Update regarding BCM

October 31 2008 - 9:13AM

UK Regulatory

RNS Number : 1723H

LIT PLC

31 October 2008

LIT plc

LIT plc ("LIT") announces that on 29 October 2008 it received a letter from the directors of Babcock & Brown Capital Limited ("BCM") in

reply to the non-binding indicative proposal that LIT made on 27 October 2008(which is subject to certain terms and conditions and may or

may not lead to an offer) for the acquisition of BCM by LIT (the "Proposal"). According to the letter, the directors of BCM currently do not

intend to provide due diligence access on the basis of the Proposal. LIT is now assessing its options in this regard and intends to seek an

ongoing dialogue with BCM.

The market capitalisation of BCM was A$338 million as of 31 October 2008 and in the Proposal it was contemplated that LIT may consider

making an offer (subject to certain terms and conditions and which may or may not lead to an offer) to acquire BCM for a combination of LIT

shares and cash dividend, returning to BCM shareholders a substantial amount of the existing BCM parent company excess balance sheet cash

which was AU$ 344 million as of 30 June 2008.

If a transaction was implemented successfully, LIT would add eircom and Golden Pages to its existing portfolio companies, TDG Ltd. and

the Laxey Investment Trust.

Further information on BCM, sourced from the BCM 2008 annual report, is set out below.

BCM listed on the Australian Securities Exchange in February 2005 as an Australian-based investment company that would focus on a

concentrated portfolio with a flexible investment horizon. At 30 June 2008, BCM had A$448 million invested in eircom Group plc ("eircom"),

Ireland's incumbent telecommunications provider, A$107 million invested in Golden Pages, the leading Israeli directories business and

approximately A$367 million in available cash resources.

BCM holds a 57.1% interest in eircom representing an investment of approximately A$448 million. Associates of Babcock & Brown hold an

additional 7.9% and existing and former employees hold the remaining 35% through their share ownership trust, the ESOT. eircom owns

Ireland's copper and fibre backbone telecommunications network. It is the largest provider of fixed line wholesale and retail

telecommunication services in Ireland and has 69% of the fast growing retail DSL broadband market. eircom's mobile business has a growing

19% share of the mobile market.

BCM acquired 100% of Golden Pages in July 2007. Golden Pages is the leading Israeli directories business with a portfolio of

complementary directory and internet search businesses operating across four distribution platforms. Golden Pages was acquired for an

enterprise value of A$248 million, requiring an equity investment of A$150 million. Following a refinance in February 2008 the equity

investment at 30 June 2008 was A$107 million.

As at 30 June 2008 BCM held A$367 million in available cash reserves. Since 30 June 2008, BCM remitted approximately A$38 million to

Golden Pages that will be used to repay existing debt facilities.

BCM reported a consolidated profit (net profit after tax) of A$101.2 million at 30 June 2008. Consolidated EBITDA for the same period

was A$1,281.7 million (pre goodwill impairment provision on Golden Pages of A$4.3 million).

LIT plc 01624 690 900

Alex Paiusco, Chief Executive

Mike Haxby, Chief Financial and Risk Officer

KBC Peel Hunt Ltd, Nominated Adviser and Broker 020 7418 8900

Guy Wiehahn or Oliver Stratton

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMGMFGFMGGRZM

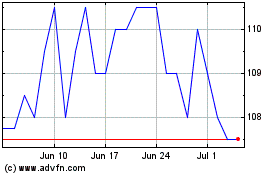

Litigation Capital Manag... (LSE:LIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

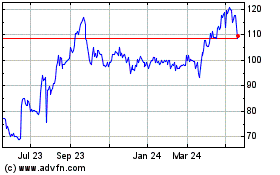

Litigation Capital Manag... (LSE:LIT)

Historical Stock Chart

From Jul 2023 to Jul 2024