TIDMMCM

RNS Number : 5812E

MC Mining Limited

30 June 2023

Announcement 30 June 2023

MAKHADO PROJECT - SIGNIFICANT INCREASES IN MINE LIFE AND COAL

RESERVES

MC Mining Limited (MC Mining or the Company) is pleased to

announce the results of the updated Life of Mine (LOM) plan and

Coal Reserve estimate for its fully-licensed and shovel-ready

Makhado steelmaking hard coking coal project (Makhado Project,

Makhado or the Project).

Highlights:

-- the updated LOM plan(2) demonstrates a significantly

increased mine life (+27%), at a higher annual mine production rate

(+25%) and results in robust project financial returns, whilst

using updated conservative cost, macro-economic and coal price

assumptions;

-- Proved and Probable Coal Reserves estimates, reported in

accordance to JORC Code guidelines [1] , have substantially

increased (+53%, from 69 to 106 million tonnes (Mt) [2] ) as a

result of the detailed mine designs completed for the East Pit

deposit in preparation for mine start; and

-- steady progress has been made with critical early works activities in line with the Project's Implementation Plan [3] .

The LOM plan builds on the recently completed five-year

Implementation Plan that envisaged initially mining the East Pit.

The plan incorporates the exploitation of all portions of the East,

Central and West coal deposits that are mineable by surface mining

methods. The Coal Reserve estimate is derived from this updated LOM

plan that applies updated costs, macro-economic and coal price

assumptions.

The updated LOM plan and Coal Reserve estimate are required to

conclude funding discussions that are part of the ongoing

implementation of the Makhado Project mine-build. The Project is

67.3%-owned by MCM through a local subsidiary, Baobab Mining &

Exploration Pty Ltd (BM&E). All figures are reported for the

full project in US$ and ZAR.

-- The updated LOM plan is a significant improvement on the

Scenario 2 plan completed in August 2022 to a pre-feasibility level

of confidence (Scenario 2) [4] , as is demonstrated by:

o improved production metrics:

-- a 25% increase in the targeted rate of mining from 3.2 to 4.0

million (M) tonnes per annum (Mtpa) run-of-mine (ROM) coal; and

-- a 100% increase in coal handling and processing plant

capacity, from 2.0 to 4.0 Mtpa; resulting in

-- a 30% increase in planned annual sales of 64 Mid Volatile

(Vol) steelmaking hard coking coal (HCC) to 0.81 Mtpa and a 15%

increase in planned annual sales of 5,500 kcal thermal coal (TC) to

0.62 Mtpa ([5]) ;

-- a 60% increase of total salable coal products from 26 to 41

million tonnes (Mt) over the mine life;

-- a 27% increase in the LOM from 22 to 28 years; and

-- the time to first production increasing from 12 to 18 months

due to the new plant build whilst keeping the payback period

materially unchanged at 3.5 years from the start of

construction.

o using updated and conservative cost and macro-economic

assumptions that account for recent inflationary and market cost

escalations in key production inputs, these being:

-- a 6% increase in estimated fully-allocated costs (C3) to

average US$83 (ZAR1,563) per tonne of saleable coal over the

LOM;

-- an 11% increase in the estimated project peak funding

requirements to US$96 M (ZAR1.8 billion (Bn));

-- a 22% increase in the forecast ZAR:US$ foreign currency

exchange (Forex) rate from ZAR15.47 to average ZAR18.83 [6] over

the LOM;

-- a marginally higher indexed premium HCC price forecast from

US$212 to US$215 per tonne sold on a free on board basis (FOB) [7]

over the LOM, sourced from independent advisors Afriforesight;

and

-- a marginally higher indexed API4 thermal coal price (6,000

kcal) forecast from US$106 to US$108 per tonne (FOB) [8] over the

LOM.

o resulting in the following planned financial returns for the

Project:

-- a 20% improvement in free cashflows to US$936 M (ZAR17.6

Bn);

-- a 17% increase in the post tax Net Present Value (NPV) from

ZAR5.8 Bn (real, post-tax, at a 6% discount rate) to ZAR6.8Bn (due

to exchange rate movements, a 4% reduction in US$ terms to US$361

M); and

-- an internal rate of return (IRR) (real, post-tax) of 37% and

EBITDA margin of 30%.

-- Proved and Probable Coal Reserves estimates, reported in

accordance to JORC Code guidelines, have substantially increased

compared to the estimates reported previously [9] , to result

in:

o a 53% increase in total Coal Reserves from 69 to 106 Mt due to

the revision in the East Pit optimisation and mine design;

o a 64% increase in salable steelmaking HCC from 13.7 to 22.5 Mt

achieved at an overall yield of 21.2%; and

o a 57% increase in salable TC from 11.9 to 18.7 Mt achieved at

an overall yield of 17.6%.

The Coal Resource estimate on which this Coal Reserve estimate

is based remains unchanged at 296 Mt of mineable tonnes in situ

(MTIS) in the Measured and Indicated categories as previously

announced by the Company [10] . The reported Coal Resource is

inclusive of the Coal Reserve.

-- Steady progress has been made with critical early works

activities in line with the Implementation Plan, to advance the

Project towards commencement of production, including:

o commencement with works relating to the power supply overhead

transmission line;

o construction of a bridge across the Mutamba river to provide

access to the project site;

o order placement for key long-lead items; and

o progressing with the selection of mine-operating

contractors.

Chief Executive Officer, Mr. Godfrey Gomwe, commented:

"The Makhado Project continues to progress on schedule in

preparation for first coal production to no later than 18 months

after construction starts. We are pleased to see a substantial

increase in our Coal Reserves and consequently mine life at a

much-improved annual production rate for saleable coal products.

This bodes well for moving operations down the cost curve whilst

aiming to take advantage of the near-term steelmaking HCC coal

price boons. We continue to focus on advancing early works

activities whilst funding activities are concluded in H2 CY2023, so

that mine commissioning meets scheduled [production?] timelines. We

are also excited to have strong contenders to be our partner mining

contractors and partner coal beneficiation plant operating

contractors in the managed tender processes currently under way and

due for completion during the third quarter of 2023."

Key Project metrics are provided in the following tables.

Table 1: Key Production Parameters

Mining Production Rate - (Average) Mtpa 3.9

---------------- -----

Total ROM Mined (over the mine life) Mt 106

---------------- -----

Total Waste Mined (over the mine life) BCM ( million) 260

---------------- -----

Stripping Ratio (Waste: ROM) BCM:tonnes 2.5

---------------- -----

Steelmaking HCC Yield % 21.2

---------------- -----

TC Yield % 17.6

---------------- -----

Total Coal Sales - All Products Mt 41.2

---------------- -----

Coal Sales 5,500 kcal TC - Export Mt 18.7

---------------- -----

Coal Sales - Steelmaking HCC (Domestic and Export) Mt 22.5

---------------- -----

Steelmaking HCC - Domestic Mt 11.2

---------------- -----

Steelmaking HCC - Export Mt 11.3

---------------- -----

Figure 1: ZAR:US$ foreign exchange rate forecast assumptions

(real) as provided by ABSA Bank as of June 2023.

Figure 2: Coal Prices forecast assumptions (real) as provided by

Afriforesight as of June 2023.

Table 2: Calculations Showing Adjustments from Indexed to

Realised Coal Prices (averages over the life of mine)

Indexed HCC Premium (source: Afriforesight

June 2023 forecast) 215

--------------------------------------------- ----

Price Discount [11] -21

--------------------------------------------- ----

Realised 64 mid vol HCC Price (Export) 193

--------------------------------------------- ----

Sales Price adjustments -19

--------------------------------------------- ----

Realised 64 mid vol HCC Price (Domestic) 175

--------------------------------------------- ----

Indexed TC - 6,000 kcal (source:

Afriforesight June 2023 forecast) 108

--------------------------------------------- ----

Price Discount -17

--------------------------------------------- ----

Sales Price adjustments [12] -61

--------------------------------------------- ----

Realised TC 5,500 kcal Price 29

--------------------------------------------- ----

Table 3: Capital Expenditure Estimate

Construction Capital + 10% Contingency 90.8 1,709

------ ------

Extension Capital + 20% Contingency

(From Year 14) 28.6 539

------ ------

Sustaining Capital 12.7 240

------ ------

Total LOM Capital (+/-15%) 132.1 2,488

------ ------

Table 4: Operating Margins Parameters

Fully-allocated Cost Margin (C3 Margin) 27%

----

EBITDA Margin 30%

----

Table 5:Comparison of LOM Plan (June 2023) to Scenario 2 Plan

(August 2022)

Production Metrics

Total ROM Mined (over

the mine life) Mt 106 69 37

------------- ----- ----- ----

Total Waste Mined (over

the mine life) BCM 260 146 114

------------- ----- ----- ----

Stripping Ratio (Waste:

ROM) BCM:t 2.5 2.1 0.3

------------- ----- ----- ----

Coal Sales - 5,500 kcal

TC - Export Mt 18.7 11.9 6.8

------------- ----- ----- ----

Coal Sales - steelmaking

64 Mid Vol HCC Mt 22.5 13.7 8.8

------------- ----- ----- ----

Construction period Months 18 12 6

------------- ----- ----- ----

Macro-economic Assumptions and Coal Prices

Long term ZAR:US$ exchange

rate used(2) ZAR:US$ 18.8 15.5 3.4

------------- ----- ----- ----

Benchmark

Prices (real,

long term) Premium HCC price(3) US$/t 215 212 3

---------------------- ------------- ----- ----- ----

API4 (6,000 kcal)

thermal coal

price(4) US$/t 108 106 2

---------------------- ------------------------------ ----- ----- ----

Realised 64 Mid Vol HCC

Prices (real) (export) US$/t 193 177 16

---------------------- ------------- ----- ----- ----

64 Mid Vol HCC

(domestic) US$/t 175 171 3

---------------------- ------------------------------ ----- ----- ----

TC 5,500 kcal US$/t 29 61 -32

---------------------- ------------------------------ ----- ----- ----

Cost Estimates

Fully-allocated Unit Costs US$/salable

(C3) t 83 78 5

------------- ----- ----- ----

Construction Capital ZAR 'Bn 1.7 1.2 0.5

------------- ----- ----- ----

Financial Evaluation

Outcomes

------------- ----- ----- ----

Peak Funding Requirements ZAR 'Bn 1.8 1.3 0.5

------------- ----- ----- ----

Free cashflow (post tax) ZAR 'Bn 17.6 12.1 5.5

------------- ----- ----- ----

Post-tax IRR % 37 41 -4

------------- ----- ----- ----

Post-tax NPV(6%) ZAR 'Bn 6.8 5.8 1

------------- ----- ----- ----

Post-tax NPV(10%) ZAR 'Bn 4.0 3.8 0.2

------------- ----- ----- ----

Average payback period

(years) Years 3.5 3.5 0

------------- ----- ----- ----

The NPV is most sensitive to variances in the USD:ZAR Forex

rate, HCC price and HCC yields. The NPV increases by 45%, 35% and

25%, respectively, when the USD:ZAR Forex rate, HCC price and HCC

yields are each increased by 10%. Conversely, the NPV is less

sensitive to changes in mining operating costs and product trucking

costs. The NPV decreases by 12% and 9% when mining costs and

product trucking costs are increased by 10% respectively.

The break-even indexed premium HCC and API4 TC (6,000 kcal)

prices, where the NPV is zero, were calculated to be US$171/t and

US$86/t, respectively at the production ratios presented in the LOM

Plan.

The LOM Plan is an improvement, in many aspects, on the project

development scenario selected in August 2022 (Scenario 2) as the

preferred plan to be taken forward. Whilst the Scenario 2 plan was

compiled at a pre-feasibility level of confidence (+/-30%), the LOM

plan has been prepared with capital cost estimates within a +/-10%

accuracy level for the first five years of the project and

thereafter within +/- 30%. The capex for the first five years,

exluding any sustaining capex, is ZAR1.7Bn to construct the Makhado

Project (+/-10% accuracy) while LOM plan includes a further

ZAR0.5Bn (+/-30% accuracy) to develop the Central and West pits.

The reference date for the cost estimates is April 2023.

CRITICAL EARLY WORKS IMPLEMENTATION PROGRESS

The Company continues with critical early works being:

-- commencement with detailed design, procurement and

construction of the power supply overhead transmission line, with

construction team now mobilised onsite - a critical path

activity;

-- refurbishment of onsite accommodation to house project construction crews;

-- placement of orders for key long-lead time items;

-- progress with the managed tender processes for selecting

contractors to partner as the lead mining and coal beneficiation

plant operating contractors;

-- mobilisation of construction contractors for the construction

of the main access road, main bridge and civil works for bulk water

reticulation; and

-- progress with erection of fencing to secure the project site.

SUMMARY OF COAL RESERVES ESTIMATE

Coal Reserves Estimate Update

MCM's equity share in Makhado is 67.3%. A summary of the Gross

net Coal Reserve estimate is shown in Table 65.

Table 6: Makhado Project Coal Reserves Estimate as at 28 June

2023 (Gross)

East Pit Proved 49 695 22.3% 11 101 17.6% 8 743

------------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 4 878 23.2% 1 129 17.3% 843

------------------------ ------------------ ------ ------------------- ------ -------------------

Total 54 573 22.4% 12 230 17.6% 9 586

------------------------ ------------------ ------ ------------------- ------ -------------------

Central Pit Proved 21 947 21.3% 4 685 17.1% 3 747

------------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 1 158 24.7% 286 16.9% 196

------------------------ ------------------ ------ ------------------- ------ -------------------

Total 23 105 21.5% 4 971 17.1% 3 944

------------------------ ------------------ ------ ------------------- ------ -------------------

West Pit Proved 26 114 18.7% 4 885 18.3% 4 791

------------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 2 462 17.5% 431 15.3% 376

------------------------ ------------------ ------ ------------------- ------ -------------------

Total 28 576 18.6% 5 317 18.1% 5 167

------------------------ ------------------ ------ ------------------- ------ -------------------

Combined Proved 97 756 21.1% 20 672 17.7% 17 281

------------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 8 498 21.7% 1 846 16.7% 1 415

------------------------ ------------------ ------ ------------------- ------ -------------------

Total 106 254 21.2% 22 518 17.6% 18 697

------------------------ ------------------ ------ ------------------- ------ -------------------

Gross Coal Reserve Estimate (Proved and Probable) as at 28 june

2023

Notes

1. GTIS based on a 1.4 washability

2. MTIS excludes the Fripps Farm and is limited to the 200 m depth cut-off.

3. MTIS includes geological losses of 5% on Measured, 8% on

Indicated and 10% on Inferred Coal Resources.

4. Quality parameters applied to GTIS to obtain MTIS.

5. Minimum coal seam thickness of 0.5 m applied.

6. HCC Ash content <= 10%, TC Ash content <= 25.9% and Volatile material > 20%.

7. The Coal Reserve estimation includes diluted Measured and

Indicated Coal Resources only.

8. No Inferred Coal Resources have been included in the Coal Reserve estimation.

9. The Coal Reserve estimate was completed using a realised coal

price of US$193t for 64 Mid Vol HCC (export) and US$29/t for TC

5,000 kcal after product quality discounts and offtake-related

deductions were applied.

Key Assumptions and JORC Code Requirements

Coal Resources are reported inclusive of Coal Reserves.

The coal price assumptions used to estimate Coal Reserves were

indexed values of US$215/t for steelmaking premium HCC and US$108/t

for API4 Thermal Coal (6,000 kcal), on a real basis. The

corresponding realised coal prices for two salable products after

making quality and sales price adjustments were US$193/t for the 64

Mid Vol HCC for export and US$29/t for the TC 5,500 kcal at an

assumed ZAR:US$ Forex rate of ZAR18.83. The long-term indexed coal

price forecasts were sourced from Afriforesight and the Forex rate

assumptions were sourced from ABSA Bank Ltd as of June 2023.

The Coal Resources and Coal Reserves have been classified in

accordance with the guidelines set out in the Australasian Code for

Reporting Exploration Results, Mineral Resources and Ore Reserves,

published by the Joint Ore Reserves Committee (JORC), of the

Australasian Institute of Mining and Metallurgy, the Australian

Institute of Geoscientists and the Minerals Council of Australia,

December 2012 (the JORC Code or JORC 2012).

Material Information for the Makhado Project coal deposit,

including a summary of material information pursuant to ASX Listing

Rule 5.9 and the Assessment and Reporting Criteria in accordance

with JORC 2012 requirements in the body of this anouncement, may be

found on the Company's website:

https://protect-za.mimecast.com/s/s9V-Cg5yVQI3GEmTNJvpn?domain=mcmining.co.za

The conversion from mineable tonnes in situ Coal Resource (MTIS)

to Coal Reserves is illustrated in the waterfall chart in Figure

3.

Figure 3: Coal Resource to Coal Reserve Conversion Waterfall

Chart

Coal Resources and Coal Reserves Governance Statement

In accordance with ASX Listing Rule 5.21.5, governance of the

Company's Coal Resources and Coal Reserves development and

management activities are through the management and owner's team

for MCM.

Senior geological and mining engineering staff contracted by MCM

oversee reviews and technical evaluations of the estimates and

evaluate these with reference to industry standards and empirical

estimates for physical, cost and performance measures. The

evaluation process also draws upon internal skill sets in

operational and project management, coal processing and

commercial/financial areas of the business.

The MCM Safety, Health, Environment and Technical Committee

(SHETech Committee) is responsible for monitoring the planning,

prioritisation and progress of the estimation and reporting of Coal

Resources. These definition activities are conducted within a

framework of quality assurance and quality control protocols

covering aspects including drill hole siting, sample collection,

sample preparation and analysis as well as sample and data

security. The SHETech Committee is responsible for the reporting of

Coal Reserves.

A four-level compliance process guides the control and assurance

activities by the SHETech Committee, being:

-- provision of Company policies, standards, procedures and guidelines;

-- Coal Resources and Coal Reserves reporting based on

well-founded geological and mining assumptions and compliance with

external standards such as the JORC Code;

-- internal and third-party reviews of process conformance and compliance; and

-- internal and third-party assessment of compliance and data veracity.

The Company reports its Coal Resources and Coal Reserves, as a

minimum, on an annual basis and in accordance with ASX Listing Rule

5.21 and clause 14 of Appendix 5A (the JORC Code). Competent

Persons named by the Company are either members of the South

African Institute of Mining and Metallurgy or the South African

Council for Natural Scientific Professions, which are 'Recognised

Professional Organisations' (RPOs), included in a list promulgated

by the ASX from time to time, hence qualify as Competent Persons as

defined in the JORC Code.

Summary of Material Information

The updated Coal Reserve estimate reported in Table 6 is based

on the Coal Resource estimate as reported by the Company as of 28

June 2022 with modifying factors applied. The modifying factors and

associated criteria used in determining the Coal Reserve are

summarised below, in accordance with ASX Listing Rule 5.9.1.

Table 7: Modifying Factors for Coal Reserves Calculations

Minimum Mineable Coal Seam Thickness m 0.5

--- ------

Geological Losses (Measured & Indicated) % 5 & 8

--- ------

Mining Loss Factor % 5

--- ------

Minimum Product Volatiles % 20

--- ------

Mining Contamination % 5

--- ------

Practical Yield % 95

--- ------

Comparison of Coal Reserves Estimates

Tables 6 to 9 compare the 2022 Coal Reserves estimate with the

updated Coal Reserve estimate as at 28 June 2023. Changes in the

Coal Reserves are due to the revision of pit optimisations and

detailed mine designs of the East Pit. MCM's equity share is 67.3%

of the Coal Reserves estimate shown below. Coal Reserves are

included in the Coal Resource estimate.

Table 8: Makhado Project Coal Reserves Changes from Previous

Estimate - East Pit (gross)

30-Jun-22 Proved 14 739 19.1% 2 814 16.1% 2 369

----------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 2 925 21.0% 614 15.3% 448

---------------------- ------------------ ------ ------------------- ------ -------------------

Total 17 663 19.4% 3 428 15.9% 2 816

---------------------- ------------------ ------ ------------------- ------ -------------------

Changes Proved 34 956 3.2% 8 287 1.5% 6 375

----------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 1 954 2.1% 515 2.0% 395

---------------------- ------------------ ------ ------------------- ------ -------------------

Total 36 910 3.0% 8 802 1.6% 6 770

---------------------- ------------------ ------ ------------------- ------ -------------------

28-Jun-23 Proved 49 695 22.3% 11 101 17.6% 8 743

----------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 4 878 23.2% 1 129 17.3% 843

---------------------- ------------------ ------ ------------------- ------ -------------------

Total 54 573 22.4% 12 230 17.6% 9 586

---------------------- ------------------ ------ ------------------- ------ -------------------

Table 9: Makhado Project Coal Reserves Changes from Previous

Estimate - Central Pit (gross)

30-Jun-22 Proved 21 947 21.3% 4 685 17.1% 3 747

----------- ---------- -------------------- ------ -------------------- ------ --------------------

Probable 1 158 24.7% 286 16.9% 196

---------------------- -------------------- ------ -------------------- ------ --------------------

Total 23 105 21.5% 4 971 17.1% 3 944

---------------------- -------------------- ------ -------------------- ------ --------------------

Changes Proved - 0.0% - 0.0% -

----------- ---------- -------------------- ------ -------------------- ------ --------------------

Probable - 0.0% - 0.0% -

---------------------- -------------------- ------ -------------------- ------ --------------------

Total - 0.0% - 0.0% -

---------------------- -------------------- ------ -------------------- ------ --------------------

28-Jun-23 Proved 21 947 21.3% 4 685 17.1% 3 747

----------- ---------- -------------------- ------ -------------------- ------ --------------------

Probable 1 158 24.7% 286 16.9% 196

---------------------- -------------------- ------ -------------------- ------ --------------------

Total 23 105 21.5% 4 971 17.1% 3 944

---------------------- -------------------- ------ -------------------- ------ --------------------

Table 10: Makhado Project Coal Reserves Changes from Previous

Estimate - West Pit (gross)

30-Jun-22 Proved 26 114 18.7% 4 885 18.3% 4 791

----------- ---------- -------------------- ------ -------------------- ------ --------------------

Probable 2 462 17.5% 431 15.3% 376

---------------------- -------------------- ------ -------------------- ------ --------------------

Total 28 576 18.6% 5 317 18.1% 5 167

---------------------- -------------------- ------ -------------------- ------ --------------------

Changes Proved - 0.0% - 0.0% -

----------- ---------- -------------------- ------ -------------------- ------ --------------------

Probable - 0.0% - 0.0% -

---------------------- -------------------- ------ -------------------- ------ --------------------

Total - 0.0% - 0.0% -

---------------------- -------------------- ------ -------------------- ------ --------------------

28-Jun-23 Proved 26 114 18.7% 4 885 18.3% 4 791

----------- ---------- -------------------- ------ -------------------- ------ --------------------

Probable 2 462 17.5% 431 15.3% 376

---------------------- -------------------- ------ -------------------- ------ --------------------

Total 28 576 18.6% 5 317 18.1% 5 167

---------------------- -------------------- ------ -------------------- ------ --------------------

Table 11: Makhado Project Coal Reserves Changes from Previous

Estimate - East, Central and West Pits combined (gross)

30-Jun-22 Proved 62 800 19.7% 12 384 17.4% 10 907

----------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 6 545 20.3% 1 331 15.6% 1 020

---------------------- ------------------ ------ ------------------- ------ -------------------

Total 69 345 19.8% 13 716 17.2% 11 927

---------------------- ------------------ ------ ------------------- ------ -------------------

Changes Proved 34 956 1.4% 8 287 0.3% 6 375

----------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 1 954 1.4% 515 1.1% 395

---------------------- ------------------ ------ ------------------- ------ -------------------

Total 36 910 1.4% 8 802 0.4% 6 770

---------------------- ------------------ ------ ------------------- ------ -------------------

28-Jun-23 Proved 97 756 21.1% 20 672 17.7% 17 281

----------- ---------- ------------------ ------ ------------------- ------ -------------------

Probable 8 498 21.7% 1 846 16.7% 1 415

---------------------- ------------------ ------ ------------------- ------ -------------------

Total 106 254 21.2% 22 518 17.6% 18 697

---------------------- ------------------ ------ ------------------- ------ -------------------

Notes: Gross Coal Reserve Estimate (Proved and Probable) as at

28 June 2023

1. GTIS based on a 1.4 washability.

2. MTIS excludes the Fripps Farm and is limited to the 200 m depth cut-off.

3. MTIS includes geological losses of 5% on Measured, 8% on

Indicated and 10% on Inferred Coal Resources.

4. Quality parameters applied to GTIS to obtain MTIS.

5. Minimum coal seam thickness of 0.5 m applied.

6. HCC Ash content <= 10%, TC Ash content <= 25.9% and Volatile material > 20%.

7. The Coal Reserve estimation includes diluted Measured and

Indicated Coal Resources only.

8. No Inferred Coal Resources have been included in the Coal Reserve estimation.

9. The Coal Reserve estimate was completed using a realised coal

price of US$193t for HCC (export) and US$29/t for TC after product

quality discounts and offtake-related deductions.

COMPETENT PERSONS STATEMENTS

Coal Resources Estimate

The information in this report that relates to Coal Resources

has been compiled by technical consultants and employees of MCM

under the supervision of Mr John Sparrow B.Sc. (Hons), M.Sc. (Econ.

Geol), SAIMM. Mr Sparrow is a full-time employee of MCM and has

sufficient experience which is relevant to the style of

mineralisation and types of deposit under consideration and to the

activities which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the "Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves". Mr Sparrow consents to the inclusion in this report of

the matters based on his information in the form and context in

which it appears.

Coal Reserves Estimate

The information in this report that relates to Coal Reserves has

been compiled by technical consultants and employees of MCM under

the supervision of Mr Ben Bruwer, B Engineering (Mining

Engineering), SAIMM. Mr. Bruwer is a principal mining consultant at

ABCONN Engineering Pty Ltd. Mr Bruwer has sufficient experience

which is relevant to the style of mineralisation and types of

deposit under consideration and to the activities which he is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the "Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves". Mr Bruwer consents to

the inclusion in this report of the matters based on his

information in the form and context in which it appears.

WAY FORWARD

The Company anticipates that the funding arrangements will be

concluded in H2 CY2023. The tender adjudication for major

contractors, notably the mining contractor and CHPP operator, is

expected to be completed in early Q3 CY2023, followed by the final

investment decision, ensuring that the Makhado Project execution

processes are broadened from early works to include full scale

implementation. First coal production remains expected no later

than 18 months from construction start-date.

Godfrey Gomwe

Managing Director and Chief Executive Officer

This announcement has been approved by the Company's Disclosure

Committee.

All figures are in South African rand or United States dollars

unless otherwise stated.

For more information contact:

Endeavour Corporate

Tony Bevan Company Secretary Services +61 8 9316 9100

Company advisors:

James Harris / James Dance Nominated Adviser Strand Hanson Limited +44 20 7409 3494

Rory Scott Broker (AIM) Tennyson Securities +44 20 7186 9031

Financial PR (South R&A Strategic

Marion Brower Africa) Communications +27 11 880 3924

BSM Sponsors Proprietary Limited is the nominated JSE Sponsor

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

About MC Mining Limited:

MC Mining is an AIM/ASX/JSE-listed coal exploration, development

and mining company operating in South Africa. MC Mining's key

projects include the Uitkomst Colliery (metallurgical and thermal

coal), Makhado Project (hard coking coal), Vele Colliery (semi-soft

coking and thermal coal), and the Greater Soutpansberg Projects

(coking and thermal coal).

All figures are denominated in United States dollars unless

otherwise stated. Safety metrics are compared to the preceding

quarter while financial and operational metrics are measured

against the comparable period in the previous financial year. A

copy of this report is available on the Company's website,

www.mcmining.co.za .

Glossary

Term Definition

MCM/ the Company MC Mining LImited

BM&E Baobab Mining & Exploration (Pty) Ltd

Mtpa Million tonnes per annum

HCC hard coking coal

TC Thermal coal

Mt Million tonnes

Bn Billion

FOB Free on board

Forex Foreign exchange rate

NPV Net present value

IRR Internal rate of return

m Million

GTIS Gross tonnes in situ

MTIS mineable tonnes in situ

JORC Australasian Code of Reporting of Exploration Results, Mineral Resources and

Ore Reserves,

2012 Edition

SHETech Committee Safety, Health, Enmvitonment & Technical Committee

SAIMM South African Institute of Mining and Metallurgy

Forward-looking statements

This Announcement, including information included or

incorporated by reference in this Announcement, may contain

"forward-looking statements" concerning MC Mining that are subject

to risks and uncertainties. Generally, the words "will", "may",

"should", "continue", "believes", "expects", "intends",

"anticipates" or similar expressions identify forward-looking

statements. These forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those expressed in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond MC

Mining's ability to control or estimate precisely, such as future

market conditions, changes in regulatory environment and the

behaviour of other market participants. MC Mining cannot give any

assurance that such forward-looking statements will prove to have

been correct. The reader is cautioned not to place undue reliance

on these forward-looking statements. MC Mining assumes no

obligation and does not undertake any obligation to update or

revise publicly any of the forward-looking statements set out

herein, whether as a result of new information, future events or

otherwise, except to the extent legally required.

Statements of intention

Statements of intention are statements of current intentions

only, which may change as new information becomes available or

circumstances change.

[1] In accordance with ASX Listing Rule 5.21 and Appendix 5A

(the JORC Code) under the supervision of a Competent Person.

[2] Conpared to the 30 August 2022 announcement, Coal Reserves

increased 53%, saleable steelmaking HCC increased 64% and saleable

TC increased by 57%.

[3] Refer to Company announcement of 26 April 2023 Makhado

Project Update.

[4] Refer to Company announcement 30 August 2022 Makhado, Vele

and GSP Updates (Alternative Development Scenarios).

[5] Note that the average annual production for the first five

years of operations is higher at 0.88 Mtpa of HCC and 0.73 Mtpa of

TC as a result of prioritising the mining of higher yielding coal

zones.

[6] ABSA Bank foreign exchange rate consensus long term

forecasts as from June 2023.

[7] Afriforesight coal price consensus long-term forecasts as

from June 2023.

[8] Ibid.

[9] Makhado Coal Reserves as stated in the Company's 30 June

2022 Resources & Reserves Statement, reported in accordance to

JORC Code reporting guidelines.

[10] Makhado Coal Resources as stated in the Company's 30 June

2022 Resources & Reserves Statement, reported in accordance to

JORC Code reporting guidelines, Annual report 22 September

2022.

[11] HCC64 index trades at an average 10% discount to the

premium HCC price.

[12] Sales price adjustments include transport and port

logistics charges.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTURRAROWUNOAR

(END) Dow Jones Newswires

June 30, 2023 07:15 ET (11:15 GMT)

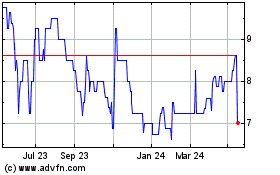

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

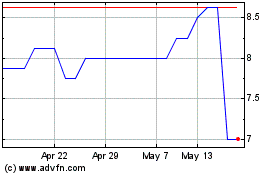

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jul 2023 to Jul 2024