TIDMOCN

RNS Number : 5309L

Ocean Wilsons Holdings Ltd

16 May 2022

Ocean Wilsons Holdings Limited

Quarterly Update - Q1 2022

Ocean Wilsons Holdings Limited (LSE: OCN) today announces its

first quarter update for 2022.

Our Operations

Ocean Wilsons Holdings Limited ("Ocean Wilsons", the "Company")

is a Bermuda based investment holding company with two

subsidiaries: Ocean Wilsons Investments Limited ("OWIL") which

manages a portfolio of international investments, and Wilson Sons

Holdings Brazil S.A. ("Wilson Sons"), which operates a maritime

services and logistics company in Brazil.

Wilson Sons' Q1 2022 Financial Results

Wilson Sons reports 1Q22 EBITDA of US$45.9 million (1Q21 US$41.9

million), a 9.5% increase over the same quarter last year.

-- Robust towage results due to a better revenue mix and

resilient volumes.

-- Container terminal volumes continue to be impacted by

the limited availability of empty containers and worldwide

logistics bottlenecks.

-- Wilson Sons shareholder approval of a six-for-one stock

split for all the shares of the company to be traded "ex"

split as of 16 May 2022.

Group revenue for the quarter ended 31 March 2022 of US$101.4

million was 9.6% higher than the comparative period (2021: US$92.5

million) principally due to strong towage revenues, benefitting

from an improved mix and resilient volumes. On a constant currency

basis, revenue was 4.4% higher than prior year. The average USD/BRL

exchange rate in the period at R$5.16 was 5.3% lower than the

comparative period (2021 R$5.45).

Container terminal revenue for the quarter was 3.9% higher than

prior year at US$35.0 million (2021: US$33.7 million) mainly due to

increased demand in warehousing and other services. Total

containers moved declined 14.7% at 161,500 TEUs (2021: 189,300

TEUs) as the impact of global container availability and delays in

off-loading cargo continue to prove challenging. Import volumes in

the period declined with the closure of some Chinese ports as Covid

restrictions have been reintroduced. Towage revenue at US$48.5

million was 7.8% higher than the first quarter of 2021 (US$45.0

million).

Net profit for the period of US$27.8 million was US$23.0 million

higher than the comparative period in 2021 (US$4.8 million) with

improved operating profits and foreign exchange gains.

The full earnings release is available on the Wilson Sons

website ( www.wilsonsons.com.br ) and at the Brazilian stock

exchange website.

The CEO of Wilson Sons Limited operations in Brazil, Fernando

Salek, stated:

Wilson Sons' 1Q22 EBITDA of US$45.9 million with robust towage

revenues EBITDA grew 9.5% year over year.

Towage results were strong with an increased average revenue per

manoeuvre despite the decrease in operating volume mainly due to

the reduction of containerized cargo. Towage net revenues increased

to US$48.5 million in 1Q22, from US$45.0 million in 1Q21.

Container terminal operating volumes were impacted by the

limited availability of empty containers and worldwide logistics

bottlenecks causing vessel call cancellations. We believe that this

challenging scenario will remain throughout 2022 given port

closures in China in this first quarter.

This month we released our first sustainability report in line

with the Global Reporting Initiative (GRI). Through this report we

bring increased disclosure of Wilson Sons' environmental, social

and governance performance and strategy. One of the key material

priorities for us and our stakeholders is safety to which we are

pleased to confirm our commitment and report that during the

quarter and since September 2021 we have had no lost time

accidents. As such our LTFR has reduced to 0.51 on a trailing

twelve-month basis.

This month we will deliver the first out of a series of six

80-ton bollard pull tugboats from our shipyard. The vessels are IMO

Tier III certified which attests to the elimination of nitrogen

oxide (NOx) emissions and will introduce an innovative concept for

the tugboats in the country. By increasing the hydrodynamic

efficiency of the vessels, the new design allows an estimated

reduction of up to 14% in greenhouse gas emissions, compared to

previous technology.

We are pleased to have delivered very resilient financial

results despite the challenging worldwide trade environment and

logistical bottlenecks, lack of empty containers and cancellation

of vessel calls.

Fernando Salek

CEO

Investment Portfolio quarterly update

Current market conditions are both complex and challenging. The

year began with an expectation of rising inflation and declining

growth but importantly there was a belief that inflation would

start to ease as the year progressed and that growth, whilst

slowing, would not enter recession. As the year has progressed

however, the combination of the war in Ukraine together with the

slowdown in China due to its zero COVID policy has served to place

further upward pressure on inflation and downward pressure on

growth. As a result, the market is trying to determine whether or

not central banks can regain control of inflation but not at the

expense of growth. The investment portfolio, whilst clearly

impacted by these events, has a high degree of diversity both by

geography, sector and asset type; which together with our long-term

mandate is expected to manage the current uncertainty. The

defensive part of the portfolio continues to be resilient. To date,

the private asset investments have substantially maintained their

value, but there will undoubtedly be a lag between private and

public assets over time.

At 31 March 2022, the investment portfolio including cash under

management amounted to US$328.2 million (31 December 2021:

$351.8million) a decrease of a 6.7% decrease. At 31 March 2022, the

investment portfolio represents US$9.28 or GBP7.08 per Ocean

Wilsons share value. At 30 April 2022, the investment portfolio

including cash under management amounted to US$312.9 million, a

decrease of US$38.9 million (11.0%).

Enquiries

Company Contact

Leslie Rans, CPA +1 441 295 1309

Chief Operating and Financial

Officer

Media

David Haggie +44 20 7562 4444

Haggie Partners LLP

Peel Hunt, Broker

Edward Allsopp, Charles +44 20 7418 8900

Batten

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFVELFFLELBBBF

(END) Dow Jones Newswires

May 16, 2022 02:01 ET (06:01 GMT)

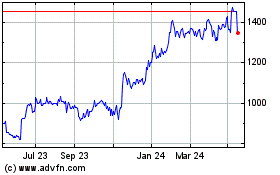

Ocean Wilsons (holdings)... (LSE:OCN)

Historical Stock Chart

From Oct 2024 to Nov 2024

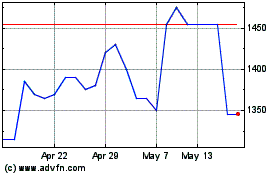

Ocean Wilsons (holdings)... (LSE:OCN)

Historical Stock Chart

From Nov 2023 to Nov 2024