TIDMMCM

RNS Number : 2833D

Motivcom PLC

27 March 2014

27 March 2014

Motivcom plc

("Motivcom", "the Company" or "the Group")

Final Results for the year ended 31 December 2013

Motivcom plc (AIM:MCM), a leading business services group

offering incentives & loyalty expertise and meetings &

event management services to major blue-chip corporate clients, is

pleased to announce its final results for the year ended 31

December 2013.

HIGHLIGHTS

-- Headline operating profit* increased by 5% to GBP4,375,000 (2012: GBP4,147,000)

-- Headline profit before tax increased by 6% to GBP4,359,000 (2012: GBP4,121,000)

-- Headline basic earnings per share++ increased by 11% to 12.00 pence (2012: 10.79 pence)

-- Operating profit increased by 7% to GBP2,900,000 (2012: GBP2,713,000)

-- Profit before tax increased by 13% to GBP2,817,000 (2012: GBP2,502,000)

-- Basic earnings per share increased by 5 % to 6.86 pence (2012: 6.52 pence)

-- Proposed final dividend of 3.6 pence per share to be paid on

18 June 2014, making a total dividend of 5.4 pence per share (2012:

4.5 pence per share), an increase of 20%

-- Net cash balances at 31 December 2013 of GBP6,388,000 (2012:

GBP11,993,000) having accounted for, inter alia, April 2013 share

tender offer cost of GBP3,364,000

*Operating profit of GBP2,900,000 (2012: GBP2,713,000) plus

amortisation and impairment of intangible assets of GBP1,500,000

(2012: GBP2,075,000) and acquisition expenses of GBPnil (2012:

GBP59,000) less contingent consideration adjustment credit of

GBP25,000 (2012: GBP700,000).

Profit before tax of GBP2,817,000 (2012: GBP2,502,000) plus

amortisation and impairment of intangible assets of GBP1,500,000

(2012: GBP2,075,000), acquisition expenses of GBPnil (2012:

GBP59,000) and unwinding of discount relating to contingent

consideration liability of GBP67,000 (2012: GBP185,000), less

contingent consideration adjustment credit of GBP25,000 (2012:

GBP700,000).

++ See reconciliation in Note 5

Commenting on the results, Colin Lloyd, Chairman of Motivcom

plc, said: "The Board is pleased to announce an increase in

headline operating profit during the period, although budgetary

pressures have continued to impact the Meetings and Events

business, resulting in the overall outcome for the year being

slightly lower than the Board's expectations. The Group continues

to make good progress on its stated five year strategy, with the

Motivation division performing particularly well, increasing

headline operating profit by 72%, and the Employee Benefits market

also seeing uplift during the period, particularly in the SME

sector.

Given the Group's strong cash balance and ongoing cash

generation, the Board has proposed a final dividend of 3.6 pence, a

20% increase over 2012. The Group is cautiously optimistic about

the Group's prospects, assuming no material change to the economic

environment."

- Ends -

For further information:

Motivcom

Sue Hocken Tel: +44 (0) 845 053 5529

sue.hocken@motivcom.com www.motivcom.com

Grant Thornton Corporate Finance

Philip Secrett / Salmaan Khawaja / Tel: +44 (0)207 383 5100

Jamie Barklem

philip.j.secrett@uk.gt.com www.gtuk.com

Numis Securities Limited

David Poutney/James Serjeant Tel: +44 (0)207 383 5100

Media enquiries:

Abchurch

Joanne Shears / Quincy Allan Tel: +44 (0) 207 398 7710

joanne.shears@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

I am pleased to report that the results for the year to 31

December 2013 show an increase over the outcome for 2012, albeit

slightly below the Board's expectations. As set out in the interim

report for the period ended 30 June 2013, the event management and

live production areas have continued to see budgetary pressures and

reducing numbers of delegates impacting volume, average spend per

head and profitability. Whilst a flat performance was expected for

the events business area in 2013, the final outturn was impacted by

lower than expected new business intake in this area towards the

end of the year. The Board remains cautious about the levels of new

events business in the Meetings & Events business.

The Group remains cash generative and maintains a strong balance

sheet with average net cash of circa GBP3 million which enables the

continuation of a progressive dividend policy. The April 2013 share

tender offer successfully returned GBP3.3 million of cash to

shareholders.

Financial update

Headline operating profit increased by 5% to GBP4,375,000 (2012:

GBP4,147,000) on a gross profit that decreased by 2% to

GBP28,717,000 (2012: GBP29,317,000). Headline profit before tax

increased by 6% to GBP4,359,000 (2012: GBP4,121,000). Headline

basic earnings per share increased by 11% to 12.00 pence (2012:

10.79 pence).

Net cash balances stood at GBP6,388,000 (2012: GBP11,933,000)

after the Company's share tender offer in April 2013 which cost

GBP3.4 million. The 2012 net cash balance contained an exceptional

GBP3.5 million of cash relating to client pass through costs that

were paid out in early January 2013.

Dividends

In view of the cash generative nature of the Group's business,

the Company proposes a final dividend for 2013 of 3.6 pence per

share. This makes a total dividend per share of 5.4 pence for 2013

(2012: total dividend of 4.5 pence), an increase of 20%. This final

dividend will be paid on 18 June 2014 to shareholders on the

register at close of business on 4 April 2014.

The Board intends to grow the dividend in real terms whilst

aiming for earnings cover of two times over the medium term.

Strategy

As stated in my previous reports the Board has set a clear and

achievable five year strategy for the Group covering people and

client development, new products and services as well as executing

appropriate acquisitions as they arise. This strategy is being met

through the various developments set out in this report. The Board

believes that the strategy will continue to build on the core

strengths of the Group and places Motivcom in an excellent position

to take advantage of the reported upturn in the economy.

Divisional Reports

Motivation

The Motivation division increased gross profit by 18% to GBP6.9

million and divisional headline operating profit increased by 72%

to GBP2.6 million. The increase in gross profit has dropped

directly to the operating profit of the division reflecting the

upside of growing scale in the operation combined with tight cost

control. Whilst some modest investment in operating resources will

be required in 2014 to meet the demands of a growing client base,

the division maintains a positive outlook.

Motivation programme activity developed well in 2013; our

clients continue to recognise the positive impact of employee

engagement on productivity, customer satisfaction and employee

attrition. In response to slow decision making in terms of new

business, there was an increased focus on existing client

development which proved fruitful. In addition our increasing

expertise in digital marketing for new business lead generation is

working well, and a number of new client wins in early 2014 is

testament to that success.

Voucher and gift card volumes were down 3% on 2012 to GBP66

million. Whilst slightly disappointing this is more a reflection of

certain one off voucher based promotions in early 2012 rather than

a poor 2013. Operational efficiencies were delivered from a

continued migration from paper vouchers to plastic gift cards with

49% of the volume on plastic at the end of 2013. A strong end to

the year indicates a positive sentiment from our wide client base

in this area.

Following a slightly hesitant start to the year, Spree, the

Group's prepaid MasterCard(R) product, has continued to expand. In

2013, load values were up 10% to GBP184 million (2012: GBP170

million). This growth was primarily driven by the expansion of

existing card programmes which also benefited from improved

profitability as the investment in data analytics and marketing to

our existing cardholder base showed good returns.

Promotions

In the Promotions division, gross profit increased by 9% to

GBP9.3 million but divisional headline operating profits fell by

26% from GBP1 million to GBP0.8 million. The operating loss in

Summersault Communications widened by GBP0.1 million in 2013 and

final margins in fixed fee business were lower than expected.

Employee Benefits

All Employee Benefit markets continued to see healthy growth in

2013. The SME market remained strong, with employers looking to

provide more to staff without significant cost. We also re-enforced

our position in the Public sector, both winning a number of

significant new contracts and also retaining existing ones.

Innovation and market leading product led to a record year for new

business intake and retention levels for our existing clients

exceeded expectations. Testimony to this was our award for 'Best

Voluntary Benefits provider of the Year' at the Workplace Savings

and Benefits Awards in October 2013.

2013 was another good year for Allsave, the Group's flagship

child care provider despite pressure on fee rates due to a highly

competitive market place and a reduction in voucher value for

higher rate taxpayers. Pleasingly the number of scheme members grew

by 11% which we believe outperformed the market. Client retention

remains a major strength in the business as client relationships

are secured and enhanced through excellent customer service and

client activity. As a result we continue to grow existing schemes

year on year. With the announcement of the new Tax Free Childcare

("TFC") Scheme by the Government from autumn 2015, Allsave has been

working closely with HMRC in the TFC consultation process, to input

into the design of the new TFC scheme.

The outlook for 2014 looks particularly promising for this area

of the business. Our Intermediary relationships are strengthening

and marketing campaigns are resulting in a healthy pipeline of

leads with good conversion expected. Quarter 2 will see the launch

of a portfolio of salary sacrifice products and voluntary benefits

which will secure our commitment to the B2B market to both existing

clients and new prospects.

Sales Promotion

2013 was both a challenging and positive year for fixed fee

sales promotions at P&MM. Sales were strong but margins were

lower than anticipated. We nevertheless ended the year with good

figures and a positive outlook.

The Board is confident about 2014 as we have recently recruited

some particularly experienced business developers. We continue to

look at business structures in order to improve both our

profitability and client service and have exciting development

opportunities with long term clients that should help us have a

strong year.

Treatme, our in house experience and activity brand, has bedded

into the Group, meeting the challenges of its relocation from

Chester to Milton Keynes and the employment of a whole new customer

service team. We began implementing a strategy of becoming a market

leading player through a new website, improved customer journey and

increased breadth and depth of product offering, whilst maintaining

a firm control on marketing costs. Treatme is now in a very

advantageous position to move forward and 2014 is already looking

positive with all the key KPIs improving.

Our Entice customer loyalty proposition was significantly

re-engineered during the course of the year which resulted in

excellent new client confirmations in the latter part of 2013 for

delivery in 2014. Further major investment is being made in the

product and talent during 2014 from which we expect to deliver

further continued growth during the year.

Overall, although the markets we operate in remain very

competitive, we are confident we can continue to outperform the

market.

Meetings & Event Management

Gross profit in the Events division fell by 18% to GBP12.2

million and divisional headline operating profits decreased by 50%

to GBP0.9 million. Whilst venue find volumes were 24% above budget

the event and live production areas continued to see budgetary

pressures and reducing numbers of delegates impacting volume,

average spend per head and profitability. Expected new business

intake towards the end of the year in this area was also lower than

expected.

2013 has been a year of evolution for the Meetings and Events

division. Following a fundamental strategic review, the business is

being reorganised under one primary brand, Zibrant, and into three

core operating areas. These will focus on meeting booking, meeting

management and creative production and communications. These core

functions will provide each market sector with more specialist

skill sets and provide more clarity of message to prospective

clients.

Gross profit in 2014 is expected to be maintained at the 2013

level. Our cost reduction programme continued in 2013 and will

continue into 2014 as we re-engineer and right-size the

business.

During this time we have also invested in the Events division,

recruiting new creative talent into our live creative production

area to strengthen our competitive offering and win new business.

In the meetings booking area we are investing in new software to

improve the product offering and reduce cost of delivery.

The anticipated upturn in the events business has, to date, not

materialised and the Board remains cautious about the Meeting &

Events area of the business. However, there has been a gradual

recovery in the meeting booking environment which we expect to

continue into 2014 and beyond. This recovery coupled with the

continued restructure of our event management services provides a

platform for medium term growth.

Outlook

The Group is cautiously optimistic about the Group's prospects,

assuming no material change to the economic environment.

Colin Lloyd

Chairman

26 March 2014

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2013

Year ended Year ended

31 31

December 2013 December 2012

Note GBP000 GBP000

Revenue 2 95,990 106,590

Cost of sales (67,273) (77,273)

-------------- --------------

Gross profit 28,717 29,317

Administrative expenses (24,342) (25,170)

Amortisation and impairment of

intangibles (1,500) (2,075)

Acquisition expenses - (59)

Contingent consideration adjustment 25 700

-------------- --------------

Operating profit 2,900 2,713

Interest expense 3 (151) (291)

Interest income 68 80

-------------- --------------

Profit before income tax 2,817 2,502

Income tax expense 4 (896) (572)

-------------- --------------

Profit for the period 1,921 1,930

============== ==============

Attributable to:

Equity holders of the Company 1,921 1,930

============== ==============

Earnings per share for profit

attributable to the equity holders

of the Company during the year

(expressed in pence)

- basic 5 6.86 6.52

============== ==============

- diluted 5 6.81 6.35

============== ==============

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2013

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Profit for the period 1,921 1,930

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss

Deferred tax on property 52 42

-------------- --------------

Other comprehensive income, net

of tax 52 42

-------------- --------------

Total comprehensive income for

the period 1,973 1,972

============== ==============

Attributable to:

Equity holders of the Company 1,973 1,972

============== ==============

CONSOLIDATED BALANCE SHEET

AT 31 DECEMBER 2013

Year ended Year ended

31 31 December

December 2013 2012

GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 4,433 4,623

Intangible assets 22,149 23,649

--------------- -------------

26,582 28,272

--------------- -------------

Current assets

Inventories 798 743

Trade and other receivables 24,241 22,475

Cash and cash equivalents 10,188 13,933

--------------- -------------

35,227 37,151

--------------- -------------

Total assets 61,809 65,423

=============== =============

EQUITY

Capital and reserves attributable

to the Company's equity holders

Share capital 140 155

Share premium account 9,944 9,944

Own shares (1,016) (1,083)

Capital redemption reserve 15 -

Other reserves 75 75

Retained earnings 10,872 13,696

--------------- -------------

Total equity 20,030 22,787

=============== =============

LIABILITIES

Non-current liabilities

Borrowings 1,594 1,800

Deferred income tax liabilities 362 329

Provisions - 267

--------------- -------------

1,956 2,396

--------------- -------------

Current liabilities

Trade and other payables 36,938 39,455

Current income tax liabilities 245 138

Borrowings 2,193 200

Provisions 447 447

--------------- -------------

39,823 40,240

--------------- -------------

Total liabilities 41,779 42,636

=============== =============

Total equity and liabilities 61,809 65,423

=============== =============

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2013

Year ended Year ended

31 31 December

December 2013 2012

Note GBP000 GBP000

Cash flows from operating activities

Cash generated from operations 7 636 8,662

Interest paid (97) (89)

Income tax paid (752) (1,110)

--------------- -------------

Net cash (used in)/generated from

operating activities (213) 7,463

--------------- -------------

Cash flows from investing activities

Acquisition of subsidiaries, net

of cash acquired (309) (552)

Purchases of property, plant and

equipment (PPE) (401) (239)

Proceeds on disposal of PPE - 658

Interest received 68 80

--------------- -------------

Net cash used in investing activities (642) (53)

--------------- -------------

Cash flows from financing activities

Payment of dividends (1,393) (1,287)

Payments to acquire own shares (3,364) (91)

Proceeds from issue of shares 67 262

Repayments of borrowings 1,800 (3,550)

--------------- -------------

Net cash used in financing activities (2,890) (4,666)

--------------- -------------

Net (decrease)/increase in cash

and cash equivalents (3,745) 2,744

Cash and cash equivalents at beginning

of period 13,933 11,189

--------------- -------------

Cash and cash equivalents at end

of period 10,188 13,933

=============== =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2013

Share Share Own Capital Other Retained Total

capital premium shares redemption reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2012 155 9,944 (1,254) - 75 13,026 21,946

Dividends paid - - - - - (1,287) (1,287)

Share based payments - - - - - 24 24

Own shares disposed

of on exercise of

options - - 262 - - - 262

Purchase of own shares - - (91) - - (91)

Deferred tax on equity

share based payments - - - - - (39) (39)

--------- --------- -------- ------------ ---------- ---------- ----------

Transactions with

owners - - 171 - - (1,302) (1,131)

--------- --------- -------- ------------ ---------- ---------- ----------

Profit for the period - - - - - 1,930 1,930

Other comprehensive

income:

* Deferred tax on property - - - - - 42 42

--------- --------- -------- ------------ ---------- ---------- ----------

Total comprehensive

income for the period - - - - - 1,972 1,972

--------- --------- -------- ------------ ---------- ---------- ----------

Balance at 31 December

2012 155 9,944 (1,083) - 75 13,696 22,787

Dividends paid - - - - - (1,393) (1,393)

Share based payments - - - - - 8 8

Own shares disposed

of on exercise of

options - - 67 - - - 67

Purchase and cancellation

of own shares (15) - - 15 - (3,364) (3,364)

Deferred tax on equity

share based payments - - - - - (48) (48)

--------- --------- -------- ------------ ---------- ---------- ----------

Transactions with

owners (15) - 67 15 - (4,797) (4,730)

--------- --------- -------- ------------ ---------- ---------- ----------

Profit for the period - - - - - 1,921 1,921

Other comprehensive

income:

Deferred tax on property - - - - - 52 52

--------- --------- -------- ------------ ---------- ---------- ----------

Total comprehensive

income for the period - - - - - 1,973 1,973

At 31 December 2013 140 9,944 (1,016) 15 75 10,872 20,030

========= ========= ======== ============ ========== ========== ==========

NOTES TO THE FINANCIAL INFORMATION

1 Basis of information in this announcement

The financial information in this announcement does not

constitute the Company's statutory accounts for the years ended 31

December 2013 or 31 December 2012 but is derived from those

accounts.

Statutory Accounts for 2012 have been delivered to the Registrar

of Companies and those for 2013 will be delivered following the

Company's annual general meeting. The auditor has reported on those

accounts; their reports were (i) unqualified, (ii) did not include

a reference to any matters to which the auditor drew attention by

way of emphasis without qualifying their report and (iii) did not

contain any statement under section 498 (2) or (3) of the Companies

Act 2006.

This announcement has been prepared on the basis of the Group's

accounting policies. These are set out in its Annual Report and

Accounts for the year ended 31 December 2012 which is available on

the Group's website (www.motivcom.com).

The financial statements are prepared on a going concern basis.

In considering going concern, the directors have reviewed the

Group's future cash requirements and earnings projections. The

directors believe these forecasts have been prepared on a prudent

basis and have also considered the impact of a range of potential

changes to trading performance. The directors have concluded that

the Group should be able to operate within its current facilities

and comply with its banking covenants for the foreseeable future

and therefore believe it is appropriate to prepare the financial

statements of the Group on a going concern basis. This is supported

by the Group's liquidity position at the year end.

2 Segment information

At 31 December 2013 the Group is organised into three main

business segments - (1) development and administration of third

party motivation and incentive programmes ("Motivation") - (2) the

provision of incentive travel, live events and venue find

("Events") - (3) trade and consumer sales promotions, employee

benefit products and communications ("Promotions"). Unallocated

costs represent corporate and share-based payment expenses.

The segment results for the year ended 31 December 2013 are as

follows:

Motivation Events Promotions Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue from external

clients 33,270 33,077 29,341 302 95,990

=========== ========= =========== ============ ==========

Inter-segment revenues 3,422 377 67 (3,866) -

=========== ========= =========== ============ ==========

Gross profit 6,903 12,232 9,280 302 28,717

Administrative expenses (4,307) (11,340) (8,507) (188) (24,342)

----------

Headline operating profit 2,596 892 773 114 4,375

=========== ========= =========== ============

Amortisation and impairment

of intangibles (1,500)

Acquisition expenses -

Contingent consideration

adjustment 25

----------

Operating profit 2,900

Net interest expense (83)

Profit before tax 2,817

==========

The segment results for the year ended 31 December 2012 are as

follows:

Motivation Events Promotions Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue from external

clients 38,236 44,439 23,915 - 106,590

=========== ========= =========== ============ ==========

Inter-segment revenues 4,038 414 559 (5,011) -

=========== ========= =========== ============ ==========

Gross profit 5,867 14,903 8,547 - 29,317

Administrative expenses (4,357) (13,105) (7,498) (210) (25,170)

----------

Headline operating profit 1,510 1,798 1,049 (210) 4,147

=========== ========= =========== ============

Amortisation and impairment

of intangibles (2,075)

Acquisition expenses (59)

Contingent consideration

adjustment 700

----------

Operating profit 2,713

Net interest expense (211)

Profit before tax 2,502

==========

The Group's business is divided into two main streams -

Incentives and Loyalty ("Incentives") and Meetings and Event

Management ("Meetings"). Incentives comprises the segment results

of Motivation and Promotions but also includes the motivation

business of AYMTM Limited included in Events. Meetings comprises

the segment results of Events less the motivation business of AYMTM

Limited. The Group recognises that this additional information

enables its shareholders better appreciate the nature of its

business.

The analysis for the year ended 31 December 2013 is as

follows:

Incentives Meetings Unallocated Group

GBP000 GBP000 GBP000 GBP000

Revenue from external

clients 72,299 23,389 302 95,990

=========== ========= ============ ==========

Inter-segment revenues 3,489 377 (3,866) -

=========== ========= ============ ==========

Gross profit 17,430 10,985 302 28,717

Administrative expenses (13,765) (10,389) (188) (24,342)

----------

Headline operating profit 3,665 596 114 4,375

=========== ========= ============

Amortisation and impairment

of intangibles (1,500)

Acquisition expenses -

Contingent consideration

adjustment 25

----------

Operating profit 2,900

Net interest expense (83)

Profit before tax 2,817

==========

The analysis for the year ended 31 December 2012 is as

follows:

Incentives Meetings Unallocated Group

GBP000 GBP000 GBP000 GBP000

Revenue from external

clients 69,287 37,303 - 106,590

=========== ========= ============ ==========

Inter-segment revenues 4,597 414 (5,011) -

=========== ========= ============ ==========

Gross profit 16,114 13,203 - 29,317

Administrative expenses (12,836) (12,124) (210) (25,170)

----------

Headline operating profit 3,278 1,079 (210) 4,147

=========== ========= ============

Amortisation and impairment

of intangibles (2,075)

Acquisition expenses (59)

Contingent consideration

adjustment 700

----------

Operating profit 2,713

Net interest expense (211)

Profit before tax 2,502

==========

The home country of the Company and its subsidiaries is England.

The Group's sales are mainly in countries within the UK and the

eurozone and, allocated on the basis of the country in which the

customer is located, are as follows:

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

UK 92,628 101,696

Rest of Europe 2,053 4,037

Other countries 1,309 857

95,990 106,590

============== ==============

No client represented greater than 10% of Group revenue in

either 2013 or 2012.

3 Interest expense

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Interest expense:

- bank borrowings 78 89

- debt finance costs 6 17

* unwinding of discount relating to contingent

consideration liability 67 185

151 291

============== ==============

4 Income tax expense

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Current tax 897 684

Under/(over) provision of tax for prior

year 21 (5)

-------------- --------------

918 679

Deferred tax - origination and reversal

of temporary differences (16) (123)

Deferred tax - effect of change in tax

rate (6) 16

896 572

============== ==============

The tax on the Group's profit before tax differs from the

theoretical amount that would arise using the weighted average tax

rate applicable to profits of the consolidated companies as

follows:

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Profit before tax 2,817 2,502

============== ==============

Tax calculated at domestic tax rates

applicable to profits in the United

Kingdom 896 613

Under/(over) provision of tax for prior

year 21 (5)

Expenses not deductible for tax purposes (16) 102

Deduction for share options exercised (5) (138)

Tax charge 896 572

============== ==============

The weighted average applicable tax rate was 31.8% (2012:

22.9%).

5 Earnings per share

Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Profit attributable to equity holders

of the Company 1,921 1,930

-------------- --------------

Weighted average number of ordinary

shares in issue (thousands) 28,002 29,620

Basic earnings per share in pence 6.86 6.52

============== ==============

Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all contracted dilutive potential ordinary shares.

The Company has only one category of dilutive potential ordinary

shares, share options.

The calculation is performed for the share options to determine

the number of shares that could have been acquired at fair value

(determined as the average annual market share price of the

Company's shares) based on the monetary value of the subscription

rights attached to outstanding share options and taking account of

the yet unexpensed share based payment charge relating to those

options. The number of shares calculated as above is compared with

the number of shares that would have been issued assuming the

exercise of the share options. Tranches two to four of the options

granted to C T Lloyd have been excluded from this calculation as

all the conditions attaching to the proposed options had not been

met at 31 December 2013.

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Profit attributable to equity holders

of the Company 1,921 1,930

-------------- --------------

Weighted average number of ordinary

shares in issue (thousands) 28,002 29,620

Adjustment for share options (thousands) 212 776

-------------- --------------

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 28,214 30,396

Diluted earnings per share in pence 6.81 6.35

============== ==============

Headline Basic

Headline basic earnings per share is calculated by dividing the

profit attributable to equity holders of the Company plus (i) the

amortisation of intangible assets, (ii) acquisition expenses and

(iii) adjustments to contingent consideration by the weighted

average number of ordinary shares in issue during the period.

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Profit attributable to equity holders

of the Company 1,921 1,930

Amortisation and impairment of intangibles

(after deduction of tax) 1,397 1,577

Acquisition expenses - 59

Unwinding of discount relating to contingent

consideration liability (after deduction

of tax) 67 165

Contingent consideration adjustment

(after adding back tax) (25) (534)

-------------- --------------

Headline profit attributable to equity

holders of the Company 3,360 3,197

-------------- --------------

Weighted average number of ordinary

shares in issue (thousands) 28,002 29,620

Headline basic earnings per share in

pence 12.00 10.79

============== ==============

6 Dividends

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Dividends paid

- 2012 final dividend of 3.0 pence per

share 803 835

- 2013 interim dividend of 1.80 pence

per share 590 452

1,393 1,287

============== ==============

The proposed final dividend for the year ended 31 December 2013

of 3.6 pence per share is subject to approval by shareholders at

the Annual General Meeting and has not been included as a liability

in these financial statements. The total amount proposed is

GBP979,636.

7 Cash generated from operations

Year ended Year ended

31 31

December 2013 December 2012

GBP000 GBP000

Profit for the period before tax 2,817 2,502

Adjustments for:

- depreciation) 583 679

- loss on disposal of property, plant

and equipment 8 87

- amortisation and impairment of intangibles 1,500 2,075

- write back of deferred consideration (25) -

- net interest 83 211

- share based payments 8 24

Changes in working capital (excluding

the effects of acquisitions):

- inventories (55) (123)

- trade and other receivables (1,766) 1,477

- trade and other payables (2,517) 1,730

Cash generated from operations 636 8,662

============== ==============

8 Acquisitions

No acquisitions were made in 2013. In 2012, GBP300,000 was

expended on the acquisition of the entire issued share capital of

TreatMe.Net Limited. GBP641,000 was in respect of goodwill. The net

cash outflow on this acquisition was GBP244,000, being GBP300,000

consideration settled in cash less GBP56,000 cash acquired. In 2013

GBP309,000 (2012 - GBP308,000) was expended in cash in respect of

contingent consideration relating to the 2011 acquisition of

Allsave Limited and My Family Care Vouchers Limited.

9 Share Capital

On 15 April 2013 the Company purchased 3,010,181 of its own

shares at a price per share of 110 pence for a total cost of

GBP3,311,000 by means of a Tender Offer to all shareholders.

Additionally, costs of GBP53,000 were incurred. The shares were

immediately cancelled on 15 April 2013 and GBP15,051 transferred

from share capital to capital redemption reserve.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UNONRSKAOUAR

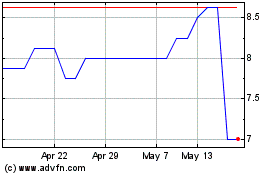

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

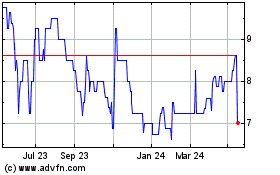

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jul 2023 to Jul 2024