Medoro Resources Announces 2004 Year-end Results

TORONTO, May 2 /CNW/ - Medoro Resources Ltd. (TSX-V/AIM:MRL) announced

today its 2004 year-end results for the periods ending December 31, 2004.

Medoro was formed following the business combination between Full Riches

Investments Limited and a wholly-owned subsidiary of Gold Mines of Sardinia,

plc.

For the year ended December 31, 2004, Medoro reported a loss of

$9.9 million or $0.14 per share as compared to a loss of $0.3 million or $0.07

per share in the previous period. The 2004 results largely reflects the loss

on disposal of the majority of the Gold Mines of Sardinia assets.

On October 20, 2004, the company announced the completion of the sale of

most of its assets in Sardegna to Sargold Resource Corporation for a total of

(euro) 6 million plus $1 million in Sargold shares payable over a period of

60 months. With this sale, Medoro significantly improved its financial

position, ending the year with cash of $2.4 million, receivables of

$10.6 million and no debt. Subsequent to the end of the year, Medoro also

completed two private placements for gross proceeds of $4.9 million.

With these transactions, Medoro has completed its transformation from an

under-funded, marginally profitable former gold producer to a well-funded

junior explorer. At Monte Ollasteddu, Gold Fields has completed a geophysical

survey to follow up on last year's drilling results and help better identify

targets for this year's program, which is expected to commence as soon as

necessary approvals are obtained. The company continues to seek a joint

venture partner for its Pestarena project and is actively pursuing other

opportunities elsewhere in Europe.

Financial Statements follow

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Balance Sheets

(Expressed in Canadian dollars)

-------------------------------------------------------------------------

December 31, October 31,

2004 2003

-------------- --------------

ASSETS

CURRENT

Cash and cash equivalents $ 2,448,813 $ 3,221,339

Accounts receivable 75,981 9,468

Promissory note (Note 5 (b)) - 50,000

Prepaid and deposits - 1,973

Current portion of note receivable

(Note 5 (a)) 747,908 -

-------------------------------------------------------------------------

3,272,702 3,282,780

LOAN RECEIVABLE (Note 3) - 662,925

NOTE AND SHARES RECEIVABLE (Note 5 (a)) 5,882,880 -

MINERAL PROPERTIES (Note 6) 5,979,873 -

-------------------------------------------------------------------------

$ 15,135,455 $ 3,945,705

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES

CURRENT

Accounts payable and accrued

liabilities $ 401,534 $ 97,762

FUTURE INCOME TAXES (Note 8) 2,130,031 -

-------------------------------------------------------------------------

2,531,565 97,762

-------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Share capital (Note 7) 29,161,976 6,706,001

Contributed surplus (Note 7) 584,622 -

Shares to be issued (Note 3 (e)) - 15,000

Special warrants (Note 3 (b)) - 2,490,905

Subscriptions received (Note 3 (b)) - 1,255,000

Deficit (17,142,708) (6,618,963)

-------------------------------------------------------------------------

12,603,890 3,847,943

-------------------------------------------------------------------------

$ 15,135,455 $ 3,945,705

-------------------------------------------------------------------------

-------------------------------------------------------------------------

MEDORO RESOURCES LTD. (formerly Full Riches Investments Ltd.)

Consolidated Statements of Operations and Deficit

(Expressed in Canadian dollars)

Fourteen

months ended Year ended

December 31, December 31,

2004 2003

-------------- --------------

OPERATING EXPENSES

Amortization $ - $ 97

Bank charges and interest 5,730 5,824

Bridge financing fee - 15,000

Consulting fees 922,425 65,419

Director fees 119,409 -

Insurance - 8,000

Investor relations, transfer agent and

filing fees 168,921 10,774

Legal and accounting 537,145 68,139

Office 22,330 9,249

Rent 4,000 10,560

Stock-based compensation 160,269 -

Telephone 2,080 508

Travel and promotion 527,348 4,935

-------------------------------------------------------------------------

2,469,657 198,505

-------------------------------------------------------------------------

OTHER INCOME (EXPENSES)

Accreted interest on note receivable 162,593 -

Foreign exchange gain (loss) 208,575 (2,850)

Interest income 44,846 6,516

Loss on disposal of capital assets - (1,844)

Other income 3,805 -

-------------------------------------------------------------------------

419,819 1,822

-------------------------------------------------------------------------

NET LOSS FROM CONTINUING OPERATIONS (2,049,838) (196,683)

NET LOSS FROM DISCONTINUED OPERATIONS

(Note 5) (8,228,907) (150,000)

-------------------------------------------------------------------------

NET LOSS FOR THE PERIOD (10,278,745) (346,683)

-------------------------------------------------------------------------

DEFICIT, BEGINNING OF PERIOD (6,618,963) (6,272,280)

CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING

POLICY (Note 2(i))

(245,000) -

-------------------------------------------------------------------------

ADJUSTED OPENING BALANCE (6,863,963) (6,272,280)

-------------------------------------------------------------------------

DEFICIT, END OF PERIOD $ (17,142,708) $ (6,618,963)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LOSS PER SHARE FROM CONTINUING OPERATIONS $ (0.03) $ (0.03)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LOSS PER SHARE FROM DISCONTINUED

OPERATIONS $ (0.12) $ (0.03)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

BASIC AND DILUTED LOSS PER SHARE $ (0.15) $ (0.06)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

BASIC AND DILUTED WEIGHTED-AVERAGE NUMBER

OF COMMON SHARES OUTSTANDING 68,590,779 5,935,925

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying Notes to the Consolidated Financial Statements.

MEDORO RESOURCES LTD. (formerly Full Riches Investments Ltd.)

Consolidated Statements of Cash Flows (Expressed in Canadian dollars)

Fourteen

months ended Year ended

December 31, December 31,

2004 2003

-------------- --------------

OPERATING ACTIVITIES

Net loss from continuing operations $ (2,049,838) $ (196,683)

Items not affecting cash:

Loss on disposal of capital assets - 1,844

Amortization - 97

Stock compensation expense 160,269 -

Foreign exchange (gain) loss on note

receivable (208,575) 2,850

Accreted interest on note receivable (162,593) -

Bridge financing fee - 15,000

-------------------------------------------------------------------------

(2,260,737) (176,892)

Changes in non-cash working capital items

Accounts receivable (66,513) (8,107)

Prepaid and deposits 1,973 2,465

Accounts payable and accrued liabilities 303,772 80,414

-------------------------------------------------------------------------

(2,021,505) (102,120)

-------------------------------------------------------------------------

INVESTING ACTIVITIES

Acquisition of mineral properties

(Note 4) (1,006,042) -

Proceeds on disposition of subsidiary,

net (Note 5 (a)) 763,130 -

Repayment of promissory note 50,000 -

Advances to Gold Mines of Sardinia plc - (662,925)

-------------------------------------------------------------------------

(192,912) (662,925)

-------------------------------------------------------------------------

FINANCING ACTIVITIES

Issuance of common shares for cash 7,528,485 -

Proceeds from bridge financing - 660,900

Repayment of bridge financing - (660,900)

Issuance of special warrants - 2,490,905

Issuance of subscriptions receipts - 1,255,000

-------------------------------------------------------------------------

7,528,485 3,745,905

-------------------------------------------------------------------------

NET INCREASE IN CASH FROM CONTINUING

OPERATIONS 5,314,068 2,980,860

NET DECREASE IN CASH FROM DISCONTINUED

OPERATIONS (Note 5 (a)) (6,086,594) -

CASH, BEGINNING OF PERIOD 3,221,339 240,479

-------------------------------------------------------------------------

CASH, END OF PERIOD $ 2,448,813 $ 3,221,339

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying Notes to the Consolidated Financial Statements.

MEDORO RESOURCES LTD. (formerly Full Riches Investments Ltd.)

Consolidated Statements of Cash Flows (Expressed in Canadian dollars)

SUPPLEMENTAL CASH FLOW INFORMATION

Fourteen

months ended Year ended

December 31, December 31,

2004 2003

-------------- --------------

Interest paid $ - $ 5,070

-------------------------------------------------------------------------

-------------------------------------------------------------------------

The following transactions are not reflected in the consolidated

statement of cash flows:

During the fourteen month period ended December 31, 2004:

(i) 44,171,118 common shares, 5,793,918 share purchase warrants and

1,182,888 share purchase options with a value of $8,895,626 were

issued in connection with the acquisition of Sardinia Gold Mining

SpA (Note 3).

(ii) 4,000,000 common shares with a value of $2,200,000 were issued in

connection with the acquisition of Miniere di Pestarena srl

(Note 4).

(iii) 1,000,000 common shares with a value of $180,000 were issued in

consideration for services provided in connection with the sale of

GMS Australia (Note 5 (a)).

(iv) 140,624 common shares with a value of $70,312 as payment for

certain liabilities.

(v) 75,000 common shares with a value of $15,000 as consideration for

a bridge facility (Note 3 (c)).

(vi) The Company received a long-term note, payable in cash and shares,

with a discounted value of $6,630,788 as consideration on the sale

of GMS Australia (Note 5 (a)).

See accompanying Notes to the Consolidated Financial Statements.

For further information: Peter Volk, Assistant Secretary,

(416) 603-4653, info(at)medororesources.com

(MRL)

END

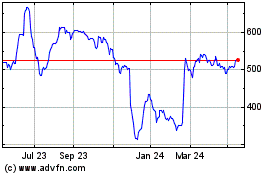

Marlowe (LSE:MRL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Jul 2023 to Jul 2024