TIDMNTBR

RNS Number : 5504H

Northern Bear Plc

25 November 2022

25 November 2022

Northern Bear plc

("Northern Bear" or the "Company")

Interim results for the six month period ended 30 September

2022

The board of directors of Northern Bear (the "Board") is pleased

to announce the unaudited interim results for the Company and its

subsidiaries (together the "Group") for the six months to 30

September 2022.

Financial Summary

-- Revenue of GBP34.0m (H1 FY 22: GBP30.0m)

-- Adjusted operating profit* of GBP1.5 m (H1 FY 22: GBP1.5m)

-- Net bank debt of GBP1.9m at 30 September 2022

-- Settlement of legal claim against Springs Roofing Limited, as

previously announced on 8 July 2022

-- Strong order book supportive of trading for the remainder of the financial year

* stated prior to the impact of amortisation

Jeff Baryshnik, Non-Executive Chairman of Northern Bear,

commented:

"We are pleased to announce solid operating results for the

period despite significant inflationary headwinds. The Group enjoys

a strong order book, so we are well positioned for the remainder of

the financial year."

For further information please contact:

+44 (0) 166

Northern Bear plc 182 0369

Jeff Baryshnik - Non-Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris +44 (0) 20 7409

James Bellman 3494

Chairman's statement

Introduction

I am pleased to report the unaudited interim results for the six

months ended 30 September 2022 (the "Period", "H1 FY23") for

Northern Bear plc (the "Company" and, together with its

subsidiaries, the "Group").

I am pleased to confirm the Group's results for the Period, with

adjusted operating profit (stated prior to the impact of

amortisation) of GBP1.5m (H1 FY22: GBP1.5m) and diluted earnings

per share of 6.0p (H1 FY22: 6.1p).

In our last Annual Report and Accounts published in July 2022,

we noted the continued industry-wide challenges with respect to

both availability and price inflation of construction materials.

There also have been well-publicised challenges in relation to

attracting and retaining employees in the construction industry.

Despite the impact of these headwinds on our businesses, our Group

generated solid operating results whilst further investing in the

Group's businesses.

Trading

Despite industry-wide challenges, our Group companies generated

strong results in aggregate during the Period. Our companies have

strong and well-established supplier relationships and have been

able, on the whole, to work with our robust supply chain to ensure

continuity of supply for contracts. Additionally, we have not

experienced any slowdown in business to date despite widely

publicised concerns about rising interest rates and their potential

effects on construction generally and the housing market more

specifically.

Revenue for the Period was GBP34.0m (H1 FY22: GBP30.0m) and,

through the greater economy of scale from higher revenues along

with continued careful contract selection and execution, gross

margins were increased to 20.7% (H1 FY22: 19.5%).

However, administrative expenses increased to GBP5.6m (H1 FY22:

GBP4.5m) in large part due to increases in payroll, motor and fuel

expenses, insurance costs, and general cost inflation. The payroll

increase relates primarily to the recruitment of additional

commercial and operational staff, in particular at MGM and Isoler,

both of which have performed strongly in recent years and are

businesses where we see further opportunities for profitable

growth.

Overall profit before income tax for the Period was GBP1.4m (H1

FY22: GBP1.4m) and diluted earnings per share was 6.0p (H1 FY2022:

6.1p).

Cash flow

Net bank debt at 30 September 2022 was GBP1.9m (30 September

2021: GBP0.6m net cash, 31 March 2022: GBP2.2m net cash).

We had stated in the 2022 annual results that the cash position

at 31 March 2022 reflected some favourable working capital swings

which, to an extent, would be expected to reverse post year-end.

This was the case, and the current customer and contract mix, along

with increased turnover levels, has created an increased working

capital requirement which reduced the cash balance during the

Period.

As we announced in July 2022, one of the Company's subsidiaries,

Springs Roofing Limited ("Springs"), settled a claim by Engie

Regeneration (FHM) Limited for GBP0.6 million, which also impacted

the Group's consolidated cash balances. The claim related to

roofing work undertaken between April 2009 and March 2011 on seven

care home properties. The Springs directors believed that the claim

was without merit and this position was supported by third-party

technical expert and legal advice. In reaching the agreed

settlement set out above, Springs considered the management time

commitment, the legal costs and the commercial risk of continued

litigation. Springs, and the wider Group, retain excellent

commercial relationships with Engie (now known as Equans), which

continues to be an important and valued customer. The settlement

was satisfied from the Group's existing cash resources in August

2022 and was previously recorded as an exceptional item in the

Group's annual results to March 2022.

As we have emphasised previously, the net cash/bank debt

position represents a snapshot at a particular point in time and

our net cash/bank debt position can move by up to GBP1.5m in a

matter of days given the nature, size and variety of contracts and

their associated working capital requirements. The highest net cash

position during the Period was GBP2.1m, the lowest net bank debt

position during the Period was GBP2.7m, and the average net bank

debt position during the Period was GBP0.7m.

Our existing GBP3.5m revolving credit facility with Virgin Money

plc (previously known as Yorkshire Bank) was last renewed in March

2020 and provides us with committed working capital facilities to

May 2023, along with a GBP1.0m overdraft facility which is

renewable annually. We have already commenced initial renewal

discussions with Virgin Money and these have been positive to

date.

Strategy and Dividend

As previously announced, I commenced a process of engaging with

the Board and management to discuss and review the Group's strategy

and approach to capital allocation with a focus on further

increasing shareholder value. As part of this review, we have

increased our emphasis on seeking higher margin business

opportunities with the goal of continually improving our operating

margins. We anticipate completing this review over the coming

months.

As a result of this ongoing review, which includes dividend

policy, we did not declare a final dividend for the year ended

March 2022. I would note that we have the cash resources available

to pay a final dividend commensurable with prior year dividends,

should we have decided to declare one. Any future dividends would

be in line with the Group's relative performance, after taking into

account the Group's available resources, working capital

requirements, corporate opportunities, debt obligations, and the

macro-economic environment.

Outlook

Our forward order book remains strong and should continue to

support our trading performance for the remainder of the financial

year, subject to the ongoing supply chain and staffing challenges

noted above, the winter weather conditions, and the wider

macro-economic environment.

We note the Bank of England's recent commentary on the UK

economic outlook and the likelihood of recession, along with the

potential impact of higher interest rates on the construction

industry and housing market, and ever-increasing energy costs.

Our Group traded profitably through the last major recession in

2008-2009 and we have relatively limited exposure to new build

housing work at approximately 10 to 15% of current Group turnover.

While we are mindful that trading conditions may well become more

challenging, our results in October were in line with management

expectations and we have not seen any drop-off in trading to date.

Further, although we have been impacted by higher fuel and vehicle

costs in the Period, our Group exposure to heat, light and power

costs is relatively low at less than GBP0.1m per annum.

Conclusion

I am pleased to report solid results for the Period despite

widespread industry challenges. As always, our loyal, dedicated and

skilled workforce is a key part of our success, and we make every

effort to support them, including through continued training and

health and safety compliance. I would like to thank all of our

employees for their hard work and contribution.

Jeff Baryshnik

Non-Executive Chairman

25 November 2022

6 months ended 6 months ended Year ended

30 September 30 September

2022 2021 31 March 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 33,951 29,973 61,098

Cost of sales (26,935) (24,114) (48,642)

--------------- --------------- --------------

Gross profit 7,016 5,859 12,456

Other operating income 13 86 99

Administrative expenses (5,573) (4,459) (10,005)

--------------- --------------- --------------

Operating profit (before

amortisation and other

adjustments) 1,456 1,486 2,550

--------------- --------------- --------------

One-off costs - - (648)

Impairment charge - - (2,612)

Amortisation of intangible

assets arising on acquisitions (6) (7) (13)

--------------- --------------- --------------

Operating profit/(loss) 1,450 1,479 (723)

Finance costs (89) (65) (156)

--------------- --------------

Profit/(loss) before income

tax 1,361 1,414 (879)

Income tax expense (234) (270) (449)

--------------- --------------- --------------

Profit/(loss) for the

period 1,127 1,144 (1,328)

--------------- --------------- --------------

Total comprehensive income/(loss)

attributable to equity

holders of the parent 1,127 1,144 (1,328)

=============== =============== ==============

Earnings per share from

continuing operations

Basic earnings/(loss) per

share 6.0p 6.1p (7.1)p

Diluted earnings/(loss)

per share 6.0p 6.1p (7.1)p

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 4,550 3,893 4,413

Right of use asset 1,596 1,183 1,702

Intangible assets 15,413 18,037 15,419

Trade and other receivables 783 1,006 708

Total non-current assets 22,342 24,119 22,242

Inventories 1,383 1,080 1,404

Trade and other receivables 14,535 12,010 12,152

Cash and cash equivalents 150 563 3,233

Total current assets 16,068 13,653 16,789

------------- ------------- ---------

Total assets 38,410 37,772 39,031

============= ============= =========

Equity

Share capital 190 190 190

Capital redemption reserve 6 6 6

Share premium 5,169 5,169 5,169

Merger reserve 9,703 9,703 9,703

Retained earnings 7,034 8,362 5,907

Total equity attributable

to equity holders of the Company 22,102 23,430 20,975

============= ============= =========

Liabilities

Loans and borrowings - - 1,000

Trade and other payables 168 - 58

Lease liabilities 1,433 1,078 1,606

Deferred tax liabilities 879 487 879

Total non-current liabilities 2,480 1,565 3,543

------------- ------------- ---------

Loans and borrowings 2,028 22 38

Deferred consideration - 50 -

Trade and other payables 10,796 11,703 13,210

Provisions - - 600

Lease liabilities 615 565 609

Current tax payable 389 437 56

Total current liabilities 13,828 12,777 14,513

------------- ------------- ---------

Total liabilities 16,308 14,342 18,056

============= ============= =========

Total equity and liabilities 38,410 37,772 39,031

============= ============= =========

Capital

Share redemption Share Merger Retained Total

capital reserve premium reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2021 190 6 5,169 9,703 7,218 22,286

Total comprehensive income

for the period

Profit for the period - - - - 1,144 1,144

At 30 September 2021 190 6 5,169 9,703 8,362 23,430

========= ============ ========= ========= ========== ========

At 1 April 2021 190 6 5,169 9,703 7,218 22,286

Total comprehensive income

for the year

Loss for the year - - - - (1,328) (1,328)

Transactions with owners,

recorded directly in equity

Exercise of share options - - - - 17 17

At 31 March 2022 190 6 5,169 9,703 5,907 20,975

========= ============ ========= ========= ========== ========

At 1 April 2022 190 6 5,169 9,703 5,907 20,975

Total comprehensive income

for the period

Profit for the period - - - - 1,127 1,127

At 30 September 2022 190 6 5,169 9,703 7,034 22,102

========= ============ ========= ========= ========== ========

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating profit/(loss) for

the period 1,450 1,479 (723)

Adjustments for:

Depreciation of property,

plant and equipment 361 312 671

Depreciation of lease asset 204 174 374

Amortisation 6 7 13

Impairment charge - - 2,612

Profit/(loss) on sale of property,

plant and equipment (16) (5) (29)

2,005 1,967 2,918

Change in inventories 21 (106) (430)

Change in trade and other

receivables (2,458) (2,301) (2,145)

Change in trade and other

payables (2,903) (355) 1,810

--------------- --------------- -----------

Cash (used in)/generated

from operations (3,335) (795) 2,153

Interest paid (56) (42) (101)

Tax paid 99 111 (57)

--------------- --------------- -----------

Net cash flow from operating

activities (3,292) (726) 1,995

--------------- --------------- -----------

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 193 240 588

Acquisition of property, plant

and equipment (614) (727) (1,747)

Acquisition of subsidiary

(net of cash acquired) - - (50)

--------------- --------------- -----------

Net cash from investing activities (421) (487) (1,209)

--------------- --------------- -----------

Cash flows from financing

activities

Issue of borrowings 990 - 1,010

Repayment of borrowings - (6) -

Repayment of lease liabilities (360) (332) (694)

Proceeds from the exercise

of share options - - 17

Net cash from financing activities 630 (338) 333

--------------- --------------- -----------

Net decrease in cash and

cash equivalents (3,083) (1,551) 1,119

Cash and cash equivalents

at start of period 3,233 2,114 2,114

Cash and cash equivalents

at end of period 150 563 3,233

=============== =============== ===========

1. Basis of preparation

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the UK. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 March 2022 Annual Report

and Financial Statements. The financial information for the half

years ended 30 September 2022 and 30 September 2021 does not

constitute statutory accounts within the meaning of Section 434 (3)

of the Companies Act 2006 and both periods are unaudited. The

financial information has not been prepared (and is not required to

be prepared) in accordance with IAS 34 Interim Financial

Reporting.

The annual consolidated financial statements of Northern Bear

plc (the "Company", or, together with its subsidiaries, the

"Group") are prepared in accordance with the requirements of the

Companies Act 2006 and UK adopted International Accounting

Standards. The comparative financial information for the year ended

31 March 2022 included within this report does not constitute the

full statutory Annual Report for that period. The statutory Annual

Report and Financial Statements for the year ended 31 March 2022

have been filed with the Registrar of Companies. The Independent

Auditors' Report on the Annual Report and Financial Statements for

the year ended 31 March 2022 was i) unqualified, ii) did not draw

attention to any matters by way of emphasis, and iii) did not

contain a statement under 498(2) - (3) of the Companies Act

2006.

2. Accounting policies

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2022 annual financial statements, as set out in Notes 2 and

3 of that document, except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 April 2022, and will be adopted in the

2023 financial statements. The accounting policies applied are

based on the recognition and measurement principles of IFRS in

issue as adopted by the UK and are effective at 31 March 2023 or

are expected to be adopted and effective at 31 March 2023.

New and amended standards and interpretations issued by the IASB

that will apply for the first time in the next annual financial

statements include:

-- Reference to the Conceptual Framework (Amendments to IFRS 3

Business Combina ti ons) - e ff ec ti ve date on or a ft er 1

January 2022;

-- Property, Plant and Equipment: Proceeds before Intended Use

(Amendments to IAS 16) - e ff ec ti ve date on or a ft er 1 January

2022;

-- Onerous Contracts - Cost of Ful fi lling a Contract

(Amendments to IAS 37 Provisions, Con ti ngent Liabili ti es and

Con ti ngent Assets) - e ff ec ti ve date on or a ft er 1 January

2022; and

-- Annual improvements 2018 - 2020 cycle - e ff ec ti ve date on or a ft er 1 January 2022.

Adoption of the above standards and interpretations is not

expected to have a material impact on the Group's financial

statements.

3. Taxation

The taxation charge for the six months ended 30 September 2022

is calculated by applying the Directors' best estimate of the

annual effective tax rate to the profit for the period.

4. Earnings per share

Basic earnings per share is the profit or loss for the period

divided by the weighted average number of ordinary shares

outstanding, excluding those held in treasury, calculated as

follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

Profit/(loss) for the period

(GBP'000) 1,127 1,144 (1,328)

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held

in treasury for the proportion

of the year held in treasury

('000) 18,725 18,665 18,674

Basic earnings/(loss) per share 6.0p 6.1p (7.1)p

------------- ------------- -----------

The calculation of diluted earnings per share is the profit or

loss for the period divided by the weighted average number of

ordinary shares outstanding, after adjustment for the effects of

all potential dilutive ordinary shares, excluding those in

treasury, calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

Profit/(loss) for the period

(GBP'000) 1,127 1,144 (1,328)

------------- ------------- -----------

Weighted average number of

ordinary shares excluding shares

held in treasury for the proportion

of the year held in treasury

('000) 18,725 18,665 18,674

Effect of potential dilutive

ordinary shares ('000) 15 43 42

------------- ------------- -----------

Diluted weighted average number

of ordinary shares excluding

shares held in treasury for

the proportion of the year

held in treasury ('000) 18,740 18,708 18,716

------------- ------------- -----------

Diluted earnings/(loss) per

share 6.0p 6.1p (7.1)p

------------- ------------- -----------

The following additional earnings per share figures are

presented as the Directors believe they provide a better

understanding of the trading performance of the Group.

Adjusted basic and diluted earnings per share is the profit or

loss for the period, adjusted for impairment charges, acquisition

related items, and transaction and other one-off costs, divided by

the weighted average number of ordinary shares outstanding as

presented above.

Adjusted earnings per share is calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

Profit/(loss) for the period (GBP'000) 1,127 1,144 (1,328)

Impairment charge - - 2,612

One-off costs - - 648

Amortisation of intangible assets

arising on acquisitions 6 7 13

Corporation tax effect of above

items - - (123)

------------- ------------- -----------

Adjusted profit for the period

(GBP'000) 1,133 1,151 1,822

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held in

treasury for the proportion of

the year held in treasury ('000) 18,725 18,665 18,674

Adjusted basic earnings per

share 6.1p 6.2p 9.8p

------------- ------------- -----------

Adjusted diluted earnings per

share 6.0p 6.2p 9.7p

------------- ------------- -----------

5. Finance costs

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

On bank loans and overdrafts 56 42 101

Finance charges on lease liabilities 33 23 55

Total finance costs 89 65 156

------------- ------------- -----------

6. Principal risks and uncertainties

The Directors consider that the principal risks and

uncertainties which could have a material impact on the Group's

performance in the remaining six months of the financial year

remain the same as those stated on page 11 to 14, and 68 to 71 of

our Annual Report and Financial Statements for the year ended 31

March 2022, which are available on the Company's website,

www.northernbearplc.com .

7. Half year report

The condensed financial statements were approved by the Board of

Directors on 25 November 2022 and are available on the Company's

website, www.northernbearplc.com . Copies will be sent to

shareholders and are available on application to the Company's

registered office.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law pursuant to the European Union

(Withdrawal) Act 2018, as amended.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEUFILEESELF

(END) Dow Jones Newswires

November 25, 2022 02:00 ET (07:00 GMT)

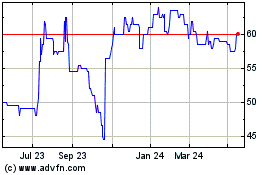

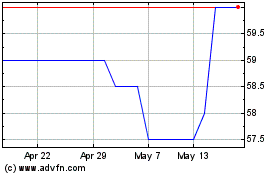

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Jul 2023 to Jul 2024