RNS Number:3124Y

London Finance & Investment Grp.PLC

5 February 2001

London Finance & Investment Group P.L.C.

Directors Registered office

D.C. Marshall, Chairman

25 City Road

R.A. Good

London, EC1Y 1BQ

Dr. F.W.A.A. Lucas

J.M. Robotham, OBE, FCA, MSI

5th February 2001

TO THE MEMBERS

The directors are pleased to present the unaudited interim results of the

company for the six months ended 31st December 2000.

Results

Our profit on ordinary activities attributable to shareholders for the six

months was #883,000 compared to #228,000 for the same period in 1999 and

earnings per share were 3.46p (1999 - 0.89p), an increase of 289%

The increase in dividends received is mainly due to a dividend of #64,000 from

our investment in Creston plc. The increase in contribution from management

services results mainly from one off tasks undertaken on behalf of overseas

clients. The contribution to profits by our associated company, Western

Selection P.L.C., for its half year to 31st December 2000 was #715,000 (1999 -

#80,000). This substantial increase occurred as a result of exceptional

profits realised on the sale of part of Western's strategic investment in The

Sanctuary Group PLC and the receipt of an exceptional dividend from its

strategic investment in Creston plc.

As is our practice, we are not paying an interim dividend; the dividend paid

in October was for the 12 months ended on 30th June 2000. At 31st December

2000 our net asset value per share was 61.1p, an increase of 22% from 30th

June 2000 and 9% from 31st December 1999. This compares favourably with falls

in both the FTSE 100, which was down 1.43% over the last six months and 10.21%

over the year, and the FTSE All Share, which fell 1.52% in the last six months

and 6.85% in over the year. The increase in net asset value is mainly due to a

significant increase in the market value of our strategic investment in

Marylebone Warwick Balfour Group Plc, which is held as a long term fixed

asset.

If we value our investment in Western at net asset value, rather than market

value, our net assets per share at 31st December 2000 were 76p compared to 60p

at 30th June 2000.

Investment policy and management

Our investment policy is to have strategic stakes in a few special situations,

and hold a diversified general portfolio of U.K. and European listed equities.

Strategic investments are minority positions where we seek to exercise

influence over the management of the investment. We are represented on the

boards of our strategic investments and, in turn, Western is also represented

on the boards of its two strategic investments, Creston plc and The Sanctuary

Group PLC.

Our general portfolio is managed by two of our non-executive directors,

Richard Good and Michael Robotham. Decisions in relation to both our strategic

and unlisted investments are taken by the board as a whole.

Strategic Investments

Marylebone Warwick Balfour Group Plc's strategy is the creation of a series of

highly cash generative businesses, each of which has property at its core.

Operations are split into 6 areas:

MWB Business Exchange, which provides 755,000 square feet of serviced offices

in 29 centres,

Hotels, most of which have 20-year management agreements with recognised

operators,

Retail Stores, which owns the Liberty brand, retail operations and properties,

Fund Management, which has invested #530m out of #650m committed by three

leisure funds,

Asset Management, which owns and manages commercial property, and

Project Management, which covers activities that create one-off profits or

fees, over a defined time-scale, with clearly contained risk.

The group announced profits before tax of #11,418,000 for its year ended 30th

June 2000 (1999: #6,320,000) and dividends for the year of 2.8p (1999: 2.5p)

per share. Earnings per share increased by 3% to 9.8p. At 30th June 2000 the

group had net assets with a book value in excess of #210m (1999: 83m), and net

assets per share of 202p (up from 143p at 30th June 1999).

On 3rd November 2000, the company announced that it had raised #62 million to

fund capital investment through a placing and open offer for 28.7 million

shares at 215p. The share price at 31st December was 233.5p compared to 155.5p

at 31st December 1999.

Megalomedia plc announced profits for its first half to 30th September 2000 of

#2,304,000, mainly from the disposal of its Contract Publishing business.

Since 30th September it has announced the disposal of its Post Production

Digital Services business to its management for #12,000,000.

This leaves the Company with a strong balance sheet including cash resources

after the disposal of approximately #20.9m (28p per share) and further loan

note receivables of #2.2m, compared to a market capitalisation of #16.6m. We

have acquired a further 245,000 Megalomedia shares in the period for #56,000.

The share price at 31st December was 22p compared to 32.5p at 31st December

1999.

Western Selection P.L.C., our associate strategic investment company,

announced profits after tax for the six months to 31st December 2000 of #

1,753,500 compared with #188,900 for the same period in the previous year.

Western expects to at least maintain its dividend of 0.40p for its current

year. The net asset value of Western, at market values, has increased to #

14,719,000 from #11,179,000 at 31st December 1999. This equates to 33.8p per

share at 31st December 2000, an increase of 14% since 30th June 2000. The

share price at 31st December was 14.75p compared to 19.25p at 31st December

1999 and, following the announcement of its interim results, the price has

increased to 18p at 31st January 2001.

Western has strategic investments in The Sanctuary Group PLC and Creston plc

and has recently reported on them as follows:

The Sanctuary Group PLC, Western's main strategic investment, is a

diversified media group and owner and exploiter of intellectual property

rights, which continues to expand through both acquisition and organic

means. Sanctuary is organised into four divisions: Music, covering

management, record companies, agency and books, New Media, covering

internet related activities, Facilities, covering recording and rehearsal

facilities and Screen, covering television production and distribution.

Sanctuary has issued preliminary results for the twelve months to 30th

September 2000, reporting an increase in turnover of 91% and operating

profits before interest and tax of #5,533,000 (1999: #3,303,000). Earnings

per share increased 14% to 1.88p from 1.65p last year, and the full year

dividend is increased from 0.20p to 0.25p. The Sanctuary share price has

increased from 56.5p at 30th June 2000 to 76p at 31st December 2000.

Creston plc has recently announced the disposal of its remaining property

interests and its restructuring into the holding company of a Marketing

Services Group with the intention of embarking on a buy and build

strategy. Its acquisition of Marketing Sciences Limited and Synergy

Consulting Limited was approved by shareholders on 29th January 2001.

Creston believes that there is great growth potential in providing

consultancy advice to established companies on marketing strategies, and

also believes that there are good opportunities to identify synergistic

benefits within the manufacturing services industry.

The net assets of the company at 31st December 2000 were substantially

unchanged from the 87p reported at 30th September 2000 after a final

dividend for the nine month period to 31st March 2000 of 32.5p (1999:

3.0p). The Creston share price was 115p at 30th June, declined to 90p at

31st December 2000 following the payment of the 32.5p final dividend.

Subsequent to the completion of the acquisition and re-listing the shares

have improved to 110p on 31st January 2001.

Conclusion

The market appreciates the underlying value of some of our Strategic

Investments but others remain undervalued. We continue to work with the

management of our Strategic Investments to help grow their businesses and

enhance shareholder value.

The General Portfolio of investments has outperformed recently compared to the

market, mainly because of our exposure to European stocks. Two thirds of our

General Portfolio comprises shares listed in the UK and, taken as a whole,

these investments have performed in line with the market. Future developments

for telecommunications and technology stocks are uncertain and we continue to

limit our exposure to these sectors. General Portfolio investments are held

for the medium to long term and we expect that they will provide a reasonable

return over time by way of both income and capital growth.

We declared a dividend for the year to 30th June 2000 of 1.1p per share, which

was paid in October. As mentioned above, it is not our intention to pay

interim dividends; and subject to unforeseen circumstances, we expect to at

least maintain our dividend for the year to 30th June 2001, which we

anticipate paying in October 2001.

David C. Marshall

Chairman

Unaudited Consolidated Profit & Loss Account

Half Year Ended Year Ended

31st December 30th June

2000 1999 2000

#000 #000 #000

Operating Income

Dividends received 174 106 306

Interest and sundry income 16 14 29

Profit on sales of investments 136 214 325

326 334 660

Management services income 238 212 433

564 546 1,093

Administrative expenses

Investment operations (137) (134) (271)

Management services (186) (212) (430)

Total administrative expenses (323) (346) (701)

Operating profit 241 200 392

Share of result of associated undertaking 715 80 350

Interest payable (58) (48) (104)

Profit on ordinary activities before 898 232 638

taxation

Tax on result of ordinary activities - (4) (16)

Profit on ordinary activities after 898 228 622

taxation

Minority interest (15) - (1)

Profit attributable to members of the 883 228 621

holding company

Proposed dividend - - (281)

Retained profit for the period 883 228 340

Earnings per share 3.46 p 0.89 p 2.43 p

Dividend per share Nil Nil 1.10 p

Unaudited Consolidated Balance Sheet

31st December 30th June

2000 1999 2000

#000 #000 #000

Fixed assets

Tangible assets 509 517 517

Investments 7,199 6,320 6,499

7,708 6,837 7,016

Current assets

Listed investments 3,537 3,553 3,710

Unlisted investments 43 66 55

Debtors 225 175 146

Cash, bank balances and deposits 238 46 53

4,043 3,840 3,964

Creditors falling due within one year(1,828) (1,773) (1,962)

Net Current Assets 2,215 2,067 2,002

Total Assets less Current Liabilities 9,923 8,904 9,018

Capital and Reserves

Called up share capital 1,277 1,276 1,276

Share premium account 961 956 957

Reserves 363 361 361

Profit and loss account 7,254 6,259 6,371

Shareholders funds 9,855 8,852 8,965

Minority equity interests 68 52 53

9,923 8,904 9,018

Notes:-

1. The results for the half-year are unaudited and have been prepared on

the basis of the accounting policies adopted in the accounts for the year

ended 30th June 2000. The financial information in this interim report does

not constitute statutory accounts within the meaning of Section 240(5) of the

Companies Act 1985. The audited accounts of the Group for the period ended

30th June 2000 have been reported on by the Group's auditors and have been

delivered to the Registrar of Companies. The report of the auditors was

unqualified and did not contain a statement under Section 237(2) or 272(3) of

the Companies Act 1985.

2. Earnings per share are based on the profit after taxation and

minorities, and on the average number of shares 25,530,338 (December 1999 -

25,520,274 and June 2000 - 25,523,710), in issue during the period.

Consolidated Cash Flow Statement Half Year Ended Full Year

31 December 30 June

2000 1999 2000

#000 #000 #000

Cash inflow/(outflow) on operating activities 304 551 (18)

Returns on investments and servicing of finance

Dividends received 270 168 369

Interest paid (58) (48) (104)

Net cash inflow from returns on investments and 212 120 265

servicing of finance

Taxation recovered/(paid) 5 2 (10)

Investing activities

Tangible fixed assets - purchased (5) (20) (31)

Fixed asset investments - purchased (56) (635) (511)

- 188 167

- proceeds on disposal

Net cash outflow from investment activities (61) (467) (375)

Equity dividend paid - Company (281) (255) (255)

Fnancing

Share capital issued 6 - 1

Net drawdown of loan facility - - 350

Net cash inflow from financing 6 - 351

Increase/(Decrease) in cash 185 (49) (42)

Balance Sheet Analysis taking investments at market value

Half Year Ended Year Ended

31st December 30th June

2000 1999 2000

#000 #000 #000

Principal investments at

market value:-

Marylebone Warwick Balfour 7,005 4,665 4,830

Group Plc

Megalomedia plc 902 1,253 867

Western Selection P.L.C. 2,841 3,811 2,604

Creston plc 186 365 238

10,934 10,094 8,539

General equity portfolio 5,557 5,201 5,479

(see analysis below)

Tangible fixed assets 509 517 517

Cash, bank balances and 238 46 53

deposits

Bank overdraft (1,500) (1,600) (1,500)

Other net (liabilities)/ (61) 143 (261)

assets

Minority interests (68) (52) (53)

Net assets 15,609 14,349 12,774

Net assets per share 61.11 p 56.22 p 50.05 p

+ Lonfin owns 40.48% of the issued shares of Western Selection P.L.C. and

accounts for it as an associated company. Taking Western's investments at

market value at 31st December 2000 our investment had an underlying value of

approximately #6.5 million.

# %

Market Value of General Portfolio at 31st December 2000

UTi Worldwide 317,840 5.72

Unilever 286,500 5.16

Nestle 231,933 4.17

ING Groep 218,542 3.93

Diageo 194,400 3.50

HSBC Holding 192,075 3.46

UBS 188,156 3.39

Zurich Financial 187,633 3.38

Barclays 186,480 3.36

GlaxoSmithKline 170,232 3.06

Liberty International 165,750 2.98

Shell Transport & Trading 164,700 2.96

Prudential 161,550 2.91

Schroders 158,520 2.85

Lloyds TSB Group 155,760 2.80

BAA 148,320 2.67

Roche Holdings 136,407 2.45

AstraZeneca 135,000 2.43

CGNU 129,840 2.34

Cadbury Schweppes 129,640 2.33

Anglo American 129,172 2.32

Schweiz-Ruckversicherungs 128,393 2.31

Credit Suisse Group 127,236 2.29

Reuters Group 124,634 2.24

BOC Group 122,040 2.20

Novartis 118,354 2.13

De Beers 115,172 2.07

BAE Systems 114,600 2.06

Cable & Wireless 108,360 1.95

Marconi Electronic Systems 107,850 1.94

Fortis 107,500 1.93

Vodafone Group 98,200 1.77

Pearsons 95,400 1.72

Wyndeham Press Group 93,000 1.67

J. Sainsbury 79,400 1.43

Fuller, Smith &Turner 68,000 1.22

Tibbett & Britten Group 57,500 1.03

Other (less than 1%) 102,780 1.85

5,556,868 100.00

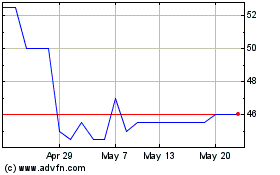

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

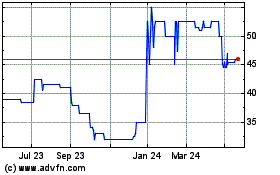

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jul 2023 to Jul 2024