TIDMPPC

RNS Number : 5312J

President Energy PLC

24 August 2021

24 August 2021

PRESIDENT ENERGY PLC

("President", "the Company", or "the Group")

Audited Results for the year ended 31 December 2020

2021 update and outlook

AGM date and Investor Presentation

President (AIM: PPC), the upstream oil and gas company with a

diverse portfolio of production and exploration assets focused

primarily in Argentina, is pleased to announce its audited results

for the year ended 31 December 2020 and a 2021 update and

outlook.

In the face of the unprecedented challenges in 2020, including

the dramatic drop in the oil price to less than US$20 per barrel,

the Company still delivered solid progress and operational

profitability, with adjusted EBITDA* of almost US$2.1 million on

turnover of approximately US$28 million. This demonstrates the

continued strength of the Group and resilience in navigating

through the perfect storm of Covid-19 and its tsunami of

economically challenging waves which enveloped the whole of the

World.

The Company's Annual Report will be posted to shareholders by

the end of August.

Highlights FY2020

Financial

-- Group revenue to 31 December 2020 of US$27.8 million (2019: US$40.8 million) largely due to significantly lower average realised commodity prices, with a reduction of 40% in Argentina to US$30.0 per boe (2019: US$49.9 per boe) and 34% in the US to US$29.9 (2019: US$45.5 per boe)

-- Free cash generation from core operations* (excluding

workovers) US$6.2 million (2019: US$15.1 million)

-- Net cash generated by operating activities US$4.4 million (2019: US$21.5 million)

-- Adjusted EBITDA* remained positive in the face of

unprecedented adversity at US$2.1 million (2019: US$11.6

million)

-- Borrowings at year end significantly reduced year on year by

22% to US$17.6million (2019: US$22.6 million). Of this, only US$6.5

million is third party financial debt with the balance being to

IYA, an affiliate company of Peter Levine

-- After depreciation, depletion and amortisation of US$10.3

million (2019: US$10.5 million), reflecting the challenging trading

conditions, a loss after tax for the year arose of US$11.3 million

(2019 loss: US$88.3 million)

Corporate

-- Trafigura, one of the largest commodity traders in the world

and a major offtaker of President, became a ca. 16% shareholder

-- Atome created as a UK intermediate holding company focusing

on developing a hydrogen and ammonia production, marketing and

sales business. Work with significant potential is being progressed

as is an intended spin off and separate flotation on the London

Stock Exchange for later this year

Operations

-- An increase of 12% in Group net average production to 2,714 boepd (2019: 2,415 boepd)

-- Two new wells successfully drilled in Argentina in 2020 on

time and budget with follow-on drilling targets identified

-- Significant new infrastructure completed in Argentina

including laying some 20km of new pipelines and installing new

compressors

-- Continued improvement in Argentina core operating performance

with well operating costs per boe in 2020, excluding royalties and

workovers*, reduced by 17% to US$17.6 per boe (2019: US$21.1)

-- Group-wide administrative costs per barrel* were further

reduced to US$4.7 per boe (2019: US$4.8 per boe)

Production and reserves

-- Net 2P (proven and probable) reserves in Argentina at year

end, as confirmed by an independent reserves audit, decreased to

24.3 mmboe (2019: 25.9 mmboe)

-- Louisiana 1P proven producing reserves estimated at 724 mboe (2019: 540 mboe)

* calculation of all quoted metrics not directly corresponding

to GAAP measures are detailed in the Alternative Performance

Measure glossary and cross referenced to the Notes where

applicable

Peter Levine, Chairman, commented in the Chairman's

Statement:

"When I wrote my statement on 30 June last year, I don't think

any of us could have imagined that 14 months on we would still be

battling the impact of Covid-19. As I said previously, I spent

several months earlier this year travelling around our operations

in South America overseeing our exciting work programme and

advancing a material investment in our Paraguay assets. During that

time, I saw first-hand the devastation wrought by the global

pandemic and the significant sacrifices required to keep businesses

operational during such difficult times. Having myself been

hospitalised for two weeks, although thankfully now well on the way

to recovery, I remain eternally grateful for the skill and

dedication shown by the medical professionals in Paraguay and

across the Globe.

As I said at the time, I have never been one to sit behind a

desk to manage my business and I am willing to put myself in harm's

way for the benefit of our stakeholders so say none of this to gain

sympathy. I make these observations so that people might understand

the dedication shown by our hardworking employees in the face of

such adversity. It is this dedication that has led to us delivering

all the progress noted in the last 20 months.

Day by day our Company gets stronger although always subject to

intermittent variables which do throw stones in our path to deflect

us. We do all we can to grow President organically and by strategic

initiative. I am confident that 2021 will be seen by its end as a

year of progress with the Paraguay farmout, new drilling in Salta

and the spin off and float of Atome all set to be completed by year

end.

We successfully controlled what we could and the key performance

metrics through 2020 bear witness to this: - increased average

production, reduced operating and administrative costs as well as

overall debt. I am sincerely grateful to everyone within the

business for their efforts. We have a lot of work to do this year,

but we are very much up for it and relishing the prospects.

The energy landscape has changed even faster and more

dramatically than anticipated. President, as an energy company

focused on long term goals, embraces this and shareholders may have

noticed the rapid progress we are making with Atome Limited, the

subsidiary we formed earlier this year to focus on hydrogen-related

opportunities."

Production

Natural Gas

Oil (bbls) (mmcf) Total (mmboe)

Country 2020 2019 2020 2019 2020 2019

Argentina 623,946 768,594 1,648.5 334.1 898.7 824.3

USA 50,582 32,798 263.3 145.7 94.5 57.1

674,528 801,392 1,911.8 479.8 993.2 881.4

-------- -------- -------- ------ --------------- ------

Net Reserves (mboe) Argentina USA Total

As at 31 December

2019 25,929.1 539.7 26,468.8

Revisions in reserves (729.3) 248.2 (481.1)

Acquisition USA 0.0 30.4 30.4

Production (898.7) (94.5) (993.2)

As at 31 December

2020 24,301.1 723.8 25,024.9

---------- ------- ---------

Reserve revisions in Argentina reflect the results of production

performance and workovers in the year and the subsequent

independent auditor's reserve report by J@R Consultora. It is

important to note that the reserves as at 31 December 2020 do not

represent the total of what is present and/or recoverable in the

respective fields in Rio Negro but only rather what are present

and/or recoverable over the term of President's current licenses as

at the audit date.

Impact of COVID-19 on our operations

The first priority is the welfare and health of our employees

and families as well as our contractors working in the field.

President monitors and checks on the health of all its employees

and follows strict guidelines. Measures include restricting numbers

travelling to fields in vehicles, monitoring health of operatives

daily and social distancing. These necessary extra precautions have

had no impact on production levels.

The Company successfully transitioned in the year to staggered

office / home working for all our administration and office staff

in Argentina, with everyone equipped with all necessary IT

infrastructure when working remotely. Moral is excellent with a

strong sense of togetherness throughout and there has been no

decrease in efficiency although there have been delays in

administration, particularly in relation to the annual audit that

led to the delay in the release of these annual results. At the

time of this statement, office working is making a partial

carefully planned and implemented comeback. President has no

offices in the UK or Louisiana, so the Company is well used to

working remotely and economically.

Production from operations has not been affected and there have

been no shut-in wells or choke back of our wells.

Climate Change

President, acknowledges and takes due regard to the increasing

emphasis on climate change around the World as evidenced by the

activities regarding Atome. With regards to our core non renewables

business, we acknowledge climate change as a risk facing President

that will continue to be considered regularly by the Board.

Outlook

2021 will be a very busy year for the Company with a record

number of wells to be drilled and a return to growth. There are

several things for investors to look out for in the full year

results of 2021.

1. Three new wells have been drilled in Rio Negro in the first

half of 2021, with a further 3 to be drilled in Salta in the second

half of the year.

2. The return to activity in Puesto Guardian is significant with

the real beneficial impact on the Company only occurring in all

material effects from the start of 2022 when it is projected all

wells will be on stream. Puesto Guardian is a long-term concession

to 2050 and 100% owned and operated by President. Current

production is stable and showing good reservoir properties albeit

low in volume due directly to the fact that there have been no new

successful drilled wells there for some 10 years. Unproduced

reserves of scale are unquestionably present and there is

significant potential to grow. The hard lessons that have been

learnt from unsuccessful drilling in the past has given President a

determination to succeed with the Company now having the resource

and a drilling and engineering design team that have proved

themselves able to deliver in action. Moreover, with higher oil

prices mitigating the greater discount for Salta oil and all

necessary infrastructure in place to cope with greater volume,

there are potentially materially enhanced margin barrels to be

had.

3. Along with drilling and workover operations, President

continues with the infrastructure projects previously announced

including the treatment plant commissioned at the date of this

report fully operational resulting in an estimated $4/boe reduction

in operating costs.

4. The much-awaited Paraguay farm-out is now only awaiting

regulatory approvals, currently expected before the end of

September, and in the meantime, negotiations regarding long lead

items and the drilling rig are in progress with various site visits

having taken place. Drilling is expected to commence in the first

half of 2022 at the high impact Delray complex of prospects

internally estimated to contain 230 MMbo of unrisked oil in

place.

5. As to oil prices, whilst our modest Louisiana operations

approximately track WTI and Louisiana Light prices, Argentina

realisation prices are always based on the price of Medanito crude

and, in Rio Negro and Salta, President's realisation price is

currently estimated approximately US$55 per barrel.

6. Gas prices in Argentina reflect the current modest supply

squeeze which is expected to exacerbate over the winter with

current spot prices of approximately US$4 per MMBtu.

7. The unaudited results for the first half of the current year

will be announced in due course. Two of the key unaudited metrics

are that Group turnover was up 24.8% over the same period in 2020

at US$17.1 million on average Group production approximately the

same as for the previous full year at 2,648 boepd.

8. Whilst more information will be given in the half year

results, our production in Louisiana is reduced due to our main

Triche well requiring a workover for which we have long awaited a

suitable rig, hopefully due now in or around October. Group

production remains stable with gas production, albeit higher year

on year, still not achieving our expectation due to initial

declines in our new gas wells that we are currently working to

address

Oil and gas business acquisition strategy

President remains committed to growing its oil and gas business

by acquisition where appropriate and material efforts continue to

be made in this regard, including considering opportunities outside

of its present areas.

Each and every opportunity is carefully considered; however, in

the absence of suitable prospects and terms, the Company continues

to avoid spending acquisition dollars with all the direct and

hidden risks, costs and expenses when much under-utilised existing

production assets in the Company's portfolio, such as Salta, can be

exploited.

Atome

President is progressing high impact work with potential major

long-term upside.

The Directors consider that there is present and potential

future material shareholder value in Atome which we expect the

projected forthcoming flotation to realise and unlock for

President's own shareholders as well as providing those coming in

on the listing with significant upside in a sector of increasing

importance in the drive towards a carbon neutral future.

Annual General Meeting and Investor Q&A

The Annual General Meeting will be held on Thursday 23 September

2021 at 11 a.m. BST at Field Fisher, Riverbank House, 2 Swan Ln,

London EC4R 3TT and President is pleased to announce that Peter

Levine (Chairman) and Rob Shepherd (Finance Director) will provide

a live presentation relating to Annual General Meeting via the

Investor Meet Company platform on the same day, 23rd Sep 2021, at

1:00pm BST.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet PRESIDENT ENERGY PLC via:

https://www.investormeetcompany.com/president-energy-plc/register-investor

.

Investors who already follow PRESIDENT ENERGY PLC on the

Investor Meet Company platform will automatically be invited.

Contact:

President Energy PLC

Peter Levine, Chairman

Rob Shepherd, Group FD +44 (0) 207 016 7950

finnCap (Nominated Advisor and Broker)

Christopher Raggett, Tim Harper +44 (0) 207 220 0500

Detailed financial review

In 2020, we faced unprecedented challenges with the Covid-19

pandemic and resulting economic turbulence that led, amongst other

things, to a collapse in oil prices. Our continued focus on

financial discipline throughout the business has allowed the Group

to continue to make progress in our core business through

investment in new wells and development of gas assets in

Argentina.

Revenue fell by 32% to US$27.8 million (2019: US$40.8 million),

depressed by lower oil prices in both Argentina and the USA despite

higher overall sales volume. Overall Group production rose by 12%

reaching 2,714 boepd (2019: 2,415 boepd). Lower average product

prices for the year of US$30.0/boe (2019: US$49.6/boe) in part

reflected the growth in gas sales but mainly lower oil prices

through a turbulent year. Cost of sales of US$31.8 million (2019:

US$37.3 million) decreased due to lower well operating costs and

lower product price related royalty and production tax

expenses.

After depreciation, depletion and amortisation of US$10.3

million (2019: US$10.5 million) and administrative expenses of

US$4.6 million (2019: US$4.4 million), the Group recorded an

operating loss of US$8.7 million (2019: loss US$0.9 million)

After an impairment of US$1.9 million (2019: US$88.2 million)

related principally to intangible exploration assets in Argentina,

the loss for the year before tax was US$10.3 million (2019: loss

US$93.6 million) and, after tax, a loss for the year arose of

US$11.3 million (2019 loss: US$88.3 million).

Argentine operating performance

Production in Argentina increased by 9% to 898,704 boe (2019:

824,272 boe) or 2,455 boepd (2019: 2,258 boepd). Oil production

fell by 19% more than offset by a near fourfold increase in gas

production for the second year running. Average realised sales

prices in Argentina fell 40% to US$30.0 per boe (2019: US$49.9 per

boe) in line with the decline in world prices during the year.

Well operating costs in Argentina before non-recurring items*

fell by 17% to US$17.6/boe (2019: US$21.1/boe) as the focus

remained on cost control. Depreciation fell during the year to

US$10.9/boe (2019: US$12.3/boe)* following the impairment of Puesto

Guardian at the end of 2019.

Overall, following the annual independent review, proved and

probable reserves in Argentina fell by 3%. An impairment review was

conducted on Puesto Guardian following on from the write down in

2019 and on Rio Negro following a reduction in reserves recognised

at 31 December 2020. With respect to Rio Negro, President intends

to exercise its legal right to renew and extend its core Puesto

Flores/Estancia Vieja concession, currently due to expire in

November 2027, for a further ten years until November 2037 in

accordance with Argentine legislation, and consequently concrete

discussions with the Province of Rio Negro are progressing. Such an

extension will have a positive effect on reserves and on future

cash flow generation but was not considered in the impairment

review. No impairment was considered in relation to either asset

nor were the conditions considered sufficient to reverse the

impairment on Puesto Guardian recognised in 2019.

Over the past few years, the Group has been considering future

steps relating to the Matorras & Ocultar licences in Argentina;

in light of the uncertainty of future activity on the licence, the

Directors have now prudently decided to impair the intangible asset

in line with IFRS6 impairment indicators.

USA operating performance

Production from the Group's working interest in US operations

rose by 65% to 258 boepd (2019: 156 boepd). Production levels

recovered in 2020 following extensive flooding in Louisiana and a

workover of the Triche well in 2019 which had resulted in the

shutdown of the wells and facilities for four months.

Average realised prices in the US fell 34% on the prior year to

US$29.9/boe (2019: US$45.6/boe). Well operating costs excluding

royalty related expenses and non-recurring workovers* fell by 33%

to US$6.6 /boe (2019: US$9.8 /boe). Depreciation fell during the

year to US$3.6/boe (2019: US$4.9/boe)* following an increase in

reserves.

Following the completion of the technical review of the

Jefferson Island licence in the USA, and in light of the

macroeconomic conditions, it was decided to impair the asset

(US$0.1 million). The licence has been relinquished.

Corporate

Group administrative expense remained stable at US$4.6 million

(2019: US$4.4 million). While operations in Argentina and the USA

progressed, the price environment proved challenging, generating an

operating loss of US$8.7m (2019 loss US$0.9 million).

At the end of 2019, the Directors made the judgement that a

partial impairment of US$48.5 million was appropriate on the Pirity

licence reflecting indications arising during the farm out process.

When considering the fair valuation of the Paraguay asset, the

Directors have considered both the output of discussions from the

farm down process and internal assessments. Discussions with a

state-owned energy partner resumed in 2020 with an agreement

subject to regulatory approval announced in June 2021. It is

anticipated that the drilling in Paraguay will take place in 2022

after the farm down process has been completed later in 2021.

Accordingly, management considered that in light of the commitment

to drill and that the potential economic value remains unchanged,

it is appropriate to continue to capitalise the balance of US$53

million at 31 December 2020 (2019: US$54 million).

The Group's primary investment focus during 2020 was on

maintaining growth in core areas, increasing production in

Argentina whist maintaining a tight control on costs and cash flow

margins. In response to the challenging environment, the Group took

action to maintain financial stability.

In the first six months of 2020, the international commodity

trading and logistics group Trafigura agreed to subscribe for new

ordinary shares in the Company for a total sum of US$10 million at

an average share price of 2.4 pence per share, thereby becoming a

16.7 per cent shareholder in President. During the same period,

IYA, a Peter Levine group company, converted US$7.2 million of

monies owed to it from the Company into new ordinary shares at the

same average price. The net effect of the above has been to reduce

liabilities by some US$17 million.

On 4 June 2020, the Company announced that it had raised GBP4.73

million before expenses by way of placing ordinary shares,

including certain shares issued in settlement under direction

agreements. During 2020, US$0.83 million was received from Compañia

General De Combustibles S.A under a subscription agreement.

Investment in the Oil & Gas Assets component of Property,

Plant and Equipment in the year amounted to US$8.9 million (2019:

US$ 10.3 million) with the drilling and completion of two wells on

Las Bases and Estancia Vieja concessions, completion of gas

infrastructure projects and capital workovers. In the USA,

President acquired additional licence interests in the Triche well.

Lease additions of US$2.5 million (2019: US$ 1.4 million) largely

comprise the recognition of new contracts on a compressor and

generators in support of the increase in gas production. Contract

modifications during the initial phase of the Covid-19 pandemic and

the termination of drilling equipment contracts resulted in net

disposals in the year.

Overall, Trade and Other Payables decreased to US$13.8 million

(2019: US$26.5 million) largely due to early repayment of the

US$10.0 million contract liability with Trafigura S.A under an

offtake agreement and lower drilling related accruals.

Trade and Other Receivables decreased to US$4.6 million (2019:

US$6.5 million) in connection with the settlements made. The

Group's net current liability of US$4.8 million (2019: US$19.8

million) has decreased during the year due to early repayment of

the advance under the offtake arrangement with Trafigura S.A.

Furthermore, stripping out the liabilities on drilling and

acquisition investment activity, as detailed in Note 19, which are

periodic in nature, shows that the underlying net current liability

from ongoing operations is significantly lower at US$0.8 million

(2019: US$3.2 million). Year-end cash balances were US$1.1 million

(2019: US$0.9 million).

Key Performance Indicators

Key Performance Indicators are used to measure the extent to

which Directors and management are reaching key objectives. The

principal methods by which the Directors monitor the Group's

performance are volumes of net production, well operating costs and

the extent of exploration success. The Directors also carry out a

regular review of cash available for exploration and development

and review actual capital expenditure and operating expenses

against forecasts and budgets.

Increase/

2020 2019 (Decrease)

Production mboe

USA 94.5 57.1 65.5%

Argentina 898.7 824.3 9.0%

Total net hydrocarbons 993.2 881.4 12.7%

------- ------- ------------

Well operating costs US$000*

USA 623 982 -36.6%

Argentina 15,867 18,429 -13.9%

Total operating costs 16,490 19,411 -15.0%

------- ------- ------------

Well operating costs per boe

US$*

USA 6.6 17.2 -61.7%

Argentina 17.7 22.4 -21.0%

Total well operating costs per

boe US$ 16.6 22.0 -24.6%

------- ------- ------------

* calculation of all quoted metrics not directly corresponding

to GAAP measures are detailed in the Alternative Performance

Measure glossary and cross referenced to the Notes where

applicable

Consolidated Statement of Comprehensive Income

Year ended 31 December 2020

2020 2019

Note US$000 US$000

Continuing Operations

Revenue 27,771 40,812

Cost of sales 2 (31,775) (37,304)

--------- ---------

Gross profit/(loss) (4,004) 3,508

Administrative expenses 3 (4,648) (4,367)

--------- ---------

Operating profit /(loss) before impairment and non-operating

gains/(losses) (8,652) (859)

Presented as:

Adjusted EBITDA 2,115 11,552

Non-recurring items (86) (1,649)

EBITDA excluding share options 2,029 9,903

Depreciation, depletion & amortisation (10,271) (10,529)

Share based payment expense (410) (233)

Operating profit / (loss) (8,652) (859)

---------------------------------------------------------- ----- ---------

Non-operating gains / (losses) 4 (137) (337)

Impairment credit / (charge) 5 (1,884) (88,160)

--------- ---------

Profit / (loss) after impairment and non-operating

gains/(losses) (10,673) (89,356)

Finance income 4,506 641

Finance costs (4,084) (4,847)

--------- ---------

Profit / (loss) before tax (10,251) (93,562)

Income tax (charge)/credit comprises:

Current tax income tax (charge)/credit (2) 4

Deferred tax: foreign exchange arising on provision

for future taxes (3,530) (4,496)

Deferred tax: released on impairment - 10,078

Deferred tax being underlying provision for

future taxes 2,498 (301)

---------------------------------------------------------- ----- --------- ---------

Total income tax (charge)/credit (1,034) 5,285

Profit / (loss) for the year from continuing

operations (11,285) (88,277)

Other comprehensive income, net of tax

Items that may be reclassified subsequently

to profit or loss

Exchange differences on translation of foreign

operations - -

Total comprehensive profit /(loss) for the

year attributable

--------- ---------

to the equity holders of the parent (11,285) (88,277)

========= =========

Earnings / loss per share 6 US cents US cents

Basic profit/(loss) per share from continuing

operations (0.69) (7.90)

========= =========

Diluted profit(loss) per share from continuing

operations (0.69) (7.90)

========= =========

Consolidated Statement of Financial Position

31 December 2020

2020 2019

ASSETS Note US$000 US$000

Non-current assets

Intangible exploration & evaluation

assets 52,703 55,750

Goodwill 705 705

Property, plant and equipment 54,489 54,092

Deferred tax 567 1,248

Other non-current assets 102 351

108,566 112,146

---------- ----------

Current assets

Trade and other receivables 4,554 6,498

Stock 1,336 28

Cash and cash equivalents 1,144 895

7,034 7,421

---------- ----------

TOTAL ASSETS 115,600 119,567

========== ==========

LIABILITIES

Current liabilities

Trade and other payables 10,287 24,770

Borrowings 1,539 2,462

11,826 27,232

---------- ----------

Non-current liabilities

Trade and other payables 3,536 1,697

Long-term provisions 6,399 5,520

Borrowings 16,097 20,107

Deferred tax 1,375 1,024

27,407 28,348

---------- ----------

TOTAL LIABILITIES 39,233 55,580

========== ==========

EQUITY

Share capital 35,708 24,465

Share premium 257,992 245,692

Translation reserve (50,240) (50,240)

Profit and loss account (174,631) (163,346)

Reserve for share-based payments 7,538 7,416

TOTAL EQUITY 76,367 63,987

---------- ----------

TOTAL EQUITY AND LIABILITIES 115,600 119,567

========== ==========

Consolidated Statement of Changes in Equity

Year ended 31 December 2020

Reserve

for

Profit share-

and

Share Share Translation loss based

capital premium reserve account payments Total

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 1 January

2019 23,654 240,904 (50,240) (75,069) 7,183 146,432

Share-based payments - - - - 233 233

Issue of ordinary

shares 569 3,986 - - - 4,555

Costs of issue - (492) - - - (492)

Debt conversion 130 906 - - - 1,036

Subscription 112 388 - - - 500

Transactions with

the owners 811 4,788 - - 233 5,832

-------- -------- ------------ ---------- --------- ---------

Profit for the year - - - (88,277) - (88,277)

Total comprehensive

income for

the year - - - (88,277) - (88,277)

-------- -------- ------------ ---------- --------- ---------

Balance at 1 January

2020 24,465 245,692 (50,240) (163,346) 7,416 63,987

Share-based payments - - - - 122 122

Issue of ordinary

shares 2,604 2,213 - - - 4,817

Costs of issue - (434) - - - (434)

Debt conversion 3,344 3,869 - - - 7,213

Subscription 4,691 6,139 - - - 10,830

Issued in settlement 604 513 - - - 1,117

Transactions with

the owners 11,243 12,300 - - 122 23,665

-------- -------- ------------ ---------- --------- ---------

Profit for the year - - - (11,285) - (11,285)

Total comprehensive

income for

the year - - - (11,285) - (11,285)

-------- -------- ------------ ---------- --------- ---------

Balance at 31 December

2020 35,708 257,992 (50,240) (174,631) 7,538 76,367

======== ======== ============ ========== ========= =========

Consolidated Statement of Cash Flows

Year ended 31 December 2020

2020 2019

US$000 US$000

Cash flows from operating activities

Cash generated by operating activities

(note 26) 4,438 21,487

Interest received 105 184

Taxes refunded - 4

4,543 21,675

--------- ---------

Cash flows from investing activities

Expenditure on exploration and evaluation

assets (173) (263)

Expenditure on development and production

assets (11,395) (12,628)

Proceeds from asset sales 78 52

Acquisition & licence extension in Argentina (678) (2,395)

USA acquisition (158) -

Deposits with state authorities 249 -

Expenditure on abandonment - (283)

(12,077) (15,517)

--------- ---------

Cash flows from financing activities

Loan drawn 4,954 3,407

Proceeds from issue of shares (net of

expenses) 5,213 4,563

Loan converted to equity - -

Repayment of obligations under leases (868) (719)

Repayment of borrowings (5,076) (9,900)

Payment of interest and loan fees (696) (4,036)

3,527 (6,685)

--------- ---------

Net decrease in cash and cash equivalents (4,007) (527)

Opening cash and cash equivalents at

beginning of year 895 1,970

Exchange gains/(losses) on cash and cash

equivalents 4,256 (548)

Closing cash and cash equivalents 1,144 895

========= =========

Notes

1. Accounting policies and preparation

The financial information set out in this announcement does not

constitute the Company's statutory accounts for the years ended 31

December 2020 or 2019 but is derived from the 2020 accounts.

A copy of the statutory accounts for the year to 31 December

2019 has been delivered to the Registrar of Companies and is also

available on the Company's website. Statutory accounts for 2020

will be delivered in due course. The auditors have reported on

those accounts; their report was (i) unqualified, (ii) did not

include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006 in respect of the accounts for 2019 nor

2020.

Whilst the financial statements from which this preliminary

announcement is derived have been prepared in accordance with

International Financial Reporting Standards ("IFRS") and applicable

law, this announcement does not itself contain sufficient

information to comply with IFRS. The Annual Report, containing full

financial statements that comply with IFRS, will be sent out to

shareholders later in August 2021.

The Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Therefore, in the preparation of the

20120financial statements they continue to adopt the going concern

basis.

2020 2019

2 Cost of sales US$000 US$000

Depreciation 10,109 10,412

Royalties & production taxes 5,176 7,481

Well operating costs 16,490 19,411

31,775 37,304

======= =======

Well operating costs include US$86,000 (2019: US$1,163,000) in

non-recurring workover costs expensed in the period. During 2019,

an exceptional bonus of US$305,000 was paid to field personnel and

hence included in well operating costs in Argentina.

2020 2019

3 Administrative expenses US$000 US$000

Directors and staff costs (including

non-executive Directors) 2,391 3,655

Share-based payments 410 233

Depreciation 162 117

Other 1,685 362

4,648 4,367

======= =======

To allow for meaningful comparison, staff costs, share based

payments and depreciation expenses are reflected gross before the

effect of allocations to operating costs or balance sheet assets.

Other expenses are shown net of the effect of allocations US$1.5

million (2019: US$1.6 million). During 2019, an exceptional bonus

of US$609,000 was included in director and staff costs. This was

partly offset by a one-off credit of US$428,000 arising on change

in bank transaction taxes in Argentina.

4 Other non-operating (gains)/losses 2020 2019

US$000 US$000

Reverse of provision for recoverable

taxes 19 236

Movement on estimated credit loss on

trade debtors 6 56

(Gain)/ loss on termination of leases (86) -

Other (gains)/losses arising on asset

disposals 198 45

137 337

======= =======

2020 2019

5 Impairment (credit) / charge US$000 US$000

DP1002 well in Argentina (PP&E) - (216)

Puesto Guardian in Argentina (PP&E) - 39,913

Pirity licence in Paraguay (Intangible) - 48,463

Matorras & Ocultar in Argentina (intangible) 1,759 -

Jefferson Island (intangible) 125 -

1,884 88,160

======= =======

6. Earnings / (Loss) per share 2020 2019

US$000 US$000

Net profit / (loss) for the period attributable

to

the equity holders of the Parent Company (11,285) (88,277)

========== ==========

Number Number

'000 '000

Weighted average number of shares in issue 1,641,684 1,116,944

========== ==========

US cents US cents

Earnings /(loss) per share

Basic earnings / (loss) per share from

continuing operations (0.69) (7.90)

========== ==========

Diluted earnings / (loss) per share from

continuing operations (0.69) (7.90)

========== ==========

At 31 December 2020, 32,146,921 (2019: 42,126,694) share option

and share warrant awards were in issue that, if exercised, would

dilute earnings per share in the future. No dilution per share was

calculated for 2020 and 2019 as with the reported loss they are

anti-dilutive.

7. Notes to the consolidated statement

cash flows 2020 2019

US$000 US$000

Profit / (loss) from operations before

taxation (10,251) (93,562)

Interest on bank deposits (105) (184)

Interest payable and loan fees 4,084 4,847

Depreciation of property, plant and equipment 10,271 10,529

Impairment (credit)/charge 1,884 88,160

(Gain) / loss on non-operating transaction 137 337

Share-based payments 410 233

Foreign exchange difference (4,401) (457)

--------- ---------

Operating cash flows before movements

in working capital 2,029 9,903

Decrease / (increase) in receivables 1,421 3,592

Movement in stock 28 56

Increase / (decrease) in payables 960 7,936

--------- ---------

Net cash generated by operating activities 4,438 21,487

========= =========

8 Segment reporting

Argentina Paraguay USA UK Total

2020 2020 2020 2020 2020

US$000 US$000 US$000 US$000 US$000

Revenue 24,915 - 2,856 - 27,771

Cost of sales

Depreciation 9,766 - 343 - 10,109

Royalties & production

taxes 4,448 - 728 - 5,176

Well operating costs 15,867 - 623 - 16,490

Administrative expenses 1,859 73 422 2,294 4,648

Segment costs 31,940 73 2,116 2,294 36,423

---------- --------- ------- -------- --------

Segment operating profit/(loss) (7,025) (73) 740 (2,294) (8,652)

========== ========= ======= ======== ========

Argentina Paraguay USA UK Total

2019 2019 2019 2019 2019

US$000 US$000 US$000 US$000 US$000

Revenue 38,220 - 2,592 - 40,812

Cost of sales

Depreciation 10,133 - 279 - 10,412

Release of abandonment

provision - - - - -

Royalties & production

taxes 6,801 - 680 - 7,481

Well operating costs 18,429 - 982 - 19,411

Administrative expenses 1,374 94 425 2,474 4,367

Segment costs 36,737 94 2,366 2,474 41,671

---------- --------- ------- -------- --------

Segment operating profit/(loss) 1,483 (94) 226 (2,474) (859)

========== ========= ======= ======== ========

Segment assets Argentina Paraguay USA UK Total

2020 2020 2020 2020 2020

US$000 US$000 US$000 US$000 US$000

Intangible assets 129 52,574 - - 52,703

Goodwill 705 - - - 705

Property, plant and equipment 52,637 - 1,852 - 54,489

---------- --------- ------- ------- --------

53,471 52,574 1,852 - 107,897

Other assets 3,975 1,352 936 296 6,559

--------

57,446 53,926 2,788 296 114,456

========== ========= ======= ======= ========

Argentina Paraguay USA UK Total

2019 2019 2019 2019 2019

US$000 US$000 US$000 US$000 US$000

Intangible assets 1,859 53,766 125 - 55,750

Goodwill 705 - - - 705

Property, plant and equipment 52,344 42 1,706 - 54,092

---------- --------- ------- ------- --------

54,908 53,808 1,831 - 110,547

Other assets 5,685 16 2,130 294 8,125

--------

60,593 53,824 3,961 294 118,672

========== ========= ======= ======= ========

Segment assets can be reconciled to the Group as follows:

2020 2019

US$000 US$000

Segment assets 114,456 118,672

Group cash 1,144 895

Group assets 115,600 119,567

======== ========

Segment liabilities Argentina Paraguay USA UK Total

2020 2020 2020 2020 2020

US$000 US$000 US$000 US$000 US$000

Total liabilities 23,870 56 1,675 13,632 39,233

========== ========= ======= ======= =======

Argentina Paraguay USA UK Total

2019 2019 2019 2019 2019

US$000 US$000 US$000 US$000 US$000

Total liabilities 32,455 275 1,869 20,981 55,580

========== ========= ======= ======= =======

Alternative Performance Measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles. These non-IFRS measures include net debt and

well operating and underlying well operating costs per boe and free

cash flow. Where used in the context of segmental disclosure the

metrics are calculated in the same manner.

Total operating cost and underlying well operating cost per

boe

Total operating cost per boe is a useful straight forward

indicator of the Group's costs incurred to produce oil and gas

including all relevant expenses. However, since royalty, production

taxes and similar expenses are not controllable these have been

disaggregated to allow well operating costs to be measured.

2020 2019

Total operating cost per boe US$000 US$000

Royalties & production taxes (Note 2) 5,176 7,481

Well operating costs (Note 2) 16,490 19,411

Total operating costs 21,666 26,892

------- -------

Production (mmboe) 993.2 881.4

Total operating costs per boe US$ 21.81 30.51

======= =======

Where one-off or cyclical costs, such as workovers, are material

these have been disclosed and the underlying well cost per boe

referred to show the core performance. These have been defined and

calculated as follows:

2020 2019

Underlying well operating cost per boe US$000 US$000

Well operating costs (Note 2) 16,490 19,411

Less workover costs (per text in Note 2) (86) (1,163)

Less Exceptional staff bonus in Operating

expense (text in Note 2) - (305)

16,404 17,943

Production (mmboe) 993.2 881.4

Underlying well operating costs per boe US$ 16.52 20.36

======= ========

A 17% reduction in core operating performance arose in Argentina

and was calculated as follows:

2020 2019

US$000 US$000

Well operating costs (Note 2) 15,867 18,429

Less workover costs (86) (739)

Less Exceptional staff bonus in Operating

expense (text in Note 2) 0 (305)

15,781 17,385

Production (mmboe) 898.7 824.3

Underlying well operating costs per boe US$ 17.56 21.09

======= =======

Administrative cost per barrel

Underlying administrative expense excluding non-recurring items

is calculated as follows:

2020 2019

Administrative cost per boe US$000 US$000

Administrative expense (Note 3) 4,648 4,367

Arising on change in bank transaction taxes

in Argentina - 428

Exceptional staff bonus in Admin expense

(text in Note 3) - (609)

4,648 4,186

Production (mmboe) 993.2 881.4

Administrative cost per boe 4.68 4.75

======= =======

Adjusted EBITDA

The calculation is detailed on the Income Statement with further

details on the non-recurring items below.

Non-recurring items

Where referred to in the calculation of Adjusted EBITDA and in

alternative performance measures these comprise the following:

2020 2019

Non-recurring US$000 US$000

Workover costs (per text in Note 2) 86 1,163

Arising on change in bank transaction taxes

in Argentina - (428)

Exceptional staff bonus in Admin expense

(per text in Note 3) - 609

Exceptional staff bonus in Operating expense

(per text in Note 2) - 305

86 1,649

------- -------

Free cash generation from core operations

A measure of cash generation from operations excluding changes

in working capital, administrative expense and non-recurring

workovers. Used by management as an indication of cash generation

at asset level.

2020 2019

US$000 US$000

Sales 27,771 40,812

Royalties & production taxes (Note2) (5,176) (7,481)

Well operating costs (Note 2) (16,490) (19,411)

Add back non-recurring workovers 86 1,163

6,191 15,083

--------- ---------

Including the foreign exchange gains of US$4.4 million which

largely arise on the treasury management of cash resources

("treasury income") takes the cash generation in the period to

US$10.6 million (2019: US$15.5 million).

Reconciliation to cash flow from operations

The reported cash flow generated from operating activities can

be reconciled to free cashflows from core operations as

follows:

2020 2019

US$000 US$000

Net cash generated by operating activities 4,438 21,487

Working capital movement per Note 7 (2,409) (11,584)

Add back administrative expense per Note

3 4,648 4,367

Add back non cash depreciation in admin expense

(Note 3) (162) (117)

Add back non cash share based payments in

admin expense (Note 3) (410) (233)

Add back non-recurring workovers 86 1,163

6,191 15,083

-------- ---------

Deprecation per boe

Depreciation per barrel of oil equivalent can change between

accounting periods due to costs incurred, changes in reserves or

changes in future costs and hence is a useful metric for reporting

purposes. Where calculated on at a group or segment level the

calculation is as follows:

-- Reported depreciation charge as reported in Cost of Sales per

Note 2 in accordance with IFRS GAAP reporting

-- Divided by the barrel of oil equivalent of production

reported in the Chairman's Statement in accordance with industry

standards and state reports

Glossary

Boe barrels of oil equivalent

Bopd barrels of oil per day

Boepd barrels of oil equivalent per day

MMscf/d million standard cubic feet of gas production per day

1P proven hydrocarbon reserves

2P proven and probable hydrocarbon reserves

Contingent Resources Quantities of hydrocarbons estimated to be

potentially recoverable from known accumulations

Prospective Resources Quantities of hydrocarbons estimated to be

potentially recoverable from undiscovered accumulations

NPV10 net present value over the life of the

concessions/licences discounted by 10%

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

FR ZZGZRMFMGMZZ

(END) Dow Jones Newswires

August 24, 2021 02:00 ET (06:00 GMT)

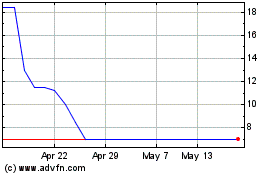

Molecular Energies (LSE:MEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Molecular Energies (LSE:MEN)

Historical Stock Chart

From Jul 2023 to Jul 2024