NBPE Announces June Monthly NAV Estimate & 2H 2024 Dividend Payment

July 17 2024 - 2:00AM

UK Regulatory

NBPE Announces June Monthly NAV Estimate & 2H 2024 Dividend

Payment

THE INFORMATION CONTAINED HEREIN IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION IN OR INTO AUSTRALIA, CANADA, ITALY, DENMARK,

JAPAN, THE UNITED STATES, OR TO ANY NATIONAL OF SUCH

JURISDICTIONS

NBPE Announces June Monthly NAV Estimate & 2H 2024 Dividend

Payment

17 July 2024

NB Private Equity Partners (NBPE), the $1.3bn1, FTSE

250, listed private equity investment company managed by Neuberger

Berman, today announces its 30 June 2024 monthly NAV estimate.

NAV Highlights (30 June 2024)

- NAV per share was $27.39 (£21.67), a decrease of 0.4% in the

month

- Q1 2024 private valuations up 2.4% on a constant currency

basis; year to date performance offset by quoted holdings and

foreign exchange adjustments

- $386 million of available liquidity at 30 June 2024

- 2H 2024 dividend of $0.47 per share, in-line with the previous

dividend in February 2024. Annualised dividend yield on 30 June

2024 NAV of 3.4%; annualised share price yield is 4.4% based on the

closing share price of £16.70 on 15 July 2024

- 98% of the portfolio valued based on Q1 2024 private valuations

or quoted holdings as of 30 June 2024.2 Q2 2024 private

company valuation information is expected in the coming weeks

|

As of 30 June 2024 |

YTD |

1 Year |

3 years |

5 years |

10 years |

NAV TR (USD)*

Annualised |

(0.8%) |

(0.4%) |

5.3%

1.7% |

73.8%

11.7% |

170.1%

10.4% |

MSCI World TR (USD)*

Annualised |

12.0% |

20.8% |

23.8%

7.4% |

78.8%

12.3% |

153.2%

9.7% |

Share price TR (GBP)*

Annualised |

(1.8%) |

11.7% |

31.1%

9.5% |

75.7%

11.9% |

297.4%

14.8% |

FTSE All-Share TR (GBP)*

Annualised |

7.4% |

13.0% |

23.9%

7.4% |

30.9%

5.5% |

77.8%

5.9% |

*Reflects cumulative returns over the time periods shown and

are not annualised.

Portfolio Update to 30 June 2024

NAV performance during the month driven by:

- 0.2% NAV decrease ($2 million) from the receipt of additional

private company valuation information

- 0.3% NAV decrease ($4 million) from negative FX movements

- 0.2% NAV increase ($3 million) from the value of quoted

holdings (which now constitute 6% of portfolio fair value)

- 0.1% NAV decrease ($2 million) attributable to expense accruals

and changes in the Zero Dividend Preference share (ZDP)

liability

Realisations from the portfolio continue in 2024

- $126 million of realisations received year to date, driven by

previously announced sales of Cotiviti, Melissa & Doug, FV

Hospital and Safefleet as well as partial sales of public stock and

continued realisations from the legacy income investment

portfolio

$72 million invested through 30 June 2024 in new and

follow-on investments

- $25 million invested in FDH Aero, a leading parts distributor

to the aerospace and defense industry

- $38 million invested into two U.S. healthcare businesses,

Benecon and Zeus

- $9 million of additional new and follow on investments

Well positioned to take advantage of investment opportunities

with significant available liquidity at 30 June 2024

- $386 million of available liquidity

– $210 million undrawn credit line and $176 million of cash /

liquid investments

Portfolio Valuation

The fair value of NBPE’s portfolio as of 30 June 2024 was

based on the following information:

-

6% of the portfolio was valued as of 30 June 2024

-

2% of the portfolio was valued as of 31 May 2024

-

- 2% in private direct investments

-

92% of the portfolio was valued as of 31 March 2024

-

- 91% in private direct investments

- 1% in private fund investments

2H 2024 Dividend3

NBPE announces the 2H 2024 dividend of $0.47 per share, in-line

with the previous dividend in February 2024. The dividend timetable

is set forth below

|

Distribution amount: |

$0.47 per Share |

|

Ex-dividend date: |

25 July 2024 |

|

Dividend record date: |

26 July 2024 |

|

Final day for Currency Election: |

2 August 2024 |

|

Final day for Dividend Re-investment Plan Election: |

2 August 2024 |

|

Payment date: |

30 August 2024 |

For further information, please contact:

NBPE Investor

Relations +44 (0)

20 3214 9002

Luke

Mason

NBPrivateMarketsIR@nb.com

Kaso Legg Communications +44

(0)20 3995 6673

Charles

Gorman

nbpe@kl-communications.com

Luke Dampier

Charlotte Francis

Supplementary Information (as at 30 June

2024)

| Company Name |

Vintage |

Lead Sponsor |

Sector |

Fair Value ($m) |

%

of FV |

| Action |

2020 |

3i |

Consumer |

86.6 |

6.8% |

| Osaic |

2019 |

Reverence

Capital |

Financial

Services |

56.5 |

4.4% |

| Solenis |

2021 |

Platinum

Equity |

Industrials |

54.1 |

4.3% |

|

BeyondTrust |

2018 |

Francisco

Partners |

Technology /

IT |

39.6 |

3.1% |

| Branded Cities

Network |

2017 |

Shamrock

Capital |

Communications

/ Media |

39.2 |

3.1% |

| Monroe

Engineering |

2021 |

AEA

Investors |

Industrials |

36.2 |

2.8% |

| Business

Services Company* |

2017 |

Not

Disclosed |

Business

Services |

35.1 |

2.8% |

| True

Potential |

2022 |

Cinven |

Financial

Services |

34.9 |

2.7% |

| Constellation

Automotive |

2019 |

TDR

Capital |

Business

Services |

32.4 |

2.5% |

| Marquee

Brands |

2014 |

Neuberger

Berman |

Consumer |

31.6 |

2.5% |

| Kroll |

2020 |

Further Global

/ Stone Point |

Financial

Services |

31.4 |

2.5% |

| Staples |

2017 |

Sycamore

Partners |

Business

Services |

30.2 |

2.4% |

| Fortna |

2017 |

THL |

Industrials |

28.7 |

2.3% |

| Viant |

2018 |

JLL

Partners |

Healthcare |

27.1 |

2.1% |

| Stubhub |

2020 |

Neuberger

Berman |

Consumer |

26.4 |

2.1% |

| GFL (NYSE:

GFL) |

2018 |

BC

Partners |

Business

Services |

26.3 |

2.1% |

| FDH Aero |

2024 |

Audax

Group |

Industrials |

25.0 |

2.0% |

| Benecon |

2024 |

TA

Associates |

Healthcare |

25.0 |

2.0% |

| Agiliti |

2019 |

THL |

Healthcare |

25.0 |

2.0% |

|

Engineering |

2020 |

NB Renaissance

/ Bain Capital |

Technology /

IT |

24.8 |

2.0% |

| AutoStore

(OB.AUTO) |

2019 |

THL |

Industrials |

24.5 |

1.9% |

| Addison

Group |

2021 |

Trilantic

Capital Partners |

Business

Services |

23.8 |

1.9% |

| Auctane |

2021 |

Thoma

Bravo |

Technology /

IT |

22.7 |

1.8% |

| Excelitas |

2022 |

AEA

Investors |

Industrials |

21.9 |

1.7% |

| Solace

Systems |

2016 |

Bridge Growth

Partners |

Technology /

IT |

21.2 |

1.7% |

| Qpark |

2017 |

KKR |

Transportation |

20.0 |

1.6% |

| Renaissance

Learning |

2018 |

Francisco

Partners |

Technology /

IT |

19.5 |

1.5% |

| Exact |

2019 |

KKR |

Technology /

IT |

19.1 |

1.5% |

| Bylight |

2017 |

Sagewind

Partners |

Technology /

IT |

18.7 |

1.5% |

| USI |

2017 |

KKR |

Financial

Services |

18.4 |

1.4% |

|

Total Top 30 Investments |

|

|

925.9 |

72.9% |

*Undisclosed company due to confidentiality

provisions.

| Geography |

%

of Portfolio |

| North

America |

74% |

| Europe |

25% |

| Asia / Rest of

World |

1% |

|

Total Portfolio |

100% |

| |

|

| Industry |

%

of Portfolio |

| Consumer /

E-commerce |

22% |

| Tech, Media

& Telecom |

22% |

| Industrials /

Industrial Technology |

17% |

| Financial

Services |

13% |

| Business

Services |

12% |

|

Healthcare |

9% |

| Other |

4% |

| Energy |

1% |

|

Total Portfolio |

100% |

| |

|

| Vintage Year |

%

of Portfolio |

| 2016 &

Earlier |

11% |

| 2017 |

19% |

| 2018 |

14% |

| 2019 |

14% |

| 2020 |

14% |

| 2021 |

16% |

| 2022 |

5% |

| 2023 |

2% |

| 2024 |

5% |

|

Total Portfolio |

100% |

About NB Private Equity Partners

Limited

NBPE invests in direct private equity investments alongside market

leading private equity firms globally. NB Alternatives Advisers LLC

(the “Investment Manager”), an indirect wholly owned subsidiary of

Neuberger Berman Group LLC, is responsible for sourcing, execution

and management of NBPE. The vast majority of direct investments are

made with no management fee / no carried interest payable to

third-party GPs, offering greater fee efficiency than other listed

private equity companies. NBPE seeks capital appreciation through

growth in net asset value over time while paying a bi-annual

dividend.

LEI number: 213800UJH93NH8IOFQ77

About Neuberger Berman

Neuberger Berman is an employee-owned, private, independent

investment manager founded in 1939 with over 2,800 employees in 26

countries. The firm manages $481 billion of equities, fixed income,

private equity, real estate and hedge fund portfolios for global

institutions, advisors and individuals. Neuberger Berman’s

investment philosophy is founded on active management, fundamental

research and engaged ownership. The PRI identified the firm as part

of the Leader’s Group, a designation awarded to fewer than 1% of

investment firms for excellence in environmental, social and

governance practices. Neuberger Berman has been named by Pensions

& Investments as the #1 or #2 Best Place to Work in Money

Management for each of the last ten years (firms with more than

1,000 employees). Visit www.nb.com for more information. Data as of

June 30, 2024.

1 Based on net asset value.

2 One company valued as of 31 May 2024.

3 While the Company declares

dividends in US Dollars, Shareholders will receive Sterling

dividends at the prevailing rate at the time of currency

conversion, unless an election to receive dividends in US Dollars

is made on forms which are available on NBPE’s website prior to the

currency election date listed below. If an investor has previously

elected to receive US Dollars, that election will be used unless

changed. Investors may also participate in a dividend re-investment

plan (forms for which are available on NBPE’s website) if they wish

to increase their shareholdings instead of receiving cash

dividends.

- June 2024 NBPE FactsheetvF

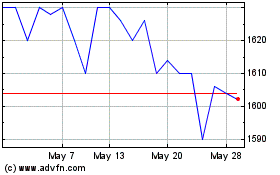

Nb Private Equity Partners (LSE:NBPE)

Historical Stock Chart

From Oct 2024 to Nov 2024

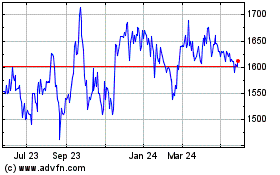

Nb Private Equity Partners (LSE:NBPE)

Historical Stock Chart

From Nov 2023 to Nov 2024