Medoro Resources Announces Third Quarter Results

TORONTO, Nov. 29 /CNW/ - Medoro Resources Ltd. (TSX-V/AIM:MRL) announced

today its 2005 third quarter results for the periods ending September 30,

2005.

For the quarter ended September 30, 2005, Medoro reported a loss of

$4.1 million or $0.03 per share as compared to a loss of $1.8 million or $0.02

per share in the same quarter of 2004. The loss in the quarter primarily

relates to the write-off of the investment in Miniere di Pestarena srl during

the quarter.

For the first nine months, the company reported a net loss of

$5.0 million or $0.04 per share as compared to a loss of $4.9 million or $0.08

per share for the eleven months ended September 30, 2004.

At September 30, 2005 the company had cash and short-term investments of

$5.8 million, undiscounted receivables of $8.4 million and working capital of

$7.5 million.

Subsequent to the end of the period, the company was advised by Bolivar

Gold that Gold Fields Ltd. had formally relinquished its right to earn a 60%

interest in the Monte Ollasteddu prospect from Bolivar Gold, primarily as a

result of continuing difficulties in obtaining drilling permits in a timely

fashion. Bolivar Gold has also advised Medoro Resources that it is reviewing

its position with respect to its option to earn a 70% interest in Monte

Ollasteddu and that no decision has been made as to whether Bolivar Gold

intends to maintain its option by funding all costs through completion of a

bankable feasibility study, either alone or in conjunction with a new joint

venture partner, or whether it intends to also relinquish its option.

The company has increased and broadened its search for new opportunities,

both in terms of location and commodity, in the hope of finding a suitable

investment to provide the company with new opportunities without undue funding

obligations.

Financial Statements follow

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Balance Sheets

(Expressed in Canadian dollars)

-------------------------------------------------------------------------

September 30, December 31,

2005 2004

------------- -------------

ASSETS (Unaudited) (Audited)

CURRENT

Cash and cash equivalents $ 286,668 $ 2,448,813

Investments (Note 2) 5,500,000 -

Accounts receivable 136,557 75,981

Prepayments and deposits 20,885 -

Current portion of note receivable

(Note 3) 1,555,721 747,908

-------------------------------------------------------------------------

7,499,831 3,272,702

NOTE AND SHARES RECEIVABLE (Note 3) 4,408,059 5,882,880

PROPERTY, PLANT AND EQUIPMENT 18,047 -

MINERAL PROPERTIES 1,000,000 5,979,873

-------------------------------------------------------------------------

$ 12,925,937 $ 15,135,455

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES

CURRENT

Accounts payable and accrued liabilities $ 41,177 $ 401,534

FUTURE INCOME TAXES 356,200 2,130,031

-------------------------------------------------------------------------

397,377 2,531,565

-------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Share capital (Note 5) 34,111,117 29,161,976

Contributed surplus (Note 5) 587,392 584,622

Deficit (22,169,949) (17,142,708)

-------------------------------------------------------------------------

12,528,560 12,603,890

-------------------------------------------------------------------------

$ 12,925,937 $ 15,135,455

-------------------------------------------------------------------------

-------------------------------------------------------------------------

These unaudited interim consolidated financial statements for the periods

ended September 30, 2005 have not been reviewed by the Company's

auditors.

See accompanying Notes to the unaudited interim Consolidated Financial

Statements.

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Unaudited Statements of Operations and Deficit

(Expressed in Canadian dollars)

(Unaudited)

Nine Eleven

Three months ended months ended months ended

September 30, September 30,

2005 2004 2005 2004

--------------------------- ---------------------------

Operating expenses:

General and

administration $ 414,192 $ 1,264,335 $ 1,367,765 $ 3,562,194

Stock-based

compensation 2,770 126,600 2,770 126,600

Exploration - 441,858 - 997,472

------------- ------------- ------------- -------------

(416,962) (1,832,793) (1,370,535) (4,686,266)

Other income

(expenses):

Accreted

interest on

note and

shares

receivable 160,839 - 587,879 -

Depreciation

and

amortization - - - (305,870)

Foreign

exchange gain

(loss) (399,446) (13,505) (878,842) 31,923

Loss on

disposal of

investment (3,450,328) - (3,450,328) -

Interest income 13,516 13,192 46,395 93,411

Other income (337) - 38,190 -

------------- ------------- ------------- -------------

(225,428) (313) (206,378) (180,536)

------------- ------------- ------------- -------------

Net income for

the period $ (4,092,718) $ (1,833,106) $ (5,027,241) $ (4,866,802)

Deficit,

beginning of

the period (18,077,231) (9,652,659) (17,142,708) (6,618,963)

------------- ------------- ------------- -------------

Deficit, end of

the period $(22,169,949) $(11,485,765) $(22,169,949) $(11,485,765)

------------- ------------- ------------- -------------

------------- ------------- ------------- -------------

Basic and

diluted income

per share $ (0.03) $ (0.02) $ (0.04) $ (0.08)

------------- ------------- ------------- -------------

Weighted

average number

of common

Shares

outstanding 124,714,974 84,670,649 112,669,327 57,264,086

------------- ------------- ------------- -------------

------------- ------------- ------------- -------------

See accompanying notes to the unaudited interim Consolidated Financial

Statements.

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Statements of Cash Flows

(Expressed in Canadian dollars)

(Unaudited)

Nine Eleven

Three months ended months ended months ended

September 30, September 30,

2005 2004 2005 2004

--------------------------- ---------------------------

Cash provided by

(used in):

Operating

activities:

Net loss $ (4,092,718) $ (1,833,106) $ (5,027,241) $ (4,866,802)

Loss on

disposition of

investment 3,450,328 - 3,450,328 -

Items not

affecting cash:

Loss on

disposition

of capital

assets - - - 305,870

Stock-based

compensation 2,770 126,600 2,770 126,600

Unrealized

foreign

exchange on

note receivable 348,147 13,505 920,776 (31,923)

Accreted

interest on

note and

shares

receivable (195,494) - (622,533) -

Changes in

non-cash working

capital (329,475) 489,267 (686,104) (10,103)

------------- ------------- ------------- -------------

$ (816,442) $ (1,203,734) $ (1,962,004) $ (4,476,358)

------------- ------------- ------------- -------------

Investing

activities:

Acquisition of

mineral

properties - - - (1,006,042)

Property, plant

and equipment 85,264 - (18,047) (11,548)

Short-term

investments (5,500,000) - (5,500,000) -

Acquisition of

Sardinia Gold

Mining SpA - - - (2,104,279)

Repayment of

note

receivable 368,765 - 368,765 50,000

------------- ------------- ------------- -------------

$ (5,045,971) $ - $ (5,149,282) $ (3,071,869)

------------- ------------- ------------- -------------

Financing

activities:

Issue of common

shares for

cash net of

share issue

cost (41,678) - 4,949,141 -

Issue of

special

warrants - - - 295,000

Issue of

subscriptions

receipt - - - 8,015,000

Issue cost on

warrants and

subscriptions - - - (781,515)

------------- ------------- ------------- -------------

$ (41,678) $ - $ 4,949,141 $ 7,528,485

Foreign

exchange impact

on cash - (49,419) - (62,205)

------------- ------------- ------------- -------------

Net increase

(decrease) in

cash and cash

equivalents $ (5,904,091) $ (1,253,153) $ (2,162,145) $ (81,947)

Cash and cash

equivalents,

beginning of

the period 6,190,759 4,392,545 2,448,813 3,221,339

------------- ------------- ------------- -------------

Cash and cash

equivalents, end

of the period $ 286,668 $ 3,139,392 $ 286,668 $ 3,139,392

-------------------------------------------------------

-------------------------------------------------------

See accompanying notes to the unaudited interim Consolidated Financial

Statements.

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Notes to the unaudited Consolidated Financial Statements

Three and nine month periods ended September 30, 2005

And three and eleven month periods ended September 30, 2004

(Expressed in Canadian dollars)

-------------------------------------------------------------------------

1. SIGNIFICANT ACCOUNTING POLICIES

The unaudited interim consolidated financial statements are prepared

in accordance with Canadian generally accepted accounting principles

("GAAP") for interim financial statements. These interim financial

statements do not contain all disclosures required under GAAP and,

accordingly, should be read in conjunction with the Company's audited

financial statements for the fourteen month period ended December 31,

2004. These interim consolidated financial statements have been

prepared following the same accounting policies and method of

computations as the Company's audited financial statements for the

fourteen month period ended December 31, 2004.

Stock-based compensation

Effective November 1, 2003, the Company adopted the recommendations

of the amended Handbook Section 3870, "Stock-based Compensation and

Other Stock-based Payments" ("Section 3870") for stock options issued

on or after November 1, 2002. Section 3870 established standards for

recognition, measurement and disclosure of stock-based compensation

and other stock-based payments made in exchange for goods and

services provided by employees and non-employees. The standard

requires that a fair value-based method of accounting be applied to

all stock-based payments to non-employees and to employee awards that

are direct awards of stock that call for settlement in cash or other

assets or are appreciation rights that call for settlement by the

issuance of equity instruments. Accordingly the Company has restated

and adjusted the opening deficit of the comparative period to reflect

the cumulative effect of the change in 2003.

Previously, the Company provided note disclosure of pro forma net

loss as if the fair value based method had been used on stock options

granted to employees and directors after January 1, 2002. The amended

recommendations have been applied using the retroactive method

without restatement and had the effect of increasing contributed

surplus and opening deficit at November 1, 2003 by $245,000.

2. INVESTMENTS

Investments are held in guaranteed investment certificates or freely

tradable listed securities, with an original term to maturity greater

than three months, earning approximately the equivalent of short-term

money market investments.

3. NOTES AND SHARES RECEIVABLE

The discounted value as at September 30, 2005 of the notes and shares

receivable from Sargold Resources Corporation ("Sargold") is as

follows:

Note receivable (a)(i) $ 5,360,119

Shares receivable (a)(ii) 603,661

---------------------------------------------------------------------

5,963,780

Current portion of note receivable (1,555,721)

---------------------------------------------------------------------

$ 4,408,059

---------------------------------------------------------------------

---------------------------------------------------------------------

(a) (i) $7,351,575 (euro 5.25 million) discounted using a

3.75% risk free interest rate and a 10% risk premium.

The following schedule represents the amounts receivable,

discounted at September 30, 2005 and the percentage of

shares to be released upon each individual payment:

% of June 30, 2005

Shares -----------------------------------

Released Discounted Discounted

Upon Value Value

Date Amount Payment (Euros) ($)

-------- ----------------- ---------- ----------------- -----------------

August

30,

2006 euro 1,250,000 25.0% euro 1,110,991 $ 1,555,721

August

30,

2007 1,000,000 16.7% 781,356 1,094,133

August

30,

2008 1,500,000 25.0% 1,029,997 1,442,305

August

30,

2009 1,500,000 25.0% 905,492 1,267,960

---------------------------- -----------------------------------

euro 5,250,000 91.7% euro 3,827,836 $ 5,360,119

----------------------------------------------------------------

----------------------------------------------------------------

(ii) Common shares of Sargold to be issued on or by August 30,

2009 for a value equal to $1 million, to be valued at the

market price (as determined according to TSX Venture

Exchange policy) as at August 30, 2009, subject to a

minimum price of $0.225. At September 30, 2005 Sargold

shares had a ten day closing average of $0.20. The

discounted value as at September 30, 2005, using a 13.75%

discount rate, was $603,661.

During the quarter, the Company and Sargold agreed to amend the

payment provisions of Sargold's promissory note in the amount of

euro 5,500,000, dated October 20, 2004. Under the terms of the

amendment, Sargold repaid euro 250,000 (originally euro 500,000)

on August 30, 2005 and on the due date of its second installment

(August 30, 2006) will pay, the amount of euro 1,250,000

(originally euro 1,000,000). The previously scheduled release from

escrow has been deferred to August 30, 2006. The postponed amount

(euro 250,000) will carry simple interest at a rate of 6% per annum

commencing August 30, 2005.

4. DISPOSITION OF MINIERE DE PASTARENA

The Acquisition Agreement entered between the Company and

Investimenti Minerari s.r.l. where the Company agreed to purchase all

the shares issued and outstanding of Miniere de Pastarena s.r.l.

("MDP") required the Company to incur euro 1.7 million in exploration

costs by March 2006.

Since the Company has been unsuccessful in finding a joint venture

partner to fund the exploration of MDP, the Board of Directors agreed

on August 3, 2005 to revert the shares to the Vendor in order to

cease ongoing maintenance and permitting obligations, which were

increasing as time passed.

The Company also paid euro 250,000 to the Vendor in consideration of

the assumption by the Vendor of all outstanding liabilities incurred

by MDP.

The Company has recorded a loss of $3,450,328 on the disposition of

this investment.

5. SHARE CAPITAL

(a) Common shares

Authorized: an unlimited number of common shares with no par value

Issued and outstanding:

Number of Contributed

Shares Amount Surplus

------------- -------------- --------------

Balance, October 31, 2003

and 2002 5,935,925 $ 6,706,001 $ -

Cumulative effect of change

in accounting policy 245,000

------------- -------------- --------------

Adjusted balance, October 31,

2003 5,935,925 6,706,001 245,000

---------------------------- --------------

Issued prior to amalgamation 75,626,261 19,941,692 117,950

Fair value of options and

warrants exchanged - - 61,403

Issued as consideration for

services in connection with

the amalgamation 319,857 63,971 -

Issued in settlement of

accrued liabilities 140,624 70,312 -

Issued to acquire Miniere

di Pestarena srl 4,000,000 2,200,000 -

Issued as consideration for

services in connection with

the sale of GMS Australia 1,000,000 180,000 -

Stock-based compensation - - 160,269

-------------------------------------------

Closing balance as at

December 31, 2004 87,022,667 $ 29,161,976 $ 584,622

Issued under private

placement, net of share

issue costs 37,692,307 4,949,141 -

Stock-based compensation - - 2,770

------------- -------------- --------------

Balance at September 30,

2005 124,714,974 $ 34,111,117 $ 587,392

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(b) Warrants

Number of Exercise

Warrants Price

Balance, October 31, 2003 and 2002 - $ -

GMS England warrants exchanged for

Warrants of the Company 5,793,918 1.14

Agent's warrants 687,000 0.70

-------------------------------------------------------------------------

Balance, December 31, 2004 6,480,918 1.10

Warrants issued in conjunction with private

placement 15,000,000 0.23

Warrants expired during the period (352,890) 3.30

-------------------------------------------------------------------------

Balance, September 30, 2005 21,128,028 $ 0.44

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(c) Incentive stock option plan

A summary of the changes in the Company's incentive share

option plan for the periods ended September 30, 2005 and

December 31, 2004 are as follows:

September 30, 2005 December 31, 2004

---------------------------- ----------------------------

Weighted Weighted

Average Average

Exercise Exercise

Options Price Options Price

------------- ---------------------------- -------------

Outstanding,

beginning of

period 6,138,790 $ 0.79 2,500,000 $ 0.70

Options granted 50,000 0.11 2,475,000 0.25

Options

cancelled (1,148,109) 1.97 (19,098) 2.76

Issued in

replacement

of GMS options - - 1,182,888 2.16

-------------------------------------------------------------------------

Outstanding,

end of period 5,040,681 $ 0.52 6,138,790 $ 0.79

-------------------------------------------------------------------------

-------------------------------------------------------------------------

The following table summarizes information concerning outstanding and

exercisable options at September 30, 2005:

Options outstanding and exercisable

-------------------------------------------------------------------------

Weighted Weighted

Average Average

Number Remaining Exercise

Outstanding Life in Years Price

-------------------------------------------------------------------------

2,485,000 2.98 $ 0.70

180,681 0.75 1.81

2,375,000 3.70 0.23

-------------------------------------------------------------------------

5,040,681 3.24 $ 0.52

-------------------------------------------------------------------------

-------------------------------------------------------------------------

6. RELATED PARTY TRANSACTIONS

During the nine months ended September 30, 2005 and the eleven month

period ended September 30, 2004, the Company paid the following

amounts to related parties:

(a) Consulting fees of $124,508 (2004 - $29,600) to a company in

which two directors of the Company are officers.

(b) Consulting fees of $62,006 (2004 - $130,344) to officers of the

Company for professional services.

(c) Consulting fees of $143,953 (2004 - $211,833) to directors of

the Company.

These transactions are in the normal course of operations and are

measured at the exchange amounts, which is the amount of

consideration established and agreed to by the related parties.

For further information: Peter Volk, Secretary, (416) 603-4653,

info(at)medororesources.com

(MRL.)

END

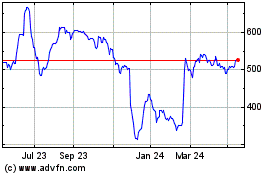

Marlowe (LSE:MRL)

Historical Stock Chart

From Jul 2024 to Aug 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Aug 2023 to Aug 2024