TIDMLDSG

RNS Number : 0284R

Leeds Group PLC

24 October 2023

Date: 24 October 2023

Leeds Group plc

("Leeds Group" or "the Group")

Final Results for the year ended 31 May 2023

and Notice of AGM

Leeds Group announces its audited final results of the Group for

the year to 31 May 2023 and that its Annual General Meeting will be

held at 2.15pm on 22 November 2023 at the Radisson Blu Hotel,

Chicago Avenue, Manchester Airport, M30 3RA.

Strategic Report

Chairman's Statement

It has been yet another challenging year for the Group.

The textile markets in Germany and other European countries

have, over the past few years been negatively affected by the

Covid-19 pandemic and the consequences of the Russian armed

aggression in Ukraine. Both situations severely affected consumer

confidence which has now been further impacted by high inflation

and increased interest rates. Margins are low at the commodity end

of the market and it is clear that the market as a whole would

benefit from some degree of consolidation. Against this background,

Group trading has continued to struggle.

As previously communicated it became clear to Hemmers management

last autumn, that its retail subsidiary KMR could not continue to

operate and Hemmers' management made the decision to place it into

an insolvency process, which was accepted by the German Courts on 7

October 2022. The insolvency process is ongoing. Full control

passed to the insolvency administrator on 1 January 2023 and at

that point KMR ceased to be a subsidiary within the Group. However,

Hemmers are still exposed to a loan guarantee in relation to KMR

and this has been provided for in the financial statements.

The Group's focus is now solely to return Hemmers to

profitability. Hemmers management will continue to assess the cost

base to make sure it aligns with the reduced sales levels and look

to make efficiencies wherever they can to ensure Hemmers is as

competitive as it can be in the marketplace. The Directors will

continue to look at all options available to the Group to maximise

shareholder value.

Finance and Operating Review

Group highlights

-- Group revenue for all operations in the year was GBP27,817,000 (2022: GBP29,590,000).

-- Group operating loss was GBP509,000 (2022: loss GBP2,990,000

which included an impairment charge of GBP1,662,000).

-- The interest charge was GBP384,000 (2022: GBP255,000) reflecting higher interest rates.

-- Group loss before tax was GBP893,000 (2022: loss GBP3,245,000).

-- The tax credit in the year was GBP53,000 (2022: charge GBP4,000).

-- Total loss per share was 3.1p (2022: loss per share 11.9p).

Hemmers

Hemmers is an international business engaged in designing,

importing, warehousing, and wholesaling of fabrics from its base in

Germany. The markets in Germany and other European countries have

over the past few years been affected by the Covid-19 pandemic and

the conflict in Ukraine and more recently by high inflation and

high interest rates. Management have made significant reductions in

the cost base and will continue to align costs with sales levels

and look to make efficiencies wherever they can to ensure Hemmers

is as competitive as it can be in the marketplace.

External sales increased slightly in the year to GBP24,290,000

(2022: GBP23,998,000). The gross contribution percentage increased

to 35% (2022: 34%) and the gross profit increased to GBP5,156,000

(2022: GBP4,440,000). Hemmers reported a loss before interest of

GBP248,000 (2022: loss GBP415,000) after exceptional consultancy

charges of GBP403.000. External interest has increased to

GBP337,000 (2022: GBP162,000) due to increased interest rates.

Hemmers bank debt, net of cash, increased in the year to

GBP6,046,000 (2022: GBP5,643,000). The bank debt is secured on the

assets of Hemmers.

KMR

On 7 October 2022, the German Courts accepted Hemmers'

management decision to place its subsidiary KMR into an insolvency

process. As a result of the insolvency, an impairment charge of

GBP1,662,000 was recognised in last year's accounts with the assets

relating to the KMR retail shops being written down to a GBPnil net

book value. Full control passed to the insolvency administrator on

1 January 2023 and at that point KMR ceased to be a subsidiary

within the Group. The results for KMR are only consolidated for the

7 months to 31 December 2022 and are reported as a discontinued

operation in these financial statements.

The loss for the 7-month period before interest for the year was

GBP32,000 (2022: loss GBP2,277,000 for 12 months) and the loss

after interest was GBP79,000 (2022: loss GBP2,370,000). During the

year, KMR's freehold property was sold for GBP521,000 realising a

profit on sale of GBP139,000. The Group made a net gain of

GBP138,000 on the transfer of its assets to the insolvency

administrator.

Fixed Assets

The net book amount of tangible fixed assets is GBP6,487,000

(2022: GBP7,335,000). Capital additions in the year amounted to

GBP51,000 (2022: GBP447,000). During the year, KMR's freehold

property was sold for GBP521,000 realising a profit on sale of

GBP139,000.

The net book value of right-to-use assets is GBP207,000 (2022:

GBP170,000). These relate to car leases, of which there were

GBP142,000 additions during the year (2022: GBP45,000).

Working Capital and Cash Flow

Net debt decreased from GBP6,381,000 to GBP5,812,000 in the

year. Net cash generated in the year at average exchange rates was

GBP1,892,000 (2022: used GBP344,000). Working capital, which

comprises inventories, trade and other receivables and trade and

other payables, decreased in the year by GBP2,239,000 (2022:

increased by GBP1,139,000) mainly due to lower levels of stock as

there was no KMR stock this year. Loan repayments of GBP539,000

(2022: GBP708,000) have been made this year. There were no new

loans taken out in the year (2022: GBP2,835,000).

L ease liability repayments (including interest) of GBP698,000

(2022: GBP1,059,000) were made in the year.

The Group continues to carefully monitor its working capital

requirements to ensure it operates within its current banking

facilities.

Net Asset Value

Net assets decreased in the year by GBP738,000 as follows:

Net assets Per share

GBP000 pence

At 31 May 2022 11,177 40.9

Loss after tax (840) (3.1)

Translation differences 102 0.4

At 31 May 2023 10,439 38.2

Debt Profile

The funding policy of the Group continues to match its funding

requirements in a cost-effective fashion with an appropriate

combination of short and longer-term debt. Property investments

have been financed by long term loans at fixed interest rates

between 1.05% and 1.65%. Working capital finance, when required, is

via short term loans of three months currently attracting interest

at rates of between 1.5% and 3%. Bank debt in the subsidiary is

secured by charges on inventories, receivables and property and is

without recourse to the Parent Company.

Principal risks and uncertainties

The Board has identified the main categories of business risk in

relation to the Group's strategic aims and objectives, and has

considered reasonable steps to prevent, mitigate and manage these

risks. The principal risks identified are as follows:

Funding risk

The Group has a combination of short-term borrowing facilities

and longer-term loan agreements secured on Group assets. The Group

remains dependent upon the support of these funders and there is a

risk that failure in a company to meet banking covenants could have

implications for the Group. Borrowing facilities are monitored

regularly and the facilities agreed are more than needed for the

Group's requirements. The Group has close working relationships

with their current funders but believe alternative banking funders

could be secured if required.

Hemmers has a maximum working capital facility of EUR11m,

restricted to the borrowing base which is calculated as 70% of

eligible inventory and 80% of eligible debtors. In the financial

year 2023, this resulted in average availability of EUR8.4m (2022:

EUR7.7m) with a range of EUR7.2m to EUR10.0m (2022: EUR6.5m to

EUR8.8m) and minimum headroom of EUR1.0m (2022: EUR3.2m) in the

year. In the forecast period to 31 May 2025, the estimated

availability range is EUR7m to EUR8.8m and the minimum headroom

EUR0.3m. The facility is committed until 31 May 2024. Hemmers also

has another working capital facility of EUR1m secured on working

capital which was fully drawn at the year end. The facilities are

uncommitted, but the bank is obliged to give reasonable notice of

any change.

The Directors consider that there will be sufficient headroom

available within the Hemmers working capital facility and,

therefore, the Directors are of the opinion that it is appropriate

to apply the going concern basis of preparation to the financial

statements.

However, the Directors acknowledge that the volatile global

situation could have an impact on the future trading result of

Hemmers and in turn could affect the ability of the Group to meet

its forecasts and therefore comply with banking covenants in

downside scenarios. In addition, the Group has borrowing facilities

which are due for renewal within one year of the date of approval

of these financial statements, which the Group relies on to operate

as a going concern. The Directors will look to renew the existing

facilities when they are due for renewal, although acknowledge the

conditions noted above give rise to a material uncertainty around

the going concern of the Group.

Market risk

There is always the ongoing threat of reduced market demand.

This has been seen this year and the Group continues to strive to

combat the reduced demand by looking at other markets both

domestically and internationally and looking at expanding its

product ranges. The commercial risks of operating in the highly

competitive European fabric market are limited by the fact that

Hemmers has a wide range of suppliers, and no customer accounts for

more than 5% of revenues.

Foreign exchange risk

Most fabric purchased by Hemmers is paid for in US dollars,

while the Euro is the principal currency in which Hemmers sells its

product. The Euro/dollar rate is of greater significance to Leeds

Group than the strength of Sterling. The Hemmers' management

continue to manage this transactional currency risk by a

combination of forward exchange contracts with reputable banks and

sales price increases where necessary.

Audit Opinion

As set out in note 7 of this announcement below, the Independent

Auditor's Report on the Annual Report and Financial Statements for

the year ended 31 May 2023 was qualified on the basis that they

were unable to obtain sufficient audit evidence in respect of the

subsidiary KMR and its performance, as stated within the

Consolidated Statement of Comprehensive Income under discontinued

operations. Except for the qualification noted above the

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 May 2023 did not contain a

statement under section 498(2) of the Companies Act 2006 or section

498(3).

In auditing the financial statements for the year ended 31 May

2023, the Group Auditors have concluded that the Directors' use of

the going concern basis of accounting in the preparation of the

financial statements is appropriate. However, the Independent

Auditor's Report draws attention to note 2 in the Group financial

statements (note 1 of this announcement below) which states that

the Group and Parent Company incurred substantial losses during the

year and that the Group and Parent Company's operational existence

is dependent on the continued support from the Group's bank

facilities and the eventual return to profitability. The impact of

this gives rise to a material uncertainty around the going concern

of the Group. The auditor's opinion is unqualified and not modified

in respect of this matter.

The strategic report was approved by the Board of Directors on

23 October 2023 and signed on its behalf by:

Jan G Holmstrom

Non-Executive Chairman

Consolidated Statement of Comprehensive Income

for the year ended 31 May 2023

Year ended 31 May 2023 Year ended 31 May 2022

Discontinued Continuing Total Discontinued Continuing Total

operations operations operations operations

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 3,527 24,290 27,817 5,592 23,998 29,590

Cost of sales (3,249) (19,134) (22,383) (4,551) (19,570) (24,121)

Gross profit 278 5,156 5,434 1,041 4,428 5,469

Distribution costs (690) (1,513) (2,203) (1,082) (1,401) (2,483)

Impairment of assets

Gain on discontinued

operations Administrative

costs - - - (1,662) - (1,662)

138 - 138 - - -

225 (4,274) (4,049) (606) (3,855) (4,461)

Total administrative

costs 363 (4,274) (3,911) (2,268) (3,855) (6,123)

Other income 17 154 171 32 115 147

Loss from operations (32) (477) (509) (2,277) (713) (2,990)

Finance expense (47) (337) (384) (93) (162) (255)

Loss before tax (79) (814) (893) (2,370) (875) (3,245)

Tax credit/(charge) - 53 53 - (4) (4)

Loss for the year

attributable to the

equity holders of

the Parent Company (79) (761) (840) (2,370) (879) (3,249)

Other comprehensive

profit/(loss)

Translation differences

on foreign operations 15 87 102 (22) (113) (135)

Total comprehensive

loss for the year

attributable to the

equity holders of

the Parent Company (64) (674) (738) (2,392) (992) (3,384)

There is no tax effect relating to other comprehensive

income/(loss) for the year. Amounts included in other comprehensive

income/(loss) may be reclassified subsequently as profit or

loss.

Loss per share attributable to the equity holders of the

Company

Year ended Year ended

31 May 2023 31 May 2022

Basic and diluted total loss per

share (pence) 3.1p 11.9p

Consolidated Statement of Financial Position

at 31 May 2023

31 May 2023 31 May 2022

GBP000 GBP000

Assets

Non-current assets

Property, plant, and equipment 6,487 7,335

Right-of-use assets 207 170

Intangible assets 46 52

Total non-current assets 6,740 7,557

Current assets

Inventories 8,218 11,994

Trade and other receivables 3,199 2,864

Tax recoverable - 13

Cash on demand and on short term deposit 234 471

Total current assets 11,651 15,342

Total assets 18,391 22,899

Liabilities

Non-current liabilities

Loans and borrowings (544) (836)

Lease liabilities (112) (1,165)

Total non-current liabilities (656) (2,001)

Current liabilities

Trade and other payables (1,353) (3,065)

Loans and borrowings (5,502) (5,671)

Lease liabilities (97) (885)

Provisions (344) (100)

Total current liabilities (7,296) (9,721)

Total liabilities (7,952) (11,722)

TOTAL NET ASSETS 10,439 11,177

Capital and reserves attributable to

equity holders of the Company

Share capital 3,279 3,279

Capital redemption reserve 1,113 1,113

Foreign exchange reserve 2,152 2,050

Retained earnings 3,895 4,735

TOTAL EQUITY 10,439 11,177

The financial statements were approved and authorised for issue

by the Board of Directors on 23 October 2023 and were signed on

behalf of the Board by:-

Jan G Holmstrom

Non-Executive Chairman

Consolidated Cash Flow Statement

for the year ended 31 May 2023

Year ended Year ended

31 May 2023 31 May 2022

GBP000 GBP000

Cash flows from operating activities

Loss for the year (840) (3,249)

Adjustments for:

Government assistance credit (59) (119)

Depreciation of property, plant, and

equipment 608 735

Impairment of property, plant, and equipment - 42

Depreciation of right-of-use assets 103 827

Impairment of right-of-use assets - 1,620

Amortisation of intangible assets 6 5

Finance expense - interest on bank loans 347 179

Finance expense - interest lease liabilities 37 76

Gain on sale of property, plant, and

equipment (142) -

Loss on sale of right-of-use assets 3 -

Gain on discontinued operations (138) -

Tax (credit)/charge (53) 4

Cash from operating activities before

changes in working capital and provisions (128) 120

Decrease/(increase) in inventories 2,744 (1,818)

(Increase) in trade and other receivables (404) (43)

(Decrease)/increase in trade and other

payables (101) 722

Cash generated from/(used in) operating

activities 2,111 (1,019)

Tax (paid)/received (32) 114

Net cash flows generated from/(used

in) operating activities 2,079 (905)

Investing activities

Purchase of property, plant, and equipment (51) (447)

Proceeds from the sale of fixed assets 521 -

Net cash generated from/(used in) investing

activities 470 (447)

Financing activities

Bank borrowings drawn - 2,835

Bank borrowing disposed of 868 -

Bank borrowings repaid (539) (708)

Repayment of principal on lease liabilities (661) (983)

Repayment of interest on lease liabilities (37) (76)

Bank interest paid (347) (179)

Government assistance received 59 119

Net cash (used in)/generated from financing

activities (657) 1,008

Net increase/(decrease) in cash and

cash equivalents 1,892 (344)

Translation loss on cash and cash equivalents (3) (2)

Cash and cash equivalents at the beginning

of the year 126 472

Cash and cash equivalents disposed of (1,781) -

Cash and cash equivalents at the end

of the year 234 126

Cash on demand or on short term deposit 234 471

Bank overdrafts - (345)

Cash and cash equivalents at the end

of the year 234 126

Consolidated Statement of Changes in Equity

for the year ended 31 May 2023

Share Capital Foreign Retained Total

capital redemption exchange earnings equity

reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000

At 31 May 2021 3,279 1,113 2,185 7,984 14,561

Loss for the year - - - (3,249) (3,249)

Other comprehensive loss - - (135) - (135)

Total comprehensive loss - - (135) (3,249) (3,384)

At 31 May 2022 3,279 1,113 2,050 4,735 11,177

Loss for the year - - - (840) (840)

Other comprehensive income - - 102 - 102

Total comprehensive income/(loss) - - 102 (840) (738)

At 31 May 2023 3,279 1,113 2,152 3,895 10,439

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Share capital The nominal value of issued ordinary shares

in the Company.

Capital redemption reserve Amounts transferred from share capital on

redemption of issued shares.

Treasury share reserve Cost of own shares held in treasury.

Foreign exchange reserve Gains/(losses) arising on retranslation of

the net assets of overseas operations into

sterling.

Retained earnings Cumulative net gains/(losses) recognised

in the consolidated statement of comprehensive

income after deducting the cost of cancelled

treasury shares.

Notes

1. Basis of preparation

The Group financial statements have been properly prepared using

the recognition and measurement principles of United Kingdom

adopted International Financial Reporting Standards ("UK adopted

IFRS").

Going Concern

When considering its opinion about the application of the going

concern basis of preparation of the financial statements the

Directors have given due consideration to:

-- The performance of the Group in the last financial year and

the robustness of forecasts for the next 24 months, which return

the Group to profit.

-- The financing facilities available to the Group and the

circumstances in which these could be limited or withdrawn.

Financial performance and forecasts

Forecasts have been prepared for the 24-month period to May 2025

which indicate a return to modest profit over that period. The

Company has sensitised these forecasts for a reduction in revenues

for Hemmers and the banking facilities remain adequate. The

Directors are of the opinion that this is a reasonable worst case,

and the currently available facilities would be sufficient in this

scenario.

For purposes of the going concern assessment, the Group make

estimates of likely future cash flows which are based on

assumptions given the uncertainties involved. The key assumptions

include (i) No significant deterioration in general market

conditions; (ii) No significant customer loss; (iii) No significant

increase in raw material prices (iii) Continued support of lenders.

These assumptions are made by management based on recent

performance, external forecasts and management's knowledge and

expertise of the cashflow drivers. Management continually monitors

the Group's cash balances and forecasts cash flows, including

stress testing in respect of the timing of those cash flows.

Financing facilities

The operating business of the Group, Hemmers which is located in

Germany. The Parent Company, which has no borrowing facilities, is

located in the UK. Hemmers has four sources of funding:

-- Term loans which have funded property purchases. These are

repayable in instalments over the term as detailed in note 6. They

are secured over the associated properties and that security could

be called in the event that the business defaulted on

repayment.

-- A maximum working capital facility of EUR11m, restricted to

the borrowing base which is calculated as 70% of eligible inventory

and 80% of eligible debtors. In the financial year 2023, this

resulted in average availability of EUR8.4m (2022: EUR7.7m) with a

range of EUR7.2m to EUR10.0m (2022: EUR6.5m to EUR8.8m) and minimum

headroom of EUR1.0m (2022: EUR3.2m) in the year. In the forecast

period to 31 May 2025, the estimated availability range is EUR7m to

EUR8.8m and the minimum headroom EUR0.3m. The covenants on this

facility are an equity ratio which must exceed 50% of gross assets

at the financial year end and profit for the previous six months to

exceed EUR121,000. At 31 May 2023, the ratio was 52% and the

previous six months profit was EUR347,000. The facility is

committed until 31 May 2024.

-- A further working capital facility of EUR1m secured on

working capital which was fully drawn at the year end. The

facilities are uncommitted, but the bank is obliged to give

reasonable notice of any change.

-- A EUR3m Parent Company loan which is currently subordinated to the working capital facility.

The Directors consider there will be sufficient headroom

available in the Hemmers working capital facility and, therefore,

the Directors are of the opinion that it is appropriate to apply

the going concern basis of preparation to the financial

statements.

However, the Directors acknowledge that the volatile global

situation could have an impact on the future trading result of

Hemmers and in turn could affect the ability of the Group to meet

its forecasts and therefore comply with banking covenants in

downside scenarios. In addition, the Group has borrowing facilities

which are due for renewal within one year of the date of approval

of these financial statements, which the Group relies on to operate

as a going concern. The Directors will look to renew the existing

facilities when they are due for renewal, although acknowledge the

conditions noted above give rise to a material uncertainty around

the going concern of the Group.

2. Dividends

The Directors do not recommend the payment of a dividend in 2023

(2022: GBPnil).

3. Loss per share

Year ended 31 May 2023

Loss per share Discontinued Continuing

Total

operations operations Group

Numerator

Total loss for the year GBP79,000 GBP761,000 GBP840,000

Denominator

Weighted average number of shares 27,320,843 27,320,843 27,320,843

Basic and diluted loss per share 0.3p 2.8p 3.1p

Year ended 31 May 2022

Loss per share Discontinued Continuing

Total

operations operations Group

Numerator

Total loss for the year GBP2,370,000 GBP879,000 GBP3,249,000

Denominator

Weighted average number of shares 27,320,843 27,320,843 27,320,843

Basic and diluted loss per share 8.7p 3.2p 11.9p

Since there are no outstanding share options, there is no

difference between basic and diluted earnings per share.

4. Discontinued operations

On 7 October 2022, the German Courts accepted Hemmers'

management decision to place its subsidiary KMR into an insolvency

process. The insolvency process is ongoing although full control

passed to the insolvency administrator on 1 January 2023 and at

that point KMR ceased to be a subsidiary within the Group. The gain

has arisen due to the assets being transferred to the insolvency

administrator and any IFRS adjustments reversed. There was no tax

impact on the gain which arose on transfer.

KMR balance IFRS adj Total

sheet at insolvency

date GBP000 GBP000

GBP000

Fixed assets (136) 133 (3)

Current assets less current

liabilities 254 (213) 41

Finance lease liability - 1,360 1,360

Provision - (347) (347)

118 933 1,051

Cash (1,781) - (1,781)

Loan 868 - 868

Net cash effect (913) - (913)

(Loss)/gain on transfer (795) 933 138

5. Segmental information

Year ended 31 May Discontinued Continuing operations Total

2023 operations

KMR Hemmers Inter Parent Group

segmental Company

GBP000 GBP000 GBP000 GBP000 GBP000

External revenue 3,527 24,290 - - 27,817

Inter-segmental revenue 3 416 (419) - -

Cost of sales (3,252) (19,550) 419 - (22,383)

Gross profit 278 5,156 - - 5,434

Distribution costs (690) (1,513) - - (2,203)

Admin expenses 363 (4,171) 127 (229) (3,911)

Other income 17 280 (127) - 171

Operating loss (32) (248) - (229) (509)

Finance expense (47) (337) - - (384)

Internal interest - (208) - 208 -

Loss before tax (79) (793) - (21) (893)

At 31 May 2023 Discontinued Continuing operations Total

operations

KMR Hemmers Adj Parent Group

Company

GBP000 GBP000 GBP000 GBP000 GBP000

Total assets - 15,572 - 2,819 18,391

Total liabilities - (7,852) - (100) (7,952)

Total net assets - 7,720 - 2,719 10,439

Year ended 31 May Discontinued Continuing operations Total

2022 operations

KMR Hemmers Inter Parent Group

segmental Company

GBP000 GBP000 GBP000 GBP000 GBP000

External revenue 5,592 23,998 - - 29,590

Inter-segmental revenue - 1,069 (1,069) - -

Cost of sales (4,551) (20,627) 1,057 - (24,121)

Gross profit/(loss) 1,041 4,440 (12) - 5,469

Distribution costs (1,082) (1,401) - - (2,483)

Admin expenses (2,268) (3,763) 194 (286) (6,123)

Other income 32 309 (194) - 147

Operating loss (2,277) (415) (12) (286) (2,990)

Finance expense (93) (162) - - (255)

Internal interest - (204) - 204 -

Loss before tax (2,370) (781) (12) (82) (3,245)

At 31 May 2022 Discontinued Continuing operations Total

operations

KMR Hemmers Adj Parent Group

Company GBP000

GBP000 GBP000 GBP000 GBP000

Total assets 2,819 17,392 (123) 2,811 22,899

Total liabilities (3,540) (8,091) - (91) (11,722)

Total net (liabilities)/assets (721) 9,301 (123) 2,720 11,177

6. Loans and borrowings

The book value of loans and borrowings are as follows:

31 May 2023 31 May

GBP000 2022

GBP000

Current

Secured bank loans 5,502 5,671

Non - current

Secured bank loans 544 836

Total loans and borrowings 6,046 6,507

Current loans and borrowings

At 31 May 2023 current loans and borrowings of GBP5,502,000

(2022: GBP5,671,000) comprise short term loans of GBP5,201,000

(2022: GBP5,373,000) and instalments due on long term loans

detailed below of GBP301,000 (2022: GBP298,000). The interest rate

on the short-term loans ranges from 1.5% to 3% (2022: 1.25% to 3%)

and these loans are secured on working capital of Hemmers. The

short-term loans are drawn down by Hemmers against short-term

borrowing facilities of up to a maximum of GBP10.3m (EUR12m). At 31

May 2023, the total borrowing facility available totalled GBP7.1m

(EUR8.2m) of which GBP5.2m (EUR6m) has been utilised including any

overdrafts, therefore the headroom within the facility was GBP1.9m

(EUR2.2m). Neither the Parent Company nor its subsidiary Hemmers

have any other borrowing facilities. The bank borrowing facilities

are reviewed annually every May and remain in place for Hemmers for

the forthcoming year.

Non-current loans and borrowings

Non-current loans were drawn down in 2016 and 2017 to finance

developments at the Hemmers warehouses in Nordhorn.

The Group's loans and borrowings are within the accounts of

Hemmers. They are denominated in Euros, and their principal terms

are as follows:

Fixed Repayment Final repayment 31 May 31 May

interest profile date 2023 2022

rate GBP000 GBP000

Loan September

1 1.65% Equal quarterly instalments 2025 358 590

Loan

2 1.05% Equal quarterly instalments March 2026 186 246

Non-current loans 544 836

7. Other information

The financial information in this financial results announcement

has been prepared by the Directors using the recognition and

measurement principles of United Kingdom adopted International

Financial Reporting Standards ("UK adopted IFRS"). The financial

information for the year ended 31 May 2023 does not constitute the

statutory accounts of the Company for 2022 and 2023 but are

extracted from the audited accounts.

The statutory accounts for the year ended 31 May 2023 and 31 May

2022 have been reported on by MHA, Statutory Auditor. The

Independent Auditor's Report on the Annual Report and Financial

Statements for 2023 is qualified and for 2022 unqualified and did

not draw attention to any matters by way of emphasis. Both the

Financial Statements for 2023 and 2022 did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006. The Independent

Auditor's Report on the Annual Report and Financial Statements for

the year ended 31 May 2023 was qualified on the basis that they

were unable to obtain sufficient audit evidence in respect of the

subsidiary KMR and its performance, as stated within the

Consolidated Statement of Comprehensive Income under discontinued

operations. Except for the qualification noted above the

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 May 2023 did not contain a

statement under section 498(2) of the Companies Act 2006 or section

498(3).

In auditing the financial statements for the year ended 31 May

2023, the Group Auditors have concluded that the Directors' use of

the going concern basis of accounting in the preparation of the

financial statements is appropriate. However, the Independent

Auditor's Report draws attention to note 2 in the Group financial

statements (note 1 above) which states that the Group and Parent

Company incurred substantial losses during the year and that the

Group and Parent Company's operational existence is dependent on

the continued support from the Group's bank facilities and the

eventual return to profitability. The impact of this gives rise to

a material uncertainty around the going concern of the Group. The

auditor's opinion is unqualified and not modified in respect of

this matter. An extract from the Independent Auditor's Report is

set out below:

We draw your attention to note 2 in the financial statements

which states that the Group and Parent Company incurred substantial

losses during the year and that the Group and Parent Company's

operational existence is dependent on the continued support from

the Group's bank facilities and the eventual return to

profitability.

The impact of this together with other matters set out in the

note, indicate that a material uncertainty exists that may cast

significant doubt on the Group's ability to continue as a going

concern. Our opinion is not modified in respect of this matter. In

auditing the financial statements, we have concluded that the

Directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the Directors' assessment of the Group and Parent

Company's ability to continue to adopt the going concern basis of

accounting included:

Our evaluation of the Directors' assessment of the Group's and

the Parent Company's ability to continue to adopt the going concern

basis of accounting included:

-- The consideration of inherent risks to the Group's operations

and specifically its business model.

-- The evaluation of how those risks might impact on the Group's

available financial resources.

-- Review of the mathematical accuracy of the cashflow forecast

model prepared by management and corroboration of key data inputs

to supporting documentation for consistency of assumptions used

with our knowledge obtained during the audit.

-- Challenging management for reasonableness of assumptions in

respect of the timing and quantum of cash receipts and payments

included in the cash flow model.

-- Holding discussions with management regarding future

financing plans, corroborating these where necessary and assessing

the impact on the cash flow forecast.

-- Review of the Group's external debt exposure to determine if

any future repayments have been included within the Group's cash

flow projections.

-- Holding discussions with management and completing reviews of

any events after the reporting period to identify if these may

impact on the Group's ability to continue as a going concern.

The statutory accounts for the year ended 31 May 2022 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 May 2023 will be delivered to the Registrar of

Companies following the Annual General Meeting. The Annual Report

and Financial Statements giving notice of the 2023 Annual General

Meeting, have been today published on the Group's website at

www.leedsgroup.plc.uk and have been sent to those shareholders who

have elected to receive a hard copy of the Annual Report and

Financial Statements by the post.

The Annual General Meeting will be held at 2.15pm on 22 November

2023 at the Radisson Blu Hotel, Chicago Avenue, Manchester Airport,

M30 3RA.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and has been arranged for release

by Jan G Holmstrom, Non-Executive Chairman. The Directors of the

Company are responsible for the release of this announcement.

Enquiries:

Leeds Group plc Cairn Financial Advisers LLP (nominated

adviser)

Dawn Henderson - 01937 547877 Liam Murray/Sandy Jamieson - 020

7213 0880

Note:

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not a guarantee of future performance and are

subject to known and unknown risks, uncertainties, and other

factors, some of which are beyond the Company's control, are

difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the

forward-looking statements. The Company cautions security holders

and prospective security holders not to place undue reliance on

these forward-looking statements, which reflect the view of the

Company only as of the date of this announcement. The

forward-looking statements made in this announcement relate only to

events as of the date on which the statements are made. The Company

will not undertake any obligation to release publicly any revisions

or updates to these forward-looking statements to reflect events,

circumstances, or unanticipated events occurring after the date of

this announcement except as required by law or by any appropriate

regulatory authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFVAIELVFIV

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

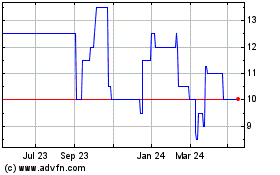

Leeds (LSE:LDSG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Leeds (LSE:LDSG)

Historical Stock Chart

From Feb 2024 to Feb 2025