TIDMMIRI

RNS Number : 5298B

Mirriad Advertising PLC

02 June 2023

2 June 2023

Mirriad Advertising plc

("Mirriad" or the "Company")

Results of General Meeting, Open Offer, PDMR Dealings and Total

Voting Rights

Mirriad, the leading in-content advertising company, is pleased

to announce that at its General Meeting held earlier today all

resolutions, as set out in the Circular dated 16 May 2023 relating

to a conditional Placing to raise GBP5.75 million (before expenses)

and an Open Offer to raise up to an additional GBP2 million (before

expenses), were duly passed. The proxy votes received from

Shareholders on each Resolution were as follows:

For Against Withheld

Votes % Votes %

------------ ------ -------- ----- ---------

Ordinary Resolution

------------------------------------------------

To authorise the

directors to allot

ordinary shares 145,647,535 99.91 133,476 0.09 89,277

------------ ------ -------- ----- ---------

Special Resolution

------------------------------------------------

To disapply Section

561 of the Companies

Act 2006 145,492,435 99.78 320,576 0.22 67,277

------------ ------ -------- ----- ---------

The number of Ordinary Shares in issue on 2 June 2023 was

279,180,808. Shareholders were entitled to one vote per share.

Accordingly, the Placing and the Open Offer are expected to

complete, conditional on Admission, at 8.00 a.m. on 5 June 2023 (or

such later time and/or date as Panmure Gordon, Baden Hill and the

Company may agree, but in any event by no later than 8.00 a.m. on

30 June 2023).

Result of the Open Offer

The Company is also pleased to announce that it has raised

GBP0.55 million via the Open Offer and, accordingly, has raised

total gross proceeds of approximately GBP6.30 million through the

Placing and Open Offer.

The Open Offer closed for acceptances at 11.00 a.m. on 1 June

2023. Valid acceptances have been received in respect of 18,461,929

Open Offer Shares, representing approximately 27.69 per cent. of

the Open Offer Shares available under the Open Offer. In accordance

with the terms and conditions of the Open Offer, all applications

made pursuant to the Open Offer (and Excess Shares applied for

under the Excess Application Facility) have been met in full. The

Company has therefore raised gross proceeds of approximately

GBP0.55 million through the Open Offer.

Directors' Dealings

As set out in the Circular dated 16 May 2023, Participating

Directors indicated their intention to participate in the Open

Offer. The results of their participation in the Open Offer and

therefore, upon Admission, their interests in Ordinary Shares will

be as follows:

Director Position Number Percentage Number Number Percentage

of Ordinary interest of Shares of Ordinary interest

Shares in Existing acquired Shares in the

held prior Ordinary under the held following Enlarged

to the Share Capital Open Offer the Placing Share Capital

Placing and Open upon Admission

and Open Offer

Offer

Stephan Chief Executive

Beringer Officer 358,333 0.13 833,333 1,191,666 0.24

----------------- ------------- --------------- ------------ ---------------- ----------------

Non-Executive

John Pearson Chairman 261,666 0.09 333,333 594,999 0.12

----------------- ------------- --------------- ------------ ---------------- ----------------

Bob Head Non-Executive

(1) Director 183,333 0.07 135,267 318,600 0.07

----------------- ------------- --------------- ------------ ---------------- ----------------

1. As stated in the Circular Bob Head intended to subscribe for

134,166 Open Offer Shares. He has chosen to subscribe for an

additional 1,101 Open Offer Shares at an additional cost of

GBP33.03.

Interests of the Concert Party

Following the result of the Open Offer, the interests of each of

the members of the Concert Party in the issued ordinary share

capital of the Company and the existence of which is known to, or

could with reasonable due diligence be ascertained by, any Director

following Admission are as follows:

Number of Percentage Number of Percentage

Ordinary interest Ordinary interest

Shares held in Existing Shares held in the Enlarged

prior to Ordinary following Share Capital

the Placing Share Capital the Placing upon Admission

and Open and Open

Offer Offer

IP2IPO Portfolio L.P.

(acting by its general

partner IP2IPO Portfolio

(GP) Limited) (1) 34,460,238 12.34 34,460,238 7.04

------------- --------------- ------------- -----------------

Parkwalk Advisors

Ltd 35,977,908 12.89 35,977,908 7.24

------------- --------------- ------------- -----------------

Dr Mark Alexander

Reilly 66,666 0.02 66,666 0.01

------------- --------------- ------------- -----------------

Alastair Hugh Lowell

Kilgour (2) 791,668 0.28 791,668 0.16

------------- --------------- ------------- -----------------

Lois Day - - - -

------------- --------------- ------------- -----------------

Total 71,296,480 25.54 71,296,480 14.57

------------- --------------- ------------- -----------------

1. Includes (1) 50,001 Ordinary Shares held by two IP Group plc

directors, who each hold 16,667 Ordinary Shares, and those

directors are also directors of IP2IPO Portfolio (GP) Limited and

(2) 16,667 Ordinary Shares held by one other director of IP2IPO

Portfolio (GP) Limited.

2. Held indirectly.

Admission and Total Voting Rights

Application has been made to the London Stock Exchange for a

total of 210,128,596 New Ordinary Shares to be admitted to trading

on AIM. It is expected that Admission and dealings in the

210,128,596 New Ordinary Shares will commence at 8.00 a.m. on 5

June 2023. The New Ordinary Shares will rank pari passu with the

existing Ordinary Shares. Following Admission, the Enlarged Share

Capital of the Company will consist of 489,309,404 Ordinary Shares,

none of which are held in treasury. Therefore, the total number of

voting rights in the Company will be 489,309,404 and this figure

may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company.

This announcement should be read in conjunction with the full

text of the Circular posted to Shareholders on 16 May 2023, a copy

of which is available on the Company's website at:

https://www.mirriadplc.com/investor-relations .

The same definitions apply throughout this announcement as are

applied in the Circular.

The person responsible for the release of this announcement on

behalf of the Company is David Dorans, Chief Financial Officer.

S

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

The Market Abuse Regulation (EU 596/2014) pursuant to The Market

Abuse (Amendment) (EU Exit) Regulations 2018 (the "Market Abuse

Regulations"). Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

About Mirriad

Mirriad's award-winning solution unleashes new revenue for

content producers and distributors by creating new advertising

inventory in content. Our patented, AI and computer vision

technology dynamically inserts products and innovative signage

formats after content is produced. Mirriad's market-first solution

seamlessly integrates with existing subscription and advertising

models, and dramatically improves the viewer experience by limiting

commercial interruptions.

Mirriad currently operates in the US, Europe and the Middle

East.

Enquiries:

Mirriad Advertising plc

Stephan Beringer, Chief Executive Officer

David Dorans, Chief Financial Officer

Tel: +44 (0)207 884 2530

Financial Adviser, Nominated Adviser and Joint Broker:

Panmure Gordon

James Sinclair-Ford / Daphne Zhang (Corporate Advisory)

Rupert Dearden (Corporate Broking)

Tel: +44 (0)20 7886 2500

Financial Communications:

Charlotte Street Partners

Tom Gillingham Tel: +44 (0) 7741 659021

The notifications below are made in accordance with the

requirements of the Market Abuse Regulations:

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name John Pearson

Stephan Beringer

Bob Head

------------------------- ------------------------------------------------

Reason for the notification

2

---------------------------------------------------------------------------

a) Position / status Non-Executive Chairman (John Pearson)

Chief Executive Officer (Stephan Beringer)

Non-Executive Director (Bob Head)

------------------------- ------------------------------------------------

b) Initial notification Initial notification

/ amendment

------------------------- ------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------

a) Name Mirriad Advertising plc

------------------------- ------------------------------------------------

b) LEI 213800ZKOK9GIME7HE62

------------------------- ------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---------------------------------------------------------------------------

a) Description of Ordinary shares of GBP0.00001 each

the financial ISIN: GB00BF52QY14

instrument, type

of instrument

Identification

code

------------------------- ------------------------------------------------

b) Nature of the Subscription for Ordinary Shares through

transaction Open Offer

------------------------- ------------------------------------------------

c) Price(s) and volume(s) Subscription price of 3p each

333,333 Ordinary Shares (John Pearson)

833,333 Ordinary Shares (Stephan Beringer)

135,267 Ordinary Shares (Bob Head)

------------------------- ------------------------------------------------

d) Aggregated information 333,333 Ordinary Shares and GBP10,000 (John

- Aggregated volume Pearson)

- Price 833,333 Ordinary Shares and GBP25,000 (Stephan

Beringer)

135,267 Ordinary Shares and GBP4,025 (Bob

Head)

------------------------- ------------------------------------------------

e) Date of the transaction 2 June 2023

------------------------- ------------------------------------------------

f) Place of the transaction Outside a trading venue

------------------------- ------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAFKAEDNDEFA

(END) Dow Jones Newswires

June 02, 2023 07:40 ET (11:40 GMT)

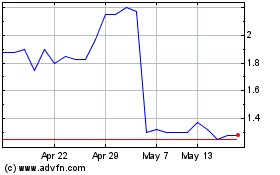

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

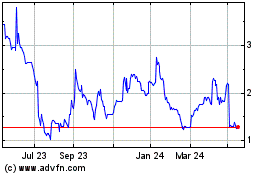

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Jul 2023 to Jul 2024