Interim Management Statement (5175D)

May 17 2012 - 2:00AM

UK Regulatory

TIDMLSL

RNS Number : 5175D

LSL Property Services

17 May 2012

For Immediate Release 17 May 2012

LSL Property Services plc

("LSL" or "the Group")

Interim Management Statement

LSL, a leading provider of residential property services,

incorporating Estate Agency and Related Services and Surveying and

Valuation Services businesses, issues this Interim Management

Statement for the period from 1 January 2012 to 16 May 2012.

The housing market has remained subdued in the period with Total

Mortgage Approvals for the first quarter flat compared to the first

quarter of 2011(1) and the year on year growth trend for both Total

Mortgage Approvals and House Purchase approvals has declined over

each of the last three months. Market data is not yet available for

April.

Against this backdrop the Group has traded in line with the

Board's expectations during the period. Turnover for the 3 months

ended 31 March 2012 compared with the same period in 2011 and also

for the 4 months ended 30 April 2012 is set out below both in total

and on a like-for-like basis (excluding Marsh & Parsons):

Total Total LFL LFL

----------------

3 mths to 31 4 mths to 3 mths to 4 mths to

Mar 30 Apr 31 Mar 30 Apr

----------------

Group +22% +20% +9% +8%

Estate Agency +40% +37% +19% +17%

Surveying -7% -8% -7% -8%

--------------- ---------------- ----------- ---------- ----------

Following strong trading in March, which was helped by changes

to stamp duty, activity levels for April were disappointing.

Transaction run rates for the two weeks from 1 May to 16 May have

returned to being in line with expectations.

Estate Agency and Related Services:

Estate Agency has traded well and in particular there has been

strong like-for-like year on year growth in lettings and financial

services of 23% and 24% respectively. Residential sales income has

been restricted by low instruction volumes and stock levels,

including the London market. Marsh & Parsons has performed in

line with expectations and opened a new branch in Earls Court in

April, which has made a good start. Asset Management increased

revenue by 9% in the first quarter in a market where repossessions

were flat year on year.

Surveying and Valuation Services:

Surveying performance has been satisfactory given both continued

low levels of mortgage activity, including a 12% reduction in

remortgage volumes compared to the first quarter of 2011 and

further reductions in market share among some of our key lender

clients. There has been continued growth of private survey services

income.

Outlook:

While there has been some improvement in consumer confidence

this has been more than offset by a further reduction in the

availability of mortgage credit driven by tighter prudential

regulation, decline in supply of wholesale funding and tighter

product regulation. Overall LSL retains a cautious view of the

market for 2012 particularly given the recent deterioration in

prospects for the Eurozone which may cause the banks to restrict

mortgage supply further.

However, the Board is confident of delivering further progress

in 2012, through its major organic growth initiatives, including

lettings and the contribution from new income streams in both

Estate Agency and Related Services and Surveying and Valuation

Services. The Group remains well placed to increase shareholder

value and will continue to pursue value accretive acquisitions

using its strong balance sheet.

(1) Source: Bank of England

For further information, please contact:

Simon Embley, Group Chief Executive Officer

Steve Cooke, Group Finance Director

LSL Property Services plc 0203 215 1015

Richard Darby, Nicola Cronk, Louise Hadcocks

Buchanan 0207 466 5000

Notes to Editors:

LSL Property Services plc is a leading provider of residential

property to its two key customer groups. Services to consumers

include: residential sales, lettings, surveying and advice on

mortgages and non investment insurance products. Services to

mortgage lenders include: valuations and panel management services,

asset management and property management services. For further

information, please visit our website: www.lslps.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSGGUAWAUPPGQQ

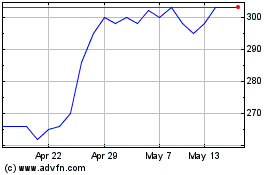

Lsl Property Services (LSE:LSL)

Historical Stock Chart

From Jun 2024 to Jul 2024

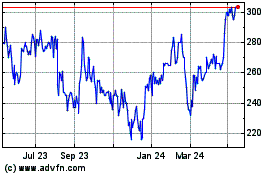

Lsl Property Services (LSE:LSL)

Historical Stock Chart

From Jul 2023 to Jul 2024