Marlowe Holdings Limited Half Yearly Report (9402D)

October 30 2015 - 3:00AM

UK Regulatory

TIDMMRL

RNS Number : 9402D

Marlowe Holdings Limited

30 October 2015

30 October 2015

Marlowe Holdings Limited ("Marlowe")

Half-Year Results 2015

Marlowe (AIM:MRL), the AIM listed cash shell, today issues its

half-year results for the period to 30 September, 2015.

Summary:

-- Placing of GBP5.2m completed in May to pursue investment

opportunities; total cash currently available for acquisitions of

GBP8.3m;

-- Potential platform and bolt-on acquisition targets identified;

-- Strategy fine-tuned to focus on annuity-type recurring asset

maintenance services underpinned by the customer's obligation to

meet stringent regulatory and legislative requirements;

-- Acquisitions team strengthened by new appointments;

attractive pipeline of investment opportunities;

-- Half-year results show a broadly break-even performance (loss

of GBP2k) for the 6 months to September.

Commenting on progress Alex Dacre, Chief Executive, said:

"Since the appointment of the new Board on 15 May 2015, and the

completion of an oversubscribed share placing, we have been

encouraged by the progress made in developing Marlowe's

buy-and-build growth strategy.

During the period, we have identified attractive potential

platform and bolt-on targets in line with our investment strategy.

We believe that the targets identified could form the foundations

of a dynamic B2B service group, focused on delivering essential

annuity-type recurring asset maintenance services underpinned by

the customer's obligation to meet stringent regulatory and

legislative requirements. These requirements can result in a high

level of forward revenue visibility. The targets occupy large,

fragmented and operationally complex markets which we believe are

poised for consolidation, offer attractive economies of scale and

have growing barriers to entry. We look forward to executing our

strategy and are confident that significant further progress will

be made in the coming months.

Since May, as we have fine-tuned this strategy, we have made key

appointments to the acquisitions team and have developed an

attractive pipeline of investment opportunities. These represent

the kind of deals that members of the Marlowe Board have a proven

track record in completing. The markets that we are targeting offer

significant scope for further growth through bolt-on acquisitions

which can be executed at fair valuations and frequently fall below

the radar of private equity or the large US owned multi-nationals

who often occupy these types of markets. And, as a UK focused

specialist with short lines of communication and the ability to

move decisively and quickly, we believe we have a significant

competitive advantage.

Finally, I'd like to take this opportunity to thank our

shareholders for their continued support. I would only add that I

and my fellow directors have, as a demonstration of our commitment

to the success of your company, been working without remuneration

since the Board's appointment. We look forward to updating

shareholders of Marlowe's progress in due course."

Suspension of shares to trading on AIM

The Company notes the announcement made yesterday concerning the

movement in share price and that it is contemplating a potential

acquisition which would constitute a reverse takeover under the AIM

Rules. As a result, trading in the Company's shares will be

suspended until such time as an admission document is published in

relation to the potential acquisition or the talks otherwise

conclude. The Company will update shareholders with further

information in due course. There can be no certainty that these

discussions will lead to any transaction completing.

Enquires and further information:

Marlowe Holdings Limited

Alex Dacre, Chief Executive IR@marloweplc.com

Derek O'Neill, Group Finance Director +44 207 248 6700

Cenkos Securities

Nicholas Wells +44 207 397 8920

Summarised

Income

Statement

(unaudited)

Six months

ended

September 30 2015 2014

GBP000 GBP000

Interest Income 65 48

Administrative

expenses (67) (35)

Net

profit/(loss)

before and

after

taxation (2) 13

--------------------------------------------------------- ----------------------------------------------------------

Earnings per

ordinary

share (basic

and

diluted)

--------------------------------------------------------- ----------------------------------------------------------

(in pence) (0.02) 0.20

--------------------------------------------------------- ----------------------------------------------------------

Summarised

Balance

Sheet 30 September 31 March

2015 2015

(unaudited) (audited)

GBP000 GBP000

Fixed Assets

Property, plant

and

equipment 6 -

Current Assets

Cash and cash

equivalents 8,293 3,156

Other

receivables 21 26

--------------------------------------------------------- ----------------------------------------------------------

Total assets 8,320 3,182

Current

liabilities

Other

payables (10) (21)

Net assets 8,310 3,161

--------------------------------------------------------- ----------------------------------------------------------

Shareholders'

equity

Share capital 7,292 3,000

Share premium 859 -

Retained

earnings 159 161

--------------------------------------------------------- ----------------------------------------------------------

Total

shareholders'

equity 8,310 3,161

--------------------------------------------------------- ----------------------------------------------------------

Summarised

Statement

of Cash

Flows

(unaudited)

Six months

ended

September 30 2015 2014

GBP000 GBP000

---------------------------------------------------------- ----------------------------------------------------------

Net cash

generated

from

operating

activities (20) 39

Net cash

generated

from

investing

activities 6 -

Net cash

generated

from

financing

activities 5,151 -

---------------------------------------------------------- ----------------------------------------------------------

Net increase

in cash

for the

period 5,137 39

---------------------------------------------------------- ----------------------------------------------------------

Cash at

beginning

of period 3,156 3,128

---------------------------------------------------------- ----------------------------------------------------------

Cash at end

of period 8,293 3,167

(MORE TO FOLLOW) Dow Jones Newswires

October 30, 2015 03:00 ET (07:00 GMT)

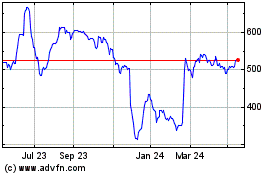

Marlowe (LSE:MRL)

Historical Stock Chart

From May 2024 to Jun 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Jun 2023 to Jun 2024