TIDMLOOP

RNS Number : 4373B

LoopUp Group PLC

30 September 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM THE

UNITED STATES, CANADA, THE REPUBLIC OF SOUTH AFRICA, AUSTRALIA OR

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION,

DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL.

30 September 2022

LoopUp Group plc

("LoopUp", the "Group" or the "Company")

Results of Broker Offer

Further to the announcement made on 29 September 2022 by the

Company in connection with the placing and subscription to raise

GBP3.5 million (before expenses), LoopUp Group plc (AIM: LOOP), the

cloud platform for premium hybrid communications, announces that

the Broker Offer undertaken through Turner Pope Investments (TPI)

Limited ("TPI") has now closed. TPI received, and the Company has

accepted, applications for 520,000 Broker Offer Shares

(representing an additional GBP26,000raised before expenses).

The Broker Offer was undertaken to provide shareholders and

other investors who did not initially participate in the Placing

the opportunity to invest in the Company, following the closing of

the accelerated bookbuild.

Application will be made to the London Stock Exchange for

admission of the Broker Offer Shares to trading on AIM with

admission expected to take place at 8.00 a.m. on 18 October 2022,

subject to the passing of the Resolutions at the General Meeting to

be held on 17 October 2022.

The Broker Offer Shares will, when issued, be credited as fully

paid and rank pari passu with the existing Ordinary Shares.

Capitalised terms used in this announcement shall, unless

otherwise defined, have the same meanings as set out in the

Company's announcement of 28 September 2022.

The person responsible for arranging the release of this

announcement on behalf of the Company is Steve Flavell, Co-Chief

Executive of the Company.

Enquiries:

For further information, please contact:

LoopUp Group plc via FTI

Steve Flavell, co-CEO

Panmure Gordon (UK) Limited (Nominated Adviser +44 (0) 20 7886

& Joint Broker) 2500

Dominic Morley / Alina Vaskina (Corporate

Finance)

Erik Anderson (Corporate Broking)

+44 (0) 20 7397

Cenkos Securities Limited (Joint Broker) 8900

Giles Balleny / Dan Hodkinson (Corporate Finance)

Dale Bellis / Alex Pollen (Sales)

Turner Pope Investments (Joint Broker to

the transaction) +44 (0) 20 3657

James Pope / Andy Thacker 0050

+44 (0) 20 3727

FTI Consulting, LLP (Public Relations Adviser) 1000

Matt Dixon / Jamille Smith / Tom Blundell

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018

("MAR").

IMPORTANT NOTICES

THE PLACING SHARES AND THE BROKER OFFER SHARE HAVE NOT BEEN AND

WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF

1933, AS AMENDED (THE "SECURITIES ACT") OR WITH ANY SECURITIES

REGULATORY AUTHORITY OF ANY STATE OR JURISDICTION OF THE UNITED

STATES, AND MAY NOT BE OFFERED, SOLD OR TRANSFERRED, DIRECTLY OR

INDIRECTLY, IN THE UNITED STATES EXCEPT PURSUANT TO AN EXEMPTION

FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION

REQUIREMENTS OF THE SECURITIES ACT AND IN COMPLIANCE WITH ANY

APPLICABLE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION OF

THE UNITED STATES. THE PLACING SHARES AND BROKER OFFER SHARES ARE

BEING OFFERED AND SOLD ONLY OUTSIDE OF THE UNITED STATES IN

"OFFSHORE TRANSACTIONS" WITHIN THE MEANING OF, AND IN ACCORDANCE

WITH, REGULATION S UNDER THE SECURITIES ACT AND OTHERWISE IN

ACCORDANCE WITH APPLICABLE LAWS. NO PUBLIC OFFERING OF THE PLACING

SHARES OR BROKER OFFER SHARES IS BEING MADE IN THE UNITED STATES OR

ELSEWHERE.

The Placing Shares and Broker Offer Shares have not been

approved or disapproved by the US Securities and Exchange

Commission, any state securities commission or other regulatory

authority in the United States, nor have any of the foregoing

authorities passed upon or endorsed the merits of the Placing or

the accuracy or adequacy of this announcement. Any representation

to the contrary is a criminal offence in the United States. The

relevant clearances have not been, nor will they be, obtained from

the securities commission of any province or territory of Canada,

no prospectus has been lodged with, or registered by, the

Australian Securities and Investments Commission or the Japanese

Ministry of Finance; the relevant clearances have not been, and

will not be, obtained from the South Africa Reserve Bank or any

other applicable body in the Republic of South Africa in relation

to the Placing Shares and the Placing Shares have not been, nor

will they be, registered under or offered in compliance with the

securities laws of any state, province or territory of Australia,

Canada, the Republic of South Africa or Japan. Accordingly, the

Placing Shares may not (unless an exemption under the relevant

securities laws is applicable) be offered, sold, resold or

delivered, directly or indirectly, in or into Australia, Canada,

the Republic of South Africa or Japan or any other jurisdiction

outside the United Kingdom.

Each of the Joint Bookrunners is authorised and regulated by the

Financial Conduct Authority in the United Kingdom and is acting

exclusively for the Company and no one else in connection with the

Bookbuilding Process and the Placing, and neither of the Joint

Bookrunners will be responsible to anyone (including any Placees)

other than the Company for providing the protections afforded to

its clients or for providing advice in relation to the Bookbuilding

Process or the Placing or any other matters referred to in this

Announcement.

TPI is authorised and regulated by the Financial Conduct

Authority in the United Kingdom and is acting exclusively for the

Company and no one else in connection with the Broker Option, and

TPI will not be responsible to anyone (including any participants

in the Broker Offer) other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Broker Offer or any other matters referred to in

this Announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKNEDSFAEFA

(END) Dow Jones Newswires

September 30, 2022 12:55 ET (16:55 GMT)

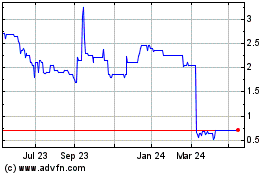

Loopup (LSE:LOOP)

Historical Stock Chart

From Nov 2024 to Dec 2024

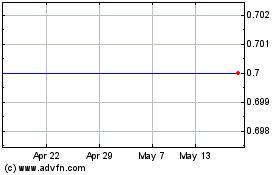

Loopup (LSE:LOOP)

Historical Stock Chart

From Dec 2023 to Dec 2024