Proposal to De-list from AIM

May 02 2008 - 3:00AM

UK Regulatory

Medoro Resources Announces Proposal to De-list from AIM

TORONTO, May 2 /CNW/ - Medoro Resources Ltd. (TSX-V: MRS/AIM: MRL)

announced today that it proposes to request that the London Stock Exchange plc

cancel the admission of its common shares from AIM. Cancellation is subject to

passing of a special resolution at an Annual and Special Meeting of

Shareholders to be held at 10:00 am (Toronto time) on May 27, 2008 at the

offices of Blake, Cassels & Graydon LLP, 199 Bay Street, Suite 2800, Commerce

Court West, Toronto, Ontario, Canada. In order to be passed, 75% of the votes

cast at the meeting in person or by proxy must be voted in favour of the

resolution. Should such resolution be passed, it is anticipated that the

cancellation of trading on AIM will be effected on or around June 5, 2008. A

circular convening the meeting will be sent to Medoro shareholders shortly and

can now be accessed through www.sedar.com.

Rationale for Cancellation

When the company was first established, much of the liquidity in its

shares arose from activity on AIM; however, over the past four years, that has

shifted dramatically so that the vast majority of the trading and liquidity

arises from the company's listing on the TSX Venture Exchange.

Due to the relatively low number of the Company's shareholders holding

shares on the Jersey shareholder register (Jersey being where the AIM

shareholder register is maintained), and the low volume of trading in shares

on AIM, as compared to the regulatory and financial commitment required to

maintain an AIM listing, the board of Medoro considers it in the best interest

of the Company to seek a cancellation of its shares from trading on AIM. The

relatively low profile of the Company and inactive trading on AIM do not, in

the Board's view, justify the costs and inconvenience of maintaining a second

listing on AIM.

As an alternative market will continue to exist for the trading in the

shares, given the Company's continued listing on the TSXV, shareholders

currently trading or holding AIM listed shares on the Jersey shareholder

register, will continue to be able to trade their shares on the TSXV and

should therefore not be materially prejudiced by the proposed cancellation

from AIM. Shareholders who have traded on AIM or hold their shares on the

Jersey shareholder register are advised to consult their stockbroker, bank

manager, solicitor, accountant or other independent professional adviser for

the procedure to follow to transmit their shares to the Canadian shareholder

register, or to contact the company's UK transfer agents at Capita Registrars,

The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU or by phone on 0871

664 0300 (Calls cost 10 pence per minute plus network extras), +44 (0)20 8639

3399 (from outside the UK), +44 (0) 8639 2220 or ssd(at)capitaregistrars.com

for the procedure to follow. For those not familiar with the Canadian

securities system, public information on the Company can be accessed through

www.sedar.com, an independent website on which all regulatory filings must be

made.

Medoro Resources is a gold exploration and development company focused on

acquiring properties of merit for potential joint ventures with senior

producers. The company holds a 100% interest in the Lo Increible 4A and 4B

concessions in Venezuela and interests in eleven gold exploration areas in the

Republic of Mali. Additional information on the company can be found by

visiting the company's website at www.medororesources.com. Medoro's Nominated

Adviser for the purposes of AIM is Canaccord Adams Ltd. (Ryan Gaffney/Robin

Birchall), +44 (0) 20 7050 6500.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

This press release contains forward-looking statements based on

assumptions, uncertainties and management's best estimates of future events.

Actual results may differ materially from those currently anticipated.

Investors are cautioned that such forward-looking statements involve risks and

uncertainties. Important factors that could cause actual results to differ

materially from those expressed or implied by such forward looking statements

are detailed from time to time in the company's periodic reports filed with

the British Columbia Securities Commission and other regulatory authorities.

The company has no intention or obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise.

For further information: Robert Doyle, Chief Executive Officer, (416)

603-4653, rdoyle@medororesources.com

(MRS. MRL)

END

Marlowe (LSE:MRL)

Historical Stock Chart

From May 2024 to Jun 2024

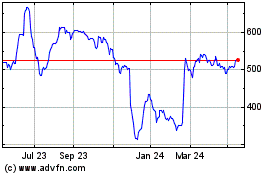

Marlowe (LSE:MRL)

Historical Stock Chart

From Jun 2023 to Jun 2024