TIDMMXCT TIDMTTM

RNS Number : 0207S

MaxCyte, Inc.

11 November 2021

MaxCyte Reports Third Quarter Financial Results

GAITHERSBURG, MD, November 11, 2021 - MaxCyte, Inc., (NASDAQ:

MXCT; LSE: MXCT, MXCN), a leading commercial cell-engineering

company focused on providing enabling platform technologies to

advance innovative cell-based research as well as next-generation

cell therapeutic discovery, development and commercialization,

today announced third quarter ended September 30, 2021 financial

results.

Third Quarter and Recent Highlights

-- Total revenue was $10.1 million in the third quarter of 2021,

representing 50% growth compared to the same period in 2020.

-- Excluding Strategic Platform License (SPL) Program-related

revenue, revenue from cell therapy customers was $6.2 million for

the third quarter, an increase of 38% compared to the same period

in 2020.

-- SPL Program-related revenue was $2.0 million in the third

quarter -- the highest SPL Program-related revenue we have received

in any quarter to-date -- as compared to $0.3 million for the same

period in 2020.

-- Revenue from drug discovery customers was $1.9 million in the

third quarter, a decrease of 5% compared to the same period in

2020, but up sequentially from the second quarter of 2021.

-- With the addition of Myeloid Therapeutics, Inc., Celularity,

Inc., Sana Biotechnology, Inc., and Nkarta, Inc. signed

year-to-date, the total number of SPLs now stands at 15.

"We are pleased to report very strong third quarter results

driven by ongoing strength in sales to cell therapy customers and

robust SPL Program-related revenue." said Doug Doerfler, President

and CEO of MaxCyte.

"We continue to expand our customer base and increase the number

of strategic partnerships, now with 15 SPL agreements in place

following the announcement of our agreement with Nkarta in early

November. The vast majority of our SPL agreements enable MaxCyte to

participate in pre-commercial milestones and post-commercial

sales-based payments on SPL-related Programs. We remain bullish

around the potential for our SPL partnerships to generate

meaningful revenue for the business over the next 12 to 18 months

and beyond as our partners continue to see clinical success.

We are also making important and strategic investments in our

business, expanding our marketing, R&D and product development

capabilities, launching innovative solutions to drive future

growth, bolstering our leading internal and field-based cell

engineering expertise, expanding our manufacturing capabilities as

our customers move closer to commercialization, and adding strong

talent across all facets of our business."

"Overall, MaxCyte remains well-positioned to support growing

adoption of the ExPERT(TM) platform technology for cellular-based

research and next-generation therapeutic development."

Third Quarter Financial Results

Total revenue for the third quarter of 2021 was $10.1 million,

compared to $6.8 million in the third quarter of 2020, representing

growth of 50%. Sales to cell therapy customers, across both

instruments and single use disposables, were collectively up 38%

compared to the same period last year.

Success in recognizing revenue from our SPL Programs was also a

primary source of strength in the quarter. The Company recognized

$2.0 million in SPL Program-related revenue in the quarter

(comprised of pre-commercial milestone revenues) as compared to

$0.3 million in SPL Program-related revenue in the third quarter of

2020.

Gross profit for the third quarter of 2021 was $9.2 million (91%

gross margin), compared to $6.0 million (89% gross margin) in the

same period of the prior year. The increase in gross margin was

driven by the higher SPL Program-related revenues; excluding SPL

Program-related revenues, gross margin was relatively

unchanged.

Operating expenses for the third quarter of 2021 were $11.6

million, compared to operating expenses of $8.9 million in the

third quarter of 2020. The overall increase in operating expense

was principally driven by a $3.4 million increase in compensation

expense associated with increased headcount and higher stock-based

compensation (principally due to stock-price appreciation), as well

as a $1.2 million increase in legal, public company and

professional service expenses.

Partially offsetting this expense growth was a $2.5 million

decline in CARMA(TM)-related expenses compared with the same period

last year. As of March 2021, all pre-clinical and clinical

activities related to the CARMA(TM) platform were substantially

completed.

Third quarter 2021 net loss was ($2.7) million compared to net

loss of ($3.1) million for the same period in 2020.

Total cash, cash equivalents and short-term investments were

$255.9 million as of September 30, 2021.

Preliminary 2021 Revenue

We are updating our revenue projection for fiscal year 2021. We

now expect to achieve at least $33.0 million in revenue for fiscal

year 2021, up from our prior guidance of greater than $30 million

in revenue for the year.

Executive Leadership Addition

James Lovgren has joined MaxCyte as Senior Vice President of

Global Marketing. Mr. Lovgren brings deep experience in cell

therapy to the role, where he will help grow adoption of the

MaxCyte ExPERT(TM) platform in cellular-based research and

next-generation drug development. Most recently, Mr. Lovgren served

as Vice President at Berkeley Lights, where he was responsible for

cell therapy strategy, including product development and marketing.

Previously, he served as General Manager at Thermo Fisher

Scientific in the cell and gene therapy business, overseeing the

launch of several strategic products. He also held leadership

positions at Minerva Biotechnologies, ORGN3N and Life Technologies.

Mr. Lovgren earned his master's degree in business administration

at North Carolina State University and his bachelor's degree in

biology at University of North Florida.

Webcast and Conference Call Details

MaxCyte will host a conference call today, November 10, 2021, at

4:30 p.m. Eastern Time. Interested parties may access the live

teleconference by dialing (844) 679-0933 for domestic callers or

(918) 922-6914 for international callers, followed by Conference

ID: 5098687. A live and archived webcast of the event will be

available on the "Events" section of the MaxCyte website at

https://investors.maxcyte.com/ .

Form 10-Q

MaxCyte expects to file its Quarterly Report on Form 10-Q for

the period ended September 30, 2021 with the SEC on November 10,

2021. When filed, a copy of the Form 10-Q will be available on the

SEC's website at www.sec.gov and will also be available under the

"SEC filings" page of the Investors section of the Company's

website, https://investors.maxcyte.com/ .

About MaxCyte

MaxCyte is a leading commercial cell-engineering company focused

on providing enabling platform technologies to advance innovative

cell-based research as well as next-generation cell therapeutic

discovery, development and commercialization. Over the past 20

years, we have developed and commercialized our proprietary Flow

Electroporation(R) platform, which facilitates complex engineering

of a wide variety of cells. Our ExPERT(TM) platform, which is based

on our Flow Electroporation technology, has been designed to

support the rapidly expanding cell therapy market and can be

utilized across the continuum of the high-growth cell therapy

sector, from discovery and development through commercialization of

next-generation, cell-based medicines. The ExPERT family of

products includes: three instruments, the ATx(TM), STx(TM) and

GTx(TM); a portfolio of proprietary related disposable processing

assemblies; and software protocols, all supported by a robust

worldwide intellectual property portfolio.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding our revenue guidance for the year ending

December 31, 2021 and expectations regarding adoption of the

ExPERT(TM) platform, expansion of and revenue from our SPL Programs

and the progression of our customers' programs into and through

clinical trials. The words "may," "might," "will," "could,"

"would," "should," "expect," "plan," "anticipate," "intend,"

"believe," "expect," "estimate," "seek," "predict," "future,"

"project," "potential," "continue," "target" and similar words or

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Any forward-looking statements in this press

release are based on management's current expectations and beliefs

and are subject to a number of risks, uncertainties and important

factors that may cause actual events or results to differ

materially from those expressed or implied by any forward-looking

statements contained in this press release, including, without

limitation, risks associated with the impact of COVID-19 on our

operations; the timing of our customers' ongoing and planned

clinical trials; the adequacy of our cash resources and

availability of financing on commercially reasonable terms; and

general market and economic conditions. These and other risks and

uncertainties are described in greater detail in the section

entitled "Risk Factors" in our final prospectus dated July 29,

2021, filed with the Securities and Exchange Commission on July 30,

2021, as well as discussions of potential risks, uncertainties, and

other important factors in the other filings that we make with the

Securities and Exchange Commission from time to time. These

documents are available under the "SEC filings" page of the

Investors section of our website at http://investors.maxcyte.com.

Any forward-looking statements represent our views only as of the

date of this press release and should not be relied upon as

representing our views as of any subsequent date. We explicitly

disclaim any obligation to update any forward-looking statements,

whether

as a result of new information, future events or otherwise. No

representations or warranties (expressed or implied) are made about

the accuracy of any such forward-looking statements.

MaxCyte Contacts:

US IR Adviser +1 415-937-5400

Gilmartin Group ir@maxcyte.com

David Deuchler, CFA

Nominated Adviser and Joint Corporate Broker

Panmure Gordon

Emma Earl / Freddy Crossley

Corporate Broking

Rupert Dearden +44 (0)20 7886 2500

UK IR Adviser +44 (0)203 709 5700

Consilium Strategic Communications maxcyte@consilium-comms.com

Mary-Jane Elliott

Chris Welsh

MaxCyte, Inc.

Condensed Consolidated Balance Sheets

September December

30, 31,

2021 2020

--------------- --------------

(Unaudited) (Note 2)

Assets

Current assets:

Cash and cash equivalents $ 58,973,500 $ 18,755,200

Short-term investments, at amortized cost 196,914,700 16,007,500

Accounts receivable, net 5,958,100 5,171,900

Inventory, net 4,148,400 4,315,800

Other current assets 3,541,900 1,003,000

-------------- -------------

Total current assets 269,536,600 45,253,400

Property and equipment, net 6,810,100 4,546,200

Right of use asset - operating leases 1,025,100 1,728,300

Right of use asset - finance leases - 218,300

Other assets 318,100 33,900

-------------- -------------

Total assets $ 277,689,900 $ 51,780,100

============== =============

Liabilities and stockholders' equity

Current liabilities:

Accounts payable $ 723,300 $ 890,200

Accrued expenses and other 4,955,800 5,308,500

Operating lease liability, current 572,300 572,600

Deferred revenue, current portion 6,325,800 4,843,000

-------------- -------------

Total current liabilities 12,577,200 11,614,300

Note payable, net of discount, and deferred

fees - 4,917,000

Operating lease liability, net of current

portion 500,200 1,234,600

Other liabilities 496,600 788,800

-------------- -------------

Total liabilities 13,574,000 18,554,700

-------------- -------------

Commitments and contingencies (Note 7)

Stockholders' equity

Common stock, $0.01 par value; 200,000,000

shares authorized, 100,434,032 and 77,382,473

shares issued and outstanding at September

30, 2021 and December 31, 2020, respectively 1,004,300 773,800

Additional paid-in capital 372,541,700 127,673,900

Accumulated deficit (109,430,100) (95,222,300)

-------------- -------------

Total stockholders' equity 264,115,900 33,225,400

-------------- -------------

Total liabilities and stockholders' equity $ 277,689,900 $ 51,780,100

============== =============

MaxCyte, Inc.

Unaudited Condensed Consolidated Statements of Operations

Three Months Ended September 30, Nine Months Ended September 30,

------------------------------------ -----------------------------------

2021 2020 2021 2020

------------------- --------------- ------------------- --------------

Revenue $ 10,139,100 $ 6,762,600 $ 23,742,100 $ 17,654,900

Cost of goods sold 943,800 734,800 2,421,500 1,860,100

--------------- -------------- --------------- -------------

Gross profit 9,195,300 6,027,800 21,320,600 15,794,800

--------------- -------------- --------------- -------------

Operating expenses:

Research and development 2,774,800 4,517,900 12,058,000 12,852,800

Sales and marketing 3,211,500 2,039,000 8,913,500 5,933,000

General and administrative 5,651,900 2,313,200 13,582,500 5,684,200

--------------- -------------- --------------- -------------

Total operating expenses 11,638,200 8,870,100 34,554,000 24,470,000

--------------- -------------- --------------- -------------

Operating loss (2,442,900) (2,842,300) (13,233,400) (8,675,200)

--------------- -------------- --------------- -------------

Other income (expense):

Interest and other expense (289,000) (263,200) (1,044,400) (545,000)

Interest income 51,500 6,800 70,000 55,500

--------------- -------------- --------------- -------------

Total other income (expense) (237,500) (256,400) (974,400) (489,500)

--------------- -------------- --------------- -------------

Provision for income taxes - - - -

--------------- -------------- --------------- -------------

Net loss $ (2,680,400) $ (3,098,700) $ (14,207,800) $ (9,164,700)

=============== ============== =============== =============

Basic and diluted net loss

per share $ (0.03) $ (0.04) $ (0.16) $ (0.14)

=============== ============== =============== =============

Weighted average shares

outstanding, basic and

diluted 84,706,516 77,085,305 87,178,217 66,812,252

=============== ============== =============== =============

MaxCyte, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

Nine Months Ended September

30,

-------------------------------

2021 2020

--------------- --------------

Cash flows from operating activities:

Net loss $ (14,207,800) $ (9,164,700)

Adjustments to reconcile net loss to net cash

used in operating activities:

Depreciation and amortization 1,007,400 768,500

Net book value of consigned equipment sold 39,200 35,700

Loss on disposal of fixed assets 18,500 6,500

Fair value adjustment of liability classified

warrant 645,400 199,400

Stock-based compensation 5,510,400 1,704,600

Bad debt recovery - (117,200)

Amortization of discounts on short-term investments (39,500) (5,300)

Noncash interest expense 5,400 16,300

Changes in operating assets and liabilities:

Accounts receivable (786,200) (379,200)

Inventory (300,200) (782,200)

Other current assets (2,538,900) (357,000)

Right of use asset - operating leases 858,000 390,200

Right of use asset - finance lease 63,500 59,600

Other assets (284,200) (33,900)

Accounts payable, accrued expenses and other (431,350) (548,900)

Operating lease liability (734,700) (278,600)

Deferred revenue 1,482,800 1,461,300

Other liabilities (27,100) 155,000

-------------- -------------

Net cash used in operating activities (9,719,350) (6,869,900)

-------------- -------------

Cash flows from investing activities:

Purchases of short-term investments (202,867,700) (16,988,400)

Maturities of short-term investments 22,000,000 2,500,000

Purchases of property and equipment (2,712,050) (1,713,300)

Proceeds from sale of equipment 4,600 -

-------------- -------------

Net cash used in investing activities (183,575,150) (16,201,700)

-------------- -------------

Cash flows from financing activities:

Net proceeds from issuance of common stock 236,077,300 28,567,200

Borrowings under notes payable - 1,440,000

Principal payments on notes payable (4,922,400) (1,440,000)

Proceeds from exercise of stock options 2,424,000 285,900

Principal payments on finance leases (66,100) (39,500)

-------------- -------------

Net cash provided by financing activities 233,512,800 28,813,600

-------------- -------------

Net increase in cash and cash equivalents 40,218,300 5,742,000

Cash and cash equivalents, beginning of period 18,755,200 15,210,800

-------------- -------------

Cash and cash equivalents, end of period $ 58,973,500 $ 20,952,800

============== =============

MaxCyte, Inc.

Unaudited Revenue by Market (in thousands)

Three Months Ended Nine Months Ended September

September 30, 30,

--------------------- ------------------------------

2021 2020 2021 2020

----------- -------- -------------- --------------

Cell Therapy $ 6,226 $ 4,509 $ 15,721 $ 10,697

Drug Discovery 1,909 2,002 5,510 4,952

Program-related 2,004 252 2,512 2,005

----------- -------- -------------- --------------

Total Revenue $ 10,139 $ 6,763 $ 23,742 $ 17,655

=========== ======== ============== ==============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTBMBBTMTIBTMB

(END) Dow Jones Newswires

November 11, 2021 02:00 ET (07:00 GMT)

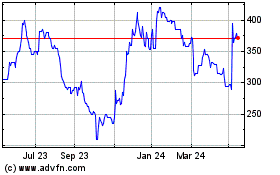

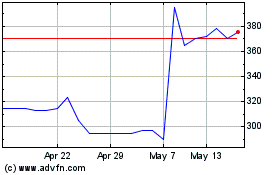

Maxcyte (LSE:MXCT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Maxcyte (LSE:MXCT)

Historical Stock Chart

From Jul 2023 to Jul 2024