MC Mining Limited Appendix 5B (6735R)

October 31 2019 - 3:01AM

UK Regulatory

TIDMMCM

RNS Number : 6735R

MC Mining Limited

31 October 2019

99+Rule 5.5

Appendix 5B

Mining exploration entity and oil and gas exploration entity

quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97,

01/07/98, 30/09/01, 01/06/10, 17/12/10, 01/05/13, 01/09/16

Name of entity

-----------------------------------------------------

MC Mining Limited

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

98 008 905 388 30 September 2019

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows $USD'000 (3 months)

$USD'000

1. Cash flows from operating

activities

1.1 Receipts from customers 5,841 5,841

1.2 Payments for

(a) exploration & evaluation (750) (750)

(b) development - -

(c) production (5,351) (5,351)

(d) staff costs (908) (908)

(e) administration and corporate

costs (1,105) (1,105)

1.3 Dividends received (see note - -

3)

1.4 Interest received 52 52

1.5 Interest and other costs of - -

finance paid

1.6 Income taxes paid - -

1.7 Research and development refunds - -

1.8 Other (provide details if - -

material)

---------------- ----------------

Net cash from / (used in)

1.9 operating activities (2,221) (2,221)

----- --------------------------------- ---------------- ----------------

2. Cash flows from investing

activities

2.1 Payments to acquire: - -

(a) property, plant and

equipment (162) (162)

(b) tenements (see item 10) - -

(c) investments (174) (174)

(d) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) property, plant and

equipment 1,187 1,187

(b) tenements (see item 10) - -

(c) investments - -

(d) other non-current assets - -

2.3 Cash flows from loans to - -

other entities

2.4 Dividends received (see note - -

3)

Other (provide details if

material)-deferred

consideration

2.5 payment on acquisitions (1,098) (1,098)

---------------- ----------------

Net cash from / (used in)

2.6 investing activities (247) (247)

------- ------------------------------- ---------------- ----------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of shares - -

3.2 Proceeds from issue of - -

convertible

notes

3.3 Proceeds from exercise of - -

share options

3.4 Transaction costs related - -

to issues of shares,

convertible

notes or options

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings (252) (252)

3.7 Transaction costs related - -

to loans and borrowings

3.8 Dividends paid - -

Other (provide details if

3.9 material) (180) (180)

---------------- ----------------

Net cash from / (used in)

3.10 financing activities (432) (432)

------- ------------------------------- ---------------- ----------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 8,843 8,843

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (2,221) (2,221)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (247) (247)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) (432) (432)

Effect of movement in exchange

4.5 rates on cash held (693) (693)

---------------- ----------------

Cash and cash equivalents

4.6 at end of period 5,250 5,250

------- ------------------------------- ---------------- ----------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $USD'000 $USD'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 5,217 8,808

5.2 Call deposits 33 35

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 5,250 8,843

---- ----------------------------------- ---------------- -----------------

6. Payments to directors of the entity and Current quarter

their associates $USD'000

Aggregate amount of payments to these parties

6.1 included in item 1.2 279

----------------

6.2 Aggregate amount of cash flow from loans

to these parties included in item 2.3

----------------

6.3 Include below any explanation necessary to understand

the transactions included in items 6.1 and 6.2

----- -----------------------------------------------------------------

Salary payments for the quarter made to the Executive directors

and director fees paid to the Non-Executive directors.

7. Payments to related entities of the entity Current quarter

and their associates $USD'000

7.1 Aggregate amount of payments to these parties

included in item 1.2

----------------

7.2 Aggregate amount of cash flow from loans

to these parties included in item 2.3

----------------

7.3 Include below any explanation necessary to understand

the transactions included in items 7.1 and 7.2

---- ----------------------------------------------------------------

8. Financing facilities available Total facility Amount drawn

Add notes as necessary for amount at quarter at quarter end

an understanding of the position end $USD'000

$USD'000

8.1 Loan facilities 15,820 7,910

------------------- ----------------

8.2 Credit standby arrangements

------------------- ----------------

8.3 Other (please specify) 2,301 983

------------------- ----------------

8.4 Include below a description of each facility above, including

the lender, interest rate and whether it is secured or

unsecured. If any additional facilities have been entered

into or are proposed to be entered into after quarter

end, include details of those facilities as well.

---- -------------------------------------------------------------------------

$USD7.9 million facility of the $USD 15.8 million provided

by the Industrial Development Corporation of South Africa to

the company's subsidiary is still available for drawdown. The

loan is payable on the third anniversary of each advance plus

a real after tax rate of return of 16% on the advanced amount.

The $USD 2.3 million facility was secured during the 2019 financial

year, from ABSA Bank. $USD 1.3 million of the facility is for

short-term working capital requirements and potential expansion

opportunities. The $USD1.3 million has a floating coupon at

the South African Prime rate (currently 10.0% per annum) plus

1.0%, with the operating mine Uitkomst Colliery debtors ceded

as security. The facility is subject to annual review. This

facility was undrawn at the end of the quarter.

The balance of the $USD2.3 million relates to an equipment

lease facility that has been utilised. The lease facility has

a five-year term at the South Africa prime interest rate (currently

10% per annum)

9. Estimated cash outflows for next $USD'000

quarter

9.1 Exploration and evaluation -

9.2 Development -

9.3 Production (5,344)

9.4 Staff costs (1,705)

9.5 Administration and corporate costs (1,295)

9.6 Other (811)

---------

9.7 Total estimated cash outflows (9,155)

---- ----------------------------------- ---------

10. Changes in tenements Tenement Nature of interest Interest Interest

(items 2.1(b) reference at beginning at end

and 2.2(b) above) and location of quarter of quarter

10.1 Interests in

mining tenements

and petroleum

tenements lapsed,

relinquished

or reduced

----- --------------------- -------------- ------------------- -------------- ------------

10.2 Interests in

mining tenements

and petroleum

tenements acquired

or increased

----- --------------------- -------------- ------------------- -------------- ------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Sign here:

............................................................ Date:

.............................................

(Director/Company secretary)

Print name: .........................................................

Notes

1. The quarterly report provides a basis for informing the

market how the entity's activities have been financed for the past

quarter and the effect on its cash position. An entity that wishes

to disclose additional information is encouraged to do so, in a

note or notes included in or attached to this report.

2. If this quarterly report has been prepared in accordance with

Australian Accounting Standards, the definitions in, and provisions

of, AASB 6: Exploration for and Evaluation of Mineral Resources and

AASB 107: Statement of Cash Flows apply to this report. If this

quarterly report has been prepared in accordance with other

accounting standards agreed by ASX pursuant to Listing Rule 19.11A,

the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDWGGPPUUPBGCU

(END) Dow Jones Newswires

October 31, 2019 03:01 ET (07:01 GMT)

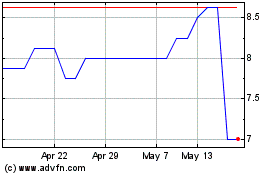

Mc Mining (LSE:MCM)

Historical Stock Chart

From May 2024 to Jun 2024

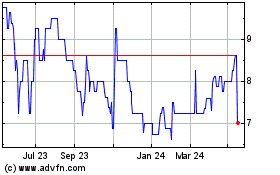

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2023 to Jun 2024