services Bermuda - Investments Unallocated Consolidated

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Result for the period

ended 30 June 2022

(unaudited)

Sale of services 210,980 - - 210,980

Net return on investment

portfolio at fair value

through profit or loss - (50,525) - (50,525)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Profit/(loss) before tax 43,047 (50,740) (2,023) (9,716)

Tax expense (10,723) - - (10,723)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Profit/(loss) after tax 32,324 (50,740) (2,023) (20,439)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Financial position at 30

June 2022 (unaudited)

Segment assets 1,052,805 297,566 785 1,351,156

Segment liabilities (620,485) (1,167) (223) (621,875)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Brazil -

Maritime Services Bermuda - Investments Unallocated Consolidated

------------------------------------------------ ------------------ --------------------- ----------- ------------

Result for the period ended 30 June 2021

(unaudited)

Sale of services 188,877 - - 188,877

Net return on investment portfolio at fair value

through profit or loss - 26,676 - 26,676

------------------------------------------------ ------------------ --------------------- ----------- ------------

Profit/(loss) before tax 41,849 26,598 (2,245) 66,202

Tax expense (14,424) - - (14,424)

------------------------------------------------ ------------------ --------------------- ----------- ------------

Profit/(loss) after tax 27,425 26,598 (2,245) 51,778

------------------------------------------------ ------------------ --------------------- ----------- ------------

Financial position at 31 December 2021 (audited)

Segment assets 1,025,791 351,774 2,782 1,380,347

Segment liabilities (594,218) (2,211) (246) (596,675)

------------------------------------------------ ------------------ --------------------- ----------- ------------

4 Revenue

An analysis of the Group's revenue is as follows:

Unaudited Unaudited

30 June 2022 30 June 2021

----------------------------------------------------------------------------------- ------------- -------------

Sale of services 210,980 188,877

----------------------------------------------------------------------------------- ------------- -------------

Net income from underlying investment vehicles 7,596 1,162

Profit on disposal of financial assets at fair value through profit or loss 15,618 4,988

Unrealised (losses)/gains on financial assets at fair value through profit or loss (68,036) 23,398

Write down of Russia-focused investments (note 7) (4,077) -

----------------------------------------------------------------------------------- ------------- -------------

Returns on investment portfolio at fair value through profit or loss (48,899) 29,548

----------------------------------------------------------------------------------- ------------- -------------

Interest on bank deposits 1,720 705

Other interest 1,973 602

----------------------------------------------------------------------------------- ------------- -------------

Other investment income 3,693 1,307

----------------------------------------------------------------------------------- ------------- -------------

Total Revenue 165,774 219,732

----------------------------------------------------------------------------------- ------------- -------------

The Group derives its revenue from contracts with customers from

the sale of services in its Brazil - Maritime services segment. The

revenue from contracts with customers can be disaggregated as

follows:

Unaudited Unaudited

30 June 2022 30 June 2021

-------------------------------------------- ------------- -------------

Harbour manoeuvres 94,462 83,776

Special operations 7,258 9,156

Ship agency 4,542 4,247

-------------------------------------------- ------------- -------------

Towage and ship agency services 106,262 97,179

-------------------------------------------- ------------- -------------

Container handling 36,250 36,453

Warehousing 21,107 16,426

Ancillary services 9,868 10,622

Offshore support bases 4,504 3,183

Other services 5,814 5,830

-------------------------------------------- ------------- -------------

Port terminals 77,543 72,514

-------------------------------------------- ------------- -------------

Logistics 24,210 16,012

-------------------------------------------- ------------- -------------

Shipyard 2,965 3,172

-------------------------------------------- ------------- -------------

Total Revenue from contracts with customers 210,980 188,877

-------------------------------------------- ------------- -------------

Contract balance

Trade receivables are generally received within 30 days. The net

carrying amount of operational trade receivables at the end of the

reporting period was US$48.4 million (31 December 2021: US$49.1

million). These amounts include US$10.9 million (31 December 2021:

US$13.5 million) of contract assets (unbilled accounts

receivables). There were no contract liabilities as of 30 June 2022

(31 December 2021: none).

Performance obligations

Revenue is measured based on the consideration specified in a

contract with a customer. The Group recognises revenue when it

transfers control over a good or service to a customer, and the

payment is generally due within 30 days. The disaggregation of

revenue from contracts with customers based on the timing of

performance obligations is as follows:

Unaudited Unaudited

30 June 2022 30 June 2021

-------------------------------------------- ------------- -------------

At a point of time 208,015 185,705

Over time 2,965 3,172

Total Revenue from contracts with customers 210,980 188,877

-------------------------------------------- ------------- -------------

5 Finance costs

Finance costs are classified as follows:

Unaudited Unaudited

30 June 2022 30 June 2021

-------------------------------------- ------------- -------------

Interest on lease liabilities (7,843) (6,790)

Interest on bank overdrafts and loans (9,771) (7,755)

Other interest costs (456) (39)

-------------------------------------- ------------- -------------

Finance costs (18,070) (14,584)

-------------------------------------- ------------- -------------

6 Taxation

At the present time, no income, profit, capital or capital gains

taxes are levied in Bermuda and accordingly, no expenses or

provisions for such taxes has been recorded by the Group for its

Bermuda operations. The Company has received an undertaking from

the Bermuda Government exempting it from all such taxes until 31

March 2035.

Tax expense

The reconciliation of the amounts recognised in profit or loss

is as follows:

Unaudited Unaudited

30 June 2022 30 June 2021

--------------------------------------------------------------- ------------- -------------

Current tax expense

Brazilian corporation tax (7,999) (10,549)

Brazilian social contribution (3,859) (4,035)

--------------------------------------------------------------- ------------- -------------

Total current tax expense (11,858) (14,584)

--------------------------------------------------------------- ------------- -------------

Deferred tax - origination and reversal of timing differences

Charge for the period in respect of deferred tax liabilities (7,987) (3,448)

Credit for the period in respect of deferred tax assets 9,122 3,608

--------------------------------------------------------------- ------------- -------------

Total deferred tax credit 1,135 160

--------------------------------------------------------------- ------------- -------------

Total tax expense (10,723) (14,424)

--------------------------------------------------------------- ------------- -------------

Brazilian corporation tax is calculated at 25% (2021: 25%) of

the taxable profit for the year. Brazilian social contribution tax

is calculated at 9% (2021: 9%) of the taxable profit for the

year.

7 Financial assets at fair value through profit or loss

The movement in financial assets at fair value through profit or

loss is as follows:

Unaudited Audited

30 June 2022 31 December 2021

------------------------------------------------------------------------------------ ------------- -----------------

Opening balance - 1 January 392,931 347,464

Additions, at cost 59,418 72,811

Disposals, at market value (88,448) (73,064)

(Decrease)/increase in fair value of financial assets at fair value through profit

or loss (68,036) 33,850

Write down of Russia-focused investments(1) (4,077) -

Profit on disposal of financial assets at fair value through profit or loss 15,618 11,870

------------------------------------------------------------------------------------ ------------- -----------------

Closing balance 307,406 392,931

------------------------------------------------------------------------------------ ------------- -----------------

Bermuda - Investments segment 285,900 349,613

Brazil - Maritime services segment 21,506 43,318

------------------------------------------------------------------------------------ ------------- -----------------

(1) During the period ended 30 June 2022, the Company wrote down

the full value of its investment in Prosperity Quest Fund, a

Russia-focused equity fund held within the investments segment

portfolio, following the issue of an investor notice announcing the

suspension of its net asset valuation, subscriptions and

redemptions.

Bermuda - Investments segment

The financial assets at fair value through profit or loss held

in this segment represent investments in listed equity securities,

funds and unquoted equities that present the Group with opportunity

for return through dividend income and capital appreciation.

At the end of the reporting period, the Group had entered into

commitment agreements with respect to the investment portfolio for

capital subscriptions. The classification of those commitments

based on their expiry date is as follows:

Unaudited Audited

30 June 2022 31 December 2021

-------------------------------------- ------------- -----------------

Within one year 5,008 5,219

In the second to fifth year inclusive 3,493 2,946

After five years 36,825 35,056

-------------------------------------- ------------- -----------------

Total 45,326 43,221

-------------------------------------- ------------- -----------------

Brazil - Maritime Services segment

The financial assets at fair value through profit or loss held

in this segment are held and managed separately from the Bermuda -

Investments segment portfolio and consist of US Dollar denominated

depository notes, an investment fund and an exchange fund both

privately managed.

8 Trade and other receivables

Trade and other receivables are classified as follows:

Unaudited Audited

30 June 2022 31 December 2021

---------------------------------------------------------- ------------- -----------------

Non-current

Other trade receivables 1,538 1,580

---------------------------------------------------------- ------------- -----------------

Total other trade receivables 1,538 1,580

---------------------------------------------------------- ------------- -----------------

Current

Trade receivable for the sale of services 38,231 35,915

Unbilled trade receivables 10,857 13,517

---------------------------------------------------------- ------------- -----------------

Total gross current trade receivables 49,088 49,432

Allowance for expected credit loss (660) (338)

---------------------------------------------------------- ------------- -----------------

Total current trade receivables 48,428 49,094

---------------------------------------------------------- ------------- -----------------

Prepayments 9,244 6,646

Insurance claim receivable 1,056 632

Employee advances 1,814 1,236

Proceed receivable from disposal of financial instruments 7,009 -

Other receivables 3,112 1,742

---------------------------------------------------------- ------------- -----------------

Total other current receivables 22,235 10,256

---------------------------------------------------------- ------------- -----------------

Total trade and other receivables 70,663 59,350

---------------------------------------------------------- ------------- -----------------

The aging of the trade receivables is as follows:

Unaudited Audited

30 June 2022 31 December 2021

------------------------------ ------------- -----------------

Current 41,349 43,160

From 0 - 30 days 5,494 4,098

From 31 - 90 days 1,015 858

From 91 - 180 days 499 988

More than 180 days 731 328

------------------------------ ------------- -----------------

Total gross trade receivables 49,088 49,432

------------------------------ ------------- -----------------

The movement in allowance for expected credit loss is as

follows:

Unaudited Audited

30 June 2022 31 December 2021

-------------------------------------------------------------- ------------- -----------------

Opening balance - 1 January (338) (554)

(Increase)/decrease in allowance recognised in profit or loss (300) 188

Exchange differences (22) 28

-------------------------------------------------------------- ------------- -----------------

Closing balance (660) (338)

-------------------------------------------------------------- ------------- -----------------

9 Joint arrangements

The Group holds the following significant interests in joint

operations and joint ventures at the end of the reporting

period:

Proportion of ownership

----------------------------

Unaudited Unaudited

Place of incorporation and operation 30 June 2022 30 June 2021

------------------------------------------------- ------------------------------------- ------------- -------------

Joint operations

Towage

Consórcio de Rebocadores Baia de São

Marcos(1) Brazil - 50%

Joint ventures

Logistics

Porto Campinas, Logística e Intermodal

Ltda Brazil 50% 50%

Offshore

Wilson, Sons Ultratug Participações

S.A. Brazil 50% 50%

Atlantic Offshore S.A. Panamá 50% 50%

------------------------------------------------- ------------------------------------- ------------- -------------

(1) The joint operation was terminated in December 2021.

Joint ventures

The aggregated Group's interests in joint ventures are equity

accounted. The Group has not given separate disclosure of each

material joint ventures because they belong to the same economic

group. The financial information of the joint ventures and

reconciliations to the share of result of joint ventures and the

investment in joint ventures recognised for the period are as

follows:

Unaudited Unaudited

30 June 2022 30 June 2021

----------------------------------------- ------------- -------------

Sales of services 77,097 55,389

Operating expenses (39,143) (31,992)

Depreciation and amortisation (31,499) (24,582)

Foreign exchange gains on monetary items 6,274 4,217

----------------------------------------- ------------- -------------

Results from operating activities 12,729 3,032

----------------------------------------- ------------- -------------

Finance income 2,409 48

Finance costs (9,245) (7,948)

Profit/(loss) before tax 5,893 (4,868)

----------------------------------------- ------------- -------------

Tax (expense)/credit (4,835) 3,368

----------------------------------------- ------------- -------------

Profit/(loss) for the period 1,058 (1,500)

----------------------------------------- ------------- -------------

Participation 50% 50%

Share of result of joint ventures 529 (749)

----------------------------------------- ------------- -------------

Unaudited Audited

30 June 2022 31 December 2021

----------------------------------------------------------- ------------- -----------------

Non-current assets 680,438 584,886

Other current assets 36,936 46,548

Cash and cash equivalents 5,741 7,541

----------------------------------------------------------- ------------- -----------------

Total assets 723,115 638,975

----------------------------------------------------------- ------------- -----------------

Non-current liabilities 430,808 375,988

Other current liabilities 48,875 49,173

Trade and other payables 86,820 66,567

Total liabilities 566,503 491,728

----------------------------------------------------------- ------------- -----------------

Total net assets 156,612 147,247

----------------------------------------------------------- ------------- -----------------

Participation 50% 50%

Group's share of net assets 78,306 73,624

----------------------------------------------------------- ------------- -----------------

Cumulative elimination of profit on construction contracts (11,198) (12,071)

----------------------------------------------------------- ------------- -----------------

Investment in joint ventures 67,108 61,553

----------------------------------------------------------- ------------- -----------------

The movement in investment in joint ventures is as follows:

Unaudited Audited

30 June 2022 31 December 2021

------------------------------------------------ -------------- -----------------

Opening balance - 1 January 61,553 26,185

Share of result of joint ventures 529 (5,029)

Capital increase 4,937 40,207

Elimination of profit on construction contracts (55) 17

Post-employment benefits - 10

Translation reserve 144 163

Closing balance 67,108 61,553

------------------------------------------------ -------------- -----------------

Guarantees

The joint venture Wilson, Sons Ultratug Participações S.A. has

loans with the Brazilian Development Bank which are guaranteed by a

lien on the financed supply vessel and by a corporate guarantee

from its participants, proportionate to their ownership. The

Group's subsidiary Wilson Sons Holdings Brasil Ltda. is

guaranteeing US$151.5 million (31 December 2021: US$160.4

million).

The joint venture Wilson, Sons Ultratug Participações S.A. has a

loan with Banco do Brasil guaranteed by a pledge on the financed

offshore support vessels, a letter of credit issued by Banco de

Crédito e Inversiones and its long-term contracts with Petrobas.

The joint venture has to maintain a cash reserve account, presented

as long-term investment, until full repayment of the loan

agreement, amounting to US$2.0 million (31 December 2021: US$2.1

million).

Covenants

As of 30 June 2022, a subsidiary of the joint venture Wilson

Sons Ultratug Participações S.A. was not in compliance with one of

its covenants' ratios. In the event of non-compliance, the joint

venture has to increase its capital within a year to reach US$5.4

million. As the capital will be increased to that amount within a

year, management will not negotiate a waiver letter from Banco do

Brasil. There are no other capital commitments for the joint

ventures as of 30 June 2022.

10 Property, plant and equipment

Property, plant and equipment are classified as follows:

Land and Vehicles, plant Assets under

buildings Floating Craft and equipment construction Total

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

Cost

At 1 January

2021 279,313 525,484 209,034 292 1,014,123

Additions 8,992 22,152 6,919 9,289 47,352

Transfers

from joint

operations - 1,350 32 - 1,382

Transfers (16) 1,462 (1,446) - -

Disposals (1,998) (9,196) (4,607) - (15,801)

Exchange

differences (11,608) - (11,468) - (23,076)

At 1 January

2022 274,683 541,252 198,464 9,581 1,023,980

Additions 4,474 9,286 1,978 11,775 27,513

Transfers to

intangible

assets - - (43) - (43)

Disposals (16) (2,303) (540) - (2,859)

Exchange

differences 10,418 - 10,188 - 20,606

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

At 30 June 2022 289,559 548,235 210,047 21,356 1,069,197

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

Accumulated

depreciation

At 1 January

2021 79,628 245,583 109,774 - 434,985

Charge for

the period 7,989 26,070 12,572 - 46,631

Elimination

on

construction

contracts - 25 - - 25

Disposals (1,193) (6,842) (3,053) - (11,088)

Exchange

differences (3,773) - (5,855) - (9,628)

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

At 1 January

2022 82,651 264,836 113,438 - 460,925

Charge for

the period 4,267 13,316 6,123 - 23,706

Elimination

on

construction

contracts - 42 - - 42

Disposals (16) (2,251) (410) - (2,677)

Exchange

differences 3,397 - 5,333 - 8,730

At 30 June 2022 90,299 275,943 124,484 - 490,726

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

Carrying Amount

At 31 December

2021 192,032 276,416 85,026 9,581 563,055

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

At 30 June 2022 199,260 272,292 85,563 21,356 578,471

--------------- ----------------------- --------------------- --------------------- --------------------- ---------

Land and buildings with a net book value of US$0.2 million (31

December 2021: US$0.2 million) and plant and equipment with a

carrying amount of US$0.1 million (31 December 2021: US$0.1

million) have been given in guarantee for various legal

processes.

The Group has pledged assets with a carrying amount of US$257.2

million (31 December 2021: US$251.6 million) to secure loans

granted to the Group.

No borrowing costs were capitalised for the period ended 30 June

2022 and 2021.

The Group has contractual commitments to suppliers for the

acquisition and construction of property, plant and equipment

amounting to US$20.3 million (31 December 2021: US$14.2

million).

11 Lease arrangements

Right-of-use assets

Right-of-use assets are classified as follows:

Operational Floating Vehicles, plant

facilities craft Buildings and equipment Total

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

Cost

At 1 January 2021 154,710 7,278 5,697 9,749 177,434

Additions - 7,353 176 189 7,718

Contractual

amendments 33,466 (838) 119 40 32,787

Terminated

contracts (15,662) - (177) (806) (16,645)

Exchange

differences (5,396) (716) (427) (326) (6,865)

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

At 1 January 2022 167,118 13,077 5,388 8,846 194,429

Additions 17,213 5,793 50 12 23,068

Contractual

amendments - 2,702 1,291 490 4,483

Terminated

contracts - (2,796) (50) (44) (2,890)

Exchange

differences 9,594 475 79 173 10,321

------------------- ----------------- ------------------ ------------------ -----------------

At 30 June 2022 193,925 19,251 6,758 9,477 229,411

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

Accumulated

depreciation

At 1 January 2021 13,739 4,750 2,421 7,246 28,156

Charge for the

period 7,410 4,187 980 748 13,325

Terminated

contracts (3,264) - (504) (598) (4,366)

Exchange

differences 413 (743) 63 (288) (555)

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

At 1 January 2022 18,298 8,194 2,960 7,108 36,560

Charge for the

period 4,122 2,414 533 412 7,481

Terminated

contracts - (1,226) (34) (37) (1,297)

Exchange

differences 994 217 46 125 1,382

At 30 June 2022 23,414 9,599 3,505 7,608 44,126

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

Carrying Amount

At 31 December 2021 148,820 4,883 2,428 1,738 157,869

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

At 30 June 2022 170,511 9,652 3,253 1,869 185,285

------------------- ------------------- ----------------- ------------------ ------------------ -----------------

Lease liabilities

Lease liabilities are classified as follows:

Unaudited Audited

Discount rate 30 June 2022 31 December 2021

------------------------------------ --------------- ------------- -----------------

Operational facilities 5.17% - 9.33% 184,803 159,444

Floating craft 7.75% - 10.52% 9,321 4,823

Buildings 4.41% - 17.19% 3,164 2,139

Vehicles, plant and equipment 4.87% - 12.9% 1,721 1,437

------------------------------------ --------------- ------------- -----------------

Total lease liabilities 199,009 167,843

----------------------------------------------------- ------------- -----------------

Total current lease liabilities 24,438 19,449

Total non-current lease liabilities 174,571 148,394

----------------------------------------------------- ------------- -----------------

The maturity analysis of contractual undiscounted cash flows is

as follows:

Unaudited Audited

30 June 2022 31 December 2021

-------------------------------------- ------------- -----------------

Within one year 25,659 20,323

In the second year 46,278 37,535

In the third to fifth years inclusive 88,227 32,767

After five years 310,193 313,102

-------------------------------------- ------------- -----------------

Total cash flows 470,357 403,727

-------------------------------------- ------------- -----------------

Adjustment to present value (271,348) (235,884)

-------------------------------------- ------------- -----------------

Total lease liabilities 199,009 167,843

-------------------------------------- ------------- -----------------

12 Other intangible assets

Other intangible assets are classified as follows:

Concession-

Computer Software rights Other Total

--------------------------------- ----------------- ----------- ----- -------

Cost

At 1 January 2021 41,107 16,013 47 57,167

Additions 1,375 - - 1,375

Disposals (925) - - (925)

Exchange differences (634) (512) (2) (1,148)

--------------------------------- ----------------- ----------- ----- -------

At 1 January 2022 40,923 15,501 45 56,469

Additions 575 - - 575

Transfers from property, plant

and equipment 43 - - 43

Disposals (192) - - (192)

Exchange differences 526 254 2 782

At 30 June 2022 41,875 15,755 47 57,677

--------------------------------- ----------------- ----------- ----- -------

Accumulated amortisation

At 1 January 2021 34,348 5,852 - 40,200

Charge for the period 2,298 420 - 2,718

Disposals (695) - - (695)

Exchange differences (411) (324) - (735)

--------------------------------- ----------------- ----------- ----- -------

At 1 January 2022 35,540 5,948 - 41,488

Charge for the period 962 213 - 1,175

Disposals (192) - - (192)

Exchange differences 358 89 - 447

--------------------------------- ----------------- ----------- ----- -------

At 30 June 2022 36,668 6,250 - 42,918

--------------------------------- ----------------- ----------- ----- -------

Carrying amount

At 31 December 2021 5,383 9,553 45 14,981

--------------------------------- ----------------- ----------- ----- -------

At 30 June 2022 5,207 9,505 47 14,759

--------------------------------- ----------------- ----------- ----- -------

13 Goodwill

Goodwill is classified as follows:

Tecon Rio Grande Tecon Salvador Total

----------------------- ---------------- -------------- ------

Carrying amount

At 1 January 2021 10,949 2,480 13,429

Exchange differences (157) - (157)

----------------------- ---------------- -------------- ------

At 1 January 2022 10,792 2,480 13,272

Exchange differences 139 - 139

----------------------- ---------------- -------------- ------

At 30 June 2022 10,931 2,480 13,411

----------------------- ---------------- -------------- ------

The goodwill associated with each cash-generating unit "CGU"

(Tecon Salvador and Tecon Rio Grande) is attributed to the Brazil -

Maritime Services segment.

14 Trade and other payables

Trade and other payables are classified as follows:

Unaudited Audited

30 June 2022 31 December 2021

--------------------------------- ------------- -----------------

Trade payables (19,555) (29,242)

Accruals (8,538) (7,424)

Other payables (350) (441)

Provisions for employee benefits (17,927) (19,547)

Deferred income (1,828) (1,859)

Total trade and other payables (48,198) (58,513)

--------------------------------- ------------- -----------------

15 Bank loans and overdrafts

The movement in bank loans and overdrafts is as follows:

Unaudited Audited

30 June 2022 31 December 2021

---------------------------- ------------- -----------------

Opening balance - 1 January (301,599) (342,661)

Additions (20,476) (19,438)

Principal amortisation 24,312 57,926

Interest amortisation 6,527 10,390

Accrued interest (9,807) (16,246)

Exchange difference (5,519) 8,430

---------------------------- ------------- -----------------

Closing balance (306,562) (301,599)

---------------------------- ------------- -----------------

The breakdown of bank loans and overdrafts by maturity is as

follows:

Unaudited Audited

30 June 2022 31 December 2021

-------------------------------------------- ------------- -----------------

Within one year (57,859) (45,287)

In the second year (38,374) (47,961)

In the third to fifth years (inclusive) (94,014) (86,671)

After five years (116,315) (121,680)

-------------------------------------------- ------------- -----------------

Total bank loans and overdrafts (306,562) (301,599)

-------------------------------------------- ------------- -----------------

Amounts due for settlement within 12 months (57,859) (45,287)

Amounts due for settlement after 12 months (248,703) (256,312)

-------------------------------------------- ------------- -----------------

Guarantees

A portion of the loan agreements relies on corporate guarantees

from the Group's subsidiary party to the agreement. For some

contracts, the corporate guarantee is in addition to a pledge of

the respective financed tugboat or a lien over the logistics and

port operations equipment financed (note 10).

Covenants

Some of the loan agreements include obligations related to

financial indicators, including Net Debt/EBITDA, PL/Total Debt,