TIDMMXC

RNS Number : 6590Y

MGC Pharmaceuticals Limited

14 May 2021

MGC Pharmaceuticals Ltd

Option Conversion - Appendix 2A & Escrow Shares

14 May 2021

ASX Code: MXC

LSE Code: MXC

MGC Pharmaceuticals Ltd (ASX: MXC, 'MGC Pharma' or 'the

Company'), confirms the attached Appendix 2A refers to:

1. The issue of 26,884,731 ordinary shares following the

acquisition of MediCaNL Inc ( MediCaNL ), amounting to $1,800,000

which represents 30% of the total consideration.

2. The issue of 555,555 ordinary shares following the exercise

of $0.045 Listed Options for a total consideration of $25,000.

Release of Shares from Voluntary Escrow:

Furthermore, the Company wishes to advise in accordance with ASX

Listing Rule 3.10A, that 15,151,515 fully paid ordinary shares held

by Cannvalate Pty Ltd ( Escrowed Shares ) will be released from

voluntary escrow on 21 May 2021.

The Escrowed Shares were subject to voluntary escrow

restrictions following the acquisition of Medicinal Cannabis

Clinics, as announced on 23 November 2022. 15,151,515 ordinary

shares will remain in escrow until 23 November 2021.

Cleansing Notice:

Pursuant to section 708A(5)(e) of the Corporations Act 2001

(Cth) (Corporations Act), the Company gives notice in relation to

the 26,884,731 ordinary shares issued to the vendors of MediCaNL

that:

(a) the Company issued the Shares without disclosure under Part 6D.2 of the Corporations Act; and

(b) as at the date of this notice, the Company has complied with

the provisions of Chapter 2M of the Corporations Act as they apply

to the Company;

(c) as at the date of this notice, the Company has complied with

section 674 of the Corporations Act as it applies to the Company;

and

(d) as at the date of this notice, there is no information to be

disclosed which is "excluded information" as defined in subsection

708A(7) of the Corporations Act that is reasonable for investors

and their professional advisors to find in a disclosure

document.

-Ends-

Authorised for issue by Nadine Barry, Company Secretary, further

information, please contact:

PR/IR Advisors - Media & MGC Pharmaceuticals Ltd

Capital Partners Roby Zomer

Rod Hinchcliffe (IR) +61 CEO & Managing Director

412 277 377 +61 8 6382 3390

Rod.Hinchcliffe@mcpartners.com.au info@mgcpharma.com.au

UK Broker - Turner Pope UK PR Advisors - Tavistock

Andy Thacker Charles Vivian +44 207 920 3150

info@TurnerPope.com mgcpharma@tavistock.co.uk

Zoe Alexander +44 20 3657 Tim Pearson +44 7983 118 502

0050

About MGC Pharma

MGC Pharmaceuticals Ltd (LSE: MXC, ASX: MXC) is a European based

bio-pharma company developing and supplying affordable standardised

phytocannabinoid derived medicines to patients globally. The

Company's founders were key figures in the global medical cannabis

industry and the core business strategy is to develop and supply

high quality phytocannabinoid derived medicines for the growing

demand in the medical markets in Europe, North America and

Australasia. MGC Pharma has a robust product offering targeting two

widespread medical conditions - epilepsy and dementia - and has

further products in the development pipeline.

Employing its 'Nature to Medicine' strategy, MGC Pharma has

partnered with renowned institutions and academia to optimise

cultivation and the development of targeted phytocannabinoid

derived medicines products prior to production in the Company's

EU-GMP Certified manufacturing facility.

MGC Pharma has a number of research collaborations with world

renowned academic institutions, and including recent research

highlighting the positive impact of using specific phytocannabinoid

formulations developed by MGC Pharma in the treatment of

glioblastoma, the most aggressive and so far therapeutically

resistant primary brain tumour.

MGC Pharma has a growing patient base in Australia, the UK,

Brazil and Ireland and has a global distribution footprint via an

extensive network of commercial partners meaning that it is poised

to supply the global market.

Follow us through our social media channels :

Twitter: @MGC_Pharma

Facebook: @mgcpharmaceuticals

LinkedIn: MGC Pharmaceuticals Ltd.

Instagram: @mgc_pharma

Appendix 2A

Application for quotation of +securities

Information or documents not available now must be given to ASX

as soon as available. Information and documents given to ASX become

ASX's property and may be made public.

If you are an entity incorporated outside Australia and you are

seeking quotation of a new class of +securities other than CDIs,

you will need to obtain and provide an International Securities

Identification Number (ISIN) for that class. Further information on

the requirement for the notification of an ISIN is available from

the Create Online Forms page. ASX is unable to create the new ISIN

for non-Australian issuers.

*Denotes minimum information required for first lodgement of

this form, with exceptions provided in specific notes for certain

questions. The balance of the information, where applicable, must

be provided as soon as reasonably practicable by the entity.

Part 1 - Entity and announcement details

Question Question Answer

no

1.1 *Name of entity MGC Pharmaceuticals Ltd

We (the entity here named)

apply for +quotation of the

following +securities and

agree to the matters set

out in Appendix 2A of the

ASX Listing Rules. ([1])

-------------------------------------- -------------------------------

1.2 *Registration type and number ABN 30 116 800 269

Please supply your ABN, ARSN,

ARBN, ACN or another registration

type and number (if you supply

another registration type,

please specify both the type

of registration and the registration

number).

-------------------------------------- -------------------------------

1.3 *ASX issuer code

-------------------------------------- -------------------------------

1.4 *This announcement is A new announcement

Tick whichever is applicable. An update/amendment to a

previous announcement

A cancellation of a previous

announcement

-------------------------------------- -------------------------------

1.4a *Reason for update N/A

Mandatory only if "Update"

ticked in Q1.4 above. A reason

must be provided for an update.

-------------------------------------- -------------------------------

1.4b *Date of previous announcement N/A

to this update

Mandatory only if "Update"

ticked in Q1.4 above.

-------------------------------------- -------------------------------

1.4c *Reason for cancellation N/A

Mandatory only if "Cancellation"

ticked in Q1.4 above.

-------------------------------------- -------------------------------

1.4d *Date of previous announcement N/A

to this cancellation

Mandatory only if "Cancellation"

ticked in Q1.4 above.

-------------------------------------- -------------------------------

1.5 *Date of this announcement 14 May 2021

-------------------------------------- -------------------------------

Part 2 - Type of issue

Question Question Answer

No.

2.1 *The + securities to be quoted Being issued as part of

are: a transaction or transactions

Select whichever item is applicable. previously announced to the

If you wish to apply for quotation market in an Appendix 3B

of different types of issues Being issued under a +dividend

of securities, please complete or distribution plan

a separate Appendix 2A for Being issued as a result

each type of issue. of options being exercised

or other +convertible securities

being converted

Unquoted partly paid +securities

that have been paid up and

are now quoted fully paid

+securities

+Restricted securities where

the escrow period has expired

or is about to expire

+Securities previously issued

under an +employee incentive

scheme where the restrictions

on transfer have ceased or

are about to cease

+Securities issued under

an +employee incentive scheme

that are not subject to a

restriction on transfer or

that are to be quoted notwithstanding

there is a restriction on

transfer

Other

------------------------------------------ ----------------------------------------

2.2a.1 *Date of Appendix 3B notifying 1. N/A

the market of the proposed 2. 22 April 2021

issue of +securities for which

quotation is now being sought

Answer this question if your

response to Q2.1 is "Being

issued as part of a transaction

or transactions previously

announced to the market in

an Appendix 3B"

------------------------------------------ ----------------------------------------

2.2a.2 *Are there any further issues Yes

of +securities yet to take

place to complete the transaction(s)

referred to in the Appendix

3B?

Answer this question if your

response to Q2.1 is "Being

issued as part of a transaction

or transactions previously

announced to the market in

an Appendix 3B".

------------------------------------------ ----------------------------------------

2.2a.2.1 *Please provide details of 1. 30% of the consideration

the further issues of +securities shares relating to the MediCaNL

yet to take place to complete acquisition have been issued,

the transaction(s) referred with the remaining 70% to

to in the Appendix 3B be issued over 13 months

Answer this question if your as detailed in the 3B on

response to Q2.1 is "Being 22 April 2021

issued as part of a transaction 2. N/A

or transactions previously

announced to the market in

an Appendix 3B" and your response

to Q2.2a.2 is "Yes".

Please provide details of

the proposed dates and number

of securities for the further

issues. This may be the case,

for example, if the Appendix

3B related to an accelerated

pro rata offer with an institutional

component being quoted on

one date and a retail component

being quoted on a later date.

------------------------------------------ ----------------------------------------

2.2b.1 *Date of Appendix 3A.1 lodged N/A

with ASX in relation to the

underlying +dividend or distribution

Answer this question if your

response to Q2.1 is "Being

issued under a dividend or

distribution plan".

------------------------------------------ ----------------------------------------

2.2b.2 *Does the +dividend or distribution N/A

plan meet the requirement

of listing rule 7.2 exception

4 that it does not impose

a limit on participation?

Answer this question if your

response to Q2.1 is "Being

issued under a dividend or

distribution plan".

Note: Exception 4 only applies

where security holders are

able to elect to receive all

of their dividend or distribution

as securities. For example,

Exception 4 would not apply

in the following circumstances:

1) The entity has specified

a dollar limit on the level

of participation e.g. security

holders can only participate

to a maximum value of $x in

respect of their entitlement,

or 2) The entity has specified

a maximum number of securities

that can participate in the

plan e.g. security holders

can only receive securities

in lieu of dividend payable

for x number of securities.

------------------------------------------ ----------------------------------------

2.2c.1 Please state the number and 1. N/A

type of options that were 2. Listed options (ASX: MXCOE)

exercised or other +convertible exercised at $0.045 into

securities that were converted 555,555 Ordinary Fully Paid

(including their ASX security Shares

code)

Answer this question if your

response to Q2.1 is "Being

issued as a result of options

being exercised or other convertible

securities being converted".

------------------------------------------ ----------------------------------------

2.2c.2 And the date the options were 1. N/A

exercised or other +convertible 2. 10 May 2021

securities were converted

Answer this question if your

response to Q2.1 is "Being

issued as a result of options

being exercised or other convertible

securities being converted".

Note: If this occurred over

a range of dates, enter the

date the last of the options

was exercised or convertible

securities was converted.

------------------------------------------ ----------------------------------------

2.2d.1 Please state the number and N/A

type of partly paid +securities

(including their ASX security

code) that were fully paid

up

Answer this question if your

response to Q2.1 is "Unquoted

partly paid securities that

have been paid up and are

now quoted fully paid securities".

------------------------------------------ ----------------------------------------

2.2d.2 And the date the + securities N/A

were fully paid up

Answer this question if your

response to Q2.1 is "Unquoted

partly paid securities that

have been paid up and are

now quoted fully paid securities".

Note: If this occurred over

a range of dates, enter the

date the last of the securities

was fully paid up.

------------------------------------------ ----------------------------------------

2.2e.1 Please state the number and N/A

type of +restricted securities

(including their ASX security

code) where the escrow period

has expired or is about to

expire

Answer this question if your

response to Q2.1 is "Restricted

securities where the escrow

period has expired or is about

to expire".

------------------------------------------ ----------------------------------------

2.2e.2 And the date the escrow restrictions N/A

have ceased or will cease

Answer this question if your

response to Q2.1 is "Restricted

securities where the escrow

period has expired or is about

to expire".

Note: If this occurred over

a range of dates, enter the

date the last of the escrow

restrictions has ceased or

will cease.

------------------------------------------ ----------------------------------------

2.2f.1 Please state the number and N/A

type of +securities (including

their ASX security code) previously

issued under the +employee

incentive scheme where the

restrictions on transfer have

ceased or are about to cease

Answer this question if your

response to Q2.1 is "Securities

previously issued under an

employee incentive scheme

where the restrictions on

transfer have ceased or are

about to cease".

------------------------------------------ ----------------------------------------

2.2f.2 And the date the restrictions N/A

on transfer have ceased or

will cease:

Answer this question if your

response to Q2.1 is "Securities

previously issued under an

employee incentive scheme

where the restrictions on

transfer have ceased or are

about to cease".

Note: If this occurred over

a range of dates, enter the

date the last of the restrictions

on transfer has ceased or

will cease.

------------------------------------------ ----------------------------------------

2.2g.1 Please state the number and N/A

type of +securities (including

their ASX security code) issued

under an +employee incentive

scheme that are not subject

to a restriction on transfer

or that are to be quoted notwithstanding

there is a restriction on

transfer

Answer this question if your

response to Q2.1 is "Securities

issued under an employee incentive

scheme that are not subject

to a restriction on transfer

or that are to be quoted notwithstanding

there is a restriction on

transfer".

------------------------------------------ ----------------------------------------

2.2g.2 *Please attach a document N/A

or provide details of a URL

link for a document lodged

with ASX detailing the terms

of the + employee incentive

scheme or a summary of the

terms.

Answer this question if your

response to Q2.1 is "Securities

issued under an employee incentive

scheme that are not subject

to a restriction on transfer

or that are to be quoted notwithstanding

there is a restriction on

transfer".

------------------------------------------ ----------------------------------------

2.2g.3 *Are any of these +securities N/A

being issued to +key management

personnel (KMP) or an +associate

Answer this question if your

response to Q2.1 is "Securities

issued under an employee incentive

scheme that are not subject

to a restriction on transfer

or that are to be quoted notwithstanding

there is a restriction on

transfer".

------------------------------------------ ----------------------------------------

2.2g.3.a *Provide details of the recipients and the number of

+securities issued to each of them.

Answer this question if your response to Q2.1 is "Securities

issued under an employee incentive scheme that are not

subject to a restriction on transfer or that are to be

quoted notwithstanding there is a restriction on transfer"

and your response to Q2.2g.3 is "Yes". Repeat the detail

in the table below for each KMP involved in the issue.

If the securities are being issued to the KMP, repeat

the name of the KMP or insert "Same" in "Name of registered

holder". If the securities are being issued to an associate

of a KMP, insert the name of the associate in "Name of

registered holder".

Name of KMP Name of registered Number of +securities

holder

------------------------------------------------------------------------------------

2.2h.1 * The purpose(s) for which To raise additional working

the entity is issuing the capital

+securities is: To fund the retirement of

Answer this question if your debt

response to Q2.1 is "Other". To pay for the acquisition

You may select one or more of an asset [provide details

of the items in the list. below]

To pay for services rendered

[provide details below]

Other [provide details below]

Additional details :

------------------------------------------ ----------------------------------------

2.2h.2 *Please provide any further N/A

information needed to understand

the circumstances in which

you are applying to have these

+securities quoted on ASX,

including (if applicable)

why the issue of the +securities

has not been previously announced

to the market in an Appendix

3B

You must answer this question

if your response to Q2.1 is

"Other". If there is no other

information to provide, please

answer "Not applicable" or

"N/A".

------------------------------------------ ----------------------------------------

2.2i *Are these +securities being N/A

offered under a +disclosure

document or +PDS?

Answer this question if your

response to Q2.1 is any option

other than "Being issued as

part of a transaction or transactions

previously announced to the

market in an Appendix 3B".

------------------------------------------ ----------------------------------------

2.2i.1 *Date of +disclosure document N/A

or +PDS?

Answer this question if your

response to Q2.1 is any option

other than "Being issued as

part of a transaction or transactions

previously announced to the

market in an Appendix 3B"

and your response to Q2.2i

is "Yes".

Under the Corporations Act,

the entity must apply for

quotation of the securities

within 7 days of the date

of the disclosure document

or PDS.

------------------------------------------ ----------------------------------------

2.3 *The +securities to be quoted Additional +securities in

are: a class that is already quoted

Tick whichever is applicable on ASX ("existing class")

New +securities in a class

that is not yet quoted on

ASX ("new class")

------------------------------------------ ----------------------------------------

Part 3A - number and type of +securities to be quoted (existing

class or new class) where issue has previously been notified to ASX

in an Appendix 3B

Answer the questions in this Part if your response to Q2.1 is

"Being issued as part of a transaction or transactions previously

announced to the market in an Appendix 3B" and your response to

Q2.3 is "existing class" or "new class".

Question Question Answer

No.

3A.1 *ASX security code & description -

--------------------------------- -------

3A.2 *Number of +securities to -

be quoted

--------------------------------- -------

Part 3B - number and type of +securities to be quoted (existing

class) where issue has not previously been notified to ASX in an

Appendix 3B

Answer the questions in this Part if your response to Q2.1 is

anything other than "Being issued as part of a transaction or

transactions previously announced to the market in an Appendix 3B"

and your response to Q2.3 is "existing class".

Question Question Answer

No.

3B.1 *ASX security code & description MXC

--------------------------------------------------------- ---------------------------

3B.2 *Number of +securities to 27,440,286 ordinary shares

be quoted

--------------------------------------------------------- ---------------------------

3B.3a *Will the +securities to be Yes

quoted rank equally in all

respects from their issue

date with the existing issued

+securities in that class?

--------------------------------------------------------- ---------------------------

3B.3b *Is the actual date from which N/A

the +securities will rank

equally (non-ranking end date)

known?

Answer this question if your

response to Q3B.3a is "No".

--------------------------------------------------------- ---------------------------

3B.3c *Provide the actual non-ranking N/A

end date

Answer this question if your

response to Q3B.3a is "No"

and your response to Q3B.3b

is "Yes".

--------------------------------------------------------- ---------------------------

3B.3d *Provide the estimated non-ranking N/A

end period

Answer this question if your

response to Q3B.3a is "No"

and your response to Q3B.3b

is "No".

--------------------------------------------------------- ---------------------------

3B.3e *Please state the extent to N/A

which the +securities do not

rank equally:

* in relation to the next dividend, distribution or

interest payment; or

* for any other reason

Answer this question if your

response to Q3B.3a is "No".

For example, the securities

may not rank at all, or may

rank proportionately based

on the percentage of the period

in question they have been

on issue, for the next dividend,

distribution or interest payment;

or they may not be entitled

to participate in some other

event, such as an entitlement

issue.

--------------------------------------------------------- ---------------------------

Part 3C - number and type of +securities to be quoted (new

class) where issue has not previously been notified to ASX in an

Appendix 3B

Answer the questions in this Part if your response to Q2.1 is

anything other than "Being issued as part of a transaction or

transactions previously announced to the market in an Appendix 3B"

and your response to Q2.3 is "new class".

Question Question Answer

No.

3C.1 *Security description N/A

-------------------------------------------------------------- -------------------------------------

3C.2 *Security type Ordinary fully or partly

Select one item from the list paid shares/units

that best describes the securities Options

the subject of this form. +Convertible debt securities

This will determine more detailed Non-convertible +debt securities

questions to be asked about Redeemable preference shares/units

the security later in this Other

section. Select "ordinary

fully or partly paid shares/units"

for stapled securities or

CDIs. For interest rate securities,

please select the appropriate

choice from either "Convertible

debt securities" or "Non-convertible

debt securities". Select "Other"

for performance shares/units

and performance options/rights

or if the selections available

in the list do not appropriately

describe the security being

issued.

-------------------------------------------------------------- -------------------------------------

3C.3 ISIN code N/A

Answer this question if you

are an entity incorporated

outside Australia and you

are seeking quotation of a

new class of securities other

than CDIs. See also the note

at the top of this form.

-------------------------------------------------------------- -------------------------------------

3C.4 *Number of +securities to N/A

be quoted

-------------------------------------------------------------- -------------------------------------

3C.5a *Will all the +securities N/A

issued in this class rank

equally in all respects from

the issue date?

-------------------------------------------------------------- -------------------------------------

3C.5b *Is the actual date from which N/A

the +securities will rank

equally (non-ranking end date)

known?

Answer this question if your

response to Q3C.5a is "No".

-------------------------------------------------------------- -------------------------------------

3C.5c *Provide the actual non-ranking N/A

end date

Answer this question if your

response to Q3C.5a is "No"

and your response to Q3C.5b

is "Yes".

-------------------------------------------------------------- -------------------------------------

3C.5d *Provide the estimated non-ranking N/A

end period

Answer this question if your

response to Q3C.5a is "No"

and your response to Q3C.5b

is "No".

-------------------------------------------------------------- -------------------------------------

3C.5e *Please state the extent to N/A

which the +securities do not

rank equally:

* in relation to the next dividend, distribution or

interest payment; or

* for any other reason

Answer this question if your

response to Q3C.5a is "No".

For example, the securities

may not rank at all, or may

rank proportionately based

on the percentage of the period

in question they have been

on issue, for the next dividend,

distribution or interest payment;

or they may not be entitled

to participate in some other

event, such as an entitlement

issue.

-------------------------------------------------------------- -------------------------------------

3C.6 Please attach a document or N/A

provide a URL link for a document

lodged with ASX setting out

the material terms of the

+securities to be quoted

You may cross-reference a

disclosure document, PDS,

information memorandum, investor

presentation or other announcement

with this information provided

it has been released to the

ASX Market Announcements Platform.

-------------------------------------------------------------- -------------------------------------

3C.7 *Have you received confirmation N/A

from ASX that the terms of

the +securities are appropriate

and equitable under listing

rule 6.1?

Answer this question only

if you are an ASX Listing.

(ASX Foreign Exempt Listings

and ASX Debt Listings do not

have to answer this question).

If your response is "No" and

the securities have any unusual

terms, you should approach

ASX as soon as possible for

confirmation under listing

rule 6.1 that the terms are

appropriate and equitable.

-------------------------------------------------------------- -------------------------------------

3C.8 *Provide a distribution schedule for the new +securities

according to the categories set out in the left hand

column - including the number of recipients and the total

percentage of the new +securities held by the recipients

in each category. Number of +securities Number of holders Total percentage

held of +securities held

1 - 1,000 N/A

------------------ ---------------------

1,001 - 5,000

------------------ ---------------------

5,001 - 10,000

------------------ ---------------------

10,001 - 100,000

------------------ ---------------------

100,001 and over

------------------ ---------------------

Answer this question only if you are an ASX Listing (ASX

Foreign Exempt Listings and ASX Debt Listings do not

have to answer this question) and the securities to be

quoted have already been issued.

Note: if the securities to be quoted have not yet been

issued, under listing rule 3.10.5, you will need to provide

to ASX a list of the 20 largest recipients of the new

+securities, and the number and percentage of the new

+securities received by each of those recipients, and

a distribution schedule for the securities when they

are issued.

-----------------------------------------------------------------------------------------------------

3C.9a Ordinary fully or partly paid shares/units details

Answer the questions in this section if you selected

this security type in your response to Question 3C.2.

-----------------------------------------------------------------------------------------------------

* + Security currency N/A

This is the currency in which

the face amount of an issue

is denominated. It will also

typically be the currency

in which distributions are

declared.

------------------------------------------------------------ ---------------------------------------

*Will there be CDIs issued N/A

over the + securities?

------------------------------------------------------------ ---------------------------------------

*CDI ratio N/A

Answer this question if you

answered "Yes" to the previous

question. This is the ratio

at which CDIs can be transmuted

into the underlying security

(e.g. 4:1 means 4 CDIs represent

1 underlying security whereas

1:4 means 1 CDI represents

4 underlying securities).

------------------------------------------------------------ ---------------------------------------

*Is it a partly paid class N/A

of + security?

------------------------------------------------------------ ---------------------------------------

*Paid up amount: unpaid amount N/A

Answer this question if answered

"Yes" to the previous question.

The paid up amount represents

the amount of application

money and/or calls which

have been paid on any security

considered 'partly paid'

The unpaid amount represents

the unpaid or yet to be called

amount on any security considered

'partly paid'.

The amounts should be provided

per the security currency

(e.g. if the security currency

is AUD, then the paid up

and unpaid amount per security

in AUD).

------------------------------------------------------------ ---------------------------------------

*Is it a stapled + security? N/A

This is a security class

that comprises a number of

ordinary shares and/or ordinary

units issued by separate

entities that are stapled

together for the purposes

of trading.

------------------------------------------------------------ ---------------------------------------

3C.9b Option details

Answer the questions in this section if you selected

this security type in your response to Question 3C.2.

-----------------------------------------------------------------------------------------------------

* + Security currency N/A

This is the currency in which

the exercise price is payable.

------------------------------------------------------------ ---------------------------------------

*Exercise price N/A

The price at which each option

can be exercised and convert

into the underlying security.

The exercise price should

be provided per the security

currency (i.e. if the security

currency is AUD, the exercise

price should be expressed

in AUD).

------------------------------------------------------------ ---------------------------------------

*Expiry date N/A

The date on which the options

expire or terminate.

------------------------------------------------------------ ---------------------------------------

*Details of the number and N/A

type of + security (including

its ASX security code if

the + security is quoted

on ASX) that will be issued

if an option is exercised

For example, if the option

can be exercised to receive

one fully paid ordinary share

with ASX security code ABC,

please insert "One fully

paid ordinary share (ASX:ABC)".

------------------------------------------------------------ ---------------------------------------

3C.9c Details of non-convertible +debt securities, +convertible

debt securities, or redeemable preference shares/units

Answer the questions in this section if you selected

one of these security types in your response to Question

3C.2.

Refer to Guidance Note 34 and the " Guide to the Naming

Conventions and Security Descriptions for ASX Quoted

Debt and Hybrid Securities " for further information

on certain terms used in this section

-----------------------------------------------------------------------------------------------------

*Type of + security Simple corporate bond

Select one item from the Non-convertible note or bond

list Convertible note or bond

Preference share/unit

Capital note

Hybrid security

Other

------------------------------------------------------------ ---------------------------------------

* + Security currency N/A

This is the currency in which

the face value of the security

is denominated. It will also

typically be the currency

in which interest or distributions

are paid.

------------------------------------------------------------ ---------------------------------------

Face value N/A

This is the principal amount

of each security.

The face value should be

provided per the security

currency (i.e. if security

currency is AUD, then the

face value per security in

AUD).

------------------------------------------------------------ ---------------------------------------

*Interest rate type Fixed rate

Select one item from the Floating rate

list Indexed rate

Select the appropriate interest Variable rate

rate type per the terms of Zero coupon/no interest

the security. Definitions Other

for each type are provided

in the Guide to the Naming

Conventions and Security

Descriptions for ASX Quoted

Debt and Hybrid Securities

------------------------------------------------------------ ---------------------------------------

Frequency of coupon/interest Monthly

payments per year Quarterly

Select one item from the Semi-annual

list. Annual

No coupon/interest payments

Other

------------------------------------------------------------ ---------------------------------------

First interest payment date N/A

A response is not required

if you have selected "No

coupon/interest payments"

in response to the question

above on the frequency of

coupon/interest payments

------------------------------------------------------------ ---------------------------------------

Interest rate per annum N/A

Answer this question if the

interest rate type is fixed.

------------------------------------------------------------ ---------------------------------------

*Is the interest rate per N/A

annum estimated at this time?

Answer this question if the

interest rate type is fixed.

------------------------------------------------------------ ---------------------------------------

If the interest rate per N/A

annum is estimated, then

what is the date for this

information to be announced

to the market (if known)

Answer this question if the

interest rate type is fixed

and your response to the

previous question is "Yes".

Answer "Unknown" if the date

is not known at this time.

------------------------------------------------------------ ---------------------------------------

*Does the interest rate include N/A

a reference rate, base rate

or market rate (e.g. BBSW

or CPI)?

Answer this question if the

interest rate type is floating

or indexed.

------------------------------------------------------------ ---------------------------------------

*What is the reference rate, N/A

base rate or market rate?

Answer this question if the

interest rate type is floating

or indexed and your response

to the previous question

is "Yes".

------------------------------------------------------------ ---------------------------------------

*Does the interest rate include N/A

a margin above the reference

rate, base rate or market

rate?

Answer this question if the

interest rate type is floating

or indexed.

------------------------------------------------------------ ---------------------------------------

*What is the margin above N/A

the reference rate, base

rate or market rate (expressed

as a percent per annum)

Answer this question if

the interest rate type is

floating or indexed and your

response to the previous

question is "Yes" .

------------------------------------------------------------ ---------------------------------------

*S128F of the Income Tax s128F exempt

Assessment Act status applicable Not s128F exempt

to the + security s128F exemption status unknown

Select one item from the Not applicable

list

For financial products which

are likely to give rise to

a payment to which s128F

of the Income Tax Assessment

Act applies, ASX requests

issuers to confirm the s128F

status of the security:

* "s128F exempt" means interest payments are not

taxable to non-residents;

* "Not s128F exempt" means interest payments are

taxable to non-residents;

* "s128F exemption status unknown" means the issuer is

unable to advise the status;

* "Not applicable" means s128F is not applicable to

this security

------------------------------------------------------------ ---------------------------------------

*Is the + security perpetual N/A

(i.e. no maturity date)?

------------------------------------------------------------ ---------------------------------------

*Maturity date N/A

Answer this question if the

security is not perpetual

------------------------------------------------------------ ---------------------------------------

*Select other features applicable Simple

to the + security Subordinated

Up to 4 features can be selected. Secured

Further information is available Converting

in the Guide to the Naming Convertible

Conventions and Security Transformable

Descriptions for ASX Quoted Exchangeable

Debt and Hybrid Securities. Cumulative

Non-Cumulative

Redeemable

Extendable

Reset

Step-Down

Step-Up

Stapled

None of the above

------------------------------------------------------------ ---------------------------------------

*Is there a first trigger N/A

date on which a right of

conversion, redemption, call

or put can be exercised (whichever

is first)?

------------------------------------------------------------ ---------------------------------------

*If yes, what is the first N/A

trigger date

Answer this question if

your response to the previous

question is "Yes" .

------------------------------------------------------------ ---------------------------------------

Details of the number and N/A

type of + security (including

its ASX security code if

the + security is quoted

on ASX) that will be issued

if the +securities to be

quoted are converted, transformed

or exchanged

Answer this question if the

security features include

"converting", "convertible",

"transformable" or "exchangeable".

For example, if the security

can be converted into 1,000

fully paid ordinary shares

with ASX security code ABC,

please insert "1,000 fully

paid ordinary shares (ASX:ABC)".

------------------------------------------------------------ ---------------------------------------

Part 4 - Issue details

Question Question Answer

No.

4.1 *Have the +securities to Yes

be quoted been issued yet?

------------------------------------ --------------------------------------

4.1a *What was their date of issue? 1. 10 May 2021

Answer this question if your 2. 10 May 2021

response to Q4.1 is "Yes".

------------------------------------ --------------------------------------

4.1b *What is their proposed date N/A

of issue?

Answer this question if your

response to Q4.1 is "No".

------------------------------------ --------------------------------------

4.2 *Are the +securities to be 1. No

quoted being issued for a 2. Yes, 555,555 Shares issued

cash consideration? on exercise of options

If the securities are being

issued for nil cash consideration,

answer this question "No".

------------------------------------ --------------------------------------

4.2a *In what currency is the AUD

cash consideration being

paid

For example, if the consideration

is being paid in Australian

Dollars, state AUD.

Answer this question if your

response to Q4.2 is "Yes".

------------------------------------ --------------------------------------

4.2b * What is the issue price 1. N/A

per +security 2. Exercise price - $0.045

Answer this question if your (555,555 listed Options) expiry

response to Q4.2 is "Yes" 31 August 2021

and by reference to the issue

currency provided in your

response to Q4.2a.

Note: you cannot enter a

nil amount here. If the securities

are being issued for nil

cash consideration, answer

Q4.2 as "No" and complete

Q4.2c and Q4.2d.

------------------------------------ --------------------------------------

4.2c Please describe the consideration 1. $0.0670 per share ($1.8m)

being provided for the +securities being 26,884,731 consideration

to be quoted shares, calculated by 10 day

Answer this question if your VWAP prior to 21 April 2021

response to Q4.2 is "No". 2. N/A

------------------------------------ --------------------------------------

4.2d Please provide an estimate N/A

(in AUD) of the value of

the consideration being provided

per +security for the +securities

to be quoted

Answer this question if your

response to Q4.2 is "No".

------------------------------------ --------------------------------------

4.3 Any other information the N/A

entity wishes to provide

about the issue

------------------------------------ --------------------------------------

Part 5 - Issued capital following quotation

Following the quotation of the +securities the subject of this

application, the issued capital of the entity will comprise:

Note: the figures provided in the tables in sections 5.1 and

5.2 below are used to calculate the total market capitalisation

of the entity published by ASX from time to time. Please make

sure you include in the relevant table each class of securities

issued by the entity.

If you have quoted CHESS Depository Interests (CDIs) issued

over your securities, include them in the table in section 5.1

and include in the table in section 5.2 any securities that

do not have CDIs issued over them (and therefore are not quoted

on ASX).

Restricted securities should only be included in the table in

section 5.1 if you are applying to have them quoted because

the escrow period for the securities has expired or is about

to expire. Otherwise include them in the table in section 5.2.

5.1 *Quoted +securities (total number of each +class of +securities

quoted on ASX following the +quotation of the +securities

the subject of this application) ASX security code and description Total number of +securities

on issue

MXC: Fully Paid Ordinary Shares 2,310,679,974

MXCOE: Listed Options exercisable

at $0.045 expiring 31 August

2021 77,647,601

----------------------------

--------------------------------------------------------------------------------------------------------------------------

5.2 *Unquoted +securities (total number of each +class of

+securities issued but not quoted on ASX): ASX security code and description Total number of +securities

on issue

Unlisted Options ($0.15, 30 June

2021)

Unlisted Options ($0.05, 31 August

2023)

Unlisted Options ($0.06, 31 August

2023)

10,000,000

Unlisted Options ($0.07, 31 August

2023) 16,300,000

Unlisted Options ($0.026, 31 17,500,000

March 2023)*

17,500,000

Unlisted Options (GBP0.01475,

31 March 2023) 7,692,308

Performance Rights (BM/RZ)* 26,440,678

2020 Incentive Performance Rights* 10,000,000

2021 A Incentive Performance 14,550,000

Rights*

3,725,000

2021 B Incentive Performance

Rights* 9,275,000

Convertible Notes 3,850,000

----------------------------

* Subject to vesting conditions

--------------------------------------------------------------------------------------------------------------------------

Part 6 - Other Listing Rule requirements

The questions in this Part should only be answered if you are an

ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do

not need to complete this Part) and:

- your response to Q2.1 is "Being issued under a

dividend/distribution plan" and the response to Q2.2b.2 is "No";

or

- your response to Q2.1 is "Other".

Note that if your response to Q2.1 is "Being issued as part of a

transaction or transactions previously announced to the market in

an Appendix 3B", it is assumed that you will have provided the

information referred to in this Part in the Appendix 3B.

Question Question Answer

No.

6.1 *Has the entity obtained, N/A

or is it obtaining, +security

holder approval for the issue

under listing rule 7.1?

----------------------------------- -------

6.1a *Date of meeting or proposed N/A

meeting to approve the issue

under listing rule 7.1

Answer this question if the

response to Q6.1 is "Yes".

----------------------------------- -------

6.1b *Are any of the +securities N/A

being issued without +security

holder approval using the

entity's 15% placement capacity

under listing rule 7.1?

Answer this question if the

response to Q6.1 is "No".

----------------------------------- -------

6.1b.1 *How many +securities are N/A

being issued without +security

holder approval using the

entity's 15% placement capacity

under listing rule 7.1?

Answer this question if the

response to Q6.1 is "No" and

the response to Q6.1b is "Yes".

Please complete and separately

send by email to your ASX

listings adviser a work sheet

in the form of Annexure B

to Guidance Note 21 confirming

the entity has the available

capacity under listing rule

7.1 to issue that number of

securities.

----------------------------------- -------

6.1c *Are any of the +securities N/A

being issued without +security

holder approval using the

entity's additional 10% placement

capacity under listing rule

7.1A (if applicable)?

Answer this question if the

response to Q6.1 is "No".

----------------------------------- -------

6.1c.1 *How many +securities are N/A

being issued without +security

holder approval using the

entity's additional 10% placement

capacity under listing rule

7.1A?

Answer this question if the

response to Q6.1 is "No" and

the response to Q6.1c is "Yes".

Please complete and separately

send by email to your ASX

listings adviser a work sheet

in the form of Annexure C

to Guidance Note 21 confirming

the entity has the available

capacity under listing rule

7.1A to issue that number

of securities.

Introduced 01/12/19, amended 31/01/20

[1] Appendix 2A of the Listing Rules includes a warranty that an

offer of the securities for sale within 12 months after their issue

will not require disclosure under section 707(3) or 1012C(6) of the

Corporations Act. If the securities to be quoted have been issued

by way of a pro rata offer, to give this warranty, you will

generally need to have lodged a cleansing notice with ASX under

section 708AA(2)(f) or 1012DAA(2)(f) of the Corporations Act within

24 hours before the securities are offered (see ASIC Regulatory

Guide 189 Disclosure relief for rights issues). If in doubt, please

consult your legal adviser.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKSLFLPFEEA

(END) Dow Jones Newswires

May 14, 2021 02:50 ET (06:50 GMT)

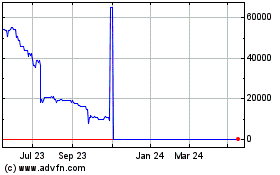

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Jan 2024 to Jan 2025