TIDMLWDB

RNS Number : 7923V

Law Debenture Corp PLC

26 July 2018

Law Debenture

The Law Debenture Corporation p.l.c. today published its results

for the half-year ended 30 June 2018.

Investment Trust Highlights:

-- NAV total return for the six months was 4.7%, compared to

1.7% returned by the benchmark FTSE All Share Index

-- The trust has consistently outperformed its benchmark, with

outperformance on a six month, one, five and ten year metric

-- The trust currently yields 3% which is one of the higher yields in the sector

-- On-going charges remain low at 0.43% compared to a sector average of 1.36%

-- The UK remained the central focus of the portfolio, key

contributors included GKN, Senior and Rolls Royce

Independent Professional Services (IPS) Highlights:

-- Leading wholly owned independent provider of professional

services, a key differentiator to other investment trusts

-- New CEO leading a strengthened senior management team, with a

clear mandate to grow profitability while maintaining the unique

brand and reputation of Law Debenture

-- Strengthened team has delivered a top line revenue increase

of 12.7% (net of cost of sales) and profit after tax of 10.7% on

prior period. We believe there is more we can do to drive

shareholder value from these businesses in the coming years.

Dividends:

-- Following approval at the AGM, a final dividend for 2017 of

11.8 pence per share was paid in April 2018

-- The Corporation attaches considerable importance to the

dividend, which it aims to increase annually

-- The Board declared an interim dividend of 6.0 pence per

share, an increase of 9.1% on prior year

-- This higher dividend has been supported by stronger performance from the IPS business

Commenting, Robert Hingley, Chairman, said:

"I am pleased with the progress we have seen from our IPS

businesses over the period. Driving increased revenues while

controlling costs has supported payment to our shareholders of a

dividend that is 9.1% higher than prior year. Our investment trust

has consistently outperformed its benchmark, with outperformance on

a six month, one, five and ten year metric. We continue to work

hard to drive shareholder value across our unique business."

Commenting, Denis Jackson, Chief Executive Officer, said:

"I took over the mantle of Chief Executive at the start of this

year with a clear mandate to drive growth across our IPS

businesses. I am delighted with the response from our business

heads and their teams who have achieved a 12.7% growth in income

(net of cost of sales) and a 10.7% growth in profit compared to

this time last year. We have made a positive start, but I believe

there is much more we can do to drive shareholder value from these

businesses in the coming years."

Contact Information

Denis Jackson Katie Thorpe

-------------------------------

Chief Executive Officer Chief Financial Officer

-------------------------------

Email: denis.jackson@lawdeb.com Email: katie.thorpe@lawdeb.com

-------------------------------

Tel: +44 (0) 207 606 5451 Tel: +44 (0) 207 606 5451

-------------------------------

The Law Debenture Corporation p.l.c. and its subsidiaries

Half yearly report for the six months to 30 June 2018

(unaudited)

The directors recommend an interim dividend of 6.0p on the

ordinary shares for the six months to 30 June 2018. The report

including the unaudited results for the period was as follows:

Group summary

We are a global investment trust and a leading provider of

independent professional services.

From its origins in 1889, Law Debenture has diversified to

become a group with a unique range of activities in the financial

and professional services sectors. The group divides into two

distinct areas of business.

Investment trust

Our portfolio of investments is managed by James Henderson of

Janus Henderson Investors*.

Our objective is to achieve long term capital growth in real

terms and steadily increasing income. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index

through investing in a portfolio diversified both geographically

and by industry.

Independent professional services

We are a leading provider of independent professional services.

Our activities are corporate trusts, pension trusts, corporate

services (including agent for service of process), whistle blowing

services and governance services. We have offices in the UK, Cayman

Islands, Channel Islands, Delaware, Dublin, Hong Kong and New

York.

Companies, agencies, organisations and individuals throughout

the world rely upon Law Debenture to carry out its duties with the

independence and professionalism upon which its reputation is

built.

Performance to 30 June 2018

6 months 1 year 5 years 10 years

% % % %

-------------------------- --------- ----------- ------------ ----------

NAV total return 1 4.7 10.3 70.2 168.8

-------------------------- --------- ----------- ------------ ----------

FTSE Actuaries All-Share

Index total return 1.7 9.0 52.8 111.2

-------------------------- --------- ----------- ------------ ----------

Share price total

return 1 (3.3) 7.3 44.1 203.0

-------------------------- --------- ----------- ------------ ----------

1 Net Asset Value at fair value calculated in accordance with

AIC methodology, based on performance data held by Law

Debenture.

30 June

2018

%

------------------- --------

Ongoing charges 2 0.43

--------------------- --------

Gearing 2 5

--------------------- --------

Ongoing charges are stated as at 31 December 2017 and are based

on the costs of the investment trust, including

the Janus Henderson Investors management fee of 0.30% of NAV for

the investment trust. There is no performance element related to

the fee.

2 Source: AIC

* Managed under a contract terminable by either side on six

months' notice.

Financial summary

30 June 30 June 31 December

2018 2017 2017

pence pence pence

----------------------------- -------- -------- ----------------

Net revenue return per

share:

- Investment trust 8.28 8.11 11.61

- Independent professional

services 3.60 3.26 9.93

Group charges - - 0.12

----------------------------- -------- -------- ----------------

Group net revenue return

per share 11.88 11.37 21.66

----------------------------- -------- -------- ----------------

Capital return per share 4.78 39.49 67.10

Dividends per share 6.00 5.50 17.30

Share price 596.00 572.00 629.00

NAV per share at fair value

1 688.29 641.10 669.53

----------------------------- -------- -------- ----------------

% % %

----------------------------- -------- -------- ----------------

(Discount) (13.4) (10.8) (6.1)

----------------------------- -------- -------- ----------------

1 Net Asset Value at fair value calculated in accordance with

AIC methodology, based on performance data held by Law

Debenture

including fair value of the IPS business and long term

borrowings.

NAV per share

30 June 30 June 31 December

2018 2017 2017

pence pence pence

----------------------------- ------------ ---------- ------------

NAV per share per financial

statements 638.21 599.96 633.28

Fair value adjustment for

IPS 70.08 65.99 61.57

Debt fair value adjustment (20.00) (24.85) (25.32)

----------------------------- ------------ ---------- ------------

NAV per share as disclosed

with debt at fair value 688.29 641.10 669.53

----------------------------- ------------ ---------- ------------

Fair valuation of the independent professional services

businesses

The fair valuation of the independent professional services

businesses (IPS) is based upon the historic earnings before

interest, taxation, depreciation and amortisation (EBITDA), an

appropriate multiple and the surplus net assets of the business at

their underlying fair value. The multiple applied in valuing the

IPS is from comparable companies sourced from market data, with

appropriate adjustments to reflect the difference between the

comparable companies and the IPS in respect of growth, margin, size

and liquidity.

30 June 30 June 31 December

2018 2017 2017

GBP000 GBP000 GBP000

------------------------- -------- -------- ------------

EBITDA at a multiple of

8.4

(30 June 2017: 8.3; 31

December 2017: 7.9) 87,696 82,004 77,396

Surplus net assets 22,800 16,730 17,176

------------------------- -------- -------- ------------

110,496 98,734 94,572

------------------------- -------- -------- ------------

An increase or decrease of 1 in the multiple would give rise to

a GBP10.4 million change in the fair valuation of the IPS. The

adjustment to NAV to reflect the IPS fair value is an increase of

70.08p per share (30 June 2017: 65.99p; 31 December 2017:

61.57p).

Half yearly management report

Performance

Our Net Asset Value total return for the six months to 30 June

2018 was 4.7%, compared to a total return of 1.7% for the FTSE

Actuaries All-Share Index. Net revenue per share was 11.88p, 4.5%

higher than the corresponding period last year (2017: 11.37p).

Dividend

The board has declared an interim dividend of 6.0p (2017: 5.5p).

The dividend will be paid on 7 September 2018 to holders on the

record date of 10 August 2018. The current expectation of the

directors is that the final dividend will be at least

maintained.

Investment trust review

Although the first six months of the year was one of significant

change in the global economic environment, it did not fundamentally

alter the picture regarding equities. The potential for equity

market disruption from the onset of a trade war between the US and

other countries, combined with a rise in the US bond yield, were

countered by a pick-up in US economic activity which drove better

corporate operating performance and margin growth. The result has

been strong earnings and cash generation.

At a stock level the biggest contributor was GKN which was

purchased by Melrose. Two other aerospace related stocks, Senior

and Rolls Royce, were also large contributors. The aerospace

industry in the UK is an area of excellence. It should continue to

be a good investment area as the number of miles flown globally is

growing at over twice the level of the increase in GDP. However,

the proceeds from the GKN takeover have not yet been directed back

into this segment as we monitor the potential impact of Brexit.

The detractors included Cummins, the US diesel engine

manufacturer, which had been a strong contributor last year but

subsequently suffered some share price weakness this year as

investor concerns rose over the effect of tariffs between the US

and China.

During the period under review we continued to look for

opportunities to refresh the portfolio and remain on the lookout

for new investments. As an example we undertook to support the

capital raising for Ceres Power, a fuel cell company that may be on

the cusp of achieving substantial orders after its joint venture

tie up with a major Chinese bus maker.

Investment trust outlook

Although companies have achieved strong earnings growth,

valuations have drifted lower. Dividends produced by equities

continue to grow substantially faster than inflation. The yield on

the portfolio is running at a higher level than the yield on gilts.

This could mean a small increase in investor confidence will lead

to a strong upward movement in share prices as investors reallocate

back to UK equities, which are currently unpopular with investors.

Concerns remain about the health of the economy, but, with our

investment in a collection of good dynamic businesses, we believe

in aggregate they can find a way to prosper going forward. We do

not believe this is reflected in valuations and for this reason, we

have been a net buyer of equities, with gearing moving up a modest

amount to 5% at the period end.

Independent professional services review

Our wholly owned IPS businesses are leading providers of

independent professional services, providing Law Debenture with a

key differentiator to other investment trusts. As indicated in the

2017 annual report, our new CEO is leading a strengthened senior

management team, with a clear mandate to grow profitability, while

maintaining the unique brand and reputation of Law Debenture.

This strengthened team has delivered a topline revenue increase

of 12.7% (net of cost of sales) and profit after tax has increased

by 10.7% compared to the prior period. We are pleased that this

increase in profitability has supported an increase in dividend

payment to our shareholders of 9.1% compared to the prior

period.

The fair value of our IPS businesses has increased by 17% over

the first half of this year, which reflects a combination of higher

market multiples for relevant comparators and improved

profitability. We believe there is more we can do to drive

shareholder value from these businesses in the coming years.

Group income statement

for the six months ended 30 June (unaudited)

30 June 2018 30 June 2017

------------------------------ -----------------------------------

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- --------- -------- --------- ---------- ------------ ---------

UK dividends 10,618 - 10,618 10,135 - 10,135

UK special dividends 669 - 669 743 - 743

Overseas dividends 2,251 - 2,251 2,537 - 2,537

Overseas special

dividends 90 - 90 50 - 50

13,628 - 13,628 13,465 - 13,465

Interest income 165 - 165 47 - 47

Independent

professional

services fees 16,010 - 16,010 14,669 - 14,669

Other income 69 - 69 220 - 220

Total income 29,872 - 29,872 28,401 - 28,401

Net gain on

investments

held

at fair value

through profit

or loss - 5,939 5,939 - 46,828 46,828

---------------------- --------- -------- --------- ---------- ------------ ---------

Gross income

and capital

gains 29,872 5,939 35,811 28,401 46,828 75,229

Cost of sales (1,548) - (1,548) (1,838) - (1,838)

Administrative

expenses (11,321) (289) (11,610) (10,287) (178) (10,465)

---------------------- --------- -------- --------- ---------- ------------ ---------

Operating profit 17,003 5,650 22,653 16,276 46,650 62,926

Finance costs

Interest payable (2,386) - (2,386) (2,322) - (2,322)

---------------------- --------- -------- --------- ---------- ------------ ---------

Profit before

taxation 14,617 5,650 20,267 13,954 46,650 60,604

Taxation (578) - (578) (521) - (521)

Profit for period 14,039 5,650 19,689 13,433 46,650 60,083

---------------------- --------- -------- --------- ---------- ------------ ---------

Return per ordinary

share (pence) 11.88 4.78 16.66 11.37 39.49 50.86

---------------------- --------- -------- --------- ---------- ------------ ---------

Diluted return

per ordinary

share (pence) 11.88 4.78 16.66 11.37 39.49 50.86

---------------------- --------- -------- --------- ---------- ------------ ---------

Statement of comprehensive income

for the six months ended 30 June (unaudited)

30 June 2018 30 June 2017

-------------------------------------------- ----------------------------------------------

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ -------------- ------------- ------------- ---------------- ------------- -------------

Profit for the

period 14,039 5,650 19,689 13,433 46,650 60,083

Foreign exchange

on translation

of foreign operations - 136 136 - (119) (119)

------------------------ -------------- ------------- ------------- ---------------- ------------- -------------

Total comprehensive

income for the

period 14,039 5,786 19,825 13,433 46,531 59,964

------------------------ -------------- ------------- ------------- ---------------- ------------- -------------

Group statement of financial position

30 June 30 June 31 December

2018 2017 2017

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Assets

Non current assets

Goodwill 1,932 1,941 1,920

Property, plant and equipment 99 136 129

Other intangible assets 154 145 161

Investments held at fair

value through profit or

loss 771,982 735,791 735,872

Retirement benefit asset 754 - 300

Deferred tax assets 639 1,076 614

---------------------------------- ------------- ------------- ------------

Total non current assets 775,560 739,089 738,996

---------------------------------- ------------- ------------- ------------

Current assets

Trade and other receivables 5,335 6,910 6,417

Other accrued income and

prepaid expenses 6,892 6,068 5,003

Derivative financial instruments - 1,017 -

Cash and cash equivalents 105,247 94,462 134,011

---------------------------------- ------------- ------------- ------------

Total current assets 117,474 108,457 145,431

---------------------------------- ------------- ------------- ------------

Total assets 893,034 847,546 884,427

---------------------------------- ------------- ------------- ------------

Liabilities

Current liabilities

Trade and other payables 11,629 11,534 11,649

Corporation tax payable 456 23 -

Other taxation including

social security 800 597 570

Deferred income 3,978 3,871 3,942

Derivative financial instruments 3,021 - 299

---------------------------------- ------------- ------------- ------------

Total current liabilities 19,884 16,025 16,460

---------------------------------- ------------- ------------- ------------

Non current liabilities

and deferred income

Long term borrowings 114,090 114,046 114,068

Retirement benefit obligations - 1,863 -

Deferred income 3,811 4,199 3,974

Provision for onerous contracts 1,128 2,551 1,667

---------------------------------- ------------- ------------- ------------

Total non current liabilities 119,029 122,659 119,709

---------------------------------- ------------- ------------- ------------

Total net assets 754,121 708,862 748,258

---------------------------------- ------------- ------------- ------------

Equity

Called up share capital 5,918 5,918 5,918

Share premium 8,790 8,753 8,787

Own shares (1,056) (1,034) (1,033)

Capital redemption 8 8 8

Translation reserve 1,797 2,037 1,661

Capital reserves 693,994 655,727 688,344

Retained earnings 44,670 37,453 44,573

Total equity 754,121 708,862 748,258

---------------------------------- ------------- ------------- ------------

Group statement of cash flows

31 December

30 June 30 June 2017

2018 (unaudited) 2017 (unaudited) (audited)

GBP000 GBP000 GBP000

--------------------------------- ------------------ ------------------ --------------

Operating activities

Operating profit before

interest payable and taxation 22,653 62,926 111,037

(Gains) on investments (5,650) (46,650) (79,267)

(Profit) on sale of unlisted

investment - - (3,275)

Foreign exchange (gains) (12) (11) (13)

Depreciation of property,

plant and equipment 51 49 101

Amortisation of intangible

assets 41 21 61

(Increase) in receivables (807) (1,695) (137)

Increase/(decrease) in payables 105 (1,659) (2,000)

Transfer from capital reserves (114) (40) (142)

Normal pension contributions

in excess of cost (454) (437) (800)

--------------------------------- ------------------ ------------------ --------------

Cash generated from operating

activities 15,813 12,504 25,565

--------------------------------- ------------------ ------------------ --------------

Taxation (147) (262) (1,035)

Operating cash flow 15,666 12,242 24,530

--------------------------------- ------------------ ------------------ --------------

Investing activities

Acquisition of property,

plant and equipment (21) (27) (74)

Expenditure on intangible

assets (34) (96) (149)

Purchase of investments (66,829) (38,385) (80,356)

Sale of investments 36,529 45,442 120,089

Sale of unlisted investment - - 3,318

Cash flow from investing

activities (30,355) 6,934 42,828

--------------------------------- ------------------ ------------------ --------------

Financing activities

Derivative financial instrument 1,812 (1,148) 1,698

Interest paid (2,925) (2,888) (5,916)

Dividends paid (13,942) (13,582) (20,081)

Proceeds of increase in

share capital 3 32 66

Purchase of own shares (23) 163 164

--------------------------------- ------------------ ------------------ --------------

Net cash flow from financing

activities (15,075) (17,423) (24,069)

--------------------------------- ------------------ ------------------ --------------

Net (decrease)/increase

in cash and cash equivalents (29,764) 1,753 43,289

--------------------------------- ------------------ ------------------ --------------

Cash and cash equivalents

at beginning of period 134,011 94,804 94,804

Foreign exchange gains/(losses)

on cash and cash equivalents 1,000 (2,095) (4,082)

--------------------------------- ------------------ ------------------ --------------

Cash and cash equivalents

at end of period 105,247 94,462 134,011

--------------------------------- ------------------ ------------------ --------------

Cash and cash equivalents

comprise

Cash and cash equivalents 105,247 94,462 134,011

Group statement of changes in equity

Share Share Own Capital Translation Capital Retained

capital premium shares redemption reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ------------ --------- ------------ ------------ ------------ ---------- ---------- ----------

Balance

at 1 January

2018 5,918 8,787 1,033) 8 1,661 688,344 44,573 748,258

--------------- ------------ --------- ------------ ------------ ------------ ---------- ---------- ----------

Profit - - - - - 5,650 14,039 19,689

Foreign

exchange - - - - 136 - - 136

--------------- ------------ --------- ------------ ------------ ------------ ---------- ---------- ----------

Total

comprehensive

income for

the period - - - - 136 5,650 14,039 19,825

Issue of

shares - 3 - - - - - 3

Movement

in own shares - - (23) - - - - (23)

Dividend

relating

to 2017 - - - - - - (13,942) (13,942)

Total equity

at 30 June

2018 5,918 8,790 (1,056) 8 1,797 693,994 44,670 754,121

--------------- ------------ --------- ------------ ------------ ------------ ---------- ---------- ----------

Group segmental analysis

Independent professional

Investment trust services Group charges Total

------------------------------------------ ------------------------------------- --------------------------------- -------------------------------------

30 30 31 30 30 31 30 30 31

June June Dec June June Dec June June Dec 30 June 30 June 31 Dec

2018 2017 2017 2018 2017 2017 2018 2017 2017 2018 2017 2017

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

Revenue

Segment income 13,628 13,465 21,463 16,012 14,669 31,021 - - - 29,640 28,134 52,484

Net gain

on investments - - - - - 3,275 - - - - - 3,275

Other income 67 63 95 2 157 249 - - - 69 220 344

Cost of sales - - - (1,548) (1,838) (3,875) - - - (1,548) (1,838) (3,875)

Administration

costs (1,665) (1,661) (3,274) (9,658) (8,626) (17,658) - - - (11,323) (10,287) (20,842)

Release onerous

contracts - - - - - - - - 245 - - 245

----------------

12,030 11,867 18,284 4,808 4,362 13,102 - - 245 16,838 16,229 31,631

Interest

(net) (2,249) (2,280) (4,561) 28 5 (85) - - - (2,221) (2,275) (4,646)

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

Return,

including

profit on

ordinary

activities

before

taxation 9,781 9,587 13,723 4,836 4,367 13,017 - - 245 14,617 13,954 26,985

Taxation - - - (578) (521) (1,287) - - (104) (578) (521) (1,391)

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

Return,

including

profit

attributable

to

shareholders 9,781 9,587 13,723 4,258 3,846 11,730 - - 141 14,039 13,433 25,594

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

Revenue

return

per ordinary

share (pence) 8.28 8.11 11.61 3.60 3.26 9.93 - - 0.12 11.88 11.37 21.66

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

Assets 821,211 784,123 816,595 71,596 63,070 67,613 227 353 227 893,034 847,546 884,435

Liabilities (93,876) (96,025) (90,152) (43,909) (40,108) (44,358) (1,128) (2,551) (1,667) (138,913) (138,684) (136,177)

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

Total net

assets 727,335 688,098 726,443 27,687 22,962 23,255 (901) (2,198) (1,440) 754,121 708,862 748,258

---------------- ------------- ---------- --------------- ---------- ---------- ------------- -------- -------- ------------- ----------- ----------- -----------

The capital element of the income statement is wholly

attributable to the investment trust.

Analysis of the investment portfolio

By geographical location

Valuation Valuation

31 December Costs Sales Appreciation 30 June

2017 Purchases of proceeds /(depreciation) 2018

GBP000 GBP000 acquisition GBP000 GBP000 GBP000 %

GBP000

United

Kingdom 532,923 47,621 (213) (27,051) 11,023 564,303 73.1

North America 68,796 - - (698) (1,009) 67,089 8.7

Europe 61,119 19,208 (30) (6,136) (3,010) 71,151 9.2

Japan 15,484 - - - (95) 15,389 2.0

Other Pacific 39,618 - - (2,644) (73) 36,901 4.8

Other 17,932 - - - (783) 17,149 2.2

--------------- ------------- ------------ ------------------ ----------- ----------------- ---------- --------

735,872 66,829 (243) (36,529) 6,053 771,982 100.0

--------------- ------------- ------------ ------------------ ----------- ----------------- ---------- --------

By sector (excluding

cash)

As at As at

30 June 31 December

2018 2017

% %

Oil & gas 11.0 9.4

Basic materials 6.9 7.1

Industrials 25.5 28.2

Consumer goods 3.8 5.9

Health care 8.2 7.5

Consumer services 8.3 8.5

Telecommunications 1.4 1.2

Utilities 3.3 1.5

Financials 28.6 28.8

Technology 3.0 1.9

100.0 100.0

---------------------- -------------------------- -------------

Investment portfolio valuation

as at 30 June 2018

UK unless otherwise stated.

Holdings in italics were acquired since

31 December 2017

GBP000 %

--------- -------

Oil & gas

Oil & gas producers

Royal Dutch Shell 33,919 4.39

BP 18,506 2.40

Indus Gas 5,697 0.74

Tullow Oil 4,898 0.63

Gibson Energy (Can) 4,662 0.60

Total (Fra) 2,503 0.32

Premier Oil 1,606 0.21

Providence Resources 366 0.05

----------------------------- --------- -------

72,157 9.34

----------------------------- --------- -------

Oil equipment & services

& distribution

Ceres Power 5,160 0.67

Schlumberger (USA) 4,062 0.53

Velocys 1,931 0.25

National Oilwell Varco

(USA) 1,643 0.21

Now (USA) 126 0.02

12,922 1.68

----------------------------- --------- -------

Total oil & gas 85,079 11.02

----------------------------- --------- -------

Basic materials

Chemicals

Croda 8,114 1.05

Elementis 5,353 0.69

Koninklijke DSM (Net) 2,086 0.27

Linde (Ger) 1,811 0.23

Brenntag (Ger) 1,446 0.19

Carclo 1,001 0.13

19,811 2.56

----------------------------- --------- -------

Forestry & paper

Mondi 8,196 1.06

8,196 1.06

----------------------------- --------- -------

Mining

Rio Tinto 15,752 2.04

BHP Billiton 9,381 1.22

25,133 3.26

----------------------------- --------- -------

Total basic materials 53,140 6.88

----------------------------- --------- -------

Industrials

Construction & materials

Marshalls 7,772 1.01

Ibstock 5,808 0.75

Balfour Beatty 5,713 0.74

Accsys Technologies 5,535 0.72

Geberit (Swi) 2,197 0.28

Assa Abloy (Swe) 1,837 0.24

28,862 3.74

----------------------------- --------- -------

Aerospace & defence

Senior 17,431 2.26

Rolls Royce 16,305 2.11

BAE Systems 11,642 1.51

Embraer (Bra) 6,474 0.84

Meggitt 4,933 0.64

56,785 7.36

----------------------------- --------- -------

General industrials

Smith (DS) 11,527 1.49

11,527 1.49

----------------------------- --------- -------

Electronic & electrical equipment

Spectris 11,088 1.44

Morgan Advanced Materials 9,786 1.27

TT Electronics 3,516 0.46

Legrand (Fra) 1,996 0.26

26,386 3.43

----------------------------- --------- -------

Industrial engineering

Hill & Smith 8,652 1.12

Caterpillar (USA) 7,193 0.93

Cummins (USA) 6,044 0.78

IMI 4,948 0.64

Deere (USA) 4,134 0.54

Weir Group 4,000 0.52

Renold 1,757 0.23

Severfield 715 0.09

37,443 4.85

----------------------------- --------- -------

Industrial transportation

Eddie Stobart Logistics 5,250 0.68

Deutsche Post (Ger) 3,012 0.39

AP Moller-Maersk (Den) 1,329 0.17

Wincanton 1,211 0.16

10,802 1.40

----------------------------- --------- -------

Support services

Johnson Service 12,410 1.61

Babcock 8,145 1.06

SGS (Swi) 2,519 0.33

Interserve 1,689 0.22

Augean 377 0.05

25,140 3.27

----------------------------- --------- -------

Total industrials 196,645 25.54

----------------------------- --------- -------

Consumer goods

Automobiles & parts

Toyota Motor (Jap) 8,039 1.04

General Motors (USA) 6,714 0.87

14,753 1.91

----------------------------- --------- -------

Beverages

Pernod-Ricard (Fra) 2,321 0.30

2,321 0.30

----------------------------- --------- -------

Food producers

Nestlé (Swi) 2,584 0.33

2,584 0.33

----------------------------- --------- -------

Household goods & home construction

Watkin Jones 7,088 0.92

7,088 0.92

----------------------------- --------- -------

Personal goods

L'Oreal (Fra) 2,476 0.32

2,476 0.32

----------------------------- --------- -------

Total consumer goods 29,222 3.78

----------------------------- --------- -------

Health care

Health care equipment & services

Becton Dickinson (USA) 9,072 1.18

Smith & Nephew 6,571 0.85

Spire Healthcare 5,004 0.65

Fresenius (Ger) 2,770 0.36

Philips Electronics (Net) 2,346 0.30

Fresenius Medical Care

(Ger) 2,247 0.29

28,010 3.63

----------------------------- --------- -------

Pharmaceuticals & biotechnology

GlaxoSmithKline 16,063 2.08

AstraZeneca 5,253 0.68

Pfizer (USA) 4,122 0.53

Johnson & Johnson (USA) 3,217 0.42

Novartis (Swi) 2,728 0.35

Novo-Nordisk (Den) 2,347 0.30

Roche (Swi) 1,581 0.20

35,311 4.56

----------------------------- --------- -------

Total health care 63,321 8.19

----------------------------- --------- -------

Consumer services

General retailers

Dunelm 3,282 0.43

Findel 2,542 0.33

Inditex (Spa) 1,252 0.16

Topps Tiles 401 0.05

7,477 0.97

----------------------------- --------- -------

Media

Relx 12,169 1.58

Sky 8,038 1.04

Daily Mail & General Trust 3,814 0.49

Mirriad Advertising 660 0.09

24,681 3.20

----------------------------- --------- -------

Travel & leisure

International Consolidated

Airlines 7,468 0.97

Irish Continental (Ire) 5,423 0.70

Greene King 4,889 0.63

Fastjet 4,374 0.57

Carnival 4,347 0.56

Marstons 2,168 0.28

Ryanair (Ire) 2,097 0.27

Paddy Power Betfair 830 0.11

31,596 4.09

----------------------------- --------- -------

Total consumer services 63,754 8.26

----------------------------- --------- -------

Telecommunications

Mobile telecommunications

Vodafone 6,433 0.83

Deutsche Telekom (Ger) 2,114 0.27

Inmarsat 1,994 0.26

Total telecommunications 10,541 1.36

----------------------------- --------- -------

Utilities

Electricity

SSE 4,063 0.53

Simec Atlantis Energy 1,886 0.24

5,949 0.77

----------------------------- --------- -------

Gas, water & multiutilities

National Grid 10,976 1.42

Severn Trent 8,908 1.15

19,884 2.57

----------------------------- --------- -------

Total utilities 25,833 3.34

----------------------------- --------- -------

Financials

Banks

HSBC 18,738 2.43

Standard Chartered 8,905 1.15

ING Group (Net) 1,535 0.20

UBS (Swi) 1,374 0.18

Permanent TSB (Ire) 7 -

30,559 3.96

----------------------------- --------- -------

Nonlife insurance

Hiscox 11,293 1.46

RSA Insurance 9,506 1.23

Direct Line Insurance 4,286 0.56

Muenchener Rueckver (Ger) 2,000 0.26

Allianz (Ger) 1,435 0.19

28,520 3.70

----------------------------- --------- -------

Life insurance/assurance

Prudential 12,731 1.65

Aviva 3,955 0.51

Chesnara 3,754 0.49

20,440 2.65

----------------------------- --------- -------

Real estate investments & services

St Modwen Properties 7,777 1.01

7,777 1.01

----------------------------- --------- -------

Real estate investment

trusts

Land Securities 9,077 1.18

Urban Logistics REIT 8,126 1.05

Mucklow (A&J) Group 4,125 0.53

Hammerson 2,610 0.34

23,938 3.10

----------------------------- --------- -------

Financial services

IP Group 7,555 0.98

Provident Financial 6,196 0.80

Allied Minds 4,200 0.54

Oxford Sciences Innovation

(unlisted) 3,700 0.48

International Personal

Finance 3,465 0.45

Standard Life Aberdeen 2,442 0.32

Amundi (Fra) 2,369 0.31

Deutsche Börse (Ger) 2,194 0.28

32,121 4.16

----------------------------- --------- -------

Equity and collective investment

instruments

Stewart Investors Asia

Pacific 16,477 2.13

Baillie Gifford Pacific 13,129 1.70

Herald Investment Trust 11,348 1.47

Templeton Emerging Markets

Investment Trust 10,675 1.38

Schroder Japan Growth Fund

(Jap) 7,350 0.95

Scottish Oriental Smaller

Company Trust 7,295 0.95

John Laing Infrastructure

Fund 3,546 0.46

Foresight Solar 3,255 0.42

Syncona 2,889 0.37

Better Capital (2012) 1,300 0.17

77,264 10.00

----------------------------- --------- -------

Total financials 220,619 28.58

----------------------------- --------- -------

Technology

Software & computer services

Microsoft (USA) 11,203 1.45

SAP (Ger) 2,764 0.36

Amadeus IT (Spa) 2,364 0.31

16,331 2.12

----------------------------- --------- -------

Technology hardware & equipment

Applied Materials (USA) 4,897 0.63

ASML (Net) 2,087 0.27

----------------------------- --------- -------

6,984 0.90

----------------------------- --------- -------

Total technology 23,315 3.02

----------------------------- --------- -------

Other

----------------------------- --------- -------

Other 213 0.03

----------------------------- --------- -------

Total other 213 0.03

----------------------------- --------- -------

Total investments 771,982 100.00

----------------------------- --------- -------

Principal risks and uncertainties

The principal risks of the Corporation relate to the investment

activities and include market price risk, foreign currency risk,

liquidity risk, interest rate risk and credit risk. These are

explained in the notes to the annual accounts for the year ended 31

December 2017. In the view of the board these risks are as

applicable to the remaining six months of the financial year as

they were to the period under review.

The principal risks of the independent professional services

business arise during the course of defaults, potential defaults

and restructurings where we have been appointed to provide

services. To mitigate these risks we work closely with our legal

advisers and, where appropriate, financial advisers, both in the

set up phase to ensure that we have as many protections as

practicable, and at all other stages whether or not there is a

danger of default.

Related party transactions

There have been no related party transactions during the period

which have materially affected the financial position or

performance of the group. During the period transactions between

the Corporation and its subsidiaries have been eliminated on

consolidation. Details of related party transactions are given in

the notes to the annual accounts.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and gives a true and fair view of the assets, liabilities,

financial position and profit of the group as required by DTR

4.2.4R;

-- the half yearly report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period.

On behalf of the board

Robert Hingley

Chairman

25 July 2018

Basis of preparation

The results for the period have been prepared in accordance with

International Financial Reporting Standards (IAS 34 - Interim

financial reporting).

The financial resources available are expected to meet the needs

of the group for the

foreseeable future. The financial statements have therefore been

prepared on a going concern basis.

The group's accounting policies during the period are the same

as in its 2017 annual financial statements, except for those that

relate to new standards effective for the first time for periods

beginning on (or after) 1 January 2018, and will be adopted in the

2018 annual financial statements. New standards impacting the group

that will be adopted in the annual financial statements for the

year ended 31 December 2018 are IFRS 9 Financial Instruments and

IFRS 15 Revenue from Contracts with Customers.

Details of the impacts are as follows:

-- IFRS 9 Financial Instruments has replaced IAS 39 Financial

Instruments: Recognition and Measurement and has not materially

impacted the results. The replacement of the 'incurred loss' model

with a forward looking 'expected credit loss' model has resulted in

an increase in the impairment provision of GBP49,000. There are no

changes to the classification of financial assets and no impact to

the fair value of long term borrowings. The group has elected to

continue to apply the hedge accounting requirements of IAS 39.

-- IFRS 15 Revenue from Contracts with Customers has had no

impact on the financial results. Revenue is measured based on the

consideration specified in a contract with a customer and is

recognised by the group when it transfers control over a service to

a customer. Each of the revenue streams generated by the IPS

businesses has been assessed and no amendment to the current

revenue recognition policy is required.

Notes

1. The financial information presented herein does not amount to

full statutory accounts within the meaning of Section 435 of the

Companies Act 2006 and has neither been audited nor reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual report and financial statements for 2017 have been filed

with the Registrar of Companies. The independent auditors' report

on the annual report and financial statements for 2017 was

unqualified, did not include a reference to any matters to which

the auditor drew attention by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

2. The calculations of NAV and earnings per share are based on:

NAV: shares at end of the period 118,162,191 (30 June 2017:

118,152,259; 31 December 2017: 118,160,055).

Income: average shares during the period 118,160,332 (30 June

2017: 118,134,437; 31 December 2017: 118,136,983).

3. Listed investments are all traded on active markets and as

defined by IFRS 7 are level 1 financial instruments. As such they

are valued at unadjusted quoted bid prices. Unlisted investments

are Level 3 financial instruments. They are valued by the directors

using unobservable inputs including underlying net assets of the

instruments.

Registered office

Fifth Floor

100 Wood Street

London EC2V 7EX

Telephone: 020 7606 5451

Facsimile: 020 7606 0643

(Registered in England No - 30397)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFERDTIEFIT

(END) Dow Jones Newswires

July 26, 2018 02:00 ET (06:00 GMT)

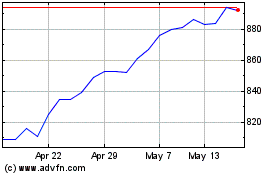

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

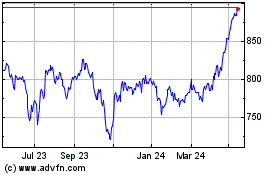

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024