TIDMMCM

RNS Number : 7928S

Motivcom PLC

29 September 2014

29 September 2014

Motivcom plc

("Motivcom" or "the Group")

Interim Results for the six months ended 30 June 2014

Motivcom plc (AIM:MCM), a leading business services group

offering incentives & loyalty expertise and meetings &

event management services to major blue-chip corporate clients, is

pleased to announce its unaudited interim results for the six

months ended 30 June 2014.

Financial Highlights

Unaudited Interim Results for the period ended 30 June 2014

* Headline operating profit from continuing operations*

decreased by 34% to GBP828,000 (2013: GBP1,246,000)

* Headline profit before tax from continuing operations

decreased by 34% to GBP819,000 (2013: GBP1,244,000)

* Headline basic earnings per share from continuing

operations++ decreased by 27% to 2.52 pence (2013:

3.47 pence)

* Operating profit from continuing operations decreased

by 35% to GBP718,000 (2013: GBP1,104,000)

* Profit before tax from continuing operations

decreased by 35% to GBP686,000 (2013: GBP1,058,000)

* Basic earnings per share from continuing operations

decreased by 28% to 2.12 pence (2013: 2.94 pence)

* Net cash of GBP3,922,000 (2013: net cash of

GBP3,838,000 after April 2013 share buyback of

GBP3,311,000)

------------------------------------------------------------------

* Operating profit from continuing operations of GBP718,000

(2013: GBP1,104,000) plus amortisation of intangibles of GBP110,000

(2013: GBP142,000)

Profit before tax from continuing activities of GBP686,000

(2013: GBP1,058,000) plus amortisation of intangibles of GBP110,000

(2013: GBP142,000) and unwinding of discount relating to contingent

consideration liability of GBP23,000 (2013: GBP44,000)

++ See reconciliation in Note 5

Commenting on the results, Colin Lloyd, Chairman of Motivcom

plc, said: "As reported on 27 June 2014 trading in the first half

of this year was below the Board's expectations. Whilst the level

of the Group's order intake remains satisfactory, the delivery of

much of this work is heavily weighted into the second half of the

year. The variation in phasing between the first and second half

has been a regularly reported characteristic of the Group's

business and this industry. The Board views this matter mainly as a

timing issue.

I am also pleased to report that, following a strategic review

of the Group's activities, an offer for the business was received

on 12 September from Sodexo Motivation Solutions UK Ltd, part of

Sodexo SA. This offer values the business at GBP1.48 per share and

the board believes it is in the best interests of the Group's

shareholders to accept. The Board is therefore recommending the

offer to shareholders."

- Ends -

For further information:

Motivcom

Sue Hocken Tel: +44 (0) 845 053

5529

sue.hocken@motivcom.com www.motivcom.com

Grant Thornton UK LLP

Philip Secrett / Salmaan Tel: +44 (0)207 383

Khawaja / Jamie Barklem 5100

philip.j.secrett@uk.gt.com www.gtuk.com

Numis Securities Limited

David Poutney/Nick Westlake Tel: +44 (0)207 383

5100

CHAIRMAN'S STATEMENT

I am pleased to report the results for Motivcom for the six

months to 30 June 2014. As reported on 27 June 2014 trading in the

first half of this year was below the Board's expectations. Whilst

the level of the Group's order intake remains satisfactory, the

delivery of much of this work is heavily weighted into the second

half of the year. The variation in phasing between the first and

second half has been a regularly reported characteristic of the

Group's business and this industry. The Board views this matter

mainly as a timing issue.

I am also pleased to report that, following a strategic review

of the Group's activities, an offer for the business was received

on 12 September from Sodexo Motivation Solutions UK Ltd, part of

Sodexo SA. This offer values the business at GBP1.48 per share and

the board believes it is in the best interests of the Group's

shareholders to accept. The Board is therefore recommending the

offer to shareholders.

Financial update

The results of the entities to be acquired by Sodexo SA have

been classified as continuing operations. The results of

Summersault Communications Limited and Zibrant Limited which were

and will be respectively acquired by their Management are

classified as discontinued operations. Additionally, discontinued

operations include a loss of GBP180,000 arising from the sale of

Summersault Communications Limited and an estimated loss of

GBP10,418,000 arising in the main from goodwill impairment on the

sale of Zibrant Limited.

The Group's gross profit from continuing operations was 1% lower

at GBP7,905,000 (2013: GBP7,971,000) whilst overheads were 5%

higher at GBP7,077,000 (2013: GBP6,725,000). This flowed through

into a headline operating profit of GBP828,000 (2013:

GBP1,246,000). Trading volumes in p&mm sales promotion were

below expectations in the first half.

The Group's gross profit from discontinued operations was 20%

lower at GBP4,623,000 (2013: GBP5,774,000). Overheads were 8% lower

at GBP4,811,000 (2013: GBP5,213,000). This flowed through into a

headline operating loss of GBP188,000 (2013: profit GBP561,000).

Trading volumes in Zibrant events were below expectations in the

first half being heavily weighted into the second half.

In light of the offer referenced above the Board does not intend

to declare an interim dividend for the half year ended 30 June

2014.

Divisional Reports

Motivation

The Motivation division has continued to deliver excellent

growth during the period with headline operating profits increasing

by 46% to GBP1,280,000 (2013: GBP876,000). New business intake from

both new and existing clients underpins this positive result and

reflects a more positive economic environment.

Motivation programme activity has benefited from both new and

existing client wins in 2014 which are at various stages of

implementation. The continued recognition by UK business that

Reward and Recognition initiatives positively impact overall

performance has resulted in an excellent pipeline of new

business.

Our voucher / gift card volumes are 7% up on the first half of

2013 and continue to benefit from the shift from paper vouchers to

plastic retailer gift cards. Improved functionality and lower

distribution costs deliver greater appeal to customers and drive

efficiencies into the operation.

Spree, our pre paid MasterCard product, has continued to grow

with transaction values in the first half reaching GBP92 million

(H1 2013: GBP88 million). Investment in cardholder marketing,

mobile solutions and product for the SME market continues to drive

growth in the cardholder base and improved profitability from

existing cardholders.

A steady stream of new business wins means that the division is

performing well and the Board anticipates that it will continue to

make good progress in the second half of 2014 and on into 2015.

Promotions

The Promotions division has performed below expectations in the

first half of 2014 with an overall headline operating loss of

GBP589,000 (2013: profit GBP201,000). Discontinued operations

contribute a headline operating loss of GBP91,000 (2013:

GBP108,000).

Employee Benefits

Growth continues to be strong within the p&mm employee

benefits division. Significant new business wins, combined with

excellent retention and new product integration for our existing

clients have resulted in a record half year. Client service levels,

product innovation and breadth of offer also continue to shine and

this has been recognised by several industry awards in recent

months.

Allsave have also performed very well and have established

several new Intermediary 'preferred partner' relationships,

resulting in a number of new client wins. In addition a new

Employee Benefits platform offering a range of sixteen services has

been developed and will be launched in the second half of 2014. The

strong reputation and relationship with existing clients, will

provide the opportunity to up-sell new products and services to

their extensive existing client base as well as attracting new

clients.

Sales Promotion

Performance in the first half of 2014 was below expectation. We

have seen promotions activity and opportunities loaded into the

second half. Whilst revenue expectations have been revised down we

have held back certain planned investment in this area that will

deliver cost savings that will help to compensate.

Events

The events division has performed below expectations in the

first half of 2014 with an overall headline operating profit of

GBP67,000 (2013: GBP805,000). Discontinued operations contribute a

headline operating loss of GBP97,000 (2013: headline operating

profit of GBP669,000).

2014 has been a year of investment and significant change in the

events environment within Motivcom. In January we launched the new

creative Zibrant LIVE! brand which has secured excellent levels of

new business which will be delivered in the second half of 2014. In

the first half of 2014 we also undertook major investment in

infrastructure updating our venues, event management, accommodation

booking, finance and HR systems, together with replacement of

certain computer hardware. The business is now in better shape and

we expect to see a significantly improved performance in the second

half of 2014.

In summary

As this is expected to be the final Chairman's report for the

Group can I thank our shareholders, our advisors, my board of

directors and the management and the staff of Motivcom for their

support over the ten years since our admission to Aim, and wish

them every success for the future.

Colin Lloyd

Chairman

26 September 2014

CONSOLIDATED INTERIM INCOME STATEMENT (UNAUDITED)

FOR THE PERIOD ENDED 30 JUNE 2014

Year ended

Six months Six months 31 December

ended ended 2013

30 30 June

June 2014 2013

Note GBP000 GBP000 GBP000

Revenue 3 40,280 35,159 77,335

Cost of sales (32,375) (27,188) (59,816)

------------- ------------- --------------

Gross profit 7,905 7,971 17,519

Administrative expenses (7,077) (6,725) (13,454)

Amortisation and impairment

of intangibles (110) (142) (283)

------------- ------------- --------------

Operating profit 3 718 1,104 3,782

Finance costs - net (32) (46) (83)

------------- ------------- --------------

Profit before income tax 686 1,058 3,699

Income tax expense (110) (210) (884)

------------- ------------- --------------

Profit for the period from

continuing operations 576 848 2,815

(Loss)/profit for the year

from discontinued operations 8 (10,598) 357 (894)

(Loss)/profit for the period (10,022) 1,205 1,921

============= ============= ==============

Attributable to:

Equity holders of the Company (10,022) 1,205 1,921

============= ============= ==============

Earnings per share for

profit attributable to

the equity holders of the

Company during the year

(expressed in pence)

Continuing operations -

basic 5 2.12 2.94 10.05

============= ============= ==============

Continuing operations -

diluted 5 2.10 2.92 9.98

============= ============= ==============

Discontinued operations

- basic 5 (38.95) 1.24 (3.19)

============= ============= ==============

Discontinued operations-

diluted 5 (38.62) 1.23 (3.17)

============= ============= ==============

CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE INCOME

(UNAUDITED)

FOR THE PERIOD ENDED 30 JUNE 2014

Six months Six months

ended ended Year ended

30 30 31 December

June 2014 June 2013 2013

GBP000 GBP000 GBP000

(Loss)/profit for the period (10,022) 1,205 1,921

Other comprehensive income:

Deferred tax on property - - 52

------------- ------------- -------------

Other comprehensive income,

net of tax - - 52

------------- ------------- -------------

Total comprehensive income

for the period (10,022) 1,205 1,973

============= ============= =============

Attributable to:

Equity holders of the Company (10,022) 1,205 1,973

============= ============= =============

CONSOLIDATED INTERIM BALANCE SHEET (UNAUDITED)

AT 30 JUNE 2014

At 31

At 30 At 30 December

June June 2013

Note 2014 2013 GBP000

GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 4,077 4,490 4,433

Intangible assets 7 9,166 23,447 22,149

13,243 27,937 26,582

--------- --------- -----------

Current assets

Inventories 521 822 798

Trade and other receivables 14,744 29,782 24,241

Cash and cash equivalents 7,612 7,721 10,188

22,877 38,325 35,227

--------- --------- -----------

Assets included in disposal

group held for sale 8 11,622 - -

--------- --------- -----------

Total assets 47,742 66,262 61,809

========= ========= ===========

EQUITY

Capital and reserves attributable

to the Company's equity

holders

Share capital 9 140 140 140

Share premium account 9,944 9,944 9,944

Own shares (1,016) (1,073) (1,016)

Capital redemption reserve 9 15 15 15

Other reserves 75 75 75

Retained earnings (138) 10,599 10,872

Total equity 9,020 19,700 20,030

========= ========= ===========

LIABILITIES

Non-current liabilities

Borrowings - 1,690 1,594

Deferred income tax liabilities 444 294 362

444 1,984 1,956

--------- --------- -----------

Current liabilities

Trade and other payables 25,710 41,573 36,938

Current income tax liabilities 102 362 245

Borrowings 3,690 2,193 2,193

Provisions 470 450 447

29,972 44,578 39,823

--------- --------- -----------

Liabilities included in

disposal group held for

sale 8 8,306 - -

--------- --------- -----------

Total liabilities 38,722 46,562 41,779

========= ========= ===========

Total equity and liabilities 47,742 66,262 61,809

========= ========= ===========

CONSOLIDATED INTERIM CASH FLOW STATEMENT (UNAUDITED)

FOR THE PERIOD ENDED 30 JUNE 2014

Year

Six months Six months ended

ended ended 31 December

30 30 2013

June 2014 June 2013 GBP000

Note GBP000 GBP000

Cash flows from operating

activities

Cash generated from/(used

in) operations 11 1,594 (3,157) 636

Interest paid (43) (51) (97)

Income tax paid (220) (219) (752)

------------- ------------- --------------

Net cash generated from/(used

in) operating activities 1,331 (3,427) (213)

------------- ------------- --------------

Cash flows from investing

activities

Acquisition of subsidiary,

net of cash acquired and

dividends due to former

shareholders 8 - (308) (309)

Purchases of property,

plant and equipment (PPE) (381) (169) (401)

Interest received 37 32 68

------------- ------------- --------------

Net cash used in investing

activities (344) (445) (642)

------------- ------------- --------------

Cash flows from financing

activities

Repayment of borrowings (100) 1,900 1,800

Payments to acquire own

shares 9 - (3,347) (3,364)

Proceeds from issue of

shares - 10 67

Dividends paid (980) (903) (1,393)

------------- ------------- --------------

Net cash used in financing

activities (1,080) (2,340) (2,890)

------------- ------------- --------------

Net decrease in cash (93) (6,212) (3,745)

Cash at beginning of period 10,188 13,933 13,933

------------- ------------- --------------

10,095 7,721 10,188

Cash held for sale in disposal (2,483) - -

group

Cash at end of period 7,612 7,721 10,188

============= ============= ==============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

FOR THE PERIOD ENDED 30 JUNE 2014

Share Share Own Capital Other Retained Total

capital premium shares redemption reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

January 2013 155 9,944 (1,083) - 75 13,696 22,787

Dividends paid - - - - - (903) (903)

Share based

payments - - - - - 1 1

Purchase and

cancellation

of own shares (15) - - 15 - (3,347) (3,347)

Disposed of

on exercise

of options - - 10 - - - 10

Deferred tax

on equity share

based payments - - - - - (53) (53)

--------- --------- -------- ------------ ---------- ---------- ----------

Transactions

with owners (15) - 10 15 - (4,302) (4,292)

--------- --------- -------- ------------ ---------- ---------- ----------

Profit for the

period - - - - - 1,205 1,205

Other comprehensive

income:

Deferred tax

on property - - - - - - -

--------- --------- -------- ------------ ---------- ---------- ----------

Total comprehensive

income for the

period - - - - - 1,205 1,205

--------- --------- -------- ------------ ---------- ---------- ----------

At 30 June 2013 140 9,944 (1,073) 15 75 10,599 19,700

Dividends paid - - - - - (490) (490)

Share based

payments - - - - - 7 7

Disposed of

on exercise

of options - - 57 - - - 57

Purchase and

cancellation

of own shares - - - - - (17) (17)

Deferred tax

on equity share

based payments - - - - - 5 5

--------- --------- -------- ------------ ---------- ---------- ----------

Transactions

with owners - - 57 - - (495) (438)

--------- --------- -------- ------------ ---------- ---------- ----------

Profit for the

period - - - - - 716 716

Other comprehensive

income:

* Deferred tax on property - - - - - 52 52

--------- --------- -------- ------------ ---------- ---------- ----------

Total comprehensive

income for the

period - - - - - 768 768

--------- --------- -------- ------------ ---------- ---------- ----------

Balance at 31

December 2013 140 9,944 (1,016) 15 75 10,872 20,030

Dividends paid - - - - - (980) (980)

Share based

payments - - - - - 7 7

Deferred tax

on equity share

based payments - - - - - (15) (15)

--------- --------- -------- ------------ ---------- ---------- ----------

Transactions

with owners - - - - - (988) (988)

--------- --------- -------- ------------ ---------- ---------- ----------

Loss for the

period - - - - - (10,022) (10,022)

Other comprehensive

income:

Deferred tax

on property - - - - - - -

--------- --------- -------- ------------ ---------- ---------- ----------

Total comprehensive

income for the

period - - - - - (10,022) (10,022)

At 30 June 2014 140 9,944 (1,016) 15 75 (138) 9,020

========= ========= ======== ============ ========== ========== ==========

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE PERIOD ENDED 30 JUNE 2014

1 General information

Motivcom plc ("the Company") and its subsidiaries (together

"Motivcom plc" or "the Group") are involved in (1) the development

and administration of third party motivation and incentive

programmes (2) the provision of incentive travel, live events and

venue finding and (3) the provision of trade and consumer sales

promotions, employee benefits products and communication

programmes.

The Company is a public limited liability company incorporated

and domiciled in England. The address of its registered office is

Avalon House, Breckland, Linford Wood, Milton Keynes MK14 6LD. The

Company has its primary and only listing on Aim, London Stock

Exchange's international market for smaller growing companies.

These unaudited condensed consolidated interim financial

statements (the interim financial statements) have been approved

for issue by the Board of Directors on 26 September 2014.

2 Basis of preparation

These interim financial statements of Motivcom plc are for the

six months ended 30 June 2014. They have been prepared in

accordance with IAS 34, Interim Financial Reporting. They do not

constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. They should be read in conjunction with the

consolidated financial statements of the Group for the year ended

31 December 2013 which are available on the Group's website

(www.motivcom.com) and have been filed with The Registrar of

Companies. The auditors report on those financial statements was

unqualified and did not contain a statement made under Section

498(3) of the Companies Act 2006.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last

financial statements for the year ended 31 December 2013.

The accounting policies have been applied consistently

throughout the Group in preparing these interim financial

statements.

The financial statements are prepared on a going concern basis.

In considering going concern, the directors have reviewed the

Group's future cash requirements and earnings projections. The

directors believe these forecasts have been prepared on a prudent

basis and have also considered the impact of a range of potential

changes to trading performance. The directors have concluded that

the Group should be able to operate within its current facilities

and comply with its banking covenants for the foreseeable future

and therefore believe it is appropriate to prepare the financial

statements of the Group on a going concern basis. This is supported

by the Group's liquidity position at 30 June 2014.

The Group's financial risk management policies are described in

its financial statements for the year ended 31 December 2013.

3 Segment Information

At 30 June 2014 the Group is organised into three main operating

segments - (1) development and administration of third party

motivation and incentive programmes ("Motivation") - (2) the

provision of incentive travel, live events and venue finding

("Events") - (3) trade and consumer sales promotions, employee

benefit products and communications ("Promotions"). Unallocated

costs represent corporate and share-based payment expenses.

The segment results for the six months ended 30 June 2014 are as

follows:

Motivation Events Promotions Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000

Continuing operations

Revenue from external

clients 18,664 7,888 13,728 - 40,280

929 2,467 81 (3,477) -

----------- -------- ----------- ------------ ---------

Inter-segment revenues

----------- -------- ----------- ------------ ---------

Total revenue 19,593 10,355 13,809 (3,477) 40,280

=========== ======== =========== ============ =========

Gross profit 3,497 1,036 3,372 - 7,905

Administrative expenses (2,217) (872) (3,870) (118) (7,077)

---------

Headline operating

profit/(loss) 1,280 164 (498) (118) 828

=========== ======== =========== ============

Amortisation and

impairment of intangibles (110)

Operating profit 718

Net interest expense (32)

Profit before tax

- Continuing 686

=========

Discontinued operations

Total revenue - 8,035 218 - 8,253

=========== ======== =========== ============ =========

Gross profit - 4,457 166 - 4,623

Administrative expenses - (4,554) (257) - (4,811)

---------

Headline operating

loss - (97) (91) - (188)

=========== ======== =========== ============

Amortisation and

impairment of intangibles (10,230)

Loss on disposal (180)

---------

Operating loss (10,598)

Net interest expense -

Loss before tax -

Discontinued (10,598)

=========

The segment results for the six months ended 30 June 2013 are as

follows:

Motivation Events Promotions Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000

Continuing Operations

Revenue from external

clients 15,479 7,397 12,283 - 35,159

2,108 1,676 743 (4,527) -

----------- -------- ----------- ------------ --------

Inter-segment revenues

----------- -------- ----------- ------------ --------

Total revenue 17,587 9,073 13,026 (4,527) 35,159

=========== ======== =========== ============ ========

Gross profit 3,001 974 3,996 - 7,971

Administrative expenses (2,125) (838) (3,687) (75) (6,725)

--------

Headline operating

profit 876 136 309 (75) 1,246

=========== ======== =========== ============

Amortisation and

impairment of intangibles (142)

--------

Operating profit 1,104

Net interest expense (46)

Profit before tax

- Continuing 1,058

========

Motivation Events Promotions Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000

Discontinued operations

Total revenue - 10,404 750 - 11,154

============ ======== =========== ============ ========

Gross profit - 5,221 553 - 5,774

Administrative expenses - (4,552) (661) - (5,213)

--------

Headline operating

profit/(loss) - 669 (108) 561

============ ======== =========== ============

Amortisation and

impairment of intangibles (60)

Operating profit 501

Net interest expense -

Profit before tax

- Discontinued 501

========

The segment results for the year ended 31 December 2013 are as

follows:

Motivation Events Promotions Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000

Continuing operations

Revenue from external

clients 33,270 15,801 27,962 302 77,335

3,422 377 67 (3,866) -

----------- -------- ----------- ------------ ---------

Inter-segment revenues

----------- -------- ----------- ------------ ---------

Total revenue 36,692 16,178 28,029 (3,564) 77,335

=========== ======== =========== ============ =========

Gross profit 6,903 1,984 8,330 302 17,519

Administrative expenses (4,307) (1,677) (7,282) (188) (13,454)

---------

Headline operating

profit 2,596 307 1,048 114 4,065

=========== ======== =========== ============

Amortisation and

impairment of intangibles (283)

---------

Operating profit 3,782

Net interest expense (83)

Profit before tax

- Continuing 3,699

=========

Discontinued operations

Total revenue - 17,276 1,379 - 18,655

=========== ======== =========== ============ =========

Gross profit - 10,248 950 - 11,198

Administrative expenses - (9,663) (1,225) - (10,888)

---------

Headline operating

profit/(loss) - 585 (275) - 310

=========== ======== =========== ============

Contingent consideration

adjustment 25

Amortisation and

impairment of intangibles (1,217)

Operating loss (882)

Net interest expense -

Loss before tax -

Discontinued (882)

=========

IFRS 8 requires that an entity reports a measure of assets and

liabilities for each reportable segment only if such an amount is

regularly provided to the Chief Operating Decision Maker. As no

such amounts are regularly provided to the Chief Operating Decision

Maker, segment assets and liabilities are not disclosed.

The Group's business is divided into two main streams -

Incentives and Loyalty ("Incentives") and Meetings and Event

Management ("Meetings"). Incentives comprises the segment results

of Motivation and Promotions but also includes the motivation

business of AYMTM Limited included in Events. Meetings comprises

the segment results of Events less the motivation business of AYMTM

Limited. The Group recognises that this additional information

enables its shareholders to better appreciate the nature of its

business.

The segment results for the six months ended 30 June 2014 are as

follows:

Incentives Meetings Unallocated Group

GBP000 GBP000 GBP000 GBP000

Continuing Operations

Revenue from external

clients 36,591 3,689 - 40,280

1,010 2,467 (3,477) -

----------- --------- ------------ ---------------

Inter-segment revenues

----------- --------- ------------ ---------------

Total revenue 37,601 6,156 (3,477) 40,280

=========== ========= ============ ===============

Gross profit 7,402 503 - 7,905

Administrative expenses (6,568) (391) (118) (7,077)

---------------

Headline operating profit 834 112 (118) 828

=========== ========= ============

Amortisation and impairment

of intangibles (110)

Operating profit 718

Net interest expense (32)

Profit before tax -

Continuing 686

===============

Discontinued Operations

Total revenue 218 8,035 - 8,253

=========== ========= ============ ===============

Gross profit 166 4,457 - 4,623

Administrative expenses (257) (4,554) - (4,811)

---------------

Headline operating loss (91) (97) - (188)

=========== ========= ============

Amortisation and impairment

of intangibles (10,230)

Loss on disposal of

subsidiary (180)

---------------

Operating loss (10,598)

Net interest expense -

Loss before tax - Discontinued (10,598)

===============

The segment results for the six months ended 30 June 2013 are as

follows:

Incentives Meetings Unallocated Group

GBP000 GBP000 GBP000 GBP000

Continuing Operations

Revenue from external

clients 32,124 3,035 - 35,159

2,851 1,676 (4,527) -

----------- --------- ------------ --------

Inter-segment revenues

----------- --------- ------------ --------

Total revenue 34,975 4,711 (4,527) 35,159

=========== ========= ============ ========

Gross profit 7,639 332 - 7,971

Administrative expenses (6,286) (364) (75) (6,725)

--------

Headline operating profit 1,353 (32) (75) 1,246

=========== ========= ============

Amortisation and impairment

of intangibles (142)

--------

Operating profit 1,104

Net interest expense (46)

Profit before tax -

Continuing 1,058

========

Discontinued Operations

Total revenue 750 10,404 - 11,154

=========== ========= ============ ========

Gross profit 553 5,221 - 5,774

Administrative expenses (661) (4,552) - (5,213)

--------

Headline operating (loss)/profit (108) 669 - 561

=========== ========= ============

Amortisation and impairment

of intangibles (60)

--------

Operating profit 501

Net interest expense -

Profit before tax -

Discontinued 291

========

The segment results for the year ended 31 December 2013 are as

follows:

Incentives Meetings Unallocated Group

GBP000 GBP000 GBP000 GBP000

Continuing Operations

Revenue from external

clients 70,920 6,113 302 77,335

3,489 377 (3,866) -

----------- --------- ------------ ---------

Inter-segment revenues

----------- --------- ------------ ---------

Total revenue 74,409 6,490 (3,564) 77,335

=========== ========= ============ =========

Gross profit 16,480 737 302 17,519

Administrative expenses (12,540) (726) (188) (13,454)

---------

Headline operating profit 3,940 11 114 4,065

=========== ========= ============

Amortisation and impairment

of intangibles (283)

---------

Operating profit 3,782

Net interest expense (83)

Profit before tax - Continuing 3,699

=========

Incentives Meetings Unallocated Group

GBP000 GBP000 GBP000 GBP000

Discontinued Operations

Total revenue 1,379 17,276 - 18,655

=========== ========= ============ =========

Gross profit 950 10,248 - 11,198

Administrative expenses (1,225) (9,663) - (10,888)

---------

Headline operating (loss)/profit (275) 585 - 310

=========== ========= ============

Contingent consideration

adjustment 25

Amortisation and impairment

of intangibles (1,217)

---------

Operating loss (882)

Net interest expense -

Loss before tax - Discontinued (882)

=========

4 Income tax expenses

Six months Six months

ended ended

30 30 Year ended

June 2014 June 31 December

GBP000 2013 2013

GBP000 GBP000

Current tax (continuing activities) 92 294 885

Overprovision of tax for prior

year - - 21

Deferred tax (continuing activities) 18 (84) (22)

110 210 884

============= ============= =============

5 Earnings per share and dividends

Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Year

Six months Six months ended

ended ended 31 December

30 30 2013

June 2014 June 2013 GBP000

GBP000 GBP000

Profit attributable to equity

holders of the company

Continuing operations 576 848 2,815

------------- ------------- --------------

Discontinued operations (10,598) 357 (894)

------------- ------------- --------------

Weighted average number of

ordinary shares in issue (thousands) 27,212 28,829 28,002

Basic earnings per share (in pence)

Continuing operations 2.12 2.94 10.05

======== ===== =======

Discontinued operations (38.95) 1.24 (3.19)

======== ===== =======

Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all contracted dilutive potential ordinary shares.

The Company has only one category of dilutive potential ordinary

shares, share options.

The calculation is performed for the share options to determine

the number of shares that could have been acquired at fair value

(determined as the average annual market share price of the

Company's shares) based on the monetary value of the subscription

rights attached to outstanding share options and taking account of

the yet unexpensed share based payment charge relating to those

options. The number of shares calculated as above is compared with

the number of shares that would have been issued assuming the

exercise of the share options. Tranches two to four of the options

granted to C T Lloyd have been excluded from this calculation as

all the conditions attaching to the proposed options had not been

met at 30 June 2014.

Year ended

Six months Six months 31 December

ended ended 2013

30 30 GBP000

June 2014 June 2013

GBP000 GBP000

Profit attributable to equity

holders of the company

Continuing operations 576 848 2,815

------------- ------------- --------------

Discontinued operations (10,598) 357 (894)

------------- ------------- --------------

Weighted average number of

ordinary shares in issue (thousands) 27,212 28,829 28,002

Adjustment for share options

(thousands) 232 178 212

------------- ------------- --------------

Weighted average number of

ordinary shares for diluted

earnings per share (thousands) 27,444 29,007 28,214

------------- ------------- --------------

Diluted earnings per share (in pence)

Continuing operations 2.10 2.92 9.98

======== ===== =======

Discontinued operations (38.62) 1.23 (3.17)

======== ===== =======

Headline basic

Headline basic earnings per share is calculated by dividing the

profit attributable to equity holders of the Company plus the

amortisation of intangible assets by the weighted average number of

ordinary shares in issue during the period.

Year ended

Six months Six months 31 December

ended ended 2013

30 30 GBP000

June 2014 June 2013

GBP000 GBP000

Continuing operations

Profit attributable to equity

holders of the Company 576 848 2,815

Amortisation of intangibles

(after deduction of tax) 86 108 217

Unwinding of discount relating

to contingent consideration

liability (after deduction

of tax) 23 44 67

------------- ------------- --------------

Headline profit attributable

to equity holders of the

Company - Continuing operations 685 1,000 3,099

------------- ------------- --------------

Discontinued operations

(Loss)/profit attributable

to equity holders of the Company (10,598) 357 (894)

Amortisation of intangibles

(after deduction of tax) 10,216 46 1,180

Unwinding of discount relating

to contingent consideration - - -

liability (after deduction

of tax)

Contingent consideration adjustment - - (25)

Loss on disposal of Summersault 180 - -

Communications Limited

--------- ---- ------

Headline profit/(loss) attributable

to equity holders of the

Company - Discontinued operations (202) 403 261

--------- ---- ------

Weighted average number of

ordinary shares in issue (thousands) 27,212 28,829 28,002

Headline basic earnings per share (in pence)

Continuing operations 2.52 3.47 11.07

======= ===== =======

Discontinued operations (0.74) 1.40 (0.93)

======= ===== =======

Dividends

During the first six months of 2014 Motivcom plc paid a final

dividend in respect of 2013 of GBP979,636 to its equity

shareholders (2013: GBP903,000). This represents a payment of 3.60

pence per share (2013: 3.00 pence).

6 Share-based payments

The Group has six contracted share option schemes, as disclosed

in the Group's most recent financial statements. The Group has not

entered into a new Sharesave scheme in the period. The following

options have been valued in accordance with the provisions of IFRS

2.

Date

of original Number Option Vesting Life

Scheme grant of options price conditions of Fair

option Value

EMI Option Scheme 21/11/2005 26,455 GBP0.945 3 Years 10 GBP0.11

Years

Sharesave Scheme 02/06/2011 49,772 GBP1.14 3 Years 3 Years GBP0.42

7

Sharesave Scheme 01/06/2012 227,293 GBP0.745 3 Years 3 Years GBP0.14

8

Sharesave Scheme 03/06/2013 174,974 GBP0.855 3 Years 3 years GBP0.08

9

CSOP 23/01/2009 60,000 GBP0.33 3 Years 10 GBP0.11

Years

Each

GBP20m

growth

C T Lloyd Option in market 10

Scheme 21/06/2007 617,425 GBP0.005 value Years GBP0.12

The fair value of services received in return for share options

granted to employees is measured by reference to the fair value of

share options granted. The estimate of fair value of the services

received is measured based on a binomial lattice model for the EMI,

CSOP and Sharesave Schemes and a Monte Carlo model for the C T

Lloyd Option Scheme. The vesting period is used as an input to

those models.

The following additional assumptions were used for the EMI

Option Schemes and the CT Lloyd Option Scheme:

- Expected volatility of 24% based on the average volatility of

the Company since flotation in August 2004

- A dividend yield of 1.20%

- Risk free interest rate of 5.31%

The following additional assumptions were used for CSOP:

- Expected volatility of 62% based on the average volatility of

the Company since flotation in August 2004

- A dividend yield of 4.79%

- Risk free interest rate of 2.49%

The following additional assumptions were used for Sharesave

Scheme 7:

- Expected volatility of 62% based on the average volatility of

the Company since flotation in August 2004

- A dividend yield of 2.32%

- Risk free interest rate of 1.06%

The following additional assumptions were used for Sharesave

Scheme 8:

- Expected volatility of 38% based on the average volatility of

the Company since flotation in August 2004

- A dividend yield of 4.37%

- Risk free interest rate of 0.34%

The following additional assumptions were used for Sharesave

Scheme 9:

- Expected volatility of 35% based on the average volatility of

the Company since flotation in August 2004

- A dividend yield of 4.00%

- Risk free interest rate of 0.71%

7 Intangible assets

Year ended

Six months Six months 31 December

ended ended 2013

30 30 GBP000

June 2014 June 2013

GBP000 GBP000

Goodwill

Balance at beginning of period 20,939 21,999 21,999

Amortisation and impairment (9,817) - (1,060)

Reclassified as asset held (2,643) - -

for disposal (note 8)

Balance at end of period 8,479 21,999 20,939

============= ============= ==============

Other intangibles

Balance at beginning of period 1,210 1,650 1,650

Amortisation and impairment (523) (202) (440)

Balance at end of period 687 1,448 1,210

============= ============= ==============

Total

Balance at beginning of period 22,149 23,649 23,649

Amortisation and impairment (10,340) (202) (1,500)

Reclassified as asset held (2,643) - -

for disposal

Balance at end of period 9,166 23,447 22,149

============= ============= ==============

An impairment of intangibles of GBP10,054,000 has been

recognised in connection with the proposed disposal of Zibrant (see

note 8) after measurement at market value less disposal costs.

8 Acquisitions and disposals

The Group did not make any acquisitions during the period, nor

in the six months ended 30 June 2013.

On 11 May 2014 the Group completed the sale of its subsidiary

Summersault Communications Limited to its management. No

consideration was payable. On 12 September 2014 the Group announced

that it had entered into an agreement for the sale of its

subsidiary Zibrant Limited to its management for consideration of

GBP2,924,000. The Group's directors consider that both of these

businesses meet the criteria under IFRS 5 for being classified as

discontinued operations, and the assets and liabilities of Zibrant

Limited have been classified as a disposal group held for sale. The

results from the discontinued operations of Summersault

Communications Limited and Zibrant Limited included in the income

statement are set out below:

Year ended

Six months Six months 31 December

ended ended 2013

30 30 GBP000

June 2014 June 2013

GBP000 GBP000

Revenue 8,253 11,154 18,655

Cost of sales (3,630) (5,380) (7,457)

------------- ------------- --------------

Gross profit 4,623 5,774 11,198

Administrative expenses (4,811) (5,213) (10,888)

Contingent consideration adjustment - - 25

Amortisation and impairment

of intangibles (10,230) (60) (1,217)

------------- ------------- --------------

Operating (loss)/profit on

discontinued operations (10,418) 501 (882)

Taxation on discontinued operations - (144) (12)

------------- ------------- --------------

(Loss)/profit after taxation

on discontinued operations (10,418) 357 (894)

------------- ------------- --------------

The net loss on the disposal of Summersault Communications

Limited is set out below:

Year ended

Six months Six months 31 December

ended ended 2013

30 30 GBP000

June 2014 June 2013

GBP000 GBP000

Consideration on disposal - - -

Net assets on disposal (152) - -

Other disposal costs (28) - -

------------- ------------- --------------

Loss on business disposal before (180) - -

taxation

Taxation on business disposal - - -

------------- ------------- --------------

Loss on business disposal after (180) - -

taxation

------------- ------------- --------------

The total result for the year after taxation on the discontinued

operations of Summersault Communications Limited and Zibrant

Limited is set out below:

(Loss)/profit after taxation

on discontinued operations (10,418) 357 (894)

Loss on business disposal after (180) - -

taxation

--------- ---- ------

(Loss)/profit for the year

from discontinued operations (10,598) 357 (894)

--------- ---- ------

The assets and liabilities classified under the disposal group

for Zibrant Limited are set out below:

Year ended

Six months Six months 31 December

ended ended 2013

30 30 GBP000

June 2014 June 2013

GBP000 GBP000

Assets classified as disposal

group

Goodwill 2,643 - -

Property, plant and equipment 440 - -

Current assets 8,574 - -

------------- ------------- --------------

Total assets classified as 11,622 - -

disposal group

------------- ------------- --------------

Liabilities classified as disposal

group

Current liabilities 8,306 - -

------------- ------------- --------------

Total liabilities classified 8,306 - -

as disposal group

------------- ------------- --------------

Net assets of disposal group 3,316 - -

------

9 Share Capital

There were no changes to share capital in the period. On 15

April 2013 the Company purchased 3,010,181 of its own shares at a

price per share of 110 pence for a total cost of GBP3,311,000 by

means of a Tender Offer to all shareholders. Additionally, costs of

GBP53,000 were incurred. The shares were immediately cancelled on

15 April 2013 and GBP15,051 transferred from share capital to

capital redemption reserve.

10 Fair value hierarchy

IFRS 7 Improving Disclosures about Financial Instruments

requires the Group to present certain information about financial

instruments measured at fair value in the balance sheet. At 30 June

2013 and 30 June 2014 the only financial instruments measured at

fair value through profit and loss were contingent consideration.

The fair value is estimated using a valuation technique.

Significant inputs into the model are based on management's

assumptions of the cash outflow and appropriate discount rates. The

fair value measurements in respect of deferred consideration are

classified as level 3 in the fair value hierarchy as inputs for the

asset or liability are not based on observable market data

(unobservable inputs).

The losses (after deduction of tax) recognised in profit and

loss account are disclosed in the table for headline basic earnings

per share in Note 5.

11 Cash generated from operations

Six months Six months

ended ended Year ended

30 30 31 December

June 2014 June 2013 2013

GBP000 GBP000 GBP000

Profit before income

tax from continuing

operations 686 1,058 3,699

Adjustments for:

- depreciation 178 186 357

- loss on disposal of

property, plant and

equipment - 3 8

- net interest payable 32 46 83

- share based payments 7 1 8

- amortisation and impairment

of intangibles 110 142 283

- write-back of deferred

consideration - - (25)

Changes in working capital

(excluding the effects

of acquisitions and

exchange differences

on consolidation):

- inventories 277 (79) (55)

- trade and other receivables 3,441 (7,307) (1,766)

- trade and other payables (2,888) 2,118 (2,517)

------------- ------------- -------------

Net cash from/(used

in) continuing operations 1,843 (3,832) 75

Net cash (used in)/from

discontinued operations (249) 675 561

Cash generated/(used

in) operations 1,594 (3,157) 636

============= ============= =============

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGZLVVLGDZM

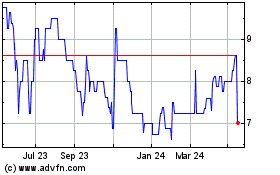

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

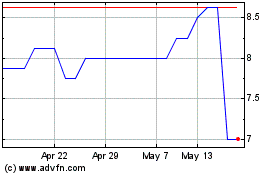

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jul 2023 to Jul 2024