Leeds Group PLC Result of General Meeting (1266Z)

January 09 2024 - 7:20AM

UK Regulatory

TIDMLDSG

RNS Number : 1266Z

Leeds Group PLC

09 January 2024

9 January 2024

Leeds Group plc

("Leeds" or the "Company")

Result of General Meeting

The Board of Leeds Group plc ('Board') announces that, at the

General Meeting held today at the Radisson Blue Hotel, Chicago

Avenue, Manchester Airport, M30 3RA, the resolution in relation to

the Proposed Sale of the Company's subsidiary, Hemmers, was duly

passed. The Proposed Sale of Hemmers is expected to complete on or

around 31 January 2023. The number of proxy votes lodged in advance

of the meeting on the resolution are as noted in the table

below:

Resolution For Against Discretionary Abstain Total

/ withheld Votes

Ordinary Business

----------- -------- -------------- ------------ -----------

Resolution 1 - Proposed

Sale of Hemmers-Itex

Textil Import Export

GmbH 15,118,090 127,000 - - 15,245,090

----------- -------- -------------- ------------ -----------

The effect of the Proposed Sale will be that the Company will no

longer have any trading business or activities and will become an

AIM Rule 15 Cash Shell. The disposal will constitute a fundamental

change of business of the Company under Rule 15 of the AIM Rules.

As such, the Company must make an acquisition or acquisitions which

constitute a reverse takeover under Rule 14 of the AIM Rules within

six months of Completion or be re-admitted to trading on AIM as an

investing company under the AIM Rules (which requires the raising

of at least GBP6 million) failing which the Ordinary Shares would

then be suspended from trading on AIM pursuant to Rule 40 of the

AIM Rules. Admission to trading on AIM would be cancelled six

months from the date of suspension, should the reason for the

suspension not have been rectified.

Going forward the Company will have no trading activities but,

through LG Nordhorn, it will own three commercial properties in

Germany with an aggregate net book value of GBP5,209,000 as at 30

November 2023. The properties will be leased back to Hemmers and,

therefore, the Continuing Group will derive an average rental

income of approximately GBP440,000 per annum over five years, which

will cover the operating expenses of the Company during that

period.

As an AIM Rule 15 Cash Shell, the Company will have operating

cash flow and will not be dependent on any subsequent fundraisings

for its working capital requirements. In the event that the Company

does require additional funding in future, there can be no

guarantees that funding will be forthcoming and the Company's

ability to raise further funds may depend on the success of

existing property investments.

It is estimated that the net cash proceeds of the Proposed Sale

on Completion will be neutral after transaction costs and any taxes

due.

Following the Proposed Sale, it is expected that the Company

will need to arrange a bank loan secured on the properties of

GBP950,000 in order to bridge the funding requirement of the

Company between paying some of the tax liabilities which arise on

the transfer of the properties until the time it can recover the

majority of the tax paid. The Company will also assume a bank

guarantee as part of the Proposed Sale in relation to KMR, a

subsidiary of Hemmers which was placed into liquidation last

financial year, amounting to a maximum amount of GBP345,000.

Therefore, the bank loan will be used to fund this additional

potential liability in respect of KMR if it crystallises.

Capitalised terms used in this Announcement shall, unless

otherwise defined, have the same meaning as set out in the

announcement on 15 December 2023.

This announcement contains inside information for the purposes

of UK Market Abuse Regulation and has been arranged for release by

Jan G Holmstrom, Chairman.

Enquiries:

Leeds Group plc Tel: 01937 547877

Dawn Henderson

Cairn Financial Advisers LLP Tel: 020 7213 0880

Nominated Adviser

Sandy Jamieson / Liam Murray / James

Western

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMBLMTTMTBMBLI

(END) Dow Jones Newswires

January 09, 2024 07:20 ET (12:20 GMT)

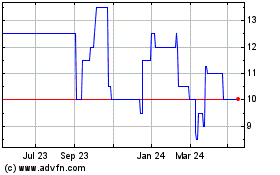

Leeds (LSE:LDSG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Leeds (LSE:LDSG)

Historical Stock Chart

From Jan 2024 to Jan 2025