TIDMNTBR

RNS Number : 7255S

Northern Bear Plc

18 July 2022

18 July 2022

Northern Bear PLC

("Northern Bear" or the "Company")

Preliminary results for the year ended 31 March 2022

The board of directors of Northern Bear (the "Board") is pleased

to announce its unaudited preliminary results for the year ended 31

March 2022 ("FY22") for the Company and its subsidiaries (together,

the "Group").

Financial summary

-- Revenue of GBP61.1m (2021: GBP49.2m)

-- Adjusted EBITDA* of GBP3.6m (2021: GBP2.3m)

-- Adjusted operating profit* of GBP2.6m (2021: GBP1.4m)

-- Adjusted basic earnings per share* of 9.8p (2021: 5.5p)

-- Cash generated from operations of GBP2.2m (2021: GBP3.8m)

-- Net cash position at year end of GBP2.2m (2021: net cash of GBP2.1m)

-- Impairment charge in relation to A1 Industrial Trucks goodwill of GBP2.6 million

-- Legal claim against Springs Roofing settled in July 2022 for GBP0.6 million

* stated prior to the impact of impairments, amortisation, and

other one-off costs

Jeff Baryshnik, Non-Executive Chairman of Northern Bear,

commented:

"We are pleased to announce strong operating results for the

year ended 31 March 2022, despite the ongoing challenges facing our

industry."

"It is a testament to the executive team and the subsidiary

operating teams that FY22 operating results exceed those of the

comparable pre-pandemic year ended 31 March 2020."

For further information contact:

+44 (0) 166

Northern Bear PLC 182 0369

Jeff Baryshnik - Non-Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris +44 (0) 20 7409

James Bellman 3494

Chairman's Statement

Introduction

I am pleased to report the results for the year to 31 March 2022

("FY22") for Northern Bear and its subsidiaries (together, the

"Group").

Despite industry-wide challenges with respect to both the

availability and increasing prices of construction materials, along

with the well-publicised issues relating to attracting and

retaining employees in our industry, we are pleased to announce

strong adjusted operating results, as defined below, for FY22 which

have exceeded those from the prior year to 31 March 2021 ("FY21")

as well as those from the comparable pre-pandemic year to 31 March

2020 ("FY20").

Trading

In the interim report for the six months to 30 September 2021

("HY22"), we noted the industry-wide challenges with respect to

both the availability and price inflation of construction

materials, along with the well-publicised issues relating to

attracting and retaining employees in our industry. Despite the

impact of these headwinds, we reported that our Group generated

strong adjusted operating results, defined as operating profit

stated prior to amortisation, one-off costs, and impairment

charges, in HY22. Our companies have strong and well-established

supplier relationships and, on the whole, have been able to work

with our robust supply chain to ensure continuity of supply for

contracts.

This situation has continued through the second half of FY22,

and the Group has generated strong adjusted operating results that

exceed those from the prior year of FY21, as well as those from the

comparable pre-pandemic year of FY20.

The Group reported an overall operating loss of GBP0.7 million

(2021: GBP1.5 million), and a retained loss of GBP1.3 million

(2021: GBP1.8 million). Both are stated after amortisation, one-off

costs, and impairment charges, more detail on which is provided

below and where the principal items are goodwill impairment of

GBP2.6 million (2021: GBP2.8 million) and provision for settlement

of a legal claim of GBP0.6 million (2021: nil). Operating profit

for FY22, before amortisation, one-off costs, and impairment

charges, was GBP2.6 million as compared with GBP1.4 million in

FY21.

Northern Bear Roofing

Despite the issues with materials and labour in the roofing

industry, our Roofing division has performed well in FY22 and

maintains a strong order book. This result is a testament to our

three Managing Directors, their teams, and their excellent

relationships with our supply chain.

Alan Chapman, our Heritage Manager and a Director at Wensley

Roofing Limited, recently retired as planned, with Adam Rhodes

assuming the role after a two-year transition period. We thank Alan

for his contributions and wish Adam the best in his new role.

As announced on 8 July 2002, we decided to settle, for the sum

of GBP0.6 million, a legal claim against Springs Roofing Limited

("Springs") brought by Engie Regeneration (FHM) Limited ("Engie"),

where court proceedings had been issued in December 2021 for an

original claim of GBP1.9 million. While the Springs directors

believed the claim was without merit, we took into consideration

the commercial risk of litigation and the potential for

irrecoverable costs to be incurred in defending the claim. Springs

and Northern Bear's other subsidiaries retain excellent commercial

relationships with Engie's (recently renamed to Equans) regional

and national management team. As such, Engie (Equans) continues to

be an important and valued customer for the Group. There are no

other pending legal claims against the Group or its subsidiaries,

and we are not aware of any matter that could lead to a material

legal claim.

Northern Bear Construction

The businesses in our Construction division performed well on

the whole in FY22, and H. Peel & Sons Limited ("H Peel") has

seen some stabilisation of its core markets.

MGM Limited ("MGM"), our specialist construction and

refurbishment business, has seen continued exceptional performance.

Along with recruiting new staff, MGM alleviated some of the

pressure on its surveyors and contract managers by employing a

buyer to optimise supply chain availability and pricing. This

released the surveyors and contracts managers to concentrate more

on their site work. The order book is historically strong, and this

business continues to grow steadily.

H Peel, our fit out and interiors business, continued to

experience challenging trading conditions in FY22 due to the

ongoing impact of COVID-19 on its core hospitality and leisure

markets. We are cautiously hopeful of a continued stabilisation in

H Peel's core markets, and of a resultant improvement in H Peel's

trading.

J Lister Electrical Limited ("J Lister"), our electrical

contractor, saw improved profitability during FY22. In light of

current order book levels, we are optimistic that trading at J

Lister will continue to improve in the current financial year.

Isoler Limited ("Isoler"), our fire protection contracting

business, has continued to perform very strongly, with an

impressive and growing reputation for good quality workmanship.

Isoler has won expanded mandates from a general contractor customer

and a local social housing provider during FY22.

Northern Bear Materials Handling

Our materials handling business, A1 Industrial Trucks Limited

("A1"), has seen an improvement in its profitability despite

disruption to new truck sales. We are now expecting lead times for

the delivery of forklift trucks to be in the region of 30 to 40

weeks due to supply chain interruptions, which could lead to a

challenging outlook over the medium term. As a result, we recorded

an impairment of goodwill of GBP2.6m in our FY22 results with

respect to A1, which is further described below.

Fortunately, A1 has now moved into its new premises on the Team

Valley trading estate in Gateshead, providing a larger footprint in

a superior location that will increase A1's profile. We also

accelerated investment in the fork-lift fleet during FY22 in

anticipation of continued supply chain challenges. This investment,

coupled with the possibility of being positioned to attract more

business from the numerous companies renting property on this

well-known trading estate, leads to an exciting time for the

business notwithstanding the ongoing supply chain challenges.

Other matters

As in prior years, we have presented amortisation and certain

other adjustments separately within the Consolidated Statement of

Comprehensive Income, to provide an indication of underlying

trading performance. The adjustments in the current year are for

the impairment charge related to A1 (as described further above and

below), amortisation of acquired intangibles, and provision for

settlement of the Springs legal claim (as described above) and

related legal costs. Adjustments in the prior year include the

impairment charge related to H Peel and amortisation. Calculations

supporting alternative performance measures are included in the

notes below.

During FY21, when our businesses were unable to operate on site,

with the consequent furloughing of direct and indirect employees,

we received significant sums from the Government's Coronavirus Job

Retention Scheme. These amounts are shown in other operating income

for FY21 and total GBP1.5 million. The majority of the related

staff costs are included in cost of sales for FY21, and this

consequently impacted reported gross margin that year. During FY22,

such amounts were much lower and totalled under GBP0.1 million.

The operating profit before amortisation and other adjustments

contributed by our trading subsidiaries was GBP3.7 million (2021:

GBP2.1 million), which was offset by corporate and central costs of

GBP1.1 million (2021: GBP0.7 million). The central costs in FY21

were unusually low due to temporary savings in corporate and

central costs due to lower activity levels and voluntary salary

reductions. Should future subsidiary profits increase via organic

growth or acquisition, central costs would not be expected to

increase proportionately and this would, therefore, provide some

operating leverage.

Impairment charge

As mentioned above, we recorded an impairment of goodwill

related to A1, our materials handling business, of GBP2.6m for

FY22.

Goodwill is a non-cash accounting estimate which arises on

acquisition of subsidiaries. We had noted in our annual report and

financial statements for FY21 that there was limited headroom when

comparing the recoverable amount to the carrying value of goodwill

at the balance sheet date. Despite some improvement in A1's trading

performance during FY22, the supply chain disruptions and

challenging industry outlook led us to record this impairment for

FY22.

The large majority of goodwill relates to acquisitions made in

the Group's early years between 2006 and 2008. These acquisitions

were completed at a time when different accounting standards were

in place which did not require separate identification of acquired

intangible assets and permitted capitalisation of deal costs,

resulting in a higher goodwill balance than would be likely under

current standards. Notwithstanding this, having impaired goodwill

related to H Peel and A1, the remaining carrying value of goodwill

is comfortably supported by current trading levels.

Cash Flow and Bank Facilities

The Group had a substantial net cash position (defined as cash

balances less the amount drawn down on our revolving credit

facility) of GBP2.2 million at 31 March 2022 (GBP2.1 million at 31

March 2021). Cash generated from operations during the year was

GBP2.2 million (2021: GBP3.8 million). These excess cash balances

have, to an extent, normalised post year-end, although the Group's

financial position remains strong.

As we have emphasised in previous years' results, our net

cash/bank debt position represents a snapshot at a particular point

in time and can move by up to GBP1.5 million in a matter of days,

given the nature, size and variety of contracts that we work on and

the related working capital balances.

The lowest position during the year was GBP1.6 million net bank

debt, the highest was GBP2.5 million net cash, and the average was

GBP0.1 million net bank debt.

We have made limited use of our committed GBP1 million overdraft

and GBP3.5 million revolving credit facility in FY22. While the

Group's working capital requirements will continue to vary

depending on the ongoing customer and contract mix, we believe that

our financial position and bank facilities provide us with ample

cash resources for the Group's ongoing operational

requirements.

Growth Initiatives

We have continued to challenge our subsidiary management teams

to consider opportunities to expand their businesses over the

medium term, notwithstanding the challenging trading conditions

during FY22. This could include a degree of geographic expansion

and/or the opportunity to broaden their product and service

offerings.

Supply Chain and Outlook

It has been widely publicised that industry-wide challenges

continue with respect to both the availability and price inflation

for construction materials. Our companies have strong and

well-established customer and supplier relationships and have been

able, on the whole, to work with both groups to ensure continuity

of supply for contracts and to pass on cost increases where

possible.

However, we have seen some impact on our results and expect this

situation could provide a short-term headwind to operations until

industry supply and demand revert to more typical levels.

Our forward order book remains strong and should support our

trading performance in the coming months, subject to potential

supply chain challenges and the business-specific considerations

noted in the trading statement above.

We regularly report that the timing of Group turnover and

profitability is difficult to predict despite the continued strong

order book, and our results can also be volatile on a month to

month basis. We will continue to update shareholders with ongoing

trading updates.

Strategy & Dividend

Following Board changes in late 2021, including my appointment

as Non-Executive Chairman, I commenced a process of engaging with

the Board and management to discuss and review the Group's strategy

and approach to capital allocation. This review remains ongoing

and, in recent months, we have assessed two potentially accretive

acquisitions of a more substantial size than those we have made

previously. Ultimately, these did not come to fruition. We continue

to explore avenues for increasing shareholder value.

As a result of our ongoing review, which includes dividend

policy, we did not declare a final dividend for the year ended 31

March 2022. I would note that we have the cash resources available

to pay a final dividend commensurable with prior year dividends,

should we have decided to declare one. Any future dividends would

be in line with the Group's relative performance, after taking into

account the Group's available resources, working capital

requirements, corporate opportunities, debt obligations, and the

macro-economic environment.

People

Anil Khera

Anil Khera joined us as a Non-Executive Director in November

2021. Mr Khera began his career at Credit Suisse, within DLJ Real

Estate Capital Partners, before joining Blackstone's real estate

investment team in 2006 where he spent 10 years, becoming a

managing director of the Real Estate Capital Markets team in 2011.

In 2016, Mr Khera founded Node Living, a fully integrated

residential investment, development and management company based in

London which operates across Europe and North America. I would like

to welcome Anil to the Board and look forward to working with him

over the coming years.

Harry Samuel

Harry Samuel joined us as a Non-Executive Director in November

2021. Mr Samuel spent over 20 years across various leadership roles

within Royal Bank of Canada ("RBC"). This included roles as Global

Head of Funding and Liquidity Asset Management, Foreign Exchange

and Commodities, and Fixed Income and Currencies, before becoming

CEO of RBC Capital Markets Europe in 2011 and subsequently CEO of

RBC Investor & Treasury Services and Chair of RBC's European

Executive Committee from 2013 to 2019. Mr Samuel currently serves

as CEO of Affordable Housing Communities Limited and Managing

Director of Affordable Housing and Healthcare Group Limited, a

leading UK developer, constructor and operator of shared ownership

communities working in partnership with local authorities, NHS

Trusts and institutional investors to create socially impactful

developments. I would like to welcome Harry to the Board and look

forward to working with him over the coming years.

Our workforce

As always, our loyal, dedicated, and skilled workforce is a key

part of our success and we make every effort both to retain and

protect them through continued training and health and safety

compliance, supported by our health and safety advisory business,

Northern Bear Safety Limited.

Conclusion

I am pleased with the Group's results for the year, particularly

in light of the ongoing headwinds and challenges facing our

industry.

I would like to once again thank all of our employees for their

hard work and commitment during a challenging year, and our

shareholders for their continued support.

Jeff Baryshnik

Non-Executive Chairman

18 July 2022

Consolidated statement of comprehensive income

for the year ended 31 March 2022

2022 2021

GBP000 GBP000

Revenue 61,098 49,182

Cost of sales (48,642) (40,726)

--------- ---------

Gross profit 12,456 8,456

Other operating income 99 1,549

Administrative expenses (10,005) (8,640)

------------------------------------------------ --------- ---------

Operating profit (before amortisation

and other adjustments) 2,550 1,365

One-off costs (648) -

Impairment charge (2,612) (2,807)

Amortisation of intangible assets arising

on acquisitions (13) (13)

------------------------------------------------ --------- ---------

Operating loss (723) (1,455)

Finance costs (156) (176)

--------- ---------

Loss before income tax (879) (1,631)

Income tax expense (449) (162)

--------- ---------

Loss for the year (1,328) (1,793)

--------- ---------

Total comprehensive income attributable

to equity holders of the parent (1,328) (1,793)

========= =========

Earnings per share from continuing operations

Basic loss per share (7.1)p (9.6)p

Diluted loss per share (7.1)p (9.6)p

--------- ---------

Consolidated balance sheet

at 31 March 2022

2022 2021

GBP000 GBP000

Assets

Property, plant and equipment 4,413 3,596

Right of use asset 1,702 1,094

Intangible assets 15,419 18,044

Trade and other receivables 708 872

Total non-current assets 22,242 23,606

-------- --------

Inventories 1,404 974

Trade and other receivables 12,152 9,843

Cash and cash equivalents 3,233 2,114

-------- --------

Total current assets 16,789 12,931

-------- --------

Total assets 39,031 36,537

======== ========

Equity

Share capital 190 190

Capital redemption reserve 6 6

Share premium 5,169 5,169

Merger reserve 9,703 9,703

Retained earnings 5,907 7,218

-------- --------

Total equity attributable to equity

holders of the Company 20,975 22,286

-------- --------

Liabilities

Loans and borrowings 1,000 -

Trade and other payables 58 122

Lease liabilities 1,606 1,039

Deferred tax liabilities 879 487

-------- --------

Total non-current liabilities 3,543 1,648

-------- --------

Loans and borrowings 38 28

Deferred consideration - 50

Trade and other payables 13,210 11,936

Provisions 600 -

Lease liabilities 609 533

Current tax payable 56 56

-------- --------

Total current liabilities 14,513 12,603

-------- --------

Total liabilities 18,056 14,251

-------- --------

Total equity and liabilities 39,031 36,537

======== ========

Consolidated statement of changes in equity

for the year ended 31 March 2022

Share Capital Share Merger Retained Total

capital redemption premium reserve earnings equity

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2020 190 6 5,169 9,703 9,011 24,079

Total comprehensive income

for the year

Loss for the year - - - - (1,793) (1,793)

At 31 March 2021 190 6 5,169 9,703 7,218 22,286

-------- ----------- -------- -------- --------- --------

At 1 April 2021 190 6 5,169 9,703 7,218 22,286

Total comprehensive income

for the year

Loss for the year - - - - (1,328) (1,328)

Transactions with owners,

recorded directly in equity

Exercise of share options - - - - 17 17

At 31 March 2022 190 6 5,169 9,703 5,907 20,975

======== =========== ======== ======== ========= ========

Consolidated statement of cash flows

for the year ended 31 March 2022

2022 2021

GBP000 GBP000

Cash flows from operating activities

Operating loss for the year (723) (1,455)

Adjustments for:

Depreciation of property, plant and equipment 671 600

Depreciation of lease asset 374 373

Amortisation 13 13

Impairment charge 2,612 2,807

(Profit)/loss on sale of property, plant

and equipment (29) -

2,918 2,338

Change in inventories (430) 33

Change in trade and other receivables (2,145) (1,434)

Change in trade and other payables 1,810 2,867

------- ---------

Cash generated from operations 2,153 3,804

Interest paid (101) (176)

Tax paid (57) (252)

------- ---------

Net cash flow from operating activities 1,995 3,376

------- ---------

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment 588 420

Acquisition of property, plant and equipment (1,747) (1,200)

Acquisition of subsidiary (net of cash

acquired) (50) (50)

---------

Net cash from investing activities (1,209) (830)

------- ---------

Cash flows from financing activities

Issue of borrowings 1,010 -

Repayment of borrowings - (3,503)

Repayment of lease liabilities (694) (587)

Proceeds from the exercise of share options 17 -

Net cash from financing activities 333 (4,090)

------- ---------

Net increase/(decrease) in cash and

cash equivalents 1,119 (1,544)

Cash and cash equivalents at start of

year 2,114 3,658

------- ---------

Cash and cash equivalents at end of

year 3,233 2,114

======= =========

Notes

1 Basis of preparation

This announcement has been prepared in accordance with the

Company's accounting policies, which in turn are prepared in

accordance with the requirements of the Companies Act 2006 and

UK-adopted international accounting standards.

The accounting policies are the same as those applied in

preparation of the financial statements for the year ended 31 March

2021, apart from the following standards, amendments and

interpretations, which became effective for the first time, and

which were adopted by the Group for the financial year ended 31

March 2022:

-- Interest Rate Benchmark Reform - Phase 2 (Amendments to IFRS

9, IAS 39, IFRS 7, IFRS 4 and IFRS 16) - effective date on or after

1 January 2021.

-- Covid 19-Related Rent Concessions Beyond 30 June 2021

(Amendment to IFRS 16 Leases) - effective date on or after 1 April

2021.

Their adoption has not had any material impact on the

disclosures or amounts reported in the financial statements.

For the purposes of their assessment of the appropriateness of

the preparation of the Group's accounts on a going concern basis,

the directors have considered the current cash position and

forecasts of future trading including working capital and

investment requirements.

During the year the Group met its day to day working capital

requirements through an existing GBP1 million bank overdraft and a

GBP3.5 million revolving credit facility. At 31 March 2022 the

Group had net cash of GBP2.2 million based on GBP3.2 million cash

and GBP1.0 million drawn on the revolving credit facility. The

overdraft facility was last renewed on 17 June 2022 for the period

to 31 May 2023. The Group's revolving credit facility was most

recently renewed on 19 March 2020 and is committed to 31 May 2023.

The Directors have a reasonable expectation of successful renewal

for both the overdraft and revolving credit facilities based on a

long standing and strong working relationship with the bank.

The Group's forecasts and projections, taking account of

reasonable possible changes in trading performance, show that the

Group and the Company should have sufficient cash resources to meet

its requirements for at least the next 12 months. Accordingly, the

adoption of the going concern basis in preparing the financial

statements remains appropriate.

2 Status of financial information

The financial information set out above does not constitute the

Company's financial statements for the years ended 31 March 2022 or

31 March 2021.

The financial statements for 2022 will be finalised on the basis

of the financial information presented by the Directors in this

preliminary announcement and will be delivered to the Registrar of

Companies following the Company's Annual General Meeting. The

results are unaudited; however, we do not expect there to be any

difference between the numbers presented and those within the

annual report.

The financial information for the year ended 31 March 2021 is

derived from the financial statements for that year, which have

been delivered to the Registrar of Companies. The auditor has

reported on the 2021 financial statements; their report was i)

unqualified, ii) did not include references to any matters to which

the auditors drew attention by way of emphasis, without qualifying

their report, and iii) did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

3 Alternative performance measures

The Group uses Adjusted Operating Profit, Adjusted EBITDA, and

Adjusted EPS as supplemental measures of the Group's profitability,

in addition to measures defined under IFRS. The directors consider

these useful due to the exclusion of specific items that could

impact a comparison of the Group's underlying profitability, and is

aware that shareholders use these measures to assist in evaluating

performance.

The adjusting items for the alternative measures of profit are

either recurring but non-cash charges (amortisation of acquired

intangible assets), one-off non-cash items (impairment charges), or

one-off exceptional items (provision for settlement of legal claim

and associated costs).

Adjusted operating profit is calculated as below:

2022 2021

GBP'000 GBP'000

Operating loss (as reported) (723) (1,455)

One-off costs 648 -

Impairment charge 2,612 2,807

Amortisation of intangible assets arising on

acquisitions 13 13

Adjusted operating profit 2,550 1,365

-------- --------

Adjusted EBITDA is calculated as below:

2022 2021

GBP'000 GBP'000

Adjusted operating profit (as above) 2,550 1,365

Depreciation of property, plant and equipment 671 600

Depreciation of lease asset 374 373

Adjusted EBITDA 3,595 2,338

-------- --------

Adjusted basic and diluted earnings per share is presented in

note 4 below.

4 Earnings per share

Basic earnings per share is the profit or loss for the year

divided by the weighted average number of ordinary shares

outstanding, excluding those in treasury, calculated as

follows:

2022 2021

Loss for the year (GBP000) (1,328) (1,793)

Weighted average number of ordinary shares

excluding shares held in treasury for the proportion

of the year held in treasury ('000) 18,674 18,665

-------- --------

Basic loss per share (7.1)p (9.6)p

The calculation of diluted earnings per share is the profit or

loss for the year divided by the weighted average number of

ordinary shares outstanding, after adjustment for the effects of

all potential dilutive ordinary shares, excluding those in

treasury, calculated as follows:

2022 2021

Loss for the year (GBP000) (1,328) (1,793)

-------- --------

Weighted average number of ordinary shares

excluding shares held in treasury for the proportion

of the year held in treasury ('000) 18,674 18,665

Effect of potential dilutive ordinary shares

('000) 42 43

-------- --------

Diluted weighted average number of ordinary

shares excluding shares held in treasury for

the proportion of the year held in treasury

('000) 18,716 18,708

-------- --------

Diluted loss per share (7.1)p (9.6)p

-------- --------

The following additional earnings per share figures are

presented as the directors believe they provide a better

understanding of the trading performance of the Group.

Adjusted basic and diluted earnings per share is the profit or

loss for the year, adjusted for impairment charges, acquisition

related items and one-off costs, divided by the weighted average

number of ordinary shares outstanding as presented above.

Adjusted earnings per share is calculated as follows:

2022 2021

Loss for the year (GBP000) (1,328) (1,793)

Impairment charge 2,612 2,807

One-off costs 648 -

Amortisation of intangible assets arising on

acquisitions 13 13

Corporation tax effect of above items (123) -

-------- --------

Adjusted profit for the year (GBP000) 1,822 1,027

Weighted average number of ordinary shares

excluding shares held in treasury for the proportion

of the year held in treasury ('000) 18,674 18,665

-------- --------

Adjusted basic earnings per share 9.8p 5.5p

Adjusted diluted earnings per share 9.7p 5.5p

-------- --------

5 Other operating income

2022 2021

GBP'000 GBP'000

Coronavirus Job Retention Scheme receipts 63 1,460

Grants received 12 65

Rental income 24 24

-------- --------

99 1,549

-------- --------

6 Finance costs

2022 2021

GBP'000 GBP'000

On bank loans and overdrafts 101 97

Finance charges on lease liabilities 55 79

156 176

-------- --------

7 Loans and borrowings

2022 2021

GBP'000 GBP'000

Non-current liabilities

Secured bank loans 1,000 -

--------

1,000 -

-------- --------

Current liabilities

Other loans 38 28

-------- --------

38 28

-------- --------

The Group retains a GBP3.5 million revolving credit facility and

a GBP1.0 million overdraft facility, both with Virgin Money plc,

for working capital purposes.

As at 31 March 2022, a total of GBP1.0 million (2021: GBPnil)

was drawn down on the revolving credit facility, providing a net

cash figure at 31 March 2022 of GBP2.2 million (2021: GBP2.1

million) after offsetting cash and cash equivalents of GBP3.2

million (2021: GBP2.1 million).

The revolving credit facility was renewed on 19 March 2020 and

is committed until 31 May 2023. The overdraft facility was last

renewed on 17 June 2022 and is next due for routine review and

renewal on 31 May 2023.

8 Availability of financial statements

The Group's Annual Report and Financial Statements for the year

ended 31 March 2022 are expected to be approved by 25 July 2022 and

will be posted to shareholders during the week commencing 25 July

2022. Further copies will be available to download on the Company's

website at: http://www.northernbearplc.com/ . It is intended that

the Annual General Meeting will take place at the Company's

registered office, A1 Grainger, Prestwick Park, Prestwick,

Newcastle upon Tyne, NE20 9SJ, at 2:00pm on 14 September 2022.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DZGMNKNNGZZM

(END) Dow Jones Newswires

July 18, 2022 02:00 ET (06:00 GMT)

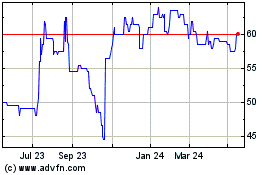

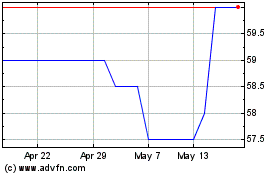

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Jul 2023 to Jul 2024